Middle East And Africa Nurse Call Systems Market

Taille du marché en milliards USD

TCAC :

%

USD

82.28 Million

USD

160.38 Million

2024

2032

USD

82.28 Million

USD

160.38 Million

2024

2032

| 2025 –2032 | |

| USD 82.28 Million | |

| USD 160.38 Million | |

|

|

|

|

Segmentation du marché des systèmes d'appel infirmier au Moyen-Orient et en Afrique, par type (systèmes à boutons, systèmes de communication intégrés, systèmes d'appel infirmier numériques et mobiles, systèmes d'interphonie, systèmes d'appel infirmier audiovisuels de base, etc.), technologie (communication filaire, communication sans fil et systèmes d'appel infirmier hybrides), application (alarmes et communications, contrôle des déplacements, optimisation des flux de travail, détection et prévention des chutes et gestion des visiteurs), utilisateur final (hôpitaux, centres de chirurgie ambulatoire, maisons de retraite, centres de vie assistée médicale, établissements de soins de longue durée, cliniques, cabinets médicaux, centres de réadaptation, services de consultation externe, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des systèmes d'appel infirmier au Moyen-Orient et en Afrique

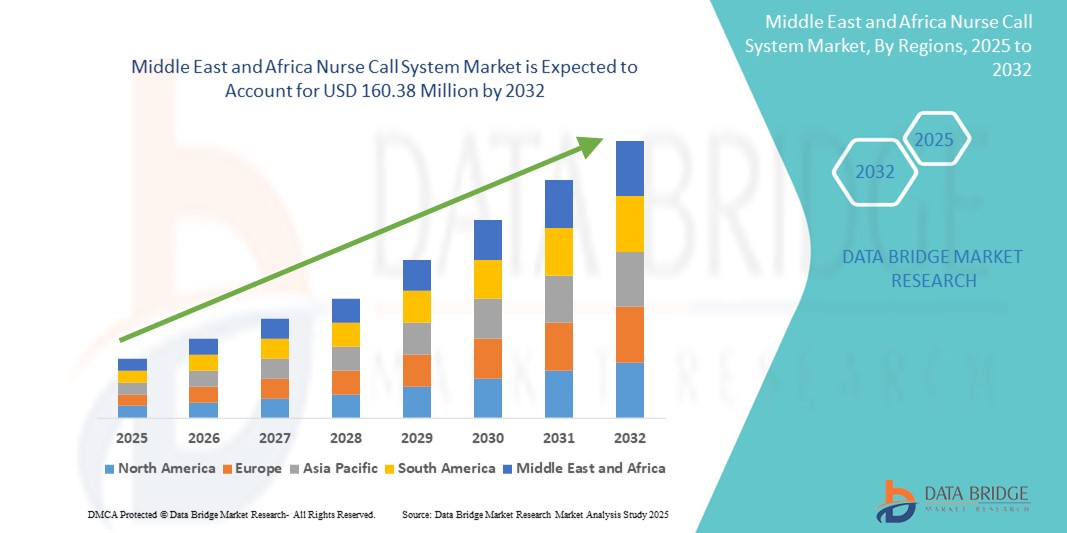

- La taille du marché des systèmes d'appel infirmier au Moyen-Orient et en Afrique était évaluée à 82,28 millions USD en 2024 et devrait atteindre 160,38 millions USD d'ici 2032 , à un TCAC de 8,70 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'expansion rapide des infrastructures de soins de santé et l'adoption croissante des technologies de santé numériques visant à améliorer l'efficacité et la sécurité des soins aux patients dans les hôpitaux et les établissements de soins aux personnes âgées.

- De plus, la demande croissante de communication en temps réel, d'amélioration des flux de travail et de réponse aux urgences en milieu médical positionne les systèmes d'appel infirmier comme un élément essentiel des réseaux de communication modernes du secteur médical. Ces facteurs convergents accélèrent le déploiement de ces solutions, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des systèmes d'appel infirmier au Moyen-Orient et en Afrique

- Les systèmes d'appel infirmier, qui permettent une communication efficace entre les patients et le personnel soignant, deviennent essentiels dans les hôpitaux, les cliniques et les établissements de soins aux personnes âgées au Moyen-Orient et en Afrique en raison de leur rôle dans l'amélioration des temps de réponse, des résultats pour les patients et de la coordination du personnel.

- La demande croissante de systèmes d'appel infirmier est principalement alimentée par le fardeau croissant des maladies chroniques, l'expansion des infrastructures de soins de santé et le besoin croissant de communication simplifiée et en temps réel dans les milieux médicaux publics et privés.

- L'Afrique du Sud a dominé le marché des systèmes d'appel infirmier avec la plus grande part de revenus de 32,9 % en 2024, soutenue par un investissement gouvernemental important dans les infrastructures de santé publique, l'adoption de systèmes informatiques de santé et la demande locale d'une meilleure communication avec les patients dans les hôpitaux urbains et les cliniques privées.

- L'Arabie saoudite devrait être le pays à la croissance la plus rapide sur le marché des systèmes d'appel infirmier au cours de la période de prévision en raison de l'augmentation des dépenses de santé, de la construction d'hôpitaux dans le cadre de Vision 2030 et des initiatives nationales favorisant la transformation numérique dans la prestation de soins de santé.

- Le segment des systèmes de communication intégrés a dominé le marché des systèmes d'appel infirmier avec une part de marché de 39,1 % en 2023, grâce à sa capacité à unifier les fonctions vocales, d'alerte et de surveillance en un seul système qui améliore l'efficacité du flux de travail et la qualité des soins aux patients.

Portée du rapport et segmentation du marché des systèmes d'appel infirmier au Moyen-Orient et en Afrique

|

Attributs |

Informations clés sur le marché des systèmes d'appel infirmier au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des systèmes d'appel infirmier au Moyen-Orient et en Afrique

« Demande croissante de systèmes de communication intégrés et sans fil »

- Une tendance significative et croissante sur le marché des systèmes d'appel infirmier au Moyen-Orient et en Afrique est la préférence croissante pour les plateformes de communication intégrées et sans fil dans les hôpitaux et les établissements de soins pour personnes âgées. Ces systèmes améliorent les capacités de coordination et de réponse en temps réel, soutenant ainsi la transition de la région vers une infrastructure de santé numérique.

- Par exemple, les solutions d'appel infirmier sans fil d'Ascom sont déployées dans des hôpitaux privés en Afrique du Sud, permettant de recevoir les alertes mobiles et les demandes des patients directement sur les appareils portables des soignants. De même, les systèmes IP de Televic gagnent du terrain en Arabie saoudite, offrant une intégration avec les logiciels de gestion hospitalière et les outils de communication vocale.

- Les systèmes sans fil sont particulièrement intéressants pour la modernisation des installations anciennes et leur déploiement dans les zones rurales ou mal desservies où l'infrastructure filaire est limitée ou coûteuse à installer. Leur évolutivité et leurs faibles exigences d'installation en font une solution pratique pour les prestataires de soins de santé publics et privés.

- Les solutions intégrées d'appel infirmier permettent une interopérabilité transparente avec l'automatisation des bâtiments, les dossiers médicaux électroniques et les systèmes de localisation en temps réel, contribuant ainsi à l'amélioration des flux de travail opérationnels et de la sécurité des patients.

- Par exemple, le système Fusion-IP d'Intercall est conçu pour s'intégrer aux systèmes de contrôle d'accès et de gestion des flux de travail, aidant les hôpitaux à centraliser la communication et à améliorer la responsabilité du personnel.

- La demande croissante de systèmes d'appel infirmiers aussi avancés et connectés reflète une évolution plus large vers des environnements de soins de santé intelligents dans des pays comme l'Arabie saoudite, les Émirats arabes unis et l'Afrique du Sud, où des initiatives de modernisation sont en cours pour améliorer la qualité des soins et l'efficacité des hôpitaux.

Dynamique du marché des systèmes d'appel infirmier au Moyen-Orient et en Afrique

Conducteur

« Développement des infrastructures de santé et demande de communication centrée sur le patient »

- L’expansion continue des établissements de santé dans les principaux pays du Moyen-Orient et d’Afrique, stimulée par les initiatives gouvernementales et l’augmentation des investissements dans les soins de santé, est un facteur majeur de l’adoption des systèmes d’appel infirmier.

- Par exemple, la Vision 2030 de l'Arabie saoudite comprend des projets de développement hospitalier à grande échelle visant à accroître les capacités de santé numérique, créant une demande importante de systèmes de communication infirmières modernes dans les institutions publiques et privées.

- Alors que les prestataires de soins de santé cherchent à améliorer les temps de réponse, à améliorer le flux de travail des soignants et à fournir des soins de meilleure qualité, les systèmes d'appel infirmier deviennent des outils essentiels dans les établissements de soins aigus et de longue durée.

- Le besoin d’une communication efficace dans les services à lits multiples, les unités de soins intensifs et les maisons de retraite alimente encore davantage la demande du marché, en particulier dans les pays en voie d’urbanisation rapide comme les Émirats arabes unis et l’Égypte.

- De plus, les normes internationales d'accréditation des hôpitaux encouragent l'utilisation de solutions avancées d'appel infirmier qui prennent en charge l'automatisation du flux de travail, les alertes en temps réel et le suivi détaillé des incidents, s'alignant ainsi sur des objectifs plus larges d'excellence opérationnelle.

Retenue/Défi

« Coûts système élevés et infrastructure technique limitée »

- Malgré une demande croissante, l'adoption de systèmes d'appel infirmiers avancés au Moyen-Orient et en Afrique est limitée par les coûts élevés associés à l'approvisionnement, à l'installation et à l'intégration du système.

- De nombreux établissements de santé dans les pays en développement de la région sont confrontés à des limitations budgétaires et privilégient l'investissement dans les infrastructures médicales de base plutôt que dans les systèmes de communication, retardant ainsi le déploiement à grande échelle.

- De plus, l'accès limité à un personnel technique qualifié pour l'installation et la maintenance pose des problèmes dans les zones rurales ou les hôpitaux nouvellement créés. Les incompatibilités infrastructurelles et le manque de préparation informatique peuvent également entraver l'intégration avec les systèmes existants.

- Par exemple, même si les systèmes sans fil réduisent les charges d'installation, ils nécessitent néanmoins un support réseau robuste et une formation du personnel, qui peuvent ne pas être facilement disponibles dans les zones à faibles ressources.

- Pour surmonter ces obstacles, les fournisseurs proposent de plus en plus de solutions évolutives, modulaires et par abonnement pour rendre la technologie d'appel infirmier plus accessible et plus rentable pour les hôpitaux de différentes tailles et ressources.

Portée du marché des systèmes d'appel infirmier au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type, de la technologie, de l’application et de l’utilisateur final.

- Par type

Au Moyen-Orient et en Afrique, le marché des systèmes d'appel infirmier se segmente en fonction du type de système : systèmes à boutons, systèmes de communication intégrés, systèmes d'appel infirmier numériques et mobiles, systèmes d'interphonie, systèmes d'appel infirmier audiovisuels de base, etc. Le segment des systèmes de communication intégrés a dominé le marché avec une part de marché de 39,1 % en 2024, stimulé par le besoin croissant d'outils de communication centralisés et multifonctionnels améliorant la sécurité des patients et l'efficacité du personnel soignant. Les hôpitaux privilégient de plus en plus ces systèmes pour leur capacité à intégrer les alertes, la messagerie, la gestion des flux de travail et la surveillance en temps réel entre les services.

Le segment des systèmes d'appel infirmier numériques et mobiles devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à l'utilisation croissante des smartphones et des technologies de santé mobiles. Ces systèmes offrent une communication flexible, des délais de réponse plus courts et améliorent les résultats pour les patients en permettant aux soignants de recevoir des alertes directement sur leurs appareils portables, réduisant ainsi les délais de prise en charge des soins intensifs.

- Par technologie

Sur le plan technologique, le marché des systèmes d'appel infirmier est segmenté en systèmes de communication filaire, sans fil et hybrides. En 2024, le segment des communications filaires détenait la plus grande part de chiffre d'affaires, grâce à sa stabilité, sa sécurité et sa préférence pour les grands établissements de santé où la constance des performances est essentielle. Ces systèmes sont généralement installés dans les unités de soins intensifs, les unités de soins intensifs et les services chirurgicaux qui nécessitent des liaisons de communication à sécurité intégrée.

Le segment des communications sans fil devrait connaître le TCAC le plus rapide entre 2025 et 2032, grâce à sa facilité d'installation, à ses faibles coûts d'infrastructure et à son évolutivité dans les centres de soins ambulatoires et les établissements de soins pour personnes âgées. Les systèmes sans fil sont particulièrement efficaces dans les régions rurales et mal desservies, où la modernisation des infrastructures traditionnelles peut s'avérer impossible.

- Par application

En fonction des applications, le marché des systèmes d'appel infirmier est segmenté en alarmes et communications, contrôle des errances, optimisation des flux de travail, détection et prévention des chutes, et gestion des visiteurs. Le segment des alarmes et communications a dominé le marché en 2024, grâce à son rôle fondamental dans la rapidité des interactions entre le personnel infirmier et les patients, les alertes d'urgence et l'efficacité des flux de travail cliniques. Cette application est essentielle pour améliorer les délais de réponse, la satisfaction des patients et l'efficacité globale des hôpitaux dans tous les contextes de soins.

Le secteur de la détection et de la prévention des chutes devrait connaître sa plus forte croissance d'ici 2032, sous l'effet du vieillissement de la population et de la forte prévalence des blessures liées aux chutes. Les systèmes modernes s'appuient sur des capteurs et des analyses prédictives pour détecter proactivement les risques, envoyer des alertes aux soignants et permettre des interventions rapides.

- Par utilisateur final

En fonction de l'utilisateur final, le marché des systèmes d'appel infirmier est segmenté en hôpitaux, centres de chirurgie ambulatoire, maisons de retraite médicalisées, résidences services médicalisées, établissements de soins de longue durée, cliniques, cabinets médicaux, centres de rééducation, services de consultation externe, etc. Le segment hospitalier a dominé le marché avec la plus grande part de chiffre d'affaires en 2024, soutenu par l'augmentation du nombre de patients, la hausse des financements publics et le besoin urgent d'outils de communication avancés pour optimiser la prestation des soins dans des environnements cliniques complexes.

Le secteur des établissements de soins de longue durée devrait connaître la croissance la plus rapide entre 2025 et 2032, propulsé par la demande croissante de soins aux personnes âgées et de prise en charge des maladies chroniques. Ces établissements nécessitent des systèmes évolutifs et faciles à utiliser qui assurent une surveillance continue, améliorent le confort des patients et favorisent la réactivité des soignants.

Analyse régionale du marché des systèmes d'appel infirmier au Moyen-Orient et en Afrique

- L'Afrique du Sud a dominé le marché des systèmes d'appel infirmier avec la plus grande part de revenus de 32,9 % en 2024, soutenue par un investissement gouvernemental important dans les infrastructures de santé publique, l'adoption de systèmes informatiques de santé et la demande locale d'une meilleure communication avec les patients dans les hôpitaux urbains et les cliniques privées.

- Les établissements de santé du pays investissent de plus en plus dans des solutions intégrées d'appel infirmier pour améliorer la sécurité des patients, rationaliser la gestion du flux de travail et permettre une communication en temps réel entre les patients et les soignants.

- Cette forte tendance à l'adoption est encore renforcée par les réformes de santé menées par le gouvernement, la demande croissante de soins de qualité aux personnes âgées et un secteur privé de la santé en pleine croissance, faisant de l'Afrique du Sud une plaque tournante clé pour le déploiement de systèmes d'appel infirmier avancés dans la région.

Aperçu du marché des systèmes d'appel infirmier en Afrique du Sud

En 2024, le marché sud-africain des systèmes d'appel infirmier a représenté la plus grande part de marché au Moyen-Orient et en Afrique, avec 32,9 %, grâce à son infrastructure de soins de santé privée bien développée et à sa forte adoption des technologies de santé numériques. Les grands centres urbains tels que Johannesburg, Le Cap et Durban sont à la pointe du déploiement de systèmes d'appel infirmier modernes, basés sur IP et intégrés aux systèmes d'information hospitaliers. Cette croissance est également soutenue par le rôle stratégique du pays en tant que pôle régional pour les fournisseurs de technologies médicales et par son engagement croissant envers l'amélioration de la communication avec les patients et de l'efficacité des soins dans les hôpitaux publics et privés.

Aperçu du marché des systèmes d'appel infirmier en Arabie saoudite

Le marché saoudien des systèmes d'appel infirmier devrait connaître sa plus forte croissance annuelle composée (TCAC) entre 2025 et 2032, grâce à des investissements massifs dans le secteur de la santé, conformément à l'initiative Vision 2030. La construction continue d'hôpitaux intelligents et l'expansion des établissements de santé accélèrent l'adoption de systèmes d'appel infirmier sans fil et hybrides. La demande croissante d'outils de communication en temps réel, combinée aux normes de santé numérique obligatoires et aux projets d'infrastructures soutenus par le gouvernement, continue de positionner l'Arabie saoudite comme un marché émergent clé pour les technologies avancées d'appel infirmier dans les environnements de soins aigus et de longue durée.

Aperçu du marché des systèmes d'appel infirmier aux Émirats arabes unis

Le marché des systèmes d'appel infirmier aux Émirats arabes unis connaît une croissance constante grâce à la forte numérisation des soins de santé, notamment à Abou Dhabi et à Dubaï. Les principales chaînes d'hôpitaux privés et les pôles de tourisme médical déploient de plus en plus de plateformes de communication intégrées pour améliorer les flux de travail et la satisfaction des patients. La robuste infrastructure informatique du pays et les cadres de santé numérique pilotés par le gouvernement favorisent l'utilisation de systèmes d'appel infirmier mobiles et connectés au cloud, dotés de fonctionnalités multilingues et centrées sur le patient.

Aperçu du marché des systèmes d'appel infirmier en Égypte

Le marché égyptien des systèmes d'appel infirmier est en pleine expansion dans la région, porté par la demande croissante de soins de santé d'une population nombreuse et par la croissance des centres médicaux privés au Caire et à Alexandrie. Alors que la modernisation du secteur public progresse progressivement, les établissements privés investissent dans des systèmes d'appel infirmier numériques pour améliorer les délais de réponse et l'efficacité opérationnelle. Les interfaces multilingues, l'intégration cloud et la compatibilité avec les logiciels de gestion hospitalière deviennent des critères d'adoption clés, notamment dans les hôpitaux urbains haut de gamme et les centres de réadaptation.

Part de marché des systèmes d'appel infirmier au Moyen-Orient et en Afrique

L'industrie des systèmes d'appel infirmier au Moyen-Orient et en Afrique est principalement dirigée par des entreprises bien établies, notamment :

- Honeywell International Inc. (États-Unis)

- Johnson Controls Inc. (États-Unis)

- Televic (Belgique)

- Intercall Systems Inc. (États-Unis)

- Ascom (Suisse)

- Schrack Seconet AG (Autriche)

- Jeron Electronic Systems Inc. (États-Unis)

- Groupe Tunstall (Royaume-Uni)

- West-Com Nurse Call Systems, Inc. (États-Unis)

- Technologies des systèmes (États-Unis)

- Systèmes de micro-appel infirmier (États-Unis)

- Medisam Medikal (Turquie)

- Caretronic (Slovénie)

- JPnovations (Canada)

- CEREDA Systems GmbH (Allemagne)

- CODACO Electronic (République tchèque)

- Hospicall (Turquie)

- Groupe Essec (Italie)

- Intercall UK (Royaume-Uni)

- Legrand SA (France)

- RUS-Intercom (Russie)

- Smartcall - RUS (Russie)

- Static Systems Group Plc (Royaume-Uni)

Quels sont les développements récents sur le marché des systèmes d’appel infirmier au Moyen-Orient et en Afrique ?

- En avril 2024, Ascom Holding AG, éminent fournisseur de solutions de communication pour le secteur de la santé, a annoncé le déploiement de ses systèmes d'appel infirmier IP avancés dans plusieurs hôpitaux d'Afrique du Sud. Cette initiative s'inscrit dans le cadre d'une stratégie nationale de modernisation des hôpitaux visant à améliorer la sécurité des patients et l'efficacité du personnel. Ce déploiement témoigne de l'engagement d'Ascom à proposer des solutions de communication évolutives et intégrées, adaptées au paysage numérique croissant des soins de santé dans la région.

- En mars 2024, Honeywell International Inc. a lancé un partenariat avec un groupe de santé de premier plan aux Émirats arabes unis pour le déploiement de systèmes d'appel infirmier sans fil intégrant des services de localisation en temps réel (RTLS). Conçus pour améliorer les délais de réponse et la surveillance des patients, ces systèmes s'inscrivent dans la stratégie d'Honeywell en matière de solutions hospitalières intelligentes, renforçant ainsi son rôle dans la transformation des infrastructures de santé au Moyen-Orient.

- En février 2024, Intercall Systems Inc., fournisseur américain de solutions d'appel infirmier, a finalisé l'installation de sa gamme Touch dans un nouvel hôpital à Riyad, en Arabie saoudite. Ce système moderne comprend des panneaux de communication vocale et une intégration mobile, prenant en charge les fonctionnalités d'un hôpital intelligent. Ce déploiement s'inscrit dans le cadre de l'initiative Vision 2030 de l'Arabie saoudite et de la dynamique nationale d'innovation dans le secteur de la santé.

- En janvier 2024, Televic Healthcare a collaboré avec un prestataire de soins de santé privé au Kenya pour tester sa solution d'appel infirmier sans fil dans les maternités et les unités de soins intensifs. Ce développement souligne les efforts stratégiques de Televic pour étendre sa présence en Afrique de l'Est en proposant des solutions de communication patient évolutives et abordables, adaptées aux marchés de la santé en forte croissance.

- En décembre 2023, Hillrom, filiale de Baxter International Inc., a annoncé la modernisation réussie de l'infrastructure d'appel infirmier de plusieurs hôpitaux égyptiens, grâce à l'intégration de sa plateforme de communication infirmière NaviCare. Cette modernisation s'inscrit dans une transformation numérique plus large des établissements de santé nord-africains et témoigne de la volonté de Hillrom de proposer des solutions intelligentes et centrées sur le patient, améliorant ainsi les flux de travail et la communication au sein des environnements cliniques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.