Middle East And Africa Medical Device Testing Market

Taille du marché en milliards USD

TCAC :

%

USD

52.26 Million

USD

96.78 Million

2021

2029

USD

52.26 Million

USD

96.78 Million

2021

2029

| 2022 –2029 | |

| USD 52.26 Million | |

| USD 96.78 Million | |

|

|

|

Marché des tests de dispositifs médicaux au Moyen-Orient et en Afrique , par type de service (services de test, services d'inspection et services de certification), type de test (tests physiques, tests chimiques/biologiques, tests de cybersécurité, tests de microbiologie et de stérilité et autres), phase (préclinique et clinique), type d'approvisionnement (interne et externalisé), classe de dispositif (classe I, classe II et classe III), produit ( dispositif médical implantable actif , dispositif médical actif, dispositif médical non actif, dispositif médical de diagnostic in vitro, dispositif médical ophtalmique, dispositif médical orthopédique et dentaire, dispositif médical vasculaire et autres) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché des tests de dispositifs médicaux au Moyen-Orient et en Afrique

Les tests des dispositifs médicaux sont le processus qui permet de démontrer que le dispositif est utilisé de manière fiable et sûre. Lors du développement de nouveaux produits, des tests de validation de conception approfondis sont appliqués. Cela comprend des tests de performance, de toxicité, d'analyse chimique et parfois des tests cliniques ou des tests sur les facteurs humains. Les tests d'assurance qualité continus sont généralement plus limités. Cela comprend généralement des contrôles dimensionnels, certains tests fonctionnels et la vérification de l'emballage. Différents types de services de tests médicaux sont disponibles sur le marché, tels que des services d'inspection et de certification.

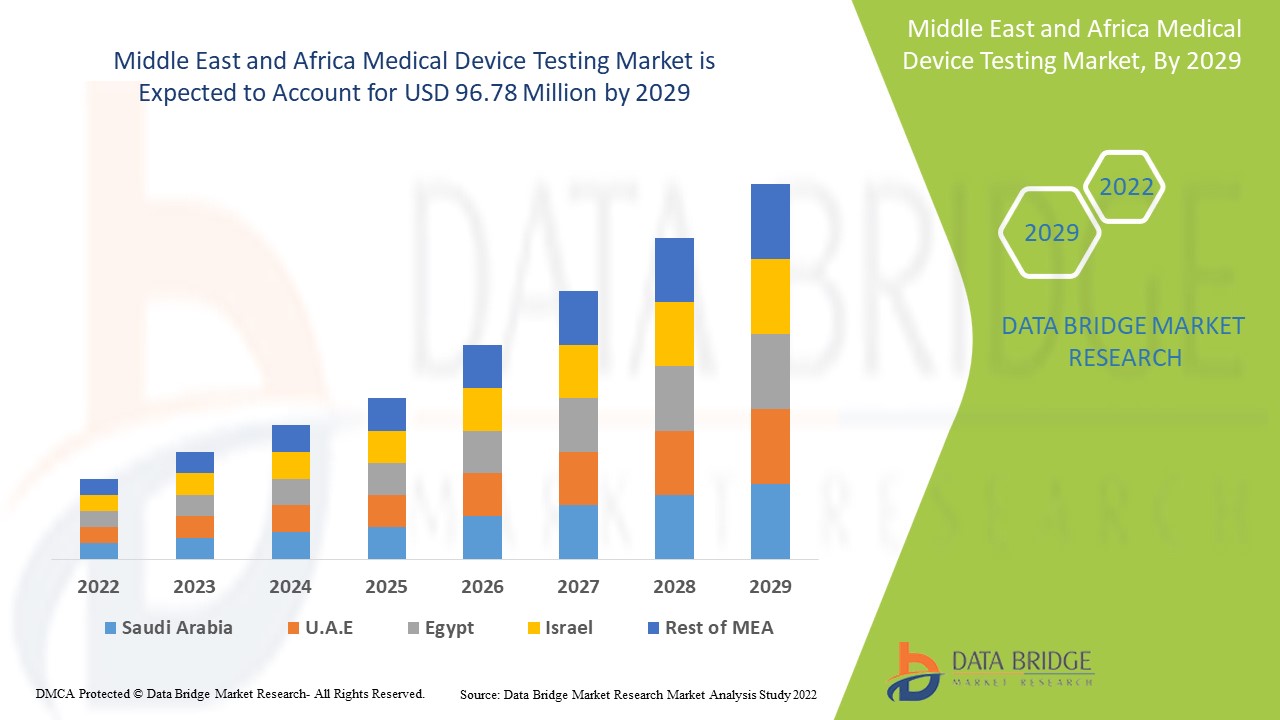

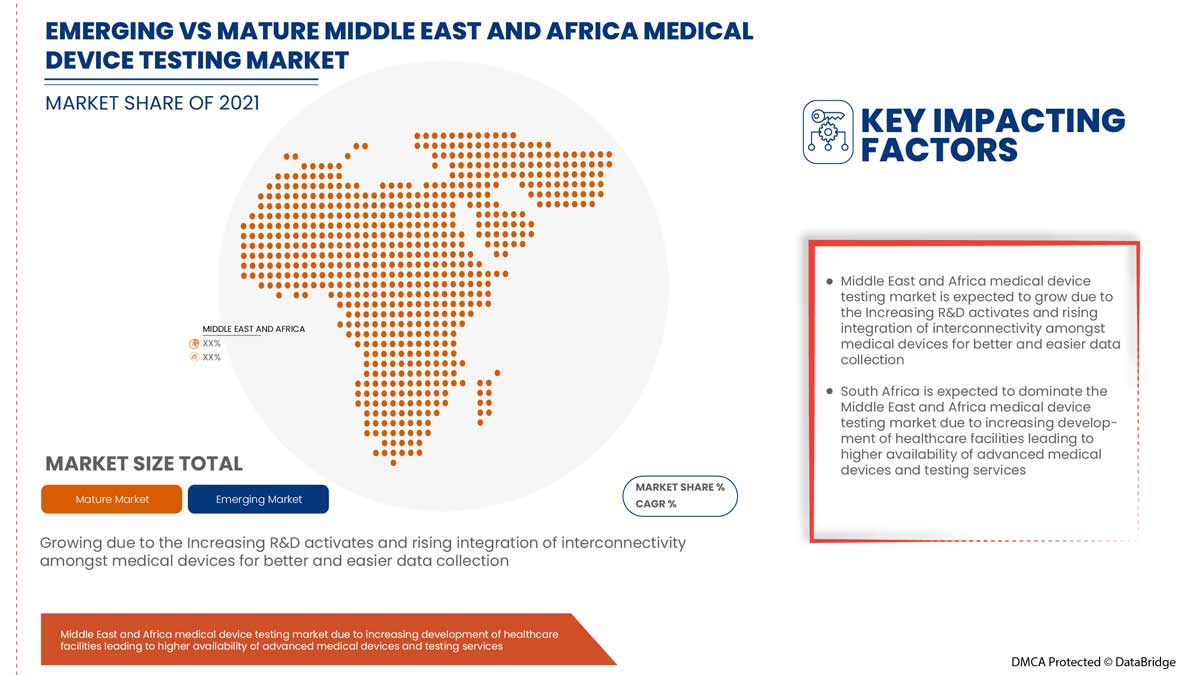

Le marché des tests de dispositifs médicaux au Moyen-Orient et en Afrique devrait croître au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 8,5 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 96,78 millions USD d'ici 2029 contre 52,26 millions USD en 2021.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de service (services de test, service d'inspection et services de certification), type de test (tests physiques, tests chimiques/biologiques, tests de cybersécurité, tests de microbiologie et de stérilité et autres), phase (préclinique et clinique), type d'approvisionnement (interne et externalisé), classe de dispositif (classe I, classe II et classe III), produit (dispositif médical implantable actif, dispositif médical actif, dispositif médical non actif, dispositif médical de diagnostic in vitro, dispositif médical ophtalmique, dispositif médical orthopédique et dentaire, dispositif médical vasculaire et autres) |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Intertek Group plc, SGS SA, Bureau Veritas, TUV SUD, TUV Rheinland, UL LLC, NSF, Eurofins Scientific, Element Materials Technology, Medical Engineering Technologies Ltd., et entre autres |

Définition du marché

Les tests des dispositifs médicaux sont le processus qui permet de démontrer que le dispositif fonctionne de manière fiable et sûre. Lors du développement de nouveaux produits, des tests de validation de conception approfondis sont appliqués. Cela comprend des tests de performance, des analyses de toxicité et chimiques, et parfois des tests sur les facteurs humains ou même des tests cliniques. Les tests d'assurance qualité continus sont généralement plus limités. Ils comprennent généralement des contrôles dimensionnels, certains tests fonctionnels et la vérification de l'emballage. Différents types de services de tests médicaux sont disponibles sur le marché, tels que des services d'inspection, des services de certification, etc.

Dynamique du marché des tests de dispositifs médicaux

Conducteurs

- Augmentation du besoin de vérification et de validation des dispositifs médicaux

Les méthodes de vérification et de validation sont largement utilisées dans le secteur de la santé. En général, la vérification est la phase de développement d'un produit pour savoir s'il est conforme aux exigences spécifiées, tandis que la validation vérifie si l'utilisation prévue a été respectée et, par conséquent, si les spécifications d'utilisabilité sont respectées. Les types de vérification et de validation les plus courants pour les dispositifs médicaux sont la vérification et la validation de la conception, des processus et des logiciels. Les dispositifs médicaux deviennent également plus petits et plus complexes dans leur conception, utilisant parfois des plastiques techniques avancés. Cela rend la validation et la vérification (V&V) d'autant plus importantes. Le résultat est une meilleure répétabilité, moins d'erreurs, moins de retouches et de reconceptions, des délais de commercialisation plus rapides, une compétitivité améliorée et des coûts de production réduits.

- Augmentation de la demande de tests in vitro

Les diagnostics in vitro (DIV) sont des tests effectués sur des échantillons tels que du sang ou des tissus prélevés sur le corps humain. Les diagnostics in vitro peuvent détecter des maladies ou d'autres affections et peuvent être utilisés pour surveiller l'état de santé général d'une personne afin de contribuer à guérir, traiter ou prévenir des maladies. Les tests in vitro sont utilisés dans la détection de diverses maladies telles que les infections par le VIH, le paludisme, l'hépatite, entre autres. La prévalence de ces maladies augmente rapidement à l'échelle mondiale, ce qui entraîne une demande croissante de tests in vitro et de divers dispositifs médicaux.

- L'escalade de l'innovation et des technologies

L'accélération du développement technologique dans le secteur de la santé a considérablement augmenté ces dernières années. Les progrès technologiques des dispositifs médicaux permettent un traitement indolore et simple pendant la gestion des maladies. De plus, l'innovation et la mise à niveau des dispositifs médicaux contribuent à un résultat précis et rapide du diagnostic des maladies. De plus, l'invention des dispositifs médicaux permet également d'optimiser la rentabilité des outils thérapeutiques basés sur la technologie pendant le traitement des maladies. De plus, de nombreux organismes gouvernementaux et organisations de soins de santé soutiennent les centres de recherche médicale. L'objectif principal de ce soutien est d'améliorer les innovations en matière de soins de santé dans le monde entier. Désormais, l'innovation croissante et les progrès technologiques renforcent la croissance des tests de dispositifs médicaux au cours de la période prévue.

Opportunité

-

Hausse des dépenses de santé

Les dépenses de santé ont augmenté dans le monde entier, en raison de l'augmentation du revenu disponible des citoyens dans divers pays. De plus, pour répondre aux besoins de la population, les organismes gouvernementaux et les organisations de santé prennent des initiatives en accélérant les dépenses de santé. L'augmentation des dépenses de santé aide simultanément les établissements de santé à améliorer leurs services de test des dispositifs médicaux au cours des dernières années.

En outre, les initiatives stratégiques prises par les principaux acteurs du marché assureront l’intégrité structurelle et les opportunités futures du marché des tests de dispositifs médicaux au cours de la période de prévision 2022-2029.

Retenue/Défi

- Obstacles au développement local des dispositifs médicaux

Toutefois, les obstacles au développement local des dispositifs médicaux et le coût élevé des dispositifs médicaux dans certaines régions peuvent entraver la production de dispositifs médicaux, ce qui freine la croissance du marché. En outre, la forte concurrence dans les industries de technologie médicale et les longs délais d'obtention de la qualification à l'étranger peuvent constituer des facteurs difficiles pour le développement du marché.

Ce rapport sur le marché des tests de dispositifs médicaux fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des tests de dispositifs médicaux, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact post-COVID-19 sur le marché des tests de dispositifs médicaux

La COVID-19 a eu un impact positif sur le marché. L'utilisation de dispositifs médicaux a augmenté au cours de ces années, tels que les scanners IRM, les ventilateurs et autres. Par conséquent, l'utilisation de divers appareils a considérablement augmenté dans la population mondiale. Par conséquent, la pandémie a eu un effet positif sur ce marché des tests

Développement récent

- En avril 2021, TUV SUD a annoncé qu'il s'était présenté au Medtec LIVE pour démontrer sa capacité à être un guichet unique pour les tests de dispositifs médicaux. Les services couvraient les tests de sécurité électrique et fonctionnelle, de cybersécurité et de logiciels, de CEM et de biocompatibilité. Les experts de TUV SUD ont participé au programme du salon et du congrès en ligne avec diverses conférences, un hack en direct et un pitch d'ascenseur

Portée du marché des tests de dispositifs médicaux au Moyen-Orient et en Afrique

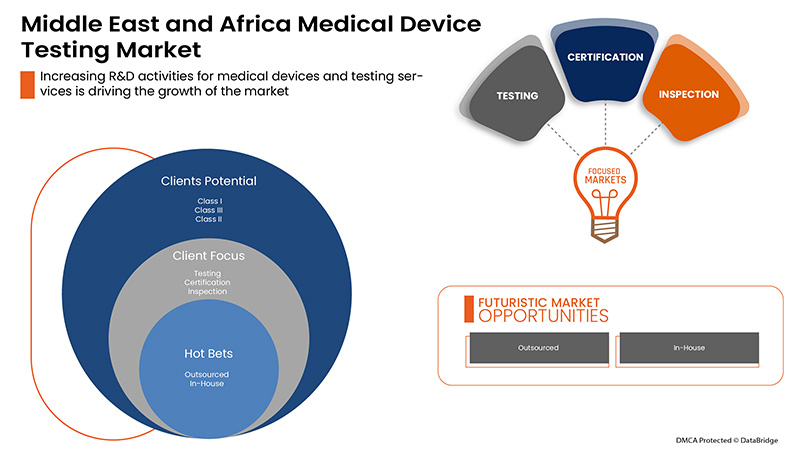

Le marché des tests de dispositifs médicaux au Moyen-Orient et en Afrique est segmenté en type de service, type de test, phase, type d'approvisionnement, classe d'appareil et produit. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de service

- Services de test

- Services d'inspection

- Services de certification

Sur la base du type de service, le marché des tests de dispositifs médicaux au Moyen-Orient et en Afrique est segmenté en services de test, services d'inspection et services de certification.

Type de test

- Tests physiques

- Tests chimiques/biologiques

- Tests de cybersécurité

- Microbiologie et tests de stérilité

- Autres

Sur la base du type de test, le marché des tests de dispositifs médicaux au Moyen-Orient et en Afrique est segmenté en tests physiques, tests chimiques/biologiques, tests de cybersécurité, tests de microbiologie et de stérilité et autres.

Phase

- Préclinique

- Clinique

Sur la base de la phase, le marché des tests de dispositifs médicaux au Moyen-Orient et en Afrique est segmenté en préclinique et clinique.

Type d'approvisionnement

- Externalisé

- En interne

Sur la base du type d'approvisionnement, le marché des tests de dispositifs médicaux au Moyen-Orient et en Afrique est segmenté en interne et en externalisation.

Classe d'appareil

- Classe I

- Classe II

- Classe III

Sur la base de la classe d'appareil, le marché des tests d'appareils médicaux du Moyen-Orient et de l'Afrique est segmenté en classe I, classe II et classe III.

Produit

- Dispositif médical implantable actif

- Dispositif médical actif

- Dispositif médical non actif

- Dispositif médical de diagnostic in vitro

- Dispositif médical ophtalmique

- Dispositif médical orthopédique et dentaire

- Dispositif médical vasculaire

- Autres

Sur la base du produit, le marché des tests de dispositifs médicaux du Moyen-Orient et de l'Afrique est segmenté en dispositif médical implantable actif, dispositif médical actif, dispositif médical non actif, dispositif médical de diagnostic in vitro, dispositif médical ophtalmique, dispositif médical orthopédique et dentaire, dispositif médical vasculaire et autres.

Analyse/perspectives régionales du marché des tests de dispositifs médicaux

Le marché des tests de dispositifs médicaux est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de service, type de test, phase, type d'approvisionnement, classe d'appareil et produit comme référencé ci-dessus.

Les pays couverts dans la région Moyen-Orient et Afrique sont l’Arabie saoudite, les Émirats arabes unis, Israël, l’Égypte, l’Afrique du Sud et le reste du Moyen-Orient et de l’Afrique.

L'Afrique du Sud domine le marché des tests de dispositifs médicaux en termes de part de marché et de chiffre d'affaires et continuera à accroître sa domination au cours de la période de prévision. Cela est dû au besoin croissant de vérifier et de valider les dispositifs médicaux dans la région.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Medical Device Testing Market Share Analysis

The medical device testing market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on medical device testing market.

Some of the major players operating in the medical device testing market are Intertek Group plc, SGS SA, Bureau Veritas, TUV SUD, TUV Rheinland, UL LLC, NSF, Eurofins Scientific, Element Materials Technology, Medical Engineering Technologies Ltd., and among others

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analysed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Middle East and Africa vs. Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry

Customization Available

Data Bridge Market Research est un leader dans la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'aux stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez pour obtenir des données dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING NEED FOR VERIFICATION VALIDATION OF MEDICAL DEVICES

6.1.2 INCREASING DEMAND FOR IN-VITRO TESTS

6.1.3 ESCALATION IN INNOVATION AND TECHNOLOGIES

6.2 RESTRAINTS

6.2.1 BARRIERS TO THE LOCAL DEVELOPMENT OF MEDICAL DEVICES

6.2.2 HIGH COST OF MEDICAL DEVICES

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 DEVELOPMENT IN AI AND IOT IN VARIOUS MEDICAL DEVICES

6.3.3 STRATEGIC INITIATIVES OF KEY PLAYERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION IN MEDICAL TECHNOLOGY INDUSTRY

6.4.2 LONG LEAD TIME FOR OVERSEAS QUALIFICATION

7 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE

7.1 OVERVIEW

7.2 TESTING SERVICES

7.3 INSPECTION SERVICES

7.4 CERTIFICATION SERVICES

8 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 CHEMICAL/BIOLOGICAL TESTING

8.3 MICROBIOLOGY AND STERILITY TESTING

8.3.1 STERILITY TEST & VALIDATION

8.3.2 BIO BURDEN DETERMINATION

8.3.3 ANTIMICROBIAL ACTIVITY TESTING

8.3.4 PYROGEN & ENDOTOXIN TESTING

8.3.5 OTHERS

8.4 PHYSICAL TESTING

8.4.1 ELECTRICAL SAFETY TESTING

8.4.2 FUNCTIONAL SAFETY TESTING

8.4.3 EMC TESTING

8.4.4 ENVIRONMENTAL TESTING

8.4.5 OTHERS

8.5 CYBERSECURITY TESTING

8.6 OTHERS

9 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY PHASE

9.1 OVERVIEW

9.2 PRECLINICAL

9.3 CLINICAL

10 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE

10.1 OVERVIEW

10.2 OUTSOURCED

10.3 IN-HOUSE

11 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS

11.1 OVERVIEW

11.2 CLASS I

11.3 CLASS III

11.4 CLASS II

12 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY PRODUCT

12.1 OVERVIEW

12.2 NON-ACTIVE MEDICAL DEVICE

12.3 ORTHOPEDIC AND DENTAL MEDICAL DEVICE

12.4 ACTIVE IMPLANT MEDICAL DEVICE

12.5 VASCULAR MEDICAL DEVICE

12.6 ACTIVE MEDICAL DEVICE

12.7 IN-VITRO DIAGNOSTICS MEDICAL DEVICE

12.8 OPTHALMIC MEDICAL DEVICE

12.9 OTHERS

13 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY GEOGRAPHY

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 LABCORP

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 CHARLES RIVER LABORATORIES.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 TUV SUD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 WUXI APPTEC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 SGS SA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 NORTH AMERICAN SCIENCE ASSOCIATES, LLC

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 HOHENSTEIN

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ARBRO PHARMACEUTICALS PRIVATE LIMITED & AURIGA RESEARCH PRIVATE LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BIOMEDICAL DEVICE LABS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 BIONEEDS

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 BUREAU VERITAS

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 CIGNITI

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 ELEMENT MATERIALS TECHNOLOGY

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 ENDOLAB MECHANICAL ENGINEERING GMBH

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 EUROFINS SCIENTIFIC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 GATEWAY ANALYTICAL.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 IMR TEST LABS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 INTERTEK GROUP PLC

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 ITC ZLIN

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MEDICAL ENGINEERING TECHNOLOGIES LTD.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 MEDISTRI SA

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 NELSON LABORATORIES, LLC- A SOTERA HEALTH COMPANY

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 NSF.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 PACE

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 Q LABORATORIES

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 TUV RHEINLAND

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 UL LLC

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 FDA REGULATIONS BASED ON DEVICES TYPE

TABLE 2 PRICES OF ESSENTIAL MEDICAL DEVICES

TABLE 3 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA TESTING SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA INSPECTION SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA CERTIFICATION SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA CHEMICAL/BIOLOGICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CYBERSECURITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA PRECLINICAL IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA CLINICAL IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA OUTSOURCED IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA IN-HOUSE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA CLASS I IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CLASS III IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA CLASS II IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA NON-ACTIVE MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA ORTHOPEDIC AND DENTAL MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA ACTIVE IMPLANT MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA VASCULAR MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA ACTIVE MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA IN-VITRO MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA OPTHALMIC MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA OTHERS IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY REGION, 2019-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 U.A.E MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.A.E MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.A.E MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.A.E MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 64 U.A.E MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.A.E MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 66 U.A.E MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 ISRAEL MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 68 ISRAEL MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 69 ISRAEL MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 70 ISRAEL PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 71 ISRAEL MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 72 ISRAEL MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 73 ISRAEL MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 74 ISRAEL MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 EGYPT MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 76 EGYPT MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 77 EGYPT MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 78 EGYPT PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 79 EGYPT MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 80 EGYPT MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 81 EGYPT MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 82 EGYPT MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 REST OF MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: MARKET TESTING TYPE COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND FOR IN-VITRO TESTS AND DEVELOPMENT IN AI AND IOT IN VARIOUS MEDICAL DEVICES ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TESTING SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA MEDICAL DEVICE TESTINGMARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET

FIGURE 15 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PHASE, 2021

FIGURE 24 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PHASE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PHASE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PHASE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, 2021

FIGURE 28 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, 2021

FIGURE 32 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PRODUCT, 2021

FIGURE 36 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 37 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 38 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 39 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET: SNAPSHOT (2021)

FIGURE 40 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2021)

FIGURE 41 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE (2022-2029)

FIGURE 44 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.