Middle East And Africa Medical Device Outsourcing Market

Taille du marché en milliards USD

TCAC :

%

USD

8.43 Billion

USD

21.47 Billion

2025

2033

USD

8.43 Billion

USD

21.47 Billion

2025

2033

| 2026 –2033 | |

| USD 8.43 Billion | |

| USD 21.47 Billion | |

|

|

|

|

Marché de l'externalisation des dispositifs médicaux au Moyen-Orient et en Afrique, par services (assurance qualité, services d'affaires réglementaires, services de conception et de développement de produits, services de test et de stérilisation de produits, services de mise en œuvre de produits, services de mise à niveau de produits, services de maintenance de produits, services de matières premières, services d'équipements médicaux électriques, fabrication sous contrat, caractérisation des matériaux et des produits chimiques), produit (produits finis, électronique, matières premières), type d'appareil (classe I, classe II, classe III), application (cardiologie, imagerie diagnostique, orthopédie, IVD, ophtalmique, chirurgie générale et plastique, administration de médicaments, dentaire, endoscopie, soins du diabète et autres), utilisateur final (petite entreprise de dispositifs médicaux, entreprise moyenne de dispositifs médicaux, grande entreprise de dispositifs médicaux et autres), pays (Afrique du Sud, Arabie saoudite, Émirats arabes unis, Israël, Égypte et reste du Moyen-Orient et de l'Afrique) Tendances et prévisions de l'industrie jusqu'en 2028.

Analyse et perspectives du marché : marché de l'externalisation des dispositifs médicaux au Moyen-Orient et en Afrique

Analyse et perspectives du marché : marché de l'externalisation des dispositifs médicaux au Moyen-Orient et en Afrique

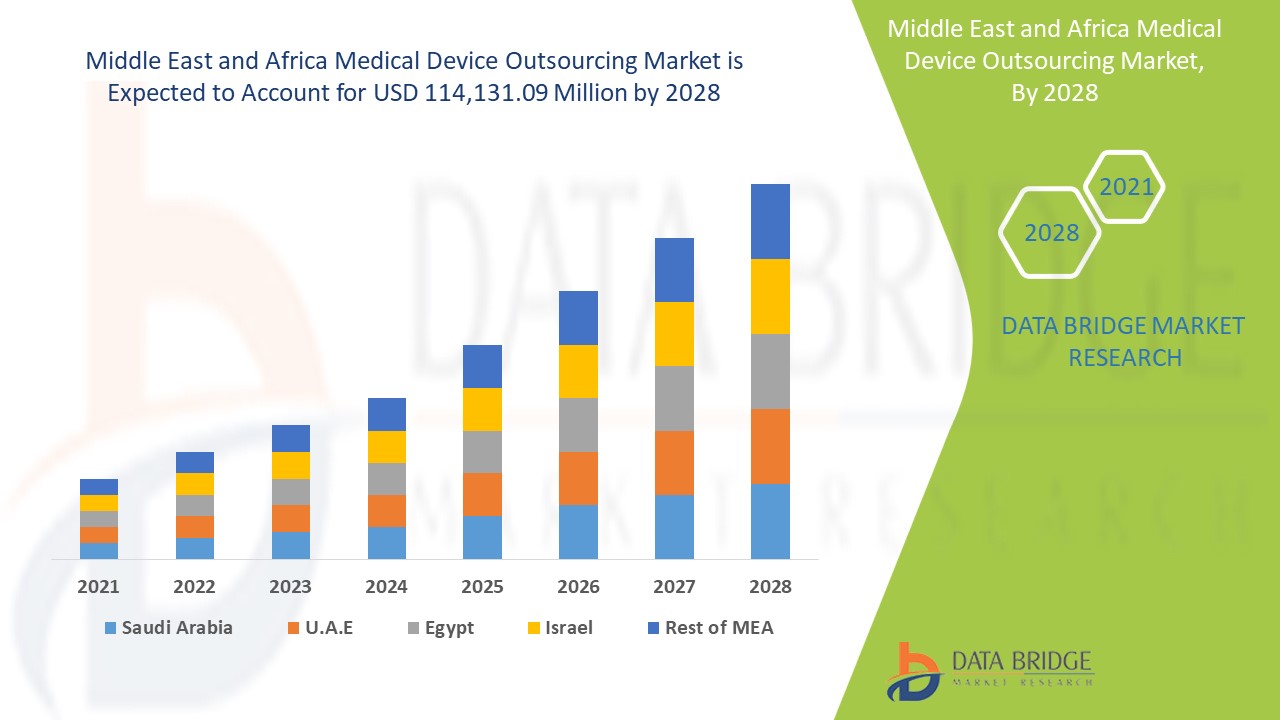

Le marché de l'externalisation des dispositifs médicaux devrait connaître une croissance du marché au cours de la période de prévision de 2020 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 12,4% au cours de la période de prévision de 2021 à 2028 et devrait atteindre 114 131,09 millions USD d'ici 2028 contre 46 676,11 millions USD en 2020. L'incidence croissante des infections chroniques, l'acceptation de l'utilisation de dispositifs non invasifs et l'augmentation des dépenses de santé sont susceptibles d'être les principaux moteurs qui propulsent la demande du marché au cours de la période de prévision.

Le besoin croissant de services de santé de qualité est alimenté par le marché mondial de l'externalisation des dispositifs médicaux. La fabrication sous contrat de dispositifs médicaux consiste à sous-traiter l'assemblage d'un dispositif médical pour le marché médical. Afin de réaliser une fabrication récurrente, les entreprises de dispositifs médicaux peuvent faire appel à des partenaires de fabrication sous contrat et bénéficier d'une efficacité des coûts, d'une chaîne d'approvisionnement rationalisée, d'un alignement logistique et de bien d'autres choses encore, le tout pour garantir que toutes les exigences de l'industrie sont satisfaites tout en leur permettant de livrer des produits commerciaux sur le marché.

Les cycles de vie des produits étant courts, les fabricants de dispositifs médicaux dépendent fortement de l'innovation et des technologies avancées pour se développer sur un marché en pleine évolution. Parmi les innovations sur le marché de l'externalisation des dispositifs médicaux, on peut citer la R&D externalisée des dispositifs médicaux, les dispositifs médicaux portables, l'approche centrée sur le patient, les examens robotisés et la chirurgie robotisée, qui conduisent souvent à une efficacité accrue, à une amélioration du rendement, à une amélioration de la qualité et à une réduction des travaux en cours (WIP), ainsi qu'à une réduction des risques commerciaux et à une accélération de l'entrée sur le marché des produits. Le marché de l'externalisation des dispositifs médicaux a connu une croissance rapide, ce qui a permis d'améliorer l'efficacité organisationnelle, de raccourcir les cycles de développement des produits et d'améliorer l'accès à la haute technologie.

Cependant, des facteurs tels que les changements de l'Organisation internationale de normalisation (ISO) : 13485, le cadre réglementaire strict, les perturbations dans la gestion de la chaîne d'approvisionnement en raison d'une pandémie entravent la croissance du marché mondial de l'externalisation des dispositifs médicaux. D'autre part, l'augmentation de la population gériatrique et l'augmentation de l'utilisation des dispositifs médicaux interventionnels (DMI) constituent des opportunités pour la croissance du marché mondial de l'externalisation des dispositifs médicaux. L'augmentation des alternatives de services et les problèmes de conformité avec l'externalisation sont les défis auxquels est confronté le marché mondial de l'externalisation des dispositifs médicaux.

Le rapport sur le marché de l'externalisation des dispositifs médicaux fournit des détails sur les parts de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché de l'externalisation des dispositifs médicaux au Moyen-Orient et en Afrique

Portée et taille du marché de l'externalisation des dispositifs médicaux au Moyen-Orient et en Afrique

Le marché de l'externalisation des dispositifs médicaux est segmenté en fonction des services, des produits, du type d'appareil, de l'application et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base des services, le marché de l'externalisation des dispositifs médicaux est segmenté en assurance qualité, services d'affaires réglementaires, services de conception et de développement de produits, services de test et de stérilisation de produits, services de mise en œuvre de produits, services de mise à niveau de produits, services de maintenance de produits, services de matières premières, services d'équipements électriques médicaux, fabrication sous contrat et caractérisation des matériaux et des produits chimiques. En 2021, le segment de la fabrication sous contrat devrait dominer le marché mondial de l'externalisation des dispositifs médicaux en raison de la non-disponibilité des machines, de la main-d'œuvre, des installations et des dépenses élevées pour la fabrication de dispositifs médicaux dans différentes régions du monde.

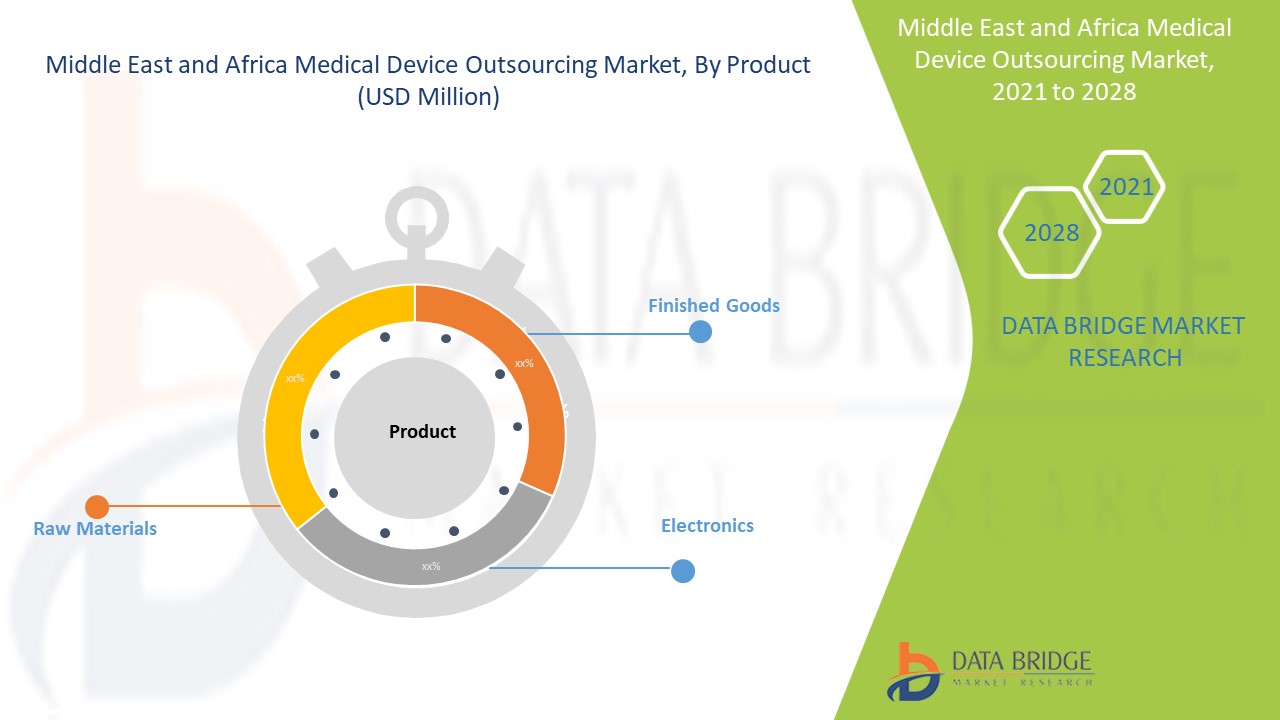

- Sur la base du produit, le marché de l'externalisation des dispositifs médicaux est segmenté en produits finis, en électronique et en matières premières. En 2021, le segment des produits finis devrait dominer le marché mondial de l'externalisation des dispositifs médicaux en raison de la demande croissante de dispositifs médicaux dans le monde entier pour traiter les patients.

- En fonction du type d'appareil, le marché de l'externalisation des dispositifs médicaux est segmenté en classe I, classe II et classe III. En 2021, le segment de classe I devrait dominer le marché mondial de l'externalisation des dispositifs médicaux en raison de la demande croissante de dispositifs médicaux dans le monde entier pour traiter les patients atteints de maladies chroniques.

- En fonction des applications, le marché de l'externalisation des dispositifs médicaux est segmenté en cardiologie, imagerie diagnostique, orthopédie, diagnostic in vitro, ophtalmologie, chirurgie générale et plastique, administration de médicaments, dentisterie, endoscopie, soins du diabète et autres. En 2021, le segment de la cardiologie devrait dominer le marché mondial de l'externalisation des dispositifs médicaux en raison de la demande croissante de dispositifs médicaux de cardiologie dans le monde entier pour traiter les patients atteints de maladies cardiovasculaires.

- En fonction de l'utilisateur final, le marché de l'externalisation des dispositifs médicaux est segmenté en petites entreprises de dispositifs médicaux, moyennes entreprises de dispositifs médicaux et grandes entreprises de dispositifs médicaux, entre autres. En 2021, le segment des petites entreprises de dispositifs médicaux devrait dominer le marché mondial de l'externalisation des dispositifs médicaux en raison du nombre croissant de petites entreprises de dispositifs médicaux dans un pays en développement.

Analyse du marché de l'externalisation des dispositifs médicaux au niveau des pays

Le marché de l'externalisation des dispositifs médicaux est analysé et des informations sur la taille du marché sont fournies par pays, services, produit, type d'appareil, application et utilisateur final.

Les pays couverts dans le rapport sur le marché de l’externalisation des dispositifs médicaux sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, Israël, l’Égypte, le Koweït et le reste du Moyen-Orient.

L’Afrique du Sud devrait dominer le marché du Moyen-Orient et de l’Afrique en raison de l’incidence croissante des infections chroniques et de l’augmentation des dépenses de santé.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Le potentiel de croissance de l'externalisation des dispositifs médicaux dans les économies émergentes et les initiatives stratégiques des acteurs du marché créent de nouvelles opportunités sur le marché de l'externalisation des dispositifs médicaux

Le marché de l'externalisation des dispositifs médicaux vous fournit également une analyse de marché détaillée pour chaque pays, la croissance d'un secteur particulier avec les ventes de dispositifs de débridement des plaies, l'impact des progrès dans l'externalisation des dispositifs médicaux et les changements dans les scénarios réglementaires avec leur soutien au marché de l'externalisation des dispositifs médicaux. Les données sont disponibles pour la période historique de 2011 à 2020.

Analyse du paysage concurrentiel et des parts de marché de l'externalisation des dispositifs médicaux

Le paysage concurrentiel du marché de l'externalisation des dispositifs médicaux fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et la portée du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché de l'externalisation des dispositifs médicaux.

Français Les principales entreprises impliquées dans l'externalisation des dispositifs médicaux sont SGS SA, TOXIKON, Pace Analytical, Intertek Group plc, WuXi AppTec, North American Science Associates, Inc., American Preclinical Services, LLC., Sterigenics US, LLC – Une société Sotera Health, Charles River Laboratories, Celestica Inc., Creganna, FLEX LTD., Heraeus Holding, Integer Holdings Corporation, Nortech Systems, Inc., Plexus Corp., Sanmina Corporation, EUROFINS SCIENTIFIC, TE Connectivity, ICON plc, Parexel International Corporation, Labcorp Drug Development, Tecomet, Inc., IQVIA, Jabil Inc. Syneos Health, PROVIDIEN LLC., Cekindo Business International East/West Industries, Inc., TÜV SÜD entre autres.

De nombreux développements de produits sont également initiés par les entreprises du monde entier, ce qui accélère également la croissance du marché de l’externalisation des dispositifs médicaux.

Par exemple,

- En juillet 2021, BREATHE et IQVIA ont collaboré pour accélérer le diagnostic et le traitement précoces des maladies respiratoires. Cette étape stratégique de collaboration visant à améliorer les résultats de santé et la qualité de vie des personnes atteintes de maladies respiratoires au Royaume-Uni devrait dynamiser le marché.

La collaboration, les coentreprises et d’autres stratégies des acteurs du marché améliorent l’entreprise sur le marché de l’externalisation des dispositifs médicaux, ce qui offre également l’avantage à l’organisation d’améliorer son offre de produits de traitement.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.