Middle East And Africa Laxative Market

Taille du marché en milliards USD

TCAC :

%

USD

587.70 Billion

USD

861.70 Billion

2024

2032

USD

587.70 Billion

USD

861.70 Billion

2024

2032

| 2025 –2032 | |

| USD 587.70 Billion | |

| USD 861.70 Billion | |

|

|

|

|

Segmentation du marché des laxatifs au Moyen-Orient et en Afrique, par type (laxatifs osmotiques, laxatifs stimulants, laxatifs de lest, laxatifs lubrifiants et émollients), arômes (avec ou sans arôme), origine (naturelle, synthétique et autres), indication (constipation chronique, syndrome de l'intestin irritable avec constipation, constipation induite par les opioïdes, constipation aiguë et autres), mode d'achat (sur ordonnance et en vente libre), forme pharmaceutique ( comprimés , gélules, poudre, solution buvable, gel, suppositoires et autres), voie d'administration (orale et rectale), population cible (enfants et adultes), circuit de distribution (hôpitaux, EHPAD, soins à domicile , pharmacies, grandes surfaces/magasins de beauté et autres), circuit de distribution (vente directe, grossistes et autres) - Tendances du secteur et prévisions jusqu'en 2032

Taille du marché des laxatifs au Moyen-Orient et en Afrique

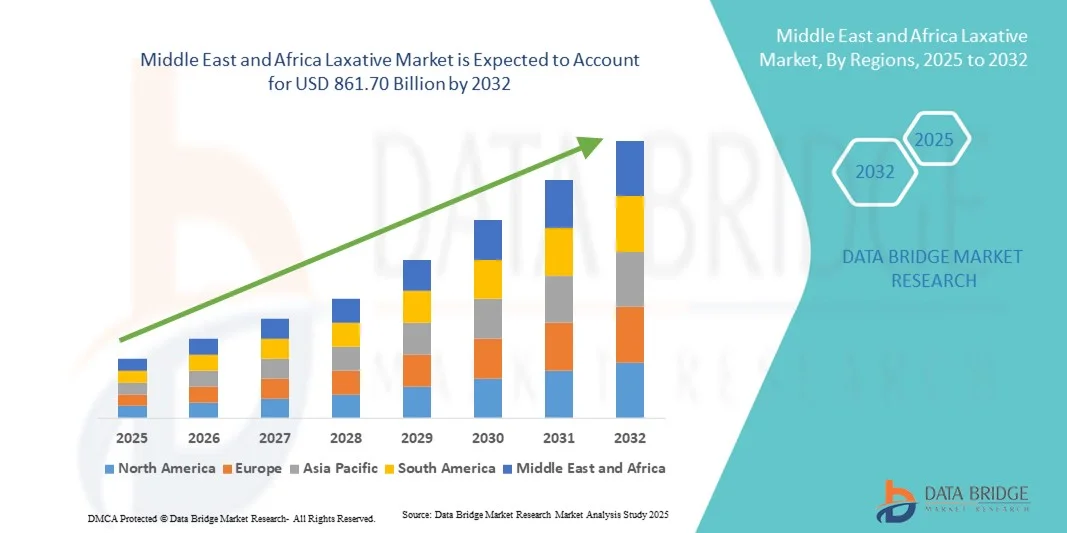

- Le marché des laxatifs au Moyen-Orient et en Afrique était évalué à 587,70 milliards de dollars américains en 2024 et devrait atteindre 861,70 milliards de dollars américains d'ici 2032 , soit un taux de croissance annuel composé (TCAC) de 4,90 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante de la constipation et des troubles gastro-intestinaux, ainsi que par une sensibilisation accrue des consommateurs à la santé digestive. Un meilleur accès aux soins de santé, l'évolution des modes de vie et des habitudes alimentaires contribuent à une demande plus forte de solutions laxatives efficaces à l'échelle mondiale.

- Par ailleurs, le marché est stimulé par le développement de laxatifs innovants et spécialisés, notamment osmotiques, stimulants, de lest et à base de plantes. L'expansion des canaux de commerce électronique, les partenariats stratégiques entre entreprises pharmaceutiques et la préférence croissante des consommateurs pour les produits en vente libre contribuent significativement à l'adoption des laxatifs et à la croissance globale du marché.

Analyse du marché des laxatifs au Moyen-Orient et en Afrique

- Le marché des laxatifs connaît une croissance significative en raison de la prévalence croissante de la constipation et des troubles gastro-intestinaux, d'une sensibilisation accrue à la santé digestive et de l'évolution des habitudes alimentaires et des modes de vie. La disponibilité croissante des laxatifs sans ordonnance et la préférence des consommateurs pour l'automédication stimulent leur utilisation à l'échelle mondiale.

- Par ailleurs, le marché est stimulé par le développement de laxatifs innovants, notamment les laxatifs de lest, osmotiques, stimulants et à base de plantes. L'expansion des plateformes de commerce électronique, les collaborations stratégiques entre les entreprises pharmaceutiques et la prise de conscience croissante des consommateurs en matière de santé contribuent significativement à la croissance du marché.

- L’Arabie saoudite a dominé le marché des laxatifs au Moyen-Orient en 2024, avec une part de marché de 41,2 %, grâce à des dépenses de santé élevées, une sensibilisation accrue à la santé digestive et un accès facilité aux médicaments sans ordonnance. Le pays est en tête dans la région grâce à l’adoption précoce de nouvelles formulations et à un réseau de distribution pharmaceutique bien établi.

- Les Émirats arabes unis devraient connaître la croissance la plus rapide du marché au Moyen-Orient au cours de la période de prévision (2025-2032), avec un TCAC de 9,3 %, grâce à l'urbanisation croissante, à l'augmentation des revenus disponibles, au développement des infrastructures de santé et à la sensibilisation accrue des consommateurs au bien-être digestif.

- Le segment oral a représenté la plus grande part de revenus du marché (84,3 %) en 2024, grâce à sa facilité d'administration, son côté pratique et l'excellente observance des patients. Les formulations orales répondent aux besoins de la constipation chronique et aiguë.

Portée du rapport et segmentation du marché des laxatifs

|

Attributs |

Principaux enseignements du marché des laxatifs |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, l'épidémiologie des patients, l'analyse du pipeline, l'analyse des prix et le cadre réglementaire. |

Tendances du marché des laxatifs au Moyen-Orient et en Afrique

La demande croissante est alimentée par une sensibilisation accrue à la santé digestive.

- Une tendance significative et croissante sur le marché des laxatifs au Moyen-Orient et en Afrique est la sensibilisation accrue de la population à la santé digestive et aux soins préventifs. Les consommateurs accordent une importance grandissante à la santé intestinale, à la gestion de leur alimentation et à leur bien-être général, ce qui stimule la demande de laxatifs efficaces et sûrs.

- Par exemple, dans la région, les consommateurs soucieux de leur santé privilégient les laxatifs naturels et à base de fibres qui soulagent en douceur sans créer de dépendance, ce qui contribue à la popularité des produits d'origine végétale. De même, les entreprises pharmaceutiques s'attachent à développer des formules alliant efficacité et effets secondaires minimes, pour traiter la constipation chronique comme occasionnelle.

- Les acteurs du marché investissent dans des formats d'administration innovants, tels que les comprimés à croquer, les poudres et les préparations pour boissons, afin d'améliorer le confort d'utilisation et l'observance thérapeutique. Par ailleurs, on observe une attention croissante portée aux formulations pédiatriques et gériatriques qui répondent aux besoins physiologiques spécifiques de ces populations.

- L'intégration des laxatifs dans les programmes de soins préventifs, conjuguée à une sensibilisation et à des recommandations croissantes des médecins, favorise leur adoption sur le marché. Les entreprises mènent également des campagnes de sensibilisation pour informer les consommateurs sur l'importance de la consommation de fibres, de l'hydratation et des modifications du mode de vie, ce qui stimule une demande soutenue.

- Cette tendance vers des laxatifs plus efficaces, plus sûrs et plus faciles d'utilisation redéfinit en profondeur les attentes des consommateurs et encourage l'innovation. Par conséquent, les principaux acteurs du marché lancent des formules adaptées à un large éventail de consommateurs, notamment ceux qui ont un système digestif sensible, des affections chroniques ou une constipation liée au mode de vie.

- La demande de laxatifs diversifiés, à la fois efficaces et pratiques, croît rapidement dans les circuits de distribution en pharmacie et en grande distribution, les consommateurs accordant une importance croissante au bien-être digestif et à l'accessibilité des solutions.

Dynamique du marché des laxatifs au Moyen-Orient et en Afrique

Conducteur

Besoin croissant dû à une sensibilisation accrue à la santé digestive et aux changements de mode de vie

- La prévalence croissante des troubles digestifs, des selles irrégulières et de la constipation liée au mode de vie au Moyen-Orient et en Afrique est un facteur important de la demande accrue de laxatifs.

- Par exemple, en mars 2024, une grande entreprise pharmaceutique a lancé un nouveau laxatif à base de plantes ciblant la constipation chronique, répondant ainsi à la demande croissante de remèdes naturels. Ces innovations de produits par des entreprises clés devraient stimuler la croissance du marché des laxatifs au cours de la période de prévision.

- Alors que les professionnels de la santé mettent l'accent sur la prévention et une bonne gestion de la santé digestive, les consommateurs recherchent des produits qui soulagent efficacement et en toute sécurité. Cela a incité les fabricants à améliorer les formules, le goût et à réduire les effets secondaires.

- De plus, l'urbanisation croissante, la sédentarité et les changements alimentaires contribuent à l'augmentation de la prévalence de la constipation, favorisant ainsi le recours aux laxatifs. Les campagnes de sensibilisation et les recommandations des médecins renforcent également la confiance des consommateurs et contribuent à l'expansion du marché.

- La commodité, l'accessibilité et la variété des types de produits, y compris les formulations en vente libre et sur ordonnance, sont des facteurs clés qui stimulent la croissance du marché. La tendance à une consommation axée sur le bien-être et à une gestion proactive de la santé digestive contribue également à l'adoption des laxatifs dans les circuits de distribution et de soins de santé.

Retenue/Défi

Préoccupations concernant la sécurité, les effets secondaires et le coût du produit

- Les inquiétudes liées aux effets secondaires potentiels, tels que la déshydratation, les déséquilibres électrolytiques ou la dépendance, constituent un frein important à l'adoption généralisée des laxatifs sur le marché. Les consommateurs peuvent hésiter à utiliser certaines formulations sans avis médical, ce qui limite la consommation de produits plus puissants ou sur ordonnance.

- Par exemple, des cas signalés d'inconfort abdominal ou de ballonnements liés à l'utilisation de laxatifs stimulants ont incité certains consommateurs à la prudence, affectant ainsi la pénétration du marché dans certains segments.

- Il est crucial de répondre à ces préoccupations en matière de sécurité par le biais d'études cliniques, d'un étiquetage transparent et de recommandations médicales afin de renforcer la confiance des consommateurs. Les entreprises s'attachent également à développer des formulations naturelles, à base de fibres et à faible dose pour minimiser les effets indésirables et rassurer les consommateurs. Par ailleurs, le coût relativement élevé de certains laxatifs innovants ou spécialisés, comparé aux options traditionnelles, peut constituer un frein pour les consommateurs sensibles au prix, notamment dans les régions en développement.

- Si les produits génériques offrent un prix abordable, les formulations haut de gamme dotées de mécanismes d'administration avancés ou d'une double action sont souvent plus chères, ce qui peut en limiter l'accessibilité.

- Pour assurer une croissance durable du marché, il est essentiel de surmonter ces défis grâce à des tests de sécurité rigoureux, à l'éducation des consommateurs sur le bon usage des produits et au développement d'options laxatives plus sûres et plus économiques.

Étendue du marché des laxatifs au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type, des arômes, de la source, de l'indication, du mode d'achat, de la forme posologique, de la voie d'administration, du type de population, du canal de vente et du canal de distribution.

- Par type

Le marché des laxatifs est segmenté selon leur type en laxatifs osmotiques, laxatifs stimulants, laxatifs de lest et laxatifs lubrifiants et émollients. En 2024, le segment des laxatifs osmotiques représentait la plus grande part de marché (42,5 %), grâce à sa large recommandation pour la prise en charge de la constipation chronique et du syndrome de l'intestin irritable avec constipation. Ces laxatifs agissent en retenant l'eau dans l'intestin, en ramollissant les selles et en favorisant le transit intestinal, ce qui améliore l'observance du traitement. Ce segment bénéficie d'une large recommandation de la part des médecins et de son intégration dans les recommandations thérapeutiques. Les laxatifs osmotiques sont privilégiés en raison de leurs effets secondaires relativement bénins et de leur efficacité prévisible. Leur disponibilité sans ordonnance et les campagnes de sensibilisation contribuent également à stimuler leur utilisation. Leur intégration dans des thérapies combinées avec des probiotiques et des compléments alimentaires soutient la demande. Les patients continuent souvent à utiliser des laxatifs osmotiques au long cours, ce qui assure la pérennité du chiffre d'affaires. Ce segment connaît une croissance constante chez les enfants et les adultes. La prévalence croissante des troubles liés à la constipation chez les populations vieillissantes consolide encore davantage sa position dominante sur le marché. La facilité d'utilisation des formulations orales telles que les comprimés, les poudres et les solutions buvables favorise leur adoption. La présence mondiale sur les marchés émergents contribue au maintien de leur part de marché.

Le segment des laxatifs stimulants devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 19,2 %, entre 2025 et 2032, porté par une utilisation croissante dans les cas de constipation aiguë et induite par les opioïdes. Ces agents agissent en stimulant la motilité intestinale, procurant un soulagement rapide. La sensibilisation des professionnels de santé et des patients à la constipation induite par les opioïdes favorise leur adoption. Les innovations en matière de formulation, notamment les comprimés à libération prolongée et les produits combinés, améliorent l'efficacité et réduisent les effets indésirables. Les hôpitaux et les établissements de soins pour personnes âgées recommandent de plus en plus les laxatifs stimulants pour des interventions de courte durée. L'essor du commerce électronique et des ventes en pharmacie en ligne accélère encore la croissance. Le segment bénéficie du nombre croissant de patients souffrant de douleurs chroniques et utilisant des opioïdes, ce qui entraîne une augmentation de la demande. Des campagnes de marketing et de sensibilisation ciblées renforcent la visibilité des produits. Les professionnels de santé intègrent de plus en plus les laxatifs stimulants dans les protocoles de traitement de la constipation aiguë. La rapidité d'action de ces produits garantit une utilisation répétée et la fidélité des prescripteurs. Les autorisations réglementaires sur de nombreux marchés améliorent leur disponibilité.

- Par saveurs

En fonction des arômes, le marché est segmenté en laxatifs aromatisés et non aromatisés. Le segment des laxatifs aromatisés a représenté la plus grande part de marché (55,3 %) en 2024, grâce à la préférence croissante des patients pour les formulations orales agréables au goût, notamment chez les enfants et les personnes âgées. Les laxatifs aromatisés améliorent l'observance et réduisent les aversions, ce qui explique leur grande popularité sous forme de sirop et de solution buvable. Ce segment bénéficie des innovations produits en matière d'arômes fruités, mentholés et neutres. Les formulations pédiatriques sont particulièrement ciblées avec des arômes attrayants pour garantir l'observance. Les agents aromatisants sont incorporés sans altérer l'efficacité, préservant ainsi les normes thérapeutiques. Ce segment favorise également la vente libre, améliorant l'accessibilité. Les campagnes marketing mettent en avant les avantages gustatifs pour les enfants et les personnes sensibles. La disponibilité de poudres et de solutions buvables aromatisées renforce encore l'adoption de ces produits. Les hôpitaux et les services de soins à domicile recommandent les options aromatisées pour une utilisation prolongée. La préférence croissante pour les médicaments au goût agréable à l'échelle mondiale consolide les parts de marché.

Le segment des produits sans arôme devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 18,7 %, entre 2025 et 2032, principalement grâce à son rapport coût-efficacité et à son adéquation aux besoins des patients adultes nécessitant une supplémentation régulière. Les formulations sans arôme peuvent être associées à d'autres boissons ou aliments, offrant ainsi une grande flexibilité d'administration. Les patients adultes et les établissements hospitaliers privilégient les options au goût neutre pour leur facilité d'utilisation. Les achats en gros et les versions génériques contribuent à une croissance plus rapide. Ce segment est largement utilisé en milieu institutionnel, notamment dans les hôpitaux et les EHPAD. Les cliniciens recommandent souvent les formulations sans arôme pour garantir une posologie constante. Les ventes de poudres sans arôme par les pharmacies en ligne accélèrent la pénétration du marché. La conformité réglementaire aux normes d'aromatisation favorise une adoption continue. Ce segment constitue une solution fiable et durable pour la prise en charge de la constipation chronique.

- Par source

Selon leur origine, le marché est segmenté en produits naturels, synthétiques et autres. Le segment des produits naturels a représenté la plus grande part de marché (48,6 %) en 2024, portée par la préférence croissante des consommateurs pour les produits à base de plantes, perçus comme plus sûrs et présentant moins d'effets secondaires. Des ingrédients comme le séné, le psyllium et l'aloe vera sont largement utilisés. La sensibilisation aux remèdes naturels et à la santé préventive favorise leur adoption. Les laxatifs naturels séduisent les patients soucieux de leur santé qui recherchent une utilisation à long terme sans exposition à des produits chimiques. Le développement du commerce électronique et la disponibilité croissante des produits en vente libre contribuent à la croissance du marché. Les enfants et les adultes privilégient de plus en plus les formulations naturelles. L'intégration aux compléments alimentaires et aux aliments fonctionnels élargit la portée du marché. La pénétration du marché est favorisée par les magasins de produits de santé et les pharmacies qui mettent l'accent sur l'étiquetage « naturel ». Les médecins recommandent des solutions naturelles pour la constipation chronique légère. Le marketing du segment des produits naturels se concentre sur les bienfaits pour le bien-être global. L'amélioration du goût et de l'appétibilité contribue à une meilleure observance du traitement par les patients.

Le segment des laxatifs de synthèse devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 20,1 %, entre 2025 et 2032, grâce à leur plus grande efficacité, leur action plus rapide et leur utilisation répandue en milieu hospitalier. Des agents de synthèse comme le polyéthylène glycol et le lactulose sont privilégiés en clinique pour la prise en charge rapide de la constipation sévère ou induite par les opioïdes. La croissance est portée par leur adoption clinique, leur standardisation et leur disponibilité sous de multiples formes galéniques. Les hôpitaux et les établissements de soins pour personnes âgées privilégient les laxatifs de synthèse pour les interventions en phase aiguë. Les pharmacies en ligne et la vente directe aux consommateurs contribuent à élargir leur diffusion. Les innovations constantes en matière de produits, notamment les formes liquides, en poudre et en comprimés, améliorent l'observance thérapeutique. Les autorisations réglementaires et les recommandations internationales favorisent une adoption clinique plus large. La demande du marché est alimentée par la prévalence croissante des troubles liés à la constipation.

- Par indication

Selon l'indication, le marché est segmenté en constipation chronique, syndrome de l'intestin irritable avec constipation (SII-C), constipation induite par les opioïdes, constipation aiguë et autres. Le segment de la constipation chronique représentait la plus grande part de marché (46,8 %) en 2024, portée par le vieillissement de la population et une sensibilisation accrue à la santé intestinale à long terme. La constipation chronique exige une prise en charge régulière, ce qui entraîne des achats fréquents de laxatifs. Les professionnels de santé recommandent une combinaison de prise en charge diététique et de traitement médicamenteux. Ce segment bénéficie de la disponibilité des médicaments sans ordonnance, des prescriptions hospitalières et des ventes en ligne. Les adultes et les personnes âgées sont les principaux utilisateurs. Le marketing met l'accent sur l'amélioration de la qualité de vie et le soulagement des symptômes. La diversification des produits (comprimés, solutions buvables, poudres et gels) favorise leur adoption. Les recommandations cliniques préconisent l'utilisation systématique des laxatifs osmotiques et de lest. La prévalence croissante de la constipation liée au mode de vie contribue à une demande soutenue. Les entreprises pharmaceutiques promeuvent activement les produits contre la constipation chronique par le biais de campagnes de sensibilisation.

Le segment de la constipation induite par les opioïdes devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 21,4 %, entre 2025 et 2032, sous l'effet de l'utilisation croissante d'analgésiques opioïdes pour la prise en charge de la douleur chronique. Le besoin d'une gestion efficace du transit intestinal chez les utilisateurs d'opioïdes stimule la demande de laxatifs stimulants et osmotiques. Les hôpitaux, les établissements de soins pour personnes âgées et les services de soins à domicile recommandent de plus en plus leur utilisation prophylactique. De nouvelles formulations à action rapide sont en cours de développement. Les pharmacies en ligne facilitent l'accès à ces traitements pour une utilisation à domicile. Des campagnes de sensibilisation ciblent les cliniciens et les patients en matière de prévention. La croissance est également soutenue par les recommandations préconisant la prise en charge de la constipation lors d'un traitement par opioïdes. La prévalence croissante de la douleur chronique à l'échelle mondiale accélère encore la croissance du marché.

- Par mode d'achat

Selon le mode d'achat, le marché est segmenté en médicaments sur ordonnance et médicaments en vente libre (OTC). En 2024, le segment OTC représentait la plus grande part de marché (58,2 %), grâce à sa grande praticité pour le consommateur et à une sensibilisation croissante à l'automédication. La disponibilité des médicaments OTC permet aux patients de gérer la constipation légère à modérée sans ordonnance, encourageant ainsi l'automédication. Les campagnes marketing et les promotions en magasin favorisent également leur adoption. Les formulations OTC comprennent des comprimés, des poudres, des solutions buvables et des gels, répondant ainsi aux différentes préférences des patients. La préférence croissante pour les traitements à domicile et la facilité d'achat contribuent à la domination du marché. La distribution des médicaments OTC en pharmacie, en supermarché et en ligne garantit une large accessibilité. Les achats répétés et l'utilisation à long terme dans le traitement des affections chroniques soutiennent la croissance du chiffre d'affaires. L'évolution démographique vers l'automédication, l'urbanisation et la pénétration croissante d'Internet favorisent l'adoption de ces médicaments. Ce segment bénéficie d'un bon rapport coût-efficacité et d'une grande disponibilité. Les professionnels de santé recommandent souvent les laxatifs OTC pour la constipation légère avant d'envisager une prescription. L'observance du traitement par les patients est plus élevée grâce à la facilité d'utilisation des formulations. Ce segment connaît également une adoption croissante des soins à domicile par les personnes âgées. Globalement, sa position dominante est confortée par la praticité, l'accessibilité financière et la variété des produits proposés.

Le segment des médicaments sur ordonnance devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 19,6 %, entre 2025 et 2032. Cette croissance est portée par des cas graves tels que la constipation induite par les opioïdes, le syndrome de l'intestin irritable avec constipation (SII-C) et les affections chroniques nécessitant un traitement supervisé. Les laxatifs sur ordonnance sont souvent associés à d'autres traitements et administrés en milieu hospitalier. Les hôpitaux, les cliniques spécialisées et les professionnels de santé jouent un rôle clé dans cette croissance. Les autorisations réglementaires et les recommandations des guides de pratique clinique favorisent l'adoption de ces médicaments. La croissance du segment des médicaments sur ordonnance est également alimentée par une meilleure connaissance des protocoles de traitement par les médecins. Les formulations avancées, telles que les agents osmotiques ou stimulants ciblés, améliorent l'efficacité. Les systèmes d'approvisionnement hospitaliers et de surveillance des patients renforcent la pénétration du marché. La croissance est soutenue par la prévalence croissante de la constipation chronique chez les adultes et les personnes âgées. Les pharmacies en ligne assurant la délivrance des ordonnances contribuent à une adoption plus rapide. Des populations de patients spécifiques, notamment les patients en oncologie et en post-opératoire, stimulent la demande. Le segment bénéficie de la préférence clinique et du soutien institutionnel. Les programmes d'éducation et de formation destinés aux professionnels de santé contribuent également à sa croissance.

- Par forme de dosage

Selon la forme galénique, le marché est segmenté en comprimés, gélules, poudres, solutions buvables et gels, suppositoires et autres. En 2024, le segment des comprimés représentait la plus grande part de marché (47,9 %), grâce à leur facilité d'utilisation, leur portabilité et la préférence des médecins. Les comprimés conviennent à la prise en charge des affections chroniques et aiguës et sont plus économiques que les autres formes galéniques. Disponibles avec ou sans arôme, ils garantissent une bonne observance thérapeutique. La vente libre et les circuits de distribution hospitaliers contribuent largement à la domination du marché. Les comprimés sont largement plébiscités par les enfants, les adultes et les personnes âgées. Ce segment bénéficie d'achats répétés et d'une utilisation prolongée pour la constipation chronique. Les innovations en matière d'enrobage et de profils de dissolution améliorent l'efficacité. L'association de comprimés avec des suppléments de fibres ou des probiotiques favorise leur adoption. La facilité de fabrication des comprimés assure leur disponibilité mondiale. Ce segment profite des efforts marketing axés sur la praticité et la fiabilité. Un taux d'observance élevé des patients soutient la croissance du chiffre d'affaires. Les comprimés restent le choix de référence en établissement et à domicile.

Le segment des poudres devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 20,2 %, entre 2025 et 2032. Cette croissance est portée par la facilité d'incorporation dans les boissons aromatisées, une solubilité améliorée et une meilleure adéquation aux soins à domicile. Les enfants et les personnes âgées bénéficient de poudres faciles à consommer. Les pharmacies en ligne améliorent l'accessibilité et la distribution. Les poudres sont idéales pour les thérapies combinées et les ingrédients fonctionnels. La croissance est alimentée par une sensibilisation accrue à l'hydratation et à l'apport en fibres dans la prise en charge de la constipation. Les hôpitaux et les centres de soins adoptent de plus en plus les formulations en poudre pour leur flexibilité. Les arômes innovants et l'amélioration de la solubilité favorisent l'observance thérapeutique. Le segment profite de la pénétration croissante du commerce électronique pour les produits de santé. L'expansion mondiale des services de soins à domicile soutient l'adoption de ces poudres. Les sachets multidoses et les conditionnements prédosés améliorent le confort d'utilisation. Un marketing ciblé auprès des parents et des aidants stimule les ventes.

- Par voie d'administration

Selon la voie d'administration, le marché est segmenté en voie orale et rectale. Le segment oral a représenté la plus grande part de marché (84,3 %) en 2024, grâce à sa facilité d'administration, sa praticité et l'excellente observance du traitement par les patients. Les formulations orales répondent aux besoins de la constipation chronique et aiguë. Comprimés, poudres, solutions buvables et gels offrent un large choix aux patients. Ce segment bénéficie d'une large disponibilité sans ordonnance et des recommandations des médecins. L'utilisation répétée dans les cas chroniques assure une croissance constante du chiffre d'affaires. Les formulations orales sont privilégiées par toutes les tranches d'âge et tous les profils démographiques. Le marketing met l'accent sur l'administration à domicile et les avantages de l'autogestion. L'intégration de produits aromatisés et riches en fibres favorise l'adoption. Les formes posologiques orales sont plus faciles à fabriquer et à distribuer, ce qui améliore l'accessibilité. Les médecins recommandent souvent les solutions orales en première intention pour la constipation légère à modérée. Les pharmacies en ligne renforcent les ventes et élargissent la clientèle. Ce segment est soutenu par des campagnes d'éducation à la santé intestinale.

Le segment rectal devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 17,8 %, entre 2025 et 2032, principalement pour le soulagement des symptômes aigus et les interventions en milieu hospitalier, notamment les suppositoires et les lavements. Les formulations rectales soulagent rapidement la constipation sévère. Les hôpitaux, les établissements de soins pour personnes âgées et les services d'urgence sont les principaux moteurs de leur adoption. L'innovation dans la composition des suppositoires améliore le confort et l'efficacité. Ce segment est utilisé aussi bien en pédiatrie qu'en soins aigus pour adultes. La sensibilisation croissante aux options rectales sûres et efficaces soutient la croissance. La pénétration du marché est renforcée par les protocoles de prescription. L'administration rectale garantit une diffusion ciblée avec une absorption systémique minimale. L'intégration aux services de soins hospitaliers contribue à la croissance du chiffre d'affaires. Les formulations avancées, à stabilité améliorée, augmentent la durée de conservation. Ce segment bénéficie de la préférence clinique pour les interventions en situation d'urgence. La disponibilité des pharmacies en ligne améliore l'accessibilité. Les programmes de formation et d'éducation des professionnels de santé encouragent une utilisation correcte.

- Par type de population

En fonction du type de population, le marché est segmenté en enfants et adultes. Le segment des adultes a représenté la plus grande part de revenus (72,5 %) en 2024, en raison d'une prévalence plus élevée de constipation chronique, du syndrome de l'intestin irritable avec constipation (SII-C) et de la constipation induite par les opioïdes. Les adultes, y compris les personnes âgées, sont les principaux utilisateurs de laxatifs, qu'ils soient en vente libre ou sur ordonnance. L'adoption de ces laxatifs est favorisée par les recommandations des médecins et l'essor de l'automédication. La disponibilité des laxatifs en vente libre et les ventes en ligne facilitent leur accès. L'utilisation régulière pour les affections chroniques assure une croissance soutenue du marché. Les hôpitaux et les services de soins à domicile contribuent significativement à la position dominante de ce segment. La variété des produits (comprimés, poudres et solutions buvables) répond aux préférences des patients adultes. Les campagnes de sensibilisation à la santé intestinale encouragent l'adoption de ces laxatifs. Les adultes sont également les principaux consommateurs de laxatifs de synthèse et de stimulants. Les recommandations cliniques préconisent leur utilisation régulière chez les adultes souffrant de constipation liée au mode de vie. Le marketing met l'accent sur l'amélioration de la qualité de vie. Ce segment bénéficie de la prise en charge par les assurances et des protocoles hospitaliers.

Le segment des enfants devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 18,9 %, entre 2025 et 2032, grâce à une sensibilisation accrue à la santé intestinale des enfants et à des formulations agréables au goût. Les sirops, poudres et comprimés à croquer aromatisés améliorent l'observance du traitement. Les parents privilégient de plus en plus les options douces, naturelles et sûres. La disponibilité sans ordonnance et les services de soins à domicile favorisent une adoption rapide. Les campagnes de sensibilisation et les programmes d'éducation sur la constipation infantile contribuent à l'augmentation de l'utilisation. Les hôpitaux et les cliniques pédiatriques recommandent des laxatifs pédiatriques spécialisés. Les plateformes de pharmacie en ligne facilitent l'accès à des formulations adaptées à l'âge. Les achats répétés pour les cas chroniques soutiennent la croissance. Les innovations en matière de goût, de texture et de solubilité améliorent l'observance. Les autorisations réglementaires pour l'usage pédiatrique renforcent la crédibilité du produit. Ce segment bénéficie de l'augmentation de l'incidence de la constipation fonctionnelle chez l'enfant.

- Par canal de vente

Selon le canal de distribution, le marché est segmenté en hôpitaux, établissements de soins pour personnes âgées, soins à domicile, pharmacies, supermarchés/magasins de santé et de beauté, et autres. Le segment des pharmacies a représenté la plus grande part de marché (52,8 %) en 2024, grâce à la disponibilité des médicaments sans ordonnance, à une large présence en points de vente et aux achats répétés. Les pharmacies offrent aux consommateurs commodité, accessibilité et conseils fiables. La variété des produits (saveurs, formes galéniques et formulations) favorise une forte adoption. La présence en milieu urbain garantit des ventes stables. Les promotions et le marketing en points de vente renforcent la visibilité. La disponibilité des médicaments sans ordonnance permet aux consommateurs de prendre soin d'eux-mêmes, soutenant ainsi la demande. Adultes et enfants bénéficient d'un accès facile. Ce segment est soutenu par une sensibilisation croissante à la santé intestinale et à la prise en charge de la constipation chronique. L'intégration aux plateformes de pharmacie en ligne renforce encore sa portée. Les pharmacies constituent des points de distribution clés pour les laxatifs naturels et synthétiques. Les achats répétés pour les cas chroniques contribuent à sa position dominante sur le marché. Une large couverture géographique assure la pénétration des zones urbaines et périurbaines.

Le segment des soins de santé à domicile devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 20,5 %, entre 2025 et 2032, porté par la tendance croissante des traitements à domicile pour la constipation chronique et les soins aux personnes âgées. Le vieillissement de la population et la commodité de l'administration à domicile stimulent cette croissance. L'intégration des pharmacies en ligne facilite l'accès aux soins et la livraison à domicile. Les prestataires de soins à domicile recommandent des formulations aromatisées et faciles à utiliser. La croissance est alimentée par la préférence des patients pour l'autogestion et la réduction des visites à l'hôpital. L'utilisation répétée dans le traitement des affections chroniques assure la stabilité des revenus. Les aidants et les parents privilégient les solutions de soins de santé à domicile pour les enfants et les adultes. Les campagnes de sensibilisation à la télésanté favorisent l'adoption de ces solutions. Le marketing direct auprès des consommateurs renforce la visibilité. Les hôpitaux et les cliniques coordonnent les prescriptions de soins à domicile. L'expansion des réseaux de soins à domicile soutient la croissance du marché. L'adoption des soins pédiatriques et gériatriques contribue de manière significative au TCAC du segment.

- Par canal de distribution

Selon le canal de distribution, le marché est segmenté en ventes directes, grossistes et autres. Le segment des ventes directes a représenté la plus grande part de marché (45,7 %) en 2024, grâce aux achats des hôpitaux et des institutions, aux initiatives de vente directe aux consommateurs et aux partenariats avec les pharmacies en ligne. Les hôpitaux et les établissements de soins pour personnes âgées privilégient l'approvisionnement direct pour leurs achats en gros. Les ventes directes des fabricants garantissent des prix plus avantageux, un approvisionnement régulier et la fidélisation à la marque. La croissance est soutenue par des campagnes marketing ciblées sur les institutions. Les partenariats avec les pharmacies en ligne permettent d'atteindre plus facilement les utilisateurs finaux. Les achats répétés pour la gestion des maladies chroniques contribuent au chiffre d'affaires. Les relations directes avec les professionnels de santé améliorent la pénétration du marché. La variété des produits et la rapidité de livraison favorisent leur adoption. Les hôpitaux privilégient les ventes directes pour un approvisionnement fiable. Les formulations pour adultes et enfants sont incluses dans les commandes groupées des institutions. La conformité réglementaire et les accords contractuels garantissent la stabilité. Les canaux d'approvisionnement directs soutiennent la distribution de produits haut de gamme.

Le segment des grossistes devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 19,8 %, entre 2025 et 2032, porté par la demande croissante des pharmacies de détail et des acheteurs institutionnels. Les grossistes assurent une distribution à grande échelle dans les zones urbaines et périurbaines. La croissance est soutenue par l'expansion des chaînes de pharmacies et des réseaux hospitaliers. L'efficacité de la distribution et la large couverture accélèrent l'adoption de ce modèle. Les marchés émergents s'appuient de plus en plus sur la distribution en gros. Les partenariats avec les détaillants et les institutions améliorent la pénétration du marché. Les grossistes facilitent l'accès aux médicaments en vente libre et sur ordonnance. La fiabilité de la chaîne d'approvisionnement garantit une disponibilité constante. Les collaborations avec les pharmacies en ligne stimulent davantage la croissance. Les grossistes gèrent de multiples formes galéniques et options aromatisées. L'expansion du marché et la demande des services de soins à domicile soutiennent le TCAC. Les réseaux de distribution en gros contribuent également à une distribution rentable.

Analyse régionale du marché des laxatifs au Moyen-Orient et en Afrique

- Le Moyen-Orient a dominé le marché des laxatifs en 2024, enregistrant la plus grande part de revenus. Cette domination s'explique par des dépenses de santé élevées, une sensibilisation accrue à la santé digestive et un accès facilité aux médicaments sans ordonnance. La région bénéficie d'une adoption précoce des formulations innovantes et d'un réseau de distribution pharmaceutique et de pharmacie bien établi.

- Au Moyen-Orient, les consommateurs accordent une importance croissante au bien-être digestif et aux soins préventifs, ce qui stimule la demande en laxatifs sûrs, efficaces et pratiques.

- Cette adoption généralisée est également favorisée par l'urbanisation croissante, l'augmentation des revenus disponibles et l'importance accrue accordée à la santé et au bien-être général, faisant des laxatifs une solution privilégiée pour la prise en charge de la constipation, qu'elle soit occasionnelle ou chronique.

Aperçu du marché des laxatifs en Arabie saoudite

En 2024, le marché saoudien des laxatifs a généré 41,2 % des revenus au Moyen-Orient, porté par des dépenses de santé élevées, de fortes recommandations médicales et un accès généralisé aux médicaments sans ordonnance. Le pays se distingue dans la région par l'adoption précoce de nouvelles formulations, un intérêt croissant pour la santé digestive et un réseau de distribution pharmaceutique performant. Par ailleurs, la multiplication des campagnes de sensibilisation et des initiatives de santé publique contribue significativement à la croissance du marché.

Aperçu du marché des laxatifs aux Émirats arabes unis

Le marché des laxatifs aux Émirats arabes unis devrait connaître la croissance la plus rapide du Moyen-Orient au cours de la période de prévision (2025-2032), avec un TCAC de 9,3 %, grâce à l'urbanisation croissante, à l'augmentation des revenus disponibles, au développement des infrastructures de santé et à une meilleure sensibilisation des consommateurs au bien-être digestif. Le pays observe une demande accrue de laxatifs innovants et pratiques, soutenue par l'expansion des réseaux de distribution pharmaceutique et un meilleur accès aux services de santé.

Part de marché des laxatifs au Moyen-Orient et en Afrique

Le marché des laxatifs est principalement dominé par des entreprises bien établies, notamment :

- Bayer AG (Allemagne)

- GlaxoSmithKline plc (Royaume-Uni)

- Boehringer Ingelheim International GmbH (Allemagne)

- Société Procter & Gamble (États-Unis)

- Sanofi (France)

- Société pharmaceutique Takeda Ltd (Japon)

- Pfizer Inc. (États-Unis)

- Abbott (États-Unis)

- Services Johnson & Johnson, Inc. (États-Unis)

- Fresenius Kabi AG (Allemagne)

- Reckitt Benckiser Group plc (Royaume-Uni)

- Nestlé SA (Suisse)

- Laboratoires Dr. Reddy's Ltd (Inde)

- Cipla Ltd (Inde)

Dernières évolutions du marché des laxatifs au Moyen-Orient et en Afrique

- En février 2023, Perrigo Company plc a lancé aux États-Unis un nouveau laxatif stimulant sans ordonnance, destiné aux patients souffrant de constipation chronique. Ce produit se présente sous une forme améliorée, plus facile à avaler, et cible une clientèle adulte plus large.

- En avril 2023, Teva Pharmaceutical Industries Ltd. a lancé aux États-Unis un laxatif non addictif à base d'extraits naturels, destiné à offrir une alternative plus douce mais efficace aux personnes souffrant de troubles du transit intestinal.

- En juin 2023, Ferring Pharmaceuticals a annoncé l'élargissement de sa gamme de laxatifs sur ordonnance en Europe, proposant de nouveaux produits pour les patients adultes et pédiatriques, dotés de mécanismes d'action novateurs pour un soulagement plus rapide et plus prévisible.

- En décembre 2023, Lupin Life Sciences Ltd. a lancé « Softovac Liquifibre », un laxatif liquide 100 % à base de plantes combinant des fibres de psyllium à d'autres actifs végétaux, ciblant les patients recherchant des alternatives naturelles pour la régularité intestinale.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.