Middle East And Africa Kickboxing Equipment Market

Taille du marché en milliards USD

TCAC :

%

USD

7.47 Million

USD

9.39 Million

2025

2033

USD

7.47 Million

USD

9.39 Million

2025

2033

| 2026 –2033 | |

| USD 7.47 Million | |

| USD 9.39 Million | |

|

|

|

|

Segmentation du marché des équipements de kickboxing au Moyen-Orient et en Afrique, par type de produit (gants, protections, bandages, sacs de frappe, coussins de frappe, bandes adhésives, vêtements, bandages cheville/genou/coude, protège-tibias, protège-dents, accessoires pour les mains, kettlebells et autres), canal de distribution (magasins de sport, e-commerce et autres), application (particulier, professionnel et institutionnel) - Tendances et prévisions du secteur jusqu'en 2033

Taille du marché des équipements de kickboxing au Moyen-Orient et en Afrique

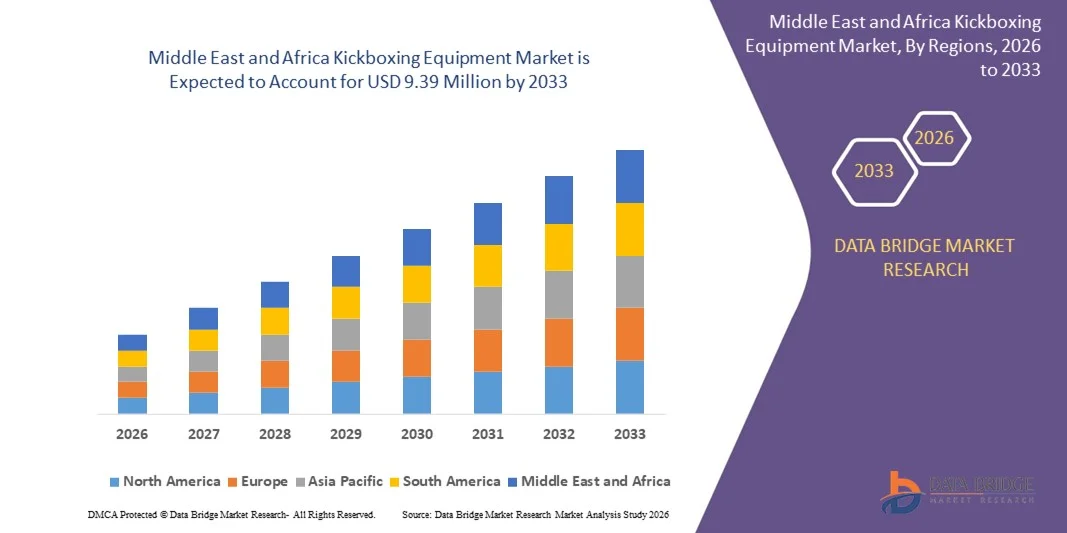

- Le marché des équipements de kickboxing au Moyen-Orient et en Afrique était évalué à 7,47 millions de dollars en 2025 et devrait atteindre 9,39 millions de dollars d'ici 2033 , avec un TCAC de 2,9 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la popularité croissante du kickboxing en tant qu'activité physique et sport de compétition, soutenue par une sensibilisation accrue à la santé et une participation croissante dans différentes tranches d'âge.

- De plus, le développement des infrastructures de salles de sport, l'influence des événements de sports de combat professionnels et l'intérêt croissant des consommateurs pour les équipements d'entraînement axés sur la sécurité et la performance accélèrent la demande d'équipements de kickboxing de haute qualité, stimulant ainsi considérablement la croissance globale du marché.

Analyse du marché des équipements de kickboxing au Moyen-Orient et en Afrique

- L'équipement de kickboxing, comprenant les gants, les protections, les coussins et les accessoires d'entraînement, joue un rôle essentiel pour garantir la sécurité des athlètes, l'amélioration de leurs performances et un entraînement efficace, tant dans un contexte récréatif que professionnel.

- La demande croissante d'équipements de kickboxing est principalement due à l'expansion des clubs de fitness et des académies d'entraînement, à l'intérêt grandissant pour les sports de combat à des fins de remise en forme et d'autodéfense, et à l'innovation continue des produits axée sur le confort, la durabilité et la prévention des blessures.

- L'Afrique du Sud a dominé le marché des équipements de kickboxing en 2025, grâce à une culture de la boxe et des sports de combat bien ancrée, à une participation croissante à l'entraînement physique et à l'adoption grandissante du kickboxing dans les salles de sport et les clubs sportifs commerciaux.

- L’Arabie saoudite devrait être la région connaissant la croissance la plus rapide sur le marché des équipements de kickboxing au cours de la période prévisionnelle, en raison de l’urbanisation rapide, de la sensibilisation croissante à la santé et de l’importance accordée par le gouvernement au sport et au fitness dans le cadre de la Vision 2030.

- Le segment des gants a dominé le marché avec une part de 44,2 % en 2025, grâce à leur utilisation obligatoire en kickboxing, tant à l'entraînement qu'en compétition. Indispensables pour la protection des mains et l'absorption des chocs, les gants génèrent une demande de remplacement constante. La pratique croissante du kickboxing et des sports de combat, axés sur le fitness, a favorisé l'adoption des gants par les débutants comme par les professionnels. Les fabricants continuent d'améliorer la qualité du rembourrage, la durabilité et l'ergonomie afin d'optimiser les performances. La large gamme de prix disponibles contribue également à la croissance des ventes de gants.

Portée du rapport et segmentation du marché des équipements de kickboxing

|

Attributs |

Aperçu du marché des équipements de kickboxing |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des équipements de kickboxing au Moyen-Orient et en Afrique

Popularité croissante des programmes d'entraînement au combat axés sur la condition physique et hybrides

- L'une des principales tendances du marché des équipements de kickboxing est la popularité croissante des programmes d'entraînement hybrides et axés sur la remise en forme, alimentée par un intérêt grandissant des consommateurs pour la forme physique fonctionnelle, le développement de l'endurance et la réduction du stress. Le kickboxing se développe rapidement dans les salles de sport, les studios de fitness et les centres de formation, car il combine entraînement cardiovasculaire, renforcement musculaire et techniques d'autodéfense.

- Par exemple, des organisations comme UFC Gym et Title Boxing Club ont développé des programmes de remise en forme structurés basés sur le kickboxing, nécessitant des gants, des paos, des sacs de frappe et des équipements de protection standardisés. Cela a engendré une demande constante d'équipements de haute qualité, conçus aussi bien pour l'entraînement individuel que pour les cours collectifs.

- L'intégration du kickboxing dans des programmes d'entraînement variés tels que le HIIT, le cross-training et la préparation physique aux arts martiaux élargit la clientèle au-delà des athlètes professionnels. Cette tendance alimente la demande en équipements polyvalents capables de résister à des entraînements intensifs et répétitifs dans les salles de sport commerciales.

- L'essor du fitness à domicile contribue également à cette tendance, les consommateurs recherchant des entraînements inspirés des sports de combat, réalisables dans des espaces restreints. Les sacs de frappe compacts, les cibles autoportantes et les gants d'entraînement gagnent en popularité auprès des particuliers en quête de séances d'entraînement immersives.

- Les académies sportives et les centres d'entraînement aux sports de combat standardisent de plus en plus leurs équipements afin de garantir la cohérence et la sécurité de l'entraînement, quel que soit le niveau de compétence. Cette tendance incite les fabricants à privilégier la durabilité, l'ergonomie et les matériaux absorbant les chocs.

- L'essor continu des programmes de combat axés sur la forme physique renforce le rôle des équipements de kickboxing comme infrastructure essentielle du fitness. Cette tendance alimente une demande à long terme dans les centres d'entraînement professionnels, les salles de sport et les espaces de remise en forme à domicile.

Dynamique du marché des équipements de kickboxing au Moyen-Orient et en Afrique

Conducteur

La pratique du kickboxing pour la santé, la forme physique et l'autodéfense connaît un essor important

- La pratique croissante du kickboxing pour la santé, la forme physique et l'autodéfense est un moteur important du marché des équipements de kickboxing, soutenue par une prise de conscience accrue des bienfaits d'un mode de vie actif et de la sécurité personnelle. Le kickboxing est de plus en plus reconnu pour ses avantages en matière de gestion du poids, de souplesse, de santé cardiovasculaire et de bien-être mental.

- Par exemple, des entreprises comme Everlast Worldwide fournissent des gants, des sacs de frappe et des équipements de protection aux salles de sport professionnelles, aux centres d'entraînement amateurs et aux chaînes de fitness du monde entier. Leur présence généralisée témoigne de la croissance constante de la pratique du kickboxing, tant en loisir qu'en compétition.

- La multiplication des clubs de fitness et des académies d'arts martiaux proposant des cours de kickboxing génère une demande soutenue en matériel d'entraînement, notamment en grandes quantités. Cette expansion favorise les achats réguliers de gants, de protections, de protège-tibias et d'accessoires de protection.

- Les programmes de sensibilisation à l'autodéfense et les initiatives de formation pour les jeunes encouragent davantage la participation, notamment chez les femmes et les jeunes adultes. Cela stimule la demande d'équipements conçus pour les débutants et axés sur la sécurité.

- La participation mondiale croissante renforce ce facteur de croissance stable pour le marché des équipements de kickboxing. L'engagement accru de tous les groupes d'âge et de tous les niveaux de compétence soutient l'expansion à long terme du marché.

Retenue/Défi

Risque élevé de blessures et problèmes de sécurité limitant l'adoption par les débutants

- Le marché des équipements de kickboxing est confronté à des difficultés en raison du risque élevé de blessures liées à des techniques d'entraînement inappropriées et à un équipement de protection inadéquat. Les craintes d'entorses, de fractures et de blessures dues aux impacts peuvent dissuader les débutants de pratiquer le kickboxing comme activité physique ou sportive.

- Par exemple, des organisations comme l'American Orthopaedic Society for Sports Medicine ont souligné que les sports de combat présentent des risques de blessures élevés en l'absence d'encadrement et d'équipement de protection adéquats. Ces préoccupations en matière de sécurité influent sur le niveau de participation et, indirectement, sur la demande d'équipement.

- L'utilisation inadéquate de gants, de casques et de protections certifiés augmente le risque de blessures liées à l'entraînement, notamment chez les débutants. Cela incite les salles de sport et les centres d'entraînement à investir dans des équipements de protection de meilleure qualité, ce qui accroît leurs coûts d'exploitation.

- Les débutants perçoivent souvent le kickboxing comme un sport physiquement intense et propice aux blessures, ce qui peut limiter leur inscription aux programmes d'entraînement. Cette perception ralentit la conversion des participants potentiels en consommateurs actifs d'équipement.

- Ces préoccupations liées à la sécurité freinent collectivement la croissance du marché en limitant l'adoption par les débutants et en soulignant le besoin de formation, d'équipement certifié et d'environnements d'entraînement contrôlés.

Étendue du marché des équipements de kickboxing au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type de produit, du canal de distribution et de l'application.

- Par type de produit

Le marché des équipements de kickboxing est segmenté, selon le type de produit, en gants, protections, bandages, sacs de frappe, paos, bandes adhésives, vêtements, genouillères/bandes de coude/chevilles, protège-tibias, protège-dents, gants, kettlebells et autres. En 2025, le segment des gants dominait le marché avec une part de 44,2 %, grâce à leur utilisation obligatoire en entraînement et en compétition. Indispensables pour la protection des mains et l'absorption des chocs, les gants génèrent une demande de remplacement constante. La pratique croissante du kickboxing et des sports de combat, axés sur le fitness, a favorisé l'adoption des gants par les débutants comme par les professionnels. Les fabricants améliorent sans cesse la qualité du rembourrage, la durabilité et l'ergonomie des gants pour optimiser les performances. Leur large disponibilité à différents prix contribue également à la croissance des ventes.

Le segment des équipements de protection devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par l'importance accrue accordée à la sécurité des athlètes et à la prévention des blessures. Le port d'équipements tels que les protège-tibias, les casques et les protège-dents est de plus en plus fréquent lors des entraînements. La participation croissante des jeunes athlètes et des athlètes féminines encourage l'utilisation de solutions de protection complètes. Les salles de sport et les académies appliquent des normes de sécurité plus strictes pendant les entraînements. Les innovations en matière de produits, utilisant des matériaux légers et résistants aux chocs, contribuent également à l'adoption de ces équipements.

- Par canal de distribution

Selon le canal de distribution, le marché des équipements de kickboxing se segmente en magasins de sport, e-commerce et autres. En 2025, le segment des magasins de sport représentait la plus grande part du chiffre d'affaires, grâce à la préférence des consommateurs pour l'évaluation physique du matériel avant achat. Les athlètes s'appuient souvent sur les conseils des vendeurs en magasin pour s'assurer d'un ajustement, d'un confort et d'une qualité optimaux, notamment pour les gants et les protections. La disponibilité immédiate des produits et la notoriété des marques favorisent les ventes en magasin. Les magasins de sport bénéficient également de partenariats avec les salles de sport et les centres d'entraînement. Ces facteurs contribuent à leur position dominante.

Le segment du commerce électronique devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, porté par l'adoption croissante du numérique et la recherche de praticité. Les plateformes en ligne proposent un large éventail de marques, des comparatifs de produits et des avis clients, facilitant ainsi les décisions d'achat éclairées. Des prix compétitifs et des promotions fréquentes attirent les consommateurs soucieux de leur budget. Le développement des ventes directes aux consommateurs par les fabricants renforce ce canal de distribution. L'amélioration de la logistique et la simplification des politiques de retour contribuent également à cette croissance en ligne.

- Sur demande

Selon l'usage, le marché des équipements de kickboxing se segmente en trois catégories : particuliers, professionnels et institutionnels. Le segment des particuliers a dominé le marché en 2025, porté par la popularité croissante du kickboxing pour la remise en forme, la gestion du poids et l'autodéfense. L'entraînement à domicile et la possession d'équipement personnel se généralisent. Les tendances fitness sur les réseaux sociaux et les programmes de coaching en ligne ont encouragé les investissements individuels dans du matériel de qualité. Les consommateurs privilégient un équipement personnalisé, adapté à leur confort et à leur niveau. Cette demande soutenue explique la position dominante de ce segment.

Le segment commercial devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par l'expansion rapide des salles de sport, des studios de fitness et des académies spécialisées en kickboxing. Les programmes d'entraînement collectif et les services de coaching professionnel nécessitent l'achat en gros d'équipements durables. L'adoption croissante du kickboxing dans les programmes de remise en forme traditionnels accroît la demande d'équipements dans les établissements commerciaux. Une utilisation fréquente entraîne des cycles de remplacement plus courts. L'ensemble de ces facteurs contribue à la forte croissance du segment commercial.

Analyse régionale du marché des équipements de kickboxing au Moyen-Orient et en Afrique

- L'Afrique du Sud a dominé le marché des équipements de kickboxing en 2025, enregistrant la plus grande part de revenus. Cette domination s'explique par une culture de la boxe et des sports de combat bien ancrée, une participation croissante aux entraînements de fitness et une adoption grandissante du kickboxing dans les salles de sport et les clubs sportifs commerciaux.

- La forte croissance des centres de remise en forme, des académies d'arts martiaux et des programmes sportifs communautaires, ainsi que l'intérêt croissant des consommateurs pour l'entraînement structuré et la remise en forme personnelle, continuent de stimuler la demande de gants, de sacs de frappe, d'équipements de protection et d'accessoires d'entraînement.

- Des initiatives de développement sportif, l'expansion des infrastructures sportives et la présence de marques d'équipement internationales et régionales telles qu'Everlast Worldwide renforcent la position dominante de l'Afrique du Sud sur le marché régional. La disponibilité croissante d'équipements de qualité professionnelle et l'importance accrue accordée à la sécurité et à la performance des athlètes consolident son leadership sur les segments récréatifs et professionnels.

Analyse du marché des équipements de kickboxing en Arabie saoudite

L'Arabie saoudite devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide du marché des équipements de kickboxing au Moyen-Orient et en Afrique entre 2026 et 2033. Cette croissance est soutenue par une urbanisation rapide, une sensibilisation accrue à la santé et un fort engagement gouvernemental en faveur du sport et du bien-être physique dans le cadre de la Vision 2030. Par exemple, des organisations comme Fitness Time ont étendu leurs programmes d'entraînement aux sports de combat et à la boxe dans les grandes villes, stimulant ainsi la demande d'équipements de kickboxing standardisés. L'augmentation des investissements dans les infrastructures sportives, la popularité croissante des cours collectifs et l'intérêt grandissant pour l'autodéfense accélèrent la croissance du marché. Le développement des salles de sport modernes, le pouvoir d'achat élevé des consommateurs et l'engouement croissant pour les sports de combat internationaux positionnent l'Arabie saoudite comme le marché à la croissance la plus rapide de la région.

Analyse du marché des équipements de kickboxing aux Émirats arabes unis

Le marché des équipements de kickboxing connaît une croissance rapide aux Émirats arabes unis, portée par un secteur du fitness florissant, des revenus disponibles élevés et une forte adoption d'équipements d'entraînement haut de gamme. Par exemple, des chaînes de fitness comme Gold's Gym Middle East proposent des programmes d'entraînement basés sur la boxe et le kickboxing, nécessitant des gants, des sacs de frappe et des protections certifiés. La demande croissante d'équipements sportifs de marque et de haute qualité, la participation accrue aux sports de combat et l'influence des tendances mondiales du fitness stimulent l'expansion du marché. Les investissements dans les académies sportives, le commerce en ligne et le développement d'un mode de vie axé sur le fitness améliorent encore l'accessibilité des produits, positionnant les Émirats arabes unis comme un marché émergent clé aux côtés de l'Arabie saoudite.

Part de marché des équipements de kickboxing au Moyen-Orient et en Afrique

Le secteur des équipements de kickboxing est principalement dominé par des entreprises bien établies, notamment :

- Everlast Worldwide, Inc. (États-Unis)

- Venum (France)

- RDX Sports (Royaume-Uni)

- Century LLC (États-Unis)

- Budoland (Allemagne)

- Combat Brands, LLC (États-Unis)

- Fairtex (Thaïlande)

- Fujian Weizhixing Sports Goods Co., Ltd (Chine)

- Hayabusa Fightwear Inc. (Canada)

- Paffen Sport GmbH & Co. KG (Allemagne)

- Revgear (États-Unis)

- Équipement de boxe Rival USA (États-Unis)

- ADVANTEST CORPORATION (Japon)

- SMAI USA (Australie)

- SPÉCIAL JUMEAU (Thaïlande)

Dernières évolutions du marché des équipements de kickboxing au Moyen-Orient et en Afrique

- En décembre 2022, Adidas AG a lancé sa nouvelle gamme d'équipements de kickboxing, comprenant gants, casques, protège-tibias et autres protections. Conçus avec des technologies de pointe et des matériaux avancés, ces équipements optimisent le confort et la sécurité des utilisateurs. La gamme privilégie une meilleure absorption des chocs, une conception légère et une durabilité accrue pour répondre aux exigences des athlètes professionnels et des amateurs de fitness. Ce lancement confirme l'engagement d'Adidas en matière d'innovation et d'excellence dans le secteur des sports de combat et renforce sa position concurrentielle sur le marché des équipements de kickboxing.

- En juillet 2022, Combat Sports International a lancé une nouvelle collection de cibles et de sacs de frappe pour le kickboxing. Robustes et ergonomiques, ces produits sont conçus pour optimiser les performances à l'entraînement et protéger les athlètes. Résistants aux impacts répétés, ils conviennent parfaitement aux salles de sport commerciales et aux centres d'entraînement professionnels. Ce lancement renforce la position de la marque sur le marché haut de gamme des équipements de kickboxing et témoigne de son engagement à fournir du matériel d'entraînement de haute qualité.

- En avril 2022, Fairtex, marque mondialement reconnue dans le domaine des sports de combat, a conclu un partenariat pluriannuel avec le Muay Thai Grand Prix afin de développer des équipements et des produits dérivés co-marqués, dans le but d'accroître la notoriété internationale de ce sport. Cette collaboration permet à Fairtex d'associer ses produits à une plateforme compétitive de premier plan et de toucher un public international plus large. Cette alliance stratégique illustre la volonté de Fairtex d'étendre son influence sur le marché grâce à des collaborations événementielles et des partenariats axés sur la marque.

- En juillet 2021, Fairtex s'est associé à Cage Warriors pour fournir gants et autres équipements à l'organisation, renforçant ainsi la visibilité et la crédibilité de la marque dans le milieu des sports de combat. Fournir du matériel à une organisation professionnelle de sports de combat positionne Fairtex comme un fournisseur de confiance d'équipements de compétition. Cette initiative soutient l'expansion stratégique de Fairtex dans les circuits de sports de combat professionnels et consolide sa réputation auprès des athlètes de haut niveau et des institutions d'entraînement.

- En avril 2021, Everlast Worldwide, Inc. a lancé sa nouvelle gamme de gants de kickboxing, dotée d'un rembourrage amélioré et d'une conception ergonomique pour un confort et une sécurité optimaux lors des entraînements et des compétitions. Ces gants sont conçus pour réduire la fatigue des mains et améliorer la répartition des impacts lors d'une utilisation prolongée. Cette innovation confirme le leadership d'Everlast dans le domaine des équipements de combat haute performance et son engagement à répondre aux exigences évolutives des athlètes en matière de performance et de sécurité.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.