Middle East And Africa Industrial Filter Cartridge Market

Taille du marché en milliards USD

TCAC :

%

USD

360.88 Million

USD

541.36 Million

2024

2032

USD

360.88 Million

USD

541.36 Million

2024

2032

| 2025 –2032 | |

| USD 360.88 Million | |

| USD 541.36 Million | |

|

|

|

|

Segmentation du marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique, par type de filtre (filtres plissés en profondeur, cartouches filtrantes en profondeur fondues-soufflées, cartouches filtrantes à haut débit, cartouches filtrantes plissées et cartouches filtrantes à enroulement), matériau (polypropylène, polyamide, PRFV, coton et autres (PTFE)), type de média (média épais, média fritté et média fin), utilisation finale (pétrole et gaz (applications liées à l'eau), traitement de l'eau et des déchets, produits chimiques, métaux, aliments et boissons, produits pharmaceutiques et autres (papier et pâte à papier, peinture et revêtement)), canal de distribution (indirect et direct) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique

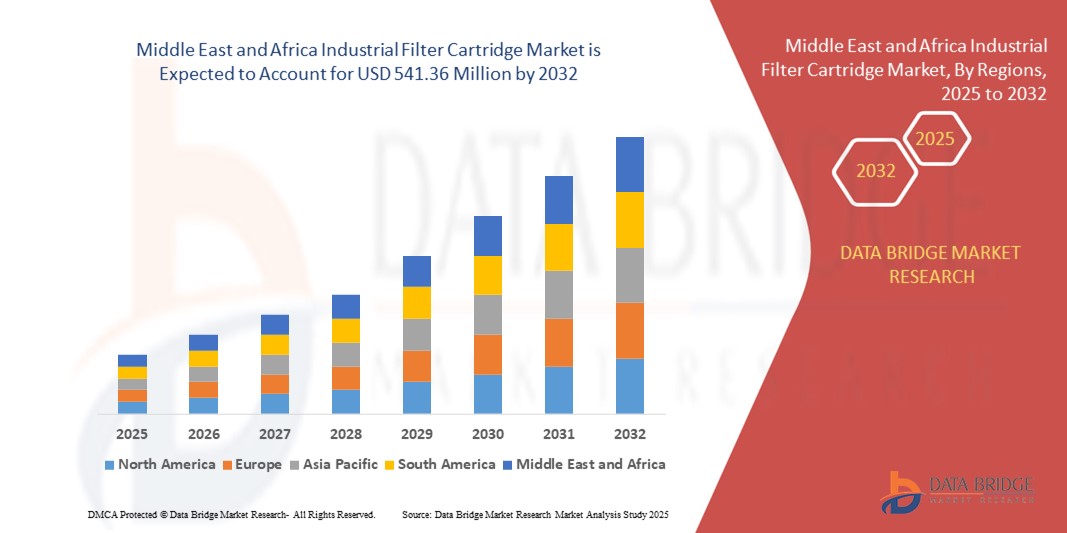

- La taille du marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique était évaluée à 360,88 millions USD en 2024 et devrait atteindre 541,36 millions USD d'ici 2032 , à un TCAC de 5,2 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par une industrialisation accrue, l'expansion des activités de fabrication et une sensibilisation croissante aux réglementations environnementales, en particulier dans les secteurs du traitement de l'eau et de la transformation chimique.

- De plus, la demande croissante de solutions de filtration efficaces et économiques dans les secteurs du pétrole et du gaz, de l'agroalimentaire et de la pharmacie positionne les cartouches filtrantes comme un composant essentiel des opérations industrielles. Ces facteurs favorisent une forte adoption et contribuent à l'expansion soutenue du marché régional.

Analyse du marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique

- Les cartouches filtrantes industrielles, utilisées pour éliminer les contaminants des liquides et des gaz, deviennent de plus en plus essentielles dans les opérations industrielles dans des secteurs tels que le pétrole et le gaz, le traitement de l'eau et les produits chimiques, en raison de leur grande efficacité, de leur rentabilité et de leur facilité d'entretien.

- La demande croissante de cartouches filtrantes industrielles est principalement motivée par des réglementations environnementales plus strictes, une industrialisation croissante et des besoins croissants en matière de traitement de l'eau dans les pays confrontés à la pénurie d'eau et à l'expansion des infrastructures.

- L'Arabie saoudite a dominé le marché des cartouches filtrantes industrielles avec la plus grande part de revenus de 29,1 % en 2024, soutenue par son industrie pétrolière et gazière massive, ses objectifs de durabilité soutenus par le gouvernement et ses investissements croissants dans le traitement des eaux usées et les systèmes de filtration industrielle.

- Les Émirats arabes unis (EAU) devraient être le pays à la croissance la plus rapide sur le marché des cartouches filtrantes industrielles au cours de la période de prévision en raison de l'urbanisation rapide, des améliorations technologiques dans la fabrication et de l'accent accru mis sur les pratiques industrielles vertes et la réutilisation de l'eau.

- Le segment des cartouches filtrantes plissées a dominé le marché des cartouches filtrantes industrielles avec une part de marché de 32,9 % en 2024, en raison de leur grande capacité de rétention des impuretés, de leur longue durée de vie opérationnelle et de leur polyvalence dans diverses applications de filtration industrielle.

Portée du rapport et segmentation du marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique

|

Attributs |

Informations clés sur le marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique

Demande croissante de filtration haute performance dans les industries soumises à des contraintes hydriques

- Une tendance majeure et croissante sur le marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique est le recours croissant aux systèmes de filtration haute performance dans les secteurs à forte consommation d'eau, tels que le pétrole et le gaz, la production d'électricité et l'agroalimentaire. La pénurie croissante d'eau dans la région a incité les industries à mettre en œuvre des solutions de filtration avancées pour optimiser la réutilisation de l'eau et garantir la fiabilité des procédés.

- Par exemple, des installations industrielles en Arabie saoudite et aux Émirats arabes unis intègrent des cartouches filtrantes plissées et à haut débit dans leurs systèmes en circuit fermé afin de réduire leur consommation d'eau tout en respectant la réglementation. De plus, les technologies de filtration sont de plus en plus souvent intégrées à des systèmes de surveillance en temps réel pour garantir une qualité de production constante et une maintenance prédictive.

- Ces systèmes de filtration avancés permettent aux industries de réduire les temps d'arrêt, d'accroître l'efficacité opérationnelle et de respecter les réglementations environnementales les plus strictes. Les fabricants innovent avec des matériaux tels que le polypropylène et le PTFE pour améliorer la résistance chimique et la durabilité, notamment dans les environnements de production difficiles.

- En conséquence, des entreprises telles que Parker Hannifin et Eaton Corporation étendent leur présence dans la région en proposant des solutions de cartouches personnalisées adaptées à des applications industrielles spécifiques.

- Cette tendance vers des technologies de filtration avancées et adaptatives transforme les normes de l'industrie et stimule la demande de solutions de cartouches filtrantes durables, efficaces et évolutives dans les secteurs sous pression pour économiser l'eau et atteindre les objectifs environnementaux.

- Le marché connaît un intérêt croissant pour des solutions qui offrent non seulement des performances de filtration mais qui s'alignent également sur les initiatives de développement durable des entreprises, en particulier dans les régions qui investissent massivement dans les infrastructures de dessalement et de réutilisation des eaux usées.

Dynamique du marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique

Conducteur

La croissance industrielle et la pénurie d'eau stimulent l'adoption

- Le développement industriel accéléré dans les principaux pays de la région, combiné à une pénurie d’eau aiguë, est l’un des principaux moteurs de la demande croissante de cartouches filtrantes industrielles.

- Par exemple, la Vision 2030 de l'Arabie saoudite comprend des investissements majeurs dans le traitement des eaux usées, ce qui stimule la demande de cartouches filtrantes liquides à haute efficacité dans des secteurs tels que la pétrochimie et le dessalement.

- Alors que les industries des Émirats arabes unis, d'Égypte et d'Afrique du Sud s'efforcent d'accroître la réutilisation de l'eau et de respecter les normes environnementales, les cartouches filtrantes sont de plus en plus utilisées dans les unités de filtration pour l'eau de traitement, le traitement des effluents et la purification des matières premières.

- Le besoin d'efficacité opérationnelle, de temps d'arrêt minimaux et de cycles de ressources propres oblige les industries à investir dans des solutions de filtration fiables qui améliorent les performances du système.

- La large applicabilité des cartouches filtrantes dans diverses industries, allant des métaux et des mines à l'alimentation et aux boissons et aux produits pharmaceutiques, continue d'élargir leur rôle en tant que composant essentiel des processus industriels.

Retenue/Défi

Dépendance aux importations et sensibilité aux coûts dans les pays en développement

- L’un des principaux défis auxquels le marché est confronté est la forte dépendance aux cartouches et composants filtrants importés, ce qui entraîne une augmentation des coûts d’approvisionnement et des délais de livraison plus longs, en particulier dans les pays en développement dont les capacités de fabrication locales sont limitées.

- Des pays comme le Kenya et le Nigéria sont souvent confrontés à des obstacles logistiques et à des fluctuations monétaires, ce qui peut augmenter le coût total des solutions de filtration industrielle et dissuader les petites industries d'adopter des systèmes avancés.

- Par exemple, en 2023, plusieurs installations de traitement de l'eau nigérianes ont connu des retards et des dépassements de coûts en raison de perturbations dans les importations de cartouches causées par des restrictions de change et une congestion portuaire ayant un impact sur la modernisation de leurs systèmes de filtration.

- De plus, les utilisateurs finaux sensibles aux coûts peuvent opter pour des alternatives de qualité inférieure ou fabriquées localement, ce qui compromet potentiellement les performances et la durée de vie.

- Pour répondre à ces enjeux, il est nécessaire de développer des capacités de production locales, de constituer des réseaux de distribution régionaux et de proposer des filtres durables et à prix compétitifs. Les acteurs du marché privilégient de plus en plus les partenariats et les coentreprises pour asseoir leur présence régionale et atténuer les difficultés d'approvisionnement, essentielles à la croissance et à la résilience à long terme sur ce marché fragmenté.

Portée du marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique

Le marché est segmenté en fonction des types de filtres, du matériau, du type de support, de l'utilisation finale et du canal de distribution.

- Par types de filtres

En fonction du type de filtre, le marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique se segmente en filtres plissés en profondeur, cartouches filtrantes en profondeur obtenues par fusion-soufflage, cartouches filtrantes à haut débit, cartouches filtrantes plissées et cartouches filtrantes à enroulement continu. Le segment des cartouches filtrantes plissées a dominé le marché avec la plus grande part de chiffre d'affaires (32,9 %) en 2024, grâce à leur grande surface, leur longue durée de vie et leur compatibilité avec un large éventail d'applications industrielles, notamment dans le traitement de l'eau et des déchets et la chimie. Leur polyvalence et leur capacité de rétention efficace des particules en font un choix privilégié pour les installations recherchant des solutions performantes et nécessitant peu d'entretien.

Le segment des cartouches filtrantes en profondeur obtenues par fusion-soufflage devrait connaître la croissance la plus rapide, soit 20,3 % entre 2025 et 2032, grâce à la demande croissante en étapes de préfiltration et à leur rentabilité dans les opérations à grande échelle. Leur capacité à capturer les particules fines et leur compatibilité avec les fluides agressifs favorisent leur utilisation croissante dans les secteurs pétrolier, gazier et pharmaceutique.

- Par matériau

En fonction du matériau, le marché des cartouches filtrantes industrielles est segmenté en polypropylène, polyamide, PRFV (plastique renforcé de fibres), coton et autres (dont le PTFE). Le polypropylène représentait la plus grande part de chiffre d'affaires en 2024, avec 38,7 %, grâce à sa résistance chimique, sa stabilité thermique et son prix abordable. Il est largement utilisé dans les applications de filtration de liquides dans les secteurs du traitement de l'eau, de l'agroalimentaire et de la pharmacie.

Le segment PTFE devrait connaître le TCAC le plus rapide au cours de la période de prévision, soutenu par son excellente résistance aux températures élevées et aux produits chimiques agressifs, ce qui le rend adapté aux applications spécialisées dans les industries de transformation chimique et métallique.

- Par type de média

En fonction du type de média, le marché des cartouches filtrantes industrielles est segmenté en médias épais, médias frittés et médias fins. Le segment des médias épais dominait le marché avec une part de marché de 41,5 % en 2024, grâce à sa capacité de rétention des impuretés et sa longévité supérieures, particulièrement appréciées dans les industries consommatrices d'eau et les systèmes de filtration à usage intensif.

Le segment des supports frittés devrait connaître la croissance la plus rapide au cours de la période de prévision, en raison de son utilisation dans des applications à haute température et haute pression où la résistance mécanique et les capacités de lavage à contre-courant sont essentielles, comme dans les installations pétrochimiques et de production d'électricité.

- Par utilisation finale

En fonction de l'utilisation finale, le marché des cartouches filtrantes industrielles est segmenté en pétrole et gaz (applications liées à l'eau), traitement de l'eau et des déchets, chimie, métaux, agroalimentaire, pharmaceutique et autres (notamment papier et pâte à papier, peinture et revêtement). Le segment du traitement de l'eau et des déchets a dominé le marché avec une part de 29,8 % en 2024, grâce à l'augmentation des investissements publics et privés dans les installations de dessalement, de réutilisation de l'eau et de traitement des eaux usées industrielles en Arabie saoudite et aux Émirats arabes unis.

Le segment pharmaceutique devrait connaître la croissance la plus rapide au cours de la période de prévision, en raison du besoin croissant d'environnements de traitement stériles et de haute pureté, ainsi que de la pression réglementaire pour maintenir des opérations sans contamination dans la fabrication de médicaments.

- Par canal de distribution

En fonction du canal de distribution, le marché des cartouches filtrantes industrielles est segmenté en ventes indirectes et directes. Le segment de la distribution indirecte (comprenant les équipementiers, les intégrateurs de systèmes et les fournisseurs industriels) détenait la part la plus importante, soit 56,3 % en 2024, grâce à sa vaste présence dans la région et à ses réseaux de fournisseurs bien établis.

Le segment de la distribution directe connaît une croissance constante au cours de la période de prévision, en particulier parmi les clients industriels à grande échelle à la recherche de solutions personnalisées et de contrats de service à long terme avec les fabricants.

Analyse régionale du marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique

- L'Arabie saoudite a dominé le marché des cartouches filtrantes industrielles avec la plus grande part de revenus de 29,1 % en 2024, soutenue par son industrie pétrolière et gazière massive, ses objectifs de durabilité soutenus par le gouvernement et ses investissements croissants dans le traitement des eaux usées et les systèmes de filtration industrielle.

- Les industries du pays privilégient les systèmes de filtration haute performance pour garantir l'efficacité opérationnelle, la conformité réglementaire et la gestion durable des ressources, en particulier dans les projets de dessalement et de réutilisation des eaux usées.

- Cette adoption généralisée est en outre soutenue par une croissance industrielle robuste, des initiatives environnementales menées par le gouvernement et l'importance croissante des technologies de conservation de l'eau, positionnant les cartouches filtrantes industrielles comme des composants essentiels pour maintenir des systèmes de traitement propres et efficaces dans des secteurs clés.

Aperçu du marché des cartouches filtrantes industrielles en Arabie saoudite

En 2024, le marché saoudien des cartouches filtrantes industrielles a représenté la plus grande part de chiffre d'affaires, soit 29,1 %, au Moyen-Orient et en Afrique, grâce à des investissements massifs dans le pétrole et le gaz, les usines de dessalement et les initiatives de réutilisation des eaux usées dans le cadre de la Vision 2030. Les secteurs industriels du Royaume intègrent des systèmes de filtration avancés pour améliorer la fiabilité des processus et garantir la conformité réglementaire. La demande est particulièrement forte pour les cartouches plissées et fondues-soufflées utilisées dans le raffinage et les services publics. Les politiques environnementales soutenues par le gouvernement et les partenariats public-privé renforcent encore le paysage des équipements de filtration dans le pays.

Aperçu du marché des cartouches filtrantes industrielles aux Émirats arabes unis (EAU)

Le marché des cartouches filtrantes industrielles des Émirats arabes unis devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce au développement des projets d'infrastructures, à l'innovation technologique et à l'accent mis sur l'automatisation industrielle. Le leadership du pays en matière de développement durable, illustré par des initiatives telles que la Stratégie 2036 pour la sécurité de l'eau aux Émirats arabes unis, crée une demande pour des systèmes de filtration performants pour la réutilisation et le dessalement de l'eau. De plus, le déploiement croissant d'usines intelligentes et de procédés industriels propres renforce le rôle des cartouches filtrantes dans le maintien d'une qualité de produit élevée et de normes environnementales élevées.

Aperçu du marché des cartouches filtrantes industrielles en Afrique du Sud

Le marché sud-africain des cartouches filtrantes industrielles connaît une croissance constante, soutenue par les développements constants des secteurs minier, de la production d'électricité et de la chimie. La modernisation des secteurs industriels accroît le besoin de systèmes de filtration fiables et nécessitant peu d'entretien. Le pays est également confronté à une pression environnementale croissante pour améliorer le traitement des eaux usées et la lutte contre la pollution, ce qui stimule la demande de cartouches filtrantes à média épais et à haut débit. Les industries locales explorent de plus en plus de solutions de filtration durables pour répondre aux normes de qualité nationales et internationales.

Aperçu du marché des cartouches filtrantes industrielles au Nigéria

Le marché nigérian des cartouches filtrantes industrielles est en plein essor, porté par l'expansion des activités manufacturières, l'augmentation des investissements dans les infrastructures de traitement de l'eau et le besoin d'améliorer la filtration de l'air et des liquides dans des secteurs tels que le ciment, l'agroalimentaire et l'énergie. Bien que le marché soit confronté à des défis tels que la dépendance aux importations et des infrastructures inégales, les initiatives gouvernementales visant à diversifier l'industrie et à faire respecter la réglementation environnementale ouvrent la voie à une croissance soutenue. Les partenariats locaux et les options de filtration abordables devraient favoriser une pénétration plus large du marché dans les années à venir.

Part de marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique

L'industrie des cartouches filtrantes industrielles du Moyen-Orient et de l'Afrique est principalement dirigée par des entreprises bien établies, notamment :

- Pall Corporation (États-Unis)

- Eaton Corporation plc (Irlande)

- Parker Hannifin Corporation (États-Unis)

- MANN+HUMMEL GmbH (Allemagne)

- Donaldson Company, Inc. (États-Unis)

- Pentair plc (Royaume-Uni)

- Camfil AB (Suède)

- Filtration Group Corporation (États-Unis)

- 3M (États-Unis)

- Lydall, Inc. (États-Unis)

- Porvair plc (Royaume-Uni)

- Graver Technologies, LLC (États-Unis)

- Critical Process Filtration, Inc. (États-Unis)

- MAHLE GmbH (Allemagne)

- Ahlstrom Oyj (Finlande)

- Suez SA (France)

- Veolia Environnement SA (France)

- GE Water & Process Technologies (États-Unis)

- SPX FLOW, Inc. (États-Unis)

- Haycarb PLC (Sri Lanka)

Quels sont les développements récents sur le marché des cartouches filtrantes industrielles au Moyen-Orient et en Afrique ?

- En décembre 2023, Pall Corporation, un leader mondial de la filtration, de la séparation et de la purification, et Tanajib, [Al-Khobar], une importante société de services pétroliers dans tout le CCG, ont annoncé aujourd'hui l'extension de son usine de Pall Arabia pour inclure des capacités de fabrication de filtres coalesceurs afin de soutenir les industries pétrolières, gazières et pétrochimiques du Royaume d'Arabie saoudite.

- En septembre 2023, Parker Hannifin Corporation a lancé des cartouches de poussière de remplacement BHA® économiques pour les dépoussiéreurs Downflo Evolution (DFE) de Donaldson, offrant une efficacité de nettoyage de l'air améliorée, des économies de coûts d'exploitation et un support client robuste pour les utilisateurs de filtration industrielle MEA

- En juillet 2023, Pall Corporation a présenté des technologies de filtration et de purification de nouvelle génération au SEMICON West, conçues pour répondre à la demande croissante en matière de fabrication de semi-conducteurs, portée par les développements de la 5G, de l'IA et de l'IoT.

- En mai 2023, 3M a annoncé un investissement de 146 millions de dollars américains visant à étendre ses capacités en matière de technologie de filtration biopharmaceutique, notamment par la modernisation de ses installations, l'amélioration de ses équipements et la création de 60 postes à temps plein dans ses sites de production européens. Cette opération renforce le leadership de 3M dans la fourniture de solutions de filtration avancées pour les bioprocédés et la fabrication pharmaceutique.

- En avril 2023, la division Filtration d'Eaton a dévoilé ses nouvelles plaques filtrantes en profondeur au charbon actif BECO CARBON ACF 03, conçues pour répondre aux normes pharmaceutiques et biopharmaceutiques rigoureuses, offrant une décoloration efficace et une séparation par adsorption avec validation de biocompatibilité intégrée.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.