Marché de l'indium au Moyen-Orient et en Afrique, par produit (primaire, secondaire et type III), application (écrans plats, matériaux semi-conducteurs, photovoltaïque, soudures, alliages, matériaux d'interface thermique et batteries) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de l'indium au Moyen-Orient et en Afrique

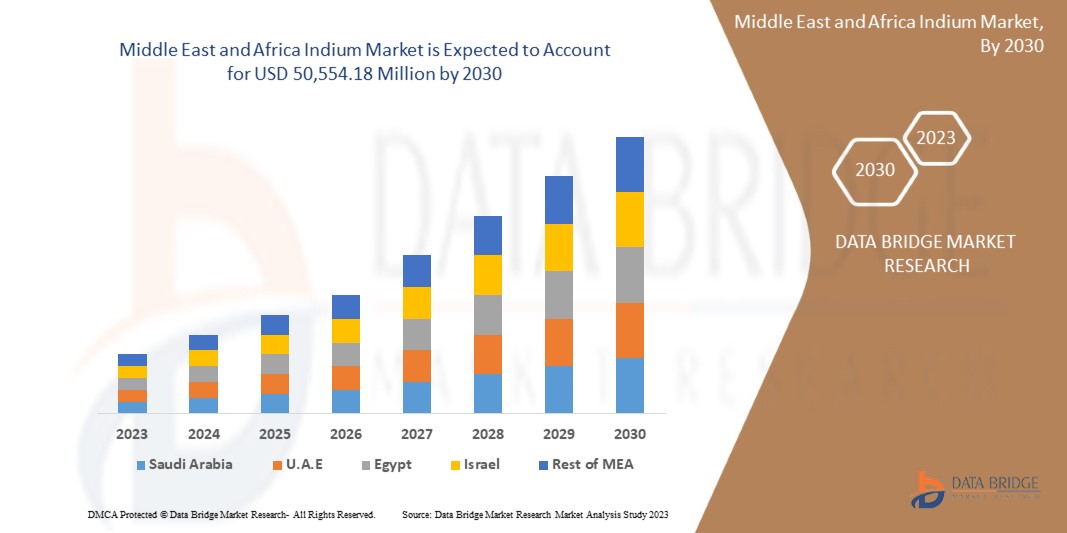

Le marché de l'indium au Moyen-Orient et en Afrique devrait connaître une croissance significative de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,7 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 50 554,18 millions USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché de l'indium est la demande croissante d'articles électroniques. La popularité croissante des panneaux solaires et leur utilisation dans les alliages dentaires devraient propulser la croissance du marché de l'indium au Moyen-Orient et en Afrique.

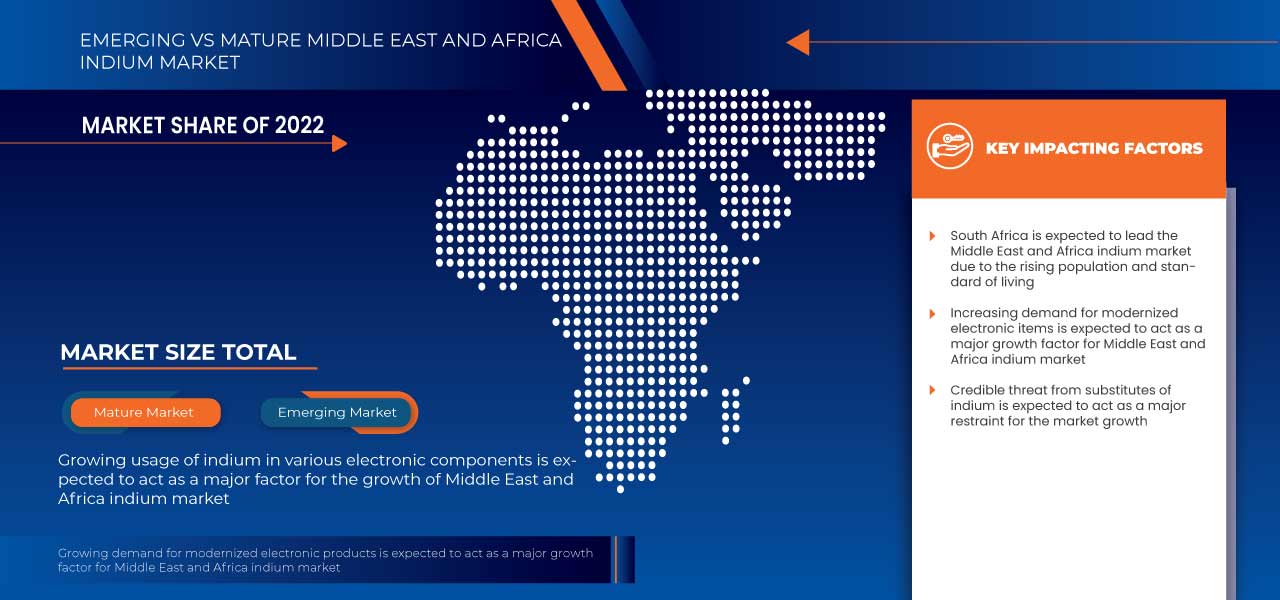

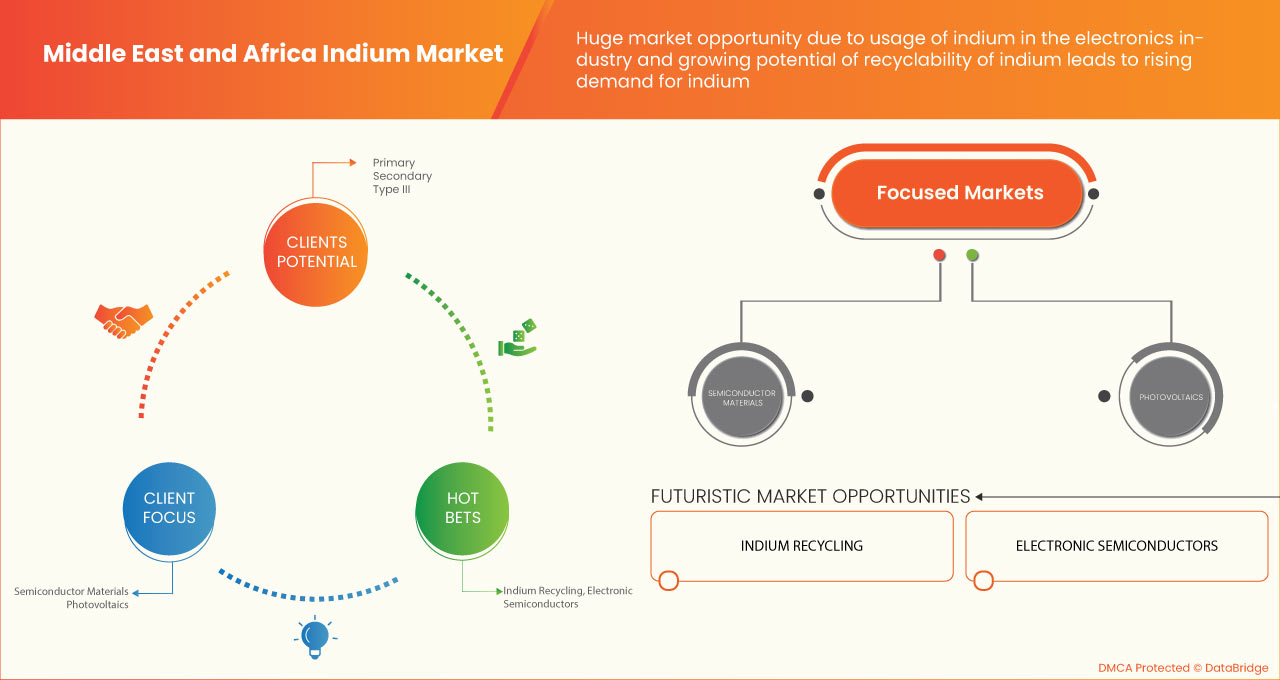

La croissance de l'industrie des semi-conducteurs et la capacité de recyclage de l'indium métallique devraient offrir des opportunités sur les marchés de l'indium au Moyen-Orient et en Afrique. Cependant, les fluctuations des prix des matières premières et les écarts importants entre l'offre et la demande devraient remettre en cause la croissance du marché. Les principales contraintes susceptibles d'avoir un impact négatif sur le marché de l'indium au Moyen-Orient et en Afrique sont la menace crédible des substituts et les problèmes environnementaux et sanitaires associés à l'indium.

Le rapport sur le marché de l'indium au Moyen-Orient et en Afrique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Contactez-nous pour un briefing d'analyste afin de comprendre l'analyse et le scénario du marché. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par produit (primaire, secondaire et type III), application (écrans plats, matériaux semi-conducteurs, photovoltaïque , soudures, alliages, matériaux d'interface thermique et batteries) |

|

Pays couverts |

Égypte, Arabie saoudite, Émirats arabes unis, Afrique du Sud, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Français Nippon Rare Metal Inc, Umicore, Teck Resources Limited, Nyrstar, Avalon Advanced Materials Inc., Ahpmat.com., Indium Corporation, Lipmann Walton & Co. Ltd, Zhuzhou Keneng New Material Co., Ltd. Inc., ESPI Metals, AIM Metals & Alloys LP, DOWA Electronics Materials Co. Ltd. et Xinlian Environmental Protection Technology Co., Ltd. entre autres. |

Définition du marché

L'indium est un métal aux propriétés diverses et distinctes. Il s'agit d'un métal blanc argenté mou présent naturellement et combiné avec du zinc et d'autres métaux. Il possède des propriétés uniques telles qu'une liaison exclusive par soudage à froid, un taux de transfert thermique élevé, des substances non métalliques, des propriétés fiables à des températures cryogéniques et une douceur.

Dynamique du marché de l'indium au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Hausse de la demande d'articles électroniques

La demande d'articles électroniques tels que les smartphones, les tablettes, les écrans plats, les ordinateurs portables et les moniteurs a augmenté dans le monde entier. La demande pour ces produits électroniques est attribuée à diverses raisons, telles que le développement de nouvelles technologies, l'augmentation du revenu disponible et l'amélioration du niveau de vie qui ont encouragé les clients à les acheter. La récente pandémie de COVID-19 a fait prospérer les ventes de ces produits, la plupart des employés et des étudiants travaillant et apprenant respectivement à domicile. Les avancées technologiques ont trouvé leur utilisation dans de nombreux domaines, notamment le développement d'applications, les logiciels, l'intelligence artificielle, les soins de santé personnalisés et la robotique, ce qui a encore accru la demande pour ces équipements. En outre, plusieurs pays en développement connaissent une transformation numérique, ce qui stimule encore davantage les ventes de ces produits électroniques.

- Augmentation de la popularité des panneaux solaires

La lumière du soleil est une source d'énergie renouvelable. La production et la fourniture d'énergie solaire sont illimitées. Comparée à d'autres sources d'énergie, comme les combustibles fossiles, qui ne sont pas renouvelables, la production d'énergie solaire est plus facile et moins coûteuse. L'utilisation de l'énergie solaire ne contribue même pas au réchauffement climatique au Moyen-Orient et en Afrique. L'architecture solaire, l'énergie solaire concentrée, les cellules et panneaux photovoltaïques sont quelques exemples de technologies d'énergie solaire.

L'indium est un métal utilisé dans la production de panneaux solaires. Même si la demande en indium a récemment été faible, il est nécessaire pour les systèmes photovoltaïques à hétérojonction. En raison de leur transparence optique, de leurs propriétés de conductivité électrique et de leur résistance chimique à l'humidité, les oxydes d'étain et d'indium sont des matériaux largement utilisés dans les panneaux solaires.

- Utilisation dans les alliages dentaires

Les alliages utilisés pour fabriquer des prothèses dentaires contiennent principalement de l'or, de l'argent et du palladium comme métaux principaux, avec 0,5 à 10 % d'indium ajouté. La résistance à la corrosion et la dureté des implants dentaires peuvent être considérablement augmentées en utilisant une quantité minimale d'indium métallique. De plus, les amalgames dentaires contiennent souvent de l'indium. Pour éviter que l'amalgame ne devienne dangereux, l'indium aide à retenir le mercure. Ainsi, l'indium aide à protéger les personnes des effets secondaires toxiques du mercure dans les amalgames dentaires.

Opportunités

- Croissance de l'industrie des semi-conducteurs

Le point d'ébullition élevé, la résistance à la corrosion et la faible résistance sont quelques-unes des propriétés de l'indium, en raison desquelles il est largement utilisé dans l'industrie des semi-conducteurs. Les composés à base d'indium tels que le trichlorure d'indium sont bien connus pour la construction de couches semi-conductrices telles que les circuits électroniques, les lasers et les LED. De plus, l'indium a des applications dans les transistors à haute et basse température. L'indium est également utilisé dans l'assemblage solaire en tant que semi-conducteur cuivre-indium-gallium-séléniure. Une telle application haut de gamme de l'indium dans les industries créera davantage d'opportunités d'augmentation des ventes pour les produits dans lesquels l'indium est utilisé.

- Capacité de recyclage de l'indium métallique

En raison de ses performances dans les semi-conducteurs et l'optoélectronique, l'indium suscite de plus en plus d'intérêt. Il s'agit d'une ressource stratégique cruciale, classée parmi les ressources clés par la Commission européenne. Il n'existe pas de minerai d'indium propre ; il est principalement produit à partir de sous-produits de plomb et de zinc.

L'indium étant largement utilisé dans les écrans LCD, le recyclage de l'indium à partir de ces panneaux LCD est effectué. Les écrans LCD endommagés sont récupérés et démontés manuellement ou automatiquement.

Restrictions

- Problèmes environnementaux et sanitaires liés à l’indium

L'indium a pollué et eu un impact négatif sur l'environnement et notre santé en raison de son utilisation intensive dans diverses applications. La quantité d'indium dans la croûte terrestre est d'environ 0,052 ppm, et il est normalement récupéré comme sous-produit de la fabrication du zinc et du cuivre car il ne forme pas facilement ses minéraux. Les impacts négatifs de l'exploitation minière sont la déforestation, les habitats de la pêche et de la faune, les précipitations irrégulières et les perturbations écologiques. En plus des mines proprement dites, les infrastructures construites pour aider les opérations minières, telles que les routes, les lignes électriques et les voies ferrées, influencent les voies de migration des animaux et aggravent la diversité des habitats. De tels impacts environnementaux négatifs freinent la croissance du marché de l'indium au Moyen-Orient et en Afrique.

- Faible concentration dans la croûte terrestre et problèmes liés à l'extraction

L'indium est un métal largement accepté et utilisé dans divers domaines, tels que les écrans plats électroniques, les dispositifs photovoltaïques et les dispositifs semi-conducteurs. En raison de ces applications aussi larges, l'indium est l'un des métaux les plus demandés. À l'intérieur de la croûte terrestre, l'indium est très faible en quantité, environ 160 ppb en poids. La production d'indium au Moyen-Orient et en Afrique ne représente que 800 tonnes par an. De plus, une si faible quantité d'indium a fait augmenter le prix de l'indium pur à 900 dollars américains par kilogramme. Une production aussi faible, une concentration moindre dans la croûte terrestre et une forte demande d'indium de la part des industries ont résisté à la croissance du marché de l'indium au Moyen-Orient et en Afrique.

Défis

- Fluctuation des prix des matières premières

L'indium est utilisé quotidiennement dans des produits tels que les LED, les écrans plats, les soudures, les panneaux solaires et bien d'autres. Cependant, l'indium est un sous-produit obtenu à partir de minerais de cuivre et de zinc. Il ne possède donc pas ses propres minéraux. Ainsi, le prix de production de l'indium dépend de la demande et des prix des métaux obtenus à partir de ces minerais. En outre, il s'agit de l'un des éléments les plus rares de la croûte terrestre. Les prix de l'indium varient également en fonction de la concurrence des utilisateurs finaux pour l'obtenir.

Toute nouvelle utilisation populaire pourrait modifier considérablement la demande globale, qui pourrait augmenter plus rapidement que les capacités disponibles. Cette situation pourrait perdurer pendant une décennie ou plus, en fonction du temps nécessaire pour augmenter considérablement les capacités de production.

- Un écart important entre l'offre et la demande

L'écart entre l'offre et la demande d'un produit est appelé « écart entre l'offre et la demande ». En tant que métal des terres rares, l'indium est l'un des métaux les plus rares de la croûte terrestre. Dans le cas de l'indium, 95 % de la production est réalisée à partir du traitement des minerais de zinc. La production d'indium est désavantagée car elle ne se produit pas à l'état natif. L'indium se trouve dans des minerais métalliques tels que le zinc et l'étain. Par conséquent, l'offre et la demande d'indium dépendent également d'autres métaux comme le zinc. Cet écart entraîne en outre une volatilité des prix des matières premières de l'indium. Une telle volatilité peut également influencer les prix des produits finis et les faire fluctuer.

La Chine produit plus de 50 % de l'indium raffiné mondial. Au cours des trois dernières années, la Chine a produit environ 1 000 tonnes d'indium par an et a également stocké plus de 3 000 tonnes .

Développement récent

- En décembre 2022, Umicore et PowerCo, une entreprise de batteries de Volkswagen, ont étendu leur collaboration dans le domaine des matériaux pour batteries. Ils étudient un accord d'approvisionnement stratégique à long terme pour alimenter la future Gigafactory de batteries de PowerCo pour véhicules électriques (VE) en Amérique du Nord. Ce développement contribuera à renforcer les opérations de l'entreprise

Portée du marché de l'indium au Moyen-Orient et en Afrique

Le marché de l'indium au Moyen-Orient et en Afrique est classé en fonction du produit et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Primaire

- Secondaire

- Type III

En fonction du produit, le marché de l'indium au Moyen-Orient et en Afrique est classé en trois segments : primaire, secondaire et de type III.

Application

- Écrans plats

- Matériaux semi-conducteurs

- Photovoltaïque

- Soudures

- Alliages

- Matériaux d'interface thermique

- Piles

En fonction de l'application, le marché de l'indium au Moyen-Orient et en Afrique est classé en sept segments : écrans plats, matériaux semi-conducteurs, photovoltaïques, soudures, alliages, matériaux d'interface thermique et batteries.

Analyse/perspectives régionales du marché de l'indium au Moyen-Orient et en Afrique

Le marché de l’indium au Moyen-Orient et en Afrique est segmenté en fonction du produit et de l’application.

Les pays du marché de l’indium au Moyen-Orient et en Afrique sont l’Égypte, l’Arabie saoudite, les Émirats arabes unis, l’Afrique du Sud, Israël et le reste du Moyen-Orient et de l’Afrique.

L’Afrique du Sud domine le marché de l’indium au Moyen-Orient et en Afrique en raison de la demande croissante d’articles électroniques.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'indium au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché de l'indium au Moyen-Orient et en Afrique fournit des détails par concurrents. Les détails inclus sont l'aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus ne concernent que les entreprises se concentrant sur le marché de l'indium au Moyen-Orient et en Afrique.

Français Certains des principaux acteurs opérant sur le marché de l'indium au Moyen-Orient et en Afrique sont Nippon Rare Metal, Inc, Umicore, Teck Resources Limited, Nyrstar, Avalon Advanced Materials Inc. Ahpmat.com. Indium Corporation, Lipmann Walton & Co. Ltd, Zhuzhou Keneng New Material Co., Ltd. Inc., ESPI Metals, AIM Metals & Alloys LP, DOWA Electronics Materials Co., Ltd. et Xinlian Environmental Protection Technology Co., Ltd. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA INDIUM MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PURITY LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT-EXPORT SCENARIO

4.2 PRICING ANALYSIS

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 SUBSTITUTE COMPETITIVE ANALYSIS

4.5 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR ELECTRONIC ITEMS

5.1.2 INCREASE IN THE POPULARITY OF SOLAR PANELS

5.1.3 USAGE IN DENTAL ALLOYS

5.1.4 APPLICATION IN BALL BEARINGS MANUFACTURING AND FIRE SPRINKLER SYSTEM

5.2 RESTRAINTS

5.2.1 CREDIBLE THREAT OF SUBSTITUTES

5.2.2 ENVIRONMENTAL AND HEALTH ISSUES ASSOCIATED WITH INDIUM

5.2.3 LOW CONCENTRATION IN EARTH'S CRUST AND EXTRACTION-RELATED ISSUES

5.3 OPPORTUNITIES

5.3.1 GROWTH IN THE SEMICONDUCTOR INDUSTRY

5.3.2 ABILITY TO RECYCLE INDIUM METAL

5.4 CHALLENGES

5.4.1 FLUCTUATION IN RAW MATERIAL PRICES

5.4.2 SIGNIFICANT DEMAND AND SUPPLY GAP

6 MIDDLE EAST & AFRICA INDIUM MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 PRIMARY

6.3 SECONDARY

6.4 TYPE III

7 MIDDLE EAST & AFRICA INDIUM MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 FLAT PANEL DISPLAYS

7.2.1 TELEVISION & DIGITAL SIGNAGE

7.2.2 PC & LAPTOP

7.2.3 SMARTPHONE & TABLETS

7.2.4 VEHICLE DISPLAY

7.2.5 SMART WEARABLES

7.2.6 OTHERS

7.3 SEMICONDUCTOR MATERIALS

7.3.1 ALUMINIUM GALLIUM INDIUM PHOSPHIDE

7.3.2 INDIUM GALLIUM ARSENIDE

7.4 PHOTOVOLTAICS

7.4.1 GROUND MOUNTED

7.4.2 ROOFTOP

7.4.3 OTHERS

7.5 SOLDERS

7.5.1 WIRES

7.5.2 PASTE

7.5.3 PERFORMS

7.5.4 BARS

7.5.5 OTHERS

7.6 ALLOYS

7.6.1 INDIUM-TIN ALLOY

7.6.2 INDIUM-LEAD ALLOY

7.6.3 INDIUM-LEAD ALLOY

7.7 THERMAL INTERFACE MATERIALS

7.8 BATTERIES

7.8.1 AUTOMOTIVE

7.8.2 PORTABLE

7.8.3 INDUSTRIAL

8 MIDDLE EAST & AFRICA INDIUM MARKET, BY REGION

8.1 MIDDLE EAST AND AFRICA

8.1.1 SOUTH AFRICA

8.1.2 ISRAEL

8.1.3 SAUDI ARABIA

8.1.4 UNITED ARAB EMIRATES

8.1.5 EGYPT

8.1.6 REST OF MIDDLE EAST AND AFRICA

9 MIDDLE EAST & AFRICA INDIUM MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

9.2 EXPANSION

9.3 COLLABORATION

9.4 AWARD

9.5 EVENTS

9.6 RECOGNITION

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 UMICORE

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATES

11.2 TECK RESOURCES LIMITED

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATE

11.3 NYRSTAR

11.3.1 COMPANY SNAPSHOT

11.3.2 COMPANY SHARE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT UPDATES

11.4 AIM METALS & ALLOYS LP

11.4.1 COMPANY SNAPSHOT

11.4.2 COMPANY SHARE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT UPDATE

11.5 INDIUM CORPORATION

11.5.1 COMPANY SNAPSHOT

11.5.2 COMPANY SHARE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT UPDATE

11.6 AHPMAT.COM

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT UPDATES

11.7 AVALON ADVANCED MATERIALS INC.

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT UPDATE

11.8 DOWA ELECTRONICS MATERIALS CO., LTD.

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT UPDATES

11.9 ESPI METALS, INC.

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT UPDATES

11.1 LIPMANN WALTON & CO. LTD

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT UPDATES

11.11 NIPPON RARE METALS, INC.

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT UPDATE

11.12 XINLIAN ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT UPDATES

11.13 ZHUZHOU KENENG NEW MATERIALS CO., LTD.

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT UPDATE

12 QUESTIONNAIRE

13 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF ARTICLES OF NIOBIUM "COLUMBIUM", GALLIUM, INDIUM, VANADIUM, AND GERMANIUM, N.E.S.; HS CODE – 811299 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF NIOBIUM "COLUMBIUM", GALLIUM, INDIUM, VANADIUM, AND GERMANIUM, N.E.S.; HS CODE – 811299 (USD THOUSAND)

TABLE 3 SUBSTITUTE MATERIALS FOR INDIUM ALONG WITH THEIR CHARACTERISTICS, APPLICATIONS, AND MANUFACTURING COMPANIES

TABLE 4 REGULATORY FRAMEWORK

TABLE 5 MIDDLE EAST & AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 7 MIDDLE EAST & AFRICA PRIMARY IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA PRIMARY IN INDIUM MARKET, BY REGION, 2021-2030 (TONS)

TABLE 9 MIDDLE EAST & AFRICA SECONDARY IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA SECONDARY IN INDIUM MARKET, BY REGION, 2021-2030 (TONS)

TABLE 11 MIDDLE EAST & AFRICA TYPE III IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA TYPE III IN INDIUM MARKET, BY REGION, 2021-2030 (TONS)

TABLE 13 MIDDLE EAST & AFRICA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA PHOTOVOLTAICS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA SOLDERS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA ALLOYS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA THERMAL INTERFACE MATERIALS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA BATTERIES IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA INDIUM MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA INDIUM MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 29 MIDDLE EAST AND AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 31 MIDDLE EAST AND AFRICA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 SOUTH AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 39 SOUTH AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 40 SOUTH AFRICA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 41 SOUTH AFRICA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 SOUTH AFRICA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 SOUTH AFRICA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 SOUTH AFRICA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 SOUTH AFRICA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 SOUTH AFRICA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 ISRAEL INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 ISRAEL INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 49 ISRAEL INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 50 ISRAEL FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 ISRAEL SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 ISRAEL PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 ISRAEL SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 ISRAEL ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 ISRAEL BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 SAUDI ARABIA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 57 SAUDI ARABIA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 58 SAUDI ARABIA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 59 SAUDI ARABIA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 SAUDI ARABIA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 SAUDI ARABIA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 SAUDI ARABIA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 SAUDI ARABIA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 SAUDI ARABIA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 UNITED ARAB EMIRATES INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 66 UNITED ARAB EMIRATES INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 67 UNITED ARAB EMIRATES INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 68 UNITED ARAB EMIRATES FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 UNITED ARAB EMIRATES SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 UNITED ARAB EMIRATES PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 UNITED ARAB EMIRATES SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 UNITED ARAB EMIRATES ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 UNITED ARAB EMIRATES BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 EGYPT INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 75 EGYPT INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 76 EGYPT INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 77 EGYPT FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 EGYPT SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 EGYPT PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 EGYPT SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 EGYPT ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 EGYPT BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 REST OF MIDDLE EAST AND AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 84 REST OF MIDDLE EAST AND AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA INDIUM MARKET

FIGURE 2 MIDDLE EAST & AFRICA INDIUM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA INDIUM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA INDIUM MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA INDIUM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA INDIUM MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA INDIUM MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA INDIUM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA INDIUM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA INDIUM MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA INDIUM MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA INDIUM MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA INDIUM MARKET: SEGMENTATION

FIGURE 14 RISING DEMAND FOR ELECTRONIC ITEMS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA INDIUM MARKET IN THE FORECAST PERIOD

FIGURE 15 PRIMARY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA INDIUM MARKET IN 2022 & 2029

FIGURE 16 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 PRICE ANALYSIS FOR THE MIDDLE EAST & AFRICA INDIUM MARKET (USD/KG)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA INDIUM MARKET

FIGURE 19 MIDDLE EAST & AFRICA INDIUM MARKET: BY PRODUCT, 2022

FIGURE 20 MIDDLE EAST & AFRICA INDIUM MARKET: BY APPLICATION, 2022

FIGURE 21 MIDDLE EAST AND AFRICA INDIUM MARKET: SNAPSHOT (2022)

FIGURE 22 MIDDLE EAST AND AFRICA INDIUM MARKET: BY COUNTRY (2022)

FIGURE 23 MIDDLE EAST AND AFRICA INDIUM MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 MIDDLE EAST AND AFRICA INDIUM MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 MIDDLE EAST AND AFRICA INDIUM MARKET: BY PRODUCT (2023 - 2030)

FIGURE 26 MIDDLE EAST & AFRICA INDIUM MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.