Middle East And Africa Health Insurance Market

Taille du marché en milliards USD

TCAC :

%

USD

155.16 Billion

USD

207.49 Billion

2024

2032

USD

155.16 Billion

USD

207.49 Billion

2024

2032

| 2025 –2032 | |

| USD 155.16 Billion | |

| USD 207.49 Billion | |

|

|

|

|

Marché de l'assurance maladie au Moyen-Orient et en Afrique par type (produits et solutions), services (hospitalisation, ambulatoire, assistance médicale, etc.), niveau de couverture (Bronze, Argent, Or et Platine), prestataires de services (assureurs maladie publics et privés), régimes d'assurance maladie (point de service (PDV), organisme de prestation de soins exclusifs (EPOS), assurance maladie à indemnisation, compte d'épargne santé (CES), accords de remboursement des frais de santé pour les petits employeurs qualifiés (QSEHRAS), organisme de prestation de soins privilégiés (PPO), organisme de maintien de la santé (HMO), etc.), données démographiques (adultes, mineurs et seniors), type de couverture (couverture à vie, couverture temporaire), utilisateur final (entreprises, particuliers, etc.), canal de distribution (vente directe, institutions financières, commerce électronique, hôpitaux, cliniques, etc.), - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché de l'assurance maladie au Moyen-Orient et en Afrique

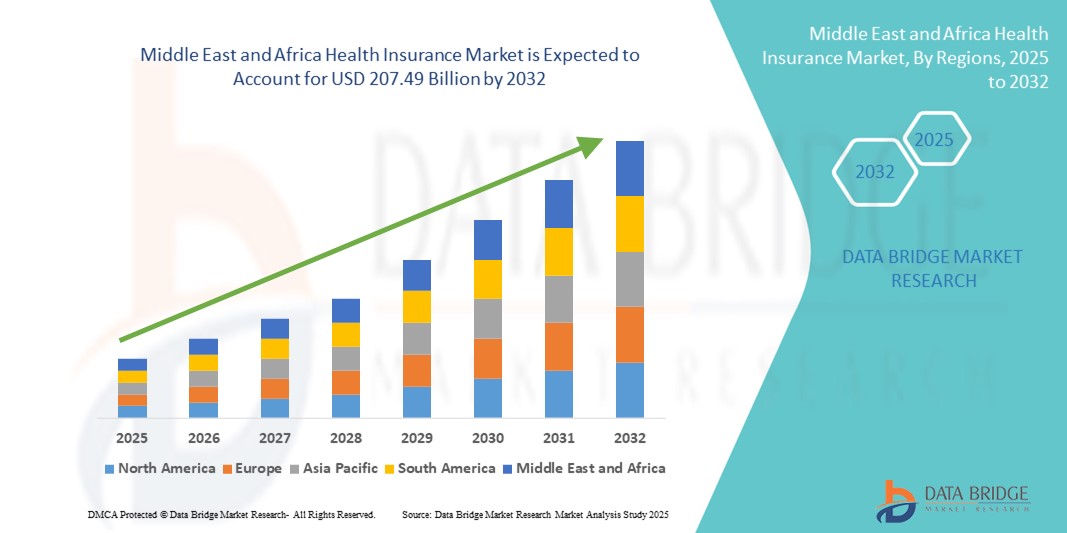

- La taille du marché de l'assurance maladie au Moyen-Orient et en Afrique était évaluée à 155,16 milliards USD en 2024 et devrait atteindre 207,49 milliards USD d'ici 2032 , à un TCAC de 3,70 % au cours de la période de prévision.

- Le marché de l'assurance maladie au Moyen-Orient et en Afrique connaît une forte croissance, portée par une prise de conscience croissante de l'importance de la couverture santé, notamment à la lumière de l'augmentation des taux de maladies chroniques, des dépenses de santé élevées à la charge des patients et de l'expansion des populations de la classe moyenne dans la région.

- Les réformes des soins de santé menées par le gouvernement, l'introduction de politiques d'assurance maladie obligatoires dans des pays comme les Émirats arabes unis et l'Arabie saoudite, ainsi que l'augmentation des investissements dans les infrastructures de santé numérique favorisent davantage l'adoption de l'assurance maladie parmi les particuliers, les familles et les entreprises.

Analyse du marché de l'assurance maladie au Moyen-Orient et en Afrique

- Le marché de l'assurance maladie au Moyen-Orient et en Afrique connaît une croissance significative en raison de la demande croissante de services de santé accessibles et abordables, de la prévalence croissante des maladies chroniques et de l'expansion des initiatives gouvernementales et du secteur privé pour améliorer la couverture sanitaire dans la région.

- La croissance du marché est tirée par une sensibilisation croissante aux avantages de l'assurance maladie, l'augmentation des dépenses de santé, des réformes réglementaires favorables et le besoin croissant de protection financière contre les urgences médicales et les coûts de traitement élevés.

- L'Arabie saoudite a dominé le marché de l'assurance maladie au Moyen-Orient et en Afrique avec une part de revenus de 34,7 % en 2024, grâce à des régimes d'assurance maladie solides dirigés par le gouvernement, à l'expansion du secteur de l'assurance privée et aux exigences d'assurance obligatoires pour les expatriés et les employés du secteur privé.

- Les Émirats arabes unis devraient être le pays à la croissance la plus rapide sur le marché de l'assurance maladie du Moyen-Orient et de l'Afrique, avec un TCAC de 11,6 % prévu entre 2025 et 2032, alimenté par l'essor du tourisme médical, l'amélioration des plateformes d'assurance numérique et les efforts du gouvernement pour une couverture sanitaire universelle.

- Le segment de l'assurance maladie individuelle a dominé le marché de l'assurance maladie au Moyen-Orient et en Afrique avec une part de revenus de 53,1 % en 2024, attribuée à l'augmentation des inscriptions parmi les travailleurs indépendants, les pigistes et les employés du secteur informel à la recherche d'une couverture santé complète et personnalisée.

Portée du rapport et segmentation du marché de l'assurance maladie au Moyen-Orient et en Afrique

|

Attributs |

Aperçu du marché de l'assurance maladie au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché de l'assurance maladie au Moyen-Orient et en Afrique

Les réformes gouvernementales et la transformation numérique stimulent le marché de l'assurance maladie au Moyen-Orient et en Afrique

- Une tendance importante qui façonne le marché de l'assurance maladie au Moyen-Orient et en Afrique est la numérisation rapide des services d'assurance, les assureurs intégrant des plateformes basées sur l'IA, des solutions de télémédecine et des applications de santé mobiles pour améliorer l'accès des clients et l'efficacité opérationnelle.

- Les gouvernements de pays comme l'Arabie saoudite et les Émirats arabes unis introduisent des réglementations en matière d'assurance maladie obligatoire pour les expatriés et les employés du secteur privé, élargissant ainsi considérablement la population assurée et améliorant l'accès aux soins de santé.

- Les startups Insurtech et les assureurs traditionnels exploitent la technologie blockchain et les systèmes basés sur le cloud pour améliorer la transparence des réclamations, prévenir la fraude et rationaliser le processus de gestion des polices, attirant ainsi des consommateurs plus jeunes et férus de technologie.

- Les investissements dans les partenariats public-privé sont en augmentation pour étendre les infrastructures de santé et la couverture d'assurance dans les régions rurales mal desservies d'Afrique du Sud, du Nigéria et du Kenya, soutenant ainsi les initiatives de financement de la santé inclusive.

- La sensibilisation post-pandémique à la protection financière contre les frais médicaux imprévus a considérablement accru la demande de régimes d'assurance maladie individuels et familiaux, en particulier parmi les travailleurs indépendants et les travailleurs du secteur informel.

- Des pays comme l’Égypte et le Maroc mettent en place des cadres de couverture sanitaire universelle (CSU), intégrant les assureurs publics et privés pour réduire les dépenses personnelles et améliorer l’accès aux services médicaux essentiels.

- Cette vague de réformes réglementaires, associée à l'innovation technologique et à une évolution vers les soins préventifs, devrait transformer le paysage du marché de l'assurance maladie au Moyen-Orient et en Afrique, favorisant une pénétration plus élevée de l'assurance et une croissance soutenue jusqu'en 2032.

Dynamique du marché de l'assurance maladie au Moyen-Orient et en Afrique

Conducteur

Une demande croissante stimulée par les réformes réglementaires, l'expansion numérique et la participation du secteur privé

- Le marché de l'assurance maladie au Moyen-Orient et en Afrique connaît une croissance robuste, alimentée par les réformes réglementaires en cours, l'expansion de l'écosystème de la santé numérique et l'implication croissante du secteur privé pour combler les lacunes en matière d'accès aux soins de santé parmi les populations urbaines et rurales.

- En avril 2024, la Banque centrale saoudienne (SAMA) a lancé un programme de bac à sable d'assurance maladie numérique pour permettre aux entreprises InsurTech de piloter des plateformes de couverture maladie alimentées par l'IA sous surveillance réglementaire, reflétant l'évolution de la région vers des modèles d'assurance axés sur la technologie.

- Des pays comme l’Égypte, le Kenya et le Maroc intensifient leurs programmes de couverture sanitaire universelle (CSU), en intégrant des régimes d’assurance privés pour réduire les dépenses personnelles et améliorer l’accessibilité aux services de santé essentiels pour les populations à faible revenu.

- La pénétration croissante des plateformes d'assurance mobiles en Afrique subsaharienne, stimulée par l'adoption des smartphones et des infrastructures d'argent mobile, permet de proposer des plans de micro-assurance santé à la demande adaptés aux travailleurs du secteur informel et aux participants à l'économie des petits boulots.

- Les assureurs basés aux Émirats arabes unis s'associent à des startups de santé numérique pour fournir des services de téléconsultation, de pharmacie électronique et de gestion des maladies chroniques regroupés dans leurs régimes d'assurance maladie, améliorant ainsi l'engagement des patients et les résultats des soins préventifs.

- Les gouvernements de la région du CCG imposent une couverture d'assurance maladie par l'employeur pour les expatriés et les travailleurs du secteur privé, contribuant ainsi à un plus large bassin de risques et à une meilleure durabilité du système de santé.

- L'expansion des fournisseurs d'assurance internationaux et des sociétés de réassurance sur des marchés tels que le Nigéria, l'Afrique du Sud et le Ghana introduit des modèles de souscription avancés, des options de police personnalisables et les meilleures pratiques mondiales dans les écosystèmes locaux.

- Les campagnes d’information sur l’assurance maladie, soutenues par des partenariats public-privé dans des pays comme le Rwanda et la Tanzanie, aident les citoyens à comprendre les avantages de la couverture, les procédures de réclamation et les droits dans le cadre des programmes nationaux d’assurance maladie.

- D'ici 2032, la convergence de l'innovation en matière de santé numérique, des environnements politiques favorables et de la demande croissante de soins accessibles et abordables continuera d'accélérer la formalisation et la croissance du marché de l'assurance maladie au Moyen-Orient et en Afrique.

Retenue/Défi

Obstacles à l'accessibilité financière, fragmentation réglementaire et lacunes en matière d'infrastructures

- Malgré la croissance du marché, le marché de l'assurance maladie au Moyen-Orient et en Afrique est confronté à des défis liés à l'accessibilité financière, à une normalisation réglementaire limitée et à une infrastructure de soins de santé sous-développée dans les régions rurales et à faible revenu.

- Par exemple, dans plusieurs pays d’Afrique subsaharienne, plus de 60 % de la population n’est toujours pas assurée en raison du coût élevé des primes et de l’absence de modèles d’assurance parrainés par l’employeur, ce qui limite l’ampleur de l’adoption de l’assurance formelle.

- Les cadres réglementaires fragmentés d’un pays à l’autre, tels que les différences dans les mandats de couverture, les protocoles de traitement des réclamations et les exigences de solvabilité, créent des complexités opérationnelles pour les assureurs régionaux et multinationaux.

- Dans des régions comme le Soudan, la Somalie et certaines parties de l’Afrique centrale, l’instabilité politique persistante, la faiblesse des capacités institutionnelles et le sous-financement des systèmes de santé publique restreignent considérablement la portée des prestataires d’assurance maladie publics et privés.

- Le scepticisme culturel à l’égard de l’assurance et un manque général de sensibilisation aux avantages de la politique conduisent à une faible utilisation, en particulier dans les communautés rurales où les pratiques de soins traditionnelles prévalent souvent sur les systèmes de santé formels.

- Les préoccupations en matière de confidentialité des données, l’insuffisance des connaissances numériques et le manque d’accès à des dossiers médicaux fiables continuent d’entraver la mise en œuvre de modèles d’assurance axés sur le numérique, en particulier parmi les populations âgées.

- Pour surmonter ces obstacles, les efforts doivent se concentrer sur les subventions aux primes pour les groupes à faible revenu, l'harmonisation réglementaire entre les régions, les partenariats public-privé en matière d'infrastructures et des campagnes de sensibilisation agressives pour améliorer la pénétration de l'assurance maladie d'ici 2032.

Portée du marché de l'assurance maladie au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type, des services, du niveau de couverture, des prestataires de services, des régimes d'assurance maladie, de la démographie, du type de couverture, de l'utilisateur final et du canal de distribution.

- Par type

Le marché de l'assurance santé au Moyen-Orient et en Afrique est segmenté en produits et solutions. Ce segment détenait la plus grande part de marché, soit 62,4 % en 2024, grâce à l'adoption généralisée d'offres d'assurance standardisées, telles que la couverture santé de base, les régimes d'assurance maladies graves et les régimes d'assurance maladie offerts par l'employeur. Ces produits sont populaires en raison de leurs avantages structurés, de leur comparabilité et de leur conformité réglementaire.

Le segment des solutions devrait enregistrer le TCAC le plus rapide, soit 9,8 % entre 2025 et 2032, grâce à la demande croissante de services d'assurance personnalisés et technologiques, tels que la gestion numérique des polices, l'intégration de la télésanté, la souscription assistée par l'IA et les plateformes de détection des fraudes. Ces innovations révolutionnent l'expérience utilisateur et l'efficacité opérationnelle dans l'ensemble de l'écosystème de l'assurance santé.

- Par services

En termes de services, le marché de l'assurance maladie au Moyen-Orient et en Afrique est segmenté en hospitalisation, ambulatoire et assistance médicale, entre autres. Le segment de l'hospitalisation a dominé le marché avec la part de chiffre d'affaires la plus élevée, soit 41,9 % en 2024, principalement en raison de la charge croissante des maladies chroniques et des coûts élevés des traitements liés aux interventions chirurgicales, aux séjours hospitaliers prolongés et aux soins intensifs. L'assurance maladie joue un rôle essentiel dans la réduction des contraintes financières des patients hospitalisés.

Le segment de l'assistance médicale devrait connaître le TCAC le plus rapide de 11,2 % entre 2025 et 2032, alimenté par le besoin croissant de services d'intervention d'urgence 24 heures sur 24, 7 jours sur 7, d'assistance ambulancière, de deuxièmes avis médicaux et de consultations de santé virtuelles, en particulier dans les zones reculées et mal desservies.

- Par niveau de couverture

En fonction du niveau de couverture, le marché de l'assurance maladie au Moyen-Orient et en Afrique est segmenté en bronze, argent, or et platine. Le segment argent a dominé le marché avec une part de chiffre d'affaires de 36,8 % en 2024, car il offre un équilibre entre des primes abordables et des frais à la charge du patient modérés. Il est particulièrement prisé par les familles à revenus moyens qui recherchent une protection adéquate sans surcharge de primes.

Le segment du platine devrait connaître le TCAC le plus rapide de 11,1 % entre 2025 et 2032, grâce à la demande croissante de plans complets et haut de gamme qui couvrent une large gamme de services avec un partage des coûts minimal, en particulier parmi les personnes fortunées et les patients ayant des besoins médicaux complexes.

- Par les prestataires de services

En fonction des prestataires de services, le marché de l'assurance maladie au Moyen-Orient et en Afrique est segmenté entre les assureurs publics et les assureurs privés. En 2024, les assureurs privés détenaient la plus grande part de marché, soit 69,1 %, grâce à leur capacité à offrir un traitement plus rapide des demandes de remboursement, des réseaux hospitaliers plus étendus et des options de couverture plus personnalisées. De nombreux employeurs et particuliers privilégient les assureurs privés pour leur efficacité et leurs services centrés sur le client.

Le segment des prestataires d’assurance maladie publique devrait connaître le TCAC le plus rapide, soit 8,9 %, entre 2025 et 2032, soutenu par un investissement public accru dans les programmes nationaux de santé, les régimes d’assurance sociale et les politiques visant à élargir l’accès aux soins de santé aux populations à faible revenu et rurales.

- Par les régimes d'assurance maladie

En termes de régimes d'assurance maladie, le marché de l'assurance maladie au Moyen-Orient et en Afrique est segmenté en POS, EPOS, indemnisation, HSA, QSEHRA, PPO, HMO, entre autres. Le segment HMO a dominé le marché avec la part de chiffre d'affaires la plus élevée (31,6 %) en 2024, grâce à sa rentabilité et à son modèle de soins coordonnés qui oblige les patients à accéder aux services par l'intermédiaire d'un médecin traitant au sein d'un réseau défini. Ce modèle est attractif tant pour les assureurs que pour les assurés grâce à des primes moins élevées et une gestion simplifiée.

Le segment HSA devrait connaître le TCAC le plus rapide de 10,9 % entre 2025 et 2032, car de plus en plus de consommateurs optent pour des régimes de santé à franchise élevée liés à des comptes d'épargne fiscalement avantageux, offrant flexibilité et contrôle sur les dépenses de santé.

- Par démographie

Sur le plan démographique, le marché de l'assurance maladie au Moyen-Orient et en Afrique est segmenté en adultes, mineurs et seniors. Le segment des adultes a dominé le marché avec une part de chiffre d'affaires de 54,8 % en 2024, représentant la plus grande population assurable recherchant activement une couverture par le biais de leurs employeurs, de régimes individuels ou de régimes publics. Les adultes sont les principaux décideurs en matière de couverture santé familiale et contribuent de manière significative au montant des primes d'assurance.

Le segment des personnes âgées devrait connaître le TCAC le plus rapide, soit 12,3 %, entre 2025 et 2032, propulsé par une population gériatrique croissante, une prévalence accrue des maladies liées à l'âge et le besoin de soins de longue durée et de prestations d'hospitalisation.

- Par type de couverture

En fonction du type de couverture, le marché de l'assurance santé au Moyen-Orient et en Afrique est segmenté en deux catégories : l'assurance vie et l'assurance temporaire. En 2024, l'assurance temporaire détenait la plus grande part de marché, avec 60,2 %, grâce à son accessibilité financière et à sa popularité auprès des jeunes et des nouveaux assurés à la recherche d'une protection temporaire ou à court ou moyen terme.

Le segment de la couverture à vie devrait connaître le TCAC le plus rapide de 9,6 % entre 2025 et 2032, car les consommateurs sont de plus en plus conscients de l’importance d’une protection financière à vie contre les risques pour la santé, notamment à la lumière de l’augmentation des maladies liées au mode de vie et de l’inflation médicale.

- Par utilisateur final

En fonction de l'utilisateur final, le marché de l'assurance maladie au Moyen-Orient et en Afrique est segmenté en entreprises, particuliers et autres. Le segment de l'assurance maladie individuelle a dominé le marché avec une part de chiffre d'affaires de 53,1 % en 2024, grâce à l'augmentation des inscriptions des travailleurs indépendants, des freelances et des salariés du secteur informel à la recherche d'une couverture santé complète et personnalisée.

Le segment des particuliers devrait également connaître le TCAC le plus rapide, soit 11,4 %, entre 2025 et 2032, car les professionnels indépendants, les travailleurs de l'économie à la demande et les populations non assurées se tournent de plus en plus vers des régimes d'assurance maladie personnels facilités par l'intégration numérique et des offres de produits simplifiées.

- Par canal de distribution

En fonction des canaux de distribution, le marché de l'assurance maladie au Moyen-Orient et en Afrique est segmenté en ventes directes, institutions financières, e-commerce, hôpitaux, cliniques, etc. En 2024, la vente directe a dominé le marché avec une part de chiffre d'affaires de 36,5 %, grâce à l'efficacité des réseaux de distribution par agents et aux interactions en face à face pour instaurer la confiance, expliquer les avantages des polices et proposer des recommandations personnalisées.

Le segment du commerce électronique devrait connaître le TCAC le plus rapide de 12,6 % entre 2025 et 2032, soutenu par la pénétration croissante d'Internet, l'accessibilité mobile et l'adoption croissante de plateformes en ligne qui permettent aux utilisateurs de comparer, d'acheter et de gérer les polices en temps réel.

Analyse régionale du marché de l'assurance maladie au Moyen-Orient et en Afrique

- Le marché de l'assurance maladie au Moyen-Orient et en Afrique représentait 8,4 % de la part de marché mondiale en 2024 et devrait croître à un TCAC de 10,7 % de 2025 à 2032, grâce à une sensibilisation croissante du public à la santé, à l'augmentation des dépenses de santé et aux initiatives politiques visant à élargir l'accès à des soins de qualité à travers diverses populations.

- Les gouvernements de la région mettent activement en œuvre des réformes réglementaires, des stratégies de numérisation et des régimes d’assurance obligatoires pour remédier à la faible pénétration de l’assurance et aux coûts élevés des soins de santé à la charge des patients.

- Le marché connaît une participation accrue des assureurs privés, des startups InsurTech et des sociétés de réassurance internationales, qui introduisent des plateformes numériques innovantes, des plans personnalisés et des modèles de souscription basés sur les risques adaptés aux segments mal desservis.

Aperçu du marché de l'assurance maladie en Arabie saoudite

Le marché saoudien de l'assurance maladie a dominé le marché avec une part de revenus de 34,7 % en 2024, grâce à des régimes d'assurance maladie publics robustes, à l'expansion du secteur de l'assurance privée et à des exigences de couverture obligatoire pour les expatriés et les employés du secteur privé. Les réformes de la Vision 2030 du pays stimulent des investissements à grande échelle dans les infrastructures de santé numérique et l'expansion de la couverture d'assurance. Le Conseil coopératif d'assurance maladie (CCHI) accélère l'adoption de systèmes de demandes de remboursement numériques standardisés et de modèles de soins intégrés, tout en améliorant la transparence et la conformité entre les prestataires. La demande croissante de formules d'assurance privée complémentaires parmi les populations urbaines à revenus élevés stimule encore la croissance du marché dans des villes comme Riyad, Djeddah et Dammam.

Aperçu du marché de l'assurance maladie aux Émirats arabes unis

Le marché de l'assurance maladie des Émirats arabes unis a conquis 22,1 % du marché régional en 2024 et devrait être le pays à la croissance la plus rapide, enregistrant un TCAC de 11,6 % entre 2025 et 2032. Cette croissance est alimentée par le statut croissant du pays en tant que pôle de tourisme médical, l'adoption généralisée des plateformes d'assurance maladie numériques et la volonté du gouvernement d'instaurer une couverture maladie universelle par le biais de mandats réglementaires tels que la loi sur l'assurance maladie de Dubaï et le programme Thiqa d'Abou Dhabi. L'intégration de la télémédecine, de la pharmacie en ligne et de l'analyse de santé basée sur l'IA améliore l'efficacité et l'accessibilité des services d'assurance maladie. Les assureurs basés aux Émirats arabes unis collaborent de plus en plus avec des start-ups de santé numérique pour proposer des services à valeur ajoutée et une couverture personnalisée, attirant ainsi davantage les expatriés et les patients internationaux à la recherche de formules de soins haut de gamme.

Part de marché de l'assurance maladie au Moyen-Orient et en Afrique

Le marché de l’assurance maladie est principalement dirigé par des entreprises bien établies, notamment :

- Bupa (Royaume-Uni)

- Now Health International (Chine)

- Cigna (États-Unis)

- Aetna Inc. (États-Unis)

- AXA (France)

- HBF Health Limited (Australie)

- Vitalité (Royaume-Uni)

- Centene Corporation (États-Unis)

- International Medical Group, Inc. (États-Unis)

- Anthem Insurance Companies, Inc. (États-Unis)

- Broadstone Corporate Benefits Limited (Royaume-Uni)

- Allianz Care (France)

- HealthCare International Middle East and Africa Network Ltd (Royaume-Uni)

- Assicurazioni Generali SPA (Italie)

- Aviva (Royaume-Uni)

- Groupe Vhi (Irlande)

- UnitedHealth Group (États-Unis)

- MAPFRE (Espagne)

- AIA Group Limited (Chine)

Derniers développements sur le marché de l'assurance maladie au Moyen-Orient et en Afrique

- En février 2025, Bupa Arabia a lancé sa plateforme CareConnect et son service Bupa Pro , révolutionnant ainsi l'assurance santé numérique en Arabie saoudite. CareConnect permet aux utilisateurs d'accéder à des cartes de santé numériques, de suivre leurs demandes de remboursement et de stocker leurs données médicales, tandis que Bupa Pro élimine les pré-approbations pour les consultations externes pour plus de 200 000 membres grâce à la validation en temps réel par API. Ces innovations visent à réduire les temps d'attente des patients et à améliorer l'accessibilité aux services de santé dans toute la région.

- En mai 2025, la Fondation de l'OMS a signé un partenariat stratégique avec Tawuniya, l'un des principaux assureurs d'Arabie saoudite, afin de stimuler l'innovation et la résilience des systèmes de santé dans la région de la Méditerranée orientale. Cette collaboration porte sur la gestion de la santé des populations, l'accélération de la santé numérique et la couverture sanitaire universelle, marquant ainsi une étape importante dans la transformation des soins de santé dans la région.

- En avril 2025, l'Autorité des services financiers d'Oman a lancé Dhamani , une plateforme numérique nationale d'assurance maladie visant à automatiser les demandes de remboursement, à améliorer la transparence et à rationaliser les processus d'assurance. Cette initiative s'inscrit dans la vision d'Oman de numériser l'écosystème de la santé et d'étendre la couverture d'assurance à davantage de citoyens et de résidents.

- En janvier 2024, AXA Égypte a lancé un nouveau produit, AXA Health Advantage , proposant des consultations de télémédecine, un soutien en santé mentale et la gestion des maladies chroniques dans le cadre de ses régimes de santé individuels et professionnels. Cette initiative répond à la demande croissante de modèles de soins hybrides dans tout le pays.

- En mars 2024, Discovery Health South Africa a annoncé son intention d'intégrer le traitement des demandes de remboursement par IA d'ici 2026, afin de réduire la fraude, d'automatiser les décisions et d'améliorer la satisfaction client. Cette initiative s'inscrit dans le cadre plus large de la transformation numérique et de l'amélioration de l'efficacité opérationnelle de Discovery.

- En juin 2024, Medgulf Insurance en Arabie saoudite s'est associée à Altibbi, un fournisseur leader de services de santé numérique, pour proposer des services de télésanté intégrés à ses contrats d'assurance. Cette intégration permet aux assurés d'accéder à des consultations à distance et à des ordonnances électroniques 24h/24 et 7j/7 via une application mobile, reflétant ainsi une tendance majeure vers les services d'assurance technologiques dans la région.

- En juin 2021, Vitality a annoncé un partenariat avec Samsung UK pour intégrer Samsung Health au programme Vitality, offrant ainsi aux membres davantage de moyens de suivre leur activité et d'améliorer leur santé. Ce nouveau partenariat avec Samsung permettra aux utilisateurs Android de bénéficier pleinement des avantages du programme Vitality. En effet, les membres pourront associer leur profil Samsung Health à leur espace membre Vitality pour enregistrer automatiquement leurs pas quotidiens et leur fréquence cardiaque et gagner des points d'activité Vitality.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.