Marché des composants électroniques au Moyen-Orient et en Afrique, par type de composants (processeurs, moteurs, batteries, microcontrôleurs, circuits intégrés, disjoncteurs, transformateurs, condensateurs, diodes, résistances, inductances, relais, commutateurs, fusibles et autres), type de produits (produits bruns, produits blancs et petits produits blancs), type de produit (composants actifs, passifs, électromécaniques et autres), type d'utilisation finale (électronique grand public, réseaux et télécommunications, automobile, fabrication, aérospatiale et défense, soins de santé et autres) Pays (Afrique du Sud, Arabie saoudite, Émirats arabes unis, Israël, Égypte et reste du Moyen-Orient et de l'Afrique) Tendances et prévisions de l'industrie jusqu'en 2028

Analyse et perspectives du marché : marché des composants électroniques au Moyen-Orient et en Afrique

Analyse et perspectives du marché : marché des composants électroniques au Moyen-Orient et en Afrique

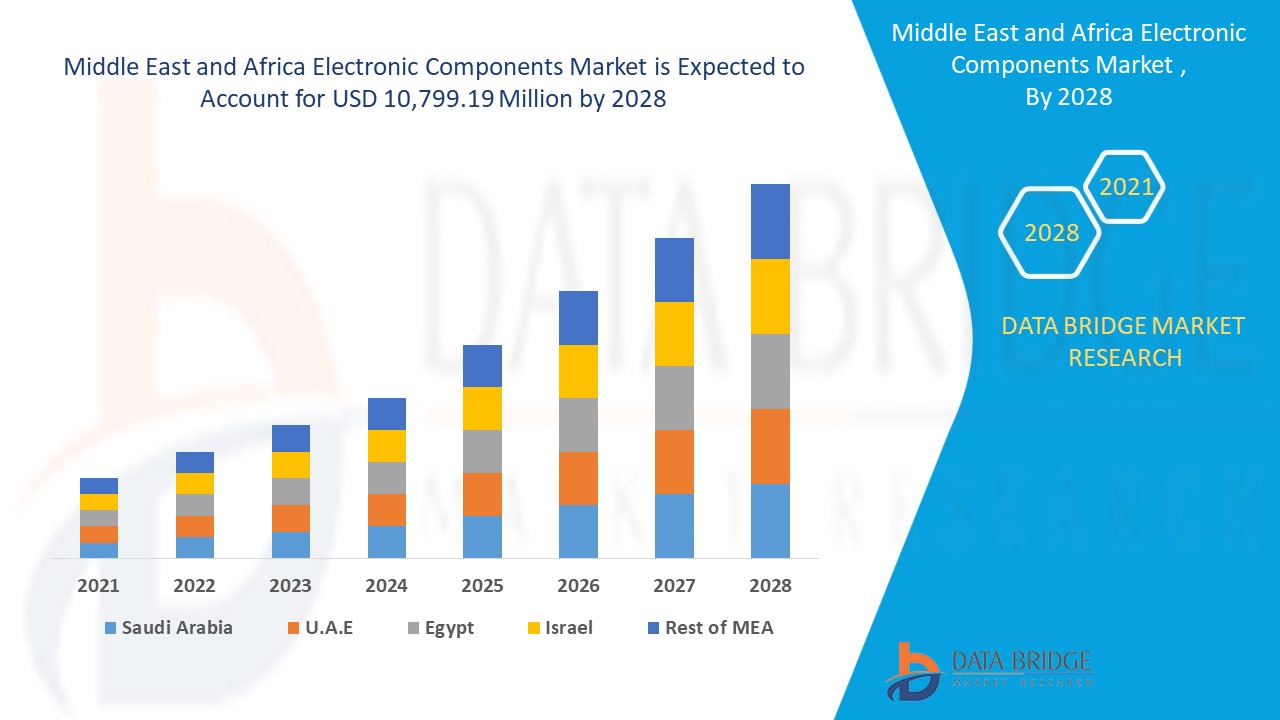

Le marché des composants électroniques du Moyen-Orient et de l'Afrique devrait connaître une croissance de marché au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 5,4 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 10 799,19 millions USD d'ici 2028. L'automatisation croissante et l'IoT dans le cadre de l'Industrie 4.0 et l'utilisation croissante de l'électronique dans la fabrication, l'automatisation et la défense agissent comme moteurs de la croissance du marché des composants électroniques.

Les composants électroniques sont des dispositifs discrets utilisés dans un système électronique pour affecter les électrons ainsi que leurs champs associés. Ce sont des éléments vitaux du circuit , qui contribuent à son fonctionnement. Les composants électroniques ont un nombre différent de bornes , qui sont connectées à d'autres composants pour créer un circuit électronique. Les composants électroniques ont de larges applications dans tous les secteurs tels que la défense, l'automobile, l'électronique grand public , la médecine, etc. En tant qu'élément essentiel du système électronique, le marché des composants électroniques a un grand potentiel de croissance à un rythme plus élevé dans un avenir proche.

L'utilisation croissante des appareils électroniques dans chaque tâche de la vie quotidienne est le principal facteur moteur du marché. La hausse des coûts des métaux et composants rares peut s'avérer être un défi. Cependant, l'adoption rapide de l'électronique dans tous les secteurs de la production et des sciences s'avère être une opportunité. Les contraintes des politiques commerciales et de la chaîne d'approvisionnement en matériaux de différents composants électroniques et les défis rencontrés en raison de l'impact de la COVID-19 sur la chaîne d'approvisionnement des matières premières sont les facteurs restrictifs.

Le rapport sur le marché des composants électroniques fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché des composants électroniques, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des composants électroniques au Moyen-Orient et en Afrique

Portée et taille du marché des composants électroniques au Moyen-Orient et en Afrique

Le marché des composants électroniques du Moyen-Orient et de l'Afrique est segmenté en fonction du type de composants, du type de matières premières, du type de produit et du type d'utilisation finale. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du type de composant, le marché des composants électroniques est segmenté en processeurs, moteurs, batteries, microcontrôleurs, circuits intégrés, disjoncteurs, transformateurs, condensateurs, diodes, résistances, inducteurs, commutateurs, relais, fusibles et autres. En 2021, le segment des processeurs devrait dominer le marché des composants électroniques car il s'agit de l'unité de traitement qui constitue un élément important de tout appareil.

- Sur la base du type de produits, le marché des composants électroniques est segmenté en produits bruns, produits blancs et petits produits blancs. En 2021, le segment des produits bruns devrait dominer le marché des composants électroniques car il comprend les téléviseurs et les téléphones, qui sont des appareils centrés sur le silicium nécessaires au niveau personnel et commercial avec un coût moyen plus élevé.

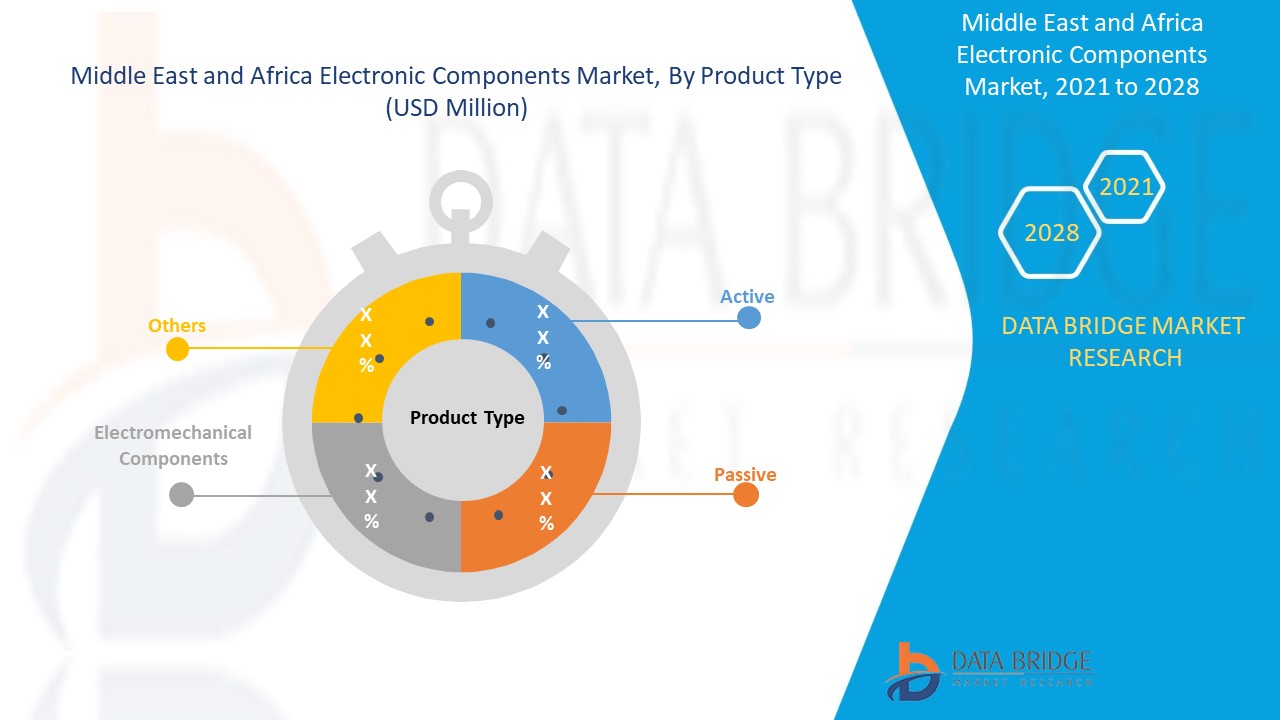

- En fonction du type de produit, le marché des composants électroniques est segmenté en composants actifs, passifs, électromécaniques et autres. En 2021, le segment actif devrait dominer le marché des composants électroniques, car les composants actifs comprennent les transistors qui détiennent une part plus importante des composants utilisés pour la construction de circuits.

- En fonction du type d'utilisation finale, le marché des composants électroniques est segmenté en électronique grand public, réseaux et télécommunications, fabrication, automobile, aérospatiale et défense, soins de santé et autres. En 2021, le segment de l'électronique grand public devrait dominer le marché des composants électroniques, car la demande constante d'électronique grand public augmente en raison de l'innovation technologique constante des appareils.

Analyse du marché des composants électroniques au Moyen-Orient et en Afrique

Le marché des composants électroniques est analysé et les informations sur la taille du marché sont fournies par pays, type de composant, type de marchandise, type de produit et type d'utilisation finale comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des composants électroniques du Moyen-Orient et de l'Afrique sont Israël, les Émirats arabes unis, l'Afrique du Sud, l'Arabie saoudite, l'Égypte et le reste du Moyen-Orient et de l'Afrique.

Israël domine le marché des composants électroniques au Moyen-Orient et en Afrique en raison de l’utilisation accrue de composants électroniques dans les biens de consommation et le secteur manufacturier de cette région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

La recherche croissante de nouvelles technologies pour la détection et l’imagerie sûres du cancer stimule la croissance du marché des composants électroniques au Moyen-Orient et en Afrique.

Le marché des composants électroniques du Moyen-Orient et de l'Afrique vous fournit également une analyse de marché détaillée pour la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2010 à 2019.

Analyse du paysage concurrentiel et des parts de marché des composants électroniques au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des composants électroniques fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché des composants électroniques.

Les principales entreprises qui vendent des composants électroniques au Moyen-Orient et en Afrique sont Intel Corporation, Qualcomm Technologies, Inc., NXP Semiconductors, Broadcom, Advanced Micro Devices, Inc., Infineon Technologies AG, KYOCERA Corporation, Texas Instruments Incorporated, TOSHIBA CORPORATION, Analog Devices, Inc., Hitachi High-Tech Corporation, Maxim Integrated, Monolithic Power Systems, Inc., SAMSUNG ELECTRONICS CO. LTD, SCHURTER et Microchip Technology Inc., entre autres acteurs nationaux. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux contrats et accords sont également initiés par des entreprises du monde entier qui accélèrent également le marché des composants électroniques.

Par exemple,

- En mai 2021, Hitachi High-Tech Corporation a annoncé la création d'une nouvelle usine de développement de technologies de semi-conducteurs aux États-Unis. L'entreprise créera une nouvelle solution Lumada qui utilisera la technologie numérique avancée d'Hitachi, cette solution sera utilisée dans les appareils électroniques grand public. Grâce à cette expansion, l'entreprise pourra répondre aux besoins des clients en matière d'appareils numériques informatiques 5G.

- En mai 2021, Qualcomm Technologies, Inc. a annoncé le Qualcomm Snapdragon Developer Kit, conçu pour permettre aux éditeurs de logiciels et aux développeurs d'applications indépendants de tester et d'optimiser leurs applications pour l'écosystème croissant d'appareils alimentés par des plates-formes de calcul Snapdragon. Conçu en collaboration avec Microsoft, ce kit de développement Windows 10 sur Arm est une ressource économique permettant aux développeurs de vérifier et de valider leurs solutions afin de garantir une expérience utilisateur exceptionnelle pour travailler, apprendre et collaborer sur des PC Windows 10 compatibles Snapdragon. Cette collaboration avec Microsoft est une ressource économique qui invite les clients à exiger le produit à grande échelle.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché renforcent l'empreinte de l'entreprise sur le marché des composants électroniques, ce qui offre également l'avantage de la croissance des bénéfices de l'organisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR SMART ELECTRONIC DEVICES

5.1.2 RISE IN PREFERENCE FOR MINIATURIZED DESIGN COMPONENT

5.1.3 RISE IN ADOPTION OF ELECTRONIC COMPONENTS IN NUMEROUS INDUSTRIES

5.1.4 RISE IN DEMAND FOR THE SOFT ELECTRONIC COMPONENTS

5.2 RESTRAINTS

5.2.1 RISE IN METAL PRICES HAMPERS THE OVERALL COMPONENT PRODUCTION COSTS

5.2.2 CHANGE IN ECONOMIC AND POLITICAL OUTLOOK

5.3 OPPORTUNITIES

5.3.1 INCREASE IN USAGE OF IOT

5.3.2 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIPS AND MERGERS

5.3.3 RISE IN ADOPTION OF ELECTRONIC COMPONENTS IN APPLICATIONS SUCH AS SATELLITE AND SPACE TECHNOLOGY

5.3.4 RISE IN AUTOMATION IN THE AUTOMOTIVE SECTOR

5.3.5 ADVENT OF DIFFERENT CONNECTED TECHNOLOGIES WITH ENHANCED EFFICIENCY

5.4 CHALLENGES

5.4.1 RISE IN DEPENDENCY OF MANUFACTURER ON DIFFERENT SUPPLIERS

5.4.2 SHORTAGE IN SUPPLY OF ELECTRONIC COMPONENTS

6 IMPACT OF COVID-19 ON THE MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET, BY COMPONENT TYPE

7.1 OVERVIEW

7.2 PROCESSORS

7.3 MOTORS

7.4 BATTERY

7.5 MICROCONTROLLER

7.6 INTEGRATED CIRCUIT (IC)

7.7 CIRCUIT BREAKERS

7.8 TRANSFORMERS

7.9 CAPACITORS

7.9.1 PAPER AND FILM

7.9.2 CERAMIC

7.9.3 ALUMINUM

7.9.4 TANTALUM

7.9.5 SUPERCAPACITOR

7.9.6 OTHERS

7.1 DIODES

7.10.1 POWER DIODE

7.10.1.1 Zener Diode

7.10.1.2 schottky diode

7.10.1.3 Rectifier diode

7.10.2 SMALL SIGNAL SWITCHING DIODE

7.10.3 RF DIODE

7.10.4 OTHERS

7.11 RESISTORS

7.12 INDUCTORS

7.13 SWITCHES

7.13.1 SINGLE POLE DOUBLE THROW (SPDT)

7.13.2 SINGLE POLE SINGLE THROW (SPST)

7.13.3 DOUBLE POLE DOUBLE THROW (DPDT)

7.13.4 DOUBLE POLE SINGLE THROW (DPST)

7.14 RELAYS

7.15 FUSE

7.16 OTHERS

8 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET, BY COMMODITIES TYPE

8.1 OVERVIEW

8.2 BROWN GOODS

8.2.1 BY TYPE

8.2.1.1 Personal Computers

8.2.1.2 TV

8.2.1.3 DVD Players

8.2.1.4 cd players

8.2.1.5 VCRs

8.2.1.6 others

8.2.2 ELECTRONIC COMPONENTS

8.2.2.1 Processors

8.2.2.2 Microcontrollers

8.2.3 INTEGRATED CIRCUITS (IC)

8.2.3.1 Battery

8.2.3.2 motors

8.2.3.3 vacuum tubes

8.2.3.4 others

8.2.4 BY MATERIAL

8.2.4.1 Metal

8.2.4.1.1 Gold

8.2.4.1.2 Palladium

8.2.4.1.3 Platinum

8.2.4.1.4 Copper

8.2.4.1.5 Tin

8.2.4.1.6 Silver

8.2.4.1.7 Nickel

8.2.4.1.8 Aluminum

8.2.4.1.9 Cobalt

8.2.4.1.10 Zinc

8.2.4.1.11 Tantalum

8.2.4.1.12 Neodymium

8.2.4.2 Plastic

8.2.4.3 By Type

8.2.4.3.1 Thermoset

8.2.4.3.2 Thermoplastic

8.3 WHITE GOODS

8.3.1 BY TYPE

8.3.1.1 refrigerators

8.3.1.2 washing machines

8.3.1.3 air conditioners

8.3.1.4 microwave Ovens

8.3.1.5 dishwashers

8.3.1.6 clothes dryers

8.3.1.7 water heaters

8.3.1.8 freezers

8.3.1.9 kitchen stoves

8.3.1.10 induction cookers

8.3.1.11 drying cabinets

8.3.1.12 trash compactors

8.3.2 BY ELECTRONIC COMPONENT

8.3.2.1 motors

8.3.2.2 Microcontrollers

8.3.2.3 Integrated Circuits (IC)

8.3.2.4 processors

8.3.2.5 battery

8.3.2.6 vacuum tubes

8.3.2.7 others

8.3.3 BY MATERIAL

8.3.3.1 Metal

8.3.3.1.1 Gold

8.3.3.1.2 Palladium

8.3.3.1.3 Platinum

8.3.3.1.4 Copper

8.3.3.1.5 Aluminum

8.3.3.1.6 Tin

8.3.3.1.7 Silver

8.3.3.1.8 Nickel

8.3.3.1.9 Tantalum

8.3.3.1.10 Neodymium

8.3.3.1.11 Cobalt

8.3.3.1.12 Zinc

8.3.3.2 Plastic

8.3.3.2.1 Thermoset

8.3.3.2.2 Thermoplastic

8.4 SMALL WHITE GOODS

8.4.1 BY TYPE

8.4.1.1 FOOD PROCESSORS

8.4.1.2 Toasters

8.4.1.3 HAIRDRYERS

8.4.1.4 KETTLES

8.4.1.5 OTHERS

8.4.2 BY ELECTRONIC COMPONENTS

8.4.2.1 microcontrollers

8.4.2.2 Integrated Circuits (IC)

8.4.2.3 Motors

8.4.2.4 processors

8.4.2.5 battery

8.4.2.6 vacuum tubes

8.4.2.7 others

8.4.3 BY MATERIAL

8.4.3.1 Metal

8.4.3.1.1 Gold

8.4.3.1.2 Palladium

8.4.3.1.3 Platinum

8.4.3.1.4 Copper

8.4.3.1.5 Tin

8.4.3.1.6 Silver

8.4.3.1.7 Nickel

8.4.3.1.8 Aluminum

8.4.3.1.9 Tantalum

8.4.3.1.10 Cobalt

8.4.3.1.11 Neodymium

8.4.3.1.12 Zinc

8.4.3.2 Plastic

8.4.3.2.1 THERMOSET

8.4.3.2.2 Thermoplastic

8.5 OTHERS

9 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 ACTIVE

9.3 PASSIVE

9.4 ELECTROMECHANICAL COMPONENTS

9.5 OTHERS

10 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET, BY END USE TYPE

10.1 OVERVIEW

10.2 CONSUMER ELECTRONICS

10.3 NETWORKING & TELECOMMUNICATION

10.4 MANUFACTURING

10.5 AUTOMOTIVE

10.6 AEROSPACE & DEFENSE

10.7 HEALTHCARE

10.8 OTHERS

11 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET, BY REGION

11.1 MIDDLE EAST & AFRICA

11.1.1 ISRAEL

11.1.2 U.A.E.

11.1.3 SOUTH AFRICA

11.1.4 SAUDI ARABIA

11.1.5 EGYPT

11.1.6 REST OF MIDDLE EAST & AFRICA

12 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 INTEL CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 QUALCOMM TECHNOLOGIES, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 BROADCOM

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 NXP SEMICONDUCTORS

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 ADVANCED MICRO DEVICES, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 ANALOG DEVICES INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 HITACHI HIGH-TECH CORPORATION

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 INFINEON TECHNOLOGIES AG

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 KYOCERA CORPORATION

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 MAXIM INTEGRATED

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 MEDIATEK INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 MICROCHIP TECHNOLOGY INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 MONOLITHIC POWER SYSTEMS, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 REWELL INDUSTRIAL CO., LTD

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 SAMSUNG ELECTRONICS CO., LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 SCHURTER

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 SK HYNIX INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 TEXAS INSTRUMENTS INCORPORATED

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 TOSHIBA CORPORATION

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 WATTS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET, BY COMPONENT TYPE, 2019-2028 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA PROCESSORS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA MOTORS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA BATTERY IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA MICROCONTROLLER IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA INTEGRATED CIRCUIT (IC) IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA CIRCUIT BREAKERS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA TRANSFORMERS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA CAPACITORS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA CAPACITORS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA DIODES IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA DIODES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA POWER DIODE IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA RESISTORS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA INDUCTORS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA SWITCHES IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA DIODES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA RELAYS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA FUSE IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA OTHERS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET, BY COMMODITIES TYPE, 2019-2028 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA OTHERS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA ACTIVE IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA PASSIVE IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA ELECTROMECHANICAL COMPONENTS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA OTHERS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET, BY END USE TYPE, 2019-2028 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA NETWORKING & TELECOMMUNICATION IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA MANUFACTURING IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA AUTOMOTIVE IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA HEALTHCARE IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA OTHERS IN ELECTRONIC COMPONENTS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA ELECTRONIC COMPONENTS MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA ELECTRONIC COMPONENTS MARKET, BY COMPONENT TYPE, 2019-2028 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA CAPACITORS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA DIODES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA POWER DIODE IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA SWITCHES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA ELECTRONIC COMPONENTS MARKET, BY COMMODITIES TYPE, 2019-2028 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 72 MIDDLE EAST & AFRICA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 74 MIDDLE EAST & AFRICA METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 75 MIDDLE EAST & AFRICA PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA ELECTRONIC COMPONENTS MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA ELECTRONIC COMPONENTS MARKET, BY END USE TYPE, 2019-2028 (USD MILLION)

TABLE 78 ISRAEL ELECTRONIC COMPONENTS MARKET, BY COMPONENT TYPE, 2019-2028 (USD MILLION)

TABLE 79 ISRAEL CAPACITORS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 80 ISRAEL DIODES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 81 ISRAEL POWER DIODE IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 82 ISRAEL SWITCHES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 83 ISRAEL ELECTRONIC COMPONENTS MARKET, BY COMMODITIES TYPE, 2019-2028 (USD MILLION)

TABLE 84 ISRAEL BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 85 ISRAEL BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 86 ISRAEL BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 87 ISRAEL METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 88 ISRAEL PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 89 ISRAEL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 90 ISRAEL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 91 ISRAEL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 92 ISRAEL METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 93 ISRAEL PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 94 ISRAEL SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 95 ISRAEL SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 96 ISRAEL SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 97 ISRAEL METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 98 ISRAEL PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 99 ISRAEL ELECTRONIC COMPONENTS MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 100 ISRAEL ELECTRONIC COMPONENTS MARKET, BY END USE TYPE, 2019-2028 (USD MILLION)

TABLE 101 U.A.E. ELECTRONIC COMPONENTS MARKET, BY COMPONENT TYPE, 2019-2028 (USD MILLION)

TABLE 102 U.A.E. CAPACITORS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 103 U.A.E. DIODES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 104 U.A.E. POWER DIODE IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 105 U.A.E. SWITCHES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 106 U.A.E. ELECTRONIC COMPONENTS MARKET, BY COMMODITIES TYPE, 2019-2028 (USD MILLION)

TABLE 107 U.A.E. BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 108 U.A.E. BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 109 U.A.E. BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 110 U.A.E. METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 111 U.A.E. PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 112 U.A.E. WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 113 U.A.E. WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 114 U.A.E. WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 115 U.A.E. METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 116 U.A.E. PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 117 U.A.E. SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 118 U.A.E. SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 119 U.A.E. SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 120 U.A.E. METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 121 U.A.E. PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 122 U.A.E. ELECTRONIC COMPONENTS MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 123 U.A.E. ELECTRONIC COMPONENTS MARKET, BY END USE TYPE, 2019-2028 (USD MILLION)

TABLE 124 SOUTH AFRICA ELECTRONIC COMPONENTS MARKET, BY COMPONENT TYPE, 2019-2028 (USD MILLION)

TABLE 125 SOUTH AFRICA CAPACITORS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 126 SOUTH AFRICA DIODES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 127 SOUTH AFRICA POWER DIODE IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 128 SOUTH AFRICA SWITCHES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 129 SOUTH AFRICA ELECTRONIC COMPONENTS MARKET, BY COMMODITIES TYPE, 2019-2028 (USD MILLION)

TABLE 130 SOUTH AFRICA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 131 SOUTH AFRICA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 132 SOUTH AFRICA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 133 SOUTH AFRICA METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 134 SOUTH AFRICA PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 135 SOUTH AFRICA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 136 SOUTH AFRICA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 137 SOUTH AFRICA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 138 SOUTH AFRICA METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 139 SOUTH AFRICA PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 140 SOUTH AFRICA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 141 SOUTH AFRICA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 142 SOUTH AFRICA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 143 SOUTH AFRICA METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 144 SOUTH AFRICA PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 145 SOUTH AFRICA ELECTRONIC COMPONENTS MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 146 SOUTH AFRICA ELECTRONIC COMPONENTS MARKET, BY END USE TYPE, 2019-2028 (USD MILLION)

TABLE 147 SAUDI ARABIA ELECTRONIC COMPONENTS MARKET, BY COMPONENT TYPE, 2019-2028 (USD MILLION)

TABLE 148 SAUDI ARABIA CAPACITORS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 149 SAUDI ARABIA DIODES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 150 SAUDI ARABIA POWER DIODE IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 151 SAUDI ARABIA SWITCHES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 152 SAUDI ARABIA ELECTRONIC COMPONENTS MARKET, BY COMMODITIES TYPE, 2019-2028 (USD MILLION)

TABLE 153 SAUDI ARABIA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 154 SAUDI ARABIA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 155 SAUDI ARABIA BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 156 SAUDI ARABIA METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 157 SAUDI ARABIA PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 158 SAUDI ARABIA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 159 SAUDI ARABIA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 160 SAUDI ARABIA WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 161 SAUDI ARABIA METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 162 SAUDI ARABIA PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 163 SAUDI ARABIA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 164 SAUDI ARABIA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 165 SAUDI ARABIA SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 166 SAUDI ARABIA METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 167 SAUDI ARABIA PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 168 SAUDI ARABIA ELECTRONIC COMPONENTS MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 169 SAUDI ARABIA ELECTRONIC COMPONENTS MARKET, BY END USE TYPE, 2019-2028 (USD MILLION)

TABLE 170 EGYPT ELECTRONIC COMPONENTS MARKET, BY COMPONENT TYPE, 2019-2028 (USD MILLION)

TABLE 171 EGYPT CAPACITORS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 172 EGYPT DIODES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 173 EGYPT POWER DIODE IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 174 EGYPT SWITCHES IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 175 EGYPT ELECTRONIC COMPONENTS MARKET, BY COMMODITIES TYPE, 2019-2028 (USD MILLION)

TABLE 176 EGYPT BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 177 EGYPT BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 178 EGYPT BROWN GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 179 EGYPT METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 180 EGYPT PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 181 EGYPT WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 182 EGYPT WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 183 EGYPT WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 184 EGYPT METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 185 EGYPT PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 186 EGYPT SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 187 EGYPT SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY ELECTRONIC COMPONENTS, 2019-2028 (USD MILLION)

TABLE 188 EGYPT SMALL WHITE GOODS IN ELECTRONIC COMPONENTS MARKET, BY MATERIAL, 2019-2028 (USD MILLION)

TABLE 189 EGYPT METAL IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 190 EGYPT PLASTIC IN ELECTRONIC COMPONENTS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 191 EGYPT ELECTRONIC COMPONENTS MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 192 EGYPT ELECTRONIC COMPONENTS MARKET, BY END USE TYPE, 2019-2028 (USD MILLION)

TABLE 193 REST OF MIDDLE EAST & AFRICA ELECTRONIC COMPONENTS MARKET, BY COMPONENT TYPE, 2019-2028 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: SEGMENTATION

FIGURE 10 INCREASE IN DEMAND FOR SMART ELECTRONIC DEVICES IS EXPECTED TO DRIVE MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 PROCESSORS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET IN 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET

FIGURE 13 COPPER PRICES (PER POUND) - 45 YEAR HISTORICAL CHART

FIGURE 14 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: BY COMPONENT TYPE, 2020

FIGURE 15 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: BY COMMODITIES TYPE, 2020

FIGURE 16 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: BY PRODUCT TYPE, 2020

FIGURE 17 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: BY END USE TYPE, 2020

FIGURE 18 MIDDLE EAST & AFRICA ELECTRONIC COMPONENTS MARKET: SNAPSHOT (2020)

FIGURE 19 MIDDLE EAST & AFRICA ELECTRONIC COMPONENTS MARKET: BY COUNTRY (2020)

FIGURE 20 MIDDLE EAST & AFRICA ELECTRONIC COMPONENTS MARKET: BY COUNTRY (2021 & 2028)

FIGURE 21 MIDDLE EAST & AFRICA ELECTRONIC COMPONENTS MARKET: BY COUNTRY (2020 & 2028)

FIGURE 22 MIDDLE EAST & AFRICA ELECTRONIC COMPONENTS MARKET: BY COMPONENT TYPE (2021-2028)

FIGURE 23 MIDDLE EAST AND AFRICA ELECTRONIC COMPONENTS MARKET: COMPANY SHARE 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.