Middle East and Africa Electric Vehicle Thermal Management System Market, By Propulsion Type (BEV, PHEV, HEV, and FCV), Technology (Active and Passive), Battery Type (Conventional and Solid-State), Battery Capacity (30-60 Kwh, 60-90 Kwh, Below 30 Kwh, and Above 90 Kwh), Vehicle Type (Passenger and Commercial), System Type (Battery Thermal Management, HVAC, Powertrain, and Others) Industry Trends and Forecast to 2029.

Middle East and Africa Electric Vehicle Thermal Management System Market Analysis and Size

Electric vehicles are a promising renewable substitute to gasoline power-based vehicles to protect the environment. Many governments are taking initiatives to promote electric vehicles and are providing tax rebates and redemption. The rise in the electric vehicles market is because the technology is upgrading at a fast rate, making the demand for electric vehicle thermal management systems in the market. The Middle East and Africa electric vehicle thermal management system market is growing rapidly due to the rise in demand for electric vehicles in the market. The companies are even launching new products to gain a larger market share.

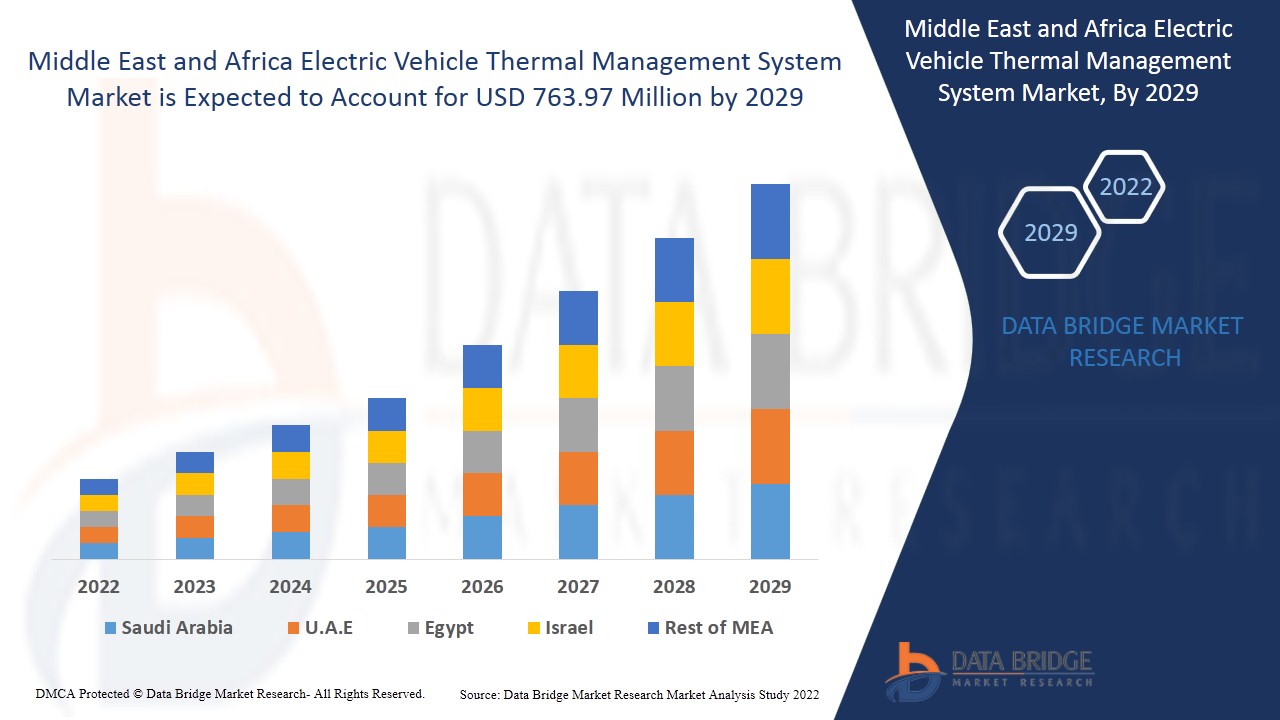

Data Bridge Market Research analyses that the Middle East and Africa electric vehicle thermal management system market is expected to reach the value of USD 763.97 million by 2029, at a CAGR of 23.3% during the forecast period. "BEV" accounts for the most prominent propulsion type segment as they are energy efficient, turning 80% of their energy input into propelling the car, and they have a regenerative braking system that collects energy and returns it to the battery when a car stops. The Middle East and Africa electric vehicle thermal management system market report also cover pricing analysis, patent analysis, and technological advancements in depth.

Middle East and Africa Electric Vehicle Thermal Management System Market Definition

The thermal management system in an electric vehicle is the solution that helps in managing the heat generated during the electrochemical processes occurring in cells, allowing the battery to operate safely and efficiently. Effective thermal management systems are required in electric vehicles to keep battery temperatures in the correct range and prevent the temperature from fluctuating inside the battery pack. Thus, thermal management systems play a vital role in the control of the battery thermal behavior.

L'adoption des véhicules électriques est en hausse dans le monde entier en raison de leur zéro émission et de leur rendement énergétique élevé. Cela a nécessité un système de gestion de batterie approprié pour atteindre des performances maximales dans diverses conditions de fonctionnement. En outre, la tendance croissante à l'augmentation des taux de charge, qui permettraient une charge plus rapide et des trajets plus longs, a accru la demande pour une gestion thermique plus efficace des véhicules électriques.

|

Rapport métrique |

Détails |

|

Année de base |

2021 |

|

Période de prévision |

2022 - 2029 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de propulsion (BEV, PHEV, HEV et FCV), technologie (active et passive), type de batterie (conventionnelle et à semi-conducteurs), capacité de la batterie (30-60 kWh, 60-90 kWh, moins de 30 kWh et plus de 90 kWh), type de véhicule (passager et commercial), type de système (gestion thermique de la batterie, CVC, groupe motopropulseur et autres) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël et le reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

MAHLE GmbH, Valeo, Marelli Holdings Co., Ltd., Continental AG, NORMA Group, MODINE MANUFACTURING COMPANY, entre autres |

Dynamique du marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

- Demande croissante de véhicules électriques

L'industrie automobile connaît une croissance énorme en raison de la demande croissante de véhicules électriques de luxe. Parmi les facteurs qui stimulent les ventes de véhicules électriques, on peut citer les réglementations gouvernementales strictes concernant les émissions des véhicules, ainsi que la demande croissante de véhicules économes en carburant, à hautes performances et à faibles émissions.

- Incitations et subventions du gouvernement pour les véhicules électriques

L'augmentation de la pollution et la raréfaction des ressources, notamment dans le secteur automobile, ont poussé le gouvernement à prendre des mesures de protection de l'environnement, ce qui a entraîné un changement de tendance dans l'industrie automobile, passant des véhicules motorisés classiques aux véhicules hybrides électriques pour protéger l'environnement. De nombreux gouvernements nationaux ont pris des mesures pour inciter à l'adoption de véhicules électriques plutôt que de véhicules classiques, comme des rabais à l'achat, des exonérations fiscales, des crédits d'impôt et quelques autres.

- Demande croissante pour une solution de refroidissement thermique

L'augmentation de la demande de véhicules électriques a conduit à des progrès dans la fabrication de batteries pour fournir plus de puissance et nécessiter des charges moins fréquentes, mais cela nécessite également un système de refroidissement efficace pour protéger la batterie contre la surchauffe. La décharge de la batterie génère de la chaleur ; plus la batterie se décharge rapidement, plus elle génère de chaleur. Cette chaleur peut entraîner la défaillance des appareils. Ainsi, pour assurer la sécurité de la batterie et du véhicule, il est devenu nécessaire de disposer d'un système de gestion thermique approprié pour augmenter sa demande sur le marché.

- Coût initial élevé

Les véhicules électriques sont les plus adaptés au transport et ont un impact moindre sur l'environnement puisqu'ils contribuent à contrôler la pollution de l'air. Cependant, le coût initial des véhicules électriques est plus élevé que celui des véhicules à moteur à essence car ils incluent des composants technologiquement améliorés qui ne nuisent pas à l'environnement. En revanche, les coûts d'exploitation des véhicules électriques sont moins élevés que ceux des véhicules à moteur à essence. Ainsi, le coût initial des véhicules électriques au Moyen-Orient et en Afrique peut limiter la croissance du marché.

- Performances de la batterie dans différentes conditions environnementales

La batterie est un système électrochimique qui implique des réactions et le transport d'ions et d'électrons. Le taux de charge/décharge ou le mécanisme de dégradation de la batterie est affecté par le changement de température. Par exemple, une température ambiante élevée permet un taux de charge relativement élevé, mais elle augmente également le taux de croissance de l'interface électrolyte solide (SEI), ce qui réduit la durée de vie de la batterie. En revanche, une température ambiante basse ralentit la croissance de l'interface électrolyte solide (SEI), mais cela favorise le placage au lithium. Par conséquent, les batteries peuvent être optimisées pour des températures élevées ou basses, mais le maintien des mêmes performances à différentes températures peut être problématique. Ces facteurs peuvent donc constituer un défi majeur pour le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique.

Impact de la pandémie de COVID-19 sur le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique

La COVID-19 a eu un impact majeur sur le marché des systèmes de gestion thermique des véhicules électriques, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui interviennent dans cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

La croissance du marché des systèmes de gestion thermique des véhicules électriques est en hausse en raison des politiques gouvernementales conçues pour soutenir la croissance des véhicules électriques. En outre, les préoccupations croissantes concernant la durabilité et les questions environnementales augmentent la demande de véhicules électriques. Ainsi, les réglementations et les incitations gouvernementales propulseront probablement la croissance du marché. Cependant, des facteurs tels que le coût initial élevé du véhicule électrique et la complexité de la conception de la solution de gestion thermique freinent la croissance du marché. La fermeture des installations de production pendant la pandémie a eu un impact significatif sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans le système de gestion thermique des véhicules électriques. Les entreprises mettront ainsi sur le marché des contrôleurs avancés et précis. En outre, les initiatives gouvernementales pour l'adoption des véhicules électriques ont conduit à la croissance du marché

Développement récent

- En septembre 2021, MAHLE GmbH a annoncé avoir développé un tout nouveau système de refroidissement pour les batteries. Ce nouveau système de refroidissement par immersion réduit les temps de charge des voitures électriques. De plus, ce système rend les batteries plus compactes, ce qui rend les voitures électriques moins chères et plus économes en ressources. Ainsi, l'entreprise pénètre profondément dans le marché de la mobilité électrique.

Portée du marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique

Le marché des systèmes de gestion thermique des véhicules électriques est segmenté en fonction du type de propulsion, de la technologie, du type de batterie, de la capacité de la batterie, du type de véhicule et du type de système. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de propulsion

- Véhicule électrique à batterie

- Véhicule hybride rechargeable

- Véhicule électrique hybride

- Véhicule à moteur à combustion interne

Sur la base du type de propulsion, le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique est segmenté en BEV, PHEV, HEV et FCV.

Technologie

- Actif

- Passif

Sur la base de la technologie, le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique a été segmenté en actif et passif.

Type de batterie

- Conventionnel

- État solide

Sur la base du type de batterie, le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique a été segmenté en conventionnel et à semi-conducteurs.

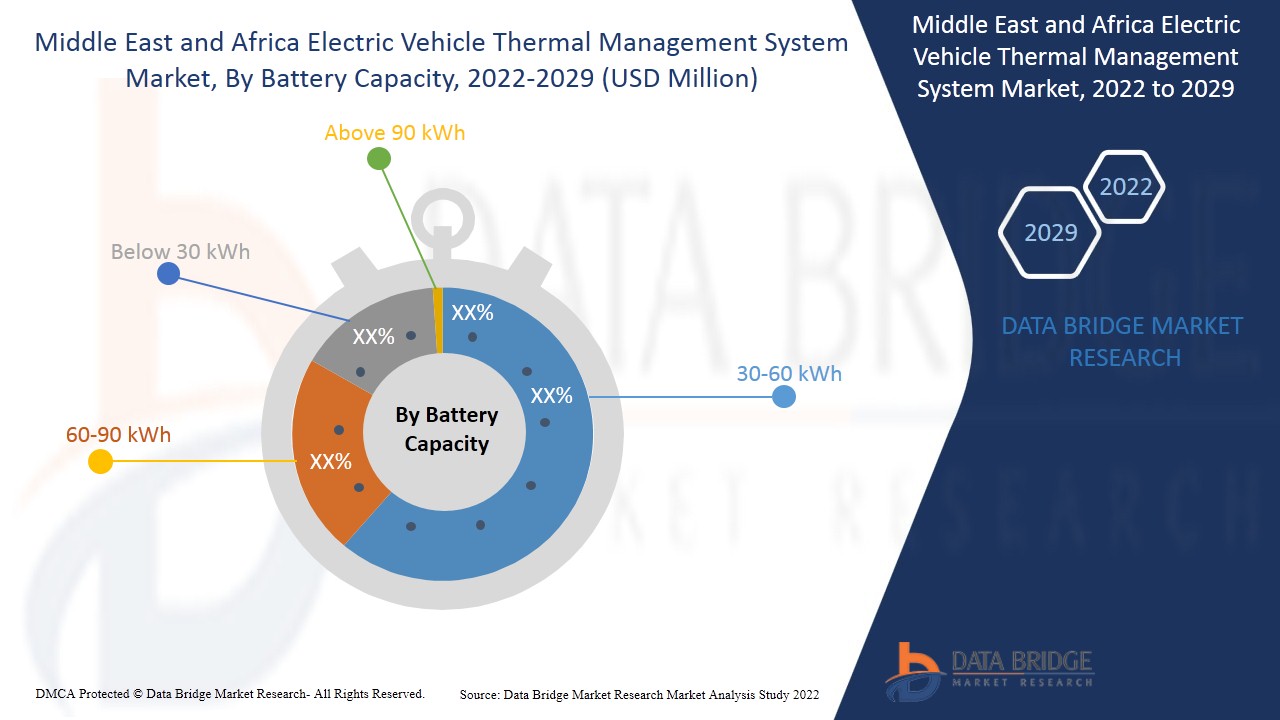

Capacité de la batterie

- 30-60 kWh

- 60-90 kWh

- Moins de 30 kWh

- Plus de 90 kWh

Sur la base de la capacité de la batterie, le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique a été segmenté en 30-60 kWh, 60-90 kWh, moins de 30 kWh et plus de 90 kWh.

Type de véhicule

- Passager

- Commercial

Sur la base du type de véhicule, le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique a été segmenté en véhicules de tourisme et commerciaux.

Type de système

- Gestion thermique de la batterie

- Chauffage, ventilation et climatisation

- Groupe motopropulseur

- Autres

Sur la base du type de système, le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique a été segmenté en gestion thermique des batteries, CVC, groupe motopropulseur et autres.

Analyse/perspectives régionales du marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique

Le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique est analysé, et des informations et tendances sur la taille du marché sont fournies par pays, type de propulsion, technologie, type de batterie, capacité de la batterie, type de véhicule et type de système comme référencé ci-dessus.

Certains pays couverts dans le rapport sur le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique sont l’Arabie saoudite, les Émirats arabes unis, l’Afrique du Sud, l’Égypte, Israël et le reste du Moyen-Orient.

Les Émirats arabes unis sont susceptibles d'être le pays qui connaît la croissance la plus rapide sur le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique. La domination du marché est due à l'essor des infrastructures, du commerce et de l'industrie dans les pays émergents tels que l'Arabie saoudite, les Émirats arabes unis et l'Afrique du Sud. Les Émirats arabes unis dominent la région du Moyen-Orient et de l'Afrique grâce aux initiatives gouvernementales. L'accent mis par le gouvernement sur l'énergie verte et ses initiatives contribue à la croissance du marché.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par les entreprises sur le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique sont :

- MAHLE GmbH

- Valéo

- Marelli Holdings Co., Ltd.

- Continental AG

- Groupe NORMA

- ENTREPRISE DE FABRICATION DE MODINE

Méthodologie de recherche : Marché des systèmes de gestion thermique des véhicules électriques au Moyen-Orient et en Afrique

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Cette étape comprend l'obtention d'informations sur le marché ou de données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, le Moyen-Orient et l'Afrique par rapport à l'analyse des parts régionales et des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 THE CHALLENGE MATRIX MARKET

2.9 MULTIVARIATE MODELING

2.1 PROPULSION TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BATTERY COOLING LINES FOR ELECTRIC AND HYBRID VEHICLES (MATERIAL)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR ELECTRIC VEHICLES

5.1.2 INCENTIVES AND SUBSIDIES BY THE GOVERNMENT FOR ELECTRIC VEHICLES

5.1.3 INCREASING ENVIRONMENTAL CONCERNS

5.1.4 RISING DEMAND FOR THERMAL COOLING SOLUTIONS

5.1.5 GOVERNMENT INITIATIVES TO REDUCE EMISSION LEVELS

5.2 RESTRAINTS

5.2.1 HIGH UPFRONT COST

5.2.2 DESIGN COMPLEXITIES OF THE COMPONENTS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS BY THE COMPANIES

5.3.2 ADOPTION OF NEW TECHNOLOGIES IN LITHIUM-ION BATTERIES

5.4 CHALLENGES

5.4.1 BATTERY PERFORMANCE IN DIFFERENT ENVIRONMENTAL CONDITIONS

5.4.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN UNDERDEVELOPED COUNTRIES

6 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE

6.1 OVERVIEW

6.2 BEV

6.3 PHEV

6.4 HEV

6.5 FCV

7 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ACTIVE

7.3 PASSIVE

8 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 SOLID-STATE

9 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY

9.1 OVERVIEW

9.2 30-60 KWH

9.3 60-90 KWH

9.4 BELOW 30 KWH

9.5 ABOVE 90 KWH

10 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER

10.2.1 BEV

10.2.2 PHEV

10.2.3 HEV

10.2.4 FCV

10.3 COMMERCIAL

10.3.1 BEV

10.3.2 PHEV

10.3.3 HEV

10.3.4 FCV

11 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE

11.1 OVERVIEW

11.2 BATTERY THERMAL MANAGEMENT SYSTEM

11.3 HVAC

11.4 POWERTRAIN

11.5 OTHERS

12 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 U.A.E.

12.1.2 SAUDI ARABIA

12.1.3 SOUTH AFRICA

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MAHLE GMBH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 VALEO

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DANA LIMITED

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 HANON SYSTEMS

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 MARELLI HOLDINGS CO., LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 A. KAYSER AUTOMOTIVE SYSTEMS GMBH

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BORGWARNER INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CONTINENTAL AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 DENSO CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 GENTHERM

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 GRAYSON

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 KENDRION N.V.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 LG CHEM

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 MODINE MANUFACTURING COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 NORMA GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 ROBERT BOSCH GMBH

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 VOSS AUTOMOTIVE GMBH

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 YMER TECHNOLOGY

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 LEVEL OF PRESENCE OF AIR POLLUTANTS IN MAJOR CITIES OF THE WORLD

TABLE 2 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA BEV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA PHEV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA HEV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA FCV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA ACTIVE IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA PASSIVE IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA CONVENTIONAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SOLID-STATE IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA 30-60 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA 60-90 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA BELOW 30 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA ABOVE 90 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 22 MIDDLE EAST & AFRICA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA BATTERY THERMAL MANAGEMENT SYSTEM IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA HVAC IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 26 MIDDLE EAST & AFRICA POWERTRAIN IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 27 MIDDLE EAST & AFRICA OTHERS IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 28 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.A.E. ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.A.E. ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 39 U.A.E. ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.A.E. ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 41 U.A.E. ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.A.E. PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.A.E. COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.A.E. ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 45 SAUDI ARABIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 46 SAUDI ARABIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 47 SAUDI ARABIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 48 SAUDI ARABIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 49 SAUDI ARABIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 55 SOUTH AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 56 SOUTH AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 57 SOUTH AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 58 SOUTH AFRICA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 61 EGYPT ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 62 EGYPT ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 63 EGYPT ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 64 EGYPT ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 65 EGYPT ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 66 EGYPT PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 67 EGYPT COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 68 EGYPT ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 69 ISRAEL ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 70 ISRAEL ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 71 ISRAEL ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 72 ISRAEL ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 73 ISRAEL ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 74 ISRAEL PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 75 ISRAEL COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 76 ISRAEL ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 77 REST OF MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR ELECTRIC VEHICLES IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 BEV PROPULSION TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET IN 2022 & 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET

FIGURE 14 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY PROPULSION TYPE 2021

FIGURE 15 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY TECHNOLOGY, 2021

FIGURE 16 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY CAPACITY, 2021

FIGURE 18 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY VEHICLE TYPE, 2021

FIGURE 19 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY SYSTEM TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: SNAPSHOT (2021)

FIGURE 21 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY PROPULSION TYPE (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.