Middle East And Africa Digital Mining Market

Taille du marché en milliards USD

TCAC :

%

USD

8.06 Billion

USD

20.85 Billion

2025

2033

USD

8.06 Billion

USD

20.85 Billion

2025

2033

| 2026 –2033 | |

| USD 8.06 Billion | |

| USD 20.85 Billion | |

|

|

|

|

Segmentation du marché de l'exploitation minière numérique au Moyen-Orient et en Afrique, par type (solutions et services), composants (capteurs intelligents, opérations autonomes, impression 3D, travailleurs connectés, centres d'opérations à distance, cybersécurité des actifs, plateformes intégrées et analyses avancées), type de métal (fer et ferro-alliages, métaux non ferreux et métaux précieux), type d'exploitation minière (à ciel ouvert et souterraine), technologie (automatisation et robotique, Internet des objets (IoT), mégadonnées, analyse du temps de vente au détail, intelligence artificielle, systèmes d'information spatiale et géographique, drones automatisés, cybersécurité, blockchain et autres), application (planification de la maintenance, solutions de mobilité de première ligne, géorepérage et autres) - Tendances du secteur et prévisions jusqu'en 2033

Quelle est la taille et le taux de croissance du marché du minage numérique au Moyen-Orient et en Afrique ?

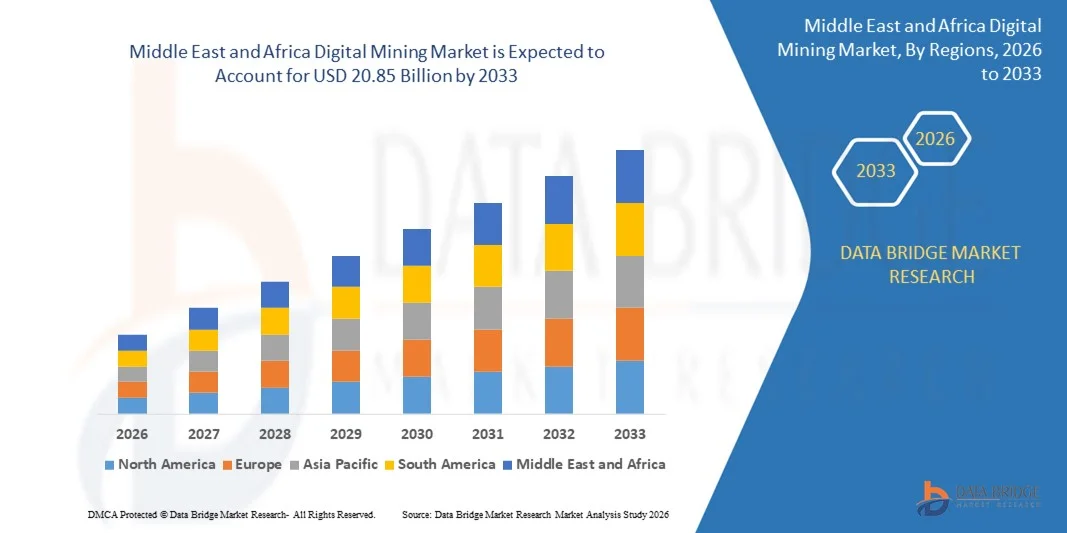

- Le marché du minage numérique au Moyen-Orient et en Afrique était évalué à 8,06 milliards de dollars en 2025 et devrait atteindre 20,85 milliards de dollars d'ici 2033 , avec un TCAC de 12,60 % au cours de la période de prévision.

- En raison de l'augmentation des accidents et des décès, les fabricants se concentrent sur les questions de sécurité et mettent donc en œuvre diverses mesures de sécurité grâce à l'exploitation minière numérique afin de garantir la sécurité des travailleurs, des installations minières et de l'environnement, ce qui stimule la croissance du marché de l'exploitation minière numérique.

- L'exploitation minière numérique exige des coûts de mise en œuvre élevés, ce qui la rend difficilement accessible aux petites et moyennes entreprises et freine ainsi la croissance du marché.

Quels sont les principaux enseignements du marché du minage numérique ?

- L'émergence de l'Internet des objets crée un besoin d'adopter l'exploitation minière numérique, ce qui représente une opportunité de croissance pour le marché de l'exploitation minière numérique.

- L'adoption de l'exploitation minière numérique, conjuguée au manque d'expertise technique, constitue un défi pour la croissance du marché de l'exploitation minière numérique, car les pays sont confrontés à des problèmes de main-d'œuvre qualifiée en raison du développement technologique et de l'innovation.

- L'Arabie saoudite a dominé le marché de l'exploitation minière numérique au Moyen-Orient et en Afrique, avec une part de revenus estimée à 36,4 % en 2025, grâce à une forte adoption des technologies d'exploitation minière numérique dans les secteurs de l'extraction minérale, du raffinage du pétrole et du gaz, et du traitement chimique en aval.

- Les Émirats arabes unis devraient enregistrer l'un des taux de croissance annuels composés (TCAC) les plus rapides de la région, à 9,47 %, grâce à l'adoption croissante de solutions numériques dans les secteurs de l'extraction de matériaux, des minéraux de construction et des matériaux industriels.

- Le segment des solutions a dominé le marché du minage numérique en 2024, avec une part de marché de 61,3 %, portée par la demande croissante de plateformes intégrées fournissant des données en temps réel, l'automatisation et des analyses pour optimiser les opérations minières.

Portée du rapport et segmentation du marché de l'exploitation minière numérique

|

Attributs |

Principaux enseignements du marché de l'exploitation minière numérique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché du minage numérique ?

L'automatisation basée sur l'IA et les données en temps réel transforment les opérations minières

- L'intégration de l'intelligence artificielle (IA), de l'automatisation et de l'analyse des données en temps réel constitue une tendance majeure et croissante sur le marché mondial de l'exploitation minière numérique, révolutionnant ainsi l'efficacité opérationnelle, la sécurité et l'optimisation des ressources dans ce secteur.

- Par exemple, des entreprises comme Caterpillar et Komatsu utilisent des camions de transport et des systèmes de forage autonomes dotés d'intelligence artificielle qui améliorent la productivité, réduisent les coûts opérationnels et renforcent la sécurité en minimisant l'intervention humaine dans les tâches minières dangereuses.

- L'IA et l'apprentissage automatique permettent la maintenance prédictive, la détection des anomalies et l'optimisation des performances des équipements, réduisant considérablement les temps d'arrêt et les pannes imprévues dans les opérations minières.

- L'intégration des plateformes minières numériques avec des capteurs IoT, la télémétrie avancée et des centres de contrôle pilotés par l'IA offre aux entreprises minières une visibilité en temps réel sur la production, l'état des équipements et les conditions environnementales.

- Cette tendance redéfinit en profondeur les attentes en matière d'exploitation minière en proposant des environnements de prise de décision plus sûrs, plus efficaces et fondés sur les données. De ce fait, des entreprises comme Hexagon AB et ABB développent des solutions minières numériques basées sur l'IA, intégrant des fonctionnalités telles que la gestion autonome des flottes, la surveillance en temps réel et l'analyse prédictive.

- La demande de solutions minières numériques qui améliorent l'efficacité opérationnelle, renforcent la sécurité et soutiennent les objectifs de développement durable croît rapidement dans le secteur minier, sous l'impulsion de la nécessité d'optimiser l'extraction des ressources dans des environnements de plus en plus complexes et isolés.

Quels sont les principaux moteurs du marché du minage numérique ?

- Le besoin croissant d'efficacité opérationnelle, de sécurité des travailleurs et de durabilité environnementale dans le secteur minier est l'un des principaux moteurs de l'adoption accélérée des technologies de l'exploitation minière numérique.

- Par exemple, en février 2024, Sandvik AB a lancé des solutions de forage autonomes avancées, permettant aux exploitations minières d'améliorer leur productivité tout en réduisant l'exposition humaine aux environnements à haut risque, illustrant ainsi l'importance accordée par le marché à la sécurité et à l'automatisation.

- Face à la raréfaction croissante des gisements et à la hausse des coûts d'extraction, les sociétés minières adoptent des plateformes d'exploitation minière numérique qui exploitent les données en temps réel, l'intelligence artificielle et l'automatisation pour optimiser les processus, maximiser la production et réduire les coûts opérationnels.

- De plus, l'importance croissante accordée aux pratiques minières durables encourage l'utilisation des technologies minières numériques pour surveiller l'impact environnemental, réduire les émissions et améliorer l'efficacité de l'exploitation des ressources.

- La capacité de contrôler les opérations à distance, de surveiller l'état des équipements et d'utiliser l'analyse prédictive améliore la disponibilité opérationnelle et minimise les interruptions imprévues, faisant de l'exploitation minière numérique un élément essentiel des opérations minières modernes.

- L'adoption croissante de l'Internet des objets (IoT), de l'intelligence artificielle (IA) et des équipements autonomes, combinée à une meilleure maîtrise du numérique et aux initiatives gouvernementales de soutien dans le secteur minier, contribue davantage à la croissance du marché mondial de l'exploitation minière numérique.

Quel facteur freine la croissance du marché du minage numérique ?

- Les préoccupations liées aux risques de cybersécurité, aux importants besoins d'investissement et aux infrastructures numériques limitées dans les régions en développement constituent des obstacles majeurs à l'adoption à plus grande échelle des technologies minières numériques.

- Par exemple, des incidents cybernétiques très médiatisés ciblant des infrastructures critiques ont sensibilisé le public à la vulnérabilité des systèmes miniers connectés aux cyberattaques, aux violations de données et aux perturbations opérationnelles.

- Il est crucial de répondre à ces préoccupations grâce à des cadres de cybersécurité robustes, des protocoles réseau sécurisés et une détection des menaces en temps réel afin d'instaurer la confiance entre les entreprises minières qui adoptent des solutions d'exploitation minière numérique.

- De plus, les coûts initiaux élevés associés à la mise en œuvre des technologies d'IA, d'IoT et d'automatisation, combinés au besoin d'expertise technique spécialisée, peuvent constituer un obstacle, notamment pour les petites et moyennes exploitations minières.

- La fracture numérique dans les régions minières émergentes, où la connectivité internet et les infrastructures numériques restent sous-développées, limite davantage l'évolutivité des solutions avancées d'exploitation minière numérique.

- Pour surmonter ces défis, il faudra accroître les investissements dans la cybersécurité, la formation de la main-d'œuvre, les partenariats entre les fournisseurs de technologies et les sociétés minières, et développer des plateformes minières numériques plus accessibles et évolutives afin de soutenir la croissance du marché à long terme.

Comment le marché du minage numérique est-il segmenté ?

Le marché est segmenté en fonction du type, des composants, du type de métal, du type d'exploitation minière, de la technologie et de l'application .

- Par type

Le marché du minage numérique se divise en deux segments principaux : les solutions et les services. En 2024, le segment des solutions a dominé ce marché, représentant 61,3 % des revenus. Cette situation s’explique par la demande croissante de plateformes intégrées fournissant des données en temps réel, l’automatisation et des outils d’analyse pour optimiser les opérations minières. Les entreprises minières investissent de plus en plus dans des solutions numériques complètes afin d’améliorer leur efficacité, de réduire les temps d’arrêt et de renforcer la sécurité.

Le segment des services devrait connaître le taux de croissance le plus rapide, soit 19,4 %, entre 2025 et 2032, porté par la demande croissante de services de conseil, d'intégration de systèmes, de maintenance et d'assistance pour garantir le bon déploiement et la gestion des technologies minières numériques. Face à l'accélération de l'adoption du numérique, les prestataires de services jouent un rôle crucial en facilitant la transformation numérique globale des opérations minières.

- Par composants

Le marché des technologies minières numériques est segmenté, selon ses composants, en capteurs intelligents, opérations autonomes, impression 3D, travailleurs connectés, centres d'opérations à distance, cybersécurité des actifs, plateformes intégrées et analyses avancées. Le segment des capteurs intelligents a généré la plus grande part de revenus en 2024, grâce à leur rôle essentiel dans la surveillance en temps réel des équipements, des conditions environnementales et des performances opérationnelles.

Le segment des opérations autonomes devrait connaître le TCAC le plus rapide entre 2025 et 2032, car les sociétés minières adoptent de plus en plus de véhicules, d'équipements de forage et de systèmes robotisés autonomes pour améliorer la sécurité et la productivité, et réduire la dépendance à la main-d'œuvre, notamment dans les environnements dangereux.

- Par type de métal

Le marché de l'extraction numérique des métaux est segmenté en fonction du type de métal : fer et ferro-alliages, métaux non ferreux et métaux précieux. Le segment du fer et des ferro-alliages a dominé le marché en 2024, représentant 47,6 % des revenus, grâce à la forte demande pour ces matériaux dans les secteurs de la construction, de l'automobile et de l'industrie, ce qui fait de leur extraction un axe prioritaire d'optimisation numérique.

Le segment des métaux précieux devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, sous l'effet de la demande mondiale croissante d'or, d'argent et de métaux du groupe platine, ainsi que de l'utilisation accrue de solutions numériques pour améliorer l'efficacité et la durabilité des opérations d'extraction de métaux précieux.

- Par type d'exploitation minière

Selon le type d'exploitation minière, le marché du minage numérique se divise en exploitation à ciel ouvert et exploitation souterraine. En 2024, l'exploitation à ciel ouvert représentait la plus grande part de marché (68,9 %), grâce à sa complexité opérationnelle relativement faible, sa rentabilité et le volume élevé d'extraction minérale qu'elle permet.

Le segment de l'exploitation minière souterraine devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, alimenté par l'exploration croissante des réserves minérales profondes, en particulier des ressources à haute valeur ajoutée, et par le besoin de technologies numériques avancées pour améliorer la sécurité et l'efficacité opérationnelle dans les environnements souterrains complexes.

- Par la technologie

Sur la base des technologies utilisées, le marché du minage numérique se segmente en automatisation et robotique, Internet des objets (IoT), analyse du Big Data, analyse en temps réel, intelligence artificielle et apprentissage automatique, systèmes d'information géographique, drones automatisés, cybersécurité, blockchain, réalité virtuelle et réalité augmentée, et autres. Le segment de l'Internet des objets (IoT) a dominé le marché en 2024, représentant la plus grande part de revenus (26,8 %), grâce au déploiement massif de capteurs et d'appareils connectés pour la surveillance en temps réel et l'optimisation opérationnelle.

Le segment de l'intelligence artificielle et de l'apprentissage automatique devrait connaître le taux de croissance annuel composé le plus rapide au cours de la période de prévision, grâce à l'utilisation croissante d'analyses prédictives basées sur l'IA, d'équipements autonomes et d'outils de prise de décision avancés qui améliorent la productivité, la sécurité et la rentabilité des opérations minières.

- Sur demande

Selon l'application, le marché des solutions numériques pour l'exploitation minière se segmente en planification de la maintenance, solutions de mobilité de première ligne, sécurité par géorepérage et autres. Le segment de la planification de la maintenance détenait la plus grande part de revenus (39,5 %) en 2024, les entreprises minières privilégiant les stratégies de maintenance prédictive pour réduire les temps d'arrêt des équipements, prolonger la durée de vie des actifs et optimiser leurs opérations.

Le segment de la sécurité par géorepérage devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, sous l'effet du besoin croissant d'améliorer la sécurité des travailleurs grâce à des alertes géolocalisées, au respect des zones réglementées et au suivi en temps réel dans les environnements miniers dangereux.

Quelle région détient la plus grande part du marché du minage numérique ?

- L’Arabie saoudite a dominé le marché de l’exploitation minière numérique au Moyen-Orient et en Afrique, avec une part de marché estimée à 36,4 % en 2025. Cette domination s’explique par l’adoption massive des technologies d’exploitation minière numérique dans les secteurs de l’extraction minérale, du raffinage du pétrole et du gaz, et de la transformation chimique en aval. Les projets miniers à grande échelle du pays, ses infrastructures industrielles de pointe et ses investissements importants dans l’automatisation, la maintenance prédictive et les plateformes d’exploitation minière intelligente, conformément à la Vision 2030, renforcent son leadership régional.

- Des investissements importants dans la transformation numérique, la collaboration entre les fournisseurs de technologies mondiaux et les entreprises minières et énergétiques publiques, ainsi que le déploiement croissant d'analyses basées sur l'IA, de la surveillance par l'Internet des objets et de solutions minières dans le cloud renforcent encore la domination de l'Arabie saoudite sur le marché minier numérique du Moyen-Orient et de l'Afrique.

- L'accent mis de plus en plus sur l'efficacité opérationnelle, la durabilité et le respect des réglementations environnementales soutient la croissance à long terme en Arabie saoudite et dans les pays voisins du Moyen-Orient et de l'Afrique.

Aperçu du marché minier numérique des Émirats arabes unis

Les Émirats arabes unis devraient enregistrer l'un des taux de croissance annuels composés (TCAC) les plus rapides de la région, à 9,47 %, grâce à l'adoption croissante des solutions numériques dans les secteurs des carrières, des minéraux de construction et des matériaux industriels. Les investissements dans les infrastructures intelligentes, l'automatisation et l'optimisation des actifs par l'analyse des données accélèrent l'expansion du marché.

Aperçu du marché minier numérique en Afrique du Sud

L'Afrique du Sud connaît une croissance soutenue, alimentée par d'importantes activités minières d'or, de platine, de charbon et de métaux de base. Le développement du marché est stimulé par l'utilisation croissante de la surveillance numérique, des équipements autonomes et de l'analyse prédictive pour améliorer la sécurité et la productivité.

Aperçu du marché minier numérique du Qatar

Le Qatar contribue modérément à la croissance régionale, grâce au déploiement croissant d'outils numériques d'optimisation des processus miniers et gaziers dans les secteurs des minéraux industriels. L'accent mis sur l'amélioration de l'efficacité et l'intégration numérique favorise une adoption généralisée.

Quelles sont les principales entreprises du marché du minage numérique ?

L'industrie du minage numérique est principalement dominée par des entreprises bien établies, notamment :

- ABB (Suisse)

- Siemens (Allemagne)

- Rockwell Automation, Inc. (États-Unis)

- SAP SE (Allemagne)

- Wipro Limited (Inde)

- Wencomine (une filiale de Hitachi Construction Machinery Co., Ltd.) (Japon)

- Cisco (États-Unis)

- Caterpillar (États-Unis)

- General Electric (États-Unis)

- Sandvik AB (Suède)

- Hexagon AB (une filiale de HEXAGON) (Suède)

- IBM Corporation (États-Unis)

- Hatch Ltd. (Canada)

- Wabtec Corporation (États-Unis)

- Komatsu Mining Corp. (une filiale de Komatsu Ltd.) (États-Unis)

- Accenture (Irlande)

- Trimble Inc. (États-Unis)

- Schneider Electric (France)

- BENTLEY SYSTEMS, INCORPORATED (États-Unis)

- Tech Mahindra Limited (Inde)

Quels sont les développements récents sur le marché mondial de la gestion intelligente des rayons ?

- En juin 2022, Metso Outotec a collaboré avec Dynamox pour intégrer sa plateforme de surveillance de l'état des équipements aux processus miniers, étendant ainsi la solution à l'ensemble de son parc d'équipements pour une efficacité opérationnelle accrue. Dynamox contribue au développement de solutions numériques conviviales et durables, faisant progresser l'industrie minière grâce à l'IA et à l'analyse de données.

- En mai 2022, Epiroc a lancé le Boomer S10 S, un équipement de forage qui améliore la productivité du développement minier grâce à une précision quasi chirurgicale. Offrant jusqu'à 25 % d'efficacité supplémentaire par rapport aux jumbos traditionnels, il permet de réaliser d'importantes économies et révolutionne les opérations minières.

- En octobre 2020, SAP SE a lancé SAP S/4HANA Cloud, une plateforme favorisant l'innovation dans tous les secteurs d'activité et prenant en charge les solutions d'entreprise intelligentes. Cette initiative renforce le portefeuille de produits SAP et contribue à la croissance du marché grâce à de nouvelles fonctionnalités et améliorations.

- En juin 2020, Wencomine a collaboré avec Oxbotica pour développer une solution d'autonomie ouverte pour le secteur minier, permettant aux clients d'intégrer divers véhicules basés sur des standards ouverts à leurs opérations. Cette collaboration enrichit l'offre de Wencomine et favorise la croissance du marché grâce à des solutions polyvalentes et adaptables.

- En avril 2020, Cisco a annoncé son intention d'acquérir Fluidmesh Networks, LLC, fournisseur de systèmes de liaison sans fil. Cette acquisition vise à tirer parti des solutions de Fluidmesh pour améliorer la sécurité et réduire les coûts dans les applications critiques telles que les mines, enrichissant ainsi l'offre de Cisco sur le marché.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.