Marché des cosmétiques au Moyen-Orient et en Afrique, par type de produit (soins de la peau, soins capillaires, maquillage, parfums et autres), nature (inorganique et biologique), catégorie (produit de masse, produit haut de gamme et produit professionnel), type d'emballage (bouteilles et pots, tubes, conteneurs, pompes et distributeurs, bâtons, bombes aérosols, sachets et blisters et bandes), canal de distribution (hors ligne et en ligne), application (femmes et hommes) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des cosmétiques au Moyen-Orient et en Afrique

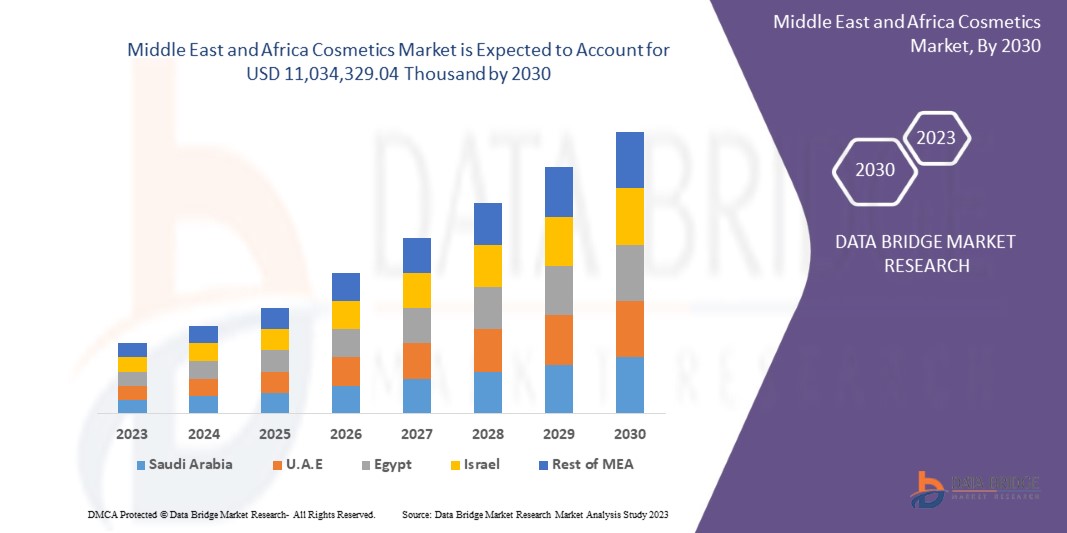

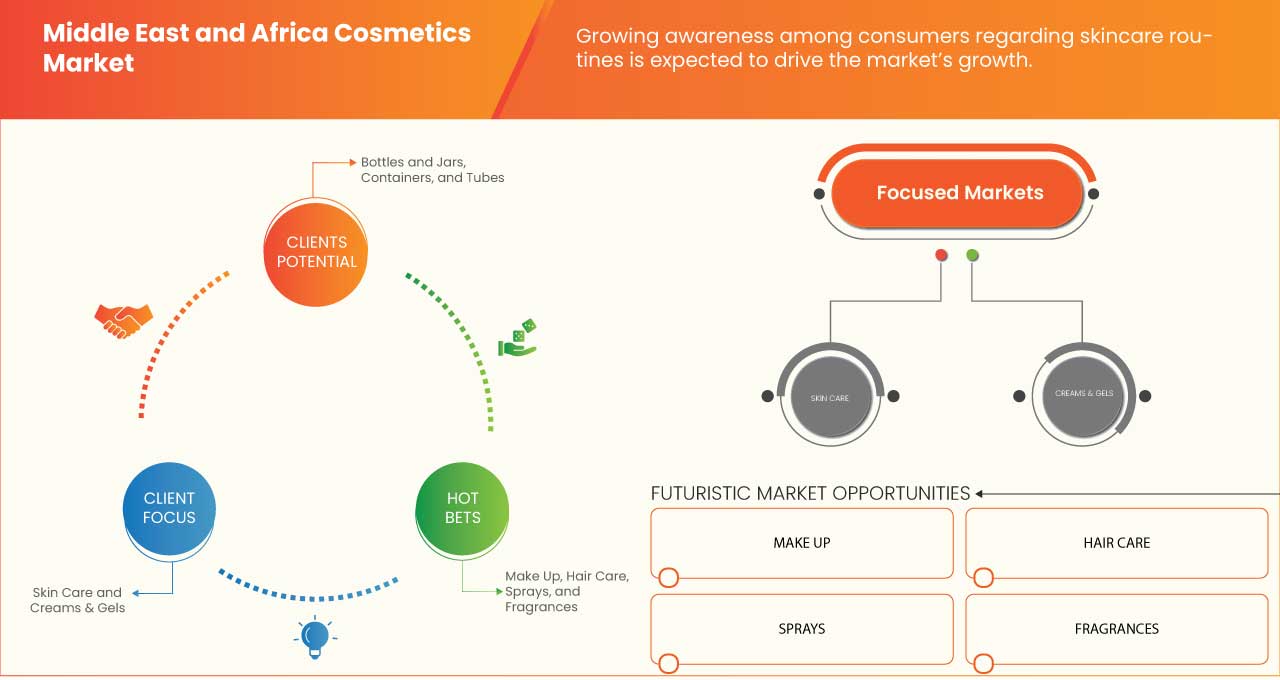

Le marché des cosmétiques devrait croître de manière significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,8 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 11 034 329,04 milliers USD d'ici 2030. La sensibilisation croissante aux routines de soins de la peau a été le principal moteur du marché des cosmétiques au Moyen-Orient et en Afrique.

Le rapport sur le marché des cosmétiques fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Type de produit (soins de la peau, soins capillaires, maquillage, parfums et autres), nature (inorganique et biologique), catégorie (produit de masse, produit haut de gamme et produit professionnel), type d'emballage (bouteilles et pots, tubes, contenants, pompes et distributeurs, bâtons, bombes aérosols , sachets, blisters et plaquettes), canal de distribution (hors ligne et en ligne), application (femmes et hommes) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Égypte, Israël, Afrique du Sud et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Procter & Gamble, L'Oréal SA, The Estée Lauder Companies Inc., Coty Inc., Shiseido Company, Limited, Colgate-Palmolive Company, Kao Corporation, Beiersdorf Group, Unilever, Revlon, Inc. et Henkel AG & Co. KGaA, entre autres |

Définition du marché

Les cosmétiques sont en grande partie conçus pour être utilisés ou appliqués afin d'améliorer la beauté et l'apparence physique d'une personne. Ces produits cosmétiques sont principalement fabriqués à partir de sources artificielles. Les produits cosmétiques sont principalement destinés au nettoyage externe, aux parfums , au changement d'apparence, à la correction des odeurs corporelles, à la protection de la peau et au conditionnement. Des anti-transpirants, parfums, maquillage et shampooings aux savons, crèmes solaires, dentifrices, cosmétiques et produits de soins personnels sont essentiels à toutes les étapes de la vie du consommateur.

Les cosmétiques sont fabriqués à partir de mélanges de composés chimiques ; ces composés sont soit dérivés de sources naturelles, soit artificiels. Les cosmétiques peuvent être destinés à un usage personnel pour les acheteurs au détail ou à des usages professionnels dans l'industrie de la beauté et du divertissement. Dans l'industrie du divertissement, les cosmétiques sont largement utilisés pour mettre en valeur les traits naturels d'une personne, ajouter de la couleur au visage d'une personne et peuvent être utilisés pour changer complètement l'apparence du visage pour ressembler à une personne, une créature ou un objet différent.

La pression pour améliorer son apparence est de plus en plus forte, car elle est un gage de confiance en soi pour les gens qui vivent dans des pays développés dont le niveau de vie est en hausse. Cela a conduit l'industrie cosmétique à se développer ces derniers temps. Les agences gouvernementales réglementent les cosmétiques car ils peuvent contenir des produits chimiques et des ingrédients nocifs pour le corps humain et l'environnement.

Dynamique du marché

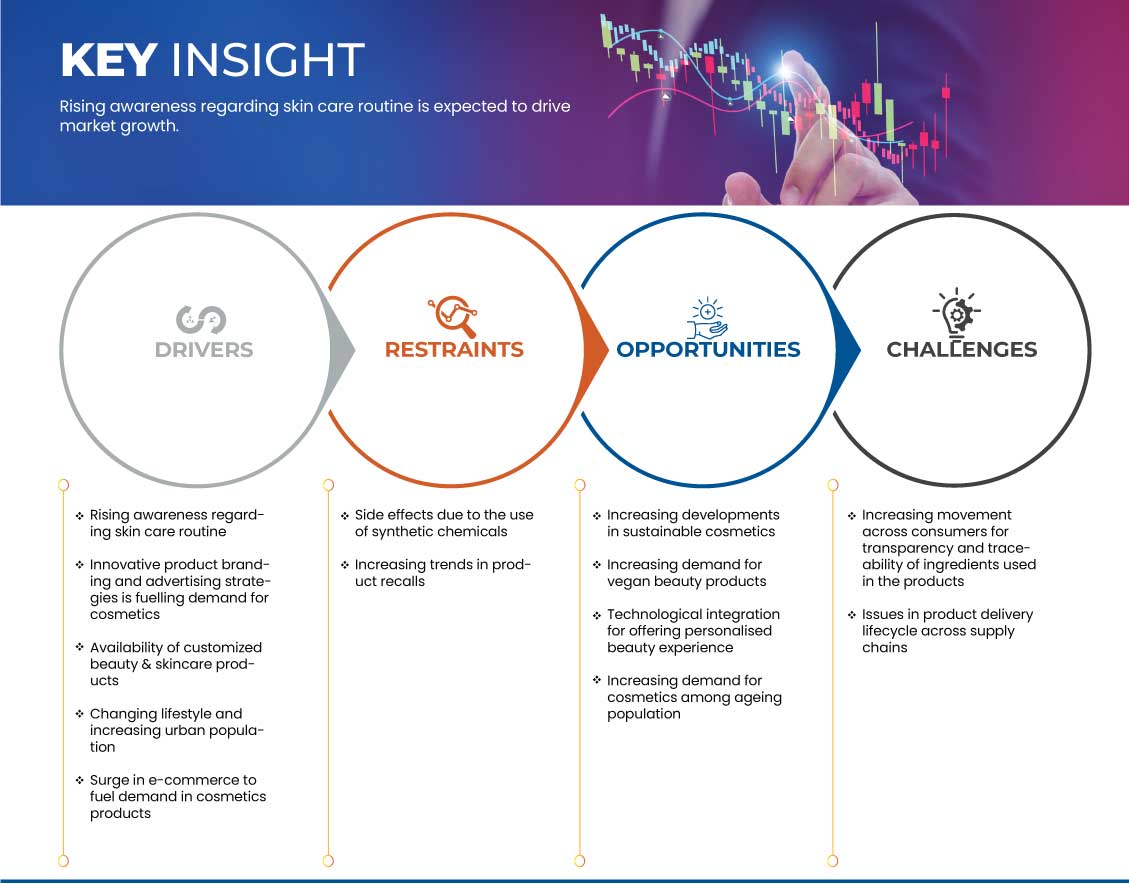

Cette section traite de la compréhension des moteurs, des opportunités, des défis et des contraintes du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Sensibilisation croissante à la routine de soins de la peau

Le marché des cosmétiques a récemment bénéficié de l'attention renouvelée portée aux routines d'hygiène et de soins personnels. La demande croissante de produits de soins personnels pour lutter contre le stress et l'anxiété, ainsi que la tendance des consommateurs à s'engager davantage dans des routines de soins personnels pour se sentir bien et avoir une meilleure apparence, ont été les principaux moteurs du marché des cosmétiques. L'intérêt pour les ingrédients naturels et biologiques a encore accru la notoriété et la demande de produits de soins de la peau tels que les masques pour le visage, les gommages corporels , les toniques et les sérums parmi les utilisateurs, car il met l'accent sur le changement de leurs soins de la peau existants.

L'industrie des soins de la peau s'est concentrée sur les femmes, et le marché a été imprégné de produits destinés aux femmes pendant très longtemps. Les principaux facteurs à l'origine de la croissance du marché comprennent l'examen minutieux des ingrédients des produits, le lancement de nouveaux produits et l'ajout d'une gamme anti-âge dans le segment des soins de la peau. De plus, ces dernières années, les médias sociaux, le commerce électronique et la nécessité d'avoir une belle apparence ont gagné en acceptation et en popularité auprès des hommes. Cela a augmenté le nombre de produits axés sur les soins de la peau pour hommes, renforçant la demande sur le marché global des cosmétiques.

- Les stratégies innovantes de branding et de publicité des produits stimulent la demande de cosmétiques

L'avènement des technologies numériques a influencé le comportement d'achat des consommateurs sur le marché des cosmétiques au Moyen-Orient et en Afrique. Les grandes marques de cosmétiques telles que L'Oréal SA et d'autres sur le marché exploitent les technologies numériques pour permettre aux consommateurs de découvrir les marques d'une toute nouvelle manière, car le consommateur moderne s'attend à une conversation à double sens pour se connecter davantage à la marque. Les avancées technologiques, les stratégies de marque innovantes et les stratégies publicitaires ont permis aux amateurs de beauté d'accéder facilement aux tendances, aux looks, au contenu et aux expériences.

Les grandes entreprises et marques de beauté innovent en permanence dans leurs stratégies de branding et de publicité de produits pour atteindre un public plus large et accroître l'engagement des clients. De nombreuses marques utilisent les plateformes de médias sociaux pour améliorer leur portée, ce qui constitue la principale stratégie de ces dernières années. Cela a permis aux marques d'augmenter leur base d'utilisateurs et leur popularité sur le marché des cosmétiques, ce qui devrait stimuler la croissance.

- Disponibilité de produits de beauté et de soins de la peau personnalisés

Les entreprises et fabricants de produits de beauté introduisent en permanence la personnalisation et la numérisation dans les produits cosmétiques, en raison de la demande croissante de soins de la peau personnalisés. Les consommateurs prennent conscience des produits de beauté et de soins de la peau disponibles sur le marché. Les avancées technologiques de l'industrie éloignent les consommateurs des produits cosmétiques conçus uniquement pour le type de peau générique. Les consommateurs deviennent extrêmement prudents dans le choix du produit en fonction de leur type de peau. En conséquence, les entreprises de beauté se concentrent sur la satisfaction de ces consommateurs avec des produits idéaux, ce qui leur permet d'accroître l'engagement des consommateurs sur le marché. Les consommateurs sont préoccupés par leurs besoins en matière de soins de la peau, de soins capillaires et de cosmétiques de couleur. Les principaux acteurs intègrent la technologie, la science et la beauté au commerce électronique pour permettre aux consommateurs d'acheter des produits personnalisés en fonction de leurs besoins.

Opportunités

- Des développements croissants dans le domaine des cosmétiques durables

La durabilité devient une priorité clé pour de nombreuses marques dans l'industrie de la beauté en constante évolution. Les entreprises s'efforcent constamment de mettre en œuvre des initiatives plus écologiques sans compromettre la qualité et la portée du produit pour attirer une population croissante de consommateurs soucieux de l'environnement. De nombreux acteurs majeurs déploient des efforts et se fixent des objectifs pour atteindre la neutralité carbone. Les entreprises s'impliquent activement dans la réduction de l'impact environnemental de leurs processus d'emballage tout au long du cycle de vie et utilisent des ingrédients respectueux de l'environnement. L'industrie de la beauté connaît de précieuses collaborations et partenariats pour explorer des matériaux alternatifs et des concepts plus responsables dans la conception des emballages.

- Demande croissante de produits de beauté végétaliens

Ces dernières années, l'adoption d'un mode de vie alternatif végétalien au sein de la population mondiale a augmenté. Les gens adoptent ce mode de vie pour améliorer leur santé globale tout en bénéficiant à leur corps à l'intérieur et à l'extérieur. Ces développements influencent également l'industrie cosmétique. Les consommateurs essaient activement de rechercher et d'adopter des produits cosmétiques végétaliens à mesure que la sensibilisation augmente. Cela peut être attribué à l'accessibilité facile aux informations en ligne sur les avantages et l'impact environnemental.

Les consommateurs sont de plus en plus sensibilisés aux produits d’origine animale tels que les cheveux, la fourrure et autres présents dans les marques de cosmétiques. Les consommateurs trouvent la cruauté envers les animaux contraire à l’éthique et sensibilisent les gens à cet égard. Cela a créé une tendance sur le marché des cosmétiques du Moyen-Orient et de l’Afrique à adopter des produits de soins personnels à base de plantes. Les grandes entreprises de fabrication de cosmétiques du monde entier se rendent compte de l’importance de fabriquer des produits qui utilisent des ingrédients d’origine minérale ou végétale plutôt que de fabriquer des produits infusés d’ingrédients extraits d’animaux.

Retenue

- Effets secondaires dus à l’utilisation de produits chimiques synthétiques

Il existe de nombreux exemples dans le secteur de la beauté où les utilisateurs ont affirmé ne pas avoir obtenu le résultat escompté par la marque. Une qualité et un grade inférieurs aux normes et des compositions nocives peuvent entraîner des allergies, une décoloration, une altération de la texture ou des dommages permanents à la peau ou aux cheveux. L'utilisation accrue et la production non réglementée ont entraîné une forte augmentation des effets secondaires subis par les consommateurs.

Il est important que le consommateur examine et étudie minutieusement le produit cosmétique avant de l'utiliser, car il peut contenir des ingrédients qui ne conviennent pas à la peau ou auxquels il est allergique. Les produits chimiques du produit peuvent être absorbés par la peau et provoquer des irritations et d'autres effets secondaires. L'augmentation des effets secondaires liés à de tels cas peut freiner la croissance du marché.

Défi

- Mouvement croissant des consommateurs en faveur de la transparence et de la traçabilité des ingrédients utilisés dans les produits

La transparence et la traçabilité de bout en bout gagnent en importance à mesure que les consommateurs sont de plus en plus informés et conscients des produits cosmétiques auxquels ils font confiance et qu'ils adoptent. Le défi consiste pour les fabricants à mettre ces informations à la disposition des consommateurs afin de progresser en matière de sécurité, de qualité et de durabilité sur le marché.

Avec l’émergence d’un mouvement de beauté propre, il est devenu plus important pour les consommateurs de comprendre le produit et sa provenance. Ainsi, un produit propre peut facilement devenir problématique en raison de dommages écologiques et de pratiques non éthiques liées à la provenance de ses ingrédients.

Cela représente un défi pour de nombreux acteurs du marché qui prétendent fournir des solutions durables pour sensibiliser leurs consommateurs à l’origine de leurs ingrédients s’ils sont vraiment sérieux en matière de durabilité.

Développement récent

- En septembre 2021, The Estée Lauder Companies Inc. a annoncé le lancement de flacons redessinés sous sa marque Clinique. Ce nouveau produit a permis à l'entreprise de réduire ses déchets de production de 10 à 15 %. Selon l'entreprise, le co-développement du flacon Clinique a représenté une étape importante dans les efforts de l'entreprise pour améliorer la conception des emballages.

Portée du marché des cosmétiques au Moyen-Orient et en Afrique

Le marché des cosmétiques est catégorisé en fonction du type de produit, de la nature, de la catégorie, du type d'emballage, du canal de distribution et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance de l'industrie et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Soins de la peau

- Soins capillaires

- Se maquiller

- Parfums

- Autres

Sur la base du type de produit, le marché est segmenté en soins de la peau, soins capillaires, maquillage, parfums et autres.

Nature

- Inorganique

- Organique

Sur la base de la nature, le marché est segmenté en inorganique et organique.

Catégorie

- Produit de masse

- Produit Premium

- Produit professionnel

Sur la base de la catégorie, le marché est segmenté en produits de masse, produits haut de gamme et produits professionnels.

Type d'emballage

- Bouteilles et bocaux

- Tubes

- Conteneurs

- Pompes et distributeurs

- Bâtons

- Bombes aérosols

- Pochettes

- Plaquettes et plaquettes

Sur la base du type d'emballage, le marché est segmenté en bouteilles et pots, tubes, conteneurs, pompes et distributeurs, bâtons, bombes aérosols, sachets et blisters et bandes.

Canal de distribution

- Hors ligne

- En ligne

Sur la base du canal de distribution, le marché est segmenté en hors ligne et en ligne.

Application

- Femmes

- Hommes

Sur la base des applications, le marché est segmenté en femmes et en hommes.

Analyse/perspectives régionales du marché des cosmétiques au Moyen-Orient et en Afrique

Le marché des cosmétiques est segmenté en fonction du type de produit, de sa nature, de sa catégorie, du type d’emballage, du canal de distribution et de l’application.

Les pays couverts sur le marché sont l’Arabie saoudite, les Émirats arabes unis, l’Égypte, Israël, l’Afrique du Sud et le reste du Moyen-Orient et de l’Afrique.

L'Arabie saoudite devrait dominer le marché en raison de sa diversité et de son offre dynamique, avec une demande énorme pour divers produits. De plus, la demande en cosmétiques est énorme dans des pays comme les Émirats arabes unis et l'Égypte en raison d'une large base de consommateurs et de la présence d'acteurs de premier plan sur le marché.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des cosmétiques

Le paysage concurrentiel du marché des cosmétiques fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché des cosmétiques.

Certains des principaux acteurs du marché opérant sur le marché sont Procter & Gamble, L'Oréal SA, The Estée Lauder Companies Inc., Coty Inc., Shiseido Company, Limited, Colgate-Palmolive Company, Kao Corporation, Beiersdorf Group, Unilever, Revlon, Inc. et Henkel AG & Co. KGaA, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA COSMETICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THE THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 CONSUMER TRENDS AND PREFERENCES

4.3 FACTORS AFFECTING BUYING DECISION

4.4 CONSUMER PRODUCT ADOPTION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING AWARENESS REGARDING SKIN CARE ROUTINE

5.1.2 INNOVATIVE PRODUCT BRANDING AND ADVERTISING STRATEGIES IS FUELLING DEMAND FOR COSMETICS

5.1.3 AVAILABILITY OF CUSTOMIZED BEAUTY & SKINCARE PRODUCTS

5.1.4 CHANGING LIFESTYLE AND INCREASING URBAN POPULATION

5.1.5 SURGE IN E-COMMERCE FUELING THE DEMAND OF COSMETICS PRODUCTS

5.2 RESTRAINTS

5.2.1 SIDE EFFECTS DUE TO THE USE OF SYNTHETIC CHEMICALS

5.2.2 INCREASING TRENDS IN PRODUCT RECALLS

5.3 OPPORTUNITIES

5.3.1 INCREASING DEVELOPMENTS IN SUSTAINABLE COSMETICS

5.3.2 INCREASING DEMAND FOR VEGAN BEAUTY PRODUCTS

5.3.3 TECHNOLOGICAL INTEGRATION FOR OFFERING PERSONALISED BEAUTY EXPERIENCE

5.3.4 INCREASING DEMAND FOR COSMETICS AMONG AGING POPULATION

5.4 CHALLENGES

5.4.1 INCREASING MOVEMENT ACROSS CONSUMERS FOR TRANSPARENCY AND TRACEABILITY OF INGREDIENTS USED IN PRODUCTS

5.4.2 ISSUES IN PRODUCT DELIVERY LIFECYCLE ACROSS SUPPLY CHAINS

6 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY COUNTRY

6.1 SAUDI ARABIA

6.2 UNITED ARAB EMIRATES

6.3 EGYPT

6.4 ISRAEL

6.5 SOUTH AFRICA

6.6 REST OF MIDDLE EAST AND AFRICA

7 COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

7.1.1 PARTNERSHIP

7.1.2 ACQUISITION

7.1.3 NEW PRODUCT LAUNCH

7.1.4 EXPANSION

7.1.5 NEW PLATFORM LAUNCH

7.1.6 PATENTS

7.1.7 SUSTAINABILITY INITIATIVES

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 L’ORÉAL S.A.

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENTS

9.2 THE ESTÉE LAUDER COMPANIES INC.

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENTS

9.3 UNILEVER

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENTS

9.4 PROCTER & GAMBLE

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENTS

9.5 BEIERSDORF GROUP

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENTS

9.6 COLGATE-PALMOLIVE COMPANY

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENTS

9.7 COTY INC.

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT DEVELOPMENTS

9.8 HENKEL AG & CO. KGAA

9.8.1 COMPANY SNAPSHOT

9.8.2 REVENUE ANALYSIS

9.8.3 PRODUCT PORTFOLIO

9.8.4 RECENT DEVELOPMENTS

9.9 KAO CORPORATION

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENTS

9.1 REVLON, INC.

9.10.1 COMPANY SNAPSHOT

9.10.2 REVENUE ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENTS

9.11 SHISEIDO COMPANY, LIMITED

9.11.1 COMPANY SNAPSHOT

9.11.2 REVENUE ANALYSIS

9.11.3 PRODUCT PORTFOLIO

9.11.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA MAKE UP IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA OFFLINE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 SAUDI ARABIA COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 SAUDI ARABIA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 SAUDI ARABIA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 SAUDI ARABIA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 SAUDI ARABIA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 SAUDI ARABIA MAKE UP IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 SAUDI ARABIA COSMETICS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 23 SAUDI ARABIA COSMETICS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 24 SAUDI ARABIA COSMETICS MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 SAUDI ARABIA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 26 SAUDI ARABIA OFFLINE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 SAUDI ARABIA COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 SAUDI ARABIA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 SAUDI ARABIA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 UNITED ARAB EMIRATES COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 UNITED ARAB EMIRATES SKIN CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 UNITED ARAB EMIRATES HAIR CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 UNITED ARAB EMIRATES HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 UNITED ARAB EMIRATES HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 UNITED ARAB EMIRATES MAKE UP IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 UNITED ARAB EMIRATES COSMETICS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 37 UNITED ARAB EMIRATES COSMETICS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 38 UNITED ARAB EMIRATES COSMETICS MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 UNITED ARAB EMIRATES COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 40 UNITED ARAB EMIRATES OFFLINE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 UNITED ARAB EMIRATES COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 UNITED ARAB EMIRATES WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 UNITED ARAB EMIRATES MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 EGYPT COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 EGYPT SKIN CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 EGYPT HAIR CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 EGYPT HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 EGYPT HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 EGYPT MAKE UP IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 EGYPT COSMETICS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 51 EGYPT COSMETICS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 52 EGYPT COSMETICS MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 EGYPT COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 54 EGYPT OFFLINE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 EGYPT COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 56 EGYPT WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 EGYPT MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 ISRAEL COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 ISRAEL SKIN CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 ISRAEL HAIR CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 ISRAEL HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 ISRAEL HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 ISRAEL MAKE UP IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 ISRAEL COSMETICS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 65 ISRAEL COSMETICS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 66 ISRAEL COSMETICS MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 ISRAEL COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 68 ISRAEL OFFLINE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 ISRAEL COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 70 ISRAEL WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 ISRAEL MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 SOUTH AFRICA COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 SOUTH AFRICA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 SOUTH AFRICA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 SOUTH AFRICA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 SOUTH AFRICA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 SOUTH AFRICA MAKE UP IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 SOUTH AFRICA COSMETICS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 79 SOUTH AFRICA COSMETICS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 80 SOUTH AFRICA COSMETICS MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 SOUTH AFRICA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 82 SOUTH AFRICA OFFLINE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 SOUTH AFRICA COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 84 SOUTH AFRICA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 SOUTH AFRICA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 REST OF MIDDLE EAST AND AFRICA COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST AND AFRICA COSMETICS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA COSMETICS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA COSMETICS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA COSMETICS MARKET: MIDDLE EAST AND AFRICA VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA COSMETICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA COSMETICS MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST AND AFRICA COSMETICS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST AND AFRICA COSMETICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST AND AFRICA COSMETICS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST AND AFRICA COSMETICS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA COSMETICS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST AND AFRICA COSMETICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST AND AFRICA COSMETICS MARKET: SEGMENTATION

FIGURE 14 SURGE IN E-COMMERCE FUELING THE DEMAND OF COSMETICS PRODUCTS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA COSMETICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 SKIN CARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA COSMETICS MARKET IN 2023 TO 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA COSMETICS MARKET

FIGURE 17 MIDDLE EAST AND AFRICA COSMETICS MARKET: SNAPSHOT (2022)

FIGURE 18 MIDDLE EAST AND AFRICA COSMETICS MARKET: BY COUNTRY (2022)

FIGURE 19 MIDDLE EAST AND AFRICA COSMETICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 20 MIDDLE EAST AND AFRICA COSMETICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 21 MIDDLE EAST AND AFRICA COSMETICS MARKET: BY PRODUCT TYPE (2023 & 2030)

FIGURE 22 MIDDLE EAST AND AFRICA COSMETICS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.