Middle East And Africa Corneal Transplant Market

Taille du marché en milliards USD

TCAC :

%

USD

22.87 Million

USD

32.76 Million

2024

2032

USD

22.87 Million

USD

32.76 Million

2024

2032

| 2025 –2032 | |

| USD 22.87 Million | |

| USD 32.76 Million | |

|

|

|

|

Segmentation du marché de la greffe de cornée au Moyen-Orient et en Afrique, par type de procédure (kératoplastie endothéliale, kératoplastie pénétrante, kératoplastie lamellaire antérieure (ALK), greffe de cellules souches limbiques cornéennes, greffe de cornée artificielle et autres), type (cornée humaine et synthétique), type de donneur (autogreffe et allogreffe), type de greffe (greffes d'épaisseur partielle (lamellaires) et greffes d'épaisseur totale (pénétrantes)), type de chirurgie (chirurgie conventionnelle et chirurgie assistée par laser), indication (dystrophie endothéliale de Fuchs, kératite infectieuse, kératopathie bulleuse, kératocône, procédures de greffe, cicatrisation cornéenne, ulcères cornéens et autres), sexe (femme et homme), tranche d'âge (gériatrique, adulte et pédiatrique), utilisateur final (hôpitaux, cliniques ophtalmologiques, centres de chirurgie ambulatoire, instituts universitaires et de recherche, et Autres) - Tendances et prévisions de l'industrie jusqu'en 2032

Taille du marché de la greffe de cornée au Moyen-Orient et en Afrique

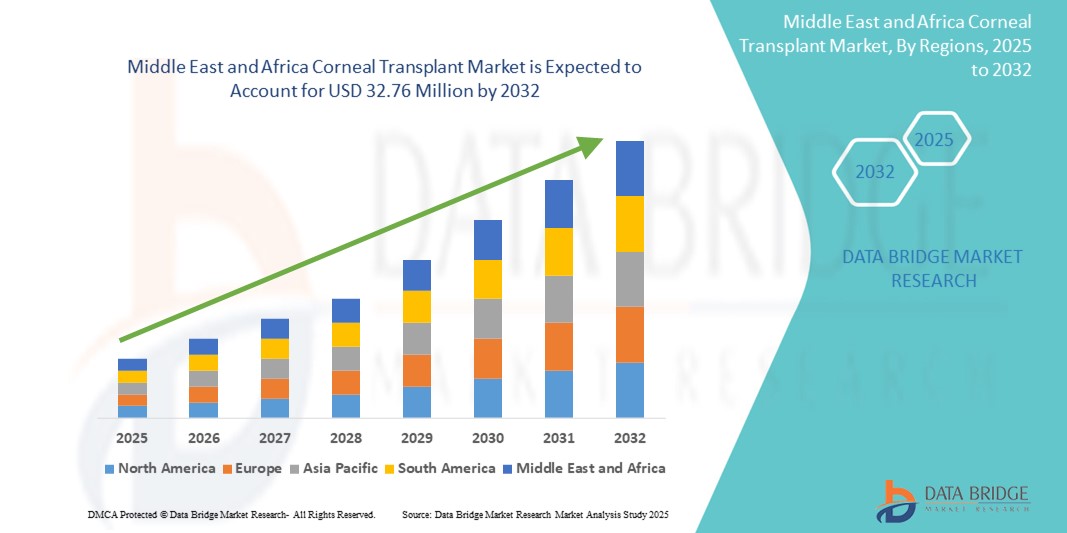

- La taille du marché de la greffe de cornée au Moyen-Orient et en Afrique était évaluée à 22,87 millions USD en 2024 et devrait atteindre 32,76 millions USD d'ici 2032 , à un TCAC de 4,60 % au cours de la période de prévision.

- L'expansion du marché est stimulée par la prévalence croissante de la cécité cornéenne, associée à une sensibilisation croissante et à une meilleure accessibilité aux soins ophtalmiques avancés et aux interventions chirurgicales dans toute la région.

- Par ailleurs, les initiatives gouvernementales et non gouvernementales croissantes visant à créer des banques d'yeux et à renforcer les infrastructures de transplantation stimulent la demande. Ces efforts collectifs favorisent une adoption plus large de la transplantation cornéenne, favorisant ainsi la croissance du marché dans toute la région Moyen-Orient et Afrique.

Analyse du marché de la greffe de cornée au Moyen-Orient et en Afrique

- Les greffes de cornée, qui consistent à remplacer des tissus cornéens endommagés ou malades par des cornées de donneurs, deviennent des procédures de plus en plus vitales au Moyen-Orient et en Afrique en raison du fardeau croissant de la cécité cornéenne, des traumatismes et des maladies oculaires infectieuses dans la région.

- La demande croissante est largement alimentée par l’augmentation des investissements dans les soins de santé, une sensibilisation accrue aux causes traitables de la déficience visuelle et le développement de centres ophtalmiques spécialisés dans des pays comme l’Afrique du Sud, l’Arabie saoudite et les Émirats arabes unis.

- L'Afrique du Sud a dominé le marché de la transplantation cornéenne au Moyen-Orient et en Afrique avec la plus grande part de revenus de 32,5 % en 2024, soutenue par une infrastructure chirurgicale plus solide, une disponibilité croissante de cornées de donneurs et des initiatives publiques-privées pour lutter contre la cécité cornéenne.

- Les Émirats arabes unis devraient être le pays à la croissance la plus rapide sur le marché de la greffe de cornée au cours de la période de prévision, grâce à des programmes avancés de modernisation des soins de santé, à l'augmentation du tourisme médical et à l'adoption croissante de technologies innovantes de traitement de la cornée.

- Le segment de la kératoplastie pénétrante a dominé le marché de la greffe de cornée avec une part de marché de 49,2 % en 2024, attribuée à son taux de réussite établi et à son adéquation à un large éventail d'affections cornéennes couramment traitées dans la région.

Portée du rapport et segmentation du marché de la greffe de cornée au Moyen-Orient et en Afrique

|

Attributs |

Perspectives clés du marché de la greffe de cornée au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché de la greffe de cornée au Moyen-Orient et en Afrique

« Promouvoir les banques oculaires et l'infrastructure chirurgicale »

- Une tendance notable qui façonne le marché de la greffe de cornée au Moyen-Orient et en Afrique est le développement continu des banques oculaires régionales et l'amélioration de l'accès à une infrastructure chirurgicale ophtalmologique de pointe. Ces efforts sont essentiels pour lutter contre le lourd fardeau de la cécité cornéenne et améliorer la disponibilité des greffes.

- Par exemple, en 2024, la Banque nationale sud-africaine des yeux a élargi son réseau de donneurs et sa capacité de préservation de la cornée, augmentant ainsi considérablement la disponibilité des greffes cornéennes. De même, l'Arabie saoudite investit dans des centres de chirurgie ophtalmologique de pointe dans le cadre de ses objectifs de santé Vision 2030.

- L'expansion des banques d'yeux améliore la qualité et la sécurité des tissus transplantables, permettant une distribution plus efficace de la cornée et réduisant les délais d'attente pour les greffes. De plus, l'intégration de technologies diagnostiques et chirurgicales avancées, notamment les lasers femtosecondes et les techniques de kératoplastie endothéliale, améliore les résultats chirurgicaux dans toute la région.

- Les partenariats public-privé émergents soutiennent des campagnes de sensibilisation, des initiatives de recrutement de donneurs et des programmes de renforcement des compétences des chirurgiens ophtalmologistes. Ces efforts permettent d'aligner progressivement la région sur les normes mondiales en matière de greffe de cornée.

- Cette tendance à la création d'un écosystème de transplantation durable remodèle les systèmes régionaux de soins oculaires et améliore l'accès aux interventions de restauration de la vue. Ainsi, des pays comme les Émirats arabes unis et l'Égypte deviennent des pôles régionaux de soins ophtalmologiques, soutenus par l'essor du tourisme médical et la croissance des investissements dans les hôpitaux ophtalmologiques spécialisés.

- L’accent mis sur l’élargissement des bassins de donneurs de cornée, l’affinement de la précision chirurgicale et la formation de professionnels qualifiés accélère le rythme de la transplantation de cornée au Moyen-Orient et en Afrique, améliorant ainsi la viabilité du marché à long terme.

Dynamique du marché de la greffe de cornée au Moyen-Orient et en Afrique

Conducteur

« Augmentation de la cécité cornéenne et initiatives gouvernementales en matière de santé oculaire »

- L'incidence croissante de la cécité cornéenne due à des traumatismes, des infections et des maladies dégénératives est un moteur majeur de la croissance du marché de la greffe de cornée au Moyen-Orient et en Afrique. Ce besoin croissant de restauration de la vision stimule la demande de solutions chirurgicales.

- Par exemple, en 2024, le ministère de la Santé des Émirats arabes unis a lancé un registre national des dons de cornée et un système de coordination des transplantations afin de simplifier l'accès et de réduire la dépendance aux tissus importés. Des initiatives similaires au Kenya et en Égypte ciblent la cécité évitable grâce à des interventions chirurgicales et à une meilleure accessibilité.

- Les gouvernements et les organismes de santé accordent une priorité croissante aux soins oculaires dans leurs stratégies nationales de santé, en mettant l'accent sur le renforcement des capacités, l'éducation des patients et le développement des infrastructures. Ces engagements politiques devraient stimuler le volume des transplantations dans les années à venir.

- Les greffes de cornée gagnent en importance en tant que solutions rentables pour restaurer la vue et améliorer la qualité de vie, notamment chez les populations mal desservies. Les campagnes de sensibilisation des donneurs et l'adoption de services mobiles de soins oculaires favorisent également un accès plus large en zones rurales.

- L'intégration de systèmes de suivi des donneurs, de méthodes de conservation améliorées et de programmes de formation spécialisés pour les chirurgiens cornéens renforcent encore le paysage régional de la transplantation, le rendant plus réactif à la demande croissante.

Retenue/Défi

« Disponibilité limitée de cornées de donneurs et coûts de traitement élevés »

- La pénurie persistante de cornées de donneurs constitue un défi majeur sur le marché de la greffe de cornée au Moyen-Orient et en Afrique. Elle limite le nombre d'interventions chirurgicales viables. Cette pénurie est particulièrement aiguë dans les pays à faibles ressources et aux systèmes de don sous-développés.

- Par exemple, de nombreux pays d'Afrique subsaharienne dépendent fortement des tissus de donneurs importés en raison d'une infrastructure locale inadéquate en matière de banques oculaires, ce qui entraîne des retards et une augmentation des coûts des procédures.

- Les coûts de traitement élevés, notamment pour les procédures de transplantation avancées telles que la DMEK ou la DSAEK, constituent un autre obstacle sur les marchés sensibles aux coûts. Les frais à la charge des patients dissuadent souvent les patients de recourir à la chirurgie, notamment dans les régions rurales et mal desservies.

- Les lacunes réglementaires, les lois incohérentes sur le don et la résistance culturelle au don d'yeux freinent également l'expansion du bassin de donneurs dans plusieurs pays. De plus, le manque de chirurgiens ophtalmologistes qualifiés et d'outils chirurgicaux modernes dans certaines régions réduit les taux de réussite des interventions et limite l'évolutivité.

- Relever ces défis grâce à un financement gouvernemental ciblé, une collaboration transfrontalière dans le domaine des services bancaires oculaires, l'éducation publique et des partenariats internationaux sera essentiel pour élargir l'accès et améliorer l'accessibilité financière dans toute la région.

Portée du marché de la greffe de cornée au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type de procédure, du type, du type de donneur, du type de greffe, du type de chirurgie, de l'indication, du sexe, de la tranche d'âge et de l'utilisateur final.

- Par type de procédure

En fonction du type d'intervention, le marché de la greffe de cornée au Moyen-Orient et en Afrique est segmenté en kératoplastie endothéliale, kératoplastie pénétrante, kératoplastie lamellaire antérieure (ALK), greffe de cellules souches limbiques cornéennes et greffe de cornée artificielle, entre autres. Le segment de la kératoplastie pénétrante a dominé le marché avec la plus grande part de marché, soit 49,2 % en 2024, en raison de sa large application dans le traitement des maladies cornéennes de pleine épaisseur, en particulier dans les régions où l'accès aux instruments chirurgicaux avancés est limité. Les hôpitaux et les centres ophtalmologiques d'Afrique du Sud et du Nigéria continuent de s'appuyer sur cette procédure traditionnelle en raison de son efficacité et de sa familiarité chirurgicale.

Le segment de la kératoplastie endothéliale devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à son caractère mini-invasif, à une récupération visuelle plus rapide et à la disponibilité croissante de chirurgiens ophtalmologistes qualifiés, notamment aux Émirats arabes unis et en Arabie saoudite. L'essor des techniques DMEK et DSAEK contribue à l'expansion de ce segment.

- Par type

Au Moyen-Orient et en Afrique, le marché de la greffe de cornée est segmenté en deux catégories : la cornée humaine et la cornée synthétique. En 2024, le segment de la cornée humaine détenait la plus grande part de chiffre d'affaires, grâce à la préférence constante pour les tissus provenant de donneurs et à la création croissante de banques oculaires dans des pays comme l'Afrique du Sud, l'Égypte et le Kenya. Sa compatibilité naturelle et ses taux de réussite élevés confirment sa domination.

Le segment synthétique devrait connaître une croissance constante au cours de la période de prévision, en raison des progrès technologiques dans le domaine des kératoprothèses et de leur utilisation croissante dans les cas d'échecs de greffes multiples ou lorsque le tissu d'un donneur humain n'est pas disponible.

- Par type de donateur

En fonction du type de donneur, le marché de la greffe de cornée au Moyen-Orient et en Afrique est segmenté en autogreffes et allogreffes. Le segment des allogreffes a dominé le marché, affichant la part de chiffre d'affaires la plus élevée en 2024, principalement en raison de la pratique courante d'utilisation de cornées de donneurs décédés et du développement des programmes de sensibilisation aux donneurs. Les efforts des ministères de la Santé régionaux et des ONG enrichissent le registre des donneurs dans des pays comme l'Égypte et le Kenya.

Le segment des autogreffes devrait connaître la croissance la plus rapide au cours de la période de prévision, principalement limité aux procédures de transplantation de cellules souches limbiques cornéennes, et est généralement utilisé dans des cas hautement spécialisés.

- Par type de greffe

En fonction du type de greffe, le marché de la greffe cornéenne au Moyen-Orient et en Afrique est segmenté en greffes d'épaisseur partielle (lamellaires) et greffes d'épaisseur totale (pénétrantes). Le segment des greffes d'épaisseur totale (pénétrantes) détenait la plus grande part de chiffre d'affaires en 2024, grâce à son utilisation établie dans les hôpitaux publics et privés et à sa capacité à traiter les pathologies cornéennes avancées et complexes dans toute la région MEA.

Le segment des greffes d'épaisseur partielle (lamellaires) devrait croître à un rythme plus élevé au cours de la période de prévision en raison de moins de complications postopératoires, d'un temps de guérison plus rapide et d'une adoption croissante dans les centres ophtalmologiques technologiquement avancés.

- Par type de chirurgie

En fonction du type d'intervention, le marché de la greffe de cornée au Moyen-Orient et en Afrique est segmenté en chirurgie conventionnelle et chirurgie assistée par laser. En 2024, le segment de la chirurgie conventionnelle a dominé le marché, en raison de l'utilisation généralisée des techniques manuelles traditionnelles dans les opérations de greffe de cornée, en particulier dans les pays à revenu faible et intermédiaire ayant un accès limité aux systèmes chirurgicaux avancés.

Le segment de la chirurgie assistée par laser devrait connaître une croissance rapide entre 2025 et 2032, grâce à la demande croissante de précision, à la réduction du temps de guérison et à l'utilisation croissante des systèmes laser femtoseconde aux Émirats arabes unis et en Arabie saoudite.

- Par indication

Sur la base des indications, le marché de la greffe de cornée au Moyen-Orient et en Afrique est segmenté en dystrophie endothéliale de Fuch, kératite infectieuse, kératopathie bulleuse, kératocône, greffes, cicatrices cornéennes, ulcères cornéens, etc. Le segment du kératocône détenait la plus grande part de chiffre d'affaires en 2024, en raison de sa forte prévalence régionale, notamment chez les jeunes adultes des pays du Moyen-Orient comme l'Arabie saoudite et les Émirats arabes unis. Un diagnostic précoce et la disponibilité d'options chirurgicales avancées sont des facteurs clés.

Le segment de la dystrophie endothéliale de Fuch devrait connaître la croissance la plus rapide au cours de la période de prévision, soutenue par l'augmentation de la population gériatrique, la sensibilisation croissante et l'accès aux procédures de kératoplastie endothéliale dans les établissements de santé urbains.

- Par sexe

Au Moyen-Orient et en Afrique, le marché de la greffe de cornée est segmenté en deux groupes : les femmes et les hommes. En 2024, le segment masculin représentait la plus grande part de marché, principalement en raison d'une exposition accrue aux lésions oculaires professionnelles et d'une prévalence accrue de traumatismes cornéens chez les hommes, notamment dans les zones industrielles d'Afrique du Sud et du Nigéria.

Le segment féminin devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à l'augmentation de l'accès des femmes aux soins de santé, à l'intensification des campagnes de sensibilisation et à l'accent mis sur l'égalité des sexes dans les initiatives régionales de santé.

- Par groupe d'âge

Au Moyen-Orient et en Afrique, le marché de la greffe de cornée est segmenté en fonction de l'âge : gériatrique, adulte et pédiatrique. Le segment adulte a dominé le marché avec la plus forte part de chiffre d'affaires en 2024, en raison de la forte incidence de pathologies telles que le kératocône et la kératite infectieuse chez les personnes en âge de travailler.

Le segment gériatrique devrait croître au rythme le plus rapide au cours de la période de prévision en raison du vieillissement de la population et de l'augmentation des cas de dysfonctionnement endothélial et de kératopathie bulleuse chez les personnes âgées aux Émirats arabes unis et en Égypte.

- Par utilisateur final

Au Moyen-Orient et en Afrique, le marché de la greffe de cornée est segmenté en fonction de l'utilisateur final : hôpitaux, cliniques ophtalmologiques, centres de chirurgie ambulatoire, instituts universitaires et de recherche, etc. En 2024, le segment hospitalier a dominé le marché, grâce à des infrastructures de pointe, des capacités chirurgicales intégrées et la présence d'ophtalmologistes qualifiés dans des établissements médicaux de premier plan en Afrique du Sud, en Égypte et aux Émirats arabes unis.

Le segment des cliniques ophtalmologiques devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à l’expansion des réseaux de soins oculaires spécialisés et à une accessibilité accrue dans les zones urbaines et suburbaines.

Analyse régionale du marché de la greffe de cornée au Moyen-Orient et en Afrique

- L'Afrique du Sud a dominé le marché de la transplantation cornéenne au Moyen-Orient et en Afrique avec la plus grande part de revenus de 32,5 % en 2024, soutenue par une infrastructure chirurgicale plus solide, une disponibilité croissante de cornées de donneurs et des initiatives publiques-privées pour lutter contre la cécité cornéenne.

- Les patients du pays bénéficient d'une sensibilisation accrue aux déficiences visuelles traitables, d'un accès à des professionnels de l'ophtalmologie qualifiés et de programmes dirigés par le gouvernement visant à réduire le fardeau de la cécité cornéenne.

- Le leadership de la région en matière de procédures de transplantation est encore renforcé par les progrès réalisés dans le domaine des banques oculaires, l'amélioration de l'accès aux technologies chirurgicales et les collaborations continues avec les organisations internationales, positionnant l'Afrique du Sud comme une plaque tournante clé pour les soins cornéens au Moyen-Orient et en Afrique.

Aperçu du marché sud-africain de la greffe de cornée

En 2024, le marché sud-africain de la greffe de cornée a représenté la plus grande part de chiffre d'affaires de la région, soit 32,5 %, grâce à ses infrastructures de soins oculaires de pointe et à son réseau croissant de programmes de don de cornée. Les partenariats public-privé et la formation renforcée des chirurgiens ophtalmologistes ont considérablement amélioré l'accès aux procédures et leurs résultats. Le pays continue d'être le leader régional en matière d'adoption grâce à un soutien gouvernemental fort, à l'expansion des registres de transplantation et à des collaborations avec des organisations internationales de santé oculaire, ce qui en fait un pôle incontournable pour les soins de la cornée.

Aperçu du marché de la greffe de cornée aux Émirats arabes unis

Le marché de la greffe de cornée aux Émirats arabes unis devrait connaître une croissance soutenue au cours de la période de prévision, grâce à des infrastructures de santé de pointe et à l'essor du tourisme médical. L'accent mis par le gouvernement sur la santé numérique, l'innovation et les soins spécialisés a permis d'accroître la disponibilité des procédures de greffe assistée par laser. Une sensibilisation croissante, conjuguée aux programmes nationaux de donateurs et à l'intégration des normes chirurgicales mondiales, favorise une forte adoption dans les hôpitaux privés et publics.

Aperçu du marché de la greffe de cornée en Arabie saoudite

Le marché de la greffe de cornée en Arabie saoudite devrait connaître une croissance constante grâce aux réformes du système de santé du pays (Vision 2030) et à la prévalence croissante des maladies cornéennes. Les investissements dans les centres ophtalmologiques et les initiatives de sensibilisation des donneurs contribuent à combler l'écart entre l'offre et la demande de cornées transplantables. Les avancées technologiques et l'amélioration de l'accès à la formation favorisent le développement de techniques chirurgicales avancées, telles que la kératoplastie endothéliale, dans les principaux hôpitaux de Riyad et de Djeddah.

Aperçu du marché égyptien de la greffe de cornée

Le marché égyptien de la greffe de cornée connaît un essor croissant, porté par la charge croissante des maladies oculaires infectieuses et des lésions cornéennes liées aux traumatismes. Le développement des services de soins oculaires publics et les collaborations avec les banques oculaires étrangères contribuent à améliorer la disponibilité des cornées. Le marché devrait bénéficier d'une solide base de patients, de campagnes de sensibilisation menées par le gouvernement et de partenariats internationaux visant à réduire la cécité cornéenne dans les régions mal desservies.

Aperçu du marché kenyan de la greffe de cornée

Le marché kenyan de la greffe de cornée devrait connaître une croissance progressive, soutenue par le développement d'initiatives de soins oculaires à but non lucratif et d'unités chirurgicales mobiles. L'amélioration de l'accès aux soins ophtalmologiques spécialisés dans les zones rurales entraîne une demande croissante de greffes de cornée abordables et efficaces. Les initiatives des organisations de santé mondiales et les améliorations apportées aux hôpitaux publics devraient améliorer l'accès aux donneurs de cornée et les résultats chirurgicaux au cours de la période de prévision.

Part de marché de la greffe de cornée au Moyen-Orient et en Afrique

L'industrie de la transplantation cornéenne au Moyen-Orient et en Afrique est principalement dirigée par des entreprises bien établies, notamment :

- CorneaGen, Inc. (États-Unis)

- KeraLink International (États-Unis)

- Aurolab (Inde)

- AJL Ophthalmic SA (Espagne)

- DIOPTEX GmbH (Autriche)

- Presbia PLC (Irlande)

- Banque oculaire des Lions de Floride (États-Unis)

- Banque oculaire de San Diego (États-Unis)

- TissueTech, Inc. (États-Unis)

- Eversight (États-Unis)

- Alcon Inc. (Suisse)

- Bausch + Lomb Incorporated (États-Unis)

- Ziemer Ophthalmic Systems AG (Suisse)

- Gebauer Medizintechnik GmbH (Allemagne)

- MEDIPHACOS Ltda. (Brésil)

- Ophtec BV (Pays-Bas)

- Surgical Specialties Corporation (États-Unis)

- EyeYon Medical Ltd. (Israël)

- Miracles Optical (Inde)

- Keramed, Inc. (États-Unis)

Quels sont les développements récents sur le marché de la greffe de cornée au Moyen-Orient et en Afrique ?

- En mai 2024, la Banque nationale sud-africaine des yeux a annoncé une importante initiative d'expansion visant à améliorer la collecte et la conservation des cornées de donneurs. Ce développement vise à répondre à la demande croissante de greffes de cornée dans la région en augmentant la disponibilité de greffons de haute qualité. Cette initiative souligne l'engagement de l'organisation à réduire la cécité cornéenne grâce au renforcement des infrastructures de banques oculaires, à l'amélioration des protocoles de manipulation des tissus et à l'élargissement des programmes de sensibilisation des donneurs en Afrique du Sud.

- En avril 2024, le Moorfields Eye Hospital de Dubaï, centre de soins ophtalmologiques de premier plan aux Émirats arabes unis, a lancé un programme avancé de greffe de cornée intégrant la technologie laser femtoseconde. Ce programme est conçu pour offrir des résultats chirurgicaux de précision pour des pathologies telles que la dystrophie de Fuchs et le kératocône. En adoptant des équipements de pointe et en respectant les normes chirurgicales internationales, Moorfields renforce son rôle de leader régional en matière de soins cornéens et soutient l'ambition des Émirats arabes unis de devenir un pôle d'excellence médicale.

- En mars 2024, l'hôpital ophtalmologique King Khaled d'Arabie saoudite a signé un accord de collaboration avec l'organisation à but non lucratif internationale Orbis International afin d'élargir les programmes de formation des chirurgiens cornéens. Ce partenariat est axé sur le renforcement des capacités, avec notamment des formations chirurgicales en direct, des ateliers et un soutien par télémédecine pour améliorer les capacités de transplantation dans tout le royaume. Cette initiative souligne l'importance des partenariats internationaux pour améliorer la qualité et l'accessibilité des soins ophtalmologiques en Arabie saoudite.

- En février 2024, le ministère de la Santé du Kenya a lancé une campagne de sensibilisation au don d'yeux, en collaboration avec des ONG régionales et des banques oculaires internationales. Cette campagne vise à accroître l'inscription des donneurs locaux et à réduire la dépendance du pays aux importations de tissus cornéens. Cette initiative reflète l'attention croissante portée par le gouvernement à la lutte contre la cécité évitable par la mobilisation des donneurs locaux et l'amélioration des infrastructures de transplantation.

- En janvier 2024, les hôpitaux et centres Magrabi d'Égypte ont mis en place un registre centralisé des greffes de cornée afin de simplifier la prise en charge des patients et d'optimiser l'allocation des tissus des donneurs. Ce système permet un suivi transparent des résultats chirurgicaux, de la compatibilité donneur-receveur et des soins postopératoires. Cette initiative reflète une approche axée sur les données pour améliorer l'efficacité des greffes, positionnant l'Égypte comme un acteur émergent de l'innovation en chirurgie ophtalmologique dans la région.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.