Middle East And Africa Aroma Chemicals Market

Taille du marché en milliards USD

TCAC :

%

USD

66.66 Billion

USD

144.53 Billion

2025

2033

USD

66.66 Billion

USD

144.53 Billion

2025

2033

| 2026 –2033 | |

| USD 66.66 Billion | |

| USD 144.53 Billion | |

|

|

|

|

Segmentation du marché des composés aromatiques au Moyen-Orient et en Afrique, par type chimique (terpènes, benzénoïdes, muscs, esters, cétones et autres), profil aromatique (floral, boisé, agrumes, fruité, herbacé, tropical et autres), couleur (incolore, blanc, jaunâtre et autres), origine (naturelle et synthétique), forme (liquide et poudre), application (produits de toilette, parfums, soins personnels, boissons, alimentation et autres), type de produit (Vainilla vainas Madagascar, Tixosil 38 x, Vainillin, Carvacrol, Propilenglicol USP, Dipropilenglicol, Éther méthylique de dipropilenglicol, Dihydromircénol, Cis-3-hexénol, Aldéhide c-18, Linalol, Lysmeral, Aldéhyde cinnamique, Citronélol, Galaxolide, Iso E Super, Géraniol, Hexylcinnamique). Aldéhyde, Aldéhide C-14, Acétate d'isoborniyle, Alcool phényléthylique, Anéthol, Eugénol, Furanéol, Cétone de framboise, Gamma-décalactone, Timbersilk, Delta-dodécalactone, Oxyde de diphényle, Eucaliptol, Anisaldéhyde, Cetalox, Hédione // MDJ, Alpha-ionone, Yara Yara, Ionone bêta, Acétate de linalyle, Acétate d'isoamyle, Butirato de Etilo, Triol 91 casher, Éthylvanilline, Canphor, Citral, Terpinoléones, Broméliacée, Jasmacyclène / Acétate de verdyle, Aldéhide C-12 MNA, Verdox // Acétate d'OTBC, Gamma-octalactone, Triacétine, Acétate de benzyle, Citronelal, Alcool benzylique, Héliotropine, Gamma-méthylionone Terpinéols, Bourgeonal, Dynascone, Bacdanol, Thymol, Coumarine, Dihydrocoumarine, Salicylate d'amyle, Salicylate d'hexyle, Salicylate de méthyle, Propionate de verdyle, Undécavertol, Nitryle de citrnélyle, Antranilate de méthyle, Acétate de terpinyle, Méthylcyclopenténolone, Acétate de PTBC, Ethylcyclopenténolone, Acide butyrique, Aldéhydes C-12 (MOA, MNA, etc.), Aldéhydes C-11, Rosaline, Oxyde de rose 90:10, Maltol, Éthylmaltol, Triplal, Caproate d'éthyle, Hexanoates et Heptanoates d'éthyle et de méthyle, Menthol, Menthol naturel, Menthol synthétique, Menthe verte 60 % et 80 %, Nérol, Exaltolide, Acétate de strialyle, Tétrahydrolinalol, Tétrahydromyrcénol Glycolate d'allyle et d'amyle, bornéol cristallisé, isobornéol, tonalid, violiff, tibutyirine, javanol et autres), et canal de distribution (direct et indirect) - Tendances et prévisions du secteur jusqu'en 2033

Quelle est la taille et le taux de croissance du marché des produits chimiques aromatiques au Moyen-Orient et en Afrique ?

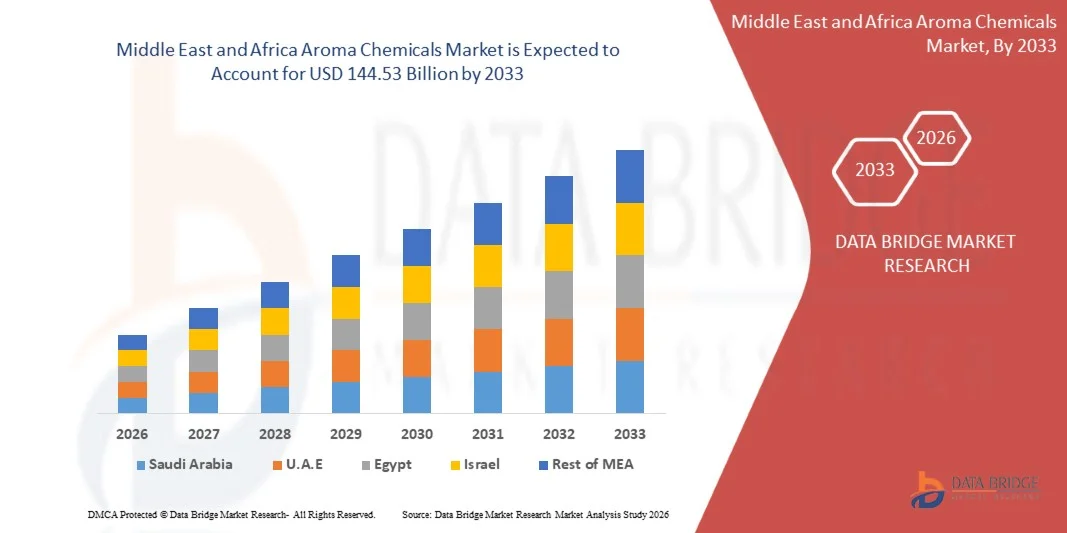

- Le marché des produits chimiques aromatiques au Moyen-Orient et en Afrique était évalué à 66,66 milliards de dollars américains en 2025 et devrait atteindre 144,53 milliards de dollars américains d'ici 2033 , avec un TCAC de 7,0 % au cours de la période de prévision.

- L'intensification des activités de construction et d'infrastructure, notamment les projets commerciaux, résidentiels et industriels, stimule la demande en produits chimiques aromatiques destinés à protéger les structures contre les infiltrations d'eau, l'humidité et la dégradation environnementale, contribuant ainsi à la croissance du marché.

- Le coût initial élevé des membranes haut de gamme et de leur installation, associé à la nécessité d'une main-d'œuvre qualifiée et de machines spécialisées, augmente les dépenses totales du projet, ce qui peut limiter leur adoption dans les projets de petite envergure ou sensibles aux coûts.

Quels sont les principaux enseignements du marché des produits chimiques aromatiques ?

- Les progrès réalisés dans les technologies d'étanchéité, telles que les membranes auto-adhésives, les solutions liquides et les feuilles synthétiques haute performance, améliorent la durabilité et la facilité d'installation, offrant ainsi d'importantes opportunités de croissance aux acteurs du marché.

- Des problèmes tels que les fuites, les installations incorrectes et les exigences de maintenance continuent d'affecter la rentabilité et les performances, constituant des obstacles majeurs à l'adoption généralisée des produits chimiques aromatiques au Moyen-Orient et en Afrique.

- L'Arabie saoudite a dominé le marché des produits chimiques aromatiques au Moyen-Orient et en Afrique avec une part de revenus de 34,5 % en 2025, grâce à l'adoption croissante de produits chimiques aromatiques de haute qualité dans les industries des parfums, des soins personnels, de l'alimentation et des boissons.

- Les Émirats arabes unis devraient enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, soit 9,8 %, entre 2026 et 2033, grâce à l'adoption de composés aromatiques naturels, durables et innovants dans les secteurs de la parfumerie, des soins personnels et de l'alimentation et des boissons.

- Le segment des terpènes a dominé le marché avec une part de revenus de 54 % en 2025, porté par une forte demande dans les parfums de luxe, les soins personnels et les applications alimentaires, en raison de leur polyvalence et de leur profil aromatique naturel.

Portée du rapport et segmentation du marché des produits chimiques aromatiques

|

Attributs |

Principaux enseignements du marché des produits chimiques aromatiques |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des produits chimiques aromatiques ?

« Demande croissante de composés aromatiques durables et performants »

- Le marché des composés aromatiques au Moyen-Orient et en Afrique connaît une tendance majeure : l’adoption croissante d’ingrédients aromatiques écologiques, naturels et multifonctionnels. Cette tendance est alimentée par une sensibilisation accrue des consommateurs à la santé, au bien-être et au développement durable, notamment dans les secteurs de l’alimentation, des boissons, des cosmétiques et des soins personnels.

- Par exemple, des entreprises comme Firmenich et Givaudan développent des composés aromatiques biodégradables d'origine végétale, dotés d'une stabilité accrue et de profils sensoriels supérieurs, afin de répondre aux normes réglementaires strictes et aux attentes des consommateurs.

- La demande croissante de composés aromatiques naturels, hypoallergéniques et à étiquetage clair accélère leur adoption dans les secteurs de l'alimentation, des boissons et des soins personnels au Moyen-Orient et en Afrique.

- Les fabricants intègrent des technologies d'extraction avancées, la microencapsulation et le traitement sans solvant pour améliorer les performances, la durée de conservation et la sécurité.

- L'augmentation des investissements en recherche et développement dans les nouveaux composés aromatiques, l'approvisionnement durable et les technologies de masquage des odeurs favorise l'innovation.

- Alors que les consommateurs continuent de privilégier le bien-être, la durabilité et les expériences sensorielles de haute qualité, les composés aromatiques naturels et de qualité supérieure devraient rester au cœur du développement des produits.

Quels sont les principaux moteurs du marché des produits chimiques aromatiques ?

- L'importance croissante accordée aux ingrédients naturels, durables et à étiquetage clair est un moteur majeur de l'expansion du marché.

- Par exemple, en 2025, DSM et Symrise ont lancé des composés aromatiques d'origine végétale et sans allergènes pour l'alimentation, les boissons et les produits de soins personnels, ciblant les consommateurs soucieux de leur santé.

- La demande croissante d'arômes et de parfums haut de gamme et fonctionnels dans les aliments, les boissons et les cosmétiques emballés stimule l'adoption

- Les progrès technologiques en matière d'extraction, de purification et d'encapsulation permettent aux fabricants de produire des ingrédients aromatiques plus stables et plus puissants.

- L'attention accrue portée par la réglementation à la sécurité, à l'étiquetage et à l'approvisionnement durable soutient la croissance du marché.

- Grâce à des investissements continus dans la R&D, l'approvisionnement durable et l'innovation axée sur le consommateur, le marché des produits chimiques aromatiques au Moyen-Orient et en Afrique devrait maintenir une forte dynamique de croissance au cours des prochaines années.

Quel facteur freine la croissance du marché des produits chimiques aromatiques ?

- Le coût élevé des composés aromatiques naturels et végétaux de qualité supérieure limite leur adoption, notamment pour les petits fabricants et les produits sensibles au prix.

- Par exemple, entre 2024 et 2025, les fluctuations des prix des matières premières, des coûts d'extraction et de la conformité réglementaire ont eu un impact sur la production et la tarification des principaux acteurs.

- Les exigences réglementaires strictes en matière de sécurité, d'étiquetage des allergènes et de conformité environnementale augmentent la complexité et les coûts opérationnels.

- Le manque de sensibilisation des consommateurs aux bienfaits des composés aromatiques naturels et fonctionnels peut freiner leur adoption à grande échelle.

- La concurrence des arômes de synthèse, des alternatives locales à bas prix et des substituts importés exerce une pression sur les prix et affecte la pénétration du marché.

- Pour relever ces défis, les fabricants privilégient les méthodes d'extraction économiques, l'approvisionnement durable, les produits éco-certifiés et les programmes de formation afin de proposer des solutions chimiques aromatiques de haute qualité, sûres et durables.

Comment le marché des produits chimiques aromatiques est-il segmenté ?

Le marché est segmenté en fonction du type chimique, du nœud aromatique, de la couleur, de la source, de la forme, de l'application, du type de produit et du canal de distribution .

• Par type chimique

Selon leur nature chimique, les terpènes sont segmentés en terpènes, benzénoïdes, muscs, esters, cétones et autres. En 2025, le segment des terpènes dominait le marché avec 54 % des revenus, porté par une forte demande dans les parfums de luxe, les produits de soins personnels et l'industrie alimentaire, grâce à leur polyvalence et à leur profil aromatique naturel.

Le marché des composés musqués devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par une préférence croissante pour les fragrances haut de gamme et longue tenue dans les parfums et produits de soins personnels de luxe. L'innovation continue dans l'extraction des terpènes synthétiques et naturels soutient l'expansion du marché, tandis que les terpènes restent privilégiés pour les applications fonctionnelles et respectueuses de l'environnement.

• Par Aroma Node

Selon le type d'arôme, le marché est segmenté en floral, boisé, hespéridé, fruité, herbacé, tropical et autres. Le segment floral dominait le marché en 2025 avec 38,6 % des revenus, grâce à son utilisation répandue dans les parfums, les produits de toilette et les produits de soins personnels.

Les composés aromatiques boisés devraient connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la demande croissante de fragrances chaudes et terreuses dans les produits de luxe et de niche. Les innovations en matière d'encapsulation et de stabilisation garantissent une conservation optimale des arômes, quelle que soit l'application.

• Par couleur

En fonction de la couleur, le marché est segmenté en incolore, blanc, jaunâtre et autres. Le segment incolore dominait le marché avec une part de revenus de 46,2 % en 2025, car ces produits chimiques sont très polyvalents, faciles à mélanger et privilégiés dans les secteurs des boissons, des cosmétiques et de l'alimentation.

Les composés aromatiques jaunâtres devraient connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, sous l'effet de la préférence des consommateurs pour les ingrédients d'origine naturelle et visuellement attrayants, ainsi que de leurs applications croissantes en parfumerie spécialisée.

• Par source

Selon la source, le marché est segmenté en extraits naturels et synthétiques. Le segment synthétique dominait le marché en 2025 avec une part de revenus de 51,3 %, grâce à une qualité constante, une facilité de production à grande échelle et un coût inférieur à celui des extraits naturels.

On prévoit que les composés aromatiques naturels connaîtront le taux de croissance annuel composé le plus rapide entre 2026 et 2033, alimenté par la préférence croissante des consommateurs pour des solutions de parfumerie naturelles, biologiques et durables dans les secteurs de l'alimentation, des boissons et des soins personnels.

• Par formulaire

Selon la forme, le marché est segmenté en deux catégories : liquides et solides. Le segment des liquides a dominé le marché en 2025 avec une part de revenus de 57,4 %, grâce à la facilité de formulation, la haute solubilité et la large applicabilité industrielle de ces produits.

On prévoit que les composés aromatiques secs connaîtront le taux de croissance annuel composé le plus rapide entre 2026 et 2033, grâce aux progrès réalisés dans les technologies d'encapsulation, de mélange de poudres et de stabilité pour les aliments et les boissons fonctionnels.

• Sur demande

Selon l'application, le marché est segmenté en produits de toilette, parfums de luxe, soins personnels, boissons, produits alimentaires et autres. Le segment des parfums de luxe a dominé le marché en 2025 avec une part de revenus de 44,7 %, portée par la demande croissante de parfums de luxe et de niche.

Le secteur des boissons devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par les boissons fonctionnelles, les eaux aromatisées et les boissons haut de gamme nécessitant des profils aromatiques uniques.

• Par type de produit

En fonction du type de produit, le marché est segmenté en : Vainilla Vainas Madagascar, Tixosil 38 x, Vainillin, Carvacrol, Propilenglicol USP, Dipropilenglicol, Dipropilenglicol Metil Eter, Dihydromircenol, Cis-3-Hexenol, Aldehide c-18, Linalool, Lysmeral, Cinnam Aldehyde, Citronelol, Galaxolide, Iso E Super, Geraniol, Hexylcinnamic Aldehyde, Aldehide C-14, Isoborniyl Acetate, Phenylethyl Alcohol, Anethole, Eugenol, Furaneol, Raspberry Ketone, Gamma-Decalactone, Timbersilk, Delta-Dodecalactona, Diphenyl Oxide, Eucaliptol, Anisaldehyde, Cetalox, Hedione // MDJ, Alpha Ionone, Yara Yara, Ionone Beta, Linalyl Acetate. Acétate d'isoamyle, butyrate d'éthyle, Triol 91 casher, éthylvanilline, Canphor, citral, terpinoléones, broméliacée, jasmacyclène/acétate de verdyle, aldéhyde C-12 MNA, Verdox/acétate d'OTBC, gamma-octalactone, triacétine, acétate de benzyle, citronelal, alcool benzylique, héliotropine, gamma-méthylionone, terpinéols, bourgeonal, dynascone, bacdanol, thymol, coumarine, dihydrocoumarine, salicylate d'amyle, salicylate d'hexyle, salicylate de méthyle, propionate de verdyle, undécavertol, nitrile de citrnélyle, antranilate de méthyle, acétate de terpinyle, méthylcyclopenténolone, acétate de PTBC, éthylcyclopenténolone, acide butyrique, aldéhydes C-12 (MOA, MNA, etc.), aldéhydes C-11, rosaline, oxyde de rose 90:10, maltol, éthylmaltol, triplal, caproate d'éthyle, hexanoates et heptanoates d'éthyle et de méthyle, menthol naturel et synthétique, menthe verte à 60 % et 80 %, nérol, exaltolide, acétate de strialyle, tétrahydrolinalol, tétrahydromyrcénol, glycolate d'allyle et d'amyle, bornéol cristallisé, isobornéol, tonalid, violiff, tibutyirine, javanol et autres. Le segment de la vanilline a dominé le marché avec 36,8 % de parts de marché en 2025, grâce à son utilisation répandue en confiserie, boissons et parfumerie.

Hedione devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, soutenue par les tendances de la parfumerie haut de gamme et la préférence croissante pour les compositions olfactives sophistiquées.

• Par canal de distribution

Selon le canal de distribution, le marché est segmenté en distribution indirecte et directe. Le segment de la distribution directe dominait le marché en 2025 avec 53,6 % des revenus, les fabricants fournissant directement des composés aromatiques aux grandes entreprises agroalimentaires et de soins personnels, garantissant ainsi la qualité et la traçabilité.

Les canaux indirects devraient connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, grâce à l'expansion des places de marché en ligne, des distributeurs et des fournisseurs spécialisés auprès des petites et moyennes entreprises.

Quelle région détient la plus grande part du marché des produits chimiques aromatiques ?

- L'Arabie saoudite a dominé le marché des composés aromatiques au Moyen-Orient et en Afrique en 2025, avec une part de marché de 34,5 %, grâce à l'adoption croissante de composés aromatiques de haute qualité dans les secteurs de la parfumerie, des soins personnels, de l'agroalimentaire et des boissons. La préférence grandissante des consommateurs pour les parfums haut de gamme, les arômes naturels et les produits à étiquetage clair stimule la croissance régionale.

- Les réglementations gouvernementales en matière de sécurité, d'étiquetage et de conformité environnementale incitent les fabricants à adopter un approvisionnement durable, des formulations écologiques et des procédés de production avancés. L'urbanisation rapide, l'expansion des réseaux de distribution et le développement industriel accélèrent encore davantage l'adoption de ces pratiques sur le marché dans toute la région.

- Les principaux acteurs tirent parti des avancées technologiques en matière d'extraction, d'encapsulation et de production de composés aromatiques de synthèse pour améliorer la constance, la qualité et l'attrait des produits pour les consommateurs, notamment dans les applications commerciales et de vente au détail haut de gamme.

Analyse du marché des produits chimiques aromatiques aux Émirats arabes unis

Les Émirats arabes unis devraient enregistrer le taux de croissance annuel composé le plus rapide, soit 9,8 %, entre 2026 et 2033, grâce à l'adoption de composés aromatiques naturels, durables et innovants dans les secteurs de la parfumerie, des soins personnels et de l'agroalimentaire. Les investissements dans les installations de production, les initiatives en matière de chimie verte et la fabrication d'ingrédients de haute qualité soutiennent la croissance du marché à long terme dans le pays.

Quelles sont les principales entreprises du marché des produits chimiques aromatiques ?

L'industrie des produits chimiques aromatiques est principalement dominée par des entreprises bien établies, notamment :

- Takasago International Corporation (Japon)

- BASF SE (Allemagne)

- DSM (Pays-Bas)

- Firmenich SA (Suisse)

- Symrise (Allemagne)

- Aromatiques orientaux (Inde)

- Bordas SA (France)

- Privi Speciality Chemicals Limited (Inde)

- Bell Flavors & Fragrances (États-Unis)

- Hindustan Mint & Agro Products Pvt. Ltd. (Inde)

- Treatt Plc (Royaume-Uni)

- Vigon International, Inc. (États-Unis)

- Cédarome (États-Unis)

- INOUE Perfume MFG. CO., LTD. (Japon)

- MANE (France)

- De Monchy Aromatics (Pays-Bas)

- Givaudan (Suisse)

- Société Kao (Japon)

Quels sont les développements récents sur le marché des produits chimiques aromatiques au Moyen-Orient et en Afrique ?

- En avril 2025, Eternis Fine Chemicals et ChainCraft BV ont conclu un partenariat stratégique majeur pour accélérer le développement de composés aromatiques biosourcés à faible empreinte carbone. Cette collaboration associe la gamme de produits innovants SensiCraft de ChainCraft, basée sur une technologie de fermentation végétale, à l'expertise de fabrication et à la chaîne d'approvisionnement performante d'Eternis, établissant ainsi une nouvelle référence en matière de durabilité dans l'industrie du parfum. Ce partenariat devrait favoriser l'adoption d'ingrédients de parfumerie écologiques de nouvelle génération.

- En avril 2025, BASF a lancé des ingrédients aromatiques à empreinte carbone réduite, permettant ainsi à ses clients d'atteindre leurs objectifs de développement durable et de réduire l'impact environnemental de leurs formulations. Cette initiative renforce l'engagement de BASF en faveur de produits chimiques aromatiques performants et respectueux de l'environnement.

- En octobre 2024, Privi a démarré la production de sa nouvelle usine d'ingrédients pour parfums de Mahad, une coentreprise entre Givaudan (49 %) et Privi (51 %). L'usine est conçue pour produire une large gamme de parfums améliorés, et prévoit d'accroître sa capacité de production au cours des prochaines années, afin de soutenir le développement du marché des composés aromatiques de haute qualité.

- En mai 2023, Firmenich International SA a finalisé sa fusion avec DSM, donnant naissance à DSM-Firmenich, un partenaire d'innovation de premier plan dans les domaines de la nutrition, de la santé, de la beauté et des arômes. Ce regroupement renforce les capacités mondiales et favorise le développement durable des ingrédients.

- En avril 2023, Bedoukian Research Inc. s'est associée à Inscripta pour développer et commercialiser des ingrédients naturels de qualité supérieure, plus constants et à impact environnemental réduit. Grâce à la plateforme GenoScaler d'Inscripta, qui optimise les souches microbiennes, BRI peut désormais produire efficacement de grands volumes d'ingrédients écologiques, renforçant ainsi les pratiques durables dans le secteur des composés aromatiques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.