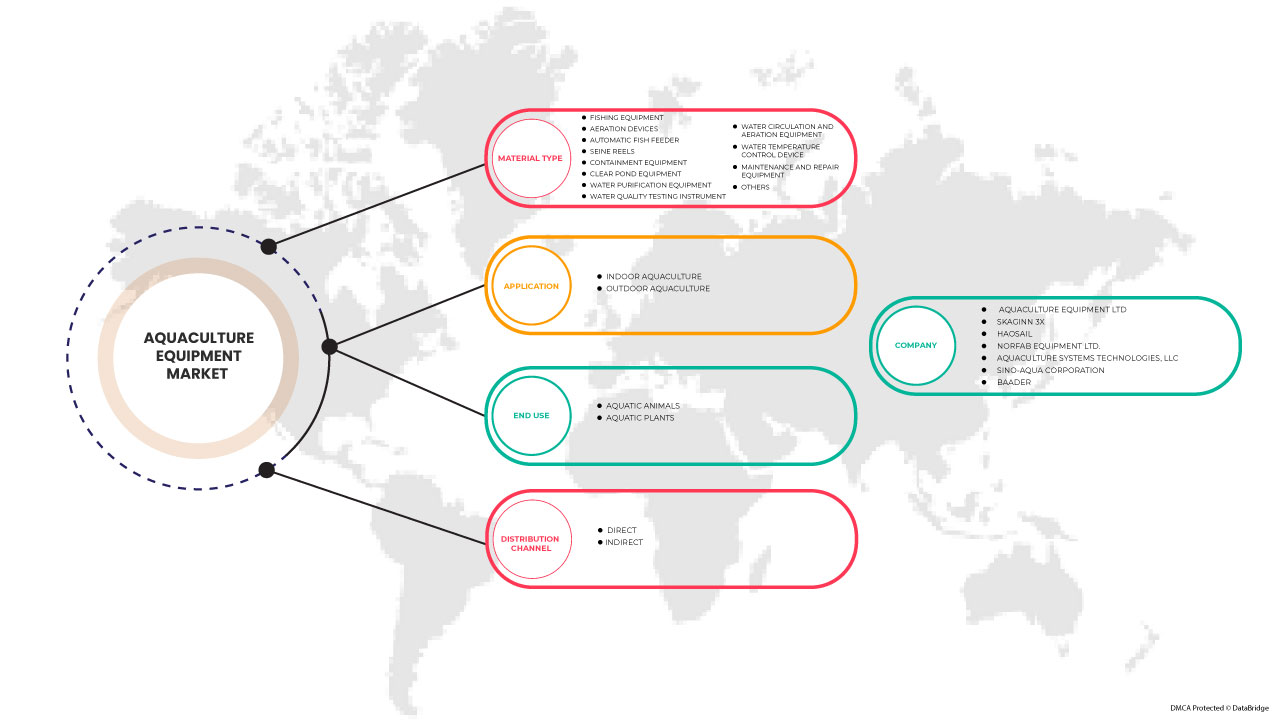

Marché des équipements d'aquaculture au Moyen-Orient et en Afrique, par type (équipement de purification de l'eau, dispositifs d'aération, équipement de circulation et d'aération de l'eau, distributeur automatique de poissons, équipement de pêche, équipement de confinement, moulinets de senne, équipement d'entretien et de réparation, dispositif de contrôle de la température de l'eau, instrument de test de la qualité de l'eau, équipement pour étang clair et autres), application (aquaculture en plein air, aquaculture en intérieur), utilisation finale (animaux aquatiques, plantes aquatiques), canal de distribution (direct, indirect), tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des équipements d'aquaculture au Moyen-Orient et en Afrique

L'augmentation du commerce des produits de la mer et la demande croissante d'équipements aquacoles devraient stimuler la demande sur le marché du Moyen-Orient et de l'Afrique. Cependant, les préoccupations concernant la sécurité alimentaire dans l'aquaculture et la propagation de maladies et de parasites mortels pourraient encore limiter la croissance du marché.

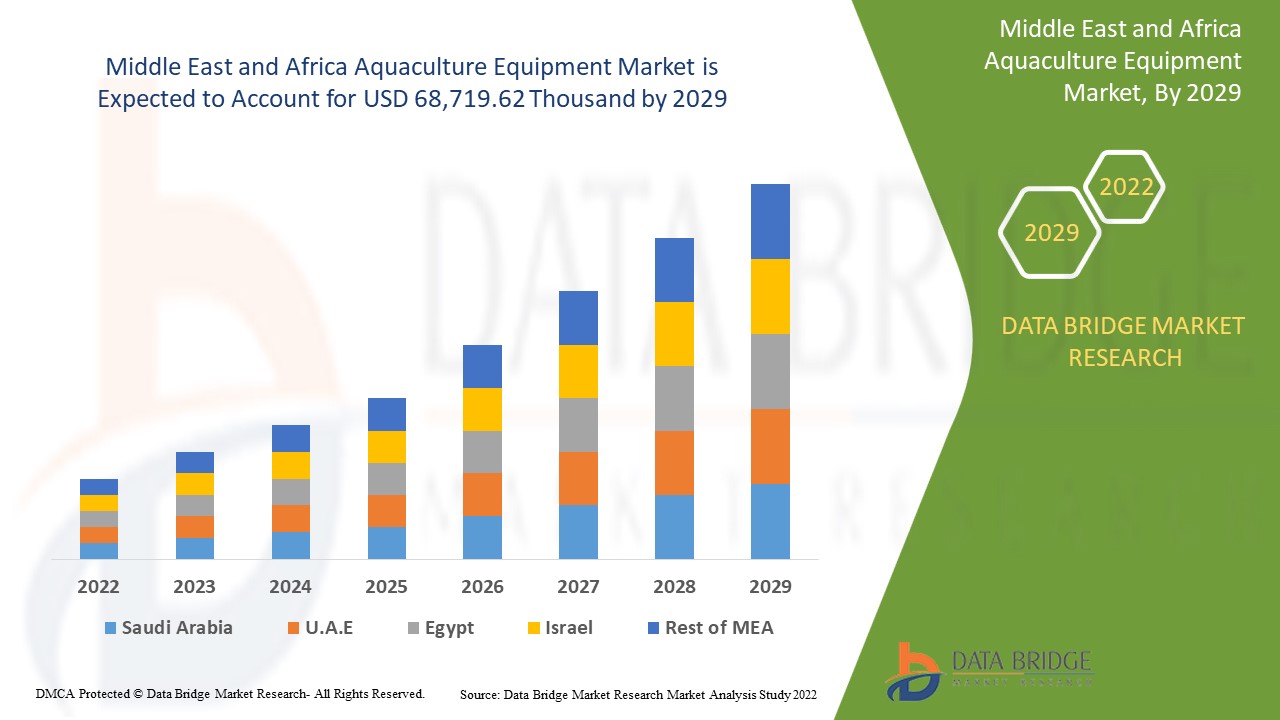

Data Bridge Market Research analyse que le marché des équipements d'aquaculture au Moyen-Orient et en Afrique devrait atteindre la valeur de 68 719,62 milliers USD d'ici 2029, à un TCAC de 3,4 % au cours de la période de prévision. Les équipements de purification de l'eau représentent le segment de type le plus important sur le marché des équipements d'aquaculture au Moyen-Orient et en Afrique. Le rapport sur le marché des équipements d'aquaculture au Moyen-Orient et en Afrique couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par type (équipement de purification de l'eau, dispositifs d'aération, équipement de circulation et d'aération de l'eau, distributeur automatique de nourriture pour poissons, équipement de pêche, équipement de confinement, moulinets de senne, équipement d'entretien et de réparation, dispositif de contrôle de la température de l'eau, instrument de test de la qualité de l'eau, équipement pour étang transparent et autres), application (aquaculture en plein air, aquaculture en intérieur), utilisation finale (animaux aquatiques, plantes aquatiques), canal de distribution (direct, indirect). |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, Oman, Qatar, Koweït, reste du Moyen-Orient et de l’Afrique. |

|

Acteurs du marché couverts |

Haosail, Norfab Equipment Ltd., Sino-Aqua Corporation, BAADER, FAIVRE Ets et Sino-Aqua Corporation entre autres.

|

Définition du marché

L'aquaculture est l'élevage de plantes aquatiques, d'animaux aquatiques et d'autres organismes aquatiques. Il s'agit de l'élevage, de l'élevage et de la récolte d'organismes dans des milieux aquatiques. Par conséquent, l'équipement d'aquaculture fait référence à l'équipement utilisé dans le processus d'élevage aquacole. Au cours de l'année, l'industrie de l'aquaculture a pris un élan significatif dans son taux de croissance et a montré un grand potentiel de croissance. En conséquence, de plus en plus d'acteurs entrent dans ce domaine.

Dynamique du marché des équipements d'aquaculture au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

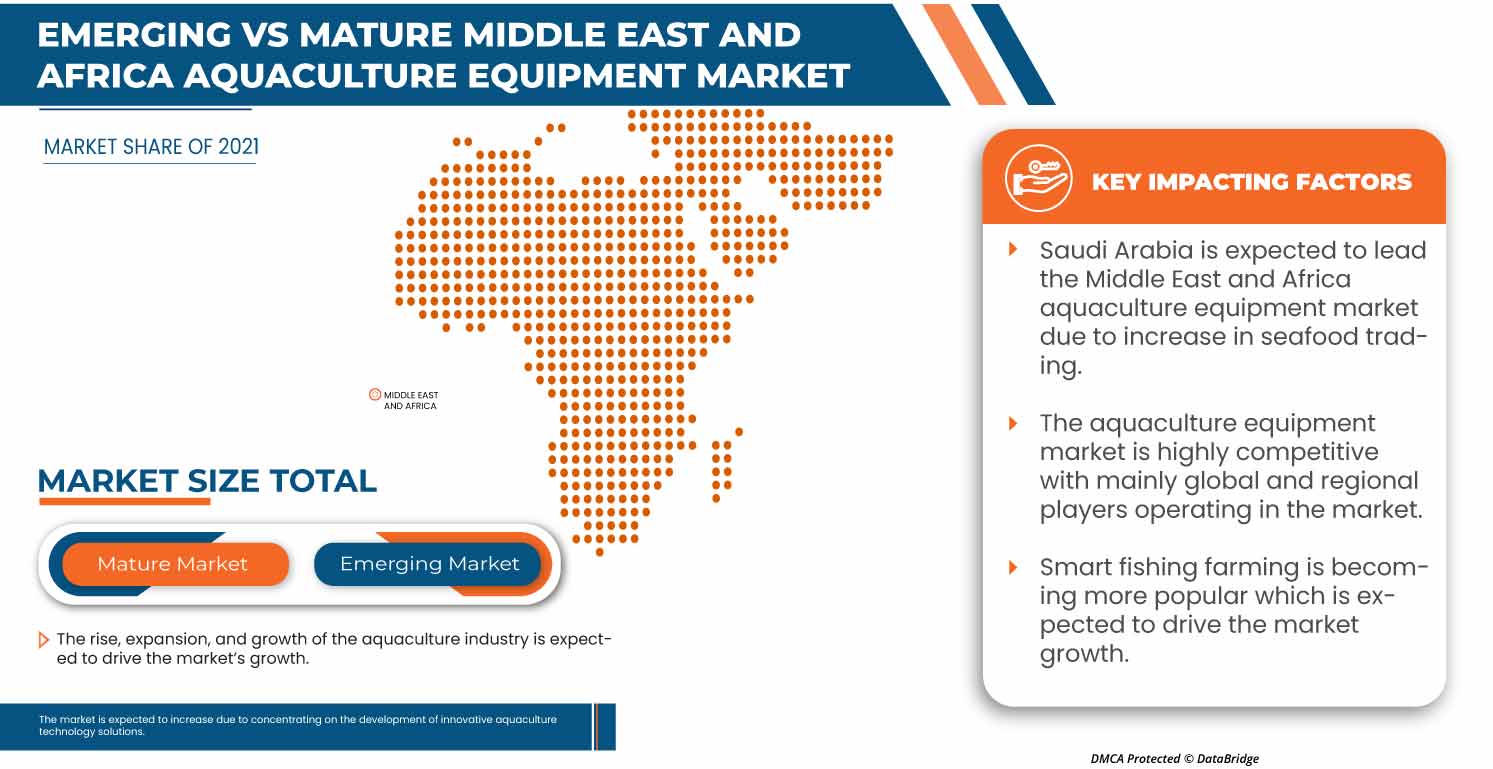

L’essor, l’expansion et la croissance de l’industrie de l’aquaculture

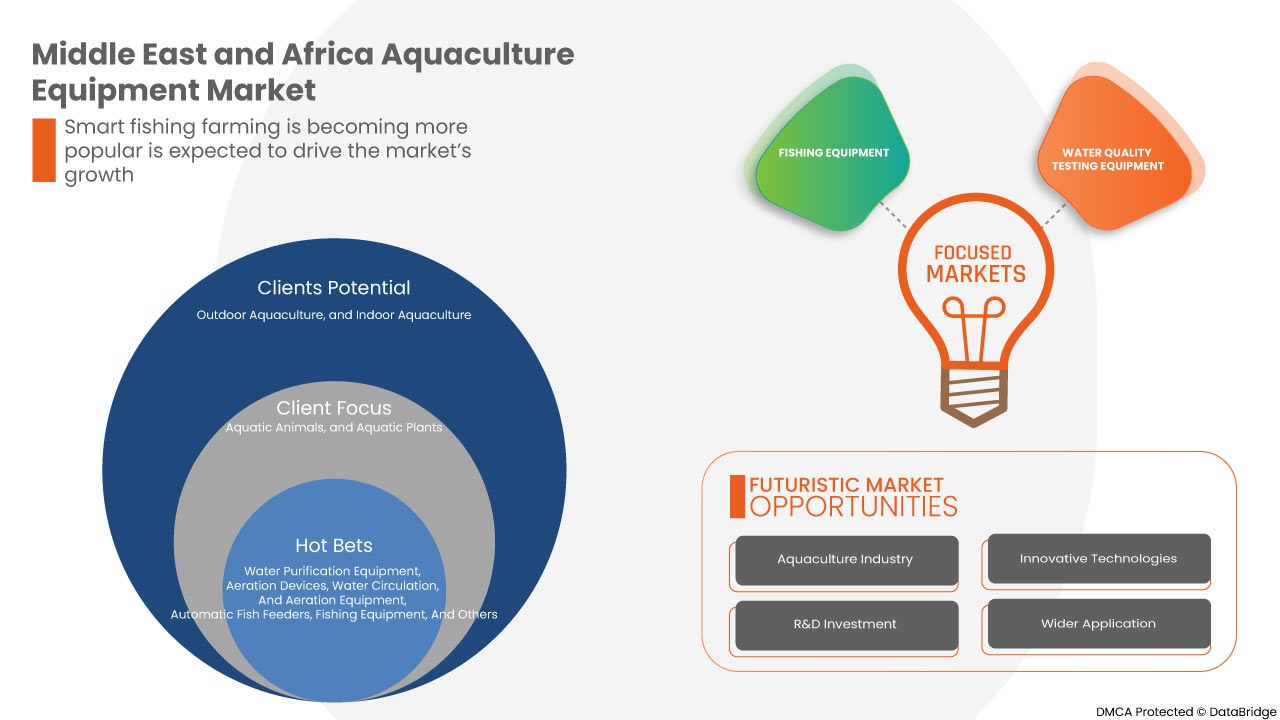

L'aquaculture, ou l'élevage de poissons et de fruits de mer, est le secteur qui connaît la croissance la plus rapide dans le secteur de l'alimentation animale. La croissance de l'aquaculture a été alimentée par l'expansion du commerce au Moyen-Orient et en Afrique, la diminution de la disponibilité des poissons sauvages, les prix compétitifs des produits, la hausse des revenus et l'urbanisation, qui contribuent tous à la hausse de la consommation de fruits de mer par habitant dans le monde. En outre, les développements techniques créatifs, les investissements dans la R&D et la coopération avec les principaux acteurs de l'industrie permettront d'étendre et d'élargir la portée mondiale de l'industrie de l'aquaculture. Cela augmentera également la croissance des équipements d'aquaculture tels que les aérateurs, les pompes, les mangeoires, les filtres et autres qui dépendent des industries de l'aquaculture. Ainsi, en raison de la croissance de l'activité aquacole, la demande d'équipements d'aquaculture augmentera. Dans un avenir prévisible, cela devrait stimuler le marché des équipements d'aquaculture au Moyen-Orient et en Afrique.

-

Augmentation du commerce des produits de la mer

Grâce à des décennies de rendements accrus dans le secteur de la pêche et de l'aquaculture et à une demande croissante au Moyen-Orient et en Afrique, les produits de la mer sont aujourd'hui l'une des catégories alimentaires les plus commercialisées au monde. Le taux de croissance le plus rapide du commerce des produits aquatiques révèle qu'une proportion plus élevée des volumes d'échanges de produits de la mer comprend diverses espèces. Les pays en développement jouent un rôle majeur dans les exportations de produits de la mer, car les pays développés dépendent de plus en plus des pays en développement pour les importations d'espèces à forte valeur ajoutée. Ainsi, l'augmentation du commerce des produits de la mer accroît la croissance des industries de l'aquaculture, ce qui entraînera une augmentation de la demande d'équipements d'aquaculture. Cela devrait stimuler le marché des équipements d'aquaculture dans un avenir proche.

Opportunités

-

Des mesures gouvernementales renforcées pour stimuler l'aquaculture

La pêche et l'aquaculture fournissent chaque jour de la nourriture à des centaines de millions de personnes dans le monde. Elles contribuent à la production alimentaire et aident les animaux en voie de disparition en remplissant diverses fonctions. Les initiatives des gouvernements, telles que les réglementations et les programmes qui favorisent l'expansion du secteur de l'aquaculture, ne servent qu'à préparer le terrain pour le développement futur, parallèlement aux solutions technologiques. Cette expansion créera des opportunités supplémentaires pour les acteurs importants de l'industrie et les agriculteurs dans un avenir proche, faisant de l'aquaculture un secteur à surveiller. En conséquence, les mesures gouvernementales croissantes visant à stimuler l'aquaculture devraient offrir une opportunité de croissance du marché des équipements d'aquaculture.

Contraintes/Défis

- Préoccupations concernant la sécurité alimentaire dans l’aquaculture

Les données épidémiologiques sur les infections d’origine alimentaire montrent que les poissons pêchés en haute mer sont généralement des aliments sûrs et sains s’ils sont réfrigérés rapidement et manipulés de manière appropriée. Les produits de l’aquaculture, en revanche, ont été liés à certains problèmes de sécurité alimentaire, car le risque de contamination par des agents chimiques et biologiques est plus élevé dans les habitats d’eau douce et côtiers que dans les océans ouverts. En conséquence, le manque d’infrastructures et les restrictions gouvernementales constantes peuvent limiter l’expansion du marché. La production aquacole deviendra certainement un moyen de plus en plus important de produire des produits aquatiques destinés à la consommation humaine, mais le risque lié à la sécurité alimentaire concernant l’aquaculture sera durement touché dans l’économie. Cette préoccupation de sécurité alimentaire dans l’aquaculture entravera la croissance de l’industrie aquacole et, par conséquent, limitera la croissance du marché des équipements d’aquaculture.

- Les difficultés de la surpêche

Alors que 90 % des stocks de poissons sauvages du monde sont entièrement pêchés, surexploités ou épuisés, l'aquaculture est en pleine expansion. Pourtant, la question de savoir si l'aquaculture est une solution à la surpêche reste controversée. La surpêche est en hausse, car les fruits de mer sont devenus l'une des denrées alimentaires les plus commercialisées de la planète. Lorsque les populations de poissons sont surexploitées, les écosystèmes marins fragiles dont dépend notre planète sont perturbés. L'aquaculture, qui couvre à la fois les espèces d'eau salée et d'eau douce, est la technique d'élevage de poissons dans des conditions contrôlées. C'est l'industrie de production alimentaire qui connaît la croissance la plus rapide au monde, représentant environ 44 % de tout le poisson consommé, mais pour maintenir son expansion, elle dépend principalement de la capture de poissons sauvages. Ainsi, les difficultés liées à la surpêche peuvent constituer un défi pour l'industrie de l'aquaculture, ce qui peut mettre à mal la croissance du marché des équipements d'aquaculture.

Impact post-COVID-19 sur le marché des équipements d'aquaculture au Moyen-Orient et en Afrique

La COVID-19 a eu un impact sur plusieurs secteurs de la fabrication au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. En raison du confinement, le marché a connu une baisse des ventes en raison de la fermeture des points de vente au détail et des restrictions d'accès des clients au cours des dernières années.

Cependant, la croissance du marché après la pandémie est due à une plus grande sensibilisation des consommateurs à la santé et à une demande croissante de fruits de mer sains et nutritifs. Cela a conduit à une popularité croissante de l'aquaculture auprès des gens en raison des divers avantages pour la santé et de la popularité croissante des aliments riches en protéines. Les principaux acteurs du marché prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de R&D pour améliorer leurs offres. Ils augmentent leur part de marché en explorant différents canaux de vente au détail et en s'étendant dans de nouvelles régions.

Développements récents

- En août 2022, SKAGINN 3X a signé un contrat avec BlueWild, Norvège, pour fournir une usine complète de transformation du poisson à bord du nouveau chalutier innovant de l'entreprise. Le chalutier est conçu pour offrir durabilité, qualité et efficacité à tous les niveaux. Il s'agit d'un accord historique pour l'organisation.

- En avril 2022, Cflow AS a participé au Nor-Shipping du 4 au 7 avril. Nor-Shipping est au cœur des océans. C'est là que les industries maritimes et océaniques se rencontrent tous les deux ans - un centre naturel pour les principaux décideurs du monde entier pour se connecter, collaborer et conclure des accords afin de débloquer de nouvelles opportunités commerciales.

Portée du marché des équipements d'aquaculture au Moyen-Orient et en Afrique

Le marché des équipements d'aquaculture du Moyen-Orient et de l'Afrique est segmenté en fonction du type, de l'application, de l'utilisation finale et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Équipement de purification de l'eau

- Dispositifs d'aération

- Équipement de circulation et d'aération de l'eau

- Distributeur automatique de nourriture pour poissons

- Matériel de pêche

- Équipement de confinement

- Moulinets à senne

- Équipement d'entretien et de réparation

- Dispositif de contrôle de la température de l'eau

- Instrument de test de la qualité de l'eau

- Équipement pour bassin transparent

- Autres

En fonction du type, le marché des équipements d'aquaculture du Moyen-Orient et de l'Afrique est segmenté en équipements de purification de l'eau, dispositifs d'aération, équipements de circulation et d'aération de l'eau, distributeur automatique de poissons, équipement de pêche, équipement de confinement, moulinets de senne, équipement d'entretien et de réparation, dispositif de contrôle de la température de l'eau, instrument de test de la qualité de l'eau, équipement d'étang clair et autres.

Application

- Aquaculture en plein air

- Aquaculture intérieure

En fonction des applications, le marché des équipements d’aquaculture du Moyen-Orient et de l’Afrique est segmenté en aquaculture de plein air et aquaculture d’intérieur.

Utilisation finale

- Animaux aquatiques

- Plantes aquatiques

En fonction de l’utilisation finale, le marché des équipements d’aquaculture du Moyen-Orient et de l’Afrique est segmenté en animaux aquatiques et plantes aquatiques.

Canal de distribution

- Direct

- Indirect

En fonction du canal de distribution, le marché des équipements d’aquaculture du Moyen-Orient et de l’Afrique est segmenté en direct et indirect.

Analyse/perspectives régionales du marché des équipements d'aquaculture au Moyen-Orient et en Afrique

Le marché des équipements d’aquaculture au Moyen-Orient et en Afrique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, application, utilisation finale et canal de distribution, comme référencé ci-dessus.

Le marché des équipements d’aquaculture du Moyen-Orient et de l’Afrique couvre des pays tels que l’Arabie saoudite, les Émirats arabes unis, l’Afrique du Sud, l’Égypte, Israël, Oman, le Qatar, le Koweït et le reste du Moyen-Orient et de l’Afrique.

L'Arabie saoudite devrait dominer le marché des équipements d'aquaculture au Moyen-Orient et en Afrique en raison du développement et de l'expansion du secteur de l'aquaculture dans le pays. L'Arabie saoudite détient la part de marché et le TCAC les plus élevés, suivie des Émirats arabes unis et de l'Afrique du Sud. L'Égypte et Israël sont deux autres pays où la demande augmente en raison de l'évolution des habitudes de consommation alimentaire et de l'expansion des chaînes de vente au détail de fruits de mer.

La section pays du rapport sur le marché des équipements d'aquaculture au Moyen-Orient et en Afrique fournit également des facteurs d'impact individuels sur le marché et des changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des indicateurs importants utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et de l'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des équipements d'aquaculture au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des équipements d'aquaculture au Moyen-Orient et en Afrique fournit des détails sur le concurrent. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises qui se concentrent sur le marché des équipements d'aquaculture au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché des équipements d'aquaculture au Moyen-Orient et en Afrique sont Haosail, Norfab Equipment Ltd., Sino-Aqua Corporation, BAADER, FAIVRE Ets et Sino-Aqua Corporation, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.1.1 COMPARATIVE BRAND ANALYSIS

4.1.2 PRODUCT VS BRAND OVERVIEW

4.2 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

4.2.1 ECONOMIC FACTOR

4.2.2 FUNCTIONAL FACTOR

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 INDUSTRY TRENDS FOR NORTHERN EUROPE

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 OVERVIEW

4.5.2 NUMBER OF NEW PRODUCT LAUNCHES

4.5.3 MEETING CONSUMER REQUIREMENT

4.6 IMPACT OF ECONOMIC SLOWDOWN

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7.1 TECHNOLOGICAL ADVANCMENTS IN NORTHERN EUROPE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 VALUE CHAIN ANALYSIS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE, EXPANSION, AND GROWTH OF THE AQUACULTURE INDUSTRY

6.1.2 INCREASE IN SEAFOOD TRADING

6.1.3 DEMAND FOR AQUAPONICS IS INCREASING

6.1.4 SMART FISH FARMING IS BECOMING MORE POPULAR

6.2 RESTRAINTS

6.2.1 CONCERNS ABOUT FOOD SAFETY IN AQUACULTURE

6.2.2 THE SPREAD OF DEADLY DISEASES AND PARASITES

6.3 OPPORTUNITIES

6.3.1 RISING GOVERNMENT MEASURES TO BOOST AQUACULTURE

6.3.2 CONCENTRATING ON THE DEVELOPMENT OF INNOVATIVE TECHNOLOGY SOLUTIONS

6.3.3 ADEQUATE AND AFFORDABLE CREDIT AVAILABILITY AND FINANCING INSTRUMENTS

6.4 CHALLENGES

6.4.1 OVERFISHING DIFFICULTIES

6.4.2 AQUACULTURE'S ENVIRONMENTAL DIFFICULTIES AND CONCERNS

7 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 WATER PURIFICATION EQUIPMENT

7.2.1 WATER PUMPS AND FILTERS

7.2.2 AERATORS

7.2.3 FEEDERS

7.2.4 PROTEIN SKIMMER

7.3 AERATION DEVICES

7.4 WATER CIRCULATION AND AERATION EQUIPMENT

7.5 AUTOMATIC FISH FEEDER

7.6 FISHING EQUIPMENT

7.7 CONTAINMENT EQUIPMENT

7.8 SEINE REELS

7.9 MAINTENANCE AND REPAIR EQUIPMENT

7.9.1 DIGGING TOOLS

7.9.2 LEVELLING TOOLS

7.9.3 DESILTING EQUIPMENT

7.9.4 OTHERS

7.1 WATER TEMPERATURE CONTROL DEVICES

7.11 WATER QUALITY TESTING INSTRUMENT

7.12 CLEAR POND EQUIPMENT

7.13 OTHERS

8 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 OUTDOOR AQUACULTURE

8.2.1 BRACKISH WATER

8.2.2 MARINE

8.3 INDOOR AQUACULTURE

9 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY END USE

9.1 OVERVIEW

9.2 AQUATIC ANIMALS

9.2.1 FISH

9.2.2 MOLLUSKS

9.2.3 CRUSTACEAN

9.2.4 OTHERS

9.3 AQUATIC PLANTS

9.3.1 SUBMERGED (SEAWEED)

9.3.2 FLOATING (ALGAE)

9.3.3 EMERGED

10 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

11 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST & AFRICA

11.1.1 SAUDI ARABIA

11.1.2 UNITED ARAB EMIRATES

11.1.3 SOUTH AFRICA

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 OMAN

11.1.7 QATAR

11.1.8 KUWAIT

11.1.9 REST OF MIDDLE EAST & AFRICA

12 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12.1.1 NEW PRODUCTION FACILITY

12.1.2 EVENT

12.1.3 NEW PRODUCT LAUNCH

12.1.4 COLLABORATION

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BAADER

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATES

14.2 SKAGINN 3X

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PORTFOLIO

14.2.4 RECENT UPDATES

14.3 AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 NANRONG SHANGHAI CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 CFLOW

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT UPDATES

14.6 AQUACULTURE EQUIPMENT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 AQUACULTURE SYSTEMS TECHNOLOGIES, LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

14.8 AQUANEERING INCORPORATED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 DURA-TECH

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATES

14.1 FAIVRE ETS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATES

14.11 FISHFARMFEEDER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATES

14.12 FREA SOLUTIONS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HAOSAIL

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 HUNG STAR ENTERPRISE CORP.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 NORFAB EQUIPMENT LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 PIONEER GROUP

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATES

14.17 RASTAQUACULTURE

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 SAGAR AQUACULTURE PVT LTD

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 SINO-AQUA CORPORATION

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATES

14.2 SRR AQUA SUPPLIERS LLP

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF AIR PUMPS, AIR OR OTHER GAS COMPRESSORS AND VENTILATING OR RECYCLING HOODS, AND OTHER AQUACULTURE EQUIPMENT; HS CODE – 841480 (USD THOUSAND)

TABLE 2 EXPORT DATA OF AIR PUMPS, AIR OR OTHER GAS COMPRESSORS AND VENTILATING OR RECYCLING HOODS AND OTHER AQUACULTURE EQUIPMENT; HS CODE – 841480 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 6 MIDDLE EAST & AFRICA WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA AERATION DEVICES IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA WATER CIRCULATION AND AERATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA AUTOMATIC FISH FEEDER IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA FISHING EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA CONTAINMENT EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA SEINE REELS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA MAINTENANCE AND REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA MAINTENANCE AND REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA WATER TEMPERATURE CONTROL DEVICES IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA WATER QUALITY TESTING INSTRUMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA CLEAR POND EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA OTHERS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA INDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA DIRECT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA INDIRECT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 34 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 36 MIDDLE EAST & AFRICA WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 44 SAUDI ARABIA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 SAUDI ARABIA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 46 SAUDI ARABIA WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 SAUDI ARABIA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 SAUDI ARABIA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 SAUDI ARABIA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 50 SAUDI ARABIA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 51 SAUDI ARABIA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 52 SAUDI ARABIA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 53 SAUDI ARABIA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 54 UNITED ARAB EMIRATES AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 UNITED ARAB EMIRATES AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 UNITED ARAB EMIRATES WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 UNITED ARAB EMIRATES MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 UNITED ARAB EMIRATES AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 UNITED ARAB EMIRATES OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 UNITED ARAB EMIRATES AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 61 UNITED ARAB EMIRATES AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 62 UNITED ARAB EMIRATES AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 63 UNITED ARAB EMIRATES AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 64 SOUTH AFRICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 SOUTH AFRICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 66 SOUTH AFRICA WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 SOUTH AFRICA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 SOUTH AFRICA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 SOUTH AFRICA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 SOUTH AFRICA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 71 SOUTH AFRICA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 72 SOUTH AFRICA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 73 SOUTH AFRICA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 74 EGYPT AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 EGYPT AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 76 EGYPT WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 EGYPT MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 EGYPT AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 EGYPT OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 EGYPT AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 81 EGYPT AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 82 EGYPT AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 83 EGYPT AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 84 ISRAEL AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 ISRAEL AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 86 ISRAEL WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 ISRAEL MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 ISRAEL AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 ISRAEL OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 ISRAEL AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 91 ISRAEL AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 92 ISRAEL AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 93 ISRAEL AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 94 OMAN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 OMAN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 96 OMAN WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 OMAN MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 OMAN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 99 OMAN OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 100 OMAN AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 101 OMAN AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 102 OMAN AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 103 OMAN AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 104 QATAR AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 QATAR AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 106 QATAR WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 QATAR MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 QATAR AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 QATAR OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 110 QATAR AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 111 QATAR AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 112 QATAR AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 113 QATAR AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 114 KUWAIT AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 KUWAIT AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 116 KUWAIT WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 KUWAIT MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 KUWAIT AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 KUWAIT OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 120 KUWAIT AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 121 KUWAIT AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 122 KUWAIT AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 123 KUWAIT AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 124 REST OF MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 REST OF MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET

FIGURE 2 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: MARKET END USE COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: SEGMENTATION

FIGURE 14 RISING, EXPANSION, AND GROWTH OF THE AQUACULTURE INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET GROWTH IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 15 WATER PURIFICATION EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS- MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET

FIGURE 18 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: BY TYPE, 2021

FIGURE 19 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: BY APPLICATION, 2021

FIGURE 20 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: BY END-USE, 2021

FIGURE 21 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: BY TYPE (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA AQUACULTURE EQUIPMENT MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.