Middle East And Africa Application Container Market

Taille du marché en milliards USD

TCAC :

%

| 2024 –2030 | |

| Dollars américains 2,713,904.63 | |

|

|

|

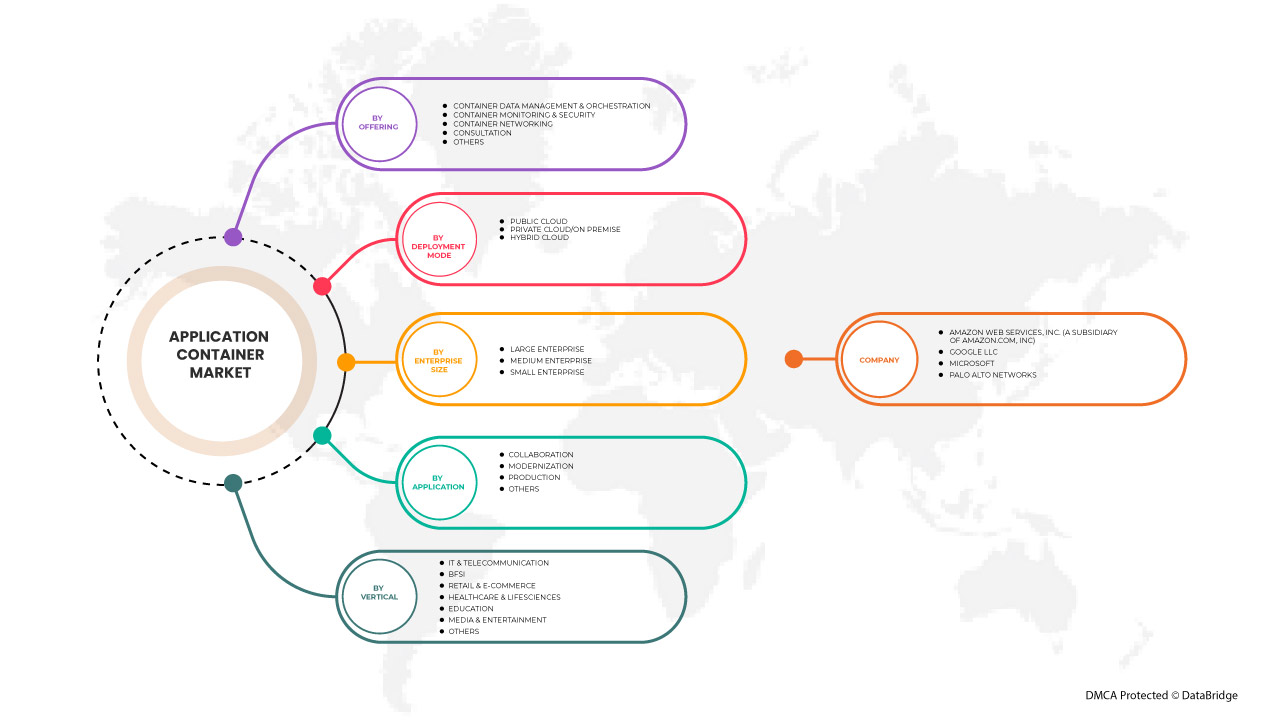

>Marché des conteneurs d'applications au Moyen-Orient et en Afrique, par offre (gestion et orchestration des données des conteneurs, surveillance et sécurité des conteneurs, mise en réseau des conteneurs, consultation et autres), mode de déploiement (cloud public, cloud privé/sur site et cloud hybride ), taille de l'entreprise (petite entreprise, moyenne entreprise et grande entreprise), application (collaboration, modernisation, production et autres), vertical (informatique et télécommunications, BFSI, vente au détail et commerce électronique, soins de santé et sciences de la vie, éducation, médias et divertissement, et autres) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des conteneurs d'applications au Moyen-Orient et en Afrique

Un conteneur d'application est un composant CDB facultatif créé par l'utilisateur qui stocke des données et des métadonnées pour un ou plusieurs back-ends d'application. Un CDB comprend zéro ou plusieurs conteneurs d'application. Dans un conteneur d'application, une application est l'ensemble nommé et versionné de données et de métadonnées communes stockées dans la racine de l'application. Dans ce contexte d'un conteneur d'application, le terme « application » signifie « définition d'application principale ». Par exemple, l'application peut inclure des définitions de tables, de vues et de packages.

Selon les analyses de Data Bridge Market Research, le marché des conteneurs d'applications devrait atteindre la valeur de 2 713 904,63 milliers de dollars d'ici 2030, à un TCAC de 30,2 % au cours de la période de prévision. « Gestion et orchestration des données des conteneurs » représente le segment d'offre le plus important sur le marché des conteneurs d'applications en raison des développements rapides des voies technologiques pour commercialiser l'utilisation des conteneurs d'applications. Le rapport sur le marché des conteneurs d'applications couvre également l'analyse des prix, l'analyse des brevets et les avancées technologiques en profondeur.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en milliers d'unités, prix en dollars américains |

|

Segments couverts |

Par offre (gestion et orchestration des données des conteneurs, surveillance et sécurité des conteneurs, mise en réseau des conteneurs, consultation et autres), mode de déploiement (cloud public, cloud privé/sur site et cloud hybride), taille de l'entreprise (petite entreprise, moyenne entreprise et grande entreprise), application (collaboration, modernisation, production et autres), vertical (informatique et télécommunications, BFSI , vente au détail et commerce électronique, soins de santé et sciences de la vie, éducation, médias et divertissement, et autres). |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Israël, Égypte et reste du Moyen-Orient et de l’Afrique. |

|

Acteurs du marché couverts |

IBM Corporation, Microsoft, Amazon Web Services, Inc. (a subsidiary of Amazon.com, Inc), Oracle, D2iQ, Inc., Alibaba Group Holding Limited, Google LLC, Mirantis, Inc., Portainer, Joyent, Broadcom, Docker Inc., VMware, Inc., Cisco Systems, Inc., Puppet, Inc., Telefonaktiebolaget LM Ericsson, Atos SE, Virtuozzo, SUSE, Palo Alto Networks, Hewlett Packard Enterprise Development LP, WEAVEWORKS and Portworx among others. |

Market Definition

Application container is a stand-alone, all-in-one package for software applications. The software application offers dependency for different business operations, including application binaries and hardware components. The containerized application includes various features such as data management, monitoring, networking, and consultation. These features can be deployed through various deployment modes for collaboration or the modernization of business operations. This software enables end-user organizations to enhance their core competencies such as security, network connectivity, customer relationships, and end-to-end services monitoring, optimizing resource utilization and saving operating costs.

Application Container Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rise in Volume of Organizational Data

Organizational data describe organizations' central characteristics, including internal processes, structures, corporate actions, employee statistics, and many others. Nowadays, documentation of existing information of an organization is in huge demand. This documentation is not done through traditional methods but in a modern way that is stored in soft copy rather than on paper. The documentation of each organization's process has been common in recent years because it is associated with many benefits for different cases, such as hiring strategy, market intelligence, industry overviews, and many others. Organizational data can also support and inform monitoring efforts by building news feeds of important events and helping spot trends within companies.

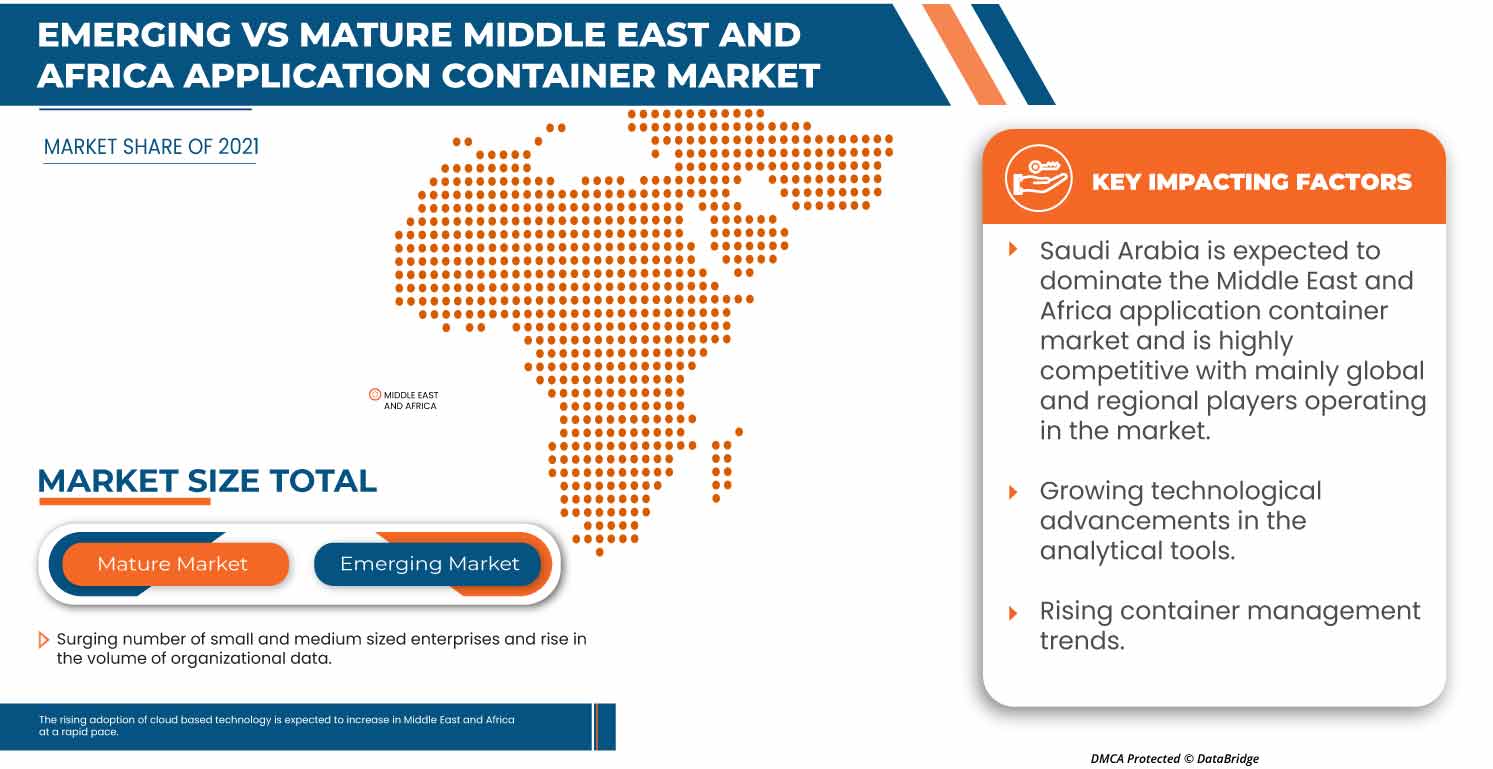

- Surging Number of Small and Medium-Sized Enterprises

Small and Medium-Sized Enterprises (SMEs) are independent firms with fewer employees and play a major role in economic growth. Moreover, SMEs contribute 60% to 70% of employment in most countries. As larger firms are downsizing and outsourcing, the function has increased revenue growth for SMEs.

Furthermore, these firms have traditionally focused on domestic markets, but others are going Middle East and Africa. In the Middle East and Africa such SMEs are mostly due to inter-firm linkages and clusters. However, networking allows SMEs to combine with greater organizations, but the data and business operations need to be digital and integrated.

Opportunities

- Rise in the Adoption of Cloud-Based Technology

Digitalization is one of the boosting factors for cloud deployment of business operations, which has a wide range of benefits and requires proper maintenance and additional equipment and infrastructure to manage the working system properly. Thus, this process includes managing collected data, saving, processing, analyzing, sharing, and implementing many more operations. However, digitalization simplifies and automates the core working operations of the business but creates a need for advanced technology and infrastructure.

Thus, digitalization is supported through cloud-based application deployment. This has created a huge demand for data management worldwide and a need for data integration and privacy policy. As a result, adopting digitalization gained a prominent role in accelerating the country's economic growth and could empower current and future generations.

- Rise in the Container Management Trends

Container management is associated with various benefits and is operated through IT admins in organizations that can start, stop, and restart the working of the containers. Thus, it includes orchestration and schedulers, security tools, storage, virtual network management systems, and monitoring.

The container management system automates orchestration, log management, monitoring, networking, load balancing, testing, and secrets management. Such benefits will support the organizations' work process as such advantages boost the usage of container management solutions.

Restraint/challenge

- Lack of Skilled Workforce and Technological Expertise

Moreover, the experts must understand the working process and integration technology with business processes. The process improvement through the application container involves data management, inputting the data, and analyzing based on a pre-scheduled set of formulas developed in the software based on users and project requirements.

The major problem associated with the application container is the proper data management by the user or the professional assigned to manage the application-related data. Managing the software by the user requires a set of skills that helps handle the software's related data properly. The application containerization involves strategic management and planning, critical technical skills that the users need to develop and excel in achieving the organizational goals.

Post-COVID-19 Impact on Application Container Market

COVID-19 significantly impacted the application container market as almost every country has opted for the shutdown for every production facility except those producing essential goods. The government has taken some strict actions, such as shutting down the production and sale of non-essential goods, blocking international trade, and many more to prevent the spread of COVID-19. The only business dealing with this pandemic is the essential services allowed to open and run the processes.

The growth of the Middle East and Africa application container market is increasing as automation in the automotive sector has increased the demand for various application container-related products. These services are widely used in data monitoring and storing data on cloud platforms. Hence, growing technological advancements in analytical tools over the forecast period. However, factors such as high chances of emergency for application container sprawl restrain the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Service providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the application container. The companies will bring advanced and accurate controllers to the market.

Recent Developments

- In November 2022, Datadog reported on the rise in Kubernetes container management system adoption. Today, nearly half of container organizations run Kubernetes to deploy and manage containers in a growing ecosystem.

- In March 2022, ABSL found the boom in digitalization and modern technologies, increasing the need for data analytics. Data analytics is often used for technological decisions, finding new market strategies, and growth opportunities for the business.

Middle East and Africa Application Container Market Scope

The Middle East and Africa application container market is segmented based on offering, deployment mode, enterprise size, application, and vertical. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Container Data Management & Orchestration

- Container Monitoring & Security

- Container Networking

- Consultation

- Others

On the basis of offering, the Middle East and Africa application container market is segmented into container data management & orchestration, container monitoring & security, container networking, consultation, and others.

Deployment Mode

- Public Cloud

- Private Cloud/On Premise

- Hybrid Cloud

On the basis of deployment mode, the Middle East and Africa application container market has been segmented into public cloud, private cloud/on premise, and hybrid cloud.

Enterprise Size

- Large Enterprise

- Medium Enterprise

- Small Enterprise

On the basis of enterprise size, the Middle East and Africa application container market has been segmented into large enterprise, medium enterprise, and small enterprise.

Application

- Collaboration

- Modernization

- Production

- Others

On the basis of application, the Middle East and Africa application container market has been segmented into collaboration, modernization, production, and others.

Vertical

- IT & Telecommunication

- BFSI

- Retail & E-commerce,

- Healthcare & Lifesciences

- Education

- Media & Entertainment

- Others

Sur la base de la verticale, le marché des conteneurs d'applications du Moyen-Orient et de l'Afrique a été segmenté en informatique et télécommunications, BFSI, vente au détail et commerce électronique, soins de santé et sciences de la vie, éducation, médias et divertissement, et autres.

Analyse/perspectives régionales du marché des conteneurs d'applications

Le marché des conteneurs d’applications est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, offre, mode de déploiement, taille de l’entreprise, application et vertical, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des conteneurs d’applications au Moyen-Orient et en Afrique sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, Israël, l’Égypte et le reste du Moyen-Orient et de l’Afrique.

L’Arabie saoudite domine le Moyen-Orient et l’Afrique en raison de ses investissements financiers en constante augmentation dans la technologie des conteneurs.

La section pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances technologiques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des conteneurs d'applications

Le paysage concurrentiel du marché des conteneurs d'applications fournit des détails sur un concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives de marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises qui se concentrent sur le marché des conteneurs d'applications.

Certains des principaux acteurs opérant sur le marché des conteneurs d'applications sont IBM Corporation, Microsoft, Amazon Web Services, Inc. (une filiale d'Amazon.com, Inc), Oracle, D2iQ, Inc., Alibaba Group Holding Limited, Google LLC, Mirantis, Inc., Portainer, Joyent, Broadcom, Docker Inc., VMware, Inc., Cisco Systems, Inc., Puppet, Inc., Telefonaktiebolaget LM Ericsson, Atos SE, Virtuozzo, SUSE, Palo Alto Networks, Hewlett Packard Enterprise Development LP, WEAVEWORKS et Portworx, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET APPLICATION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP WINNING STRATEGIES BY COMPANIES

4.2 PORTER’S FIVE FORCES ANALYSIS

4.3 ECOSYSTEM MARKET MAP

4.4 TECHNOLOGICAL TRENDS

4.5 VALUE CHAIN ANALYSIS

4.6 BRAND ANALYSIS

5 REGIONAL SUMMARY

5.1 SUMMARY WRITE-UP (NORTH AMERICA)

5.2 SUMMARY WRITE-UP (EUROPE)

5.3 SUMMARY WRITE-UP (ASIA-PACIFIC)

5.4 SUMMARY WRITE-UP (MIDDLE EAST AND AFRICA)

5.5 SUMMARY WRITE-UP (SOUTH AMERICA)

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN VOLUME OF ORGANIZATIONAL DATA

6.1.2 SURGING NUMBER OF SMALL AND MEDIUM-SIZED ENTERPRISES

6.1.3 GROWING TECHNOLOGICAL ADVANCEMENTS IN ANALYTICAL TOOLS

6.1.4 RISE IN NEED FOR BUSINESS AGILITY AND COORDINATION

6.2 RESTRAINTS

6.2.1 HIGH CHANCES OF EMERGENCY FOR APPLICATION CONTAINER SPRAWL

6.2.2 UNRELIABLE INFRASTRUCTURE IN DEVELOPING COUNTRIES

6.3 OPPORTUNITIES

6.3.1 RISING ADOPTION OF CLOUD-BASED TECHNOLOGY

6.3.2 RISING CONTAINER MANAGEMENT TRENDS

6.3.3 UPSURGE IN THE ADOPTION OF SOFTWARE ALGORITHMS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED WORKFORCE AND TECHNOLOGICAL EXPERTISE

6.4.2 LACK OF SECURITY CONCERNS

7 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY OFFERING

7.1 OVERVIEW

7.2 CONTAINER DATA MANAGEMENT & ORCHESTRATION

7.3 CONTAINER MONITORING & SECURITY

7.4 CONTAINER NETWORKING

7.5 CONSULTATION

7.6 OTHERS

8 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 PUBLIC CLOUD

8.3 PRIVATE CLOUD/ON PREMISE

8.4 HYBRID CLOUD

9 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISE

9.3 MEDIUM ENTERPRISE

9.4 SMALL ENTERPRISE

10 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 COLLABORATION

10.3 MODERNIZATION

10.4 PRODUCTION

10.5 OTHERS

11 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 IT & TELECOMMUNICATION

11.2.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.2.2 CONTAINER MONITORING & SECURITY

11.2.3 CONTAINER NETWORKING

11.2.4 CONSULTATION

11.2.5 OTHERS

11.3 BFSI

11.3.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.3.2 CONTAINER MONITORING & SECURITY

11.3.3 CONTAINER NETWORKING

11.3.4 CONSULTATION

11.3.5 OTHERS

11.4 RETAIL & E-COMMERCE

11.4.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.4.2 CONTAINER MONITORING & SECURITY

11.4.3 CONTAINER NETWORKING

11.4.4 CONSULTATION

11.4.5 OTHERS

11.5 HEALTHCARE & LIFESCIENCES

11.5.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.5.2 CONTAINER MONITORING & SECURITY

11.5.3 CONTAINER NETWORKING

11.5.4 CONSULTATION

11.5.5 OTHERS

11.6 EDUCATION

11.6.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.6.2 CONTAINER MONITORING & SECURITY

11.6.3 CONTAINER NETWORKING

11.6.4 CONSULTATION

11.6.5 OTHERS

11.7 MEDIA & ENTERTAINMENT

11.7.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.7.2 CONTAINER MONITORING & SECURITY

11.7.3 CONTAINER NETWORKING

11.7.4 CONSULTATION

11.7.5 OTHERS

11.8 OTHERS

11.8.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.8.2 CONTAINER MONITORING & SECURITY

11.8.3 CONTAINER NETWORKING

11.8.4 CONSULTATION

11.8.5 OTHERS

12 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 U.A.E.

12.1.3 EGYPT

12.1.4 SOUTH AFRICA

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 AMAZON WEB SERVICES, INC. (A SUBSIDIARY OF AMAZON.COM, INC.)

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SERVICE PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 GOOGLE LLC (A SUBSIDIARY OF ALPHABET INC.)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 MICROSOFT

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SERVICE PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 PALO ALTO NETWORKS.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SUSE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SERVICE PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ALIBABA GROUP HOLDING LIMITED

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 SERVICE PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ATOS SE

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 SERVICE PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 BROADCOM

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 SERVICE PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 CISCO SYSTEMS, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 SERVICE PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 D2IQ, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 SERVICE PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 DOCKER INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 SERVICE PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 IBM CORPORATION

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 SERVICE PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 JOYENT (ACQUIRED BY SAMSUNG)

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 MIRANTIS, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 ORACLE

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 SERVICE PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 PORTAINER

15.17.1 COMPANY SNAPSHOT

15.17.2 SERVICE PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 PORTWORX

15.18.1 COMPANY SNAPSHOT

15.18.2 SERVICE PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 PUPPET, INC. (ACQUIRED BY PREFORCE)

15.19.1 COMPANY SNAPSHOT

15.19.2 SERVICE PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TELEFONAKTIEBOLAGET LM ERICSSON

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 SERVICE PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

15.21 VIRTUOZZO

15.21.1 COMPANY SNAPSHOT

15.21.2 SERVICE PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 VMWARE, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 SERVICE PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 WEAVEWORKS

15.23.1 COMPANY SNAPSHOT

15.23.2 SERVICE PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 THE GIVEN TOP 5 COMPANIES' BRAND ANALYSIS ARE

TABLE 2 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA CONTAINER DATA MANAGEMENT & ORCHESTRATION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA CONTAINER MONITORING & SECURITY IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA CONTAINER NETWORKING IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA CONSULTATION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA OTHERS IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA PUBLIC CLOUD IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA PRIVATE CLOUD/ON PREMISE IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA HYBRID CLOUD IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA LARGE ENTERPRISE IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA MEDIUM ENTERPRISE IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA SMALL ENTERPRISE IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA COLLABORATION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA MODERNIZATION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA PRODUCTION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA BFSI IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA BFSI IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA EDUCATION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA EDUCATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA OTHERS IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA OTHERS IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA APPLICATION CONTAINER MARKET, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA BFSI IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA EDUCATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA OTHERS IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 49 SAUDI ARABIA APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 SAUDI ARABIA APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD THOUSAND)

TABLE 51 SAUDI ARABIA APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2021-2030 (USD THOUSAND)

TABLE 52 SAUDI ARABIA APPLICATION CONTAINER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 53 SAUDI ARABIA APPLICATION CONTAINER MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 54 SAUDI ARABIA IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 55 SAUDI ARABIA BFSI IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 56 SAUDI ARABIA RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 57 SAUDI ARABIA HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 58 SAUDI ARABIA EDUCATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 59 SAUDI ARABIA MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 60 SAUDI ARABIA OTHERS IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 61 U.A.E APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 62 U.A.E APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD THOUSAND)

TABLE 63 U.A.E APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2021-2030 (USD THOUSAND)

TABLE 64 U.A.E APPLICATION CONTAINER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 65 U.A.E APPLICATION CONTAINER MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 66 U.A.E IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 67 U.A.E BFSI IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 68 U.A.E RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 69 U.A.E HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 70 U.A.E EDUCATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 71 U.A.E MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 72 U.A.E OTHERS IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 73 EGYPT APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 74 EGYPT APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD THOUSAND)

TABLE 75 EGYPT APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2021-2030 (USD THOUSAND)

TABLE 76 EGYPT APPLICATION CONTAINER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 77 EGYPT APPLICATION CONTAINER MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 78 EGYPT IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 79 EGYPT BFSI IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 80 EGYPT RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 81 EGYPT HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 82 EGYPT EDUCATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 83 EGYPT MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 84 EGYPT OTHERS IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 85 SOUTH AFRICA APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 86 SOUTH AFRICA APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD THOUSAND)

TABLE 87 SOUTH AFRICA APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2021-2030 (USD THOUSAND)

TABLE 88 SOUTH AFRICA APPLICATION CONTAINER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 89 SOUTH AFRICA APPLICATION CONTAINER MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 90 SOUTH AFRICA IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 91 SOUTH AFRICA BFSI IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 92 SOUTH AFRICA RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 93 SOUTH AFRICA HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 94 SOUTH AFRICA EDUCATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 95 SOUTH AFRICA MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 96 SOUTH AFRICA OTHERS IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 97 ISRAEL APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 98 ISRAEL APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD THOUSAND)

TABLE 99 ISRAEL APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2021-2030 (USD THOUSAND)

TABLE 100 ISRAEL APPLICATION CONTAINER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 101 ISRAEL APPLICATION CONTAINER MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 102 ISRAEL IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 103 ISRAEL BFSI IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 104 ISRAEL RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 105 ISRAEL HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 106 ISRAEL EDUCATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 107 ISRAEL MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 108 ISRAEL OTHERS IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 109 REST OF MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: OFFERING TIMELINE CURVE

FIGURE 11 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: SEGMENTATION

FIGURE 13 SURGING NUMBER OF SMALL AND MEDIUM-SIZED ENTERPRISES IS BOOSTING THE GROWTH OF THE MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 CONTAINER DATA MANAGEMENT & ORCHESTRATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 CONTAINER ECOSYSTEM MARKET MAP

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET

FIGURE 17 VOLUME OF DATA CULTURE IN ORGANIZATION ACROSS WORLDWIDE

FIGURE 18 REGISTERED MSME’S IN INDIA IN FY 2022

FIGURE 19 CHANGES IN VARIOUS AGILITY FACTORS FOR ORGANIZATION

FIGURE 20 RATE OF ADOPTION OF PUBLIC CLOUD FOR BUSINESS OPERATIONS

FIGURE 21 AI ADOPTION RATES AROUND THE GLOBE

FIGURE 22 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY OFFERING, 2022

FIGURE 23 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2022

FIGURE 24 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2022

FIGURE 25 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: BY APPLICATION, 2022

FIGURE 26 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: BY VERTICAL, 2022

FIGURE 27 MIDDLE EAST AND AFRICA APPLICATION CONTAINER MARKET: SNAPSHOT (2022)

FIGURE 28 MIDDLE EAST AND AFRICA APPLICATION CONTAINER MARKET: BY COUNTRY (2022)

FIGURE 29 MIDDLE EAST AND AFRICA APPLICATION CONTAINER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 30 MIDDLE EAST AND AFRICA APPLICATION CONTAINER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 31 MIDDLE EAST AND AFRICA APPLICATION CONTAINER MARKET: BY OFFERING (2023 - 2030)

FIGURE 32 MIDDLE EAST & AFRICA APPLICATION CONTAINER MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.