Middle East And Africa Alternative Proteins Market

Taille du marché en milliards USD

TCAC :

%

USD

1,034.02 Million

USD

2,710.20 Million

2021

2029

USD

1,034.02 Million

USD

2,710.20 Million

2021

2029

| 2022 –2029 | |

| USD 1,034.02 Million | |

| USD 2,710.20 Million | |

|

|

|

|

Marché des protéines alternatives au Moyen-Orient et en Afrique par catégorie (biologique et inorganique), type de produit (protéines alternatives, protéines d’insectes, mycoprotéines, viande cultivée et autres), forme (sèche et liquide), application (aliments et boissons, aliments pour animaux, produits pharmaceutiques, soins personnels et cosmétiques et autres), – Tendances et prévisions de l’industrie jusqu’en 2029

Analyse et taille du marché des protéines alternatives au Moyen-Orient et en Afrique

Les préférences alimentaires des consommateurs évoluent au Moyen-Orient et en Afrique, et la préférence pour la viande et les produits à base de viande est faible parmi les consommateurs du Moyen-Orient et d'Afrique. Le nombre croissant de consommateurs flexitariens ou végétaliens a créé de nombreuses opportunités pour les fabricants d'introduire et d'innover dans le segment des protéines alternatives. Les préoccupations en matière de santé, l'action climatique et la sensibilisation croissante aux questions éthiques dans l'élevage industriel sont autant de facteurs qui stimulent la demande de protéines alternatives . Les entreprises de protéines alternatives se développent rapidement aujourd'hui. Pour obtenir un avantage concurrentiel sur le marché, les nouveaux entrants utilisent des technologies disruptives telles que la biologie synthétique, le big data, l'IA, l'apprentissage automatique, la robotique et l'Internet des objets.

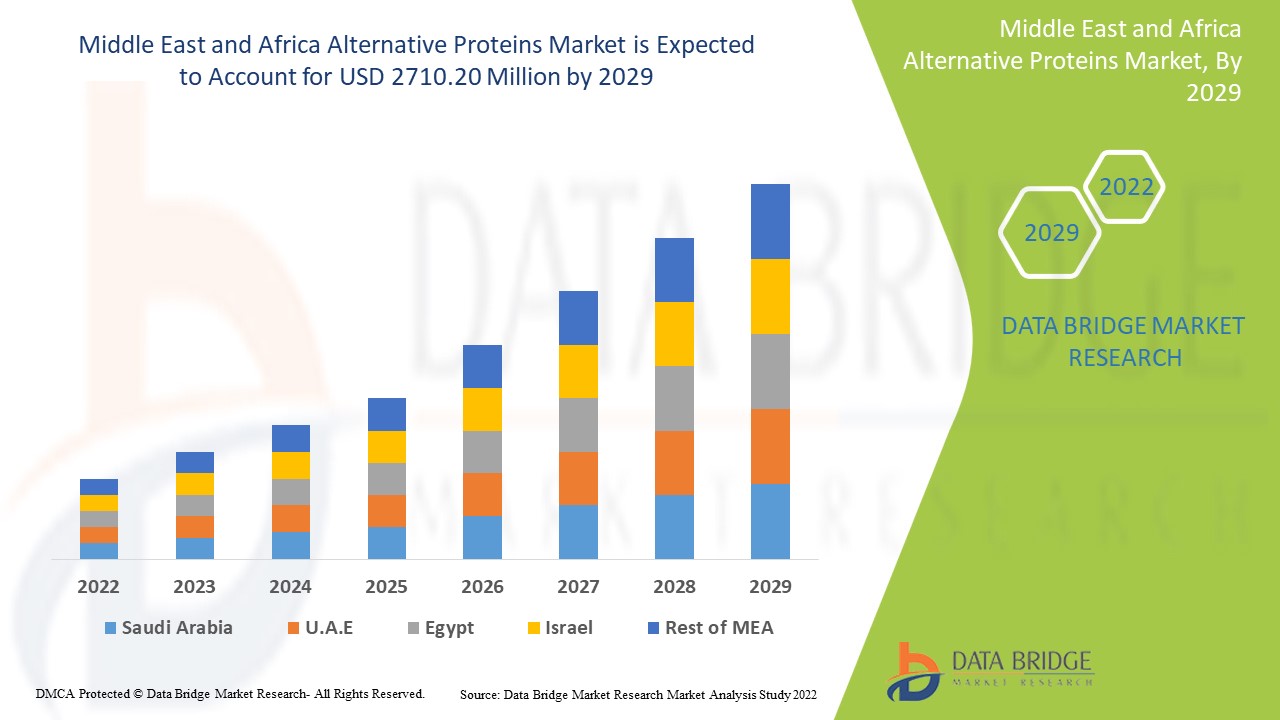

Data Bridge Market Research analyse que le marché des protéines alternatives était évalué à 1 034,02 millions USD en 2021 et devrait atteindre la valeur de 2 710,20 millions USD d'ici 2029, à un TCAC de 12,8 % au cours de la période de prévision 2022-2029.

Définition du marché

Les protéines dérivées des algues, des plantes et des insectes sont appelées protéines alternatives. Elles fournissent une quantité importante de protéines tout en nécessitant moins d'apports naturels que les sources de protéines traditionnelles telles que le poisson et la viande. Les protéines sont principalement responsables de la formation de tissus corporels maigres et de l'apport d'éléments nécessaires aux enzymes digestives.

Taille et segmentation du marché des protéines alternatives au Moyen-Orient et en Afrique

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Catégorie (biologique et inorganique), type de produit (protéines alternatives, protéines d'insectes, mycoprotéines, viande cultivée et autres), forme (sèche et liquide), application (aliments et boissons, aliments pour animaux, produits pharmaceutiques, soins personnels et cosmétiques et autres), |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Koweït et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Glanbia plc. (Irlande), Now Health Group, Inc. (États-Unis), Nutiva Inc (États-Unis), The Simply Good Food Co (États-Unis), Iovate Health Sciences International Inc. (Canada), MusclePharm Corporation (États-Unis), Kerry Group Plc (Irlande), CytoSport, Inc. (États-Unis), The Nature's Bounty Co. (États-Unis), Reliance Vitamin Company, Inc. (États-Unis), Herbalife Nutrition, Inc. (États-Unis), Danone SA (France), GNC Holdings, LLC. (États-Unis), Orgain Inc. (États-Unis), True Nutrition (États-Unis) |

|

Opportunités |

|

Dynamique du marché des protéines alternatives

Conducteurs

- L'augmentation des cas d'obésité et la sensibilisation croissante du public

La croissance du marché des protéines alternatives est favorisée par un procédé d’extrusion à haute teneur en humidité modifié et un nouveau procédé de recherche de composition. Les consommateurs qui ne consomment pas de produits laitiers, par exemple, se tournent vers les laits végétaux, qui ont connu une croissance significative ces dernières années. Cette gamme de produits innovants ou prêts à consommer sans compromis sur la texture et le goût stimule également la croissance du marché des protéines alternatives.

- Efforts constants des acteurs du marché pour une alternative éthique et durable aux produits d'origine animale

Les groupes de la société civile et les nouveaux acteurs du secteur alimentaire exercent une pression constante sur les entreprises de viande et de produits laitiers établies, afin de faire des produits à base de plantes une alternative éthique et durable aux produits d’origine animale. La tendance croissante des millennials à adopter des régimes flexitariens et sans viande indique un changement significatif dans les habitudes d’achat des générations précédentes. Des entreprises, des producteurs aux détaillants, investissent déjà dans ces opportunités. Certaines entreprises investissent dans d’autres entreprises qui produisent des alternatives pour se prémunir contre ou se préparer à une baisse de la demande de produits d’origine animale.

Opportunité

Le nombre croissant de centres de fitness et la participation accrue des femmes devraient alimenter la croissance du marché. Les protéines alternatives sont respectueuses de l'environnement. À mesure que les consommateurs prennent conscience des propriétés des protéines alternatives, ils adoptent également des produits respectueux de l'environnement et sans allergènes. L'augmentation de la demande de croissance sur le marché sans allergènes créera des opportunités de croissance au cours de la période de prévision.

Restrictions

La disponibilité de substituts à bas prix, la publicité négative et les effets secondaires entraveront la croissance du marché des compléments alimentaires à base de protéines alternatives au cours de la période de prévision. Les végétariens consomment des protéines alternatives, mais les allergies des consommateurs, telles que l'intolérance au lactose, constitueront un frein, ce qui compliquera encore davantage la croissance du marché des protéines alternatives vertes au cours de la période de prévision.

Ce rapport sur le marché des protéines alternatives fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des protéines alternatives, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché des protéines alternatives

La pandémie de COVID-19 a considérablement stimulé l'industrie des protéines alternatives. La pandémie a sensibilisé le public aux infections virales zoonotiques, dont le risque peut également être lié au bétail. En raison de l'abondance de macronutriments, de micronutriments et d'antioxydants dans les protéines alternatives, elles peuvent aider à réduire les effets des infections virales. En termes de fabrication et de distribution, cette industrie a connu une demande sans précédent de la part des fabricants et des consommateurs, en particulier pour certains produits tels que les substituts de viande et le lait végétal. La pandémie de COVID-19 a également donné lieu à certains modèles de bonnes pratiques pour l'industrie des protéines alternatives. Les gouvernements ont annoncé l'assouplissement de certaines exigences du droit de la concurrence imposées aux protéines alternatives, principalement aux produits à base de protéines végétales et aux protéines d'insectes.

Développement récent

- Protix (Pays-Bas) a levé 50 millions d'euros de fonds propres pour son expansion internationale en février 2022.

- Calysta (États-Unis) a levé 39 millions de dollars d'investissement en septembre 2021 pour soutenir la montée en puissance de la production de protéines FeedKind de Calysta au Moyen-Orient et en Afrique.

- Entomo Farms (Canada) a levé 3,7 millions de dollars canadiens (C$) (2,9 millions USD) lors d'un tour de financement mené par des investisseurs asiatiques et canadiens en janvier 2021 pour soutenir la croissance et l'expansion de l'entreprise.

- MycoTechnology (US) a levé 120,69 millions USD lors d'un tour de financement de série D auprès d'investisseurs jusqu'en juin 2020.

- En 2020, Mitsubishi Corporation, Blue Horizon Ventures, Target Middle East and Africa, ArcTern Ventures et Rubio Impact Ventures investiront 75 millions de dollars dans Mosa Meat, une entreprise néerlandaise de technologie alimentaire.

- Cricket Lab, un fabricant de protéines d'insectes basé en Thaïlande, a levé 2,1 millions de dollars de financement en 2020.

Portée du marché des protéines alternatives au Moyen-Orient et en Afrique

Le marché des protéines alternatives est segmenté en fonction de la catégorie, du type de produit, de la forme et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Catégorie

- Organique

- Inorganique

Type de produit

- Protéines alternatives

- Protéine d'insecte

- Mycoprotéine

- Viande cultivée

- Autres

Formulaire

- Sec

- Liquide

Application

- Alimentation et boissons

- Alimentation animale

- Médicaments

- Soins personnels

- Produits de beauté

- Autres

Analyse/perspectives régionales du marché des protéines alternatives

Le marché des protéines alternatives est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, catégorie, type de produit, forme et application comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des protéines alternatives sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, le Koweït et le reste du Moyen-Orient et de l’Afrique.

L'Afrique du Sud domine la sensibilisation et la demande pour les protéines alternatives est élevée dans différents secteurs tels que l'alimentation et les boissons, les aliments pour animaux et divers autres. Les gens consomment beaucoup de viande d'origine végétale et évitent la consommation de viande, ce qui explique la forte croissance du marché.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des protéines alternatives

Le paysage concurrentiel du marché des protéines alternatives fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives de marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des protéines alternatives.

Certains des principaux acteurs opérant sur le marché des protéines alternatives sont :

- Glanbia plc. (Irlande)

- Now Health Group, Inc. (États-Unis)

- Nutiva Inc (États-Unis)

- La Simply Good Food Co (États-Unis)

- Iovate Health Sciences International Inc. (Canada)

- MusclePharm Corporation (États-Unis)

- Kerry Group Plc (Irlande)

- CytoSport, Inc. (États-Unis)

- La société Nature's Bounty Co. (États-Unis)

- Reliance Vitamin Company, Inc. (États-Unis)

- Herbalife Nutrition, Inc. (États-Unis)

- Danone SA (France)

- GNC Holdings, LLC. (États-Unis)

- Orgain Inc. (États-Unis)

- True Nutrition (États-Unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CATEGORY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGULATORY FRAMEWORK AND GOVERNMENT INITIATIVES: MIDDLE EAST AND AFRICA ALTERNATIVE PROTEIN MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING NUMBER OF HEALTH CONSCIOUS CONSUMERS

6.1.2 EASY AVAILABILITY OF EDIBLE INSECTS

6.1.3 RISING AWARENESS ABOUT THE BENEFITS OF ALTERNATIVE PROTEINS

6.1.4 RISE IN POPULATION WITH LACTOSE INTOLERANT CONSUMERS

6.1.5 GROWTH IN INVESTMENTS & COLLABORATIONS IN ALTERNATIVE PROTEIN BUSINESS

6.1.6 INCREASING USAGE OF ALTERNATIVE PROTEINS IN VARIOUS APPLICATIONS

6.2 RESTRAINTS

6.2.1 LACK OF AUTOMATED FARMING METHODS

6.2.2 STRINGENT REGULATIONS ON ALTERNATIVE PROTEINS

6.2.3 HIGHER COSTS OF PROTEINS

6.3 OPPORTUNITIES

6.3.1 LESS ENVIRONMENTAL IMPACTS OF ALTERNATIVE PROTEINS

6.3.2 NEW PRODUCT INNOVATION RELATED TO ALTERNATIVE PROTEINS

6.3.3 RISE IN DEMAND FOR ORGANIC INGREDIENTS

6.3.4 NEW AND EMERGING SOURCES OF PROTEINS

6.4 CHALLENGES

6.4.1 MICROBIAL AND TOXICITY RISKS ASSOCIATED WITH INSECTS

6.4.2 USE OF GMO PRODUCTS

6.4.3 ECONOMIC CONSTRAINTS RELATED TO PROCESSING CAPACITY

7 COVID-19 IMPACT ON ALTERNATIVE PROTEIN MARKET IN FOOD & BEVERAGE INDUSTRY

7.1 INITIATIVES

7.2 CONCLUSION

8 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINSMARKET, BY CATEGORY

8.1 OVERVIEW

8.2 INORGANIC

8.3 ORGANIC

9 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 PLANT PROTEIN

9.2.1 SOY

9.2.2 WHEAT

9.2.3 PEA

9.2.4 RICE

9.2.5 OAT

9.2.6 POTATO

9.2.7 CANOLA

9.2.8 OTHERS

9.3 INSECT PROTEIN

9.3.1 CRICKETS

9.3.2 BLACK SOLDIER FLIES

9.3.3 MEALWORMS

9.3.4 BEETLES

9.3.5 CATERPILLARS

9.3.6 BEES, WASPS, ANTS

9.3.7 GRASSHOPPERS

9.3.8 OTHERS

9.4 MYCOPROTEIN

9.5 CULTURED MEAT

9.5.1 POULTRY

9.5.2 BEEF

9.5.3 PORK

9.5.4 FISH

9.5.5 OTHERS

9.6 OTHERS

10 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY FORM

10.1 OVERVIEW

10.2 LIQUID

10.3 DRY

11 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD & BEVERAGES

11.2.1 BAKERY & CONFECTIONERY PRODUCTS

11.2.1.1 BREADS

11.2.1.2 CHOCOLATE

11.2.1.3 CANDIES

11.2.1.4 CAKES, MUFFINS & DOUGHNUTS

11.2.1.5 COOKIES, CRACKERS

11.2.1.6 PIE CRUSTS & PIZZA DOUGH

11.2.1.7 CHEWING GUMS

11.2.1.8 OTHERS

11.2.2 BAKERY & CONFECTIONERY PRODUCTS, BY PRODUCT TYPE

11.2.2.1 PLANT PROTEIN

11.2.2.2 INSECT PROTEIN

11.2.2.3 MYCOPROTEIN

11.2.2.4 CULTURED MEAT

11.2.2.5 OTHERS

11.2.3 CONVENIENCE FOOD

11.2.3.1 READY TO EAT MEALS

11.2.3.2 DRESSINGS & CONDIMENTS

11.2.3.3 SOUPS & SAUCES

11.2.3.4 NOODLES & PASTA

11.2.3.5 SNACKS & EXTRUDED SNACKS

11.2.3.6 OTHERS

11.2.4 CONVENIENCE FOOD, BY PRODUCT TYPE

11.2.4.1 PLANT PROTEIN

11.2.4.2 INSECT PROTEIN

11.2.4.3 MYCOPROTEIN

11.2.4.4 OTHERS

11.2.5 DAIRY PRODUCTS

11.2.5.1 DAIRY DESSERTS

11.2.5.1.1 ICE CREAM

11.2.5.1.2 PUDDING

11.2.5.1.3 SORBET

11.2.5.1.4 OTHERS

11.2.5.2 YOGURTS

11.2.5.3 CREAMER

11.2.5.4 CHEESE

11.2.5.5 TOFU

11.2.5.6 OTHERS

11.2.6 DAIRY PRODUCTS, BY PRODUCT TYPE

11.2.6.1 PLANT PROTEIN

11.2.6.2 INSECT PROTEIN

11.2.6.3 MYCOPROTEIN

11.2.6.4 OTHERS

11.2.7 DAIRY ALTERNATIVES

11.2.7.1 MILK

11.2.7.2 YOGURTS

11.2.7.3 CREAMER

11.2.7.4 OTHERS

11.2.8 DAIRY ALTERNATIVES, BY PRODUCT TYPE

11.2.8.1 PLANT PROTEIN

11.2.8.2 INSECT PROTEIN

11.2.8.3 MYCOPROTEIN

11.2.8.4 OTHERS

11.2.9 MEAT & POULTRY PRODUCTS

11.2.9.1 SAUSAGE

11.2.9.2 BURGER PATTY

11.2.9.3 NUGGETS

11.2.9.4 MINCE

11.2.9.5 SALAMI

11.2.9.6 OTHERS

11.2.10 MEAT & POULTRY PRODUCTS, BY PRODUCT TYPE

11.2.10.1 PLANT PROTEIN

11.2.10.2 INSECT PROTEIN

11.2.10.3 MYCOPROTEIN

11.2.10.4 OTHERS

11.2.11 NUTRITIONAL BARS

11.2.11.1 PLANT PROTEIN

11.2.11.2 INSECT PROTEIN

11.2.11.3 MYCOPROTEIN

11.2.11.4 OTHERS

11.2.12 INFANT FORMULA

11.2.12.1 PLANT PROTEIN

11.2.12.2 INSECT PROTEIN

11.2.12.3 MYCOPROTEIN

11.2.12.4 OTHERS

11.2.13 BEVERAGES

11.2.13.1 DAIRY DRINKS

11.2.13.2 FRUIT JUICES

11.2.13.3 NUTRITIONAL DRINKS

11.2.13.4 FRUIT SMOOTHIE

11.2.13.5 SPORTS AND ENERGY DRINKS

11.2.13.6 OTHERS

11.2.14 BEVERAGES, BY PRODUCT TYPE

11.2.14.1 PLANT PROTEIN

11.2.14.2 INSECT PROTEIN

11.2.14.3 MYCOPROTEIN

11.2.14.4 OTHERS

11.3 ANIMAL FEED

11.3.1 RUMINANT

11.3.1.1 DAIRY CATTLE

11.3.1.2 BEEF CATTLE

11.3.1.3 CALVES

11.3.1.4 OTHERS

11.3.2 SWINE

11.3.2.1 SOW

11.3.2.2 GROWER

11.3.2.3 STARTER

11.3.3 POULTRY

11.3.3.1 BROILERS

11.3.3.2 LAYERS

11.3.3.3 BREEDERS

11.3.4 AQUATIC ANIMAL

11.3.4.1 FISH FEED

11.3.4.2 MOLLUSK FEED

11.3.4.3 CRUSTACEANS

11.3.5 PETS

11.3.5.1 DOGS

11.3.5.2 CATS

11.3.5.3 RABBITS

11.3.5.4 OTHERS

11.4 ANIMAL FEED, BY PRODUCT TYPE

11.4.1 PLANT PROTEIN

11.4.2 INSECT PROTEIN

11.4.3 MYCOPROTEIN

11.4.4 OTHERS

11.5 PERSONAL CARE & COSMETICS

11.5.1 SKIN CARE

11.5.2 HAIR CARE

11.5.3 ORAL CARE

11.5.4 OTHERS

11.6 PERSONAL CARE & COSMETICS, BY PRODUCT TYPE

11.6.1 PLANT PROTEIN

11.6.2 INSECT PROTEIN

11.6.3 MYCOPROTEIN

11.6.4 OTHERS

11.7 PHARMACEUTICALS

11.7.1 PLANT PROTEIN

11.7.2 INSECT PROTEIN

11.7.3 MYCOPROTEIN

11.7.4 OTHERS

11.8 OTHERS

12 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 UAE

12.1.4 KUWAIT

12.1.5 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CARGILL, INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 DUPONT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 BENEO

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 ADM

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 AXIOM FOODS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 CHS INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 COMPANY SHARE ANALYSIS

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENT

15.7 ENTERRA FEED CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 ENTOMOFARMS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 FARBEST BRANDS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 GLANBIA PLC

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 SOLUTION PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 INGREDION INCORPORATED

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 AGRIPROTEIN

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 KERRY GROUP PLC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 NOW FOODS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 PARABEL

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 PROTIFARM

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PROTIX B.V.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 ROQUETTE FRÈRES

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 TIANJIN NORLAND BIOTECH CO.,LTD

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 ŸNSECT

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 FAT, PROTEIN, AND LACTOSE CONTENT IN MILK OF DIFFERENT MAMMALIAN SPECIES

TABLE 2 LACTOSE INTOLERANCE IN DIFFERENT HUMAN GROUPS

TABLE 3 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINSMARKET, BY CATEGORY, 2018– 2027 (USD THOUSAND )

TABLE 4 MIDDLE EAST AND AFRICA INORGANIC IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 5 MIDDLE EAST AND AFRICA ORGANIC IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 6 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY PRDUCT TYPE, 2018-2027 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA ALTERNATIVE PLANT PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA ALTERNATIVE PLANT PROTEINS MARKET, BY PRDUCT TYPE, 2018-2027 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA ALTERNATIVE INSECT PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA ALTERNATIVE INSECT PROTEINS MARKET, BY PRDUCT TYPE, 2018-2027 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA MYCOPROTEIN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA CULTURED MEAT ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CULTURED MEAT ALTERNATIVE PROTEINS MARKET, BY PRDUCT TYPE, 2018-2027 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA OTHERS ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY FORM, 2018-2027 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA LIQUID IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA DRY IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 18 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET , BY GRADE, 2018– 2027 (USD THOUSANDS )

TABLE 19 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 20 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 21 MIDDLE EAST AND AFRICA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 22 MIDDLE EAST AND AFRICA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 23 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 24 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 25 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 26 MIDDLE EAST AND AFRICA DAIRY DESSERTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 27 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 28 MIDDLE EAST AND AFRICA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 29 MIDDLE EAST AND AFRICA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 30 MIDDLE EAST AND AFRICA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 31 MIDDLE EAST AND AFRICA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 32 MIDDLE EAST AND AFRICA NUTRITIONAL BARS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 33 MIDDLE EAST AND AFRICA INFANT FORMULA IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 34 MIDDLE EAST AND AFRICA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 35 MIDDLE EAST AND AFRICA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 36 MIDDLE EAST AND AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 37 MIDDLE EAST AND AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 38 MIDDLE EAST AND AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 39 MIDDLE EAST AND AFRICA SWINE IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 40 MIDDLE EAST AND AFRICA POULTRY IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 41 MIDDLE EAST AND AFRICA AQUATIC ANIMAL IN ALTERNATIVE PROTEINS, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 42 MIDDLE EAST AND AFRICA PETS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 43 MIDDLE EAST AND AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 44 MIDDLE EAST AND AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 45 MIDDLE EAST AND AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS))

TABLE 46 MIDDLE EAST AND AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 47 MIDDLE EAST AND AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 48 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 49 MIDDLE EAST AND AFRICA OTHERS IN ALTERNATIVE PROTEINS MARKET, BY REGION, 2018-2027 (USD THOUSANDS)

TABLE 50 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET, BY COUNTRY, 2018-2027 (USD THOUSANDS)

TABLE 51 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2018-2027 (USD THOUSANDS)

TABLE 52 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 53 MIDDLE EAST & AFRICA PLANT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 54 MIDDLE EAST & AFRICA INSECT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 55 MIDDLE EAST & AFRICA CULTURED MEAT IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 56 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET, BY FORM, 2018-2027 (USD THOUSANDS)

TABLE 57 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 58 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 59 MIDDLE EAST & AFRICA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 60 MIDDLE EAST & AFRICA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 61 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 62 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 63 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 64 MIDDLE EAST & AFRICA DAIRY DESSERTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 65 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 66 MIDDLE EAST & AFRICA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 67 MIDDLE EAST & AFRICA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 68 MIDDLE EAST & AFRICA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 69 MIDDLE EAST & AFRICA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 70 MIDDLE EAST & AFRICA NUTRITIONAL BARS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 71 MIDDLE EAST & AFRICA INFANT FORMULA IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 72 MIDDLE EAST & AFRICA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 73 MIDDLE EAST & AFRICA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 74 MIDDLE EAST & AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 75 MIDDLE EAST & AFRICA RUMINANTS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 76 MIDDLE EAST & AFRICA SWINE IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 77 MIDDLE EAST & AFRICA POULTRY IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 78 MIDDLE EAST & AFRICA AQUATIC ANIMAL IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 79 MIDDLE EAST & AFRICA PETS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 80 MIDDLE EAST & AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 81 MIDDLE EAST & AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 82 MIDDLE EAST & AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 83 MIDDLE EAST & AFRICA PHARMACEUTICALS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 84 SOUTH AFRICA ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2018-2027 (USD THOUSANDS)

TABLE 85 SOUTH AFRICA ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 86 SOUTH AFRICA PLANT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 87 SOUTH AFRICA INSECT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 88 SOUTH AFRICA CULTURED MEAT IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 89 SOUTH AFRICA ALTERNATIVE PROTEINS MARKET, BY FORM, 2018-2027 (USD THOUSANDS)

TABLE 90 SOUTH AFRICA ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 91 SOUTH AFRICA FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 92 SOUTH AFRICA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 93 SOUTH AFRICA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 94 SOUTH AFRICA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 95 SOUTH AFRICA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 96 SOUTH AFRICA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 97 SOUTH AFRICA DAIRY DESSERTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 98 SOUTH AFRICA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 99 SOUTH AFRICA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 100 SOUTH AFRICA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 101 SOUTH AFRICA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 102 SOUTH AFRICA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 103 SOUTH AFRICA NUTRITIONAL BARS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 104 SOUTH AFRICA INFANT FORMULA IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 105 SOUTH AFRICA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 106 SOUTH AFRICA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 107 SOUTH AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 108 SOUTH AFRICA RUMINANTS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 109 SOUTH AFRICA SWINE IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 110 SOUTH AFRICA POULTRY IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 111 SOUTH AFRICA AQUATIC ANIMAL IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 112 SOUTH AFRICA PETS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 113 SOUTH AFRICA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 114 SOUTH AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 115 SOUTH AFRICA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 116 SOUTH AFRICA PHARMACEUTICALS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 117 SAUDI ARABIA ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2018-2027 (USD THOUSANDS)

TABLE 118 SAUDI ARABIA ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 119 SAUDI ARABIA PLANT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 120 SAUDI ARABIA INSECT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 121 SAUDI ARABIA CULTURED MEAT IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 122 SAUDI ARABIA ALTERNATIVE PROTEINS MARKET, BY FORM, 2018-2027 (USD THOUSANDS)

TABLE 123 SAUDI ARABIA ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 124 SAUDI ARABIA FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 125 SAUDI ARABIA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 126 SAUDI ARABIA BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 127 SAUDI ARABIA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 128 SAUDI ARABIA CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 129 SAUDI ARABIA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 130 SAUDI ARABIA DAIRY DESSERTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 131 SAUDI ARABIA DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 132 SAUDI ARABIA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 133 SAUDI ARABIA DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 134 SAUDI ARABIA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 135 SAUDI ARABIA MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 136 SAUDI ARABIA NUTRITIONAL BARS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 137 SAUDI ARABIA INFANT FORMULA IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 138 SAUDI ARABIA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 139 SAUDI ARABIA BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 140 SAUDI ARABIA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 141 SAUDI ARABIA RUMINANTS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 142 SAUDI ARABIA SWINE IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 143 SAUDI ARABIA POULTRY IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 144 SAUDI ARABIA AQUATIC ANIMAL IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 145 SAUDI ARABIA PETS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 146 SAUDI ARABIA ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 147 SAUDI ARABIA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 148 SAUDI ARABIA PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 149 SAUDI ARABIA PHARMACEUTICALS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 150 UAE ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2018-2027 (USD THOUSANDS)

TABLE 151 UAE ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 152 UAE PLANT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 153 UAE INSECT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 154 UAE CULTURED MEAT IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 155 UAE ALTERNATIVE PROTEINS MARKET, BY FORM, 2018-2027 (USD THOUSANDS)

TABLE 156 UAE ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 157 UAE FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 158 UAE BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 159 UAE BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 160 UAE CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 161 UAE CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 162 UAE DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 163 UAE DAIRY DESSERTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 164 UAE DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 165 UAE DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 166 UAE DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 167 UAE MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 168 UAE MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 169 UAE NUTRITIONAL BARS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 170 UAE INFANT FORMULA IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 171 UAE BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 172 UAE BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 173 UAE ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 174 UAE RUMINANTS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 175 UAE SWINE IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 176 UAE POULTRY IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 177 UAE AQUATIC ANIMAL IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 178 UAE PETS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 179 UAE ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 180 UAE PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 181 UAE PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 182 UAE PHARMACEUTICALS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 183 KUWAIT ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2018-2027 (USD THOUSANDS)

TABLE 184 KUWAIT ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 185 KUWAIT PLANT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 186 KUWAIT INSECT PROTEIN IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 187 KUWAIT CULTURED MEAT IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 188 KUWAIT ALTERNATIVE PROTEINS MARKET, BY FORM, 2018-2027 (USD THOUSANDS)

TABLE 189 KUWAIT ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 190 KUWAIT FOOD & BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 191 KUWAIT BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 192 KUWAIT BAKERY & CONFECTIONERY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 193 KUWAIT CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 194 KUWAIT CONVENIENCE FOOD IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 195 KUWAIT DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 196 KUWAIT DAIRY DESSERTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 197 KUWAIT DAIRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 198 KUWAIT DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 199 KUWAIT DAIRY ALTERNATIVES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 200 KUWAIT MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 201 KUWAIT MEAT & POULTRY PRODUCTS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 202 KUWAIT NUTRITIONAL BARS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 203 KUWAIT INFANT FORMULA IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 204 KUWAIT BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY APPLICATION, 2018-2027 (USD THOUSANDS)

TABLE 205 KUWAIT BEVERAGES IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 206 KUWAIT ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY ANIMALS, 2018-2027 (USD THOUSANDS)

TABLE 207 KUWAIT RUMINANTS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 208 KUWAIT SWINE IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 209 KUWAIT POULTRY IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 210 KUWAIT AQUATIC ANIMAL IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 211 KUWAIT PETS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 212 KUWAIT ANIMAL FEED IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 213 KUWAIT PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY TYPE, 2018-2027 (USD THOUSANDS)

TABLE 214 KUWAIT PERSONAL CARE & COSMETICS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 215 KUWAIT PHARMACEUTICALS IN ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSANDS)

TABLE 216 REST OF MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2018-2027 (USD THOUSANDS)

Liste des figures

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET : SEGMENTATION

FIGURE 11 INCREASING NUMBER OF HEALTH CONSCIOUS CONSUMERS AND EASY AVAILABILITY OF EDIBLE INSECTS ARE LEADING THE GROWTH OF THE MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 INORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET IN 2020 & 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET

FIGURE 14 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY CATEGORY, 2019

FIGURE 15 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY PRODUCT TYPE

FIGURE 16 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET, BY FORM

FIGURE 17 FIGURE 1 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET , BY APPLICATIONS, 2019

FIGURE 18 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET: SNAPSHOT (2019)

FIGURE 19 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET: BY COUNTRY (2019)

FIGURE 20 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET: BY COUNTRY (2020 & 2027)

FIGURE 21 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET: BY COUNTRY (2019 & 2027)

FIGURE 22 MIDDLE EAST & AFRICA ALTERNATIVE PROTEINS MARKET: BY TYPE (2020-2027)

FIGURE 23 MIDDLE EAST AND AFRICA ALTERNATIVE PROTEINS MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.