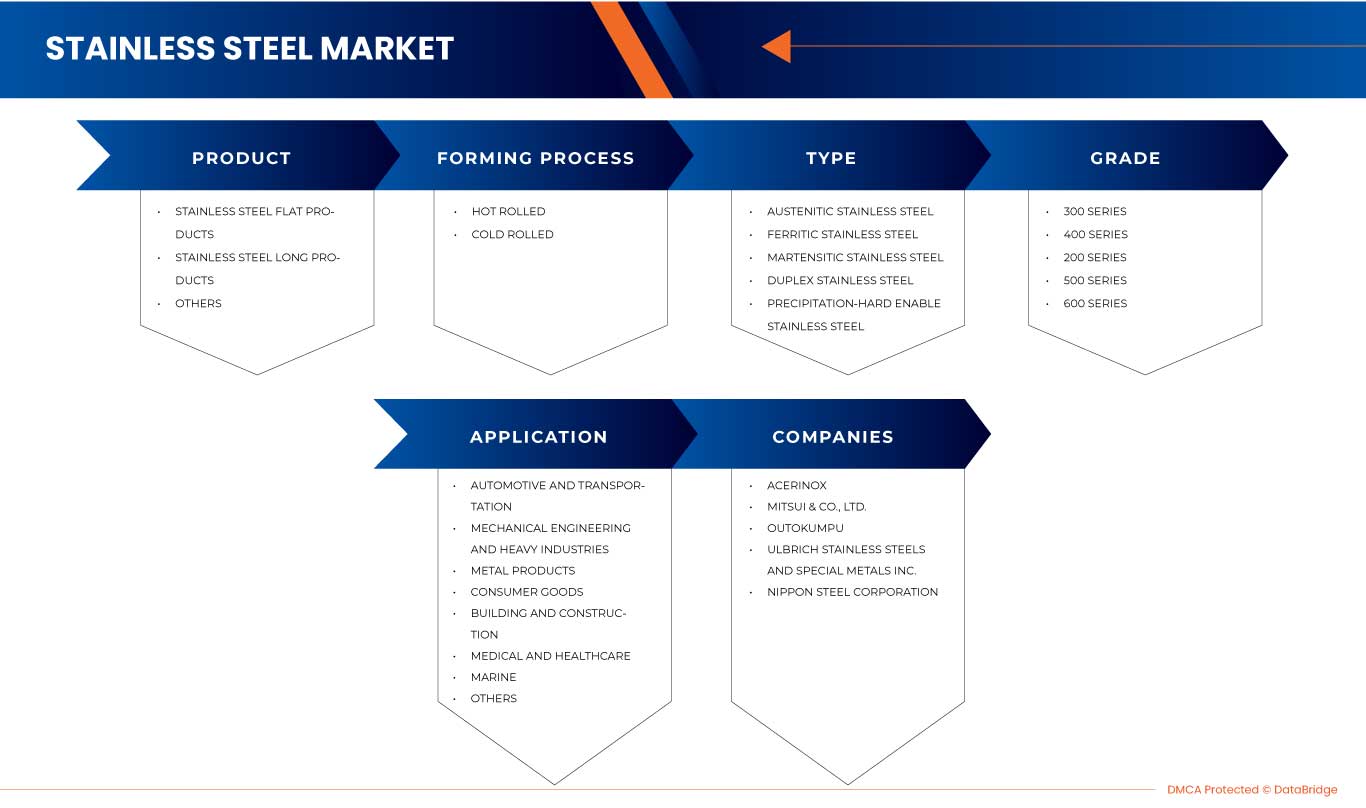

Marché mexicain de l'acier inoxydable, par produit (produits plats en acier inoxydable, produits longs en acier inoxydable et autres), procédé de formage (laminé à chaud et laminé à froid), type (acier inoxydable austénitique, acier inoxydable ferritique, acier inoxydable martensitique, acier inoxydable duplex et acier inoxydable durci par précipitation), nuance (série 300, série 400, série 200, série 500 et série 600), application (automobile et transport, génie mécanique et industries lourdes, produits métalliques, biens de consommation, médical et soins de santé, bâtiment et construction, marine et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de l'acier inoxydable au Mexique

Le marché mexicain de l'acier inoxydable devrait croître de manière significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 3,7% au cours de la période de prévision de 2023 à 2030 et devrait atteindre 991 441,52 milliers USD d'ici 2030. L'utilisation croissante de l'acier inoxydable dans diverses industries a été le principal moteur du marché mexicain de l'acier inoxydable.

Le rapport de marché fournit des détails sur les parts de marché, les nouveaux développements et l'impact des acteurs du marché national et local, et analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains et volume en tonnes |

|

Segments couverts |

Produit (produits plats en acier inoxydable, produits longs en acier inoxydable et autres), procédé de formage (laminé à chaud et laminé à froid), type (acier inoxydable austénitique, acier inoxydable ferritique, acier inoxydable martensitique, acier inoxydable duplex et acier inoxydable durci par précipitation), nuance (séries 300, 400, 200, 500 et 600), application (automobile et transport, génie mécanique et industries lourdes, produits métalliques, biens de consommation, médical et soins de santé, bâtiment et construction, marine et autres) |

|

Régions couvertes |

Nord du Mexique, centre du Mexique, est du Mexique, ouest du Mexique et sud du Mexique |

|

Acteurs du marché couverts |

Français Industeel, Acerinox, Aperam, NIPPON STEEL CORPORATION, Alleima, MITSUI & CO., LTD., Olympic Steel, Outokumpu, Ulbrich Stainless Steels and Special Metals Inc., Swiss Steel Holding AG, Gibbs Wire & Steel Company LLC, TIMEX METALS, Shrikant Steel Centre, Nitech Stainless Inc et RH Alloys, entre autres. |

Définition du marché

Un alliage de puissance est créé lorsque différents composants présents dans l'acier inoxydable sont combinés. Dans certaines circonstances, l'acier inoxydable, un alliage de fer, de chrome et de nickel, confère une résistance à la corrosion du fer. Cette qualité résistante de l'alliage est due au chrome. La couche passive est un mince film d'oxyde sécrété par le chrome. En plus du chrome, cet alliage comprend également de l'azote et du molybdène . C'est un alliage neutre pour l'environnement et inerte, ce qui le rend indéfiniment recyclable. L'acier inoxydable est solide et durable, ce qui le rend idéal pour une utilisation dans de nombreux secteurs d'activité d'utilisateurs finaux.

Dynamique du marché de l'acier inoxydable au Mexique

Cette section traite de la compréhension des moteurs, des opportunités, des défis et des contraintes du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation des activités industrielles au Mexique

L'augmentation de l'activité industrielle stimule la demande d'acier inoxydable au Mexique. Ces dernières années, l'industrialisation a considérablement augmenté dans un large éventail d'industries, notamment l'automobile, la construction, la fabrication et l'énergie. L'acier inoxydable est devenu le matériau privilégié pour un large éventail d'applications industrielles en raison de ses propriétés exceptionnelles telles que la résistance à la corrosion, la solidité et l'attrait esthétique. L'expansion des activités industrielles au Mexique s'est accompagnée d'un besoin croissant de matériaux durables et fiables. Les caractéristiques uniques de l'acier inoxydable en font un choix idéal pour diverses applications dans le paysage industriel. La polyvalence et la résilience de l'acier inoxydable le positionnent comme un acteur clé du développement économique du Mexique alors que les industries continuent d'évoluer et de s'efforcer d'être efficaces et durables.

- Urbanisation croissante et développement des infrastructures.

L'urbanisation croissante et le développement des infrastructures au Mexique sont des facteurs importants de la hausse de la demande d'acier inoxydable. La demande pour la construction de structures résidentielles et commerciales et le développement de projets d'infrastructures augmentent à mesure que l'urbanisation du pays s'accélère. L'acier inoxydable est devenu un matériau populaire pour les structures architecturales en raison de son excellente résistance à la corrosion et de sa durabilité, ce qui a accru la demande d'acier inoxydable dans le secteur de la construction.

Opportunité

- Intégration dans les industries vertes

L’intégration de l’acier inoxydable dans les industries vertes, telles que la production de véhicules électriques et d’infrastructures durables, représente une opportunité de marché pour le Mexique. L’acier inoxydable peut se positionner comme un acteur clé dans ces secteurs en développement grâce à sa robustesse et sa résistance à la corrosion inhérentes, offrant à l’industrie des perspectives de croissance prometteuses.

L'utilisation de l'acier inoxydable dans les projets d'énergie renouvelable est l'une des perspectives les plus prometteuses pour ce matériau au Mexique. Le pays a investi activement dans les sources d'énergie renouvelables telles que l'énergie éolienne, solaire et hydroélectrique afin de diversifier son bouquet énergétique et de réduire sa dépendance aux combustibles fossiles. La durabilité et la résistance à la corrosion de l'acier inoxydable en font un matériau particulièrement adapté à une variété de composants utilisés dans les infrastructures des sources d'énergie renouvelables. Par exemple, les structures de support et les éoliennes utilisées dans l'énergie éolienne sont fréquemment exposées à des conditions climatiques difficiles, telles que des vents violents et l'exposition à l'eau salée dans les zones côtières. La durabilité et la fiabilité des tours et des composants des éoliennes sont garanties par la résistance mécanique élevée de l'acier inoxydable et sa résistance à la corrosion.

Retenue

- Fluctuation des prix des matières premières

Le marché mexicain de l'acier inoxydable est freiné par la fluctuation des coûts des matières premières, en particulier pour les composants critiques tels que le nickel, le chrome et le fer. Ces matières premières sont essentielles à la production d'acier inoxydable et les variations de leurs prix peuvent avoir un impact significatif sur les coûts de production globaux supportés par les fabricants. La capacité du secteur à maintenir des prix stables et à assurer la rentabilité devient de plus en plus difficile.

La production de nuances d’acier inoxydable résistantes à la corrosion nécessite une quantité importante de nickel, une matière première largement utilisée dans le processus de fabrication de l’acier inoxydable. Alors que le fer est le constituant principal de la majorité des alliages d’acier inoxydable, le chrome est essentiel pour améliorer la résistance à la corrosion et la solidité de l’acier inoxydable. De nombreuses variables, telles que les changements des conditions du marché, les événements géopolitiques et la dynamique de l’offre et de la demande mondiales, ont un impact sur les prix de ces matières premières.

Défi

- Défis en matière d'infrastructures et de logistique

Dans certaines régions du Mexique, la circulation efficace des produits en acier inoxydable est entravée par le manque d'infrastructures de transport adéquates et par des contraintes logistiques. Ces facteurs peuvent entraîner des retards et des augmentations de coûts, ce qui affecte la croissance et la compétitivité de l'industrie de l'acier inoxydable. Il est essentiel de combler ces lacunes en matière d'infrastructures pour assurer la fluidité de la circulation des produits en acier inoxydable et soutenir la croissance de l'industrie dans ces régions.

Dans certaines régions du Mexique, le transport efficace des produits en acier inoxydable depuis les usines de fabrication jusqu'aux utilisateurs finaux ou aux centres de distribution peut être entravé en raison d'une infrastructure de transport insuffisante. Le transport de marchandises sur de longues distances peut être difficile en raison de routes, de ponts et d'autoroutes mal développés ou mal entretenus. Des retards dans les délais de livraison peuvent en résulter, affectant les délais de production et pouvant entraîner un potentiel de marché inexploité.

Développement récent

- En 2022, selon SteelOrbis Electronic Marketplace Inc., l'industrie sidérurgique du Mexique a reçu 2,14 milliards de dollars d'investissements directs étrangers (IDE), soit une augmentation de 674 % par rapport aux 276 millions de dollars de l'année précédente. Cela a placé le secteur au quatrième rang en termes de préférence des investisseurs, derrière la fabrication de véhicules et de camions, qui a reçu 2,70 milliards de dollars d'IDE la même année. Le Mexique, en tant que pays, a reçu un total de 35,29 milliards de dollars d'IDE en 2022, avec une somme cumulée de 674,54 milliards de dollars de 1999 à 2022.

Portée du marché mexicain de l'acier inoxydable

Le marché est classé en cinq segments notables en fonction du produit, du processus de formage, du type, de la qualité et de l'application. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Produits plats en acier inoxydable

- Produits longs en acier inoxydable

- Autres

Sur la base du produit, le marché mexicain de l'acier inoxydable est segmenté en produits plats en acier inoxydable, produits longs en acier inoxydable et autres.

Processus de formation

- Laminé à chaud

- Laminé à froid

Sur la base du processus de formage, le marché mexicain de l'acier inoxydable est segmenté en laminé à chaud et laminé à froid.

Taper

- Acier inoxydable austénitique

- Acier inoxydable ferritique

- Acier inoxydable martensitique

- Acier inoxydable duplex

- Acier inoxydable durci par précipitation

Sur la base du type, le marché mexicain de l'acier inoxydable est segmenté en acier inoxydable austénitique, acier inoxydable ferritique, acier inoxydable martensitique, acier inoxydable duplex et acier inoxydable durci par précipitation.

Grade

- Série 300

- Série 400

- Série 200

- Série 500

- Série 600

Sur la base de la qualité, le marché mexicain de l'acier inoxydable est segmenté en séries 300, 400, 200, 500 et 600.

Application

- Automobile et transport

- Ingénierie mécanique et industries lourdes

- Produits métalliques

- Biens de consommation

- Médical et soins de santé

- Bâtiment et construction

- Marin

- Autres

Sur la base des applications, le marché mexicain de l'acier inoxydable est segmenté en automobile et transport, construction mécanique et industries lourdes, produits métalliques, biens de consommation, médecine et soins de santé, bâtiment et construction, marine et autres.

Analyse/perspectives régionales du marché de l'acier inoxydable au Mexique

Le marché est classé en cinq segments notables sur la base du produit, du processus de formage, du type, de la qualité et de l'application.

Les régions couvertes par le marché mexicain de l'acier inoxydable sont le nord du Mexique, le centre du Mexique, l'est du Mexique, l'ouest du Mexique et le sud du Mexique.

La région du nord devrait dominer le marché mexicain de l'acier inoxydable en raison de la demande croissante de l'industrie automobile. En outre, le nord du Mexique est la région qui connaît la croissance la plus rapide en raison de la demande croissante des industries d'utilisation finale comme l'automobile, le bâtiment et la construction, etc.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mexicaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'acier inoxydable

Le paysage concurrentiel du marché fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché de l'acier inoxydable.

Certains des principaux acteurs du marché opérant sur le marché sont Industeel, Acerinox, Aperam, NIPPON STEEL CORPORATION, Alleima, MITSUI & CO., LTD., Olympic Steel, Outokumpu, Ulbrich Stainless Steels and Special Metals Inc., Swiss Steel Holding AG, Gibbs Wire & Steel Company LLC, TIMEX METALS, Shrikant Steel Centre, Nitech Stainless Inc et RH Alloys, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT’S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 COMPARATIVE OVERVIEW OF NORTH AMERICA

4.6 ADDITIONAL CUSTOMIZATION

4.7 IMPORT-EXPORT SCENARIO

4.8 PRICE INDEX SCENARIO

4.9 RAW MATERIAL COVERAGE

4.9.1 NICKEL

4.9.2 IRON ORE

4.9.3 CHROMIUM

4.9.4 SILICON

4.9.5 MOLYBDENUM

4.9.6 OTHERS

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.11 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.12 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INDUSTRIAL ACTIVITIES IN MEXICO

6.1.2 RISING URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

6.1.3 GROWING FOREIGN INVESTMENT AND TRADE AGREEMENTS

6.2 RESTRAINTS

6.2.1 FLUCTUATING RAW MATERIAL COSTS

6.2.2 COMPETITION FROM ALTERNATIVE MATERIALS

6.3 OPPORTUNITIES

6.3.1 INTEGRATION INTO GREEN INDUSTRIES

6.3.2 EXPANSION INTO MEDICAL AND HEALTHCARE SECTORS

6.4 CHALLENGES

6.4.1 INFRASTRUCTURE AND LOGISTIC CHALLENGES

6.4.2 ENVIRONMENTAL REGULATIONS COMPLIANCE

7 MEXICO STAINLESS STEEL MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 BUILDING AND CONSTRUCTION

7.2.1 BUILDING AND CONSTRUCTION

7.2.1.1 RESIDENTIAL

7.2.1.2 COMMERCIAL

7.2.1.3 INFRASTRUCTURE

7.3 AUTOMOTIVE AND TRANSPORTATION

7.3.1 AUTOMOTIVE AND TRANSPORTATION

7.3.1.1 VEHICLES

7.3.1.1.1 TWO-WHEELER

7.3.1.1.2 FOUR-WHEELER

7.3.1.1.3 OTHERS

7.3.1.2 AEROSPACE

7.3.1.2.1 COMMERCIAL AIRCRAFT

7.3.1.2.2 MILITARY AIRCRAFT

7.3.1.2.3 PRIVATE CHARTER

7.4 MARINE

7.4.1 MARINE

7.4.1.1 CARGOS

7.4.1.2 PASSENGER SHIPS

7.4.1.3 BOATS

7.4.1.4 OTHERS

7.5 CONSUMER GOODS

7.5.1 CONSUMER GOODS

7.5.1.1 KITCHEN SINKS

7.5.1.2 CUTLERY

7.5.1.3 COOKWARE

7.5.1.4 KITCHEN APPLIANCES

7.5.1.5 FURNITURE

7.5.1.6 GARDEN EQUIPMENT

7.5.1.7 OTHERS

7.6 MECHANICAL ENGINEERING AND HEAVY INDUSTRIES

7.6.1 MECHANICAL ENGINEERING AND HEAVY INDUSTRIES

7.6.1.1 AGGREGATE MINING

7.6.1.2 METAL MINING

7.6.1.3 COAL MINING

7.6.1.4 OTHERS

7.7 METAL PRODUCTS

7.8 MEDICAL AND HEALTHCARE

7.8.1 MEDICAL AND HEALTHCARE

7.8.1.1 MEDICAL DEVICES

7.8.1.2 SURGICAL TOOLS

7.9 OTHERS

8 MEXICO STAINLESS STEEL MARKET BY REGION

8.1 NORTHERN MEXICO

8.2 CENTRAL MEXICO

8.3 EASTERN MEXICO

8.4 WESTERN MEXICO

8.5 SOUTHERN MEXICO

9 MEXICO STAINLESS STEEL MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: MEXICO

9.2 ACQUISITION

9.3 SUSTAINABILITY

9.4 PARTNERSHIP

9.5 PRODUCT LAUNCH

9.6 AWARD

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 ACERINOX

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENTS

11.2 MITSUI & CO., LTD

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 PRODUCT PORTFOLIO

11.2.4 RECENT DEVELOPMENT

11.3 OUTOKUMPU

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 ULBRICH STAINLESS STEELS AND SPECIAL METALS INC.

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 RECENT DEVELOPMENTS

11.5 NIPPON STEEL CORPORATION

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENT

11.6 ALLEIMA

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENTS

11.7 APERAM

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT DEVELOPMENT

11.8 GIBBS WIRE & STEEL COMPANY LLC

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENT

11.9 INDUSTEEL

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENTS

11.1 NITECH STAINLESS INC

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

11.11 OLYMPIC STEEL

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT DEVELOPMENTS

11.12 R H ALLOYS

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENT

11.13 SHRIKANT STEEL CENTRE

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT DEVELOPMENT

11.14 SWISS STEEL HOLDING AG

11.14.1 COMPANY SNAPSHOT

11.14.2 REVENUE ANALYSIS

11.14.3 PRODUCT PORTFOLIO

11.14.4 RECENT DEVELOPMENT

11.15 TIMEX METALS

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENT

11.16 POSCO HOLDINGS

11.16.1 COMPANY SNAPSHOT

11.16.2 REVENUE ANALYSIS

11.16.3 PRODUCT PORTFOLIO

11.16.4 RECENT DEVELOPMENT

11.17 AK STEEL INTERNATIONAL B.V. (CLEVELAND-CLIFFS INC)

11.17.1 COMPANY SNAPSHOT

11.17.2 PRODUCT PORTFOLIO

11.17.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

Liste des tableaux

TABLE 1 COMPARATIVE DATA OF NORTH AMERICA STAINLESS STEEL MARKET (U.S. AND CANADA)

TABLE 2 ANNUAL APPARENT NATIONAL CONSUMPTION OF STAINLESS STEEL PRODUCTS IN MEXICO

TABLE 3 ANNUAL APPARENT REGIONAL CONSUMPTION OF STAINLESS STEEL PRODUCTS

TABLE 4 ANNUAL WEIGHTED AVERAGE MARGIN

TABLE 5 APPARENT NATIONAL CONSUMPTION ACROSS MAJOR STATES IN MEXICO

TABLE 6 CONSUMPTION DATA FOR HIGH ALLOY STAINLESS STEEL IN MEXICO

TABLE 7 ESTIMATED IMPORT AND PRODUCTION DATA OF STAINLESS STEEL IN MEXICO

TABLE 8 REGULATORY COVERAGE

TABLE 9 MEXICO STAINLESS STEEL MARKET, 2021-2030

TABLE 10 MEXICO STAINLESS STEEL MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MEXICO STAINLESS STEEL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 12 MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 13 MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 14 MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 15 MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 16 MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 17 MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 18 MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 20 MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 23 MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 24 MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 25 MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 26 MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 27 MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 NORTHERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 NORTHERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 37 NORTHERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 38 NORTHERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 39 NORTHERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 40 NORTHERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 41 NORTHERN MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 NORTHERN MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 43 NORTHERN MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTHERN MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 NORTHERN MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 46 NORTHERN MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 47 NORTHERN MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 48 NORTHERN MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 49 NORTHERN MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 50 NORTHERN MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 NORTHERN MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 NORTHERN MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 NORTHERN MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 NORTHERN MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 NORTHERN MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 NORTHERN MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 NORTHERN MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 CENTRAL MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 59 CENTRAL MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 60 CENTRAL MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 61 CENTRAL MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 62 CENTRAL MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 63 CENTRAL MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 64 CENTRAL MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 CENTRAL MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 66 CENTRAL MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 CENTRAL MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 CENTRAL MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 69 CENTRAL MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 70 CENTRAL MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 71 CENTRAL MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 72 CENTRAL MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 73 CENTRAL MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 CENTRAL MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 CENTRAL MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 CENTRAL MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 CENTRAL MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 CENTRAL MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 CENTRAL MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 CENTRAL MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 EASTERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 82 EASTERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 83 EASTERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 84 EASTERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 85 EASTERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 86 EASTERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 87 EASTERN MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 EASTERN MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 89 EASTERN MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 EASTERN MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 EASTERN MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 92 EASTERN MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 93 EASTERN MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 94 EASTERN MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 95 EASTERN MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 96 EASTERN MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 EASTERN MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 EASTERN MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 EASTERN MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 EASTERN MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 EASTERN MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 EASTERN MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 EASTERN MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 WESTERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 105 WESTERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 106 WESTERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 107 WESTERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 108 WESTERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 109 WESTERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 110 WESTERN MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 WESTERN MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 112 WESTERN MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 WESTERN MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 WESTERN MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 115 WESTERN MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 116 WESTERN MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 117 WESTERN MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 118 WESTERN MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 119 WESTERN MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 WESTERN MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 WESTERN MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 WESTERN MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 WESTERN MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 WESTERN MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 WESTERN MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 WESTERN MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 128 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 129 SOUTHERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 130 SOUTHERN MEXICO STAINLESS STEEL FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (TONS)

TABLE 131 SOUTHERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 132 SOUTHERN MEXICO STAINLESS STEEL LONG PRODUCTS IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 133 SOUTHERN MEXICO STAINLESS STEEL BARS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY FORMING PROCESS, 2021-2030 (USD THOUSAND)

TABLE 135 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 SOUTHERN MEXICO DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 137 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 138 SOUTHERN MEXICO 300 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 139 SOUTHERN MEXICO 400 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 140 SOUTHERN MEXICO 200 SERIES IN STAINLESS STEEL MARKET, BY SEGMENT, 2021-2030 (USD THOUSAND)

TABLE 141 SOUTHERN MEXICO STAINLESS STEEL MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 142 SOUTHERN MEXICO MECHANICAL ENGINEERING AND HEAVY INDUSTRIES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 SOUTHERN MEXICO BUILDING AND CONSTRUCTION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 SOUTHERN MEXICO CONSUMER GOODS IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 SOUTHERN MEXICO MARINE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 146 SOUTHERN MEXICO AUTOMOTIVE AND TRANSPORTATION IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 SOUTHERN MEXICO VEHICLES IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 SOUTHERN MEXICO AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 SOUTHERN MEXICO MEDICAL AND HEALTHCARE IN STAINLESS STEEL MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 MEXICO STAINLESS STEEL MARKET

FIGURE 2 MEXICO STAINLESS STEEL MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO STAINLESS STEEL MARKET: DROC ANALYSIS

FIGURE 4 MEXICO STAINLESS STEEL MARKET: MEXICO VS REGIONAL MARKET ANALYSIS

FIGURE 5 MEXICO STAINLESS STEEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO STAINLESS STEEL MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MEXICO STAINLESS STEEL MARKET: MULTIVARIATE MODELLING

FIGURE 8 MEXICO STAINLESS STEEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MEXICO STAINLESS STEEL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MEXICO STAINLESS STEEL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MEXICO STAINLESS STEEL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MEXICO STAINLESS STEEL MARKET: SEGMENTATION

FIGURE 13 RISING URBANIZATION AND INRASTRUCTURE DEVELOPMENT ARE EXPECTED TO DRIVE THE MEXICO STAINLESS STEEL MARKET IN THE FORECAST PERIOD

FIGURE 14 THE STAINLESS STEEL FLAT PRODUCTS ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO STAINLESS STEEL MARKET IN 2023 AND 2030

FIGURE 15 THE BELOW GRAPH SHOWS THE GREENHOUSE GAS EMISSIONS FOR STAINLESS STEEL.THE TOTAL EMISSIONS ARE 3.3 TONS OF CO2/ TON OF STAINLESS STEEL.

FIGURE 16 THE BELOW DIAGRAM SHOWS THE LIFE CYCLE OF STAINLESS STEEL IN 2010

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 THE HYBRID TECHNIQUE IS ONE OF NUMEROUS DEVELOPMENTS THAT USE HYDROGEN AS A REDUCING AGENT, WITH THE HYDROGEN BEING GENERATED THROUGH ELECTROLYSIS USING SUSTAINABLE POWER. THE MOST MAJOR ADVANTAGE FROM A NATURAL STANDPOINT IS THAT THE FUMES PRODUCED BY THIS TECHNIQUE ARE WATER RATHER THAN CARBON DIOXIDE.

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MEXICO STAINLESS STEEL MARKET

FIGURE 21 THE BELOW DATA SHOWS THE INDUSTRIAL PRODUCTION IN MEXICO

FIGURE 22 THE BELOW FIGURE SHOWS 'MEXICO'S URBAN POPULATION BY CITY SIZE CLASS, 1990–2035 (HISTORICAL AND PROJECTED)

FIGURE 23 MEXICO STAINLESS STEEL MARKET: BY APPLICATION, 2022

FIGURE 24 MEXICO STAINLESS STEEL MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.