Marché mexicain de l'emballage des fruits, par type de fruit (banane, pomme, baies, raisin, orange, fruits tropicaux, grenade et autres), type de matériau (plastique, papier, fibre/pâte moulée, bois et autres), type de produit ( emballage rigide , emballage flexible et autres), application (vente au détail, transport, services alimentaires et autres), canal de distribution (direct et indirect), tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché

L'emballage des fruits et légumes est une pratique agricole qui consiste à transporter les récoltes fraîches du champ jusqu'au client. Étant donné que tous les fruits et légumes sont des cultures périssables, le choix du bon emballage pour les fruits et légumes est crucial pour que les agriculteurs puissent survivre sur le marché. La principale fonction de l'emballage est de conserver les fruits et légumes afin de préserver leur qualité et de prolonger leur durée de conservation.

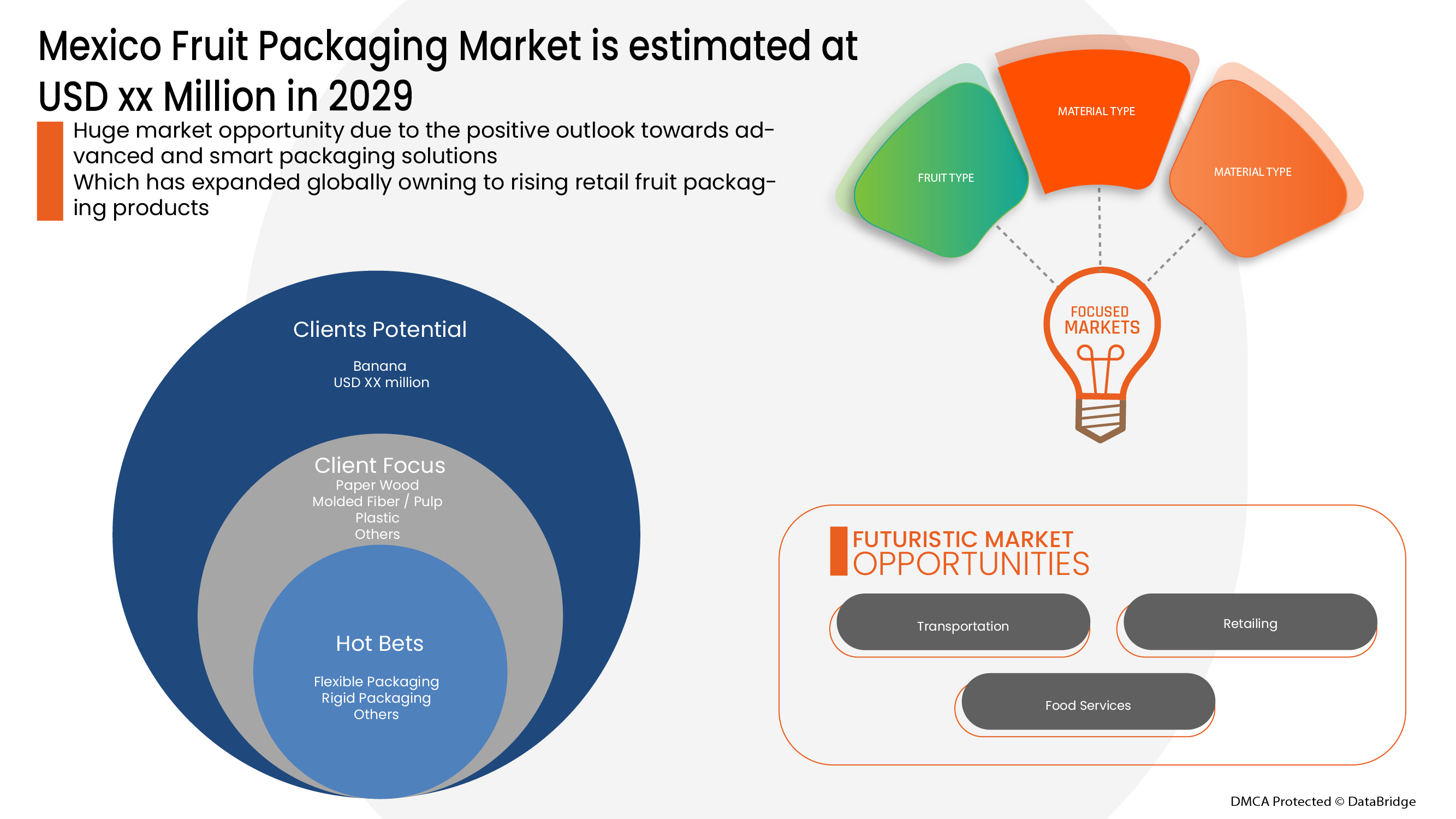

L'emballage des fruits est très avantageux pour un emballage pratique et flexible . Data Bridge Market Research analyse que l'emballage des fruits devrait atteindre la valeur de 3 932,63 millions USD d'ici 2029, à un TCAC de 1,4 % au cours de la période de prévision. La banane représente le segment de type de fruit le plus important sur le marché respectif en raison de l'augmentation du commerce électronique, des services de messagerie et de livraison de fruits. Le rapport de marché organisé par l'équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en millions d'unités, prix en USD |

|

Segments couverts |

Par type de fruit (banane, pomme, baies, raisin, orange, fruits tropicaux, grenade et autres), type de matériau (plastique, papier, fibre/pâte moulée, bois et autres), type de produit (emballage rigide, emballage flexible et autres), application (vente au détail, transport, services alimentaires et autres), canal de distribution (direct et indirect) |

|

Pays couvert |

Mexique |

|

Acteurs du marché couverts |

Mondi, DS Smith, Amcor plc, Packaging Corporation of America, International Paper, Smurfit Kappa, Sealed Air, Sonoco Products Company, WestRock Company et Huhtamaki, entre autres |

Définition du marché

Les sacs, contenants et boîtes en bois, plastique et papier, entre autres, sont les matériaux prédominants pour l'emballage des fruits et légumes . Outre les coûts très faibles des matériaux, les ensacheuses automatiques réduisent encore davantage les coûts d'emballage. Les sacs en film sont transparents, ce qui permet une inspection facile du contenu et s'adaptent facilement aux graphismes de haute qualité.

Cadre réglementaire

- Conformément à la loi sur l'emballage et l'étiquetage équitables de la FDA, les pages Web consacrées à l'étiquetage des aliments abordent les exigences d'étiquetage des aliments en vertu de la loi fédérale sur les aliments, les médicaments et les cosmétiques et de ses amendements. L'étiquetage des aliments est obligatoire pour la plupart des aliments préparés et crus, y compris les fruits et les légumes. Cette loi a édicté des réglementations exigeant que tous les « produits de consommation » soient étiquetés pour divulguer le contenu net, l'identité du produit et le nom et le lieu d'activité des produits.

- Selon la FDA (Food and Drug Administration), chaque récipient dans lequel est emballé un produit à base de fruits doit être scellé de manière à ne pouvoir être ouvert sans détruire le numéro de licence et la marque d'identification spéciale du fabricant qui doivent être affichés sur le dessus ou le col de la bouteille. Pour les fruits en conserve, des boîtes hygiéniques constituées de types de fer-blanc appropriés doivent être utilisées, tandis que, pour les fruits en bouteille, seules des bouteilles/bocaux capables d'assurer une fermeture hermétique doivent être utilisés. Les fruits confits et les écorces ainsi que les fruits secs peuvent être emballés dans des sacs en papier, des boîtes en carton ou en bois, des boîtes neuves, des bouteilles, des bocaux, de l'aluminium et d'autres contenants approuvés appropriés. Les fruits et légumes peuvent également être emballés dans des matériaux d'emballage aseptiques et flexibles de bonne qualité conformes aux normes requises établies par le gouvernement fédéral

Ces normes fournissent des qualifications pour la production d'emballages de fruits, des protocoles et des lignes directrices qui garantissent un niveau de sécurité élevé et certifient le matériau à utiliser.

Le COVID-19 a eu un impact minime sur le marché mexicain de l'emballage des fruits

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, un impact significatif a été constaté sur le marché de l'emballage des fruits. Les opérations et la chaîne d'approvisionnement de l'emballage des fruits, avec plusieurs installations de fabrication, fonctionnaient toujours dans la région. Les prestataires de services ont continué à proposer des emballages de fruits en suivant les mesures d'hygiène et de sécurité dans le scénario post-COVID.

La dynamique du marché de l'emballage des fruits au Mexique comprend :

Facteurs moteurs/opportunités rencontrées par l'industrie du conditionnement des fruits au Mexique

- Demande croissante d'emballages pratiques et flexibles

Les emballages souples sont des caractéristiques qui facilitent la vie. Ils sont faciles à stocker, à refermer, à ouvrir, à prolonger la durée de vie du produit et à transporter. L’augmentation du revenu disponible et l’amélioration du niveau de vie des consommateurs dans les pays en développement sont des facteurs qui contribuent de manière significative à la demande croissante d’aliments emballés, y compris de fruits, et cela stimule encore davantage la demande de solutions et de matériaux d’emballage plus pratiques à utiliser. En conclusion, la demande croissante des grands détaillants pour des durées de conservation prolongées et des consommateurs pour des produits de commodité stimule également la demande d’emballages souples et contribue ainsi à la croissance du marché mexicain de l’emballage de fruits

- Le commerce électronique, les services de messagerie et de livraison de fruits sont en plein essor

Le commerce électronique a transformé la façon de faire des affaires dans le monde entier. Une grande partie de la croissance de l'industrie a été déclenchée par une augmentation de la pénétration d'Internet et des smartphones. De plus, les progrès technologiques et la croissance des marchés disponibles ont facilité l'achat et la vente de biens via des portails en ligne. Les commerçants et les services de livraison continuent de suivre la demande des consommateurs sur les plateformes en ligne, affluant vers le commerce électronique en nombre record. En outre, il y a eu une augmentation continue de la demande de besoins d'emballage standardisés et de configurations de livraison aérées et humidifiées pour une durée de conservation plus longue lors du transport de produits périssables tels que les fruits et les légumes. Cela augmente à son tour la demande d'emballages de fruits et propulse ainsi la croissance du marché mexicain de l'emballage de fruits

- Perspectives positives concernant les solutions d’emballage avancées et intelligentes

L'objectif de la technologie d'emballage intelligent est de maintenir la qualité du produit et de prolonger sa durée de conservation. L'emballage actif réagit à un événement déclencheur (comme une exposition aux rayons ultraviolets ou une diminution de pression) en libérant ou en absorbant des substances du produit emballé ou de son environnement. En général, cela implique différents composants, tels que des capteurs d'humidité ou de gaz ou des films antimicrobiens, intégrés dans l'emballage lui-même. En outre, l'adoption de technologies d'emballage avancées est en hausse afin d'offrir aux consommateurs des solutions d'emballage personnalisées. Cela augmente à son tour la demande d'emballages de fruits et crée ainsi une opportunité pour le marché mexicain de l'emballage de fruits.

Contraintes/défis rencontrés par le marché mexicain de l'emballage des fruits

- Règles et réglementations gouvernementales strictes concernant les matériaux d'emballage

Les réglementations imposées par les gouvernements jouent un rôle important dans la conception des emballages pour de nombreux fabricants du marché. Il existe diverses réglementations et politiques strictes auxquelles les fabricants de produits d'emballage doivent se conformer. Les organismes gouvernementaux réglementent et surveillent les produits d'emballage des aliments, des médicaments, des cosmétiques et l'utilisation des matières premières, afin de protéger l'environnement et d'assurer la sécurité et la confiance des consommateurs. En conclusion, l'augmentation des règles et réglementations concernant la production de produits d'emballage dans toutes les régions a eu un impact sur la demande de produits d'emballage. Cela a à son tour réduit la demande d'emballages de fruits et restreint ainsi la croissance du marché mexicain de l'emballage de fruits.

- La gestion des déchets d’emballage est difficile

Les emballages alimentaires modernes permettent de rendre les aliments sûrs, fiables, stables et propres. Malheureusement, la plupart des emballages alimentaires sont conçus pour être à usage unique et ne sont pas recyclés. Au lieu de cela, les emballages sont jetés et jonchent souvent nos cours d'eau. Il s'agit donc d'un problème non seulement pour les êtres humains, mais aussi pour toute la vie aquatique. Les emballages alimentaires ont également d'autres impacts environnementaux, notamment sur notre air et notre sol. En conclusion, la fabrication d'emballages en plastique est responsable d'une quantité importante d'émissions de gaz à effet de serre et affecte donc l'air de l'environnement. Cela réduit à son tour la demande de produits d'emballage de fruits et constitue donc un défi à la croissance du marché mexicain de l'emballage de fruits.

Ce rapport sur le marché mexicain de l'emballage des fruits fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des rodenticides, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développements récents

- En mars 2021, International Paper a annoncé l'acquisition de deux usines de carton ondulé de pointe en Espagne. Cela a permis à l'entreprise de renforcer ses capacités à Madrid et en Catalogne. Cela a amélioré les solutions d'emballage de l'entreprise dans les segments de l'industrie, des fruits et légumes frais et du commerce électronique.

- En mars 2021, Packaging Corporation of America a annoncé son intention de lancer un projet de 440 millions de dollars sur trois ans visant à convertir de manière permanente une machine à papier de son usine du comté de Clarke pour produire du carton de couverture utilisé pour les emballages en carton ondulé. L'entreprise installera une usine OCC pour le recyclage des vieux conteneurs en carton ondulé et diverses modifications de l'usine de pâte à papier. Cela a conduit au développement de nouveaux produits par l'entreprise.

- En mars 2022, Amcor plc a reçu trois prix 2022 Flexible Packaging Achievement Awards, remportant plusieurs catégories parmi un nombre record de candidatures. Ces prix ont récompensé Amcor pour sa capacité à résoudre des défis clients complexes, à faire progresser la durabilité et à élever la contribution globale des emballages flexibles.

Analyse/perspectives régionales du marché de l'emballage des fruits au Mexique

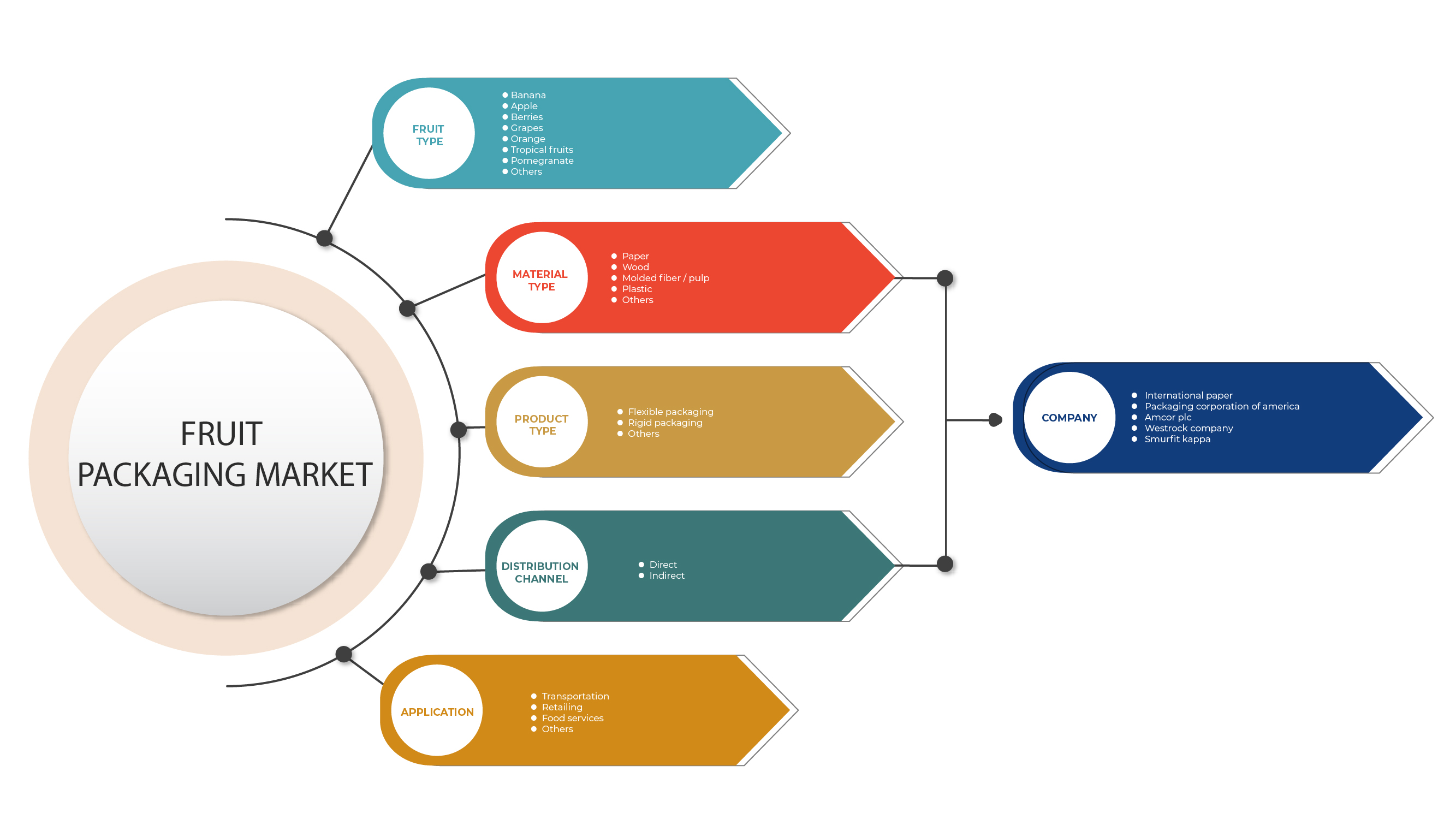

Le marché mexicain de l’emballage des fruits est segmenté en cinq segments notables qui sont basés sur le type de fruit, le type de matériau, le type de produit, l’application et le canal de distribution.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Portée du marché de l'emballage des fruits au Mexique

Le marché mexicain de l'emballage des fruits est segmenté en fonction du type de fruit, du type de matériau, du type de produit, de l'application et du canal de distribution. La croissance de ces segments vous aidera à analyser les segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de fruit

- Banane

- Pomme

- Baies

- Raisins

- Orange

- Fruits tropicaux

- Grenade

- Autres

Sur la base du type de fruit, le marché mexicain de l'emballage des fruits est segmenté en banane, pomme, baies, raisins, orange, fruits tropicaux, grenade et autres.

Type de matériau

- Papier

- Bois

- Fibre moulée / Pâte à papier

- Plastique

- Autres

Sur la base du type de matériau, le marché mexicain de l'emballage des fruits est segmenté en plastique, papier, fibres/pulpes moulées, bois et autres.

Type de produit

- Emballages souples

- Emballage rigide

- Autres

Sur la base du type de produit, le marché mexicain de l'emballage des fruits est segmenté en emballages rigides, emballages flexibles et autres.

Application

- Transport

- Commerce de détail

- Services de restauration

- Autres

Sur la base des applications, le marché mexicain de l'emballage des fruits est segmenté en vente au détail, transport, services de restauration et autres.

Canal de distribution

- Direct

- Indirect

Sur la base du canal de distribution, le marché mexicain de l’emballage des fruits est segmenté en direct et indirect.

Analyse du paysage concurrentiel et des parts de marché du secteur de l'emballage des fruits au Mexique

Le paysage concurrentiel du marché mexicain de l'emballage des fruits fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché mexicain de l'emballage des fruits.

Les acteurs opérant sur le marché mexicain de l'emballage des fruits sont Mondi, DS Smith, Amcor plc, Packaging Corporation of America, International Paper, Smurfit Kappa, Sealed Air, Sonoco Products Company, WestRock Company et Huhtamaki, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MEXICO FRUIT PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.2 LABELING AND CLAIMS

4.3 REVENUE OF SUPPLIERS

4.4 SUPPLY CHAIN ANALYSIS:

4.5 VALUE CHAIN ANALYSIS:

4.6 MARKET SHARE OF MOLDED FIBER VS OTHER SUBSTRATES AND ITS PROJECTION

4.7 MEXICO FRUIT PACKAGING MARKET, NEW PRODUCT LAUNCH STRATEGY

4.7.1 OVERVIEW

4.7.2 NUMBER OF PRODUCT LAUNCHES

4.7.2.1 LINE EXTENSION

4.7.2.2 NEW PACKAGING

4.7.2.3 RE-LAUNCHED

4.7.2.4 NEW FORMULATION

4.7.3 DIFFERENTIAL PRODUCT OFFERING

4.7.4 MEETING CONSUMER REQUIREMENT

4.7.5 PACKAGE DESIGNING

4.7.6 PRICING ANALYSIS

4.7.7 PRODUCT POSITIONING

4.7.8 CONCLUSION

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CONVENIENT AND FLEXIBLE PACKAGING

6.1.2 INCREASING ADOPTION OF ECO-FRIENDLY AND BIODEGRADABLE PRODUCTS FOR FRUIT PACKAGING

6.1.3 RISING E-COMMERCE, COURIER, AND FRUIT DELIVERY SERVICES

6.1.4 GAINING POPULARITY OF FRUITS IN PREVENTING CHRONIC DISEASES

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT RULES AND REGULATIONS REGARDING PACKAGING MATERIALS

6.2.2 USE OF HARMFUL ADDITIVES FOR WATER/OIL RESISTANCE IN FOOD PACKAGING

6.3 OPPORTUNITIES

6.3.1 POSITIVE OUTLOOK TOWARD ADVANCED AND SMART PACKAGING SOLUTIONS

6.3.2 RISING DEMAND FOR MODIFIED ATMOSPHERE PACKAGING (MAP)

6.4 CHALLENGES

6.4.1 MANAGING PACKAGING WASTE IS DIFFICULT

6.4.2 MAINTAINING STANDARD QUALITY OF PACKAGING PRODUCT

7 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE

7.1 OVERVIEW

7.2 BANANA

7.3 APPLE

7.4 BERRIES

7.4.1 STRAWBERRY

7.4.2 BLUEBERRY

7.4.3 RASPBERRY

7.4.4 BLACKBERRY

7.4.5 CRANBERRY

7.4.6 OTHERS

7.5 GRAPES

7.6 ORANGE

7.7 TROPICAL FRUITS

7.7.1 MANGO

7.7.2 PAPAYA

7.7.3 PASSION FRUIT

7.7.4 DRAGON FRUIT

7.7.5 JACKFRUIT

7.7.6 OTHERS

7.8 POMEGRANATE

7.9 OTHERS

8 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PAPER

8.3 WOOD

8.4 MOLDED FIBER / PULP

8.4.1 CARDBOARD

8.4.2 RECYCLED PAPER

8.4.3 NATURAL FIBER

8.4.3.1 SUGARCANE

8.4.3.2 BAMBOO

8.4.3.3 WHEAT STRAW

8.4.3.4 OTHERS

8.4.4 OTHERS

8.5 PLASTIC

8.5.1 POLYETHYLENE TEREPHTHALATE

8.5.2 POLYPROPYLENE (PP)

8.5.3 POLY-VINYL CHLORIDE (PVC)

8.5.4 POLYSTYRENE

8.5.5 ETHYL VINYL ACETATE (EVA)

8.5.6 OTHERS

8.6 OTHERS

9 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 FLEXIBLE PACKAGING

9.2.1 CORRUGATED

9.2.2 LAMINATED FOIL

9.2.3 OTHERS

9.3 RIGID PACKAGING

9.3.1 BOXBOARD

9.3.2 TRAYS

9.3.3 CONTAINERS

9.3.4 OTHERS

9.4 OTHERS

10 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 TRANSPORTATION

10.2.1 TRANSPORTATION, BY MATERIAL TYPE

10.2.1.1 PAPER

10.2.1.2 WOOD

10.2.1.3 MOLDED FIBER / PULP

10.2.1.3.1 CARDBOARD

10.2.1.3.2 RECYCLED PAPER

10.2.1.3.3 NATURAL FIBER

10.2.1.3.3.1 SUGARCANE

10.2.1.3.3.2 BAMBOO

10.2.1.3.3.3 WHEAT STRAW

10.2.1.3.3.4 OTHERS

10.2.1.3.4 OTHERS

10.2.1.4 PLASTIC

10.2.1.4.1 POLYETHYLENE TEREPHTHALATE

10.2.1.4.2 POLYPROPYLENE (PP)

10.2.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.2.1.4.4 POLYSTYRENE

10.2.1.4.5 ETHYL VINYL ACETATE (EVA)

10.2.1.4.6 OTHERS

10.2.1.5 OTHERS

10.3 RETAILING

10.3.1 RETAILING, BY MATERIAL TYPE

10.3.1.1 PAPER

10.3.1.2 WOOD

10.3.1.3 MOLDED FIBER / PULP

10.3.1.3.1 CARDBOARD

10.3.1.3.2 RECYCLED PAPER

10.3.1.3.3 NATURAL FIBER

10.3.1.3.3.1 SUGARCANE

10.3.1.3.3.2 BAMBOO

10.3.1.3.3.3 WHEAT STRAW

10.3.1.3.3.4 OTHERS

10.3.1.3.4 OTHERS

10.3.1.4 PLASTIC

10.3.1.4.1 POLYETHYLENE TEREPHTHALATE

10.3.1.4.2 POLYPROPYLENE (PP)

10.3.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.3.1.4.4 POLYSTYRENE

10.3.1.4.5 ETHYL VINYL ACETATE (EVA)

10.3.1.4.6 OTHERS

10.3.1.5 OTHERS

10.4 FOOD SERVICES

10.4.1 FOOD SERVICES, BY MATERIAL TYPE

10.4.1.1 PAPER

10.4.1.2 WOOD

10.4.1.3 MOLDED FIBER / PULP

10.4.1.3.1 CARDBOARD

10.4.1.3.2 RECYCLED PAPER

10.4.1.3.3 NATURAL FIBER

10.4.1.3.3.1 SUGARCANE

10.4.1.3.3.2 BAMBOO

10.4.1.3.3.3 WHEAT STRAW

10.4.1.3.3.4 OTHERS

10.4.1.3.4 OTHERS

10.4.1.4 PLASTIC

10.4.1.4.1 POLYETHYLENE TEREPHTHALATE

10.4.1.4.2 POLYPROPYLENE (PP)

10.4.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.4.1.4.4 POLYSTYRENE

10.4.1.4.5 ETHYL VINYL ACETATE (EVA)

10.4.1.4.6 OTHERS

10.4.1.5 OTHERS

10.5 OTHERS

10.5.1 OTHERS, BY MATERIAL TYPE

10.5.1.1 PAPER

10.5.1.2 WOOD

10.5.1.3 MOLDED FIBER / PULP

10.5.1.3.1 CARDBOARD

10.5.1.3.2 RECYCLED PAPER

10.5.1.3.3 NATURAL FIBER

10.5.1.3.3.1 SUGARCANE

10.5.1.3.3.2 BAMBOO

10.5.1.3.3.3 WHEAT STRAW

10.5.1.3.3.4 OTHERS

10.5.1.3.4 OTHERS

10.5.1.4 PLASTIC

10.5.1.4.1 POLYETHYLENE TEREPHTHALATE

10.5.1.4.2 POLYPROPYLENE (PP)

10.5.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.5.1.4.4 POLYSTYRENE

10.5.1.4.5 ETHYL VINYL ACETATE (EVA)

10.5.1.4.6 OTHERS

10.5.1.5 OTHERS

11 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 MEXICO FRUIT PACKAGING MARKET, BY COUNTRY

12.1 MEXICO

13 MEXICO FRUIT PACKAGING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MEXICO

13.1.1 MERGERS & ACQUISITIONS

13.1.2 EXPANSIONS

13.1.3 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 INTERNATIONAL PAPER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 PACKAGING CORPORATION OF AMERICA

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 AMCOR PLC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 WESTROCK COMPANY

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 SMURFIT KAPPA

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 DS SMITH

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 HUHTAMAKI

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 MONDI

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 SEALED AIR

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 SONOCO PRODUCTS COMPANY

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS, HS CODE - 392310 (USD MILLION)

TABLE 2 EXPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS, HS CODE - 392310 (USD MILLION)

TABLE 3 REVENUE OF SUPPLIERS (USD MILLION) (2021)

TABLE 4 MOLDED FIBER MARKET SHARE, BY MATERIAL TYPE (2022 AND 2029) (IN %)

TABLE 5 MOLDED FIBER MARKET SHARE, BY APPLICATIONS (2022 AND 2029) (IN %)

TABLE 6 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (USD MILLION)

TABLE 7 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (MILLION UNITS)

TABLE 8 MEXICO BERRIES IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MEXICO TROPICAL FRUITS IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 11 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (MILLION UNITS)

TABLE 12 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 13 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 14 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 15 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 16 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 17 MEXICO FLEXIBLE PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 MEXICO RIGID PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 19 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (MILLION UNITS)

TABLE 21 MEXICO TRANSPORTATION IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 22 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 23 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 24 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 25 MEXICO RETAILING IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 26 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 27 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 28 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 29 MEXICO FOOD SERVICES IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 30 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 31 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 32 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 33 MEXICO OTHERS IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 34 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 35 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 36 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 37 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 39 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (USD MILLION)

TABLE 40 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (MILLION UNITS)

TABLE 41 MEXICO BERRIES IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MEXICO TROPICAL FRUITS IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 44 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (MILLION UNITS)

TABLE 45 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 46 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE , 2020-2029 (USD MILLION)

TABLE 47 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 48 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 50 MEXICO FLEXIBLE PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 MEXICO RIGID PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (MILLION UNITS)

TABLE 54 MEXICO TRANSPORTATION IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 55 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 56 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 57 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 58 MEXICO RETAILING IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 59 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 60 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 61 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO FOOD SERVICES IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 63 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 66 MEXICO OTHERS IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

Liste des figures

FIGURE 1 MEXICO FRUIT PACKAGING MARKET: SEGMENTATION

FIGURE 2 MEXICO FRUIT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO FRUIT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MEXICO FRUIT PACKAGING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 MEXICO FRUIT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO FRUIT PACKAGING MARKET: MATERIAL TYPE LIFE LINE CURVE

FIGURE 7 MEXICO FRUIT PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 MEXICO FRUIT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MEXICO FRUIT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MEXICO FRUIT PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MEXICO FRUIT PACKAGING MARKET: CHALLENGE MATRIX

FIGURE 12 MEXICO FRUIT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MEXICO FRUIT PACKAGING MARKET: SEGMENTATION

FIGURE 14 GROWING DEMAND FOR CONVENIENT AND FLEXIBLE PACKAGING IS DRIVING THE MEXICO FRUIT PACKAGING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 15 BANANA IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO FRUIT PACKAGING MARKET IN 2022 & 2029

FIGURE 16 MEXICO FRUIT PACKAGING MARKET- SUPPLY CHAIN ANALYSIS

FIGURE 17 MEXICO FRUIT PACKAGING MARKET- VALUE CHAIN ANALYSIS

FIGURE 18 MEXICO FRUIT PACKAGING MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MEXICO FRUIT PACKAGING MARKET

FIGURE 20 TOP FIVE LARGEST E-COMMERCE MARKETS IN 2019 (USD BILLION)

FIGURE 21 WASTE GENERATION BY PACKAGING MATERIAL IN 2019 IN EUROPE

FIGURE 22 MEXICO FRUIT PACKAGING MARKET: BY FRUIT TYPE, 2021

FIGURE 23 MEXICO FRUIT PACKAGING MARKET: BY MATERIAL TYPE, 2021

FIGURE 24 MEXICO FRUIT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 25 MEXICO FRUIT PACKAGING MARKET: BY APPLICATION, 2021

FIGURE 26 MEXICO FRUIT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 MEXICO FRUIT PACKAGING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.