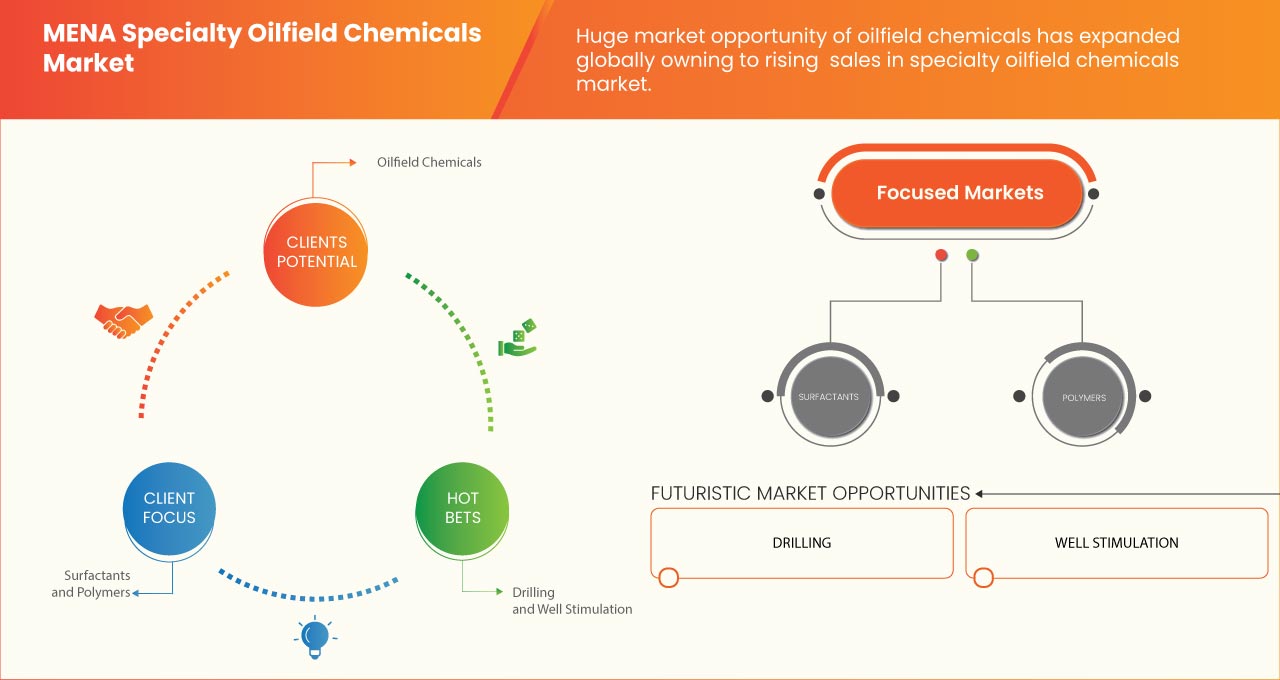

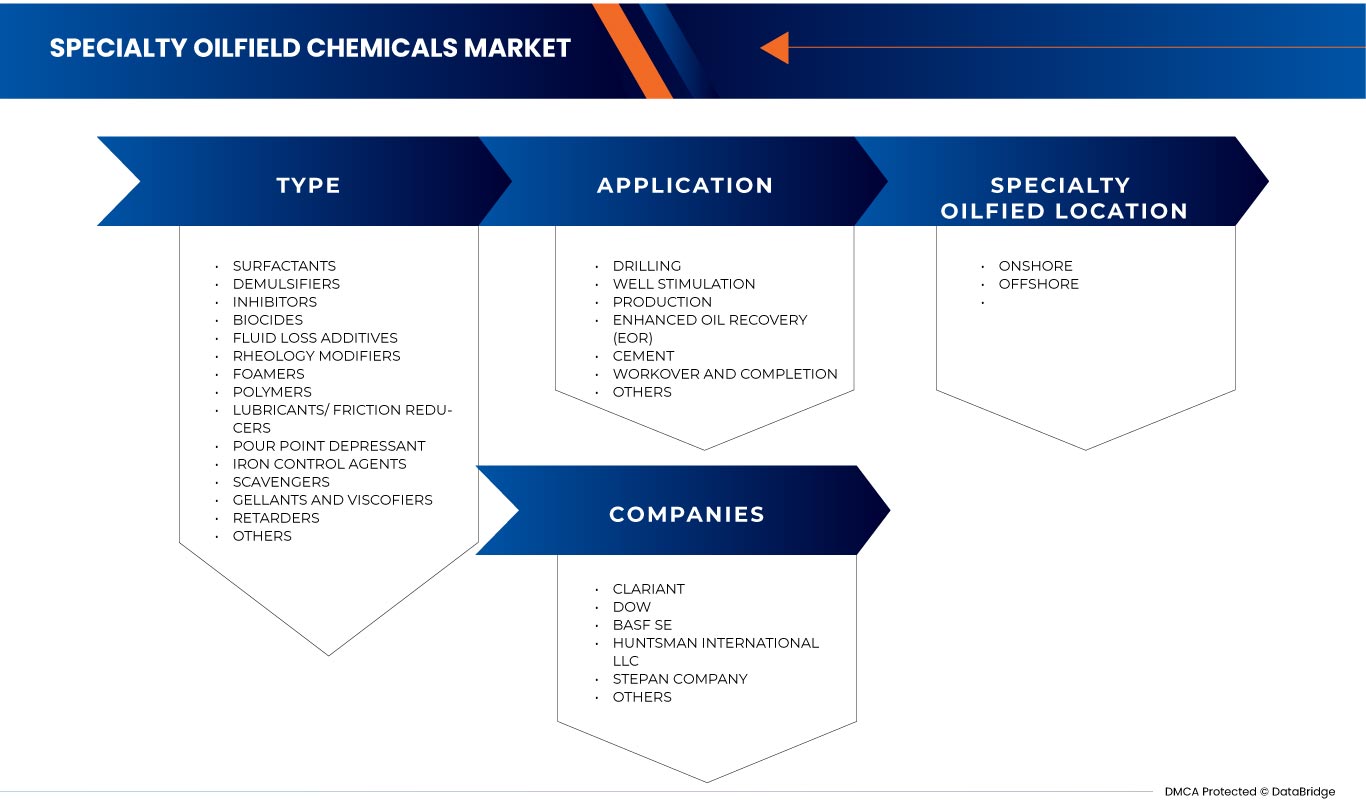

Marché des produits chimiques spécialisés pour champs pétrolifères de la région MENA, par type (tensioactifs, désémulsifiants, inhibiteurs, biocides , additifs de perte de fluides, modificateurs de rhéologie, moussants, polymères, lubrifiants/réducteurs de friction, abaisseur de point d'écoulement, agents de contrôle du fer, piégeur, gélifiants et viscoréducteurs, retardateurs et autres), par application (forage, stimulation de puits, production et récupération assistée du pétrole (EOR), ciment, reconditionnement et achèvement, et autres), emplacement des champs pétrolifères spécialisés (onshore et offshore) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des produits chimiques spécialisés pour les champs pétrolifères de la région MENA

L'industrie chimique moderne dépend fortement du pétrole brut et du gaz naturel comme matières premières. Le génie chimique et le génie pétrolier jouent un rôle important dans la production de produits pétroliers et gaziers. L'utilisation de produits chimiques spécialisés pour les champs pétrolifères permet de forer et d'exploiter plus efficacement les puits de pétrole et de gaz et d'améliorer la productivité des réservoirs du champ. Elle augmentera à mesure que l'industrie pétrolière deviendra de plus en plus dépendante de l'augmentation de la production de pétrole brut ou de produits pétroliers des champs existants.

Les produits chimiques spécialisés pour les champs pétrolifères sont fabriqués à partir de produits chimiques composés de différentes compositions chimiques qui aident à la séparation, à la liaison et au renforcement. Les produits chimiques spécialisés pour les champs pétrolifères sont des mélanges de composés chimiques naturels et synthétiques qui sont utilisés pour refroidir et lubrifier la foreuse, nettoyer le fond du trou de l'équipement de forage, transporter les déblais à la surface, contrôler les pressions de formation et contrôler les pressions de formation en fond de trou. Les produits chimiques spécialisés pour les champs pétrolifères ont des propriétés uniques qui font de ces produits la solution idéale dans de nombreuses applications différentes. Les produits chimiques spécialisés sont utilisés pour réduire le gonflement de la formation souterraine en présence d'eau.

Cependant, le prix du pétrole brut, dans la mesure où il affecte l'utilisation de produits chimiques spécialisés dans les champs pétrolifères pour l'extraction du pétrole brut, ainsi que les réglementations environnementales de plus en plus strictes et les problèmes géopolitiques, pourraient freiner la croissance du marché au cours de la période de prévision.

Les initiatives stratégiques croissantes des acteurs du marché offrent des opportunités de croissance au marché. Cependant, la forte concurrence dans les industries pétrolières et les longs délais d'obtention des qualifications à l'étranger constituent des défis majeurs pour la croissance du marché. Data Bridge Market Research analyse que le marché des produits chimiques spécialisés pour champs pétrolifères de la région MENA devrait atteindre une valeur de 241,80 millions USD d'ici 2030, à un TCAC de 4,1 % au cours de la période de prévision. Le type représente le segment de type de service le plus important du marché en raison de la demande croissante de produits chimiques spécialisés dans les sociétés pétrolières pour un meilleur traitement du pétrole et de l'eau. Ce rapport de marché couvre également l'analyse des prix, l'analyse des brevets et les avancées technologiques en profondeur.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Type (tensioactifs, désémulsifiants, inhibiteurs, biocides, additifs de perte de fluides , modificateurs de rhéologie, agents moussants, polymères, lubrifiants/réducteurs de friction, abaisseur de point d'écoulement , agents de contrôle du fer, piégeur, gélifiants, viscoréducteurs, retardateurs et autres), par application (forage, stimulation de puits, production et récupération assistée du pétrole (EOR), ciment, reconditionnement et achèvement et autres), emplacement du champ pétrolifère spécialisé (onshore et offshore) |

|

Pays couverts |

Arabie saoudite, Irak, Émirats arabes unis, Iran, Qatar, Koweït, Algérie, Libye, Égypte et le reste de la région MENA |

|

Acteurs du marché couverts |

Les principales entreprises qui opèrent sur le marché des produits chimiques spécialisés pour champs pétrolifères sont BASF SE, Solvay, Dow, Baker Hughes Company, Clariant, Evonik Industries AG, Kemira, Thermax Limited, Huntsman International LLC, Innospec, Stepan Company, EMEC, Chevron Phillips Chemical Company LLC, Versalis SpA, Halliburton, Albemarle Inc. et ChampionX entre autres. |

Définition du marché des produits chimiques spécialisés pour les champs pétrolifères de la région MENA

Les produits chimiques spécialisés pour les champs pétrolifères sont des produits chimiques couramment utilisés pour extraire efficacement le pétrole des ressources sans impacter l'environnement et les équipements. Les produits chimiques spécialisés pour les champs pétrolifères ont plusieurs fonctions positives telles que l'amélioration de la récupération du pétrole, l'optimisation du forage, la protection contre la corrosion, la prévention de la perte de boue dans différentes formations géologiques, la stabilisation du fluide de forage dans des environnements à haute pression et à haute température, etc. L'utilisation de ces produits chimiques contribue à accroître l'efficacité opérationnelle, à protéger les équipements et à améliorer les performances globales des opérations des champs pétrolifères à différentes phases de l'exploration, de la production, du transport et du raffinage du pétrole brut et du gaz naturel.

Dynamique du marché des produits chimiques spécialisés pour les champs pétrolifères de la région MENA

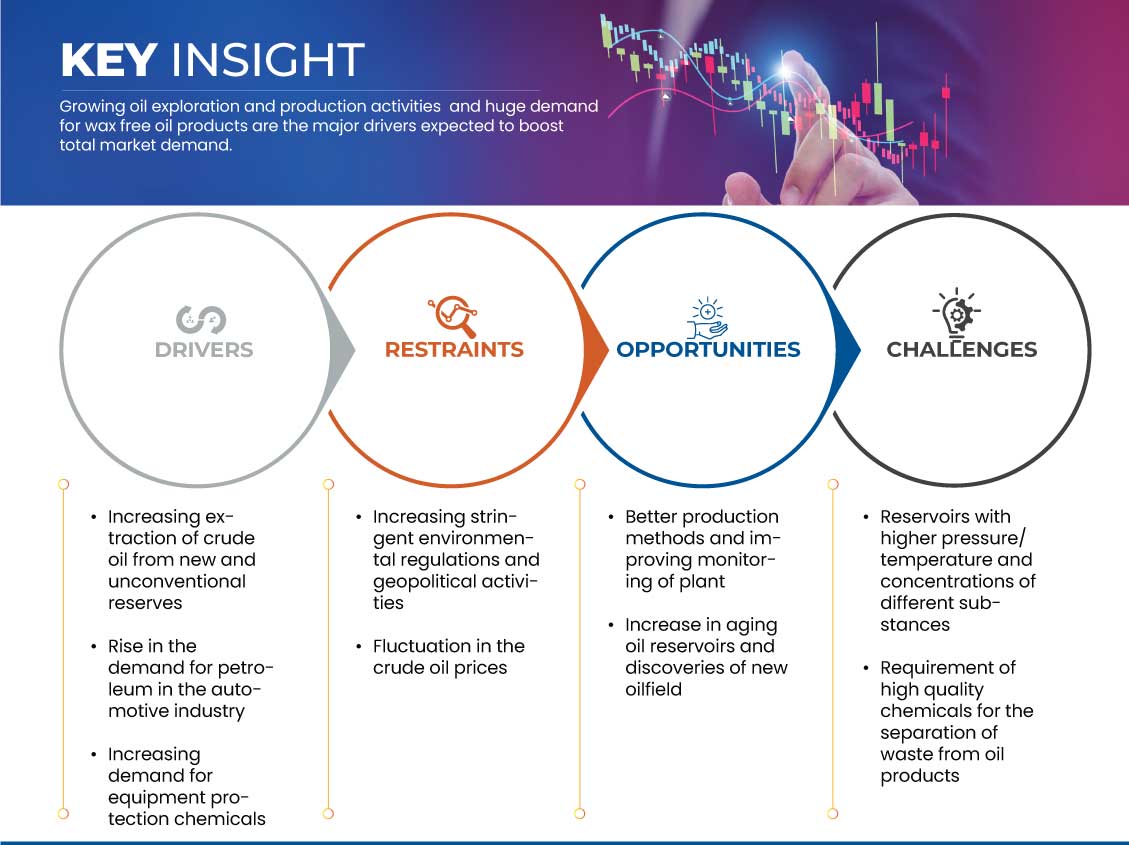

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de l'extraction de pétrole brut à partir de réserves nouvelles et non conventionnelles

Le pétrole brut est extrait des profondeurs terrestres par le biais de plusieurs procédés et de machines de forage géantes. Le pétrole brut se trouve dans de vastes réservoirs souterrains où se trouvaient d'anciennes mers. Les réservoirs de pétrole brut peuvent être trouvés sous terre ou au fond de l'océan. Le pétrole conventionnel est extrait des réservoirs souterrains à l'aide de méthodes de forage et de pompage traditionnelles. Le pétrole conventionnel est un liquide à température et pression atmosphériques. L'extraction de pétrole brut à partir de réserves non conventionnelles ne peut pas être récupérée à l'aide de méthodes de forage et de pompage traditionnelles.

Des techniques d'extraction avancées, telles que l'extraction et le forage des sables bitumineux, sont utilisées pour récupérer le pétrole plus lourd qui ne s'écoule pas de manière autonome. Les réserves non conventionnelles de pétrole léger (LTO) se trouvent profondément sous la surface de la terre, principalement dans des formations rocheuses à faible perméabilité, notamment des réservoirs de schiste, de grès et de mudstone. L'extraction du pétrole brut des réserves non conventionnelles utilise le forage horizontal et la fracturation hydraulique.

Les produits chimiques spécialisés pour les champs pétrolifères sont utilisés dans les machines et équipements utilisés pour extraire le pétrole brut des réserves. Plusieurs types de recherche sont également en cours pour trouver de nouvelles ressources pour le pétrole brut. À partir du pétrole brut, une large gamme de produits peut être créée : gaz, essence, kérosène, gazole et, finalement, asphalte. Les produits chimiques spécialisés pour les champs pétrolifères contribuent à l'extraction efficace du pétrole brut et réduisent le gaspillage de matériaux au cours des processus.

Ainsi, l’extraction croissante de pétrole brut à partir de réserves non conventionnelles augmentera la demande de produits chimiques spécialisés dans le secteur pétrolier dans une mesure plus significative, ce qui devrait stimuler la croissance du marché.

- Hausse de la demande de pétrole dans l'industrie automobile

L'industrie automobile est en constante croissance dans toutes les régions. La demande de voitures, de véhicules utilitaires lourds et de deux-roues a augmenté, ce qui a stimulé la croissance de l'industrie automobile. Les moteurs des véhicules fonctionnent avec des produits pétroliers. La demande d'automobiles a augmenté dans les pays en développement, ce qui a stimulé le besoin de produits pétroliers.

Les produits pétroliers sont extraits du pétrole brut par plusieurs procédés. Plusieurs types de produits chimiques spécialisés pour les champs pétrolifères sont utilisés au cours des processus de séparation des sous-produits du pétrole brut. Les produits chimiques spécialisés pour les champs pétrolifères augmentent l'efficacité des opérations, ce qui permet de produire des produits pétroliers de qualité souhaitable.

En conclusion, la demande croissante de produits pétroliers pour différents secteurs augmentera le besoin de produits chimiques spécialisés pour les champs pétrolifères pour la production de pétrole dans les industries de raffinage, ce qui devrait stimuler la croissance du marché.

Retenue

- Des réglementations environnementales de plus en plus strictes et des enjeux géopolitiques

Les forages pétroliers et gaziers ont de graves répercussions sur nos espaces sauvages et nos communautés. Les projets de forage se déroulent 24 heures sur 24, générant de la pollution, alimentant le changement climatique, perturbant la faune et endommageant les terres publiques. Les règles concernant les forages dans plusieurs régions deviennent de plus en plus strictes. Les forages ont un impact plus important sur l'environnement. L'augmentation des activités d'exploration pétrolière et gazière sans données de base suffisantes sur les écosystèmes des grands fonds marins a posé des défis en matière de gestion environnementale.

Les infrastructures construites pour l’extraction de pétrole et de gaz peuvent avoir des conséquences radicales sur les zones sauvages. La construction de routes, d’installations et de sites de forage nécessite un équipement lourd et peut détruire de vastes pans de nature sauvage vierge. Les grandes marées noires tuent la faune et peuvent causer des dommages durables aux écosystèmes marins.

Les fluides de forage injectés dans les puits pour la lubrification sont censés être récupérés dans des fosses revêtues pour être éliminés. Cependant, les produits chimiques spéciaux des champs pétroliers fuient souvent et sont éclaboussés autour des sites de forage, ce qui a un impact sur l'environnement. L'impact croissant des réservoirs et des produits chimiques sur l'écosystème diminue la demande de produits chimiques spéciaux pour les champs pétroliers.

En conclusion, une plus grande fluctuation du prix du pétrole brut entraînera des pertes pour les fabricants qui n'investiront pas davantage sur le marché. L'instabilité de la demande de produits pétroliers devrait freiner la croissance du marché.

Opportunité

- De meilleures méthodes de production et une meilleure surveillance des installations

Dans les industries pétrolières et gazières, les fabricants se tournent vers de meilleures méthodes et techniques de production qui peuvent améliorer la qualité du produit. Les équipements utilisés dans l'extraction du pétrole brut et le traitement du pétrole brut pour divers produits sont de plus en plus automatisés. La haute qualité des équipements est utilisée dans l'extraction du pétrole brut. L'adoption de nouvelles techniques de production dans l'usine d'extraction de pétrole augmentera la demande de produits chimiques spécialisés pour les champs pétrolifères.

Une surveillance régulière de l'usine contribuera également à réduire le coût de remplacement de l'équipement et les pertes. Lors de la production de produits pétroliers, plusieurs types de produits chimiques toxiques sont également excrétés, ce qui affecte la vie de l'usine. La surveillance régulière de l'usine n'aura aucun impact sur la qualité du produit et la capacité de production de l'équipement peut également augmenter. Le produit chimique spécialisé pour champs pétrolifères est appliqué sur la surface conformément aux suggestions de surveillance.

Ainsi, l’adoption de nouvelles techniques de production et la surveillance régulière de l’usine augmenteront la demande de produits chimiques spécialisés pour les champs pétroliers, ce qui devrait créer des opportunités de croissance du marché.

Défis

- Réservoirs avec des pressions/températures plus élevées et des concentrations de différentes substances

Les réservoirs se trouvent en profondeur dans la mer ou sur terre, là où le pétrole brut est extrait. Les flaques sont présentes dans différentes zones qui subissent une pression supplémentaire sous la terre. D'autres types de gaz sont présents à l'intérieur de la surface terrestre, augmentant la température des réservoirs. La concentration de différentes substances est également présente dans les flaques, ce qui constitue un défi pour les produits chimiques spécialisés des champs pétroliers.

Les fluctuations de pression et de température du réservoir affectent la conception et le fonctionnement du pipeline. La pression du réservoir est directement liée à la pression de la tête de puits, ce qui peut affecter la pression de fonctionnement du pipeline. Une pression de réservoir très élevée peut nécessiter une métallurgie spéciale pour la tuyauterie et des produits chimiques spéciaux pour les champs pétrolifères, ce qui peut augmenter considérablement le coût des matériaux. La présence de températures extrêmement élevées ou basses peut également éliminer la flexibilité de conception.

Le défi auquel sont confrontés les produits chimiques spécialisés pour les champs pétrolifères est de résister à un environnement hostile. Le fluide de forage doit être chimiquement stable et non corrosif dans des conditions de pression et de température élevées. Le comportement physique et chimique du ciment change considérablement à des températures et des pressions élevées.

En conclusion, les conditions de pression et de température élevées et la concertation de différentes substances dans les réservoirs devraient remettre en cause la croissance du marché.

Développements récents

- En août 2021, BASF SE et SINOPEC ont poursuivi l'expansion de leur site Verbund à Nanjing, en Chine, ce qui a permis d'augmenter la production de plusieurs usines chimiques en aval. Ce développement a permis à l'entreprise d'augmenter rapidement ses revenus

- En novembre 2019, Baker Hughes Company a décidé d'étendre ses capacités de fabrication de produits chimiques avec une nouvelle usine en Arabie saoudite. Ce développement a aidé l'entreprise à répondre à la demande croissante de produits chimiques dans différentes applications

- En septembre 2019, Evonik Industries AG a décidé d'augmenter la capacité de production de produits chimiques de spécialité en Allemagne et a décidé d'investir 441,00 millions USD dans le projet. Ce développement a aidé l'entreprise à augmenter ses locaux et sa capacité de production

Portée du marché des produits chimiques spécialisés pour les champs pétrolifères de la région MENA

Le marché des produits chimiques spécialisés pour les champs pétrolifères de la région MENA est segmenté en type, localisation et application. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Par type

- Tensioactifs

- Désémulsifiants

- Inhibiteurs

- Biocides

- Additifs pour perte de fluides

- Modificateurs de rhéologie

- Mousseurs

- Polymères

- Lubrifiants/Réducteurs de friction

- Abaisseur de point d'écoulement

- Agents de contrôle du fer

- Charognard

- Gélifiants et viscosifiants

- Retardateurs

- Autres

Sur la base du type, le marché des produits chimiques spécialisés pour champs pétroliers de la région MENA est segmenté en tensioactifs, désémulsifiants, inhibiteurs, biocides, additifs de perte de fluides, modificateurs de rhéologie, moussants, polymères, lubrifiants/ réducteurs de friction , abaisseur de point d'écoulement, agents de contrôle du fer, piégeurs, gélifiants et viscofiants, retardateurs et autres.

Par emplacement

- À terre

- Offshore

Sur la base de l'emplacement des champs pétrolifères spécialisés, le marché des produits chimiques spécialisés pour les champs pétrolifères de la région MENA est segmenté en onshore et offshore.

Par application

- Forage

- Stimulation de puits

- Production

- Récupération assistée du pétrole (RAP)

- Ciment

- Reconditionnement et achèvement

- Autres

Sur la base de l'application, le marché des produits chimiques spécialisés pour champs pétroliers de la région MENA est segmenté en forage, stimulation de puits, production, récupération assistée du pétrole (EOR), ciment, reconditionnement et complétion, et autres.

Analyse/perspectives régionales du marché des produits chimiques spécialisés pour champs pétrolifères de la région MENA

Le marché des produits chimiques spécialisés pour champs pétrolifères de la région MENA est analysé et des informations sur la taille du marché sont fournies pour le type, l'emplacement et l'application. Les pays couverts par ce rapport de marché sont l'Arabie saoudite, l'Irak, les Émirats arabes unis, l'Iran, le Qatar, le Koweït, l'Algérie, la Libye, l'Égypte et le reste de la région MENA.

Le segment de l'Arabie saoudite devrait dominer le marché des produits chimiques spécialisés pour les champs pétrolifères de la région MENA, car les entreprises étendent leurs capacités de production et concluent des accords dans différentes régions pour répondre à la demande croissante de produits chimiques spécialisés pour les champs pétrolifères dans l'industrie pétrolière et gazière.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des produits chimiques spécialisés pour champs pétrolifères de la région MENA

Le paysage concurrentiel du marché des produits chimiques spécialisés pour les champs pétrolifères de la région MENA fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché des produits chimiques spécialisés pour les champs pétrolifères de la région MENA.

Certains des principaux acteurs opérant sur le marché des produits chimiques spécialisés pour champs pétrolifères de la région MENA sont BASF SE, Solvay, Dow, Baker Hughes Company, Clariant, Evonik Industries AG, Kemira, Thermax Limited, Huntsman International LLC, Innospec, Stepan Company, EMEC, Chevron Phillips Chemical Company LLC, Versalis SpA, Halliburton, Albemarle Inc., ChampionX, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MENA SPECIALTY OILFIELD CHEMICALS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER FIVE FORCES ANALYSIS

4.3 RAW MATERIAL COVERAGE

4.3.1 PRODUCTION CONSUMPTION ANALYSIS

4.3.2 IMPORT-EXPORT SCENARIO

4.3.3 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.3.4 VENDOR SELECTION CRITERIA

4.4 REGULATORY COVERAGE

4.4.1 PRODUCT CODES

4.4.2 CERTIFIED STANDARDS

4.4.3 SAFETY STANDARDS

4.4.3.1 MATERIAL AND HANDLING

4.4.3.2 TRANSPORTATION AND PRECAUTION

4.4.3.3 TRANSPORTATION AND PRECAUTION

4.5 PRODUCTION INSIGHTS

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT’S ROLE

5.4 ANALYST RECOMMENDATIONS

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 LOGISTIC COST SCENARIO

7.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASING EXTRACTION OF CRUDE OIL FROM NEW AND UNCONVENTIONAL RESERVES

8.1.2 RISE IN THE DEMAND FOR PETROLEUM IN THE AUTOMOTIVE INDUSTRY

8.1.3 INCREASING DEMAND FOR EQUIPMENT PROTECTION CHEMICALS

8.1.4 HUGE DEMAND FOR WAX-FREE OIL PRODUCTS

8.1.5 GROWING OIL EXPLORATION & PRODUCTION ACTIVITIES

8.2 RESTRAINTS

8.2.1 INCREASING STRINGENT ENVIRONMENTAL REGULATIONS AND GEOPOLITICAL ISSUES

8.2.2 FLUCTUATION IN THE CRUDE OIL PRICES

8.3 OPPORTUNITIES

8.3.1 BETTER PRODUCTION METHODS AND IMPROVING MONITORING OF PLANT

8.3.2 INCREASE IN AGING OIL RESERVOIRS AND DISCOVERIES OF NEW OIL FIELDS

8.3.3 GROWING DEEP-WATER & ULTRA-DEEP-WATER DRILLING PROJECTS

8.4 CHALLENGES

8.4.1 RESERVOIRS HIGHER PRESSURES/TEMPERATURE AND CONCENTRATIONS OF DIFFERENT SUBSTANCES

8.4.2 REQUIREMENT OF HIGH-QUALITY CHEMICALS FOR THE SEPARATION OF WASTE FROM OIL PRODUCTS

9 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY TYPE

9.1 OVERVIEW

9.2 SURFACTANTS

9.3 DEMULSIFIERS

9.4 INHIBITORS

9.4.1 SCALE INHIBITORS

9.4.2 ACID COROSSION INHIBITORS

9.5 BIOCIDES

9.6 FLUID LOSS ADDITIVES

9.7 RHEOLOGY MODIFIERS

9.8 FOAMERS

9.9 POLYMERS

9.1 LUBRICANTS/ FRICTION REDUCERS

9.11 POUR POINT DEPRESSANT

9.12 IRON CONTROL AGENTS

9.13 SCAVENGER

9.14 GELLANTS AND VISCOSIFIERS

9.15 RETARDERS

9.16 OTHERS

10 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DRILLING

10.3 WELL STIMULATION

10.4 PRODUCTION

10.5 ENHANCED OIL RECOVERY (EOR)

10.6 CEMENT

10.7 WORKOVER & COMPLETION

10.8 OTHERS

11 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY SPECIALTY OILFIELD LOCATION

11.1 OVERVIEW

11.2 ONSHORE

11.3 OFFSHORE

12 MENA SPECIALTY OILFIELD CHEMICALS MARKET BY COUNTRIES

12.1 SAUDI ARABIA

12.2 IRAQ

12.3 UNITED ARAB EMIRATES

12.4 IRAN

12.5 KUWAIT

12.6 QATAR

12.7 ALGERIA

12.8 LIBYA

12.9 EGYPT

12.1 REST OF MENA

13 MENA SPECIALTY OILFIELD CHEMICALS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MENA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CLARIANT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 DOW

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 BASF SE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 HUNTSMAN INTERNATIONAL LLC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 STEPAN COMPANY

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ALBEMARLE INC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 BAKER HUGHES COMPANY

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 COMPANY SHARE ANALYSIS

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENT

15.8 CHAMPIONX

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 CHEVRON PHILLIPS CHEMICAL COMPANY LLC

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 EMEC

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 EVONIK INDUSTRIES AG

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 HALLIBURTON

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 COMPANY SHARE ANALYSIS

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENT

15.13 INNOSPEC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 KEMIRA

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 MULTICHEM INDUSTRIES LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 SOLVAY

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 COMPANY SHARE ANALYSIS

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENT

15.17 THERMAX LIMITED

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 VERSALIS S.P.A.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

16 QUESTIONNAIRES

17 RELATED REPORTS

Liste des tableaux

TABLE 1 U.A.E PRODUCT CODE-

TABLE 2 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY TYPE, 2021-2030 (KILO TONNES)

TABLE 4 MENA INHIBITORS IN SPECIALTY OIL FIELD CHEMICALS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 6 MENA SPECIALTY OIL FIELD CHEMICALS MARKET, BY SPECILATY OILFILED LOCATION, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 MENA SPECIALTY OILFIELD CHEMICALS MARKET: SEGMENTATION

FIGURE 2 MENA SPECIALTY OILFIELD CHEMICALS MARKET: DATA TRIANGULATION

FIGURE 3 MENA SPECIALTY OILFIELD CHEMICALS MARKET: DROC ANALYSIS

FIGURE 4 MENA SPECIALTY OILFIELD CHEMICALS MARKET: REGIONAL VS. COUNTRY MARKET ANALYSIS

FIGURE 5 MENA SPECIALTY OILFIELD CHEMICALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MENA SPECIALTY OILFIELD CHEMICALS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MENA SPECIALTY OILFIELD CHEMICALS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MENA SPECIALTY OILFIELD CHEMICALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MENA SPECIALTY OILFIELD CHEMICALS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MENA SPECIALTY OILFIELD CHEMICALS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MENA SPECIALTY OILFIELD CHEMICALS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MENA SPECIALTY OILFIELD CHEMICALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MENA SPECIALTY OILFIELD CHEMICALS MARKET: SEGMENTATION

FIGURE 14 INCREASING EXTRACTION OF CRUDE OIL FROM NEW AND UNCONVENTIONAL RESERVES IS EXPECTED TO DRIVE THE MENA SPECIALTY OILFIELD CHEMICALS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 SURFACTANTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MENA SPECIALTY OILFIELD CHEMICALS MARKET IN 2022 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MENA SPECIALTY OILFIELD CHEMICALS MARKET

FIGURE 17 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY TYPE, 2022

FIGURE 18 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 19 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 20 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY APPLICATION, 2022

FIGURE 22 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 23 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 24 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 25 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY SPECILATY OILFILED LOCATION, 2022

FIGURE 26 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY SPECILATY OILFILED LOCATION, 2023-2030 (USD MILLION)

FIGURE 27 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY SPECILATY OILFILED LOCATION, CAGR (2023-2030)

FIGURE 28 MENA SPECIALTY OIL FIELD CHEMICALS MARKET: BY SPECILATY OILFILED LOCATION, LIFELINE CURVE

FIGURE 29 MENA SPECIALTY OILFIELD CHEMICALS MARKET: SNAPSHOT (2022)

FIGURE 30 MENA SPECIALTY OILFIELD CHEMICALS MARKET: BY COUNTRY (2022)

FIGURE 31 MENA SPECIALTY OILFIELD CHEMICALS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 MENA SPECIALTY OILFIELD CHEMICALS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 MENA SPECIALTY OILFIELD CHEMICALS MARKET: BY TYPE (2023-2030)

FIGURE 34 MENA SPECIALTY OILFIELD CHEMICALS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.