Latin America G Csf Peg G Csf Market

Taille du marché en milliards USD

TCAC :

%

| 2024 –2030 | |

| Dollars américains 430.97 | |

|

|

|

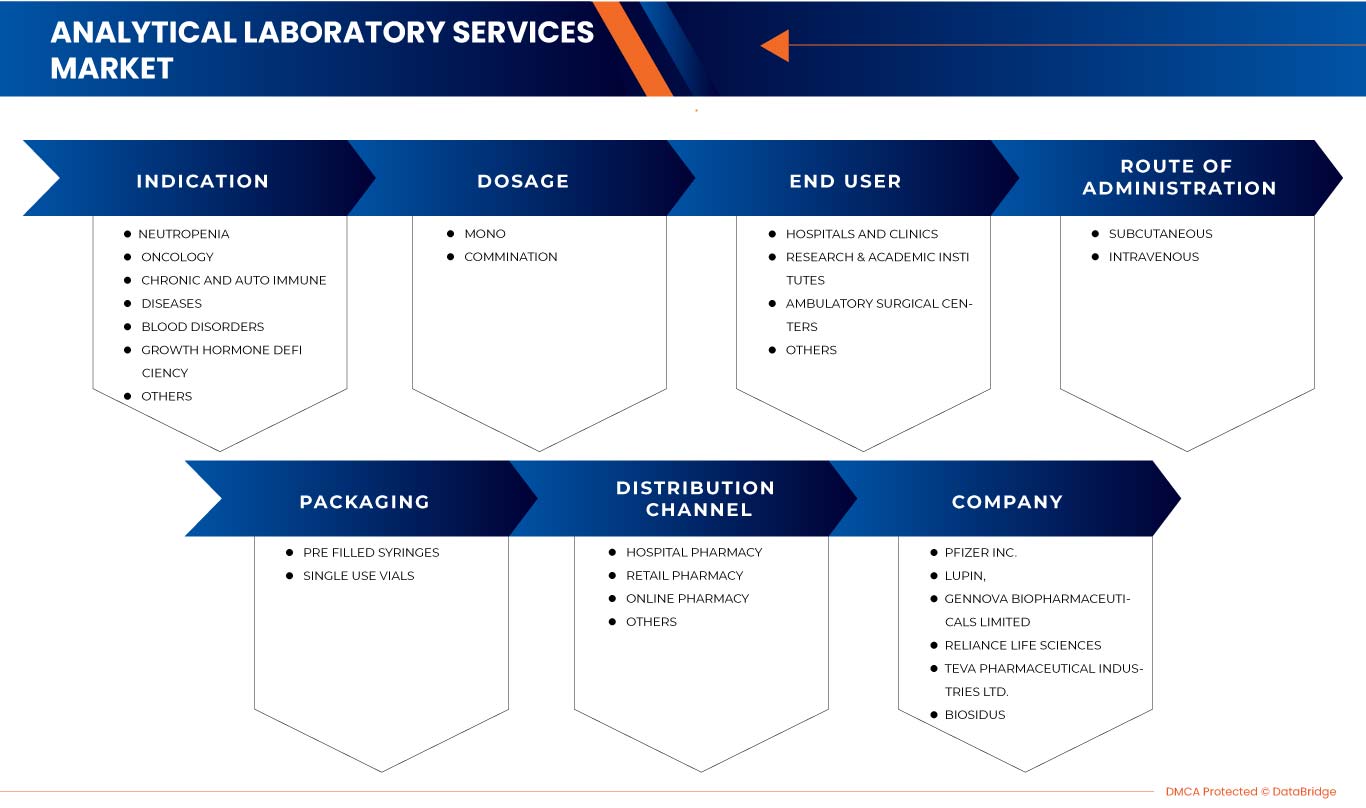

>Marché du G-CSF/PEG-G-CSF en Amérique latine, par indication ( neutropénie , oncologie, maladies chroniques et auto-immunes, troubles sanguins, déficit de l'harmonie de croissance et autres), dosage (mono et combiné), voie d'administration (intraveineuse, sous-cutanée), conditionnement (flacons à usage unique et seringues préremplies), utilisateur final (hôpitaux et cliniques, instituts de recherche et universitaires, centres de chirurgie ambulatoire et autres), canal de distribution (pharmacie hospitalière, pharmacie en ligne, pharmacie de détail et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du G-CSF/PEG-G-CSF en Amérique latine

Français L'augmentation de la prévention du cancer dans les pays développés et les gouvernements ont lancé des initiatives conscientes pour éduquer au traitement précoce, favorisant le marché de vente en Amérique latine du G-CSF biosimilaire. Grafeel, Colstim, Neukine et Filcad, qui sont des biosimilaires approuvés et sont également rentables et facilement disponibles dans les pays en développement, entraîneront une croissance significative du marché. La Chine et l'Inde sont les pays où le nombre de patients atteints de cancer augmente, ce qui est susceptible de stimuler le marché latino-américain. Ainsi, l'utilisation de biosimilaires contribue à réduire les coûts de santé des patients par rapport à l'utilisation de produits biologiques originaux, ce qui augmente la demande sur le marché de vente des biosimilaires du G-CSF en Amérique latine. En raison des processus de fabrication biologique complexes des biosimilaires individuels, les coûts des biosimilaires ne sont pas aussi bas que ceux des génériques. La prévalence croissante des maladies auto-immunes et chroniques rares devrait stimuler la croissance du marché segmentaire.

Data Bridge Market Research analyse que le marché latino-américain du G-CSF/PEG-G-CSF devrait atteindre la valeur de 430,97 millions USD d'ici 2030, à un TCAC de 4,6 % au cours de la période de prévision. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par indication (neutropénie, oncologie, maladies chroniques et auto-immunes, troubles sanguins, déficit de l'harmonie de croissance et autres), dosage (mono et combiné), voie d'administration (intraveineuse, sous-cutanée), conditionnement (flacons à usage unique et seringues préremplies), utilisateur final (hôpitaux et cliniques, instituts de recherche et universitaires, centres de chirurgie ambulatoire et autres), canal de distribution (pharmacie hospitalière, pharmacie en ligne, pharmacie de détail et autres) |

|

Pays couverts |

Mexique, Colombie, Brésil, Argentine, Chili, Pérou, Équateur, reste de l'Amérique latine |

|

Acteurs du marché couverts |

USV Private Limited, Viatris Inc., Biocon, Fresenius Kabi AG, Hangzhou Jiuyuan Gene Engineering Co., Ltd., Amgen Inc., Pfizer Inc., Sandoz International GmbH, Apotex Inc., Cadila Pharmaceuticals, Dr. Reddy’s Laboratories Ltd., Amneal Pharmaceuticals LLC., Coherus BioSciences, Accord Healthcare, NAPP PHARMACEUTICALS LIMITED., Intas Pharmaceuticals Ltd., Mundipharma International, Teva Pharmaceutical Industries Ltd., Spectrum Pharmaceuticals, Inc., Kyowa Kirin Co., Ltd., Jiangsu Hengrui Pharmaceuticals Co., Ltd., among others. |

Latin America G-CSF/ PEG-G-CSF Market Definition

Granulocyte colony-stimulating factor (G-CSF) is a medication used to treat neutropenia. This is a disease in which the number of white blood cells is lower than average and is caused by some forms of chemotherapy. The main types of G-CSF are lenograstim (Granocyte), filgrastim (Neupogen, zarzio, nivestim, accofil), long-acting (pegylated) filgrastim (pegfilgrastim, neulasta, pelmeg, ziextenco), and lipegfilgrastim (lonquex). Lenograstim is a glycosylated recombinant therapeutic agent that is chemically similar or identical to naturally occurring human granulocyte colony-stimulating factor (G-CSF). Various products include tablets and capsules and treat cancer, blood disorders, growth hormone deficiency, and chronic and autoimmune diseases.

Latin America G-CSF/ PEG-G-CSF Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing incidences of blood cancers and cancer diseases

Cancer is a general term for many diseases that can affect any part of the body. Other terms used for cancer are malignant tumors and neoplasm. One of the characteristics of cancer is the rapid formation of abnormal cells that grow beyond normal limits and can invade neighboring parts of the body and spread to other organs; the latter process is called metastasis. Extensive metastases are the leading cause of cancer death.

Filgrastim is a granulocyte colony-stimulating factor (GCSF) that helps increase the number of neutrophils in the blood. Filgrastim and pegfilgrastim are highly used to increase white blood cells after cancer chemotherapy or radiation therapy.

- Increasing cases of febrile neutropenia

Febrile neutropenia refers to fever during significant neutropenia. If a patient is neutropenic, their risk of infection may be higher than usual, and the severity of a particular infection may also be higher. Febrile neutropenia is the most common life-threatening complication of cancer treatment; its treatment is often an oncological emergency.

Febrile neutropenia is neutropenia accompanied by fever. Neutropenia refers to a decrease in the concentration of neutrophils in the blood. Neutrophils are a type of white blood cell that help fight infections as part of the immune system. The Infectious Diseases Society of America defines neutropenia as an absolute neutrophil count (ANC) of less than 1500 cells/mm3. The risk of infection and neutropenic fever increases dramatically with severe neutropenia, defined as an absolute neutrophil count (ANC) of less than 500 cells/mm3. Fever is defined as a single oral temperature greater than or equal to 101° Fahrenheit (38.3° Celsius) or a persistent temperature greater than or equal to 100.4° Fahrenheit (38.0° Celsius) or greater for one hour or longer.

Restraint

- Stringent Governmental Regulations

Pharmaceutical companies developing biosimilars such as filgrastim face a major challenge in the approval process for their products. Each country has a different approval process for all drugs, treatments, vaccines, and medical devices. However, these approval procedures are difficult to follow. This is due to the various regulations and evidence required to prove the effectiveness and safety of the product.

European Medicines Agency regulatory requirements ensure the same high quality, safety, and efficacy standards for biosimilars as for originator biologicals. They also include a rigorous comparability exercise with the reference product but are not universally accepted by regulatory bodies outside the European Union (EU). It should be noted that 'similar biologics' approved in India, 'biogenerics' approved in Iran, 'medicamento biológico similares' approved in Argentina, and non-originator biologicals approved in South Africa might not have been authorized if they had been subjected to the strict regulatory processes required for approval of biosimilars in the EU.

Opportunity

- The use of biosimilars helps reduce healthcare costs for patients

Biosimilars have the potential to fundamentally change healthcare by providing more affordable, equally effective treatments for patients and providing more treatment options for physicians. Developing biosimilars requires rigorous analysis to demonstrate their equivalence to the reference product and ensure no clinically meaningful differences in their safety, efficacy, and purity. As a result, health systems can channel long-term savings into overall improvements in patient care. To help create a thriving biosimilar market and ensure patient access, policymakers can take steps to reduce or eliminate the cost of biosimilars and encourage physicians to prescribe biosimilars compared to Europe.

Challenge

- Multiple side effects of G-CSF

Granulocyte colony-stimulating factor (G-CSF) is a drug used to treat neutropenia, a disorder in which certain forms of chemotherapy cause a lower-than-average number of white blood cells. G-CSF is a type of growth factor that makes the bone marrow produce more white blood cells to reduce the risk of infection after some types of cancer treatment. But there are multiple side effects of G-CSF, such as bone or muscle pain, Bruising, bleeding gums or nosebleeds, diarrhea, high temperature (fever), breathlessness and looking pale, sore mouth, throat, gut and back passage, and, among others. These side effects can be seen in more than 10 in 100 people (more than 10%).

According to a study performed by NCBI, most normal donors receiving G-CSF experience side effects, but these are mild to moderate in degree. Ninety percent of donors experienced some side effects of G-CSF. The most frequent effects noted were bone pain (83%), headache (39%), body aches (23%), fatigue (14%), and nausea and vomiting (12%), which is expected to act as a challenge for market growth.

Post-COVID-19 Impact on Latin America G-CSF/ PEG-G-CSF Market

The COVID-19 pandemic has had somewhat positive impact on the G-CSF/ PEG-G-CSF market. The pandemic has imposed new norms and regulations, such as social distancing and lockdowns, to prevent the spread of the virus. As a result, people all over the world were forced to stay at home, which led to new trends such as work at home. This stay at home has led decrease in diagnosis and prognosis of diseases. The increased focus on self-care, exercise and health has helped fitness apps and platforms gain significant traction in the wake of the pandemic.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launch and strategic partnerships to improve the technology and test results involved in the transplant diagnostics market.

Recent Developments

- In July 2018, Accord Healthcare, a subsidiary of Intas Pharmaceuticals Ltd., launched a pegfilgrastim biosimilar across Europe after being given Green Light for Pelgraz® (pegfilgrastim) by CHMP (Committee for Medicinal Products for Human Use). This product launched helped the company to expand their business across Europe.

- In March 2022, Kashiv Biosciences announced the approval of its Biologics License Application (BLA) for filgrastim-ayow, a biosimilar referencing Neupogen by U.S. Food and Drug Administration (FDA). The product is marketed under the proprietary name RELEUKO.

Latin America G-CSF/ PEG-G-CSF Market Scope

Latin America G-CSF/ PEG-G-CSF market is segmented into indication, dosage, route of administration, packaging, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

LATIN AMERICA G-CSF / PEG-G-CSF MARKET, BY INDICATION

- Neutropenia

- Oncology

- Chronic And Autoimmune Diseases

- Blood Disorders

- Growth Hormone Deficiency

- Others

On the basis of indication the Latin America G-CSF/PEG-G-CSF is further segmented into neutropenia, oncology, chronic and autoimmune diseases, blood disorders, growth hormone deficiency and others.

LATIN AMERICA G-CSF / PEG-G-CSF MARKET, BY DOSAGE

- Mono

- Combination

On the basis of dosage the Latin America G-CSF/PEG-G-CSF is further segmented into mono and combination.

LATIN AMERICA G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION

- Intravenous

- Subcutaneous

On the basis of route of administration the Latin America G-CSF/PEG-G-CSF is further segmented into intravenous and subcutaneous.

LATIN AMERICA G-CSF / PEG-G-CSF MARKET, BY PACKAGING

- Single Use Vials

- Pre Filled Syringes

On the basis of packaging the Latin America G-CSF/PEG-G-CSF is further segmented into single use vials and pre filled syringes.

LATIN AMERICA G-CSF / PEG-G-CSF MARKET, BY END USER

- Hospitals & Clinics

- Research & Academic Institutes

- Ambulatory Surgical Centers

- Others

On the basis of end user the Latin America G-CSF/PEG-G-CSF is further segmented into hospitals and clinics, research & academic institutes, ambulatory surgical centers and others.

LATIN AMERICA G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

- Others

On the basis of distribution channel the Latin America G-CSF/PEG-G-CSF is further segmented into hospital pharmacy, online pharmacy, retail pharmacy and others.

Latin America G-CSF/ PEG-G-CSF Market Regional Analysis/Insights

The Latin America G-CSF/ PEG-G-CSF market is analyzed and market size information is provided based on country, indication, dosage, route of administration, packaging, end user, and distribution channel.

The Latin America G-CSF/ PEG-G-CSF market comprises od the countries Mexico, Columbia, Brazil, Argentina, Chile, Peru, Ecuador, Rest of LATAM.

Mexico is dominating due to the presence of key market players in the largest consumer market with high GDP.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Latin America brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Latin America G-CSF/ PEG-G-CSF Market Share Analysis

Le paysage concurrentiel du marché du G-CSF/PEG-G-CSF en Amérique latine fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché du G-CSF/PEG-G-CSF en Amérique latine.

Français Certaines grandes entreprises présentes sur le marché sont USV Private Limited, Viatris Inc., Biocon, Fresenius Kabi AG, Hangzhou Jiuyuan Gene Engineering Co., Ltd., Amgen Inc., Pfizer Inc., Sandoz International GmbH, Apotex Inc., Cadila Pharmaceuticals, Dr. Reddy's Laboratories Ltd., Amneal Pharmaceuticals LLC., Coherus BioSciences, Accord Healthcare, NAPP PHARMACEUTICALS LIMITED., Intas Pharmaceuticals Ltd., Mundipharma International, Teva Pharmaceutical Industries Ltd., Spectrum Pharmaceuticals, Inc., Kyowa Kirin Co., Ltd., Jiangsu Hengrui Pharmaceuticals Co., Ltd., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF LATIN AMERICA G-CSF / PEG-G-CSF MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 LATIN AMERICA G-CSF/PEG-G-CSF MARKET: MERGERS AND ACQUISITION

4.4 LATIN AMERICA G-CSF / PEG-G-CSF MARKET

4.5 STRATEGIES TO THE ENTER THE MARKET

4.5.1 JOINT VENTURE (PARTNERSHIPS):

4.5.2 ACQUISITION:

4.5.3 LINE EXPANSION VIA COLLABORATION:

4.5.4 PRODUCT APPROVAL:

4.5.5 PRODUCT LAUNCH:

4.5.6 GEOGRAPHIC EXPANSION:

4.5.7 COST LEADERSHIP:

4.5.8 PRODUCT DEVELOPMENT:

4.6 LATIN AMERICA G-CSF / PEG-G-CSF MARKET, INDUSTRY INSIGHTS

4.6.1 PATENT ANALYSIS

4.6.2 DRUG TREATMENT RATE BY MATURED MARKETS

4.6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.6.4 THERAPEUTIC ASSESSMENT

4.6.5 KEY PRICING STRATEGIES

4.6.6 KEY PATIENT ENROLLMENT STRATEGIES

4.6.7 CONCLUSION

4.7 PIPELINE ANALYSIS FOR LATIN AMERICA G-CSF / PEG-G-CSF MARKET

5 EPIDEMIOLOGY

6 LATIN AMERICA G-CSF / PEG-G-CSF MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING INCIDENCES OF BLOOD CANCERS AND CANCER DISEASES

7.1.2 RISING INCIDENCES OF AUTOIMMUNE DISORDERS

7.1.3 INCREASING CASES OF FEBRILE NEUTROPENIA

7.1.4 INCREASING AWARENESS ABOUT FILGRASTIM AND PEGFILGRASTIM

7.2 RESTRAIN

7.2.1 STRINGENT GOVERNMENTAL REGULATIONS

7.2.2 AVAILABILITY OF ALTERNATIVES FOR THE CHEMOTHERAPY

7.3 OPPORTUNITIES

7.3.1 THE USE OF BIOSIMILARS HELPS REDUCE HEALTHCARE COSTS FOR PATIENTS

7.3.2 COST-EFFECTIVENESS AND PATENT EXPIRY OF BIOLOGICAL PRODUCTS

7.4 CHALLENGES

7.4.1 THE HIGH COST ASSOCIATED WITH BRANDED BIOLOGICS AND IMPROVED CHEMOTHERAPY

7.4.2 THE MULTIPLE SIDE EFFECTS OF G-CSF

8 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET, BY INDICATION

8.1 OVERVIEW

8.2 NEUTROPENIA

8.2.1 CHEMOTHERAPY INDUCED FEBRILE NEUTROPENIA (MYELOSUPPRESSIVE CHEMOTHERAPY TREATMENT)

8.2.2 SEVERE CHRONIC NEUTROPENIA

8.2.3 RADIOTHERAPY INDUCED NEUTROPENIA

8.2.4 NEUTROPENIA IN HIV PATIENTS

8.2.5 CLOZAPINE INDUCED NEUTROPENIA

8.2.6 NEUTROPENIA IN HEPATITIS C PATIENTS

8.2.7 CONGENITAL NEUTROPENIA

8.3 ONCOLOGY

8.3.1 ACUTE MYELOID LEUKEMIA RECEIVING CONSOLIDATION CHEMOTHERAPY

8.3.2 OTHERS

8.4 CHRONIC AND AUTO IMMUNE DISEASES

8.5 BLOOD DISORDERS

8.6 GROWTH HORMONE DEFICIENCY

8.7 OTHERS

9 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET, BY DOSAGE

9.1 OVERVIEW

9.2 MONO

9.3 COMBINATION

10 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION

10.1 OVERVIEW

10.2 SUBCUTANEOUS

10.3 INTRAVENOUS

11 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET, BY PACKAGING

11.1 OVERVIEW

11.2 PRE FILLED SYRINGES

11.3 SINGLE USE VIALS

12 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS AND CLINICS

12.3 RESEARCH & ACADEMIC INSTITUTES

12.4 AMBULATORY SURGICAL CENTERS

12.5 OTHERS

13 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 HOSPITALS PHARMACY

13.3 RETAIL PHARMACY

13.4 ONLINE PHARMACY

13.5 OTHERS

14 LATIN AMERICA G-CSF/PEG-G-CSF MARKET, BY REGION

14.1 LATIN AMERICA

14.1.1 MEXICO

14.1.2 COLUMBIA

14.1.3 BRAZIL

14.1.4 ARGENTINA

14.1.5 CHILE

14.1.6 PERU

14.1.7 ECUADOR

15 LATIN AMERICA G-CSF / PEG-G-CSF MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: LATIN AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PFIZER INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 VIATRIS INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 AMGEN INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 STADA ARZENEIMITTEL AG

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 TEVA PHARMACEUTICAL INDUSTRIES LTD.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 JIANGSU HENGRUI PHARMACEUTICALS CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ACCORD HEALTHCARE

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 AMNEAL PHARMACEUTICALS LLC.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 APOTEX INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 BIOCON

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 BIO SIDUS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 CADILA PHARMACEUTICALS

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 COHERUS BIOSCIENCES

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 DR. REDDY’S LABORATORIES LTD

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 FRESENIUS KABI AG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 GENNOVA BIOPHARMACEUTICALS LIMITED

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 HANGZHOU JIUYUAN GENE ENGINEERING CO., LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 INTAS PHARMACEUTICALS LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 KASHIV BIOSCIENCES, LLC.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 KYOWA KIRIN CO., LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

17.21 LUPIN

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENT

17.22 MUNDIPHARMA INTERNATIONAL.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 NAPP PHARMACEUTICALS LIMITED

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 RELIANCE LIFE SCIENCES

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 SANDOZ INTERNATIONAL GMBH

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENTS

17.26 SPECTRUM PHARMACEUTICALS, INC.

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 USV PRIVATE LIMITED

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 BELOW ARE THE RULES AND REGULATIONS TO GET APPROVAL FOR USE IN THE MARKET:

TABLE 2 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET, BY INDICATION, 2021-2030 (USD MILLION)

TABLE 3 LATIN AMERICA NEUTROPENIA IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 LATIN AMERICA NEUTROPENIA IN G-CSF/ PEG-G-CSF MARKET, BY INDICATION, 2021-2030 (USD MILLION)

TABLE 5 LATIN AMERICA ONCOLOGY IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 LATIN AMERICA ONCOLOGY IN G-CSF/ PEG-G-CSF MARKET, BY INDICATION, 2021-2030 (USD MILLION)

TABLE 7 LATIN AMERICA CHRONIC AND AUTO IMMUNE DISEASES IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 LATIN AMERICA BLOOD DISORDERS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 LATIN AMERICA GROWTH HORMONE DEFICIENCY IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 LATIN AMERICA OTHERS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET, BY DOSAGE, 2020-2029 (USD MILLION)

TABLE 12 LATIN AMERICA MONO IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 LATIN AMERICA COMBINATION IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 15 LATIN AMERICA SUBCUTANEOUS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 LATIN AMERICA INTRAVENOUS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 18 LATIN AMERICA PRE FILLED SYRINGES IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 LATIN AMERICA SINGLE USE VIALS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 LATIN AMERICA HOSPITALS AND CLINICS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 LATIN AMERICA RESEARCH & ACADEMIC INSTITUTES IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 LATIN AMERICA AMBULATORY SURGICAL CENTERS IN G-CSF/ PEG-G-CSFMARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 LATIN AMERICA OTHERS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 26 LATIN AMERICA HOSPITALS PHARMACY IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 LATIN AMERICA RETAIL PHARMACY IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 LATIN AMERICA ONLINE PHARMACY IN G-CSF/ PEG-G-CSFMARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 LATIN AMERICA OTHERS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 LATAM G-CSF / PEG-G-CSF MARKET, 2020-2030 (USD MILLION)

TABLE 31 LATAM G-CSF / PEG-G-CSF MARKET, 2020-2030 (USD MILLION)

TABLE 32 LATAM G-CSF / PEG-G-CSF MARKET, BY COUNTRY, 2020-2030 (USD MILLION)

TABLE 33 LATAM G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 34 LATAM NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 35 LATAM ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 36 LATAM G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 37 LATAM G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 38 LATAM G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 39 LATAM G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 40 LATAM G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 41 MEXICO G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 42 MEXICO NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 43 MEXICO ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 44 MEXICO G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 45 MEXICO MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 46 MEXICO G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 47 MEXICO SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 48 MEXICO INTRAVENOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 49 MEXICO G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 50 MEXICO PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 51 MEXICO G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 52 MEXICO HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 53 MEXICO HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 54 MEXICO HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 55 MEXICO RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 56 MEXICO RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 57 MEXICO RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 58 MEXICO AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 59 MEXICO AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 60 MEXICO AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 61 MEXICO G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 62 MEXICO HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 63 MEXICO HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 64 MEXICO HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 65 MEXICO RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 66 MEXICO RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 67 MEXICO RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 68 MEXICO ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 69 MEXICO ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 70 MEXICO ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 71 COLUMBIA G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 72 COLUMBIA NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 73 COLUMBIA ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 74 COLUMBIA G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 75 COLUMBIA MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 76 COLUMBIA G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 77 COLUMBIA SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 78 COLUMBIA G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 79 COLUMBIA PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 80 COLUMBIA G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 81 COLUMBIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 82 COLUMBIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 83 COLUMBIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 84 COLUMBIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 85 COLUMBIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 86 COLUMBIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 87 COLUMBIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 88 COLUMBIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 89 COLUMBIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 90 COLUMBIA G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 91 COLUMBIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 92 COLUMBIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 93 COLUMBIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 94 COLUMBIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 95 COLUMBIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 96 COLUMBIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 97 COLUMBIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 98 COLUMBIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 99 COLUMBIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 100 BRAZIL G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 101 BRAZIL NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 102 BRAZIL ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 103 BRAZIL G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 104 BRAZIL MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 105 BRAZIL G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 106 BRAZIL SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 107 BRAZIL G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 108 BRAZIL PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 109 BRAZIL G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 110 BRAZIL HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 111 BRAZIL HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 112 BRAZIL HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 113 BRAZIL RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 114 BRAZIL RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 115 BRAZIL RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 116 BRAZIL AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 117 BRAZIL AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 118 BRAZIL AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 119 BRAZIL G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 120 BRAZIL HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 121 BRAZIL HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 122 BRAZIL HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 123 BRAZIL RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 124 BRAZIL RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 125 BRAZIL RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 126 BRAZIL ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 127 BRAZIL ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 128 BRAZIL ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 129 ARGENTINA G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 130 ARGENTINA NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 131 ARGENTINA ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 132 ARGENTINA G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 133 ARGENTINA MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 134 ARGENTINA G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 135 ARGENTINA SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 136 ARGENTINA INTRAVENOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 137 ARGENTINA G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 138 ARGENTINA PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 139 ARGENTINA G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 140 ARGENTINA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 141 ARGENTINA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 142 ARGENTINA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 143 ARGENTINA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 144 ARGENTINA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 145 ARGENTINA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 146 ARGENTINA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 147 ARGENTINA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 148 ARGENTINA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 149 ARGENTINA G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 150 ARGENTINA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 151 ARGENTINA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 152 ARGENTINA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 153 ARGENTINA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 154 ARGENTINA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 155 ARGENTINA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 156 ARGENTINA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 157 ARGENTINA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 158 ARGENTINA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 159 CHILE G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 160 CHILE NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 161 CHILE ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 162 CHILE G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 163 CHILE MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 164 CHILE G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 165 CHILE SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 166 CHILE G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 167 CHILE PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 168 CHILE G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 169 CHILE HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 170 CHILE HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 171 CHILE HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 172 CHILE RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 173 CHILE RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 174 CHILE RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 175 CHILE AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 176 CHILE AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 177 CHILE AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 178 CHILE G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 179 CHILE HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 180 CHILE HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 181 CHILE HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 182 CHILE RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 183 CHILE RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 184 CHILE RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 185 CHILE ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 186 CHILE ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 187 CHILE ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 188 PERU G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 189 PERU NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 190 PERU ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 191 PERU G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 192 PERU MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 193 PERU G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 194 PERU SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 195 PERU INTRAVENOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 196 PERU G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 197 PERU PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 198 PERU SINGLE USE VIALS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 199 PERU G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 200 PERU HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 201 PERU HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 202 PERU HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 203 PERU RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 204 PERU RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 205 PERU RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 206 PERU AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 207 PERU AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 208 PERU AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 209 PERU G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 210 PERU HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 211 PERU HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 212 PERU HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 213 PERU RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 214 PERU RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 215 PERU RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 216 PERU ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 217 PERU ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 218 PERU ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 219 ECUADOR G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 220 ECUADOR NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 221 ECUADOR ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 222 ECUADOR G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 223 ECUADOR MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 224 ECUADOR G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 225 ECUADOR SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 226 ECUADOR INTRAVENOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 227 ECUADOR G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 228 ECUADOR PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 229 ECUADOR G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 230 ECUADOR HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 231 ECUADOR HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 232 ECUADOR HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 233 ECUADOR RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 234 ECUADOR RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 235 ECUADOR RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 236 ECUADOR AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 237 ECUADOR AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 238 ECUADOR AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 239 ECUADOR G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 240 ECUADOR HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 241 ECUADOR HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 242 ECUADOR HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 243 ECUADOR RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 244 ECUADOR RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 245 ECUADOR RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 246 ECUADOR ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 247 ECUADOR ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 248 ECUADOR ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

Liste des figures

FIGURE 1 LATIN AMERICA G-CSF / PEG-G-CSF MARKET: SEGMENTATION

FIGURE 2 LATIN AMERICA G-CSF / PEG-G-CSF MARKET: DATA TRIANGULATION

FIGURE 3 LATIN AMERICA G-CSF / PEG-G-CSF MARKET: DROC ANALYSIS

FIGURE 4 LATIN AMERICA G-CSF / PEG-G-CSF MARKET: LATIN AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 LATIN AMERICA G-CSF / PEG-G-CSF MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 LATIN AMERICA G-CSF / PEG-G-CSF MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 LATIN AMERICA G-CSF / PEG-G-CSF MARKET: DBMR MARKET POSITION GRID

FIGURE 8 LATIN AMERICA G-CSF / PEG-G-CSF MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 LATIN AMERICA G-CSF / PEG-G-CSF MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 LATIN AMERICA G-CSF / PEG-G-CSF MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN CANCER PROPHYLAXIS IN DEVELOPED COUNTRIES AND INITIATIVES TAKEN BY GOVERNMENTS ARE TO DRIVE THE LATIN AMERICA G-CSF / PEG-G-CSF MARKET FROM 2023 TO 2030

FIGURE 12 NEUTROPENIA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE LATIN AMERICA G-CSF / PEG-G-CSF MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE LATIN AMERICA G-CSF / PEG-G-CSF MARKET

FIGURE 14 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY INDICATION CATEGORY, 2022

FIGURE 15 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY INDICATION CATEGORY, 2021-2030 (USD MILLION)

FIGURE 16 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY INDICATION CATEGORY, CAGR (2022-2029)

FIGURE 17 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY INDICATION CATEGORY, LIFELINE CURVE

FIGURE 18 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY DOSAGE, 2022

FIGURE 19 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY DOSAGE, 2021-2030 (USD MILLION)

FIGURE 20 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY DOSAGE, CAGR (2023-2030)

FIGURE 21 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY DOSAGE, LIFELINE CURVE

FIGURE 22 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY ROUTE OF ADMINISTRATION, 2022

FIGURE 23 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

FIGURE 24 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2023-2030)

FIGURE 25 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 26 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY PACKAGING, 2022

FIGURE 27 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY PACKAGING, 2021-2030 (USD MILLION)

FIGURE 28 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY PACKAGING, CAGR (2023-2030)

FIGURE 29 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY PACKAGING, LIFELINE CURVE

FIGURE 30 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY END USER, 2022

FIGURE 31 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY END USER, 2021-2030 (USD MILLION)

FIGURE 32 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY END USER, CAGR (2023-2030)

FIGURE 33 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 35 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

FIGURE 36 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 37 LATIN AMERICA G-CSF/ PEG-G-CSF MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 LATIN AMERICA G-CSF/PEG-G-CSF MARKET: SNAPSHOT (2022)

FIGURE 39 LATIN AMERICA G-CSF/PEG-G-CSF MARKET: BY COUNTRY (2022)

FIGURE 40 LATIN AMERICA G-CSF/PEG-G-CSF MARKET: BY COUNTRY (2022 & 2030)

FIGURE 41 LATIN AMERICA G-CSF/PEG-G-CSF MARKET: BY COUNTRY (2022 & 2030)

FIGURE 42 LATIN AMERICA G-CSF/PEG-G-CSF MARKET: BY INDICATION (2023-2030)

FIGURE 43 LATIN AMERICA G-CSF / PEG-G-CSF MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.