Latam Distributed Antenna System Das Market

Taille du marché en milliards USD

TCAC :

%

USD

916.32 Million

USD

1,898.64 Million

2024

2032

USD

916.32 Million

USD

1,898.64 Million

2024

2032

| 2025 –2032 | |

| USD 916.32 Million | |

| USD 1,898.64 Million | |

|

|

|

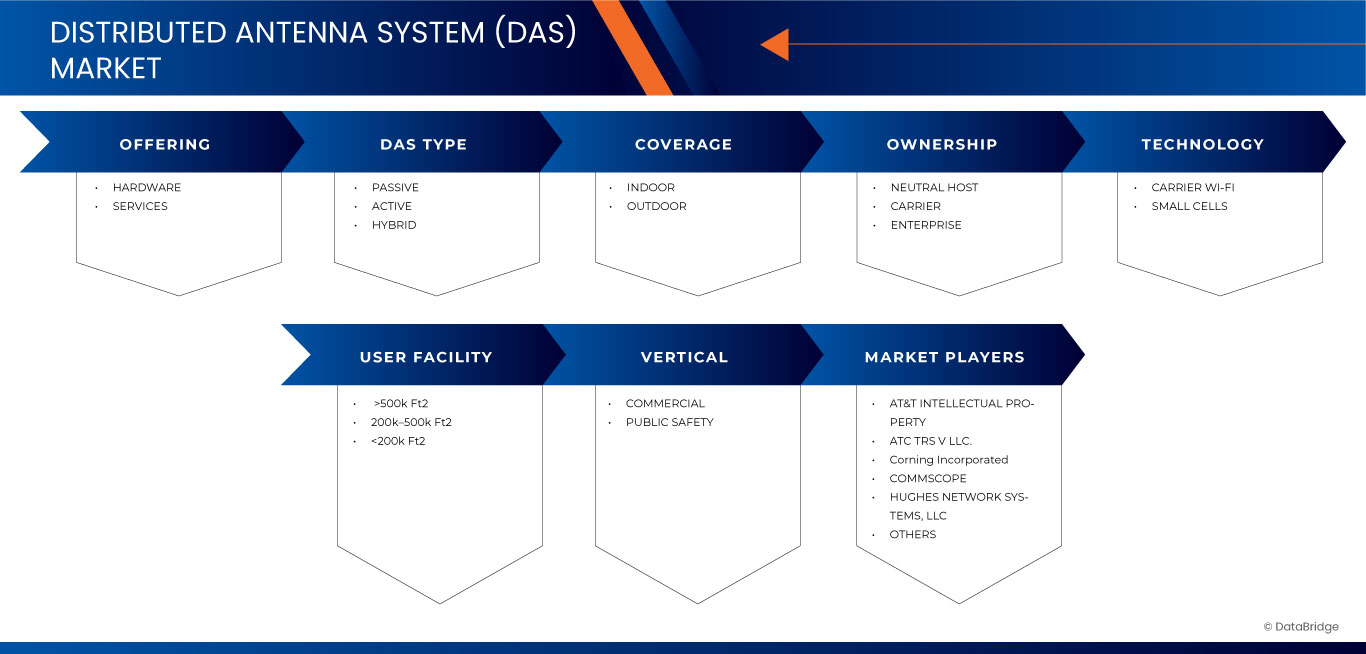

Segmentation du marché des systèmes d'antennes distribuées (DAS) en Amérique latine, par offre (matériel et services), type de DAS (passif, actif et hybride), couverture (intérieure et extérieure), propriété (hôte neutre, opérateur et entreprise), technologie (opérateur Wi-Fi et petites cellules), installation utilisateur ( 500 000 pi2, 200 000 à 500 000 pi2 et

Analyse du marché des systèmes d'antennes distribuées (DAS)

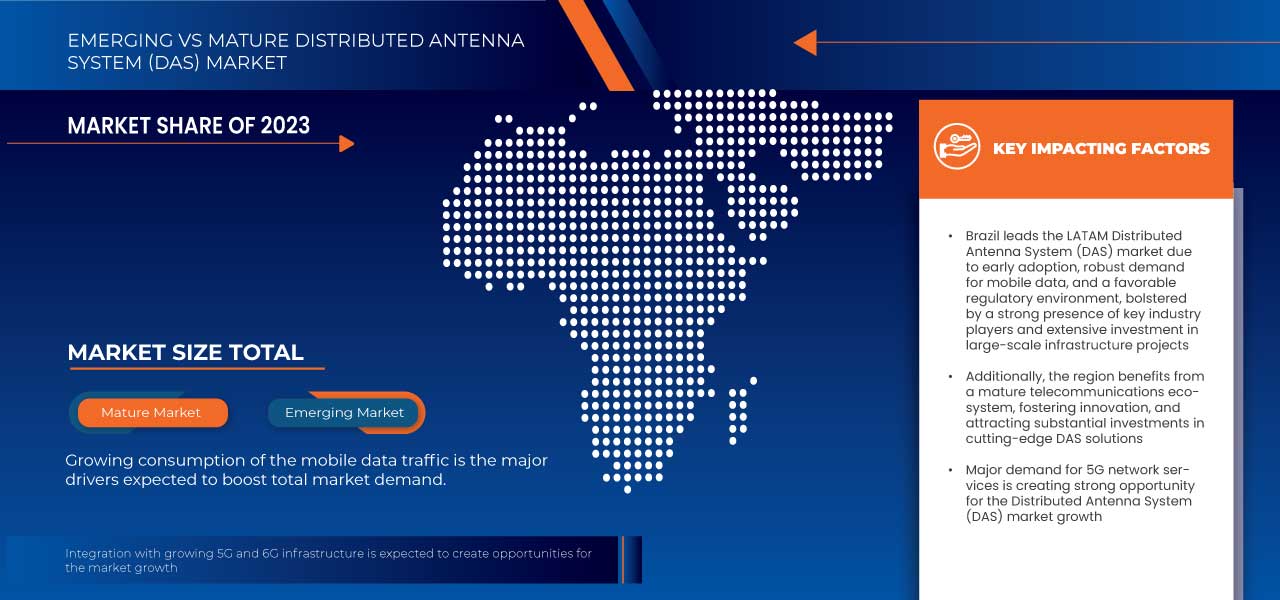

Français L'augmentation de la numérisation, de la consommation de smartphones et de la population technophile augmente la croissance du marché des systèmes d'antennes distribuées (DAS) en créant une demande pour des solutions de connectivité réseau améliorées. L'adoption croissante de la connectivité au réseau mobile et la consommation croissante du trafic de données mobiles augmentent la croissance du marché des systèmes d'antennes distribuées (DAS). Pour offrir une couverture et une connectivité réseau améliorées pour les appareils, le DAS joue un rôle majeur qui accélère la croissance du marché des systèmes d'antennes distribuées (DAS). Différents utilisateurs finaux adoptent la technologie pour améliorer la communication et le service, ce qui augmente la connectivité réseau dans presque tous les secteurs industriels et agit comme un moteur majeur du marché des systèmes d'antennes distribuées (DAS). Cependant, la présence de solutions alternatives, telles que les amplificateurs de signal et le coût d'installation élevé du réseau du système d'antennes distribuées (DAS), pourraient entraver la croissance du marché des systèmes d'antennes distribuées (DAS).

Taille du marché des systèmes d'antennes distribuées (DAS)

La taille du marché des systèmes d’antennes distribuées (DAS) d’Amérique latine a été évaluée à 1 898,64 millions USD d’ici 2032, contre 916,32 millions USD en 2024, avec un TCAC de 9,8 % au cours de la période de prévision de 2025 à 2032. En plus des informations sur le marché telles que la valeur du marché, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l’équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE.

Tendances du marché des systèmes d'antennes distribuées (DAS)

« Augmentation du besoin de connectivité sécurisée pour les personnes »

La tendance croissante à une connectivité sûre et fiable en Amérique latine représente une opportunité significative pour le marché des systèmes d'antennes distribuées (DAS). Alors que de plus en plus de personnes dans les zones urbaines et rurales dépendent des services mobiles et Internet à des fins personnelles, professionnelles et éducatives, garantir une connectivité sécurisée et ininterrompue est devenu une priorité absolue. Cette demande de sécurité ne se limite pas à la protection des données, mais également au besoin de réseaux robustes capables de gérer les pics de trafic, garantissant que les personnes puissent rester connectées en cas d'urgence, de catastrophes naturelles ou d'autres situations critiques. Les systèmes DAS peuvent jouer un rôle essentiel en fournissant la couverture et la fiabilité nécessaires à de telles solutions de connectivité sûres, en particulier dans les environnements urbains denses et les zones reculées où la connectivité est souvent inégale.

Alors que la technologie 5G continue de se déployer dans la région, le besoin de connectivité sécurisée est encore plus prononcé, en particulier pour les secteurs critiques tels que la santé, la finance et les services d'urgence. Les systèmes DAS sont particulièrement adaptés pour gérer le trafic accru et les exigences de sécurité des réseaux 5G, garantissant des opérations fluides et sûres. En outre, l'infrastructure fournie par les systèmes DAS peut prendre en charge des technologies telles que l'IoT, permettant une surveillance et une réponse en temps réel aux menaces de sécurité ou aux pannes du système. La montée en flèche de la demande de connectivité sécurisée présente un marché croissant pour les solutions DAS qui peuvent garantir aux personnes l'accès à des services de communication sécurisés et de haute qualité dans toute l'Amérique latine.

Portée du rapport et segmentation du marché des systèmes d'antennes distribuées (DAS)

|

Attributs |

Informations clés sur le marché des systèmes d'antennes distribuées (DAS) |

|

Segments couverts |

|

|

Pays couverts |

Brésil, Mexique, Argentine, Colombie et reste de l'Amérique latine |

|

Principaux acteurs du marché |

AT&T Intellectual Property (États-Unis), ATC TRS V LLC. (États-Unis), Corning Incorporated (États-Unis), CommScope, Inc. (États-Unis), Hughes Network Systems, LLC (États-Unis), Zinwave (États-Unis), HUBER+SUHNER (Suisse), BTI wireless (États-Unis), WESCO INTERNATIONAL, INC. (États-Unis) et Advanced RF Technologies, Inc. (États-Unis) entre autres |

|

Opportunités de marché |

|

|

Données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE. |

Définition du marché des systèmes d'antennes distribuées (DAS)

Un système d'antennes distribuées (DAS) est un groupe d'antennes divisées et dispersées spatialement sur une zone terrestre donnée pour améliorer les services sans fil existants comprenant des signaux cellulaires et radio. Le signal numérique est transformé en RF et RF en numérique à l'aide d'une antenne pour fournir le signal cellulaire. Un système d'antennes distribuées (DAS) est déployé pour fournir une couverture et une capacité de réseau supplémentaires dans les bâtiments et les lieux qui sont rarement utilisés mais qui sont soumis à une forte demande de services de réseau sans fil tels que les salles de concert, les stades de sport et les auditoriums. Un réseau DAS est déployé à l'intérieur ou à l'extérieur. Le système d'antennes distribuées (DAS) est composé de divers composants matériels tels que des unités de tête de réseau, une antenne, des unités radio et d'autres qui offrent une grande efficacité avec des performances améliorées pour la couverture et la connectivité du réseau.

Dynamique du marché des systèmes d'antennes distribuées (DAS)

Conducteurs

- Consommation croissante du trafic de données mobiles

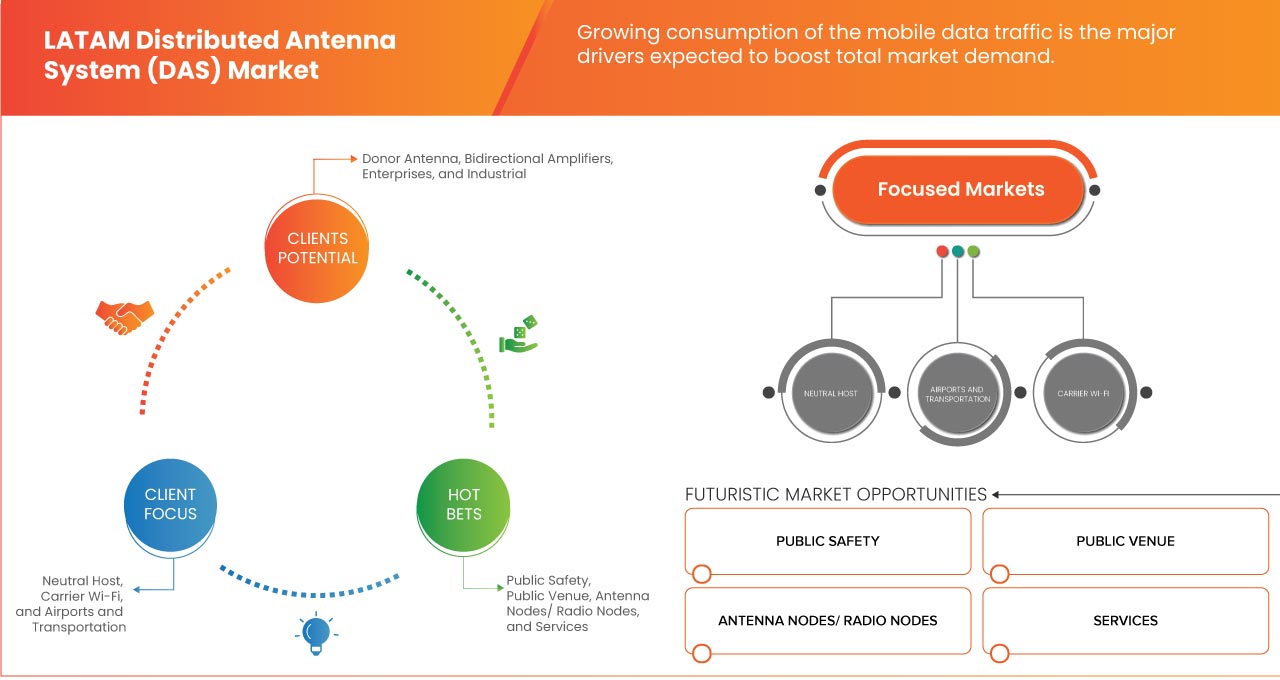

La consommation croissante de trafic de données mobiles est un facteur clé pour le marché des systèmes d'antennes distribuées (DAS) en Amérique latine (LATAM), car la région connaît une forte pénétration des smartphones et des demandes de connectivité numérique. Avec l'utilisation croissante d'applications à large bande passante telles que le streaming vidéo, les jeux en ligne et les outils de travail à distance, les réseaux mobiles sont confrontés à une pression accrue pour offrir une connectivité transparente. Le DAS offre une solution efficace en améliorant la couverture du signal et la capacité du réseau, en particulier dans les villes densément peuplées et les zones à forte infrastructure comme les aéroports, les stades et les centres commerciaux, où les systèmes de réseau traditionnels rencontrent souvent des difficultés.

En outre, l’expansion des réseaux 4G et 5G en Amérique latine accélère le besoin d’infrastructures robustes pour prendre en charge l’augmentation du trafic de données. Les pays de la région investissent activement dans les télécommunications pour combler les lacunes en matière de connectivité et répondre aux attentes des consommateurs en matière de réseaux plus rapides et plus fiables. La technologie DAS permet aux fournisseurs de services de relever ces défis de manière efficace, en offrant des performances réseau et des expériences utilisateur améliorées. Alors que les initiatives de transformation numérique prennent de l’ampleur en Amérique latine, la consommation croissante du trafic de données mobiles souligne l’importance croissante du DAS dans le paysage régional des télécommunications

Par exemple,

- En août 2024, selon l'article publié par Developing Telecom, Claro Argentina s'est associé à Nokia pour déployer l'infrastructure 5G dans tout le pays. Cet accord fournira une connectivité fiable, à faible latence et à très haut débit aux grandes villes, Nokia fournissant des équipements de son portefeuille 5G AirScale. Claro Argentina sera également le premier en Amérique latine à mettre en œuvre l'antenne active passive entrelacée de Nokia (IPAA+) sur l'ensemble de son réseau. Ce déploiement important de la 5G souligne la demande croissante de trafic de données mobiles à mesure que l'adoption de la 5G se développe. Le besoin de réseaux plus rapides et plus fiables alimentera la demande de systèmes d'antennes distribuées (DAS) pour assurer une couverture transparente, gérer des charges de données plus élevées et répondre aux besoins de connectivité des zones urbaines et rurales dans toute l'Amérique latine.

Demande croissante des différents utilisateurs finaux

La demande croissante des différents utilisateurs finaux, notamment les consommateurs, les entreprises et les industries, stimule considérablement la croissance du marché des systèmes d'antennes distribuées (DAS). La consommation de données mobiles augmentant, notamment avec l'expansion rapide des réseaux 5G, il existe un besoin croissant d'infrastructures réseau robustes et fiables. Les consommateurs exigent une connectivité transparente pour des activités telles que le streaming vidéo, les jeux en ligne et les médias sociaux, tandis que les entreprises intègrent des solutions IoT, d'automatisation et de cloud qui nécessitent un accès Internet haut débit ininterrompu. Cette dépendance croissante aux réseaux mobiles, associée à l'augmentation du nombre d'appareils connectés, pousse au déploiement de DAS pour assurer la couverture des zones à fort trafic de données et pour maintenir la fiabilité du réseau.

En outre, divers secteurs, tels que la santé, la fabrication et les transports, adoptent des technologies avancées qui reposent sur une connectivité sans fil cohérente et performante. Le besoin de DAS est particulièrement élevé dans des environnements tels que les aéroports, les stades, les hôpitaux et les installations industrielles, où les réseaux cellulaires traditionnels ont souvent du mal à fournir une couverture adéquate en raison de barrières physiques ou d'une forte densité d'utilisateurs. À mesure que ces secteurs développent leur infrastructure numérique, la demande de solutions DAS capables de prendre en charge les communications critiques, d'assurer une transmission de données fluide et d'offrir une évolutivité s'accélère. Cette large demande de secteurs divers est un facteur clé de la croissance du marché DAS à l'échelle mondiale, en particulier dans des régions comme l'Amérique latine

Par exemple,

- En novembre 2024, selon l'article publié par Stadium Tech Report, AT&T Stadium a récemment amélioré son système d'antennes distribuées (DAS) en ajoutant 14 antennes à lentille MatSing pour améliorer la couverture en bande C. Cette mise à niveau, qui offre des vitesses de téléchargement allant jusqu'à 4 Gbit/s, souligne la demande croissante de connectivité haute capacité dans les grandes salles. À mesure que l'adoption de la 5G augmente en Amérique latine, le besoin de solutions DAS avancées comme les antennes MatSing va augmenter, stimulant la croissance du marché dans la région pour répondre à la demande de connectivité transparente dans les endroits à fort trafic.

Opportunités

- Intégration avec les infrastructures 5G et 6G en pleine croissance

L’intégration des systèmes d’antennes distribuées (DAS) avec l’infrastructure 5G et 6G en pleine croissance offre une opportunité clé pour le marché DAS d’Amérique latine. Alors que les entreprises de télécommunications continuent d’étendre leurs réseaux 5G, en particulier dans les zones urbaines et densément peuplées, les technologies DAS sont essentielles pour garantir une couverture, une capacité et des performances optimales du réseau. Le besoin d’une connectivité transparente et de vitesses de données améliorées entraîne une demande croissante de déploiements DAS, qui contribuent à atténuer les lacunes de couverture, à améliorer les expériences mobiles et à prendre en charge le trafic réseau dense attendu avec la 5G et la 6G.

Avec l’évolution mondiale vers la 5G et le déploiement futur prévu des technologies 6G, les pays d’Amérique latine devraient adopter de plus en plus de solutions DAS avancées. Ces systèmes sont essentiels pour soutenir l’infrastructure évolutive nécessaire pour répondre aux exigences des technologies sans fil de nouvelle génération. L’intégration de DAS aux réseaux 5G et 6G en Amérique latine améliorera non seulement la connectivité, mais permettra également à la région de rester compétitive dans le paysage numérique mondial, favorisant l’innovation et soutenant la croissance de l’économie axée sur les données.

Par exemple,

- En mai 2023, selon l'article publié par Microwave Journal, la technologie DAS de nouvelle génération est apparue pour répondre aux besoins de la 5G. Une étude récente a révélé que plus de 80 % de l'utilisation de la voix et des données pour les téléphones mobiles se faisait à l'intérieur, ce qui indique une demande importante de services 5G de la part des utilisateurs en intérieur. Les réseaux cellulaires traditionnels ont du mal à pénétrer efficacement les bâtiments en raison des caractéristiques du spectre à haute fréquence. Cela pose des défis pour la couverture intérieure dans les transports en commun, les grands lieux et les bureaux. La technologie DAS est confrontée à des défis similaires, nécessitant une infrastructure et des interconnexions complexes pour assurer une couverture adéquate. Avec l'émergence de la 5G, les systèmes DAS évoluent pour prendre en charge des débits de données plus élevés et s'adapter à de nouvelles bandes de fréquences tout en répondant aux divers besoins des utilisateurs.

Possibilités d'amélioration du réseau dans les zones rurales

Le marché des systèmes d'antennes distribuées (DAS) d'Amérique latine présente d'importantes opportunités d'amélioration du réseau dans les zones rurales. Alors que les pays d'Amérique latine continuent de se concentrer sur l'amélioration de la connectivité, l'extension de l'infrastructure 5G aux régions rurales mal desservies est une priorité essentielle. Les systèmes DAS, avec leur capacité à fournir une couverture efficace et évolutive, sont essentiels pour combler le fossé de connectivité entre les zones urbaines et rurales. En déployant des DAS dans les zones rurales, les opérateurs de télécommunications peuvent améliorer la couverture du réseau, réduire les zones mortes du signal et fournir un Internet haut débit fiable aux communautés éloignées, améliorant ainsi l'accès aux services numériques essentiels tels que l'éducation, les soins de santé et le commerce électronique.

En plus d’améliorer la connectivité, les améliorations du réseau rural grâce aux DAS peuvent contribuer au développement économique de ces régions. Grâce à un meilleur accès au réseau, les entreprises des zones rurales peuvent étendre leur présence numérique, favorisant ainsi la croissance et l’innovation. En outre, l’intégration de la technologie DAS jouera un rôle essentiel dans le soutien du déploiement plus large des technologies de nouvelle génération telles que la 5G et les applications basées sur l’IA, qui peuvent encore améliorer la productivité et la durabilité dans les industries rurales telles que l’agriculture et l’exploitation minière. La demande croissante de connectivité dans les zones rurales représente une opportunité précieuse pour le marché des DAS de contribuer à la transformation numérique et à la croissance économique de la région.

Par exemple,

- En octobre 2024, selon l'article publié par TowerXchange, Highline a obtenu un financement de 11,9 millions de dollars de la Banque nationale de développement économique et social du Brésil (BNDES) pour construire 181 tours dans 23 États, étendant la couverture 4G et 5G, en particulier dans les zones rurales et les favelas. Financée par le Fonds d'universalisation des services de télécommunications (Fust), l'initiative vise à renforcer l'inclusion numérique. Cela représente une opportunité pour le marché des systèmes d'antennes distribuées (DAS) d'Amérique latine, car les solutions DAS seront essentielles pour améliorer la connectivité et les performances du réseau dans ces régions mal desservies, en soutenant l'infrastructure croissante de la 4G et de la 5G.

Contraintes/Défis

- Disponibilité de la solution alternative

Les technologies telles que le Wi-Fi, les petites cellules et les femtocellules présentent des options moins coûteuses et souvent plus faciles à déployer que les DAS, ce qui en fait des alternatives attrayantes dans les régions moins densément peuplées ou les bâtiments plus petits. Ces alternatives sont particulièrement avantageuses dans les zones où le déploiement rapide et la rentabilité sont prioritaires, ce qui peut limiter la demande pour les solutions DAS plus complexes et plus coûteuses. Alors que les entreprises et les organisations d'Amérique latine recherchent des solutions économiques, la concurrence de ces alternatives pourrait ralentir l'expansion des réseaux DAS sur certains marchés.

En outre, le déploiement des réseaux 5G en Amérique latine pourrait aggraver le défi de l’adoption des DAS. La technologie 5G, avec ses capacités à haut débit et sa communication à faible latence, permet une couverture plus flexible et plus efficace, en particulier dans les environnements urbains. À mesure que les réseaux 5G continuent de s’étendre dans toute la région, ils pourraient réduire le besoin d’installations DAS traditionnelles, en particulier dans les zones dotées d’une couverture de réseau mobile robuste. Cette évolution vers la 5G et d’autres technologies sans fil avancées pourrait avoir un impact sur les perspectives de croissance des DAS en Amérique latine, car les entreprises et les fournisseurs de services pourraient opter pour une infrastructure 5G et des solutions sans fil alternatives au lieu d’investir dans le déploiement de systèmes DAS.

Par exemple,

- En mars 2023, selon un article publié par Developing Telecoms Ltd., le système numérique d'intérieur 5G de Huawei, conçu pour favoriser les sociétés numériques avancées, a été dévoilé. Malgré l'accent mis par les opérateurs sur la réalisation d'une couverture nationale étendue, la couverture intérieure reste cruciale, avec environ 70 % du trafic 4G et 5G provenant de l'intérieur. Huawei a répondu à ce besoin avec sa gamme de systèmes numériques d'intérieur (DIS), offrant des alternatives supérieures aux systèmes d'antennes distribuées (DAS) traditionnels. Contrairement au DAS, qui ne prend en charge que 1T1R ou 2T2R tandis que les systèmes extérieurs atteignent jusqu'à 64T64R, le DIS de Huawei comble le fossé, garantissant une connectivité constante à l'intérieur et à l'extérieur.

- Défis technologiques limitant l'adoption dans les organisations

L’adoption des systèmes d’antennes distribuées (DAS) dans les organisations d’Amérique latine est confrontée à plusieurs défis technologiques qui peuvent entraver une mise en œuvre généralisée. L’un des principaux obstacles est la complexité de l’intégration des DAS aux infrastructures réseau existantes. De nombreuses entreprises disposent de systèmes existants qui peuvent ne pas être compatibles avec les technologies DAS avancées, ce qui nécessite des mises à niveau ou des remplacements importants. En outre, le déploiement des DAS nécessite souvent une planification minutieuse, notamment l’optimisation de la couverture du signal, la résolution des problèmes d’interférence et la garantie d’une connectivité transparente entre les différentes structures des bâtiments. Ces facteurs peuvent entraîner des coûts initiaux plus élevés et des délais d’installation plus longs, ce qui peut être dissuasif pour les organisations qui cherchent à adopter des solutions DAS.

En outre, le rythme rapide des avancées technologiques présente un autre défi. Alors que de nouvelles technologies sans fil, telles que la 5G, continuent d’émerger, les organisations doivent s’assurer que leurs solutions DAS sont évolutives et capables de prendre en charge les futures mises à niveau du réseau. L’évolution constante des normes et des technologies fait qu’il est difficile pour les organisations de s’engager dans une solution DAS spécifique sans craindre l’obsolescence. Cela peut créer une hésitation chez les entreprises d’Amérique latine, car elles sont confrontées au dilemme de choisir entre les technologies actuelles et de se préparer aux demandes futures. Par conséquent, surmonter ces défis technologiques est crucial pour favoriser l’adoption des systèmes DAS dans la région.

Par exemple,

- In January 2024, according to the article published by EBC, 5G technology expansion in Brazil faces significant challenges due to outdated local antenna laws, which hinder infrastructure installation despite progress in some municipalities. With only 7.16% of cities having updated legislation, the rollout of essential 5G networks remains slow. This highlights a critical challenge for the LATAM Distributed Antenna System (DAS) market, as advancements like 5G require regulatory alignment to enable infrastructure deployment. The lack of updated legislation and delayed adaptation in municipalities restricts the adoption of DAS solutions in organizations, limiting their ability to benefit from high-speed, reliable connectivity for enhanced operational efficiency and improved services.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Distributed Antenna System (DAS) Market Scope

The market is segmented on the basis of seven notable segments which are based on offering, DAS type, coverage, ownership, technology, user facility, and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Hardware

- Antenna Node/Radio Node

- Donar Antenna

- Bidirectional Amplifiers

- Radio Units

- Head End Units

- Others

- Services

- Installation Services

- Pre-Sales Services

- Post-Installation Services

DAS Type

- Passive

- Active

- Hybrid

Coverage

- Indoor

- Passive

- Active

- Hybrid

- Outdoor

- Passive

- Active

- Hybrid

Ownership

- Neutral Host

- Carrier

- Enterprise

Technology

- Wi-Fi

- Small Cells

User Facility

- >500K FT2

- 200K–500K FT2

- <200K FT2

Vertical

- Commercial

- By Type

- Public Venue

- Airports and Transportation

- Enterprises

- Large Enterprises

- Small and Medium Enterprises

- Industrial

- Retail

- Government

- Hospitality

- Healthcare

- Education

- Ships

- By DAS Type

- Passive

- Active

- Hybrid

- By Type

- Public Safety

- Passive

- Active

- Hybrid

Distributed Antenna System (DAS) Market Regional Analysis/Insights

The market is analyzed and market size insights and trends are provided by offering, DAS type, coverage, ownership, technology, user facility, and vertical.

The countries covered in the LATAM Distributed Antenna System (DAS) market report are Brazil, Mexico, Argentina, Colombia and Rest of LATAM.

The LATAM distributed antenna system (DAS) market is dominated by the Brazil leading due to its advanced telecommunications infrastructure and widespread adoption of wireless technologies.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Distributed Antenna System (DAS) Market Share

The market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, Market potential, investment in research and development, new Market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Distributed Antenna System (DAS) Market Leaders Operating in the Market are:

- AT&T Intellectual Property (U.S.)

- ATC TRS V LLC. (U.S.)

- Corning Incorporated (U.S.)

- CommScope, Inc. (U.S.)

- Hughes Network Systems, LLC (U.S.)

- Zinwave (U.S.)

- HUBER+SUHNER (Switzerland)

- BTI wireless (U.S.)

- WESCO INTERNATIONAL, INC. (U.S.)

- Advanced RF Technologies, Inc. (U.S.)

Recent Developments in Distributed Antenna System (DAS) Market

- In February 2024, AT&T pilots 5G for healthcare with U.S. Veterans Affairs, aiming to leverage distributed antenna systems and edge computing. With plans to deploy millimeter wave spectrum alongside MEC technologies, AT&T's initiative reflects the potential for 5G to revolutionize healthcare delivery. Despite competition from Verizon, AT&T's expansive installation at the Seattle VA Medical Center showcases its commitment to advancing healthcare through cutting-edge technology

- En juillet 2023, ATC TRS V LLC et Minnesota Wild ont amélioré l'expérience des fans au Xcel Energy Center, en déployant une solution de pointe de système d'antenne distribuée (DAS), apportant la technologie 5G à l'arène. Cette mise à niveau visait à répondre aux demandes de 1,7 million de visiteurs annuels et de plus de 150 événements, dont 44 matchs de la LNH. (ATC TRS V LLC) L'expertise d'American Tower en matière de connectivité des sites sportifs et d'innovation technologique a facilité cette mise à niveau critique du réseau, garantissant aux fans une connectivité rapide et fiable pour partager des expériences en direct. Ce développement a positionné American Tower pour une croissance future en consolidant sa réputation de fournisseur leader de solutions de connectivité avancées pour les grandes salles, en renforçant sa présence sur le marché et en attirant davantage de partenariats dans l'industrie du sport et du divertissement

- En septembre 2022, Advanced RF Technologies, Inc. a lancé des solutions sans fil en bande C, notamment les modules DAS ADXV et le répéteur SDRX, qui promettent une couverture 5G omniprésente pour les bâtiments et les lieux, répondant aux besoins de diverses parties prenantes. Avec des fréquences en bande C allant de 3,7 GHz à 3,98 GHz, ces offres facilitent les mises à niveau transparentes des systèmes 4G/LTE, garantissant une connectivité et des performances améliorées au quatrième trimestre 2022

- En octobre 2020, Advanced RF Technologies, Inc. a annoncé son adhésion à la National Systems Contractors Association (NSCA), une organisation à but non lucratif. L'entreprise est devenue le tout premier fournisseur de systèmes d'amélioration des communications radio d'urgence (ERCES) et de DAS à rejoindre l'association. Cela a contribué à accroître leur notoriété ainsi que la valeur de leur marque

- En mars 2020, Advanced RF Technologies, Inc. a annoncé son partenariat avec Windy City Wire (WCW) pour la distribution de ses solutions sans fil en bâtiment destinées aux applications commerciales et de sécurité publique. Cela a permis à l'entreprise d'étendre ses services et d'accroître sa clientèle

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 OFFERING TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET VERTICAL COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 CASE STUDY

4.3 VALUE CHAIN ANALYSIS

4.4 COMPANY COMPARATIVE ANALYSIS

4.5 PRICING ANALYSIS

4.6 PATENT ANALYSIS

4.7 TECHNOLOGICAL TRENDS

4.8 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING CONSUMPTION OF THE MOBILE DATA TRAFFIC

5.1.2 GROWING DEMAND FROM THE VARIOUS END USERS

5.1.3 DIGITAL TRANSFORMATION OF BUSINESS

5.1.4 INCREASING NUMBER OF CONNECTED DEVICES DUE TO INTERNET OF THINGS (IOTS)

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF THE ALTERNATIVE SOLUTION

5.2.2 STRICT GOVERNMENT REGULATORY NORMS

5.3 OPPORTUNITIES

5.3.1 INTEGRATION WITH GROWING 5G AND 6G INFRASTRUCTURE

5.3.2 NETWORK IMPROVEMENT OPPORTUNITIES IN THE RURAL AREAS

5.3.3 UPSURGE IN A REQUIREMENT FOR SAFE CONNECTIVITY FOR PEOPLE

5.4 CHALLENGES

5.4.1 TECHNOLOGICAL CHALLENGES RESTRICTING THE ADOPTION IN ORGANIZATIONS

5.4.2 DIFFICULTY IN UPGRADATION OF DISTRIBUTED ANTENNA SYSTEMS

6 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 ANTENNA NODES/ RADIO NODES

6.2.2 DONOR ANTENNA

6.2.3 BIDIRECTIONAL AMPLIFIERS

6.2.4 RADIO UNITS

6.2.5 HEAD END UNITS

6.2.6 OTHERS

6.3 SERVICES

6.3.1 INSTALLATION SERVICES

6.3.2 PRE-SALES SERVICES

6.3.3 POST-INSTALLATION SERVICES

7 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE

7.1 OVERVIEW

7.2 PASSIVE

7.3 ACTIVE

7.4 HYBRID

8 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE

8.1 OVERVIEW

8.2 INDOOR

8.2.1 PASSIVE

8.2.2 ACTIVE

8.2.3 HYBRID

8.3 OUTDOOR

8.3.1 PASSIVE

8.3.2 ACTIVE

8.3.3 HYBRID

9 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL

9.1 OVERVIEW

9.2 COMMERCIAL

9.2.1 PUBLIC VENUE

9.2.2 AIRPORTS AND TRANSPORTATION

9.2.3 ENTERPRISES

9.2.3.1 LARGE ENTERPRISES

9.2.3.2 SMALL AND MEDIUM ENTERPRISES

9.2.4 INDUSTRIAL

9.2.5 RETAIL

9.2.6 GOVERNMENT

9.2.7 HOSPITALITY

9.2.8 HEALTHCARE

9.2.9 EDUCATION

9.2.10 SHIPS

9.2.10.1 PASSIVE

9.2.10.2 ACTIVE

9.2.10.3 HYBRID

9.3 PUBLIC SAFETY

9.3.1 PASSIVE

9.3.2 ACTIVE

9.3.3 HYBRID

10 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE

10.1 OVERVIEW

10.2 PASSIVE

10.3 ACTIVE

10.4 HYBRID

11 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP

11.1 OVERVIEW

11.2 NEUTRAL HOST

11.3 CARRIER

11.4 ENTERPRISE

12 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY

12.1 OVERVIEW

12.2 CARRIER WI-FI

12.3 SMALL CELLS

13 LATAM DISTRIBUTED ANTENNA SYSTEM MARKET, BY COUNTRY

13.1 LATAM

13.1.1 BRAZIL

13.1.2 MEXICO

13.1.3 ARGENTINA

13.1.4 COLOMBIA

13.1.5 REST OF LATAM

14 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: LATAM

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 AT&T INTELLECTUAL PROPERTY

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 ATC TRS V LLC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 SOLUTION PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 CORNING INCORPORATED

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 APPLICATION PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 COMMSCOPE, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 HUGHES NETWORK SYSTEMS, LLC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 ADVANCED RF TECHNOLOGIES, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BTI WIRELESS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 HUBER+SUHNER

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 WESCO INTERNATIONAL, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 ZINWAVE

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2022-2032 (USD THOUSAND)

TABLE 2 LATAM HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 3 LATAM SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 4 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 5 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2022-2032 (USD THOUSAND)

TABLE 6 LATAM INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 7 LATAM OUTDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 8 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2022-2032 (USD THOUSAND)

TABLE 9 LATAM COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 10 LATAM ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY ENTERPRISE SIZE, 2022-2032 (USD THOUSAND)

TABLE 11 LATAM COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 12 LATAM PUBLIC SAFETY IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 13 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 14 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2022-2032 (USD THOUSAND)

TABLE 15 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2022-2032 (USD THOUSAND)

TABLE 16 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COUNTRY, 2022-2032 (USD THOUSAND)

TABLE 17 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2022-2032 (USD THOUSAND)

TABLE 18 BRAZIL HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 19 BRAZIL SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 20 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 21 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2022-2032 (USD THOUSAND)

TABLE 22 BRAZIL INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 23 BRAZIL OUTDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 24 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2022-2032 (USD THOUSAND)

TABLE 25 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2022-2032 (USD THOUSAND)

TABLE 26 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2022-2032 (USD THOUSAND)

TABLE 27 BRAZIL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2022-2032 (USD THOUSAND)

TABLE 28 BRAZIL COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 29 BRAZIL ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY ENTERPRISE SIZE, 2022-2032 (USD THOUSAND)

TABLE 30 BRAZIL COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 31 BRAZIL PUBLIC SAFETY IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 32 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2022-2032 (USD THOUSAND)

TABLE 33 MEXICO HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 34 MEXICO SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 35 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 36 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2022-2032 (USD THOUSAND)

TABLE 37 MEXICO INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 38 MEXICO OUTDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 39 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2022-2032 (USD THOUSAND)

TABLE 40 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2022-2032 (USD THOUSAND)

TABLE 41 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2022-2032 (USD THOUSAND)

TABLE 42 MEXICO DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2022-2032 (USD THOUSAND)

TABLE 43 MEXICO COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 44 MEXICO ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY ENTERPRISE SIZE, 2022-2032 (USD THOUSAND)

TABLE 45 MEXICO COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 46 MEXICO PUBLIC SAFETY IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 47 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2022-2032 (USD THOUSAND)

TABLE 48 ARGENTINA HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 49 ARGENTINA SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 50 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 51 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2022-2032 (USD THOUSAND)

TABLE 52 ARGENTINA INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 53 ARGENTINA OUTDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 54 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2022-2032 (USD THOUSAND)

TABLE 55 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2022-2032 (USD THOUSAND)

TABLE 56 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2022-2032 (USD THOUSAND)

TABLE 57 ARGENTINA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2022-2032 (USD THOUSAND)

TABLE 58 ARGENTINA COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 59 ARGENTINA ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY ENTERPRISE SIZE, 2022-2032 (USD THOUSAND)

TABLE 60 ARGENTINA COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 61 ARGENTINA PUBLIC SAFETY IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 62 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2022-2032 (USD THOUSAND)

TABLE 63 COLOMBIA HARDWARE IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 64 COLOMBIA SERVICES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 65 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 66 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY COVERAGE, 2022-2032 (USD THOUSAND)

TABLE 67 COLOMBIA INDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 68 COLOMBIA OUTDOOR IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 69 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OWNERSHIP, 2022-2032 (USD THOUSAND)

TABLE 70 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TECHNOLOGY, 2022-2032 (USD THOUSAND)

TABLE 71 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY USER FACILITY, 2022-2032 (USD THOUSAND)

TABLE 72 COLOMBIA DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY VERTICAL, 2022-2032 (USD THOUSAND)

TABLE 73 COLOMBIA COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 74 COLOMBIA ENTERPRISES IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY ENTERPRISE SIZE, 2022-2032 (USD THOUSAND)

TABLE 75 COLOMBIA COMMERCIAL IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 76 COLOMBIA PUBLIC SAFETY IN DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY DAS TYPE, 2022-2032 (USD THOUSAND)

TABLE 77 REST OF LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, BY OFFERING, 2022-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: SEGMENTATION

FIGURE 2 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DATA TRIANGULATION

FIGURE 3 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DROC ANALYSIS

FIGURE 4 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: LATAM VS REGIONAL MARKET ANALYSIS

FIGURE 5 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: OFFERING TIMELINE CURVE

FIGURE 7 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: MARKET VERTICAL COVERAGE GRID

FIGURE 10 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OFFERING (2024)

FIGURE 13 EXECUTIVE SUMMARY: LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 14 STRATEGIC DECISIONS: LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 15 GROWING CONSUMPTION OF THE MOBILE DATA TRAFFIC IS EXPECTED TO DRIVE LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET IN 2025 & 2032

FIGURE 17 VALUE CHAIN FOR LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 18 BRAND COMPARISON

FIGURE 19 COMPARISON OF ACTIVE, PASSIVE AND HYBRID DAS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

FIGURE 21 TOTAL MOBILE DATA TRAFFIC IN LATIN AMERICA

FIGURE 22 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OFFERING, 2024

FIGURE 23 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: DAS TYPE, 2024

FIGURE 24 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY COVERAGE, 2024

FIGURE 25 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY VERTICAL, 2024

FIGURE 26 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY DAS TYPE, 2024

FIGURE 27 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY OWNERSHIP, 2024

FIGURE 28 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: BY TECHNOLOGY, 2024

FIGURE 29 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET, SNAPSHOT (2024)

FIGURE 30 LATAM DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.