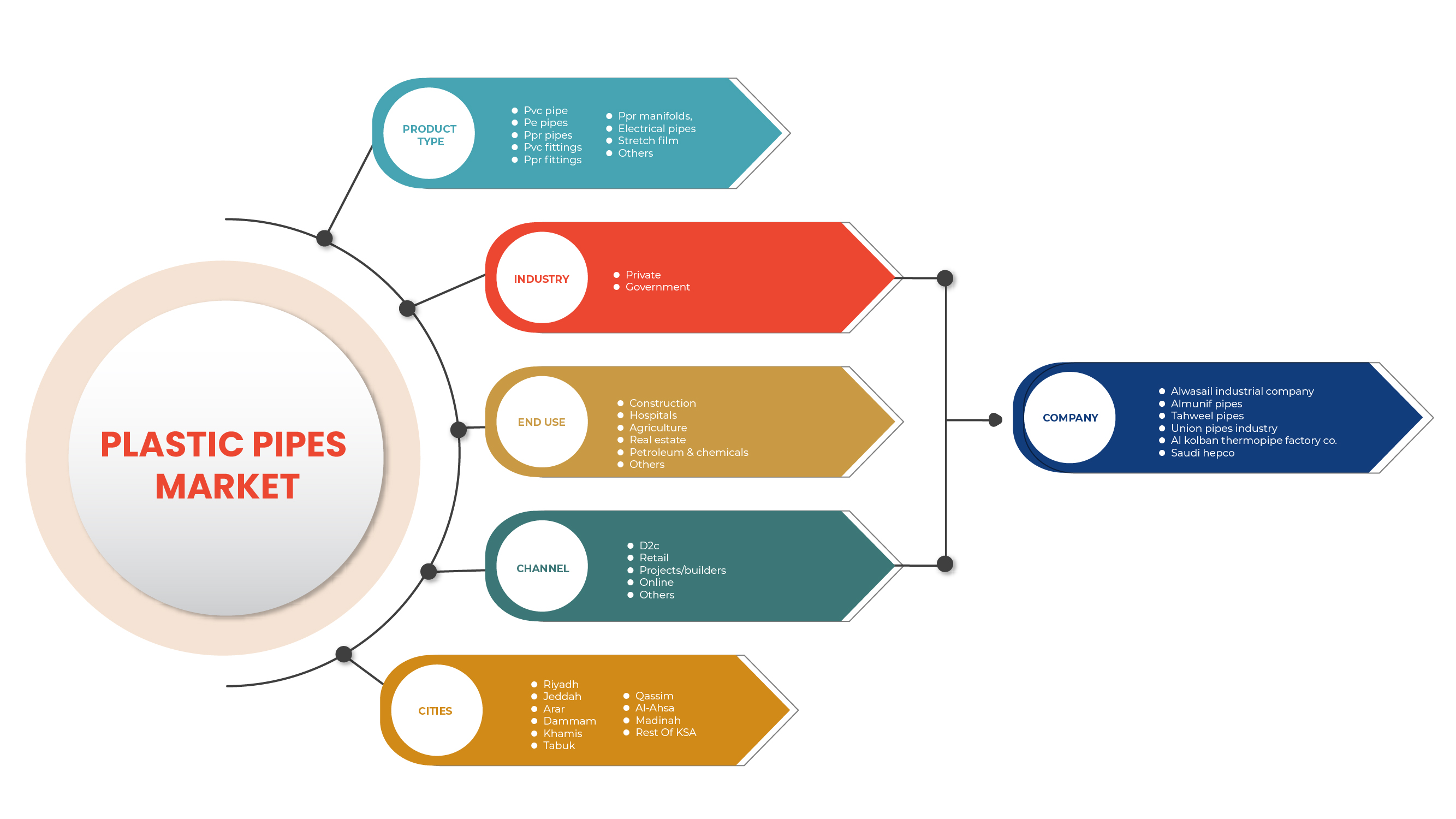

Marché des tuyaux en plastique en Arabie saoudite, par type de produit (tuyaux en PVC, tuyaux en PE, tuyaux en PPR, raccords en PVC, raccords en PPR, collecteurs en PPR, tuyaux électriques, film étirable et autres), industrie (privée et gouvernementale), utilisation finale (construction, hôpitaux, agriculture, immobilier, pétrole et produits chimiques et autres), canal (D2C, vente au détail, projets/constructeurs, en ligne et autres), villes (AL-Ahsa, Arar, Dammam, Djeddah, Khamis, Médine, Riyad, Tabuk, Qassim et reste de l'Arabie saoudite) Tendances et prévisions de l'industrie jusqu'en 2026.

Analyse et taille du marché

Les tuyaux en plastique sont des matériaux thermoplastiques produits à partir de la polymérisation de l'éthylène. Les tuyaux en plastique sont fabriqués par extrusion dans des tailles allant de ½" à 63". Les matériaux sont disponibles en bobines laminées de différentes longueurs ou en longueurs droites jusqu'à 40 pieds. En général, les petits diamètres sont enroulés et les grands diamètres sont en longueurs droites. Les tuyaux en PE en plastique sont disponibles dans de nombreuses variétés d'épaisseurs de paroi. L'un des avantages importants des tuyaux en plastique est leur faible impact environnemental par rapport aux autres matériaux.

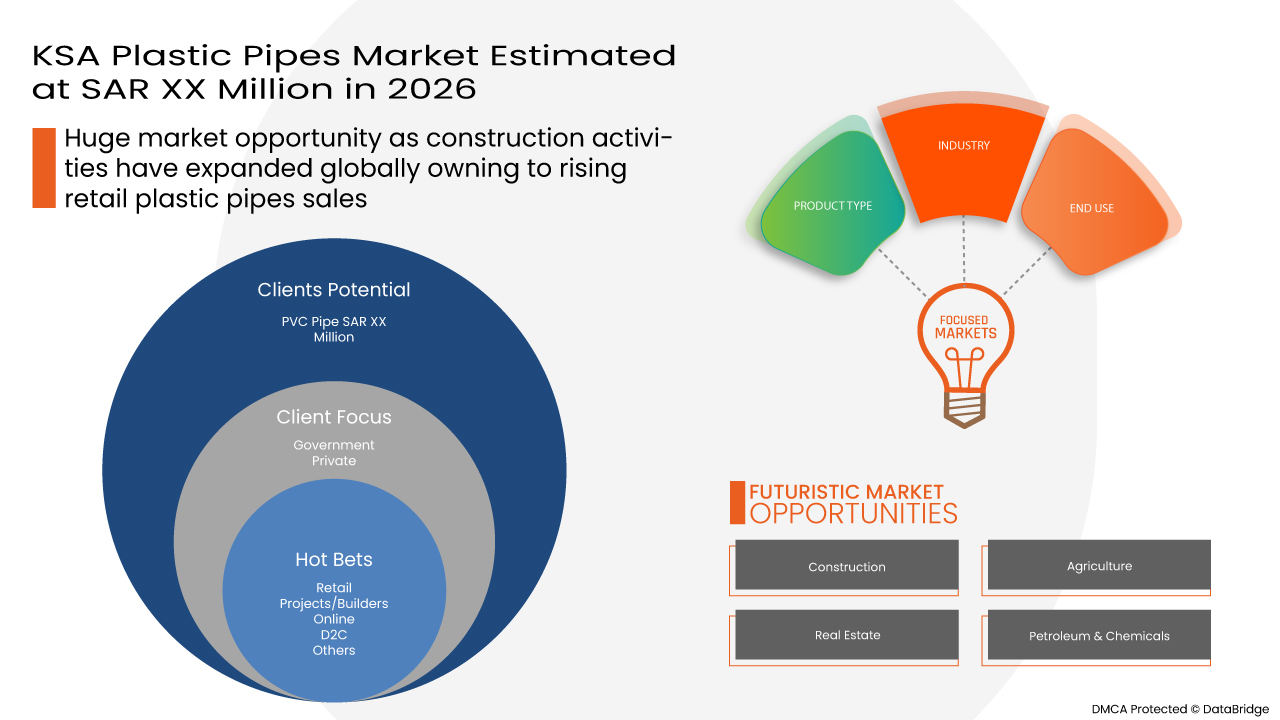

Ces tuyaux en plastique sont très utiles pour remplacer les systèmes de canalisations municipaux anciens ou obsolètes . Data Bridge Market Research analyse que le marché des tuyaux en plastique devrait atteindre la valeur de 4 755,01 millions SAR d'ici 2026, à un TCAC de 4,5 % au cours de la période de prévision. Les « tuyaux en PVC » représentent le segment de type de produit le plus important sur le marché respectif en raison de l'augmentation des activités de construction. Le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2026 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions de SAR, prix en SAR |

|

Segments couverts |

Par type de produit (tuyaux en PVC, tuyaux en PE, tuyaux en PPR, raccords en PVC, raccords en PPR, collecteurs en PPR, tuyaux électriques, film étirable et autres), industrie (privée et gouvernementale), utilisation finale (construction, hôpitaux, agriculture, immobilier, pétrole et produits chimiques et autres), canal (D2C, vente au détail, projets/constructeurs, en ligne et autres) et villes (AL-Ahsa, Arar, Dammam, Djeddah, Khamis, Médine, Riyad, Tabuk, Qassim et reste de l'Arabie saoudite) |

|

Pays couvert |

Arabie Saoudite |

|

Acteurs du marché couverts |

AL KOLBAN Thermopipe Factory Co., Manaf Holding Company, Knoah Technology, Alwasail Industrial Company, Tahweel Pipes, Abdur Rahman A. Al-Rajhi Group LLC, Saudi Hepco, Union Pipes Industry, New Products Industries Co Ltd. (Neproplast), SAPPCO et SAUDI PIPE SYSTEM |

Définition du marché

La plupart des codes de plomberie reconnaissent que les tuyaux en plastique ou en PE sont acceptables pour les services d'eau, le drainage et les égouts. Le plastique peut être utilisé à basse température sans risque de rupture fragile. Ainsi, une application majeure de certaines formulations de tuyaux en PE est destinée aux applications de transfert de chaleur à basse température telles que le chauffage par le sol, la fonte des neiges, les patinoires et les tuyaux de pompe à chaleur géothermique.

Cadre réglementaire

- ISO 13953:2001: La présente Norme internationale décrit une méthode d'essai pour la détermination de la résistance à la traction et du mode de rupture par traction des assemblages de tubes en plastique (PE) soudés bout à bout. La méthode est applicable aux assemblages soudés bout à bout entre tubes en PE de diamètre extérieur nominal. La méthode peut être utilisée, conjointement avec d'autres méthodes d'essai, pour évaluer la qualité des assemblages soudés bout à bout.

- API SPEC 15LE : 2008 : Cette spécification vise à fournir des normes pour les conduites en plastique (PE) adaptées au transport de pétrole, de gaz et d'eau non potable dans les applications souterraines, en surface et de regarnissage pour les industries productrices de pétrole et de gaz. La norme ne propose pas de répondre à toutes les préoccupations de sécurité associées à la conception, à l'installation ou à l'utilisation des produits suggérés dans le présent document

Ces normes fournissent une qualification pour la production de tubes en plastique, des protocoles et des lignes directrices qui garantissent un niveau de sécurité élevé et certifient le matériau à utiliser.

Le COVID-19 a eu un impact minimal sur le marché des tuyaux en plastique en Arabie saoudite

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, un impact significatif a été constaté sur le marché des tuyaux en plastique. Les opérations et la chaîne d'approvisionnement des tuyaux en plastique , avec plusieurs installations de fabrication, fonctionnaient toujours dans la région. Les prestataires de services ont continué à proposer des produits de tuyaux en plastique en suivant les mesures d'hygiène et de sécurité dans le scénario post-COVID.

La dynamique du marché des tuyaux en plastique en Arabie saoudite comprend :

- Demande croissante de produits alimentaires prêts à consommer

Les aliments prêts à cuire nécessitent des solutions d'emballage parfaites pour les protéger de la contamination biologique et des influences physiques. Cela a augmenté la demande de matériaux d'emballage isolants thermiques, contribuant à la croissance du marché nord-américain des emballages isolants thermiques.

- Réhabilitation et construction en cours de réseaux de canalisations municipales anciens ou obsolètes

Les ruptures de canalisations d'égouts municipales posent un certain nombre de risques environnementaux et de sécurité et nécessitent l'attention immédiate des responsables de l'urbanisme. Négliger une rupture de canalisation d'égout peut entraîner des problèmes plus coûteux et plus graves, notamment une contamination par des eaux toxiques ou des inondations, des dommages aux rues et aux trottoirs et bien d'autres. Par conséquent, les nouvelles lignes de systèmes de canalisations sont remplacées par des systèmes d'égouts endommagés et compromis grâce à l'utilisation de nouvelles technologies de canalisations en PE. En conclusion, l'utilisation de systèmes en PE a rendu le système de réparation et de construction de canalisations municipales plus facile et plus sûr. Cela a à son tour augmenté la demande de tuyaux en plastique et contribué ainsi à la croissance du marché des tuyaux en plastique en Arabie saoudite.

- Utilisation croissante des tuyaux en PEHD dans diverses industries d'utilisation finale

La création d’innovations nouvelles et avancées pour les applications d’utilisation finale se traduirait par une forte pénétration du marché et une variété de nouveaux produits. En outre, les tuyaux en PEHD sont utilisés dans le monde entier pour des applications telles que les conduites d’eau, les conduites de gaz, les conduites d’égout, les conduites de transfert de boues, l’irrigation rurale, les conduites d’alimentation des systèmes d’incendie, les conduits électriques et de communication, ainsi que les conduites d’eaux pluviales et de drainage. En conclusion, la ductilité élevée du PEHD et sa capacité à résister aux déflexions dues aux mouvements du sol peuvent résister aux chocs, à la pression et aux mouvements qui peuvent potentiellement détruire le tuyau rigide. Cela a à son tour augmenté la demande de tuyaux en plastique et contribué ainsi à la croissance du marché des tuyaux en plastique en Arabie saoudite.

- La croissance de la demande en systèmes d'irrigation en eau dans le secteur agricole

Les tuyaux en PVC PE sont durables et peuvent facilement résister à une pression et à des contraintes soudaines pendant des années. Par conséquent, la longue durée de vie des tuyaux en PVC leur confère un avantage sur les autres tuyaux, en particulier en ce qui concerne l'utilisation agricole. Dans des conditions appropriées, le tuyau peut même durer plus de 50 ans sans être remplacé. Par rapport à un tuyau métallique, un tuyau en PVC PE agricole coûte une fraction du prix, ce qui est assez économique pour les agriculteurs. En conclusion, les tuyaux en PVC PE sont très personnalisables et le marché est donc inondé de nombreux raccords de différents types et tailles de tuyaux. Cela a à son tour augmenté la demande de tuyaux en plastique et contribué ainsi à la croissance du marché des tuyaux en plastique en Arabie saoudite.

- Innovation et avancées technologiques dans le domaine des tubes PE

Les progrès réalisés dans le domaine du modèle et de la technologie des tuyaux en PEHD permettent de les utiliser dans les tuyaux en PE, qui sont également utilisés dans les applications de construction, les fils et les câbles, les tubes médicaux, les revêtements de sol, les tissus et d'autres applications industrielles. Les nouvelles avancées comprennent les raccords en PVC-O, le PPR orienté et les raccords en PVC modifiés pour les tuyaux en PE, qui sont considérablement plus résistants, permettant de réduire l'épaisseur de la paroi de près de 50 % tout en maintenant la même résistance à la pression. En outre, les progrès rapides et croissants de la technologie de production de tuyaux en plastique aideront les fabricants à réaliser davantage de bénéfices et à augmenter leurs capacités de production, ce qui, à son tour, répondra à la demande croissante de tuyaux en plastique. Cela constituera une opportunité majeure pour l'expansion et la croissance du marché des tuyaux en plastique en Arabie saoudite.

Contraintes/défis rencontrés par le marché des tuyaux en plastique en Arabie saoudite

- Risques liés aux bris de canalisations

L'éclatement des conduites d'eau est l'un des problèmes de plomberie courants auxquels les propriétaires doivent faire face. Que ce soit dans le réseau de plomberie de la maison ou dans les conduites d'alimentation, les conduites d'eau peuvent éclater sans avertissement, ce qui nécessite une réparation majeure nécessitant l'intervention d'un plombier qualifié. Les tuyaux éclatés sont souvent le résultat d'un niveau important de dommages structurels, notamment une mauvaise structure de la tuyauterie et une mauvaise qualité. En conclusion, lorsqu'un colmatage se produit dans les tuyaux, il peut provoquer une accumulation de pression dans ces tuyaux, entraînant des ruptures de tuyaux. Cela diminue à son tour la demande de tuyaux en PE et restreint ainsi la demande du marché des tuyaux en plastique en Arabie saoudite.

- Volatilité des prix des matières premières

Lors de la production de tuyaux en plastique, les gaz nocifs peuvent stimuler les maladies des plantes, inhiber la production de graines et entraver la fertilisation. Par conséquent, des réglementations strictes concernant la fabrication de tuyaux en plastique peuvent apporter à la société et à l'industrie divers avantages, rendant ainsi la production et les chaînes d'approvisionnement plus propres et plus sûres et réduisant le risque d'accidents. Cela incite également à développer des produits de tuyauterie plus sûrs et plus économes en ressources ainsi que des méthodes de production plus sûres. En conclusion, les tuyaux en PE sont reconnus comme des tuyaux de plomberie acceptables pour les services d'eau, le drainage et les applications d'égouts dans la plupart des codes de plomberie modèles, ce qui nécessite en outre des règles et réglementations différentes pour l'application des tuyaux en PE. Cela réduit à son tour la demande de tuyaux en plastique et constitue donc un défi pour la croissance du marché des tuyaux en plastique en Arabie saoudite

Ce rapport sur le marché des tuyaux en plastique en Arabie saoudite fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l’analyse des importations et des exportations, l’analyse de la production, l’optimisation de la chaîne de valeur, la part de marché, l’impact des acteurs du marché national et localisé, les opportunités d’analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l’analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d’application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d’informations sur le marché des rodenticides, contactez Data Bridge Market Research pour un briefing d’analyste. Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développement récent

- En octobre 2016, Tahweel Pipes a obtenu le certificat (DVGW), un certificat allemand prouvant que les pipes Tahweel sont saines et exemptes de croissance microbienne et de sédiments nocifs, ce qui les rend adaptées à la consommation. Cela a permis à l'entreprise de gagner une bonne part de marché dans le monde entier.

- En octobre 2020, Alwasail Industrial Company a entrepris des projets d'irrigation à Neom, en Arabie saoudite, contribuant ainsi à la transformation de la ville en un centre mondial d'innovation et de commerce de premier plan. Cela a aidé l'entreprise à générer davantage de revenus à long terme

- En mars 2021, la société industrielle Alwasail a organisé une formation pour les étudiants de l'Institut supérieur des industries du plastique dans l'usine de la société industrielle Alwasail, à Al-Qassim. Cela a aidé l'entreprise à augmenter sa capacité de production de tubes en plastique.

Portée du marché des tuyaux en plastique en Arabie saoudite

Le marché des tuyaux en plastique en Arabie saoudite est segmenté en fonction du type de produit, de l'industrie, de l'utilisation finale, du canal et des villes. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Tuyau en PVC

- Tubes en PE

- Tubes PPR

- Raccords en PVC

- Raccords PPR

- Collecteurs PPR

- Conduites électriques

- Film étirable

- Autres

En fonction du type de produit, le marché des tuyaux en plastique en Arabie saoudite est segmenté en tuyaux en PVC, tuyaux en PE, tuyaux en PPR, raccords en PVC, raccords en PPR, collecteurs en PPR, tuyaux électriques, films étirables et autres. Le segment des tuyaux en PVC devrait dominer le marché car ils sont légers, ce qui les rend faciles à transporter et sûrs à utiliser, augmentant ainsi sa demande dans le pays

Industrie

- Gouvernement

- Privé

En fonction de l'industrie, le marché des tuyaux en plastique en Arabie saoudite est segmenté en secteur privé et public. Le segment public devrait dominer le marché en raison de l'industrialisation croissante et de l'adoption de divers projets gouvernementaux ces derniers temps, ce qui augmente sa demande en Arabie saoudite

Utilisation finale

- Construction

- Immobilier

- Agriculture

- Pétrole et produits chimiques

- Hôpitaux

- Autres

En fonction de l'utilisation finale, le marché des tuyaux en plastique en Arabie saoudite est segmenté en construction, hôpitaux, agriculture, immobilier, pétrole et produits chimiques et autres. Le segment de la construction devrait dominer le marché en raison de la croissance démographique et de la construction rapide de bureaux et de bâtiments, ce qui augmente sa demande dans le pays.

Canal

- Vente au détail

- Projets/Constructeurs

- En ligne

- D2C

- Autres

En fonction des canaux, le marché des tuyaux en plastique en Arabie saoudite est segmenté en D2C, vente au détail, projets/constructeurs, en ligne et autres. Le segment de la vente au détail devrait dominer le marché car les magasins de détail proposent une grande variété de produits et sont facilement disponibles, ce qui augmente sa demande dans le pays

Villes

- Riyad

- Djeddah

- Arar

- Dammam

- Khamis

- Tabouk

- Qassim

- Al-Ahsa

- Médine

- Reste de l'Arabie saoudite

Le marché des tuyaux en plastique en Arabie saoudite est segmenté en fonction des villes : Al-Ahsa, Arar, Dammam, Djeddah, Khamis, Médine, Riyad, Tabuk, Qassim et le reste de l'Arabie saoudite. La ville de Riyad devrait dominer le marché car la plupart des activités de construction sont entreprises dans cette ville, ce qui augmente sa demande dans le pays.

Analyse du paysage concurrentiel et des parts de marché des tuyaux en plastique en Arabie saoudite

Le paysage concurrentiel du marché des tuyaux en plastique en Arabie saoudite fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence de l'Arabie saoudite, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des tuyaux en plastique en Arabie saoudite.

Certains des principaux acteurs opérant sur le marché des tuyaux en plastique en Arabie saoudite sont AL KOLBAN Thermopipe Factory Co., Manaf Holding Company, Knoah Technology, Alwasail Industrial Company, Tahweel Pipes, Abdur Rahman A. Al-Rajhi Group LLC, Saudi Hepco, Union Pipes Industry, New Products Industries Co Ltd. (Neproplast), SAPPCO et SAUDI PIPE SYSTEM entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF KSA PLASTIC PIPES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMMISSIONS/REWARDS OFFERED TO PLUMBERS BY THE KEY PLAYERS

4.2 COMMISSION/BONUS STRUCTURE PROVIDED BY KEY PLAYERS

4.2.1 SALE TEAM

4.2.2 MARKETING TEAM

4.3 DETAILS SCENARIO OF SHOPS BY CITY

4.3.1 RIYADH

4.3.2 JEDDAH

4.3.3 MECCA

4.3.4 MEDINA

4.3.5 SULTANAH

4.3.6 DAMMAM

4.3.7 TAIF

4.3.8 REST OF KSA

4.4 DETAILS OF SHOPS IN KSA

4.5 MARKET SHARE OF TOP MANUFACTURES

4.5.1 TOP MANUFACTURERS, BY PRODUCT TYPE

4.5.1.1 ALWASAIL INDUSTRIAL COMPANY

4.5.1.2 ALMUNIF PIPES

4.5.1.3 TAHWEEL PIPES

4.5.1.4 UNION PIPES INDUSTRY

4.5.1.5 AL KOLBAN THERMOPIPE FACTORY CO.

4.5.2 TOP MANUFACTURERS, BY CITIES

4.5.2.1 ALWASAIL INDUSTRIAL COMPANY

4.5.2.2 ALMUNIF PIPES

4.5.2.3 TAHWEEL PIPES

4.5.2.4 UNION PIPES INDUSTRY

4.5.2.5 AL KOLBAN THERMOPIPE FACTORY CO.

4.5.3 TOP MANUFACTURERS, BY CHANNEL

4.5.3.1 ALWASAIL INDUSTRIAL COMPANY

4.5.3.2 ALMUNIF PIPES

4.5.3.3 TAHWEEL PIPES

4.5.3.4 UNION PIPES INDUSTRY

4.5.3.5 AL KOLBAN THERMOPIPE FACTORY CO.

4.6 CREDIT TERMS OFFERED BY KEY PLAYERS

4.7 TRADE DISCOUNTS & SALES REBATES OFFERED BY KEY PLAYERS

4.8 PRODUCT TYPE WISE RETURN AS PER INDUSTRY STANDARD (%) (2021)

4.9 PRIMARY REASONS FOR RETURNS

5 CLIMATE CHANGE SCENARIO

5.1 CLIMATE CHANGE SCENARIO

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 ONGOING REHABILITATION AND CONSTRUCTION OF OLD OR OBSOLETE MUNICIPAL PIPE SYSTEMS

7.1.2 INCREASING APPLICATION OF HDPE PIPES IN VARIOUS END-USE INDUSTRIES

7.1.3 GROWTH IN DEMAND FOR WATER IRRIGATION SYSTEMS IN THE AGRICULTURAL INDUSTRY

7.2 RESTRAINTS

7.2.1 VOLATILITY IN RAW MATERIAL PRICES

7.2.2 RISK ASSOCIATED WITH PIPE BREAKAGES

7.3 OPPORTUNITIES

7.3.1 RAPID URBANIZATION ALONG WITH INCREASING INDUSTRIAL PRODUCTION

7.3.2 INNOVATION AND TECHNOLOGICAL ADVANCEMENTS IN PE PIPE

7.4 CHALLENGES

7.4.1 STRINGENT REGULATORY COMPLIANCES REGARDING THE USAGE OF PE BASED PIPES

8 KSA PLASTIC PIPES MARKET, COUNTRY ANALYSIS

8.1 OVERVIEW

9 KSA PLASTIC PIPES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 PVC PIPE

9.3 PE PIPES

9.4 PPR PIPES

9.5 PVC FITTINGS

9.6 PPR FITTINGS

9.7 PPR MANIFOLDS

9.8 ELECTRICAL PIPES

9.9 STRETCH FILM

9.1 OTHERS

10 KSA PLASTIC PIPES MARKET, BY INDUSTRY

10.1 OVERVIEW

10.2 GOVERNMENT

10.3 PRIVATE

11 KSA PLASTIC PIPES MARKET, BY END-USE

11.1 OVERVIEW

11.2 CONSTRUCTION

11.3 REAL ESTATE

11.4 AGRICULTURE

11.5 PETROLEUM & CHEMICALS

11.6 HOSPITALS

11.7 OTHERS

12 KSA PLASTIC PIPES MARKET, BY CHANNEL

12.1 OVERVIEW

12.2 RETAIL

12.3 PROJECTS/BUILDERS

12.4 ONLINE

12.5 D2C

12.6 OTHERS

13 KSA PLASTIC PIPES MARKET, BY CITIES

13.1 OVERVIEW

13.2 RIYADH

13.3 JEDDAH

13.4 ARAR

13.5 DAMMAM

13.6 KHAMIS

13.7 TABUK

13.8 QASSIM

13.9 AL-AHSA

13.1 MADINAH

13.11 REST OF KSA

14 KSA PLASTIC PIPES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: KSA

14.1.1 EXPANSIONS

14.1.2 NEW PRODUCT DEVELOPMENT

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ALWASAIL INDUSTRIAL COMPANY

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT UPDATES

16.2 ALMUNIF PIPES

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT UPDATES

16.3 TAHWEEL PIPES

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT UPDATES

16.4 UNION PIPES INDUSTRY

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT UPDATES

16.5 AL KOLBAN THERMOPIPE FACTORY CO.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT UPDATE

16.6 SAUDI HEPCO

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT UPDATE

16.7 SAPPCO

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT UPDATES

16.8 ABDUR RAHMAN A. AL-RAJHI GROUP L.L.C.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT UPDATE

16.9 KNOAH TECHNOLOGY

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT UPDATE

16.1 NEW PRODUCTS INDUSTRIES CO LTD. (NEPROPLAST)

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATE

16.11 SAUDI PIPE SYSTEMS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATE

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 EXPORT DATA OF RIGID TUBES, PIPES, AND HOSES OF POLYMERS OF ETHYLENE (PE), HS - 391721 (SAR MILLION)

TABLE 2 IMPORT DATA OF RIGID TUBES, PIPES, AND HOSES OF POLYMERS OF ETHYLENE, HS - 391721 (SAR MILLION)

TABLE 3 SALARY STRUCTURE OF SALE TEAM

TABLE 4 SALARY STRUCTURE OF MARKETING TEAM

TABLE 5 NUMBER OF SHOPS IN RIYADH

TABLE 6 NUMBER OF SHOPS IN JEDDAH

TABLE 7 NUMBER OF SHOPS IN MECCA

TABLE 8 NUMBER OF SHOPS IN MEDINA

TABLE 9 NUMBER OF SHOPS IN SULTANAH

TABLE 10 NUMBER OF SHOPS IN DAMMAM

TABLE 11 NUMBER OF SHOPS IN MEDINA

TABLE 12 NUMBER OF SHOPS IN REST OF KSA

TABLE 13 DETAILS OF SHOPS IN KSA

TABLE 14 PRODUCT TYPE WISE RETURN AS PER INDUSTRY STANDARD (IN %) (2021)

TABLE 15 KSA PLASTIC PIPES MARKET, BY COUNTRY, 2017-2026 (SAR MILLION)

TABLE 16 KSA PLASTIC PIPES MARKET, BY PRODUCT TYPE, 2017-2026 (SAR MILLION)

TABLE 17 KSA PLASTIC PIPES MARKET, BY INDUSTRY, 2017-2026 (SAR MILLION)

TABLE 18 KSA PLASTIC PIPES MARKET, BY END-USE, 2017-2026 (SAR MILLION)

TABLE 19 KSA PLASTIC PIPES MARKET, BY CHANNEL, 2017-2026 (SAR MILLION)

TABLE 20 KSA PLASTIC PIPES MARKET, BY CITIES, 2017-2026 (SAR MILLION)

Liste des figures

FIGURE 1 KSA PLASTIC PIPES MARKET: SEGMENTATION

FIGURE 2 KSA PLASTIC PIPES MARKET: DATA TRIANGULATION

FIGURE 3 KSA PLASTIC PIPES MARKET: DROC ANALYSIS

FIGURE 4 KSA PLASTIC PIPES MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 KSA PLASTIC PIPES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KSA PLASTIC PIPES MARKET: PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 KSA PLASTIC PIPES MARKET: MULTIVARIATE MODELLING

FIGURE 8 KSA PLASTIC PIPES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 KSA PLASTIC PIPES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 KSA PLASTIC PIPES MARKET: APPLICATION COVERAGE GRID

FIGURE 11 KSA PLASTIC PIPES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 KSA PLASTIC PIPES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 KSA PLASTIC PIPES MARKET: SEGMENTATION

FIGURE 14 GROWTH IN DEMAND FOR WATER IRRIGATION SYSTEMS IN THE AGRICULTURAL INDUSTRY IS EXPECTED TO DRIVE THE KSA PLASTIC PIPES MARKET IN THE FORECAST PERIOD OF 2022 TO 2026

FIGURE 15 PVC PIPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KSA PLASTIC PIPES MARKET IN 2022 & 2026

FIGURE 16 ALWASAIL INDUSTRIAL COMPANY, BY PRODUCT TYPE, 2021 (%)

FIGURE 17 ALMUNIF PIPES, BY PRODUCT TYPE, 2021 (%)

FIGURE 18 TAHWEEL PIPES, BY PRODUCT TYPE, 2021 (%)

FIGURE 19 UNION PIPES INDUSTRY, BY PRODUCT TYPE, 2021 (%)

FIGURE 20 AL KOLBAN THERMOPIPE FACTORY CO., BY PRODUCT TYPE, 2021 (%)

FIGURE 21 ALWASAIL INDUSTRIAL COMPANY, BY CITIES, 2021 (%)

FIGURE 22 ALMUNIF PIPES, BY CITIES, 2021 (%)

FIGURE 23 TAHWEEL PIPES, BY CITIES, 2021 (%)

FIGURE 24 UNION PIPES INDUSTRY, BY CITIES, 2021 (%)

FIGURE 25 AL KOLBAN THERMOPIPE FACTORY CO., BY CITIES, 2021 (%)

FIGURE 26 ALWASAIL INDUSTRIAL COMPANY, BY CHANNEL, 2021 (%)

FIGURE 27 ALMUNIF PIPES, BY CHANNEL, 2021 (%)

FIGURE 28 TAHWEEL PIPES, BY CHANNEL, 2021 (%)

FIGURE 29 UNION PIPES INDUSTRY, BY CHANNEL, 2021 (%)

FIGURE 30 AL KOLBAN THERMOPIPE FACTORY CO., BY CHANNEL, 2021 (%)

FIGURE 31 PLASTIC PIPE MANUFACTURING - SUPPLY CHAIN ANALYSIS

FIGURE 32 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE KSA PLASTIC PIPES MARKET

FIGURE 33 KSA PLASTIC PIPES MARKET, BY PRODUCT TYPE, 2021

FIGURE 34 KSA PLASTIC PIPES MARKET, BY INDUSTRY, 2021

FIGURE 35 KSA PLASTIC PIPES MARKET, BY END-USE, 2021

FIGURE 36 KSA PLASTIC PIPES MARKET, BY CHANNEL, 2021

FIGURE 37 KSA PLASTIC PIPES MARKET, BY CITIES, 2021

FIGURE 38 KSA PLASTIC PIPES MARKET: COMPANY SHARE 2021 (%)

FIGURE 39 PROFILED COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.