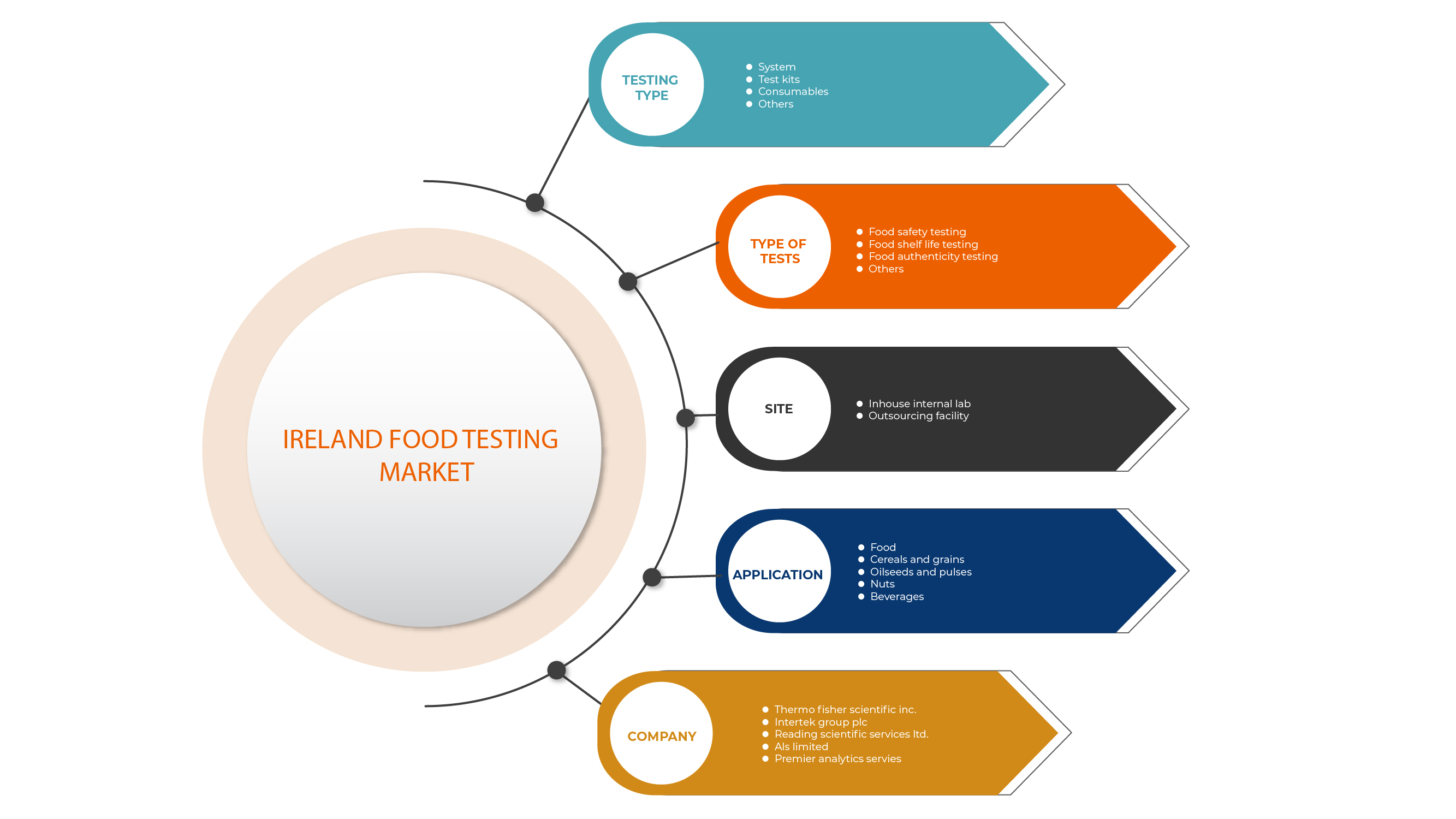

Marché des tests alimentaires en Irlande, par type de test (système, kits de test, consommables et autres), type de tests (tests de sécurité alimentaire, tests de durée de conservation des aliments, tests d'authenticité des aliments et autres), site (laboratoire interne/interne, installation d'externalisation), application (aliments, céréales et grains, oléagineux et légumineuses, noix et boissons), tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché

Les tests de produits alimentaires sont une étape importante pour définir la sécurité des aliments destinés à leur utilisation. Ils sont importants pour confirmer que les aliments sont exempts de contaminants physiques, chimiques et biologiques. Les exemples courants de contaminants alimentaires sont les bactéries et les virus tels que Escherichia coli, Salmonella, les conservateurs et les pesticides. Les tests et la sécurité des aliments sont effectués pour analyser scientifiquement la teneur en nutriments des aliments. Ils sont effectués pour fournir des informations sur de multiples caractéristiques des aliments, telles que la compréhension de la structure, de la composition et des propriétés physicochimiques. Les autres raisons pour lesquelles des tests alimentaires sont effectués sont également de tester la qualité des produits alimentaires, le contrôle de la qualité, l'inspection et le classement des aliments. Le type de tests mis en œuvre pour les tests alimentaires est le test d'authenticité des aliments et le test de durée de conservation des aliments.

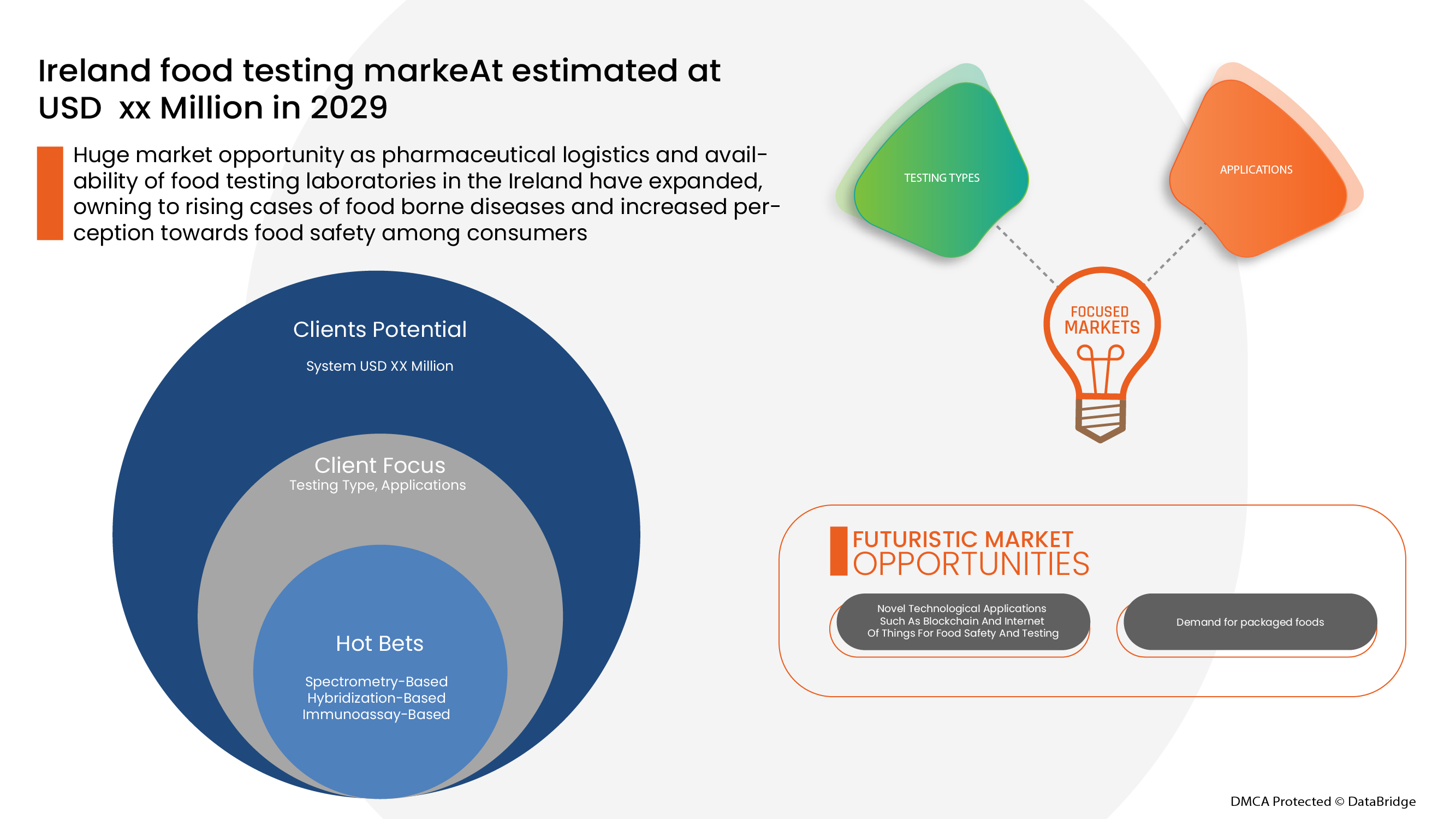

En Irlande, la recrudescence des cas de maladies d'origine alimentaire, causées par des agents pathogènes, des virus ou des aliments avariés, a de graves conséquences pour les consommateurs et les marques connues. Par conséquent, pour protéger la santé du public et respecter les réglementations en matière de sécurité alimentaire, il est essentiel de tester la présence et la détection de micro-organismes nocifs

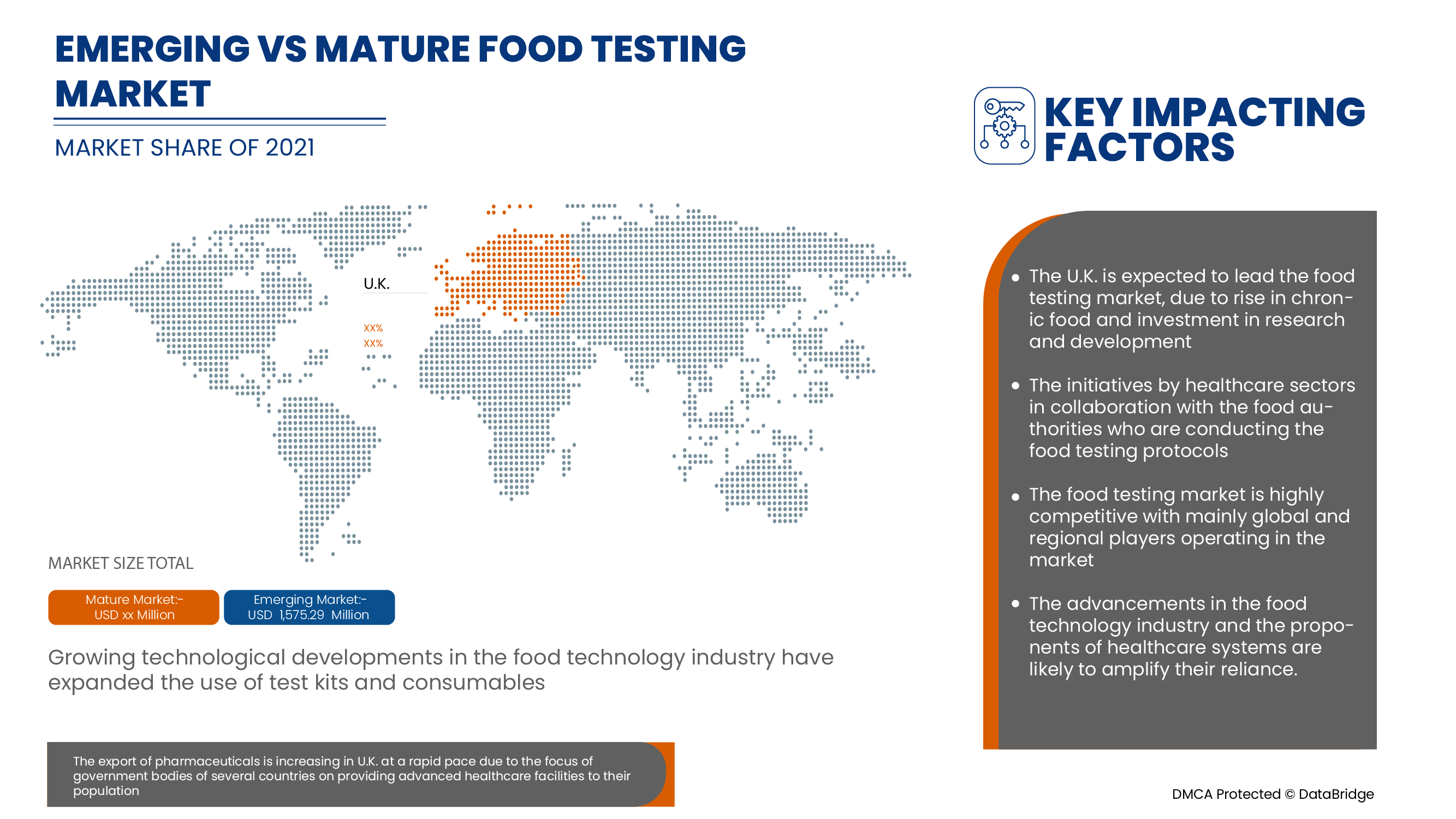

Les tests alimentaires en Irlande sont encourageants et visent à réduire la gravité des symptômes. Data Bridge Market Research analyse que le marché irlandais des tests alimentaires connaîtra un TCAC de 5,0 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Période de prévision |

2022 - 2029 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de test (système, kits de test, consommables et autres), type de tests (tests de sécurité alimentaire, tests de durée de conservation des aliments, tests d'authenticité des aliments et autres), site (laboratoire interne, installation d'externalisation), application (aliments, céréales et grains, graines oléagineuses et légumineuses, noix et boissons), |

|

Pays couvert |

Irlande |

|

Acteurs du marché couverts |

Thermo Fisher Scientific Inc., Intertek Group plc, Eurofins Scientific, ALS Limited, SGS SA, TUV SUD, NEOGEN Corporation, Microlabs Ltd, Advanced Laboratory Testing (société mère Mérieux NutriSciences) et NSF International |

Dynamique du marché des tests alimentaires en Irlande

Conducteurs

- Augmentation de l'incidence des maladies d'origine alimentaire en Irlande

Les maladies d'origine alimentaire sont également dues à une variété de bactéries, de parasites et de virus, comme par exemple Salmonella et Cryptosporidium. La Food Standards Agency indique qu'en 2021, environ 2,4 millions de cas de maladies d'origine alimentaire se sont produits en Irlande

Par exemple,

- En 2021, les données de Food Safety News en Irlande indiquent que le pathogène Campylobacter a causé environ 3 154 cas d'origine alimentaire, suivi de la cryptosporidiose qui a causé 845 cas, de la bactérie Salmonella qui a causé 173 cas. Le nombre de cas causés par des maladies d'origine hydrique est de 25 et le nombre de cas survenus en raison du pathogène yersinose est de 19.

L'augmentation des cas de maladies d'origine alimentaire en Irlande devrait sensibiliser les consommateurs à l'importance de la sécurité alimentaire et des tests. Ce concept permettrait aux organismes gouvernementaux de s'associer aux industries du marché pour développer des laboratoires de tests alimentaires dans les États en développement d'Irlande.

- Sensibilisation accrue des consommateurs à la sécurité alimentaire

La sécurité alimentaire fait référence à la manipulation et au stockage appropriés des aliments afin d'éviter l'apparition de maladies d'origine alimentaire résultant de la consommation d'aliments frelatés. La sensibilisation à la sécurité alimentaire et à l'hygiène est d'une importance vitale pour les industries agroalimentaires, afin de protéger la santé des consommateurs contre les maladies d'origine alimentaire.

Par exemple,

- En Irlande, l'Autorité irlandaise de sécurité alimentaire (FSAI) s'est associée au ministère de l'Agriculture et de la Sécurité alimentaire, un organisme subsidiaire, pour sensibiliser les organisations gouvernementales et le public à la sécurité et à l'hygiène alimentaires.

Les points ci-dessus montrent que la sensibilisation accrue des consommateurs devrait permettre de créer des partenariats avec le gouvernement et les acteurs du marché, basés dans l'industrie alimentaire, en matière de sécurité alimentaire et de tests. Cette sensibilisation accrue permettrait de diffuser les principes de sécurité alimentaire aux prestataires de services alimentaires, qui peuvent être facilement interprétés et mis en œuvre, ce qui devrait stimuler la croissance du marché des tests alimentaires .

Opportunités

- Initiatives stratégiques des acteurs du marché

Le besoin de laboratoires d'analyse des aliments pour les tests alimentaires en Irlande a augmenté en raison de l'augmentation de la prévalence et de l'incidence des maladies d'origine alimentaire, ainsi que de la sensibilisation accrue des consommateurs en Angleterre et en Irlande à la sécurité alimentaire.

Les principaux acteurs tentent également de mettre en place des stratégies spécifiques, telles que le lancement de produits, les acquisitions, les approbations, les extensions et les partenariats, pour assurer le bon fonctionnement de l'entreprise, éviter les risques et augmenter la croissance à long terme des ventes sur le marché.

Les principaux acteurs tentent également d’élaborer des stratégies spécifiques, telles que des lancements de produits, des acquisitions, des approbations, des extensions et des partenariats, pour assurer le bon fonctionnement de l’entreprise, éviter les risques et augmenter la croissance à long terme des ventes du marché.

Par exemple,

- En juillet 2021, Bureau Veritas et The Ascott Limited (Ascott), l'un des principaux propriétaires-exploitants d'hôtels internationaux, ont signé un accord mondial visant à fournir des audits et des certifications pour les normes d'hygiène et de sécurité des propriétés d'Ascott dans le monde entier. Cet accord a aidé l'entreprise à renforcer ses activités

- En avril 2021, Thermo Fisher Scientific Inc. a annoncé un accord définitif avec PPD, Inc., l'un des principaux fournisseurs mondiaux de services de recherche clinique pour l'industrie pharmaceutique et biotechnologique. Cet accord permettra à l'entreprise de fournir à ses clients des services de recherche clinique importants et de les aider de nouvelles façons à transformer rapidement une idée scientifique en médicament approuvé.

- La croissance des avancées technologiques dans le secteur des tests alimentaires

Les restrictions imposées à la chaîne d'approvisionnement alimentaire ont été imposées pour contrôler la pandémie. Les fournisseurs et les fabricants à chaque étape de la chaîne d'approvisionnement, qu'il s'agisse d'ingrédients bruts ou de produits manufacturés, sont légalement responsables de s'assurer qu'aucun constituant ou contaminant non intentionnel n'est présent dans leurs produits. Il existe une demande conséquente de techniques d'analyse sensibles et fiables dans l'ensemble de l'industrie alimentaire et des boissons. Les avancées technologiques dans l'industrie des tests alimentaires sont la spectroscopie, la chromatographie et les immuno-essais. Par conséquent, pour surmonter les obstacles, les derniers développements technologiques sont nécessaires dans les systèmes de test alimentaire pour surmonter ces processus aberrants.

Par exemple,

- En juillet 2016, Intertek Group plc a développé une technique unique de test fiable de l'authenticité du miel , en collaboration avec le département d'identification botanique, zoologique et géographique (BoogIH) du miel de miellat. La technologie innovante développée par Intertek Group plc vise à standardiser les méthodes de référence uniformes et à soutenir l'expertise technique et le leadership dans l'ensemble du réseau de services alimentaires de l'entreprise.

L'utilisation de nouvelles avancées technologiques devrait améliorer le diagnostic, la stratification des risques et la surveillance des maladies dans les échantillons alimentaires. Les nouvelles technologies innovantes devraient jouer un rôle important dans les tests de sécurité alimentaire, car elles ont un impact direct sur les coûts associés aux tests alimentaires. Par conséquent, l'utilisation de nouvelles technologies et les avancées dans le secteur des tests alimentaires devraient créer des opportunités lucratives pour le marché irlandais des tests alimentaires

Contraintes/Défis

Complexité des méthodes de test

Les laboratoires d'analyse des aliments effectuent un contrôle d'authenticité qui garantit la qualité du contenu du produit alimentaire. De cette manière, les analyses alimentaires garantissent que les consommateurs ne deviennent pas victimes de fraudes économiques et que la concurrence entre les fabricants de produits alimentaires est raisonnable.

Par exemple,

- Le manque de ressources humaines et des infrastructures obsolètes

- La pénurie de produits chimiques, utilisés pour tester des échantillons alimentaires

- La charge d'échantillons est relativement élevée et la plupart des laboratoires ne sont pas équipés pour effectuer des tests visant à vérifier la présence de microbes, de pesticides ou de métaux.

La complexité des méthodes de test entraînerait une diminution de la disponibilité des laboratoires et des installations de test en Irlande. Cela entraînerait une augmentation des cas de maladies d'origine alimentaire et des retards de traitement. Par conséquent, la complexité des méthodes de test devrait freiner la croissance du marché.

Le rapport sur le marché des tests alimentaires en Irlande fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des tests alimentaires en Irlande, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Analyse épidémiologique des patients

L'infection alimentaire en Irlande est une maladie chronique du pied relativement rare et dont l'incidence est inconnue. L'étude du National Center of Biotechnology Information (NCBI) indique qu'il y a 566 000 cas, 74 000 consultations chez des généralistes et 7 600 hospitalisations liées à des maladies d'origine alimentaire causées par 13 agents pathogènes connus au Royaume-Uni.

Le marché irlandais des tests alimentaires vous fournit également une analyse de marché détaillée pour l'analyse des patients, le pronostic et les remèdes. La prévalence, l'incidence, la mortalité et les taux d'adhésion sont quelques-unes des variables de données disponibles dans le rapport. Les analyses d'impact directes ou indirectes de l'épidémiologie sur la croissance du marché sont analysées pour créer un modèle statistique multivarié de cohorte plus robuste pour prévoir le marché au cours de la période de croissance.

Impact du Covid-19 sur le marché irlandais des tests alimentaires

La COVID-19 a eu un impact négatif sur le marché. Les confinements et l’isolement pendant les pandémies compliquent la gestion du diagnostic et du traitement. Le manque d’accès aux établissements de santé et aux laboratoires d’analyse des aliments aura également un impact sur le marché. L’isolement social augmente le stress, le désespoir et le soutien social, ce qui peut entraîner une réduction des tests d’échantillons alimentaires pendant la pandémie.

Développement récent

- En mars 2022, ALS Limited avait annoncé l'expansion de ses activités en Europe avec l'acquisition de Controlvet. Cette acquisition permettrait d'améliorer les services de test alimentaire dans la région irlandaise et de souligner l'engagement d'ALS envers le plan stratégique de croissance de l'activité alimentaire et pharmaceutique en tant que leader mondial du marché.

Portée du marché des tests alimentaires en Irlande

Le marché irlandais des tests alimentaires est segmenté en fonction du type de test, du type de test, du site et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de test

- Systèmes

- Kits de test

- Consommables

- Autres

Sur la base du type de test , le marché est segmenté en système, kits de test, consommables et autres

Type de tests

- Tests de sécurité alimentaire

- Test de durée de conservation des aliments

- Test d'authenticité des aliments

- Autres.

Sur la base des médicaments, le marché est segmenté en tests de sécurité alimentaire, tests de durée de conservation des aliments , tests d'authenticité des aliments et autres.

Site

- Laboratoire interne et interne

- Facilité d'externalisation.

Sur la base du site, le marché est segmenté en laboratoire interne et en installation d'externalisation.

Application

- Nourriture

- Céréales et grains

- Oléagineux et légumineuses

- Noix et boissons

Sur la base de la voie d'application, le marché irlandais des tests alimentaires est segmenté en aliments, céréales et grains, oléagineux et légumineuses, noix et boissons.

Analyse du paysage concurrentiel et des parts de marché des tests alimentaires en Irlande

Le paysage concurrentiel du marché irlandais des tests alimentaires fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché irlandais des tests alimentaires.

Certains des principaux acteurs opérant sur le marché irlandais des tests alimentaires sont Thermo Fisher Scientific Inc., Intertek Group plc, Reading Scientific Services Ltd., ALS Limited, Premier Analytics Servies, Campden BRI, Bia Analytical, Eurofins Scientific, Food Forensics Limited, SGS SA, Bureau Veritas, TUV SUD, NEOGEN Corporation, NSF International et Romer Labs Division Holding GmbH, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF IRELAND FOOD TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 IRELAND FOOD TESTING MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 OVERVIEW OF RISK PARTNERSHIP SERVICES

4.1.1 CONSULTANCY ADVICE

4.1.2 RISK-BASED TOOLS

4.1.3 SUPPLY CHAIN MANAGEMENT

4.1.4 AUDIT AND TRAINING

4.2 BREAKOUT OF SMALL, MEDIUM, AND LARGE MANUFACTURERS TO UNDERSTAND MARKET DYNAMICS IN THE IRELAND FOOD TESTING MARKET

4.3 EMERGING TREND ANALYSIS IN THE IRELAND FOOD TESTING MARKET

4.4 INTERNAL FOOD TESTING LABORATORY IN THE IRELAND FOOD TESTING MARKET

4.5 LAST FIVE YEARS OF ACQUIRED INTERNAL FOOD TESTING LABORATORIES

4.6 SUPPLY CHAIN ANALYSIS IN IRELAND FOOD SAFETY TESTING MARKET

4.7 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF THE IRELAND FOOD TESTING TECHNOLOGIES

4.8 TECHNOLOGICAL TRENDS IN IRELAND FOOD TESTING MARKET

4.9 THE IRELAND FOOD SAFETY TESTING MARKET- GROWING FOOD ADULTERATION CASES IN THE IRELAND

4.1 IRELAND FOOD TESTING MARKET- GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.11 IRELAND FOOD TESTING MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.12 MANUFACTURER AND RETAIL ASSESSMENTS IN TERMS OF CATEGORY GROWTH/TRENDS,

4.12.1 KEY INNOVATIONS, SPECIFIC GROWTH/STAGNATION/DECLINE CATEGORIES IN THE IRELAND FOOD TESTING MARKET

5 REGULATORY FRAMEWORK AND GUIDELINES

5.1 FOOD AND BEVERAGES SAFETY AND QUALITY REGULATIONS

5.2 FOODBORNE ILLENESS OUTBREAK AND RELEVANT ACTIONS TAKEN BY GOVERNMENT BODIES

5.3 FOOD PRODUCTS RECALLS/WITHDRAWLS

5.4 ANALYSIS OF LAW SUITS RELATED TO FOOD SAFETY TESTING

5.5 RECNTLY FORMED LAWS FOR FOOD SAFETY TESTING BY GOVERNMENT BODIES

5.6 CHANGES IN GLOBAL FOOD SAFETY REGULATIONS

6 SUMMARY WRITE UP (IRELAND)

6.1 OVERVIEW

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN CASES OF FOODBORNE DISEASES IN THE IRELAND

7.1.2 INCREASED CONSUMER AWARENESS ABOUT FOOD SAFETY

7.1.3 ROLE OF GOVERNMENT ON FOOD SAFETY

7.1.4 INCREASE IN DEMAND FOR PACKAGED FOODS

7.1.5 STRICT REGULATIONS FOR FOOD SAFETY

7.2 RESTRAINTS

7.2.1 COMPLEXITY IN TESTING METHODS

7.2.2 LACK OF MAINTENANCE ON SAFETY UNIFORM STANDARDS

7.2.3 RISE IN FOOD RECALLS

7.2.4 HIGH COST ASSOCIATED WITH THE FOOD SAFETY TESTING EQUIPMENT

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

7.3.2 RISE IN EXPENDITURE

7.3.3 THE GROWTH OF TECHNOLOGICAL ADVANCEMENTS IN THE FOOD TESTING INDUSTRY

7.4 CHALLENGES

7.4.1 LACK OF AWARENESS AND EXPERTISE ON FOOD SAFETY REGARDING HAZARDOUS EFFECTS OF AVOIDING FOOD SAFETY TESTS

7.4.2 LACK OF FOOD MANAGEMENT INFRASTRUCTURE IN THE IRELAND

8 IRELAND FOOD TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 SYSTEM

8.2.1 SPECTROMETRY-BASED

8.2.2 HYBRIDIZATION -BASED

8.2.2.1 POLYMERASE CHAIN REACTION (PCR)

8.2.2.2 MICROARRAYS

8.2.2.3 GENE AMPLIFIERS

8.2.2.4 SEQUENCERS

8.2.3 IMMUNOASSAY-BASED

8.2.4 CHROMATOGRAPHY-BASED

8.2.4.1 LIQUID CHROMATOGRAPHY

8.2.4.2 GAS CHROMATOGRAPHY

8.2.4.3 COLUMN CHROMATOGRAPHY

8.2.4.4 THIN LAYER CHROMATOGRAPHY

8.2.4.5 PAPER CHROMATOGRAPHY

8.2.5 BIOSENSORS/BIOCHIP

8.2.6 ISOTOPE METHODS

8.2.7 OTHERS

8.3 TEST KITS

8.4 CONSUMABLES

8.5 OTHERS

9 IRELAND FOOD TESTING MARKET, BY TYPE OF TESTS

9.1 OVERVIEW

9.2 FOOD SAFETY TESTING

9.2.1 ALLERGEN TESTING

9.2.1.1 PEANUT & SOY

9.2.1.2 GLUTEN

9.2.1.3 MILK

9.2.1.4 EGG

9.2.1.5 TREE NUTS

9.2.1.6 SEAFOOD

9.2.1.7 OTHERS

9.2.2 PATHOGEN TESTING

9.2.2.1 SALMONELLA SPP

9.2.2.2 E. COLI

9.2.2.3 LISTERIA SPP

9.2.2.4 VIBRIO SPP

9.2.2.5 CAMPYLOBACTER

9.2.2.6 OTHERS

9.2.3 GMO TESTING

9.2.3.1 STACKED

9.2.3.2 INSECT RESISTANCE

9.2.3.3 HERBICIDE TOLERANCE

9.2.4 MYCOTOXINS TESTING

9.2.4.1 AFLATOXINS

9.2.4.2 OCHRATOXINS

9.2.4.3 FUMONISINS

9.2.4.4 TRICHOTHECENES

9.2.4.5 DEOXYNIVALENOL

9.2.4.6 ZEARALENONE

9.2.4.7 PATULIN

9.2.5 NUTRITIONAL LABELLING

9.2.6 HEAVY METALS TESTING

9.2.6.1 ARSENIC

9.2.6.2 CADMIUM

9.2.6.3 LEAD

9.2.6.4 MERCURY

9.2.6.5 OTHERS

9.2.7 PESTICIDES TESTING

9.2.7.1 HERBICIDES

9.2.7.2 INSECTICIDES

9.2.7.3 FUNGICIDES

9.2.7.4 OTHERS

9.2.8 ORGANIC CONTAMINANTS TESTING

9.2.9 OTHERS

9.3 FOOD SHELF LIFE TESTING

9.3.1 MICROBIAL CONTAMINATION

9.3.2 CHEMICAL TESTS

9.3.3 RANCIDITY

9.3.3.1 PEROXIDE VALUE (PV)

9.3.3.2 P-ANISIDINE (P-AV)

9.3.3.3 FREE FATTY ACIDS (FFA)

9.3.4 ACIDITY LEVEL

9.3.5 NUTRIENT STABILITY

9.3.6 ORGANOLEPTIC APPEARANCE

9.3.6.1 COLOR

9.3.6.2 TEXTURE

9.3.6.3 AROMA

9.3.6.4 TASTE

9.3.6.5 PACKAGING

9.3.6.6 SEPARATION

9.3.6.7 STRATIFICATION

9.3.7 BROWNING

9.3.7.1 ENZYMATIC BROWNING

9.3.7.2 CHEMICAL BROWNING

9.3.8 FOOD SHELF LIFE TESTING, BY METHOD

9.3.8.1 REAL-TIME SHELF LIFE TESTING

9.3.8.2 ACCELERATED SHELF-LIFE TESTING

9.3.9 FOOD SHELF LIFE TESTING, BY PACKAGED FOOD CONDITION

9.3.9.1 FROZEN (-15°C TO -20°C )

9.3.9.2 REFRIGERATED (2°C TO 8°C )

9.3.9.3 AMBIENT (25°C/60%RH)

9.3.9.4 INTERMEDIATE (30°C/65%RH)

9.3.9.5 ACCELERATED (40°C/75%RH)

9.3.9.6 TROPICAL (30°C/75%RH)

9.3.9.7 OTHERS

9.4 FOOD AUTHENTICITY TESTING

9.4.1.1 ADULTERATION TESTS

9.4.1.2 ORGANIC

9.4.1.3 ALLERGEN TESTING

9.4.1.4 MEAT SPECIATION

9.4.1.5 GMO TESTING

9.4.1.6 HALAL VERIFICATION

9.4.1.7 KOSHER VERIFICATION

9.4.1.8 PROTECTED GEOGRAPHICAL INDICATION (PGI)

9.4.1.9 PROTECTED DENOMINATION OF ORIGIN (PDO)

9.4.1.10 FALSE LABELING

9.5 OTHERS

10 IRELAND FOOD TESTING MARKET, BY SITE

10.1 OVERVIEW

10.2 INHOUSE/INTERNAL LAB

10.3 OUTSOURCING FACILITY

11 IRELAND FOOD TESTING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FOOD

11.2.1 FOOD, BY TYPE

11.2.1.1 EDIBLE OILS

11.2.1.1.1 SUNFLOWER OIL

11.2.1.1.2 PEANUT OIL

11.2.1.1.3 SOYBEAN OIL

11.2.1.1.4 OLIVE OIL

11.2.1.1.5 COCONUT OIL

11.2.1.1.6 OTHERS

11.2.1.2 EDIBLE OILS, BY TESTING TYPE

11.2.1.2.1 FOOD SAFETY TESTING

11.2.1.2.2 FOOD AUTHENTICITY TESTING

11.2.1.2.3 FOOD SHELF LIFE TESTING

11.2.1.3 SPICES

11.2.1.3.1 SPICES, BY TYPE OF TESTS

11.2.1.3.1.1 FOOD SAFETY TESTING

11.2.1.3.1.2 FOOD AUTHENTICITY TESTING

11.2.1.3.1.3 FOOD SHELF LIFE TESTING

11.2.1.4 DAIRY PRODUCTS

11.2.1.4.1 DAIRY PRODUCTS, BY TYPE

11.2.1.4.1.1 CHEESE

11.2.1.4.1.1.1 CHEESE CAKE

11.2.1.4.1.1.2 CHEESE CREAM

11.2.1.4.1.1.3 CHEESE BASED DESSERTS

11.2.1.4.1.1.4 CHEESE PUDDING

11.2.1.4.1.1.5 OTHERS

11.2.1.4.1.2 PROCESSED CHEESES

11.2.1.4.1.3 ICE CREAM

11.2.1.4.1.4 YOGURT

11.2.1.4.1.5 MILK DESSERT

11.2.1.4.1.6 PUDDING

11.2.1.4.1.7 CUSTARD

11.2.1.4.1.8 OTHERS

11.2.1.5 DAIRY PRODUCTS, BY TYPE OF TESTS

11.2.1.5.1 FOOD SAFETY TESTING

11.2.1.5.2 FOOD AUTHENTICITY TESTING

11.2.1.5.3 FOOD SHELF LIFE TESTING

11.2.1.6 CONFECTIONARY

11.2.1.6.1 CONFECTIONARY, BY TYPE

11.2.1.6.1.1 JAMS AND JELLIES

11.2.1.6.1.2 CANDY BARS

11.2.1.6.1.3 JELLY CANDIES

11.2.1.6.1.4 MARMALADES

11.2.1.6.1.5 FRUIT JELLY DESSERT

11.2.1.6.1.6 MERINGUES

11.2.1.6.1.7 OTHERS

11.2.1.7 CONFECTIONARY, BY TYPE OF TESTS

11.2.1.7.1 FOOD SAFETY TESTING

11.2.1.7.2 FOOD AUTHENTICITY TESTING

11.2.1.7.3 FOOD SHELF LIFE TESTING

11.2.1.8 HERBAL EXTRACTS AND HERBS

11.2.1.8.1 HERBAL EXTRACTS AND HERBS, BY TYPE OF TESTS

11.2.1.8.1.1 FOOD SAFETY TESTING

11.2.1.8.1.2 FOOD AUTHENTICITY TESTING

11.2.1.8.1.3 FOOD SHELF LIFE TESTING

11.2.1.9 MEAT & POULTRY PRODUCTS

11.2.1.9.1 MEAT & POULTRY PRODUCTS, BY TYPE

11.2.1.9.1.1 CHICKEN

11.2.1.9.1.1.1 FROZEN

11.2.1.9.1.1.2 FRESH

11.2.1.9.1.2 PORK

11.2.1.9.1.2.1 FROZEN

11.2.1.9.1.2.2 FRESH

11.2.1.9.1.3 SEAFOOD

11.2.1.9.1.3.1 FROZEN

11.2.1.9.1.3.2 FRESH

11.2.1.9.1.4 BEEF

11.2.1.9.1.4.1 FROZEN

11.2.1.9.1.4.2 FRESH

11.2.1.9.1.5 LAMB

11.2.1.9.1.5.1 FROZEN

11.2.1.9.1.5.2 FRESH

11.2.1.9.1.6 OTHERS

11.2.1.9.1.6.1 FROZEN

11.2.1.9.1.6.2 FRESH

11.2.1.9.2 MEAT AND POULTRY PRODUCTS, BY TYPE OF TESTS

11.2.1.9.2.1 FOOD SAFETY TESTING

11.2.1.9.2.2 FOOD AUTHENTICITY TESTING

11.2.1.9.2.3 FOOD SHELF LIFE TESTING

11.2.1.10 PROCESSED FOOD

11.2.1.10.1.1 CANNED FRUITS & VEGETABLES

11.2.1.10.1.2 JAMS, PRESERVES & MARMALADES

11.2.1.10.1.3 FRUIT & VEGETABLE PUREE

11.2.1.10.1.4 SAUCES, DRESSINGS AND CONDIMENTS

11.2.1.10.1.5 READY MEALS

11.2.1.10.1.6 PICKLES

11.2.1.10.1.7 SOUPS

11.2.1.10.2 PROCESSED FOOD , BY TYPE OF TESTS

11.2.1.10.2.1 FOOD SAFETY TESTING

11.2.1.10.2.2 FOOD AUTHENTICITY TESTING

11.2.1.10.2.3 FOOD SHELF LIFE TESTING

11.2.1.11 HONEY

11.2.1.11.1 HONEY, BY TYPE OF TESTS

11.2.1.11.1.1 FOOD SAFETY TESTING

11.2.1.11.1.2 FOOD AUTHENTICITY TESTING

11.2.1.11.1.3 FOOD SHELF LIFE TESTING

11.2.1.12 BABY FOODS

11.2.1.12.1 BABY FOODS, BY TYPE OF TESTS

11.2.1.12.1.1 FOOD SAFETY TESTING

11.2.1.12.1.2 FOOD AUTHENTICITY TESTING

11.2.1.12.1.3 FOOD SHELF LIFE TESTING

11.2.1.13 PLANT BASED MEAT AND MEAT ALTERNATIVES

11.2.1.13.1 PLANT BASED MEAT AND MEAT ALTERNATIVES, BY TYPE

11.2.1.13.1.1 BURGER & PATTIES

11.2.1.13.1.2 SAUSAGES

11.2.1.13.1.3 STRIPS & NUGGETS

11.2.1.13.1.4 MEATBALLS

11.2.1.13.1.5 TEMPEH

11.2.1.13.1.6 TOFU

11.2.1.13.1.7 SEITEN

11.2.1.13.1.8 OTHERS

11.2.1.13.2 PLANT BASED MEAT AND MEAT ALTERNATIVES, BY TYPE OF TESTS

11.2.1.13.2.1 FOOD SAFETY TESTING

11.2.1.13.2.2 FOOD AUTHENTICITY TESTING

11.2.1.13.2.3 FOOD SHELF LIFE TESTING

11.2.1.14 TOBACCO

11.2.1.14.1 TOBACCO, BY TYPE OF TESTS

11.2.1.14.1.1 FOOD SAFETY TESTING

11.2.1.14.1.2 FOOD AUTHENTICITY TESTING

11.2.1.14.1.3 FOOD SHELF LIFE TESTING

11.2.1.15 CBD PRODUCTS

11.2.1.15.1 CBD, BY TYPE OF TESTS

11.2.1.15.1.1 FOOD SAFETY TESTING

11.2.1.15.1.2 FOOD AUTHENTICITY TESTING

11.2.1.15.1.3 FOOD SHELF LIFE TESTING

11.3 CEREALS & GRAINS

11.3.1 CEREALS & GRAINS, BY TYPE

11.3.1.1 WHEAT

11.3.1.2 MAIZE

11.3.1.3 BARLEY

11.3.1.4 RICE

11.3.1.5 OAT

11.3.1.6 SORGHUM

11.3.1.7 OTHERS

11.3.2 CEREALS & GRAINS, BY TYPE OF TESTS

11.3.2.1 FOOD SAFETY TESTING

11.3.2.2 FOOD AUTHENTICITY TESTING

11.3.2.3 FOOD SHELF LIFE TESTING

11.4 OIL SEEDS & PULSES

11.4.1 OILSEEDS & PULSES, BY TYPE

11.4.1.1 GRAM

11.4.1.2 PEA

11.4.1.3 LENTILS

11.4.1.4 SUNFLOWER

11.4.1.5 SOYABEAN

11.4.1.6 GROUNDNUT

11.4.1.7 SESAME

11.4.1.8 COTTON SEED

11.4.1.9 PALM

11.4.1.10 OTHERS

11.4.2 OILSEEDS & PULSES, BY TYPE OF TESTS

11.4.2.1 FOOD SAFETY TESTING

11.4.2.2 FOOD AUTHENTICITY TESTING

11.4.2.3 FOOD SHELF LIFE TESTING

11.5 NUTS

11.5.1 NUTS, BY TYPE

11.5.1.1 ALMOND

11.5.1.2 WALNUT

11.5.1.3 CASHEW NUT

11.5.1.4 BRAZIL NUT

11.5.1.5 MACADAMIA NUT

11.5.1.6 OTHERS

11.5.2 NUTS, BY TYPE OF TESTS

11.5.2.1 FOOD SAFETY TESTING

11.5.2.2 FOOD AUTHENTICITY TESTING

11.5.2.3 FOOD SHELF LIFE TESTING

11.6 BEVERAGES

11.6.1 BEVERAGES, BY TYPE

11.6.1.1 ALCOHOLIC

11.6.1.1.1 BEER

11.6.1.1.2 WINE

11.6.1.1.3 WHISKY

11.6.1.1.4 VODKA

11.6.1.1.5 TEQUILA

11.6.1.1.6 GIN

11.6.1.1.7 OTHERS

11.6.1.2 NON-ALCOHOLIC

11.6.1.2.1 CARBONATED DRINKS

11.6.1.2.2 MINERAL WATER

11.6.1.2.3 COFFEE

11.6.1.2.4 JUICES

11.6.1.2.5 SMOOTHIES

11.6.1.2.5.1 TEA

11.6.1.2.6 PLANT-BASED MILK

11.6.1.2.6.1 SOY MILK

11.6.1.2.6.2 ALMOND MILK

11.6.1.2.6.3 OAT MILK

11.6.1.2.6.4 CASHEW MILK

11.6.1.2.6.5 RICE MILK

11.6.1.2.6.6 OTHERS

11.6.1.2.7 SPORTS DRINKS

11.6.1.2.8 NUTRITIONAL DRINKS

11.6.1.2.9 OTHERS

11.6.2 BEVERAGES, BY TYPE OF TESTS

11.6.2.1 FOOD SAFETY TESTING

11.6.2.2 FOOD AUTHENTICITY TESTING

11.6.2.3 FOOD SHELF LIFE TESTING

12 IRELAND FOOD TESTING MARKET BY COUNTRY

12.1.1 IRELAND

13 IRELAND FOOD TESTING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: IRELAND

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 EUROFINS SCIENTIFIC (2021)

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 THERMO FISCHER SCIENTIFIC ( (2021)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 INTERTEK GROUP PLC (2021)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 BUREAU VERITAS

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 TÜV SÜD (2021)

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ALS LIMITED (2021)

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 SGS SA (2021)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 NEOGEN CORPORATION (2021)

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 CAMPDEN BRI (2021)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 ROMER LABS DIVISION HOLDING GMBH (A SUBSIDIARY OF DSM) (2021)

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 READING SCIENTIFIC SERVICES LIMITED (2021)

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 PREMIER ANALYTICS SERVIES (2021)

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 NSF INTERNATIONAL (2021)

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 ADVANCED LABORATORY TESTING (2021)

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 BIA ANALYTICAL (2021)

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 FOOD FORENSICS LIMITED (2021)

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 MICROLABS LTD (2021)

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 THE MARKET PLAYERS WHICH ARE UNDER THE CATEGORY OF LARGE SCALE MANUFACTURERS

TABLE 2 THE MARKET PLAYERS WHICH ARE UNDER THE CATEGORY OF SMALL AND MEDIUM SCALE MANUFACTURERS

TABLE 3 NAME OF BUSINESSES, LIKELY SCALE OF TESTING/VALUE BASED ON T/O OF BUSINESS, LOCATIONS

TABLE 4 IRELAND FOOD TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 IRELAND SYSTEM IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 IRELAND HYBRIDIZATION -BASED IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 IRELAND CHROMATOGRAPHY -BASED IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 IRELAND FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD THOUSAND)

TABLE 9 IRELAND FOOD SAFETY TESTING IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 10 IRELAND ALLERGEN TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 IRELAND PATHOGEN TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 IRELAND MYCOTOXINS TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 IRELAND HEAVY METALS TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 IRELAND PESTICIDE TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 IRELAND FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 IRELAND RANCIDITY IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 IRELAND ORGANOLEPTIC APPEARANCE IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 IRELAND BROWNING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 IRELAND FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 22 IRELAND FOOD AUTHENTICITY TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 IRELAND FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 IRELAND FOOD IN FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 IRELAND EDIBLE OILS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 IRELAND EDIBLE OILS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 28 IRELAND SPICES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 29 IRELAND DAIRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 IRELAND CHEESE IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 IRELAND DAIRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 32 IRELAND CONFECTIONARY IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 IRELAND CONFECTIONARY IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 34 IRELAND HERBAL EXTRACTS AND HERBS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 35 IRELAND MEAT AND POULTRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 IRELAND CHICKEN IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 IRELAND PORK IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 IRELAND SEAFOOD IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 IRELAND BEEF IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 IRELAND LAMB IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 IRELAND OTHERS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 IRELAND MEAT AND POULTRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 43 IRELAND PROCESSED FOOD IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 IRELAND PROCESSED FOOD IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 45 IRELAND HONEY IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 46 IRELAND BABY FOODS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 47 IRELAND PLANT BASED MEAT AND MEAT ALTERNATIVES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 IRELAND PLANT BASED MEAT AND MEAT ALTERNATIVES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 49 IRELAND TOBACCO IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 50 IRELAND CBD IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 2 IRELAND CEREALS AND GRAINS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 3 IRELAND OILSEEDS & PULSES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 IRELAND OILSEEDS & PULSES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 5 IRELAND NUTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 IRELAND NUTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 7 IRELAND BEVERAGES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 IRELAND ALCOHOLIC IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 IRELAND NON-ALCOHOLIC IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 IRELAND PLANT-BASED MILK IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 IRELAND NUTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 12 IRELAND FOOD TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 13 IRELAND SYSTEM IN FOOD TESTING MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 14 IRELAND HYBRIDIZATION-BASED IN FOOD TESTING MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 15 IRELAND CHROMATOGRAPHY-BASED IN FOOD TESTING MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 16 IRELAND FOOD TESTING MARKET, BY TYPE OF TESTS , 2020-2029 (USD MILLION)

TABLE 17 IRELAND FOOD SAFETY TESTING IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 18 IRELAND ALLERGEN TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 IRELAND PATHOGEN TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 IRELAND GMO TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 IRELAND MYCOTOXINS TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 IRELAND HEAVY METALS TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 IRELAND PESTICIDES TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 IRELAND FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 IRELAND ORGANOLEPTIC AND APPEARANCE IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 IRELAND RANCIDITY IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 IRELAND BROWNING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 IRELAND FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 29 IRELAND FOOD SHELF LIFE TESTING IN FOOD TESTING MARKET, BY PACKAGED FOOD CONDITION, 2020-2029 (USD MILLION)

TABLE 30 IRELAND FOOD AUTHENTICITY TESTING IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 IRELAND FOOD TESTING MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 32 IRELAND FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 IRELAND FOOD IN FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 IRELAND EDIBLE OILS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 IRELAND EDIBLE OILS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 36 IRELAND SPICES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 37 IRELAND DAIRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 IRELAND CHEESE IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 IRELAND DAIRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 40 IRELAND CONFECTIONERY IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 IRELAND CONFECTIONERY IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 42 IRELAND HERBAL EXTRACTS AND HERBS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 43 IRELAND MEAT AND POULTRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 IRELAND CHICKEN IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 IRELAND PORK IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 IRELAND SEAFOOD IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 IRELAND BEEF IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 IRELAND LAMB IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 IRELAND OTHERS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 IRELAND MEAT AND POULTRY PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 51 IRELAND PROCESSED FOOD IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 IRELAND PROCESSED FOOD IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 53 IRELAND HONEY IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 54 IRELAND BABY FOOD IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 55 IRELAND PLANT BASED MEAT AND MEAT ALTERNATIVES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 IRELAND PLANT BASED MEAT AND MEAT ALTERNATIVES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 57 IRELAND TOBACCO IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 58 IRELAND CBD PRODUCTS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 59 IRELAND CEREALS AND GRAINS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 IRELAND CEREALS AND GRAINS IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 61 IRELAND OILSEED AND PULSES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 IRELAND OILSEED AND PULSES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 63 IRELAND NUTS IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 IRELAND NUTS IN FOOD TESTING MARKET, B TYPE OF TESTS, 2020-2029 (USD MILLION)

TABLE 65 IRELAND BEVERAGES IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 IRELAND NON-ALCOHOLIC IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 IRELAND PLANT-BASED MILK IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 IRELAND ALCOHOLIC IN FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 IRELAND BEVERAGES IN FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 IRELAND FOOD TESTING MARKET: SEGMENTATION

FIGURE 2 IRELAND FOOD TESTING MARKET: DATA TRIANGULATION

FIGURE 3 IRELAND FOOD TESTING MARKET: DROC ANALYSIS

FIGURE 4 IRELAND FOOD TESTING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 IRELAND FOOD TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 IRELAND FOOD TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 IRELAND FOOD TESTING MARKET: DBMR POSITION GRID

FIGURE 8 IRELAND FOOD TESTING MARKET: APPLICATION COVERAGE GRID

FIGURE 9 IRELAND FOOD TESTING MARKET: SEGMENTATION

FIGURE 10 RISE IN CASES OF FOOD BORNE ILLNESS IN THE IRELAND, RISE IN TECHNOLOGICAL DEVELOPMENTS IN FOOD TESTING KITS AND RISE IN CONSUMER CONSCIOUSNESS ABOUT FOOD TESTING AND SAFETY IS EXPECTED TO DRIVE IRELAND FOOD TESTING MARKET FROM 2022 TO 2029

FIGURE 11 TESTING TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE IRELAND FOOD TESTING MARKET FROM 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE IRELAND FOOD TESTING MARKET

FIGURE 13 NUMBER OF CASES CAUSED DUE TO FOODBORNE PATHOGENS IN THE U.K. IN 2016

FIGURE 14 NUMBER OF CASES CAUSED DUE TO FOODBORNE PATHOGENS IN IRELAND IN 2021

FIGURE 15 IRELAND FOOD TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 16 IRELAND FOOD TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD THOUSAND)

FIGURE 17 IRELAND FOOD TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 18 IRELAND FOOD TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 19 IRELAND FOOD TESTINGMARKET: BY TYPE OF TESTS, 2021

FIGURE 20 IRELAND FOOD TESTINGMARKET: BY TYPE OF TESTS, 2022-2029 (USD THOUSAND)

FIGURE 21 IRELAND FOOD TESTINGMARKET: BY TYPE OF TESTS, CAGR (2022-2029)

FIGURE 22 IRELAND FOOD TESTINGMARKET: BY TYPE OF TESTS, LIFELINE CURVE

FIGURE 23 IRELAND FOOD TESTING MARKET: BY SITE, 2021

FIGURE 24 IRELAND FOOD TESTING MARKET: BY SITE, 2022-2029 (USD MILLION)

FIGURE 25 IRELAND FOOD TESTING MARKET: BY SITE, CAGR (2022-2029)

FIGURE 26 IRELAND FOOD TESTING MARKET: BY SITE, LIFELINE CURVE

FIGURE 27 IRELAND FOOD TESTING MARKET: BY APPLICATION, 2021

FIGURE 28 IRELAND FOOD TESTING MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 IRELAND FOOD TESTING MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 IRELAND FOOD TESTING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 IRELAND FOOD TESTING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.