Marché indonésien de la télésanté en entreprise, par composant (matériel, services et logiciels), mode de distribution (cloud, sur site), application (soins primaires virtuels et soins continus, téléradiologie, santé comportementale complète/télépsychiatrie, soins dermatologiques , soins de haute acuité, télésanté pédiatrique en entreprise, autres), appareil de connectivité ( smartphone , ordinateur portable et autres), utilisateur final (prestataires de soins de santé, patients et payeurs de soins de santé) - Tendances et prévisions du secteur jusqu'en 2029.

Analyse et perspectives du marché de la télésanté en entreprise en Indonésie

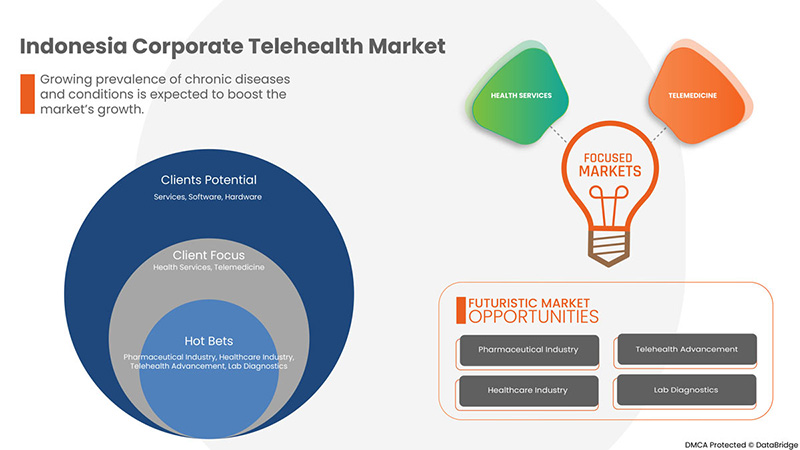

Le marché indonésien de la télésanté en entreprise devrait connaître une croissance significative au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 3,3 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 10 180,06 milliers USD d'ici 2029. Le principal facteur à l'origine de la croissance du marché de la télésanté en entreprise est l'augmentation des efforts pour employer une meilleure qualité de services de santé , la prévalence croissante des maladies et affections chroniques et la pénurie de médecins et de personnel médical selon la population indonésienne.

L'Indonésie a introduit plusieurs réformes dans différents aspects du système de santé, qui a également été affecté par des réformes multisectorielles du gouvernement et de l'administration publique. Les principales réformes multisectorielles comprennent la délégation de l'autorité pour certaines fonctions gouvernementales du gouvernement central aux gouvernements locaux, y compris la responsabilité de la gestion et de la prestation des services de santé publique, et l'introduction progressive d'une plus grande autonomie dans la gestion des organismes de service public, y compris les hôpitaux.

Le rapport sur le marché de la télésanté en entreprise en Indonésie fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par composant (matériel, services et logiciels), mode de distribution (cloud, sur site), application (soins primaires virtuels et soins continus, téléradiologie, santé comportementale complète/télépsychiatrie, soins dermatologiques , soins de haute acuité, télésanté pédiatrique en entreprise, autres), appareil de connectivité ( smartphone , ordinateur portable et autres), utilisateur final (prestataires de soins de santé, patients et payeurs de soins de santé) |

|

Pays couverts |

Indonésie |

|

Acteurs du marché couverts |

HALODOC, Alodokter, ProSehat, Good Doctor, aido health, PT Medika Komunika Teknologi, Vascular Indonesia, Get Healthy Indonesia, Intel Corporation, Cisco Systems, Inc Healthy Link et Trustmedis Indonesia |

Définition du marché

La télésanté permet aux soignants et aux infirmières de maintenir une connexion constante tout en fournissant aux fournisseurs des informations sur la santé des patients en temps réel. Les établissements de télésanté utilisent la technologie pour fournir une éducation sanitaire à distance afin d'améliorer les résultats des clients. L'augmentation de la demande de soins de télésanté est due à l'utilisation croissante d'Internet et des smartphones ainsi qu'à l'évolution des préférences des consommateurs vers un mode de vie plus sain. Les services de télésanté donnent accès aux services de santé par consultation téléphonique/vidéo, ce qui permet au patient de gagner du temps et de réduire les frais de déplacement inutiles.

Dynamique du marché de la télésanté en entreprise en Indonésie

Conducteurs

- Accroissement des efforts pour offrir des services de santé de meilleure qualité

Le gouvernement indonésien étend ses programmes de santé pour parvenir à une couverture sanitaire universelle tout en s’attaquant aux disparités régionales en termes de qualité et d’accessibilité des services, en gérant efficacement les ressources, en réduisant les coûts et en minimisant la fraude. En outre, le gouvernement fait appel au secteur privé et maintient ses investissements dans les programmes de promotion et de prévention de la santé. Le gouvernement indonésien a récemment pris des mesures dans ce sens. Il a demandé le programme national d’assurance maladie Jaminan Kesehatan Nasional (JKN) en 2014 en établissant la loi n° 40/2004 sur le système national de sécurité sociale.

- Prévalence croissante des maladies et affections chroniques

Français On constate une augmentation constante des consultations à distance et en milieu urbain en raison de la prévalence croissante des maladies chroniques, ce qui devrait contribuer à la croissance progressive du marché indonésien de la télésanté d'entreprise. L'augmentation des coûts des soins de santé, l'impulsion des innovations technologiques dans le secteur de la santé et les efforts pour trouver une solution aux problèmes d'accessibilité du secteur de la santé dans les zones reculées sont des problèmes récurrents dans les économies en développement du monde entier, y compris en Indonésie. Dans le même temps, les facteurs de risque de maladies non transmissibles (MNT), telles que l'hypertension artérielle, l'hypercholestérolémie, le surpoids et le tabagisme, augmentent. Répondre à ce schéma épidémiologique de plus en plus complexe dans un contexte de multiples macro-transitions est l'un des principaux défis du système de santé du pays, qui est pris en charge efficacement par l'utilisation des services de télésanté d'entreprise.

- Pénurie de médecins et de personnel médical par rapport à la population indonésienne

La télésanté est un produit alternatif qui s'est avéré très adapté aux conditions démographiques de l'Indonésie pendant la pandémie. Après la pandémie, l'accès limité aux établissements de santé et aux centres sociaux et économiques a entravé la capacité des patients à obtenir régulièrement des informations sur la santé, les consultations et les traitements, ce qui a nécessité l'utilisation des technologies de l'information en matière de santé. Les systèmes de santé dotés de télésanté assurent la continuité des soins ambulatoires aux patients pendant cette pandémie, dans un contexte de mesures de « confinement » et de distanciation physique, tout en réduisant la propagation communautaire et nosocomiale.

Opportunités

- Le gouvernement prend des mesures pour déployer des programmes avec des plateformes de télésanté de premier plan

Français Le gouvernement indonésien travaille dur et s'efforce de parvenir à une couverture sanitaire universelle (CSU) afin que l'ensemble de la population puisse bénéficier de services de santé complets et de qualité sans contraintes de coûts. De plus, le programme National Health Insurance/Healthy Indonesia Card (JKN/KIS) existe depuis le 1er janvier 2014. L'Administration de la sécurité sociale de la santé (BPJS) est responsable de ce programme sur la base de la loi numéro 40 de 2004 concernant le système national de sécurité sociale (SJSN). Ce programme vise à fournir un accès public aux services de santé et à assurer une protection financière. En 2020, la plupart des participants provenaient du segment PBI (APBN) à hauteur de 49,10 %. Cependant, la croissance la plus significative du nombre de participants d'une année à l'autre s'est produite dans le segment non PBI. Jusqu'à la fin de 2020, la couverture totale du JKN/KIS a atteint 222,4 millions de personnes.

- Évolution des préférences des consommateurs en faveur des services de télésanté

Les récents épisodes de la pandémie de COVID-19 ont bouleversé la vie de nombreux secteurs et forcé les gens à appliquer la distanciation sociale dans leur vie quotidienne. Diverses directives des Centers for Disease Control and Prevention (CDC) aux personnes et aux prestataires de soins de santé dans les zones touchées par la pandémie de coronavirus (COVID-19) ont été publiées. Ces directives mettent en œuvre des pratiques de distanciation sociale et recommandent spécifiquement aux établissements de santé et aux prestataires de soins de santé d'utiliser des services cliniques virtualisés. Les patients qui reçoivent des soins palliatifs par télésanté sont généralement très satisfaits car ils économisent plus de temps et d'argent. La télésanté fait référence aux télécommunications et aux technologies de l'information (TI) pour accéder à l'évaluation de la santé, au diagnostic, à l'intervention, à la consultation, à la surveillance et aux informations sur plusieurs distances.

Contraintes/Défis

- Risques liés aux menaces de cybersécurité et sécurisation de la protection des données

La télésanté repose sur la rencontre et l'envoi d'informations par voie électronique via des réseaux informatiques et l'Internet public. Les informations échangées au cours de ces sessions (ainsi que les réseaux connectés eux-mêmes) sont plus exposées aux cybermenaces. Dans le climat actuel de protection strictement réglementée, les fuites peuvent causer de graves problèmes aux établissements médicaux en termes de dommages à la réputation et d'amendes imposées par les régulateurs. Par conséquent, cette expansion rapide des services de télésanté d'entreprise par un nombre croissant de fournisseurs privés et publics survient à une époque où les cyberattaques contre le secteur de la santé sont renforcées. Ces forces créent l'impératif de répondre aux problèmes de cybersécurité uniques auxquels sont confrontés les cliniciens, les patients et les systèmes dans lesquels ils travaillent. Les organisations de soins de santé doivent s'associer à des fournisseurs de télémédecine et de cybersécurité pour tirer parti de ces technologies afin de comprendre comment mettre en œuvre et utiliser au mieux leur infrastructure et leurs produits.

- Augmentation des cas de fraude aux soins de santé

Le nombre de patients souhaitant bénéficier de consultations de télésanté a augmenté, tout comme le risque de fraude et d’abus. À l’ère des services de télésanté offerts par les entreprises, les cliniciens doivent s’assurer que leur assurance responsabilité civile ou responsabilité civile couvre la télémédecine et, si nécessaire, qu’elle couvre les services fournis dans plusieurs États. Pendant l’épidémie de COVID-19, de nombreux cliniciens utilisaient pour la première fois des services de télésanté et devaient s’assurer qu’ils étaient protégés avant de fournir des services. On constate une augmentation des fraudes en matière de télémédecine de la part d’entreprises qui versent souvent des pots-de-vin aux médecins, aux laboratoires et à d’autres personnes pour générer des commandes payées par Medicare et un autre programme de santé fédéral, dont certaines font partie d’un réseau de télémarketing qui incite des milliers de patients âgés ou handicapés à subir des tests génétiques inutiles ou à commander du matériel médical. En dehors de cela, il y a eu diverses fraudes concernant la facturation et les paiements pendant les séances de télésanté, et l’argent n’a pas été crédité à l’hôpital ou au fournisseur de services de télésanté de l’entreprise.

- Problèmes techniques liés aux procédures médicales

L’un des plus grands défis liés à l’utilisation de la télésanté est l’impossibilité de procéder à des examens physiques directs, les problèmes de compatibilité de certaines activités professionnelles avec la télésanté et les problèmes de collaboration interprofessionnelle. La limitation la plus importante de la télésanté est que certains hôpitaux et grands cabinets médicaux sont équipés pour dispenser des soins de cette manière. Pourtant, la plupart des hôpitaux et des cabinets privés ne sont pas équipés de cette manière, et certains hôpitaux peuvent ne pas disposer de technologies dédiées à des programmes tels que les soins aux victimes d’accidents vasculaires cérébraux ou les premiers soins d’urgence dans le cadre de services de télésanté. Les lacunes dans l’accès à la technologie et son utilisation par certains groupes de patients constituent une préoccupation sérieuse.

Développement récent

- En avril 2021, HALODOC a levé un financement de 80 millions USD mené par un nouvel investisseur, PT Astra Digital Internasional, une filiale de PT Astra International Tbk (Astra). D'autres investisseurs ont également participé, notamment Temasek, TMI de Telkomsel, Acrew Diversify Capital Fund, Novo Holdings et Bangkok Bank. UOB Venture Management, Singtel Innov8, Blibli Group, Allianz X, Openspace Ventures et d'autres investisseurs existants.

Impact du COVID-19 sur le marché indonésien de la télésanté en entreprise

Français Les récents épisodes de la pandémie de COVID-19 ont changé la vie dans de nombreux secteurs et ont obligé tout le monde à appliquer la distanciation sociale dans la vie quotidienne. Diverses directives des Centers for Disease Control and Prevention (CDC) aux personnes et aux prestataires de soins de santé dans les zones de pandémie de coronavirus (COVID-19) ont été mises en place. La mise en œuvre de la télésanté en l'intégrant au système de santé national a été réalisée de toute urgence pour lutter contre la pandémie de COVID-19 et d'autres complications liées à la santé. Le gouvernement indonésien a annoncé que les patients présentant des symptômes légers de COVID-19 devraient être traités par télésanté. La mise en œuvre de la télésanté en l'intégrant au système de santé national est réalisée de toute urgence pour lutter contre la pandémie de COVID-19 et d'autres complications liées à la santé. Ainsi, COVID-19 a eu un impact positif sur le marché indonésien de la télésanté d'entreprise et a stimulé sa croissance.

Portée du marché indonésien de la télésanté en entreprise

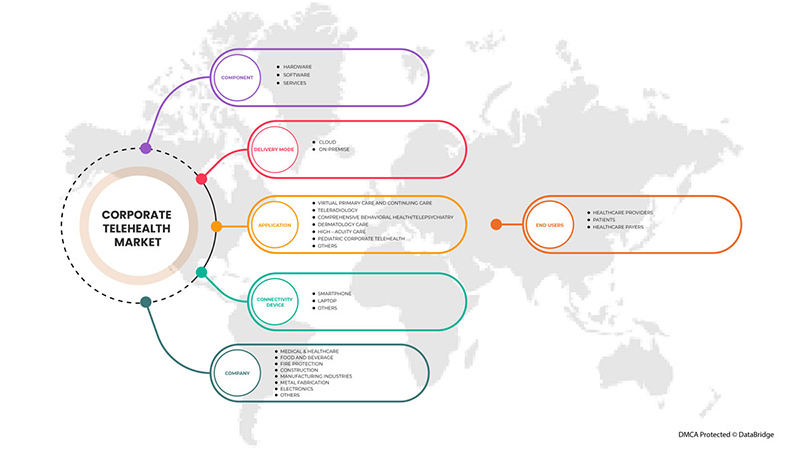

Le marché indonésien de la télésanté d'entreprise est classé en fonction du composant, du mode de livraison, de l'application, du dispositif de connectivité et de l'utilisateur final. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Composant

- Services

- Logiciel

- Matériel

Sur la base des composants, le marché indonésien de la télésanté en entreprise est classé en matériel, logiciels et services.

Mode de livraison

- Nuage

- Sur site

En fonction du mode de livraison, le marché indonésien de la télésanté en entreprise est classé en cloud et sur site.

Application

- Soins primaires et soins continus virtuels

- Téléradiologie

- Santé comportementale globale/télépsychiatrie

- Soins dermatologiques

- Soins de haute acuité

- Télésanté pédiatrique en entreprise

- Autres

Sur la base de l'application, le marché indonésien de la télésanté en entreprise est classé en soins primaires virtuels et soins continus, téléradiologie, santé comportementale complète/télépsychiatrie, soins dermatologiques, soins de haute acuité, télésanté pédiatrique et autres.

Dispositif de connectivité

- Smartphone

- Ordinateur portable

- Autres

En fonction du dispositif de connectivité, le marché indonésien de la télésanté en entreprise est classé en smartphone, ordinateur portable et autres.

Utilisateur final

- Prestataires de soins de santé

- Patients

- Les payeurs de soins de santé

En fonction de l’utilisateur final, le marché indonésien de la télésanté en entreprise est classé en prestataires de soins de santé, patients et payeurs de soins de santé.

Analyse du paysage concurrentiel et des parts de marché de la télésanté en entreprise en Indonésie

Le paysage concurrentiel du marché indonésien de la télésanté d'entreprise fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché indonésien de la télésanté d'entreprise.

Certains des principaux acteurs opérant sur le marché indonésien de la télésanté d'entreprise sont HALODOC, Alodokter, ProSehat, Good Doctor, aido health, PT Medika Komunika Teknologi, Vascular Indonesia, Get Healthy Indonesia, Intel Corporation, Cisco Systems, Inc Healthy Link et Trustmedis Indonesia, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, les grilles de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'Indonésie par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDONESIA CORPORATE TELEHEALTH MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 COMPONENT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKET STRATEGIC INITIATIVES

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 LEGAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 PORTER’S FIVE FORCES:

4.3.1 THREAT OF NEW ENTRANTS:

4.3.2 THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 TECHNOLOGICAL ANALYSIS

4.5 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN EFFORTS TO EMPLOY BETTER HEALTHCARE SERVICES QUALITY

5.1.2 GROWING PREVALENCE OF CHRONIC DISEASES AND CONDITIONS

5.1.3 SHORTAGE OF PHYSICIANS AND MEDICAL STAFF AS PER THE INDONESIAN POPULATION

5.2 RESTRAINTS

5.2.1 RISKS ASSOCIATED WITH CYBER-SECURITY THREATS AND SECURING DATA PROTECTIONS

5.2.2 INCREASING INSTANCES OF HEALTHCARE FRAUDS

5.3 OPPORTUNITIES

5.3.1 RISING ' 'GOVERNMENT'S MEASURES TO DEPLOY PROGRAMS WITH LEADING TELEHEALTH PLATFORMS

5.3.2 SHIFTING CONSUMER PREFERENCE TOWARD TELEHEALTH SERVICES

5.4 CHALLENGE

5.4.1 TECHNICAL PROBLEMS RELATED TO MEDICAL PROCEDURES

6 INDONESIA CORPORATE TELEHEALTH MARKET, BY COMPONENT

6.1 OVERVIEW

6.1.1 SERVICES

6.1.1.1 MANAGED SERVICES

6.1.1.2 PROFESSIONAL SERVICES

6.1.1.3 TRAINING AND CONSULTING

6.1.1.4 IMPLEMENTATION AND INTEGRATION

6.1.1.5 SUPPORT AND MAINTENANCE

6.1.2 SOFTWARE

6.1.2.1 REAL-TIME INTERACTIONS

6.1.2.2 REMOTE PATIENT MONITORING

6.1.2.3 STORE-AND-FORWARD CONSULTATIONS

6.1.2.4 OTHERS

6.1.3 HARDWARE

6.1.3.1 MONITORS

6.1.3.2 MEDICAL PERIPHERAL DEVICES

6.1.3.3 BLOOD PRESSURE MONITORS

6.1.3.4 BLOOD GLUCOSE METERS

6.1.3.5 PULSE OXIMETERS

6.1.3.6 WEIGHT SCALES

6.1.3.7 PEAK FLOW METERS

6.1.3.8 ECG MONITORS

6.1.3.9 ACCESSORIES

6.1.3.10 OTHERS

7 INDONESIA CORPORATE TELEHEALTH MARKET, BY DELIVERY MODEL

7.1 OVERVIEW

7.1.1 CLOUD

7.1.2 ON-PREMISE

8 INDONESIA CORPORATE TELEHEALTH MARKET, BY APPLICATION

8.1 OVERVIEW

8.1.1 VIRTUAL PRIMARY CARE AND CONTINUING CARE

8.1.1.1 DIABETIC SOLUTIONS

8.1.1.1.1 DIABETIC

8.1.1.1.2 PRE-DIABETIC

8.1.1.2 WEIGHT MANAGEMENT

8.1.1.3 OUTPATIENT CARE SOLUTIONS

8.1.1.4 HEART DISEASE

8.1.1.5 ASTHMA

8.1.2 TELERADIOLOGY

8.1.3 COMPREHENSIVE BEHAVIORAL HEALTH/TELEPSYCHIATRY

8.1.4 DERMATOLOGY CARE

8.1.4.1 HIGH-ACUITY CARE

8.1.4.1.1 STROKE SOLUTIONS

8.1.4.1.2 ICU

8.1.5 PEDIATRIC CORPORATE TELEHEALTH

8.1.6 OTHERS

9 INDONESIA CORPORATE TELEHEALTH MARKET, BY CONNECTIVITY DEVICE

9.1 OVERVIEW

9.1.1 SMART PHONE

9.1.2 LAPTOP

9.1.3 OTHERS

10 INDONESIA CORPORATE TELEHEALTH MARKET, BY END-USER

10.1 OVERVIEW

10.2 HEALTHCARE PROVIDERS

10.3 HOSPITALS

10.4 CLINICS

10.5 DIAGNOSTIC CENTERS

10.6 PHARMACIES

10.7 AMBULATORY SURGERY CENTERS (ASCS)

10.8 OTHERS

10.9 PATIENTS

10.1 HEALTHCARE PAYERS

10.11 PRIVATE

10.12 ICU

11 INDONESIA CORPORATE TELEHEALTH MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: INDONESIA

11.1.1 CERTIFICATIONS

11.1.2 FUNDING

11.1.3 ACHIEVEMENT

11.1.4 COLLOBORATION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 HALODOC

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT UPDATES

13.2 ALODOKTER

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT UPDATES

13.3 PROSEHAT

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT UPDATES

13.4 GOOD DOCTOR

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT UPDATE

13.5 AIDO HEALTH

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT UPDATE

13.6 PT MEDIKA KOMUNIKA TEKNOLOGI

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 VASCULAR INDONESIA

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

13.8 CISCO SYSTEMS, INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATE

13.9 GET HEALTHY INDONESIA

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 HEALTHY LINK

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 INTEL CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATES

13.12 TRUSTMEDIS INDONESIA

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 INDONESIA CORPORATE TELEHEALTH MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 2 INDONESIA SERVICES IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 INDONESIA SOFTWARE IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 INDONESIA HARDWARE IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 INDONESIA CORPORATE TELEHEALTH MARKET, BY DELIVERY MODEL, 2020-2029 (USD THOUSAND)

TABLE 6 INDONESIA CORPORATE TELEHEALTH MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 7 INDONESIA VIRTUAL PRIMARY CARE AND CONTINUING CARE IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 INDONESIA DIABETIC SOLUTIONS IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 INDONESIA HIGH-ACUITY CARE IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 INDONESIA CORPORATE TELEHEALTH MARKET, BY CONNECTIVITY DEVICE, 2020-2029 (USD THOUSAND)

TABLE 11 INDONESIA CORPORATE TELEHEALTH MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 12 INDONESIA HEALTHCARE PROVIDERS IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 INDONESIA HEALTHCARE PAYERS IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 INDONESIA CORPORATE TELEHEALTH MARKET: SEGMENTATION

FIGURE 2 INDONESIA CORPORATE TELEHEALTH MARKET: DATA TRIANGULATION

FIGURE 3 INDONESIA CORPORATE TELEHEALTH MARKET: DROC ANALYSIS

FIGURE 4 INDONESIA CORPORATE TELEHEALTH MARKET: INDONESIA MARKET ANALYSIS

FIGURE 5 INDONESIA CORPORATE TELEHEALTH MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDONESIA CORPORATE TELEHEALTH MARKET: THE COMPONENT LIFE LINE CURVE

FIGURE 7 INDONESIA CORPORATE TELEHEALTH MARKET: MULTIVARIATE MODELLING

FIGURE 8 INDONESIA CORPORATE TELEHEALTH MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 INDONESIA CORPORATE TELEHEALTH MARKET: DBMR MARKET POSITION GRID

FIGURE 10 INDONESIA CORPORATE TELEHEALTH MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 INDONESIA CORPORATE TELEHEALTH MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 INDONESIA CORPORATE TELEHEALTH MARKET: SEGMENTATION

FIGURE 13 INCREASE IN EFFORTS TO EMPLOY BETTER HEALTHCARE SERVICES QUALITY IS EXPECTED TO DRIVE INDONESIA CORPORATE TELEHEALTH MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 14 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDONESIA CORPORATE TELEHEALTH MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDONESIA CORPORATE TELEHEALTH MARKET

FIGURE 16 INDONESIA CORPORATE TELEHEALTH MARKET, BY COMPONENT, 2021

FIGURE 17 INDONESIA CORPORATE TELEHEALTH MARKET, BY DELIVERY MODEL, 2021

FIGURE 18 INDONESIA CORPORATE TELEHEALTH MARKET, BY APPLICATION, 2021

FIGURE 19 INDONESIA CORPORATE TELEHEALTH MARKET, BY CONNECTIVITY DEVICE, 2021

FIGURE 20 INDONESIA CORPORATE TELEHEALTH MARKET, BY END-USER, 2021

FIGURE 21 INDONESIA CORPORATE TELEHEALTH MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.