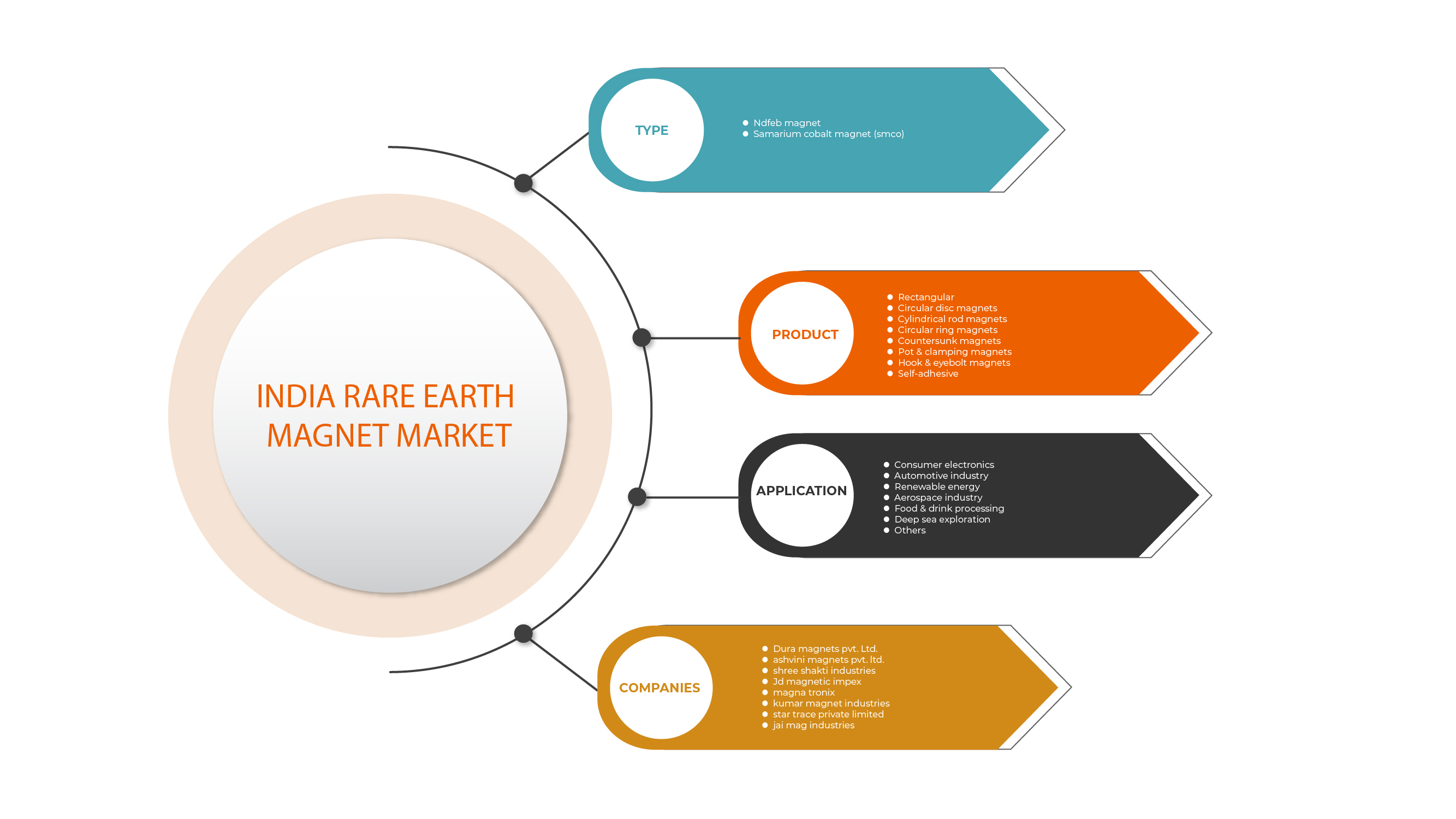

Marché indien des aimants en terres rares, par type (aimant NdFeB, aimant Samarium Cobalt (SmCo) ), produit (aimants à tête fraisée, aimants à disque circulaire, aimants à crochet et à œillet, aimants à tige cylindrique, aimants à anneau circulaire, aimants rectangulaires, auto-adhésifs, à pot et à serrage), application (industrie automobile, transformation des aliments et des boissons, industrie aérospatiale, énergie renouvelable, électronique grand public, exploration en haute mer, autres) – Tendances et prévisions de l’industrie jusqu’en 2029

Analyse et taille du marché

Les aimants aux terres rares sont une invention relativement récente. Leur origine remonte à la fin des années 1960, lorsque des scientifiques du laboratoire des matériaux de l'armée de l'air américaine ont développé un alliage yttrium-cobalt aux caractéristiques magnétiques extrêmement fortes. Le Dr Masato Sagawa a créé les premiers aimants en néodyme (NdFeB) au Japon, qui offraient un niveau de performance élevé et ont inauguré une nouvelle ère de la technologie magnétique. Les aimants aux terres rares ont rapidement attiré l'attention des fabricants et ont rapidement été découverts dans des produits de consommation et des produits professionnels.

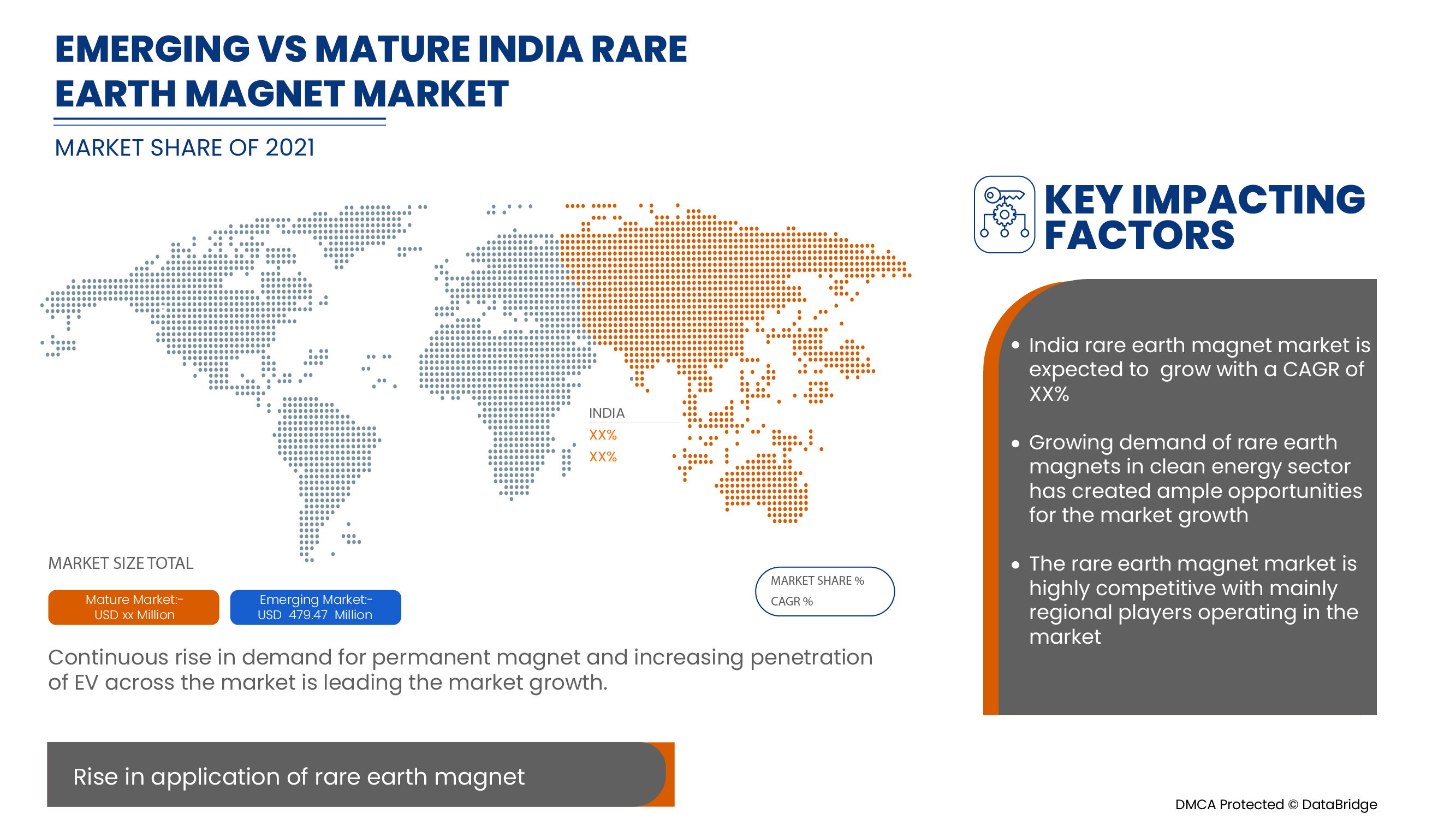

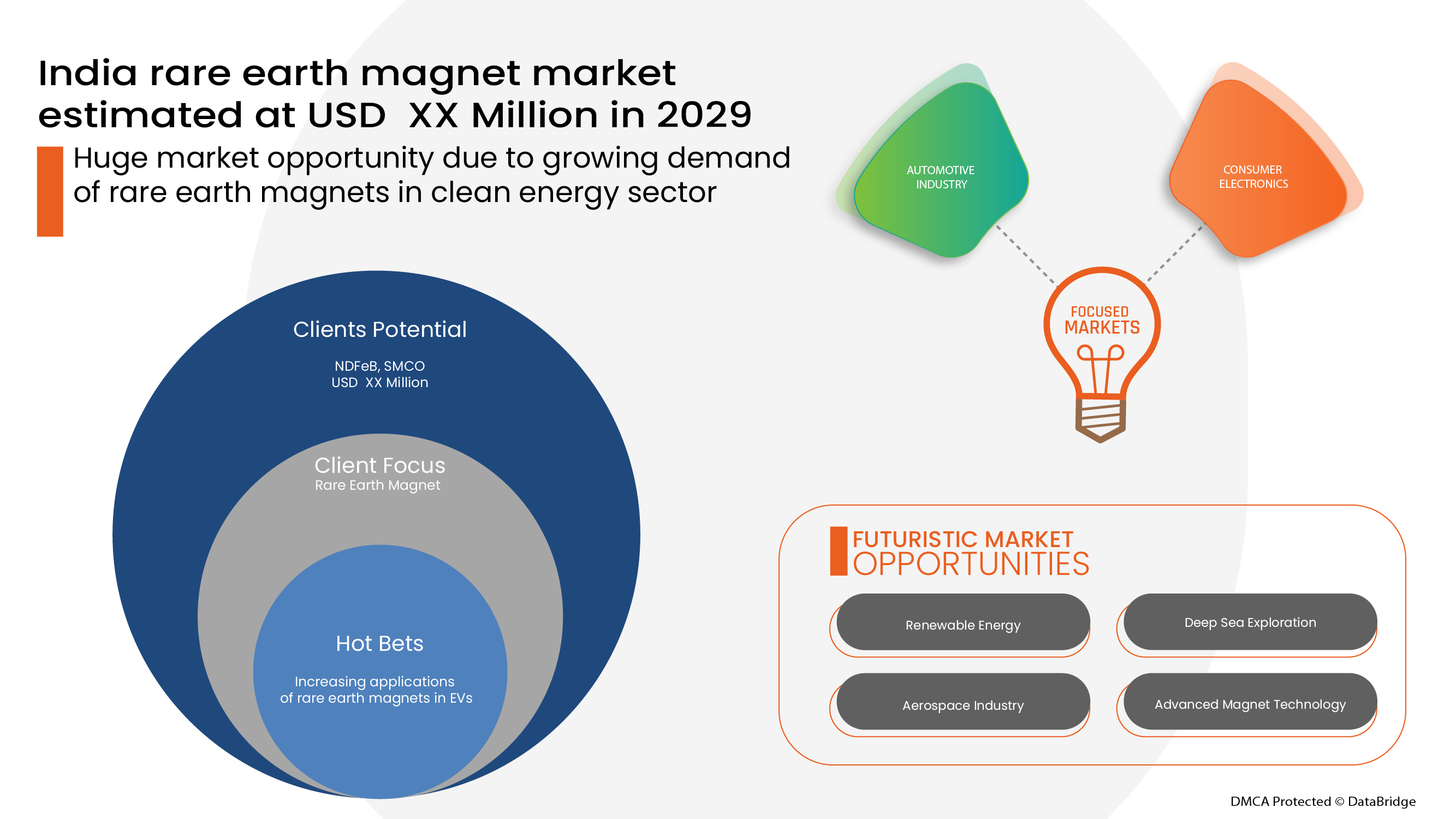

Data Bridge Market Research estime que le marché indien des aimants en terres rares devrait atteindre 479,47 millions USD d'ici 2029, à un TCAC de 7,8 % au cours de la période de prévision. Le rapport périodique sur le marché des aimants en terres rares couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en tonnes |

|

Segments couverts |

Par type (aimant NdFeB, aimant Samarium Cobalt (SmCo)), produit (aimants à tête fraisée, aimants à disque circulaire, aimants à crochet et à œillet, aimants à tige cylindrique, aimants à anneau circulaire, aimants rectangulaires, auto-adhésifs, en pot et à serrage), application (industrie automobile, transformation des aliments et des boissons, industrie aérospatiale, énergie renouvelable, électronique grand public, exploration en haute mer, autres) |

|

Pays couverts |

Inde |

|

Acteurs du marché couverts |

Jai Mag Industries, Star Trace Private Limited, Kumar Magnet Industries, Magna Tronix, JD MAGNETIC IMPEX, Shree Shakti Industries, Ashvini Magnets Pvt. Ltd. et DURA MAGNETS PVT. LTD., entre autres |

Définition du marché

Les aimants en terres rares, fabriqués à partir d'alliages d'éléments de terres rares, sont les aimants permanents les plus puissants disponibles aujourd'hui. Les aimants en terres rares ont des qualités magnétiques nettement supérieures à celles des autres matériaux magnétiques, ce qui en fait le choix privilégié pour les applications commerciales, industrielles et techniques. Les aimants en terres rares sont divisés en aimants en néodyme et en aimants en samarium-cobalt. Chacun des deux types d'aimants au cobalt, le néodyme et le samarium, possède son propre ensemble de qualités, d'avantages et de caractéristiques. Les aimants en néodyme et en samarium-cobalt sont tous deux utilisés dans diverses applications industrielles, médicales, scientifiques, aéronautiques et automobiles en raison de leurs caractéristiques et de leur résistance magnétiques solides. Les générateurs d'éoliennes, les équipements audio comme les haut-parleurs et les écouteurs, les moteurs et les servomoteurs, les équipements médicaux comme l'imagerie par résonance magnétique (IRM), l'électronique comme les disques durs d'ordinateur, et bien plus encore utilisent ce matériau.

Dynamique du marché indien des aimants à terres rares

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

Augmentation continue de la demande d'aimants permanents

Les aimants permanents peuvent conserver leurs propriétés magnétiques même lorsqu'ils sont exposés à un champ magnétique . Les terres rares, un type d'aimant permanent, sont un groupe de 17 métaux, classés en légers et lourds en fonction de leur numéro atomique, et sont essentiels à la fabrication de produits de haute technologie. Les aimants permanents composés de minéraux de terres rares sont des composants essentiels de produits respectueux du climat tels que les automobiles électriques et les éoliennes et d'autres technologies telles que les téléphones, les réfrigérateurs, les missiles et les avions de chasse. Ils constituent un élément essentiel de la chaîne d'approvisionnement mondiale en terres rares, transformant les minéraux traités en intrants précieux pour les fabricants d'électronique et d'armes.

-

Pénétration des véhicules électriques sur le marché

L'industrie automobile se concentre sur l'intégration de composants électriques légers, compacts et abordables à l'intérieur du système du véhicule pour assurer des coûts réduits et une utilisation optimale de l'espace. Les aimants en néodyme sont des aimants permanents produits à partir d'une composition de néodyme, de fer et de bore. Ce matériau reste la forme la plus puissante d'aimant permanent à base de terres rares. De plus, les aimants en néodyme étaient sans danger dans des appareils tels que les disques durs, les microphones, les haut-parleurs, les écouteurs et les roulements magnétiques, mais actuellement, les aimants en néodyme dans les moteurs électriques sont encore plus répandus que dans les moteurs électriques. Par conséquent, la demande croissante de véhicules électriques à l'échelle mondiale devrait stimuler la demande de matériaux pour aimants à base de terres rares.

Opportunité

- Demande croissante en terres rares dans le secteur des énergies renouvelables

L'énergie renouvelable est l'énergie produite à partir de sources naturelles ou de ressources renouvelables qui sont constamment renouvelées. L'Inde est le troisième plus grand consommateur d'énergie au monde après les États-Unis et la Chine. Ainsi, la demande croissante de l'Inde en énergie et en électricité oblige le gouvernement à rechercher de nouvelles façons de produire de l'énergie, en particulier renouvelable. Cela a conduit l'Inde à investir constamment dans son secteur des énergies renouvelables et à le développer. En janvier 2022, la capacité installée d'énergie renouvelable de l'Inde s'élevait à 152,36 GW, soit 38,56 % de la capacité électrique installée totale. Cela place l'Inde au quatrième rang mondial en ce qui concerne la capacité installée d'énergie renouvelable. La transition rapide vers les énergies renouvelables favorise le marché indien des éléments de terres rares, car les éléments de terres rares ont diverses propriétés nucléaires, métallurgiques, chimiques, catalytiques, électriques, magnétiques et optiques, ce qui les rend largement applicables dans les technologies propres et les secteurs des énergies renouvelables. Il contient des produits intermédiaires, notamment des aimants permanents, des aimants de terres rares, des phosphores, des alliages, des catalyseurs et des poudres de polissage. Cette transition et l'utilisation d'éléments de terres rares ont apporté des avancées techniques et des innovations à différentes industries.

Contraintes/Défis

- La gamme de prix supérieure des aimants permanents

Les prix volatils et imprévisibles des différents marchés ont des conséquences considérables pour les entreprises industrielles. Des obstacles imprévus, tels que la hausse des coûts de l'énergie et les variations inattendues des prix des matières premières, perturbent les chaînes d'approvisionnement et rendent plus difficile pour les entreprises de rester rentables. La variation des prix des matières premières pour la production d'aimants en terres rares entraîne des coûts supplémentaires sur le produit fini. En outre, de nombreuses entreprises ont du mal à évaluer correctement le risque de fortes fluctuations des coûts des matières premières. Lorsqu'une entreprise est confrontée à une augmentation des coûts des matières premières et à une baisse des prix de vente en même temps, la marge bénéficiaire de l'entreprise a tendance à diminuer dans une certaine mesure. Par conséquent, des coûts des matières premières très fluctuants et une gestion des prix inefficace peuvent compromettre le succès des entreprises, ce qui a un impact sur la croissance du marché.

- Préoccupations environnementales et sanitaires liées à l’exploitation minière des terres rares

Les terres rares sont des éléments clés qui deviennent de plus en plus essentiels pour le développement de nouvelles industries, pour l'industrie scientifique et technologique de la défense nationale. Ils ne sont pas renouvelables, ce qui en fait une ressource stratégique vitale pour une nation. Les éléments fonctionnels des terres rares sont utilisés dans les véhicules à énergie nouvelle, les équipements de défense nationale, les moteurs à aimant permanent en terres rares, le transport ferroviaire, les nouveaux produits énergétiques et d'autres domaines clés en développement vigoureux. Cette utilisation stimule la demande de croissance synergique des produits à base de terres rares et favorise même le développement régulier de l'industrie des terres rares. La valeur stratégique et économique des terres rares devient de plus en plus importante. Les principaux pays d'extraction et de distribution de gisements de terres rares dans le monde sont la Chine, les États-Unis, la Russie, le Brésil, l'Inde, l'Australie, le Groenland et la Malaisie. À mesure que l'importance des terres rares augmente, des pays comme le Brésil, l'Inde et la Russie ont commencé à extraire des éléments rares de la croûte terrestre pour garantir la demande et l'intérêt. Cela a donné lieu à divers nouveaux sites miniers à travers l'Inde ces dernières années. Mais l'extraction et le traitement des métaux des terres rares entraînent généralement des défauts environnementaux importants. De nombreux gisements sont associés à de fortes concentrations d'éléments radioactifs tels que l'uranium et le thorium, qui nécessitent un traitement et une élimination différents. L'accumulation d'éléments de terres rares dans les sols est due à la pollution causée par l'exploitation des ressources en terres rares. La pollution, les effets environnementaux et la forte concentration d'éléments radioactifs ont suscité des préoccupations environnementales dans le cadre de l'exploitation des terres rares.

Impact post-COVID-19 sur le marché indien des aimants en terres rares

Le COVID-19 a eu un impact significatif sur le marché des aimants aux terres rares, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. La production du système d'aimants aux terres rares a été entravée pendant le confinement. Dans le scénario post-confinement, la croissance du marché indien des aimants aux terres rares est attribuée à l'adoption croissante de véhicules électriques, de produits de consommation et de technologies dans toutes les régions et tous les pays. L'augmentation des systèmes d'énergie éolienne en Inde est un facteur majeur qui contribue à la croissance du marché indien des aimants aux terres rares.

Les fabricants et les fournisseurs de solutions prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer la technologie impliquée dans l'aimant aux terres rares. Grâce à cela, les entreprises apporteront des technologies avancées au marché. En outre, les initiatives gouvernementales liées aux systèmes énergétiques intelligents ont conduit à la croissance du marché

Développement récent

- Kumar Magnetic Industries a développé une large gamme de séparateurs magnétiques à base d'aimants en néodyme-fer-bore (NdFeB) car ils offrent une excellente puissance de maintien, malgré leur finesse et leur compacité. Ces séparateurs offrent également une protection contre la corrosion et sont disponibles en plusieurs finitions, en fonction de vos besoins spécifiques. Cela a permis à l'entreprise d'être reconnue sur le marché indien des aimants en terres rares.

Portée du marché indien des aimants en terres rares

Le marché indien des aimants en terres rares est segmenté en fonction du type, des produits et des applications. La croissance de ces segments vous aidera à analyser les principaux segments de croissance de l'industrie et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Aimant NdFeB

- Aimant au samarium-cobalt (SmCo)

En fonction du type, le marché indien des aimants aux terres rares est segmenté en aimants NdFeB et aimants samarium cobalt (SmCo).

Produit

- Aimants à tête fraisée

- Aimants à disque circulaire

- Aimants à crochet et à œillet

- Aimants à tige cylindrique

- Aimants à anneaux circulaires

- Rectangulaire

- Auto-adhésif

- Pot et aimants de serrage

Sur la base du produit, le marché indien des aimants aux terres rares a été segmenté en aimants fraisés, aimants à disque circulaire, aimants à crochet et à œil, aimants à tige cylindrique, aimants à anneau circulaire, aimants rectangulaires, auto-adhésifs, en pot et à serrage.

Application

- Industrie automobile

- Transformation des aliments et des boissons

- Industrie aérospatiale

- Energie renouvelable

- Électronique grand public

- Exploration des fonds marins

- Autres

Sur la base des applications, le marché indien des aimants aux terres rares a été segmenté en industrie automobile, transformation des aliments et des boissons, industrie aérospatiale, énergie renouvelable, électronique grand public, exploration en haute mer et autres.

Analyse/perspectives régionales du marché des aimants à terres rares

Le marché indien des aimants aux terres rares est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type, produit et application comme référencé ci-dessus.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances technologiques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques indiennes et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des aimants en terres rares en Inde

Le paysage concurrentiel du marché indien des aimants aux terres rares fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Inde, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus ne concernent que l'attention portée par les entreprises au marché indien des aimants aux terres rares.

Français Certains des principaux acteurs opérant sur le marché indien des aimants en terres rares sont Jai Mag Industries, Star Trace Private Limited, Kumar Magnet Industries, Magna Tronix, JD MAGNETIC IMPEX, Shree Shakti Industries, Ashvini Magnets Pvt. Ltd., DURA MAGNETS PVT. LTD.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché de l'Inde par rapport aux régions et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA RARE EARTH MAGNET MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.2 PORTER’S FIVE FORCE ANALYSIS

4.3 VENDOR SELECTION CRITERIA

4.4 PESTEL ANALYSIS

4.5 KEY PATENT ANALYSIS

4.5.1 METHOD FOR PRODUCING SINTERED NDFEB MAGNET

4.5.2 METHOD FOR RECOVERY OF NDFEB GRAINS FROM BULK SINTERED ND—FE—B MAGNETS AND/OR MAGNET SCRAPS BY ELECTROCHEMICAL ETCHING

4.5.3 METHOD AND SYSTEM FOR RECOVERING RARE EARTH ELEMENTS FROM WITHIN AN OBJECT

4.6 REGULATION COVERAGE

4.7 BRAND COMPARATIVE ANALYSIS

4.8 MAJOR MANUFACTURERS/SUPPLIERS IN NDFEB MARKET

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 CONTINUOUS RISE IN DEMAND FOR PERMANENT MAGNET

7.1.2 PENETRATION OF ELECTRIC VEHICLES ACROSS THE MARKET

7.1.3 RISE IN APPLICATION OF RARE EARTH MAGNET IN HEALTHCARE AND CONSUMER ELECTRONICS SECTOR

7.2 RESTRAINTS

7.2.1 HIGHER PRICE RANGE OF PERMANENT MAGNET

7.2.2 LOW CORROSION RESISTANCE AND HIGHER BRITTLENESS OF PERMANENT MAGNET

7.3 OPPORTUNITIES

7.3.1 GROWING DEMAND FOR RARE EARTH ELEMENTS IN THE RENEWABLE ENERGY SECTOR

7.3.2 INCREASING NEED FOR RARE EARTH MAGNETS IN ELECTRONIC & ELECTRICAL SYSTEMS

7.3.3 PRESENCE OF HIGH RESERVE OF RARE EARTH ELEMENTS IN INDIA

7.4 CHALLENGES

7.4.1 ENVIRONMENTAL AND HEALTH CONCERNS ASSOCIATED WITH RARE EARTH ELEMENTS MINING

7.4.2 LACK OF INFRASTRUCTURE IN THE INDIAN RARE EARTH INDUSTRY

8 INDIA RARE EARTH MAGNET MARKET, BY TYPE

8.1 OVERVIEW

8.2 NDFEB MAGNET

8.2.1 SINTERED NDFEB MAGNET

8.2.2 BONDED NDFEB MAGNET

8.2.3 HOT-PRESSED NDFEB MAGNET

8.3 SAMARIUM COBALT MAGNET (SMCO)

8.3.1 SM2CO17

8.3.2 SMCO5

9 INDIA RARE EARTH MAGNET MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 RECTANGULAR

9.3 CIRCULAR DISC MAGNETS

9.4 CYLINDRICAL ROD MAGNETS

9.5 CIRCULAR RING MAGNETS

9.6 COUNTERSUNK MAGNETS

9.7 POT & CLAMPING MAGNETS

9.8 HOOK & EYEBOLT MAGNETS

9.9 SELF-ADHESIVE

10 INDIA RARE EARTH MAGNET MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CONSUMER ELECTRONICS

10.3 AUTOMOTIVE INDUSTRY

10.3.1 ELECTRIC 2 & 3 WHEELERS

10.3.2 ELECTRIC 4 WHEELERS

10.3.3 OTHERS

10.4 RENEWABLE ENERGY

10.5 AEROSPACE INDUSTRY

10.6 FOOD & DRINK PROCESSING

10.7 DEEP SEA EXPLORATION

10.8 OTHERS

11 INDIA REAR EARTH MAGNET MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: INDIA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 STAR TRACE PRIVATE LIMITED

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 KUMAR MAGNETIC INDUSTRIES

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCTS PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 ASHVINI MAGNETS

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 DURA MAGNETS PVT. LTD

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENT

13.5 JAI MAG INDUSTRIES

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 JD MAGNETIC IMPEX

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCTS PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 MAGNA TRONIX

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCTS PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 SHREE SHAKTI INDUSTRIES

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 SOME GLOBAL NDFEB MANUFACTURER/SUPPLIERS

TABLE 2 SOME INDIAN NDFEB MANUFACTURER/SUPPLIERS

TABLE 3 COUNTRY MINE PRODUCTION & RESERVES OF 2020

TABLE 4 INDIA RARE EARTH MAGNET MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 INDIA RARE EARTH MAGNET MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 6 INDIA NDFEB MAGNET IN RARE EARTH MAGNET MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 INDIA NDFEB MAGNET IN RARE EARTH MAGNET MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 8 INDIA SAMARIUM COBALT MAGNET (SMCO) IN RARE EARTH MAGNET MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 INDIA SAMARIUM COBALT MAGNET (SMCO) IN RARE EARTH MAGNET MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 10 INDIA RARE EARTH MAGNET MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 INDIA RARE EARTH MAGNET MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 12 INDIA RARE EARTH MAGNET MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 INDIA RARE EARTH MAGNET MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 14 INDIA AUTOMOTIVE INDUSTRY IN RARE EARTH MAGNET MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 INDIA AUTOMOTIVE INDUSTRY IN RARE EARTH MAGNET MARKET, BY TYPE, 2020-2029 (TONS)

Liste des figures

FIGURE 1 INDIA RARE EARTH MAGNET MARKET: SEGMENTATION

FIGURE 2 INDIA RARE EARTH MAGNET MARKET: DATA TRIANGULATION

FIGURE 3 INDIA RARE EARTH MAGNET MARKET: DROC ANALYSIS

FIGURE 4 INDIA RARE EARTH MAGNET MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 INDIA RARE EARTH MAGNET MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA RARE EARTH MAGNET MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA RARE EARTH MAGNET MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA RARE EARTH MAGNET MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 INDIA RARE EARTH MAGNET MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 INDIA RARE EARTH MAGNET MARKET: SEGMENTATION

FIGURE 11 CONTINUOUS RISE IN DEMAND FOR PERMANENT MAGNET IS EXPECTED TO DRIVE INDIA RARE EARTH MAGNET MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 12 NDFEB MAGNET SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF INDIA RARE EARTH MAGNET MARKET IN 2022 TO 2029

FIGURE 13 SUPPLY CHAIN FOR RARE EARTH MAGNET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF INDIA RARE EARTH MAGNET MARKET

FIGURE 15 APPLICATIONS OF PERMANENT MAGNETS BY MARKET SHARE (2019)

FIGURE 16 ELECTRIC VEHICLE SALES IN INDIA (2020)

FIGURE 17 INDIA RARE EARTH MAGNET MARKET: BY TYPE, 2021

FIGURE 18 INDIA RARE EARTH MAGNET MARKET: BY PRODUCT, 2021

FIGURE 19 INDIA RARE EARTH MAGNET MARKET: APPLICATION, 2021

FIGURE 20 INDIA REAR EARTH MAGNET MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.