Marché indien du traitement des eaux produites, par étapes (traitement primaire, traitement secondaire, traitement tertiaire et autres), type de traitement (traitement chimique, traitement physique, traitement biologique, systèmes combinés et autres), ressource en hydrocarbures (gaz conventionnel, sables bitumineux, gaz conventionnel, méthane de houille, pétrole de réservoir étanche, gaz de schiste), capacité (moins de 100 000 barils/jour, 100 à 500 000 barils/jour, plus de 500 000 barils/jour), source de production (gaz naturel, pétrole brut), technologie ( filtration membranaire , technologie thermique, filtre biologique aéré (BAF), hydrocyclones, flottation de gaz, bassin d'évaporation, adsorption, filtration sur support, technologie d'échange d'ions, technologie d'extraction macroporeuse, oxydation chimique, autres), utilisateur final (industries pétrolières, industries gazières) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du traitement de l'eau produite en Inde

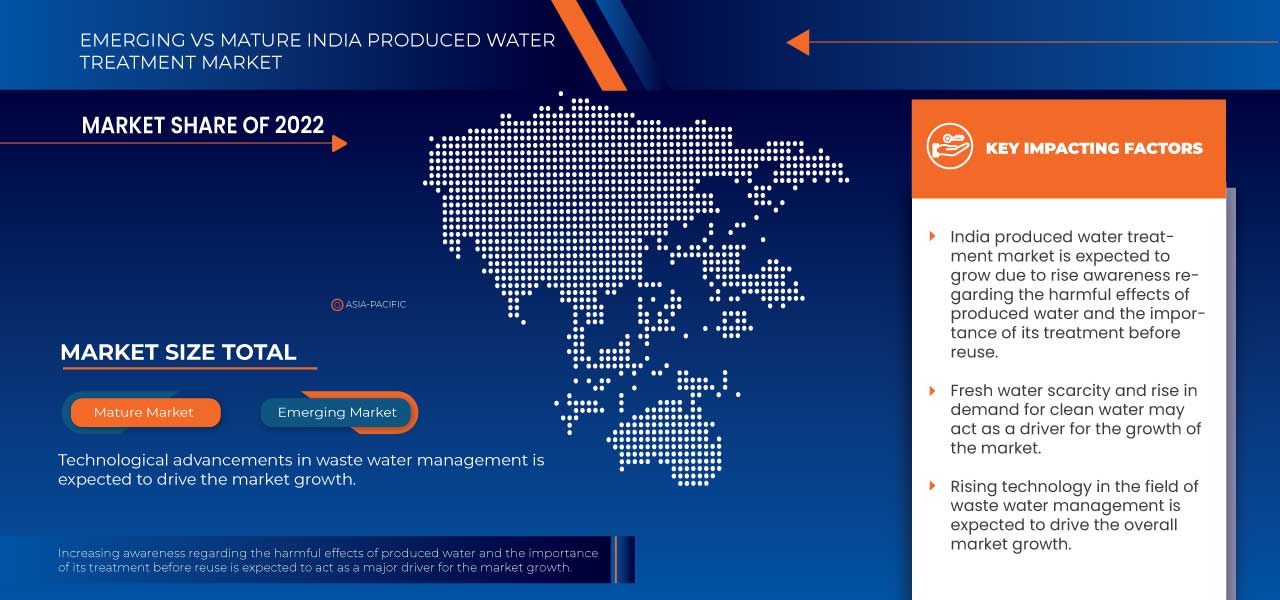

L'Inde est l'un des plus grands producteurs de pétrole et de gaz au monde. Par conséquent, une quantité importante d'eau produite est générée dans le pays. Le traitement de l'eau produite en Inde est essentiel au maintien de la durabilité environnementale et de la santé publique.

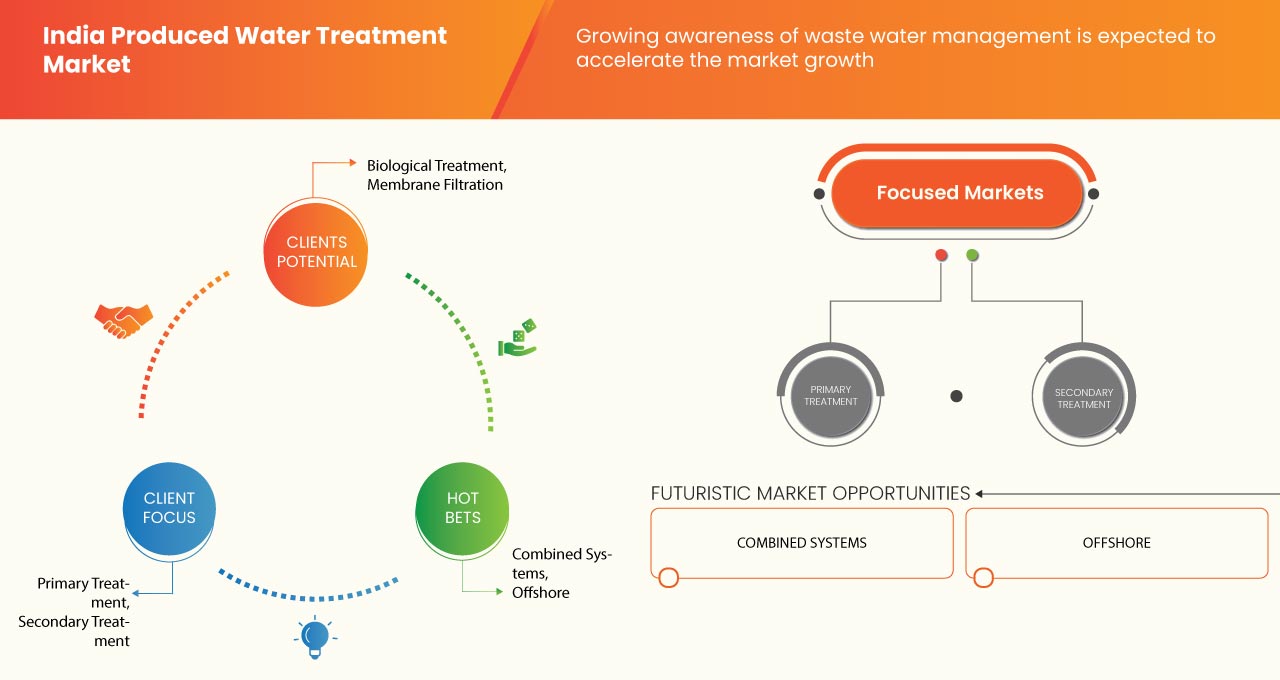

Le processus de traitement des eaux produites en Inde comprend plusieurs étapes, notamment le traitement primaire, secondaire et tertiaire.

La demande croissante de pétrole et de gaz et le nombre croissant de collaborations industrielles sont quelques-uns des facteurs qui stimulent la demande de traitement des eaux produites en Inde sur le marché.

Le principal obstacle qui pèse sur le marché est le coût élevé de la mise en place de l'usine. En outre, le cadre réglementaire strict constitue un facteur restrictif pour le marché indien du traitement des eaux de production. Les grandes entreprises élargissent leur portefeuille de produits dans le pays pour renforcer leur présence sur le marché de ces produits et solutions.

Par exemple,

- En 2022, IEI a annoncé avoir reçu le prix Water Digest Award 2022 pour la meilleure innovation en recherche. Ce prix a aidé l'entreprise à développer son secteur d'activité

Data Bridge Market Research analyse que le marché indien du traitement de l'eau produite devrait atteindre la valeur de 1 131,71 millions USD d'ici 2030, à un TCAC de 7,2 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par étapes (traitement primaire, traitement secondaire, traitement tertiaire et autres), type de traitement (traitement chimique, traitement physique, traitement biologique, systèmes combinés et autres), ressource en hydrocarbures (gaz conventionnel, sables bitumineux, gaz conventionnel, méthane de houille, pétrole de réservoirs étanches, gaz de schiste), capacité (moins de 100 000 barils par jour, de 100 à 500 000 barils par jour, plus de 500 000 barils par jour), source de production (gaz naturel, pétrole brut), technologie (filtration membranaire, technologie thermique, filtre biologique aéré (BAF), hydrocyclones, flottation de gaz, bassin d'évaporation, adsorption, filtration sur support, technologie d'échange d'ions, technologie d'extraction macroporeuse, oxydation chimique, autres), utilisateur final (industries pétrolières, industries gazières) |

|

Pays couverts |

Inde |

|

Acteurs du marché couverts |

Thermax Limited. (Inde), divaenvitec (Inde), SOPAN (Inde), www.paramountlimited.com (Inde), BPC (Inde), IEI (Inde), ALFA LAVAL (Inde), Aquatech International LLC. (États-Unis), WABAG (Inde), IDE (Israël), Wex Technologies (Inde), NETSOL WATER SOLUTIONS PVT. LTD. (Inde), OVIVO (Inde), DuPont (États-Unis), Gradiant (États-Unis), Hindustan Dorr-Oliver Ltd. (Inde), NOV Inc. (États-Unis), Chokhavatia Associates (Inde), ULTRA PURE WATER TECHNOLOGIES (Inde), Veolia (Inde) entre autres. |

Définition du marché indien du traitement des eaux de production

L'eau produite est un terme utilisé dans l'industrie pétrolière et gazière pour désigner l'eau ramenée à la surface pendant la production de pétrole et de gaz. Cette eau contient souvent des contaminants tels que de l'huile, de la graisse, des solides dissous et des produits chimiques toxiques, ce qui la rend impropre à une utilisation directe ou à un rejet dans l'environnement. Le traitement des eaux produites en Inde fait référence au processus de traitement et de nettoyage de cette eau pour éliminer les contaminants et la rendre propre à la réutilisation ou au rejet. Le processus de traitement implique généralement des méthodes physiques, chimiques et biologiques pour éliminer l'huile et la graisse, les solides en suspension, les solides dissous et d'autres polluants de l'eau.

Le traitement des eaux de production est essentiel pour protéger l'environnement et la santé publique et assurer la durabilité de la production pétrolière et gazière en Inde. Plusieurs réglementations et directives régissent le traitement des eaux de production en Inde, notamment les normes de la Direction de la sécurité de l'industrie pétrolière (OISD) et les directives du Conseil central de contrôle de la pollution (CPCB).

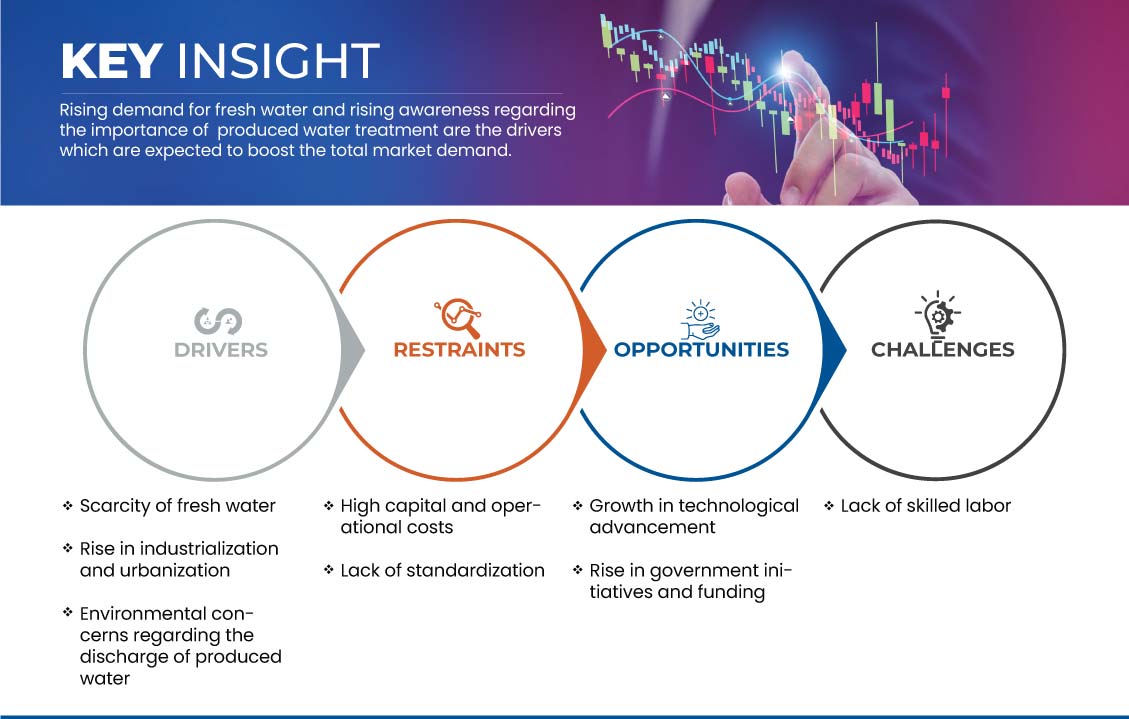

Dynamique du marché indien du traitement des eaux de production

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteur

- Pénurie d'eau douce

L'Inde connaît actuellement une grave pénurie d'eau douce en raison de la croissance démographique, de l'urbanisation rapide et de la demande accrue en eau de l'agriculture, de l'industrie et des ménages. En conséquence, la demande de sources d'eau alternatives, telles que le traitement et la réutilisation de l'eau produite par les opérations pétrolières et gazières, est en hausse.

L'eau traitée produite n'est généralement pas considérée comme potable, car elle peut encore contenir des traces de contaminants qui peuvent être nocifs pour la santé humaine. L'eau produite est extraite en même temps que le pétrole et le gaz lors des opérations de production et peut contenir divers polluants, tels que des sels, des hydrocarbures, des métaux et des produits chimiques. Mais l'eau traitée peut être réutilisée dans les industries, l'agriculture et bien d'autres domaines.

L’un des principaux facteurs à l’origine de la croissance du marché du traitement des eaux de production en Inde est la demande croissante en eau dans diverses industries. De nombreuses industries, notamment celles du pétrole et du gaz, de l’électricité et de la chimie, ont besoin de grandes quantités d’eau pour leurs activités. Les ressources en eau douce se raréfiant, ces industries se tournent vers des sources d’eau alternatives, telles que l’eau de production et son traitement en vue de sa réutilisation.

Retenue

- Coûts d'investissement et d'exploitation élevés

Alors que la croissance du marché du traitement des eaux produites en Inde est tirée par divers facteurs, tels que l’augmentation de l’industrialisation et de l’urbanisation, certains recyclages agissent également comme des facteurs restrictifs, notamment les coûts d’investissement et d’exploitation élevés.

Le traitement des eaux de production nécessite des équipements et des infrastructures spécialisés, notamment des usines de traitement, des canalisations et des installations de stockage. Le coût élevé de la mise en place et de l'entretien de ces infrastructures peut constituer un obstacle important à l'entrée de nouveaux acteurs sur le marché, en particulier des petites et moyennes entreprises.

Outre les coûts d’investissement, les coûts d’exploitation peuvent également être importants, avec des dépenses récurrentes, telles que les coûts d’énergie et de maintenance. Le coût du traitement de l’eau produite peut varier en fonction de divers facteurs, notamment le type et la quantité de contaminants dans l’eau, la technologie utilisée et l’emplacement de l’installation de traitement.

Ainsi, les coûts d’investissement et d’exploitation élevés du traitement des eaux produites devraient constituer un frein important à la croissance du marché du traitement des eaux produites en Inde.

Opportunité

Croissance des progrès technologiques

Ces dernières années, l'Inde a connu une croissance considérable en matière de progrès technologiques, en particulier dans le secteur du traitement de l'eau. Avec la demande toujours croissante d'eau propre due à la croissance démographique et à l'urbanisation, le marché indien du traitement de l'eau devrait continuer à croître rapidement. Cela représente une opportunité significative pour la croissance du marché du traitement de l'eau produite en Inde.

L'eau produite est un sous-produit de l'exploration et de la production de pétrole et de gaz. Elle contient divers contaminants, notamment du pétrole, de la graisse, des sels et des métaux lourds, ce qui rend son traitement et son élimination en toute sécurité difficiles. Cependant, avec les progrès technologiques, le traitement de l'eau produite est devenu plus efficace et plus rentable, ce qui en fait une solution viable pour l'industrie pétrolière et gazière.

La technologie qui a joué un rôle déterminant dans la croissance du traitement des eaux de production est la filtration membranaire. La filtration membranaire est un procédé qui utilise une membrane semi-perméable pour séparer les contaminants de l'eau. Elle est très efficace pour éliminer l'huile, la graisse et d'autres impuretés de l'eau produite, la rendant ainsi sûre pour le rejet ou la réutilisation. La technologie de filtration membranaire est également évolutive et peut être utilisée pour diverses applications, ce qui en fait une solution précieuse pour l'industrie pétrolière et gazière.

Défi

Manque de main d'oeuvre qualifiée

Outre les coûts d’investissement et d’exploitation élevés, le manque de main-d’œuvre qualifiée limite la croissance du traitement des eaux de production en Inde. Le traitement des eaux de production nécessite des professionnels qualifiés possédant une expertise dans un large éventail de disciplines, notamment l’ingénierie, la chimie et les sciences de l’environnement.

Malheureusement, le secteur du traitement de l'eau connaît une pénurie importante de professionnels qualifiés en Inde. Cette pénurie peut être attribuée à divers facteurs, notamment le manque d'établissements d'enseignement et de formation de qualité, le manque de sensibilisation aux possibilités de carrière dans le secteur du traitement de l'eau et la fuite des cerveaux des professionnels qualifiés dans les pays développés.

Le besoin de professionnels qualifiés et certifiés constitue un défi majeur pour le traitement des eaux produites.

Le manque de professionnels qualifiés peut conduire à un traitement inadéquat de l'eau produite, ce qui peut nuire à l'environnement et à la santé humaine. Cela peut également entraîner des inefficacités dans le processus de traitement, ce qui entraîne des coûts d'exploitation plus élevés et une qualité de l'eau traitée inférieure.

En outre, la pénurie de professionnels qualifiés peut entraver la mise en œuvre de nouvelles technologies et d’innovations dans le traitement des eaux de production. Les professionnels qualifiés sont essentiels pour développer, tester et mettre en œuvre de nouvelles technologies qui peuvent améliorer l’efficacité du traitement et réduire les coûts.

Analyse de l'impact post-COVID-19 sur le marché indien du traitement des eaux de production

Le Covid-19 s'est propagé à travers le monde et a eu un impact sur diverses industries. La baisse de la demande et des prix du pétrole brut a affecté l'industrie pétrolière et gazière, ce qui a entraîné une réduction des activités de forage, entravant ainsi la croissance du marché. Les perturbations des activités de transport maritime, des chaînes d'approvisionnement et du commerce dues à la propagation du COVID-19 ont également entravé la croissance du marché.

Développements récents

- En juillet 2022, OVIVO, un fournisseur mondial d'équipements, de technologies et de systèmes de traitement de l'eau et des eaux usées, a annoncé l'acquisition de Wastech Controls & Engineering, LLC.

- En mars 2022, ALFA LAVAL a acquis une participation minoritaire dans la société néerlandaise Marine Performance Systems (MPS). Cette acquisition a aidé l'entreprise à développer ses activités et ses produits.

Portée du marché indien du traitement de l'eau produite

Le marché indien du traitement des eaux produites est classé en sept segments notables tels que les étapes, le type de traitement, la ressource en hydrocarbures, la capacité, la source de production, la technologie et l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

ÉTAPES

- Traitement primaire

- Traitement secondaire

- Traitement tertiaire

- Autres

Sur la base des étapes, le marché indien du traitement des eaux produites est segmenté en traitement primaire, traitement secondaire, traitement tertiaire et autres.

TYPE DE TRAITEMENT

- Traitement chimique

- Traitement physique

- Traitement biologique

- Systèmes combinés

- Autres

Sur la base du type de traitement, le marché indien du traitement des eaux produites est segmenté en traitement chimique, traitement physique, traitement biologique, systèmes combinés et autres.

RESSOURCES EN HYDROCARBURES

- Pétrole conventionnel

- Sables bitumineux

- Gaz conventionnel

- Méthane de houille

- Pétrole de schiste

- Gaz de schiste

Sur la base des ressources en hydrocarbures, le marché indien du traitement des eaux produites est segmenté en pétrole conventionnel, sables bitumineux, gaz conventionnel, méthane de houille, pétrole de réservoir étanche et gaz de schiste.

CAPACITÉ

- Moins de 100 Thsnd BL/JOUR

- 100 à 500 Thsnd BL/JOUR

- Plus de 500 000 BL/JOUR

Sur la base de la capacité, le marché indien du traitement de l'eau produite est segmenté en moins de 100 000 bl/jour, 100 à 500 000 bl/jour et plus de 500 000 bl/jour.

SOURCE DE PRODUCTION

- Gaz naturel

- Huile brute

Sur la base de la source de production, le marché indien du traitement des eaux produites est segmenté en gaz naturel et pétrole brut.

TECHNOLOGIE

- Filtration membranaire

- Technologie thermique

- Filtre biologique aéré (BAF)

- Hydrocyclones

- Flotation de gaz

- Bassin d'évaporation

- Adsorption

- Filtration des médias

- Technologie d'échange d'ions

- Technologie d'extraction de polymères macroporeux

- Oxydation chimique

- Autres

Sur la base de la technologie, le marché indien du traitement de l'eau produite est segmenté en filtration membranaire, technologie thermique, filtre biologique aéré (BAF), hydrocyclones, flottation au gaz, bassin d'évaporation, adsorption, filtration sur média, technologie d'échange d'ions, technologie d'extraction de polymères macroporeux, oxydation chimique, autres.

UTILISATEUR FINAL

- Industries pétrolières

- Industries gazières

Sur la base de l'utilisateur final, le marché indien du traitement des eaux produites est segmenté en industries pétrolières et gazières.

Analyse/perspectives régionales du marché indien du traitement de l'eau produite

Le marché indien du traitement des eaux produites est classé en sept segments notables tels que les étapes, le type de traitement, la ressource en hydrocarbures, la capacité, la source de production, la technologie et l'utilisateur final.

Le pays couvert par ce rapport de marché est l’Inde.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et de l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du traitement de l'eau produite en Inde

Le paysage concurrentiel du marché indien du traitement des eaux produites fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'ampleur du produit, la domination des applications et la courbe de survie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché indien du traitement des eaux produites.

Français Certaines des principales entreprises opérant sur le marché indien du traitement des eaux produites sont Thermax Limited. (Inde), divaenvitec (Inde), SOPAN (Inde), www.paramountlimited.com (Inde), BPC (Inde), IEI (Inde), ALFA LAVAL (Inde), Aquatech International LLC. (États-Unis), WABAG (Inde), IDE (Israël), Wex Technologies (Inde), NETSOL WATER SOLUTIONS PVT. LTD. (Inde), OVIVO (Inde), DuPont (États-Unis), Gradiant (États-Unis), Hindustan Dorr-Oliver Ltd. (Inde), NOV Inc. (États-Unis), Chokhavatia Associates (Inde), ULTRA PURE WATER TECHNOLOGIES (Inde), Veolia (Inde) entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA PRODUCED WATER TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 STAGES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 INDIA PRODUCED WATER TREATMENT MARKET, REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 SCARCITY OF FRESH WATER

6.1.2 RISE IN INDUSTRIALIZATION AND URBANIZATION

6.1.3 ENVIRONMENTAL CONCERNS REGARDING THE DISCHARGE OF PRODUCED WATER

6.2 RESTRAINS

6.2.1 HIGH CAPITAL AND OPERATIONAL COSTS

6.2.2 LACK OF STANDARDIZATION

6.3 OPPORTUNITIES

6.3.1 GROWTH IN TECHNOLOGICAL ADVANCEMENT

6.3.2 RISE IN GOVERNMENT INITIATIVES AND FUNDING

6.4 CHALLENGES

6.4.1 LACK OF SKILLED LABOUR

7 INDIA PRODUCED WATER TREATMENT MARKET, BY STAGES

7.1 OVERVIEW

7.2 PRIMARY TREATMENT

7.3 SECONDARY TREATMENT

7.4 TERTIARY TREATMENT

7.5 OTHERS

8 INDIA PRODUCED WATER TREATMENT MARKET, BY TREATMENT TYPE

8.1 OVERVIEW

8.2 PHYSICAL TREATMENT

8.3 BIOLOGICAL TREATMENT

8.4 CHEMICAL TREATMENT

8.5 COMBINED SYSTEMS

8.6 OTHERS

9 INDIA PRODUCED WATER TREATMENT MARKET, BY HYDROCARBON RESOURCE

9.1 OVERVIEW

9.2 CONVENTIONAL GAS

9.3 CONVENTIONAL OIL

9.4 TIGHT OIL

9.5 COAL-BED METHANE

9.6 SHALE GAS

9.7 OIL SANDS

10 INDIA PRODUCED WATER TREATMENT MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 LESS THAN 100 THSND BL/DAY

10.3 100 TO 500 THSND BL/DAY

10.4 ABOVE 500 THSND BL/DAY

11 INDIA PRODUCED WATER TREATMENT MARKET, BY PRODUCTION SOURCE

11.1 OVERVIEW

11.2 CRUDE OIL

11.3 NATURAL GAS

12 INDIA PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY

12.1 OVERVIEW

12.2 BIOLOGICAL AERATED FILTER (BAF)

12.3 MEMBRANE FILTRATION

12.3.1 MICROFILTRATION/ULTRAFILTRATION

12.3.2 REVERSE OSMOSIS AND NANOFILTRATION

12.3.3 POLYMERIC/CERAMIC MEMBRANES

12.4 ADSORPTION

12.5 MEDIA FILTRATION

12.6 HYDROCYCLONES

12.7 CHEMICAL OXIDATION

12.8 ION EXCHANGE TECHNOLOGY

12.9 GAS FLOTATION

12.1 THERMAL TECHNOLOGY

12.10.1 MULTISTAGE FLASH

12.10.2 MULTIEFFECT DISTILLATION

12.10.3 VAPOR COMPRESSION DISTILLATION

12.10.4 MULTIEFFECT DISTILLATION– VAPOR COMPRESSION HYBRID

12.11 EVAPORATION POND

12.12 MACRO-POROUS POLYMER EXTRACTION TECHNOLOGY

12.13 OTHERS

13 INDIA PRODUCED WATER TREATMENT MARKET, BY END USER

13.1 OVERVIEW

13.2 OIL INDUSTRIES

13.2.1 BY TYPE

13.2.1.1 ONSHORE

13.2.1.2 OFFSHORE

13.2.2 BY TECHNOLOGY

13.2.2.1 BIOLOGICAL AERATED FILTER (BAF)

13.2.2.2 MEMBRANE FILTRATION

13.2.2.3 ADSORPTION

13.2.2.4 MEDIA FILTRATION

13.2.2.5 HYDROCYCLONES

13.2.2.6 CHEMICAL OXIDATION

13.2.2.7 ION EXCHANGE TECHNOLOGY

13.2.2.8 GAS FLOTATION

13.2.2.9 THERMAL TECHNOLOGY

13.2.2.10 EVAPORATION POND

13.2.2.11 MACRO-POROUS POLYMER EXTRACTION TECHNOLOGY

13.2.2.12 OTHERS

13.3 GAS INDUSTRIES

13.3.1 BY TYPE

13.3.1.1 ONSHORE

13.3.1.2 OFFSHORE

13.3.2 BY TECHNOLOGY

13.3.2.1 BIOLOGICAL AERATED FILTER (BAF)

13.3.2.2 MEMBRANE FILTRATION

13.3.2.3 ADSORPTION

13.3.2.4 MEDIA FILTRATION

13.3.2.5 HYDROCYCLONES

13.3.2.6 CHEMICAL OXIDATION

13.3.2.7 ION EXCHANGE TECHNOLOGY

13.3.2.8 GAS FLOTATION

13.3.2.9 THERMAL TECHNOLOGY

13.3.2.10 EVAPORATION POND

13.3.2.11 MACRO-POROUS POLYMER EXTRACTION TECHNOLOGY

13.3.2.12 OTHERS

14 INDIA PRODUCED WATER TREATMENT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: INDIA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 THERMAX LIMITED

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 WABAG

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 DUPONT

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 SOPAN

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENTS

16.5 GRADIANT

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 ALFA LAVAL

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AQUATECH INTERNATIONAL LLC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 BPC

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 CHOKHAVATIA ASSOCIATES

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DIVAENVITEC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 HINDUSTAN DORR-OLIVER LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 IEI

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 IDE

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 NETSOL WATER SOLUTIONS PVT. LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 NOV INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 OVIVO

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 ULTRA PURE WATER TECHNOLOGIES

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 VEOLIA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 WEX TECHNOLOGIES

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 WWW.WWW.PARAMOUNTLIMITED.COM.COM

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 INDIA PRODUCED WATER TREATMENT MARKET, BY STAGES, 2021-2030 (USD MILLION)

TABLE 2 INDIA PRODUCED WATER TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 3 INDIA PRODUCED WATER TREATMENT MARKET, BY HYDROCARBON RESOURCE, 2021-2030 (USD MILLION)

TABLE 4 INDIA PRODUCED WATER TREATMENT MARKET, BY CAPACITY, 2021-2030 (USD MILLION)

TABLE 5 INDIA PRODUCED WATER TREATMENT MARKET, BY PRODUCTION SOURCE, 2021-2030 (USD MILLION)

TABLE 6 INDIA PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 7 INDIA MEMBRANE FILTRATION IN PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 8 INDIA THERMAL TECHNOLOGY IN PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 9 INDIA PRODUCED WATER TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 10 INDIA OIL INDUSTRIES IN PRODUCED WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 INDIA OIL INDUSTRIES IN PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 12 INDIA GAS INDUSTRIES IN PRODUCED WATER TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 INDIA GAS INDUSTRIES IN PRODUCED WATER TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 INDIA PRODUCED WATER TREATMENT MARKET: SEGMENTATION

FIGURE 2 INDIA PRODUCED WATER TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 INDIA PRODUCED WATER TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 INDIA PRODUCED WATER TREATMENT MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 INDIA PRODUCED WATER TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA PRODUCED WATER TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA PRODUCED WATER TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA PRODUCED WATER TREATMENT MARKET: END USER COVERAGE GRID

FIGURE 9 INDIA PRODUCED WATER TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 INDIA PRODUCED WATER TREATMENT MARKET: SEGMENTATION

FIGURE 11 TECHNOLOGICAL ADVANCEMENT IS EXPECTED TO DRIVE THE INDIA PRODUCED WATER TREATMENT MARKET IN THE FORECAST PERIOD 2023-2030

FIGURE 12 PRIMARY TREATMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA PRODUCED WATER TREATMENT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES OF INDIA PRODUCED WATER TREATMENT MARKET

FIGURE 14 INDIA PRODUCED WATER TREATMENT MARKET: BY STAGES, 2022

FIGURE 15 INDIA PRODUCED WATER TREATMENT MARKET: BY STAGES, 2023-2030 (USD MILLION)

FIGURE 16 INDIA PRODUCED WATER TREATMENT MARKET: BY STAGES, CAGR (2023-2030)

FIGURE 17 INDIA PRODUCED WATER TREATMENT MARKET: BY STAGES, LIFELINE CURVE

FIGURE 18 INDIA PRODUCED WATER TREATMENT MARKET: BY TREATMENT TYPE, 2022

FIGURE 19 INDIA PRODUCED WATER TREATMENT MARKET: BY TREATMENT TYPE, 2023-2030 (USD MILLION)

FIGURE 20 INDIA PRODUCED WATER TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2023-2030)

FIGURE 21 INDIA PRODUCED WATER TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 22 INDIA PRODUCED WATER TREATMENT MARKET: BY HYDROCARBON RESOURCE, 2022

FIGURE 23 INDIA PRODUCED WATER TREATMENT MARKET: BY HYDROCARBON RESOURCE, 2023-2030 (USD MILLION)

FIGURE 24 INDIA PRODUCED WATER TREATMENT MARKET: BY HYDROCARBON RESOURCE, CAGR (2023-2030)

FIGURE 25 INDIA PRODUCED WATER TREATMENT MARKET: BY HYDROCARBON RESOURCE, LIFELINE CURVE

FIGURE 26 INDIA PRODUCED WATER TREATMENT MARKET: BY CAPACITY, 2022

FIGURE 27 INDIA PRODUCED WATER TREATMENT MARKET: BY CAPACITY, 2023-2030 (USD MILLION)

FIGURE 28 INDIA PRODUCED WATER TREATMENT MARKET: BY CAPACITY, CAGR (2023-2030)

FIGURE 29 INDIA PRODUCED WATER TREATMENT MARKET: BY CAPACITY, LIFELINE CURVE

FIGURE 30 INDIA PRODUCED WATER TREATMENT MARKET: BY PRODUCTION SOURCE, 2022

FIGURE 31 INDIA PRODUCED WATER TREATMENT MARKET: BY PRODUCTION SOURCE, 2023-2030 (USD MILLION)

FIGURE 32 INDIA PRODUCED WATER TREATMENT MARKET: BY PRODUCTION SOURCE, CAGR (2023-2030)

FIGURE 33 INDIA PRODUCED WATER TREATMENT MARKET: BY PRODUCTION SOURCE, LIFELINE CURVE

FIGURE 34 INDIA PRODUCED WATER TREATMENT MARKET: BY TECHNOLOGY, 2022

FIGURE 35 INDIA PRODUCED WATER TREATMENT MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 36 INDIA PRODUCED WATER TREATMENT MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 37 INDIA PRODUCED WATER TREATMENT MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 38 INDIA PRODUCED WATER TREATMENT MARKET: BY END USER, 2022

FIGURE 39 INDIA PRODUCED WATER TREATMENT MARKET: BY END USER 2023-2030 (USD MILLION)

FIGURE 40 INDIA PRODUCED WATER TREATMENT MARKET: BY END USER, CAGR (2023-2030)

FIGURE 41 INDIA PRODUCED WATER TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 INDIA PRODUCED WATER TREATMENT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.