India Phthalates And Non Phthalates Market

Taille du marché en milliards USD

TCAC :

%

| 2024 –2030 | |

| Dollars américains 132,586.98 | |

|

|

|

>Marché indien des phtalates et des non-phtalates, par produit (non-phtalates, DOP (di, octyl phtalate ), DBP (di butyl phtalate), DMP (di méthyl phtalate), DEP (di éthyl phtalate), DOA (di octyl adipate), Tec (tri éthyl citrate) et autres phtalates), application (fils et câbles, revêtements de sol et muraux, films et feuilles, tissus enduits, biens de consommation, emballages, adhésifs et produits d'étanchéité, et autres), utilisation finale (bâtiment et construction, électronique, automobile, biens de consommation, médecine et soins de santé, alimentation et boissons, sports et loisirs, et autres), tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et perspectives du marché indien des phtalates et des non-phtalates

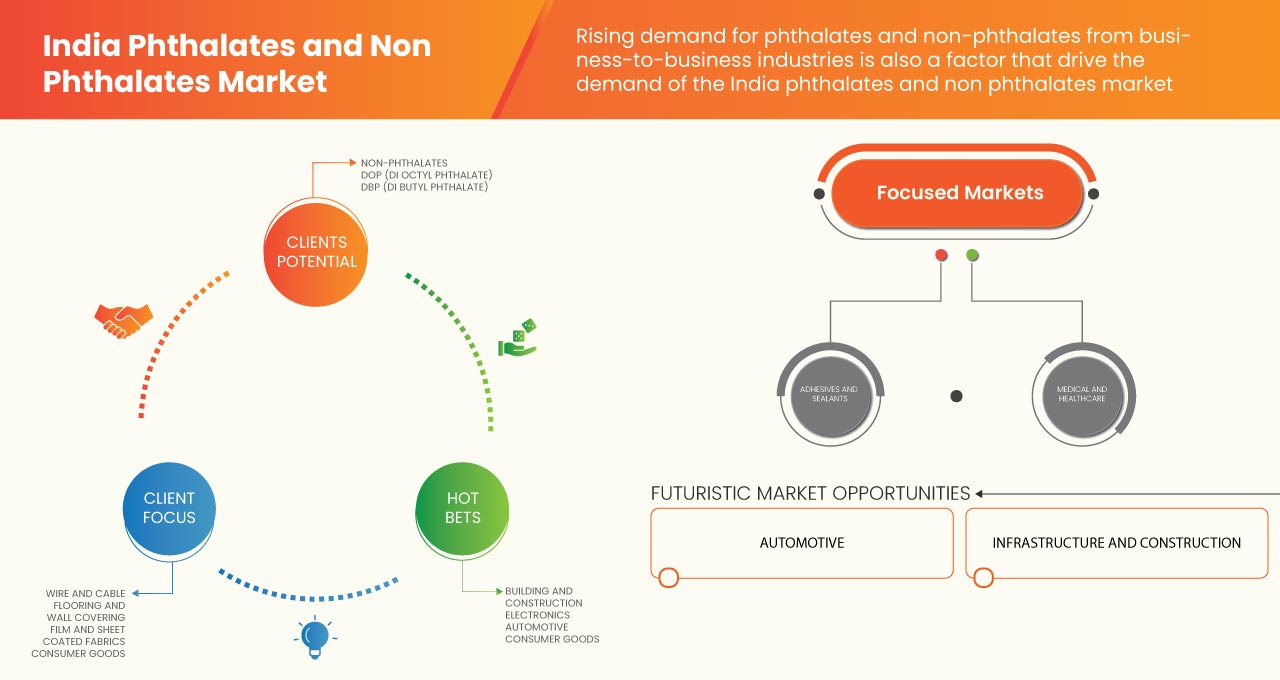

Le marché indien des phtalates et des non-phtalates devrait connaître une croissance significative de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 7,2 % de 2023 à 2030 et devrait atteindre 132 586,98 millions INR d'ici 2030. Le principal facteur à l'origine de la croissance du marché indien des phtalates et des non-phtalates est la demande croissante de phtalates et de non-phtalates du B2B.

Les plastifiants sans phtalates sont essentiellement des plastifiants exempts de phtalates. Les plastifiants sans phtalates sont utilisés pour assouplir les produits en PVC et pour augmenter leur résistance. Les plastifiants sans phtalates sont fabriqués à partir de produits pétroliers ou biosourcés. Les plastifiants à base de phtalates font partie intégrante de l'industrie du plastique ; entre 90 et 95 % de tous les phtalates sont utilisés comme plastifiants pour la production de PVC souple.

Le rapport sur le marché indien des phtalates et des non-phtalates fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Contactez-nous pour un briefing d'analyste afin de comprendre l'analyse et le scénario du marché. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions INR |

|

Segments couverts |

Produit (sans phtalates, DOP (di, octyl phtalate), DBP (dibutyl phtalate), DMP (di méthyl phtalate), DEP (di éthyl phtalate), DOA (di octyl adipate), Tec (tri éthyl citrate) et autres phtalates), application (fils et câbles, revêtements de sol et muraux, films et feuilles, tissus enduits, biens de consommation, emballages, adhésifs et produits d'étanchéité, et autres), utilisation finale (bâtiment et construction, électronique, automobile, biens de consommation, médecine et soins de santé, alimentation et boissons, sports et loisirs, et autres) |

|

Pays couverts |

Inde |

|

Acteurs du marché couverts |

KLJ Group., BASF SE, Mitsubishi Chemical Corporation., Aarti Industries Ltd., DIC Corporation, LG Chem, Evonik Industries AG, Kao Corporation., Eastman Chemical Company or its subsidiaries., NAN YA PLASTICS CORPORATION, Avient Corporation, LANXESS, Exxon Mobil Corporation., DOW, Nayakem, Nishant Organics Pvt. Ltd., Supreme Plasticizers., Payal Group, ABC Chemicals, Henan GO Biotech Co.,Ltd, Perstorp, Velsicol Chemical LLC, Indo-Nippon Chemical Co. Ltd., MarvelVinyls amongst others. |

Market Definition

Non-phthalate plasticizers are those plasticizers that are free from phthalates. The non-phthalate plasticizers are used to soften PVC products and increase their strength. Non-phthalate plasticizers are manufactured from petroleum or bio-based products, which have less effect on the human body. A few non-phthalates include DOTP (diethyl hexyl terephthalate, aka DEHT), Hexamoll DINCH (diisononyl cyclohexane dicarboxylate), as well as bio-based plasticizers, which are based on soya oil, vegetable oil. Phthalate plasticizers are an integral part of the plastic industry, especially PVC plastics, as most plastic products require flexible low viscosity material at the manufacturing time. The plastic industry is expected to grow steadily in the next few years due to increased demand for plastics in automobiles, building & construction, and consumer products.

India Phthalates and Non Phthalates Market Dynamics

This section deals with understanding the market drivers, opportunities, challenges, and restraints. All of this is discussed in detail below:

Drivers

- Growth in the medical and healthcare sector

The medical and healthcare sector has been one of the flourishing industries in India in terms of employment and revenue. The sector has flourished mainly through increasing disposable income, an aging population, increasing lifestyle diseases, using digital technologies like telemedicine, and increased foreign direct investment over the last two decades. The recent COVID-19 pandemic has paved a path to grow this sector through increased Indian start-ups organization, low-cost medical devices, and the manufacturing of generic medicines. The increasing numbers of medical insurance users and rising numbers of public health sectors in rural areas boost the healthcare and medical-based industries.

- Rising demand for phthalate and non-phthalate from business-to-business industries

In recent times there has been growth in business-to-business industries, especially markets related to plastics. The plastic industry is one of the fastest-growing industries across India. Plastics have become an important part of every aspect of modern life. Plastics find its application ranging from the automotive sector, such as automobile interiors, to the electronic sector, such as wires, cables, plastic enclosures, and many other applications. The automobile industry requires various part which is flexible or moldable in nature. Thus, to make such parts of plastics like PVC, phthalates, and non-phthalates act as plasticizers.

- Use of phthalate and non-phthalate in business-to-consumer industries

The B2C industry is rapidly changing how business is done in India. The B2C industry comprises various industries engaged in producing cosmetics, personal care products, food and beverages, home care products, and others. Such products are mostly bought from consumers through supermarkets, groceries, and e-commerce websites. Increasing disposable incomes, new technology to manufacture products, increasing foreign direct investment, favorable frameworks of government, unique marketing strategies, rapid urbanization, and the boom of e-commerce platforms are the factors that have caused the growth of the B2C industry.

Phthalate has been found in food packaging and plastics such as storage containers and lunch boxes. They are also used as a plasticizer in the manufacturing of water bottles and baby bottles.

Opportunities

- Increase in infrastructure and construction activities

A major driver of the Indian economy is the infrastructure industry. The sector receives great attention from the government to launch policies that would assure the country's construction of world-class infrastructure within a set period. This sector plays a significant role in driving India's overall growth. Power, bridges, dams, highways, and urban infrastructure development are all included in the infrastructure industry. In other words, the infrastructure sector propels the development of related industries, including townships, housing, built-up infrastructure, and construction development projects, acting as a catalyst for India's economic growth.

Phthalate is a chemical substance used to make vinyl (or PVC) flexible, malleable, and durable. Using phthalates makes floors more resilient, low maintenance, and stain resistant.

- Growth in the Indian plastic industry

The plastic industry is one of the fastest-growing industries across India. Plastics and plastic packaging have now permeated every aspect of modern life. Plastics find applications ranging from the healthcare sector, such as diagnostic equipment, plastic syringes, and Petri dishes, to food sector applications, such as packing food-related items. India produces many goods, including plastics, home furnishings, cordage, fishnets, floor coverings, medical supplies, packaging, pipes, plastic films, and raw materials. Such plastics are used up in various industries, such as electronics, construction, packaging, healthcare, and transportation.

Restraints

- Serious environmental and health effects

Phthalate is the most utilized material in plastics and cosmetics, among many other applications. They are well-known plasticizers that create a wide range of products, such as plastic packaging films, toys, floorings, personal care products, and automobile and electrical components. Due to such varied applications, phthalate is released in environments where it can be ingested, inhaled, or absorbed unintentionally. The environmental effects and detrimental health problems caused by phthalate exposure may restrain the growth of the Indian phthalate and non phthalates market.

Food, drinking water, and beverage are the main ways consumers consume phthalates. Phthalates are not chemically attached to plastic objects. They gradually leak out of them and evaporate into the air, water, food, household dust, soil, and living things, especially in hot weather.

- Credible threat of sustainable substitutes

Many compounds have been recognized as substitutes for phthalate plasticizers. The alternatives consist of citrates, sebacates, adipates, and phosphates. They are used in place of phthalates in products like toys, baby products, and medical equipment. These compounds are employed as solvents and fixatives in cosmetics, inks, adhesives, and other consumer goods, in addition to their use as substitutes for PVC plasticizers.

Epoxidized soybean oil (ESBO) is used as a plasticizer, compatibilizer, and phthalate. ESBO has also found its application as a plasticizer in seals for glass jars and as a stabilizer to decrease the UV degradation of polyvinyl chloride. Similarly, trimellitates have also been used as a substitute for diethyl phthalate, which is used in wall coverings, packaging, and flooring. In cosmetic products, acetyl tributyl citrate is used as a plasticizer in cosmetic products and PVC applications. Chemicals like DINCH are used instead of phthalate in commercial products such as toys, medical devices, and food packaging.

Challenge

- Stringent rules and regulations

Bien qu'il existe de nombreuses applications des phtalates et des produits sans phtalates dans notre vie quotidienne, d'autres problèmes de santé, tels que l'obésité, le diabète, l'asthme et la résistance à l'insuline, ont été associés à l'utilisation et à la synthèse des phtalates. L'Inde a imposé des réglementations strictes sur l'utilisation et l'exposition aux phtalates afin de réguler l'utilisation de ces produits chimiques et de protéger la santé publique.

Développements récents

- Le 28 décembre 2022, selon Fortune India, d'ici 2026, il est prévu que l'Inde exportera pour 30 milliards INR de composants automobiles, la valeur totale du secteur étant estimée à 200 milliards INR et représentant 5 à 7 % du PIB indien.

- Le 24 décembre 2022, selon The Hindu Business Line, l'industrie du tourisme médical en Inde est estimée à 9 milliards INR, ce qui en fait le 10e plus grand centre de tourisme médical en Inde, qui devrait atteindre 13 milliards INR d'ici 2026.

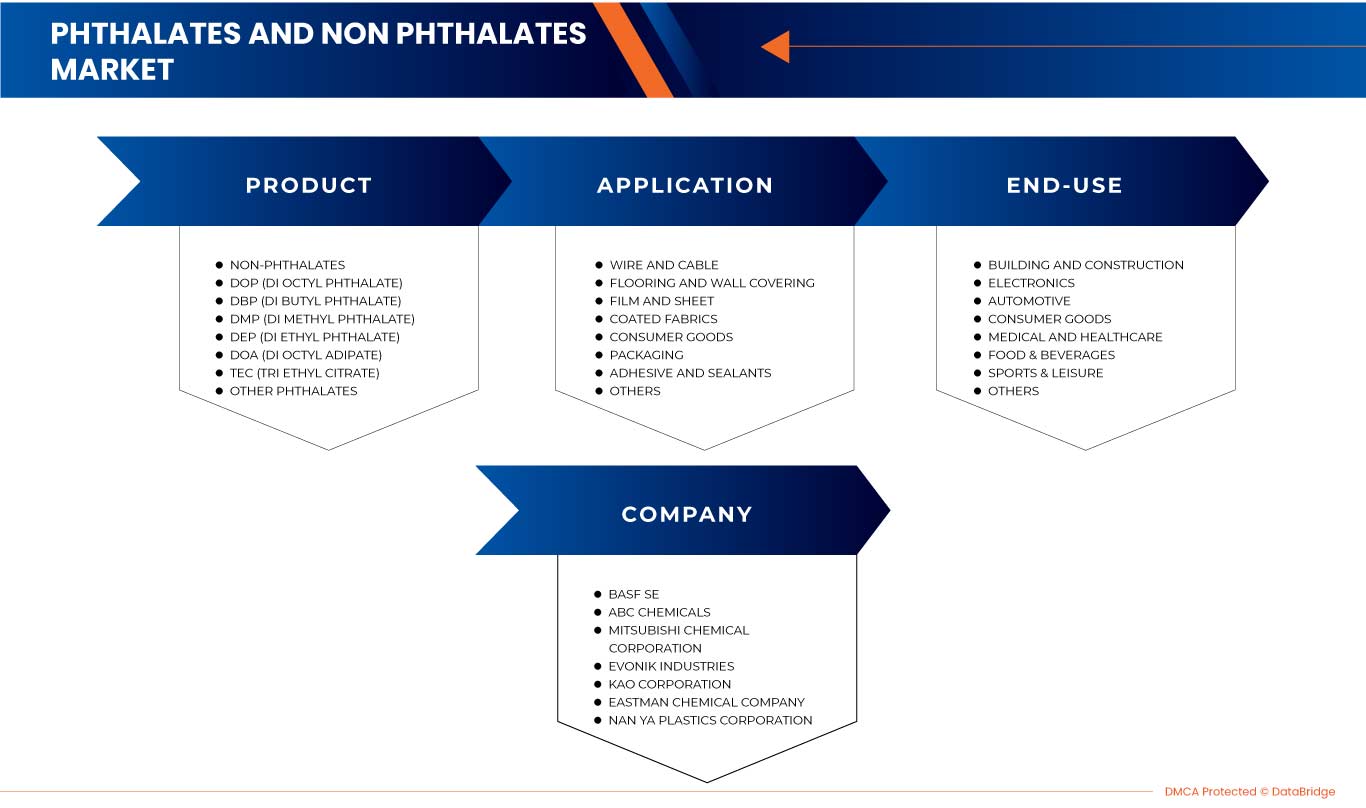

Portée du marché indien des phtalates et des non-phtalates

Le marché indien des phtalates et des non-phtalates est classé en fonction du produit, de l'application et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les principaux segments de croissance de l'industrie et à fournir aux utilisateurs un aperçu précieux du marché et des informations pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Sans phtalates

- DOP (phtalate de di, octyle)

- DBP (phtalate de dibutyle)

- DMP (phtalate de diméthyle)

- DEP (phtalate de diéthyle)

- DOA (adipate de dioctyle)

- TEC (citrate de triéthyle)

- Autres phtalates

En fonction du produit, le marché indien des phtalates et des non-phtalates est classé en non-phtalates, DOP (phtalate de di, octyle), DBP (phtalate de dibutyle), DMP (phtalate de diméthyle), DEP (phtalate de diéthyle), DOA (adipate de di octyle), TEC (citrate de triéthyle) et autres phtalates.

Application

- Fil et câble

- Revêtements de sol et de mur

- Film et feuille

- Tissus enduits

- Biens de consommation

- Conditionnement

- Adhésifs et produits d'étanchéité

- Autres

En fonction des applications, le marché indien des phtalates et des non-phtalates est classé en fils et câbles, revêtements de sol et muraux, films et feuilles, tissus enduits, biens de consommation, emballages, adhésifs et produits d'étanchéité, et autres.

Utilisation finale

- Bâtiment et construction

- Électronique

- Automobile

- Biens de consommation

- Médical et soins de santé

- Alimentation et boissons

- Sports et loisirs

- Autres

En fonction de l'utilisation finale, le marché indien des phtalates et des non-phtalates est classé en bâtiment et construction, électronique, automobile, biens de consommation, médecine et soins de santé, alimentation et boissons, sports et loisirs, et autres.

Paysage concurrentiel et analyse des parts de marché des phtalates et des non-phtalates en Inde

Le paysage concurrentiel du marché indien des phtalates et des non-phtalates fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de durée de vie du produit. Les points de données ci-dessus ne concernent que l'accent mis par l'entreprise sur le marché indien des phtalates et des non-phtalates.

Français Certains des principaux acteurs opérant sur le marché indien des phtalates et des non-phtalates sont KLJ Group., BASF SE, Mitsubishi Chemical Corporation., Aarti Industries Ltd., DIC Corporation, LG Chem, Evonik Industries AG, Kao Corporation., Eastman Chemical Company ou ses filiales., NAN YA PLASTICS CORPORATION, Avient Corporation, LANXESS, Exxon Mobil Corporation., DOW, Nayakem, Nishant Organics Pvt. Ltd., Supreme Plasticizers., Payal Group, ABC Chemicals, Henan GO Biotech Co., Ltd, Perstorp, Velsicol Chemical LLC, Indo-Nippon Chemical Co. Ltd., MarvelVinyls entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA PHTHALATES AND NON PHTHALATES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS- GEOPOLITICAL SCENARIO AND INDIAN MARKET SCENARIO

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 SUPPLY CHAIN ANALYSIS

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT'S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 RAW MATERIAL PRODUCTION COVERAGE

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VALUE CHAIN OF INDIA PHTHALATES AND NON- PHTHALATES MARKET

4.9 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN THE MEDICAL AND HEALTHCARE SECTOR

6.1.2 RISING DEMAND FOR PHTHALATES AND NON-PHTHALATES FROM BUSINESS-TO-BUSINESS INDUSTRIES

6.1.3 USE OF PHTHALATES AND NON-PHTHALATES IN BUSINESS-TO-CONSUMER INDUSTRIES

6.2 RESTRAINTS

6.2.1 SERIOUS ENVIRONMENTAL AND HEALTH EFFECTS

6.2.2 CREDIBLE THREAT OF SUSTAINABLE SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 INCREASE IN INFRASTRUCTURE AND CONSTRUCTION ACTIVITIES

6.3.2 GROWTH IN THE INDIAN PLASTIC INDUSTRY

6.4 CHALLENGE

6.4.1 STRINGENT RULES AND REGULATIONS

7 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 NON-PHTHALATES

7.2.1 MONOMERIC PLASTICIZERS

7.2.1.1 ADIPATES

7.2.1.2 TEREPHTHALATES

7.2.1.3 EPOXIES

7.2.1.4 ALIPHATICS

7.2.1.5 MALEATES

7.2.1.6 BENZOATES

7.2.1.7 TRIMELLITATES

7.2.1.8 MONOALCOHOLS

7.2.1.9 OTHERS

7.2.2 POLYMERIC PLASTICIZERS

7.2.2.1 HAXENEDIOIC ACID

7.2.2.2 PHOSPHATE ESTERS

7.2.2.3 ALKYL SULFONIC ACID ESTERS

7.2.2.4 POLYOL-CARBOXYLIC ACID ESTERS

7.2.2.5 SEBACIC

7.2.2.6 CITRIC ACID ESTERS

7.2.2.7 PENTAERYTHRITOL ESTER OF VALERIC ACID

7.2.2.8 OTHERS

7.3 DOP (DI, OCTYL PHTHALATE)

7.4 DBP (DI BUTYL PHTHALATE)

7.5 DMP (DI METHYL PHTHALATE)

7.6 DEP (DI ETHYL PHTHALATE)

7.7 DOA (DI OCTYL ADIPATE)

7.8 TEC (TRI ETHYL CITRATE)

7.9 OTHER PHTHALATES

7.9.1 DI-ISONONYL PHTHALATE (DINP)

7.9.2 DI-ISODECYL PHTHALATE (DIDP)

7.9.3 DI-ISOBUTYL PHTHALATE (DIBP)

7.9.4 DI-PROPYLHEPTYL PHTHALATE (DPHP)

7.9.5 DI-ETHYLHEXYL PHTHALATE (DEHP)

7.9.6 OTHERS

8 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 WIRE AND CABLE

8.3 FLOORING AND WALL COVERING

8.4 FILM AND SHEET

8.5 COATED FABRICS

8.6 CONSUMER GOODS

8.7 PACKAGING

8.8 ADHESIVE AND SEALANTS

8.9 OTHERS

9 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY END-USE

9.1 OVERVIEW

9.2 BUILDING AND CONSTRUCTION

9.2.1 BY SEGMENT

9.2.1.1 RESIDENTIAL

9.2.1.2 COMMERCIAL

9.2.1.3 INFRASTRUCTURE

9.2.1.4 INDUSTRIAL

9.2.2 BY PRODUCT

9.2.2.1 PHTHALATES PLASTICIZERS

9.2.2.2 NON-PHTHALATES PLASTICIZERS

9.3 ELECTRONICS

9.3.1 BY SEGMENT

9.3.1.1 CONSUMER ELECTRONICS

9.3.1.2 INDUSTRIAL ELECTRONICS

9.3.2 BY PRODUCT

9.3.2.1 PHTHALATES PLASTICIZERS

9.3.2.2 NON-PHTHALATES PLASTICIZERS

9.4 AUTOMOTIVE

9.4.1 BY SEGMENT

9.4.1.1 PASSENGER VEHICLE

9.4.1.2 COMMERCIAL VEHICLE

9.4.1.3 HEAVY DUTY VEHICLE

9.4.1.4 OTHERS

9.4.2 BY PRODUCT

9.4.2.1 PHTHALATES PLASTICIZERS

9.4.2.2 NON-PHTHALATES PLASTICIZERS

9.5 CONSUMER GOODS

9.5.1 BY SEGMENT

9.5.1.1 TOYS

9.5.1.2 STATIONERY

9.5.1.3 CHILD CARE ARTICLES

9.5.1.4 OTHERS

9.5.2 BY PRODUCT

9.5.2.1 PHTHALATES PLASTICIZERS

9.5.2.2 NON-PHTHALATES PLASTICIZERS

9.6 MEDICAL AND HEALTHCARE

9.6.1 BY PRODUCT

9.6.1.1 PHTHALATES PLASTICIZERS

9.6.1.2 NON-PHTHALATES PLASTICIZERS

9.7 FOOD & BEVERAGES

9.7.1 BY PRODUCT

9.7.1.1 PHTHALATES PLASTICIZERS

9.7.1.2 NON-PHTHALATES PLASTICIZERS

9.8 SPORTS & LEISURE

9.8.1 BY PRODUCT

9.8.1.1 PHTHALATES PLASTICIZERS

9.8.1.2 NON-PHTHALATES PLASTICIZERS

9.9 OTHERS

9.9.1 BY PRODUCT

9.9.1.1 PHTHALATES PLASTICIZERS

9.9.1.2 NON-PHTHALATES PLASTICIZERS

10 COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: INDIA

10.2 EVENT

10.3 NEW PRODUCT LAUNCH

10.4 CERTIFICATION

10.5 COMPANY LAUNCH

10.6 AWARD

10.7 COLLABORATION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 KLJ GROUP

12.1.1 COMPANY SNAPSHOT

12.1.2 PRODUCT PORTFOLIO

12.1.3 RECENT DEVELOPMENT

12.2 BASF SE

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 MITSUBISHI CHEMICAL CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 AARTI INDUSTRIES LTD.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 DIC CORPORATION

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 ABC CHEMICAL

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 AVIENT CORPORATION

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 DOW

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENTS

12.9 EASTMAN CHEMICAL COMPANY

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

12.1 EVONIK INDUSTRIES AG

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

12.11 EXXON MOBIL CORPORATION

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 HENAN GO BIOTECH CO.,LTD

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 INDO-NIPPON CHEMICAL CO. LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 KAO CORPORATION

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 LANXESS

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENT

12.16 LG CHEM

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENTS

12.17 MARVELVINYLS

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 NAN YA PLASTICS CORPORATION

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENT

12.19 NAYAKEM

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

12.2 NISHANT ORGANICS PVT. LTD.

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENTS

12.21 PAYAL GROUP

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENTS

12.22 PERSTORP HOLDING AB

12.22.1 COMPANY SNAPSHOT

12.22.2 PRODUCT PORTFOLIO

12.22.3 RECENT DEVELOPMENT

12.23 SUPREME PLASTICIZERS

12.23.1 COMPANY SNAPSHOT

12.23.2 PRODUCT PORTFOLIO

12.23.3 RECENT DEVELOPMENT

12.24 VELSICOL CHEMICAL LLC.

12.24.1 COMPANY SNAPSHOT

12.24.2 PRODUCT PORTFOLIO

12.24.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF COMPOUND PLASTICISERS FOR RUBBER OR PLASTICS, N.E.S.; HS CODE – 381220 (USD THOUSAND)

TABLE 2 EXPORT DATA OF COMPOUND PLASTICISERS FOR RUBBER OR PLASTICS, N.E.S.; HS CODE – 381220 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 5 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (KILO TONS)

TABLE 6 INDIA NON-PHTHALATES IN PHTHALATES AND NON PHTHALATES MARKET, BY TYPE, 2021-2030 (INR MILLION)

TABLE 7 INDIA MONOMERIC PLASTICIZERS IN PHTHALATES AND NON PHTHALATES MARKET, BY TYPE, 2021-2030 (INR MILLION)

TABLE 8 INDIA POLYMERIC PLASTICIZERS IN PHTHALATES AND NON PHTHALATES MARKET, BY TYPE, 2021-2030 (INR MILLION)

TABLE 9 INDIA OTHER PHTHALATES IN PHTHALATES AND NON PHTHALATES MARKET, BY TYPE, 2021-2030 (INR MILLION)

TABLE 10 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY APPLICATION, 2021-2030 (INR MILLION)

TABLE 11 INDIA PHTHALATES AND NON PHTHALATES MARKET, BY END-USE, 2021-2030 (INR MILLION)

TABLE 12 INDIA BUILDING AND CONSTRUCTION IN PHTHALATES AND NON PHTHALATES MARKET, BY SEGMENT, 2021-2030 (INR MILLION)

TABLE 13 INDIA BUILDING AND CONSTRUCTION IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 14 INDIA ELECTRONICS IN PHTHALATES AND NON PHTHALATES MARKET, BY SEGMENT, 2021-2030 (INR MILLION)

TABLE 15 INDIA ELECTRONICS IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 16 INDIA AUTOMOTIVE IN PHTHALATES AND NON PHTHALATES MARKET, BY SEGMENT, 2021-2030 (INR MILLION)

TABLE 17 INDIA AUTOMOTIVE IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 18 INDIA CONSUMER GOODS IN PHTHALATES AND NON PHTHALATES MARKET, BY SEGMENT, 2021-2030 (INR MILLION)

TABLE 19 INDIA CONSUMER GOODS IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 20 INDIA MEDICAL AND HEALTHCARE IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 21 INDIA FOOD & BEVERAGES IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 22 INDIA SPORTS & LEISURE IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

TABLE 23 INDIA OTHERS IN PHTHALATES AND NON PHTHALATES MARKET, BY PRODUCT, 2021-2030 (INR MILLION)

Liste des figures

FIGURE 1 INDIA PHTHALATES AND NON PHTHALATES MARKET

FIGURE 2 INDIA PHTHALATES AND NON PHTHALATES MARKET: DATA TRIANGULATION

FIGURE 3 INDIA PHTHALATES AND NON PHTHALATES MARKET: DROC ANALYSIS

FIGURE 4 INDIA PHTHALATES AND NON PHTHALATES MARKET: INDIA MARKET ANALYSIS

FIGURE 5 INDIA PHTHALATES AND NON PHTHALATES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA PHTHALATES AND NON PHTHALATES MARKET: THE RAW MATERIAL LIFE LINE CURVE

FIGURE 7 INDIA PHTHALATES AND NON PHTHALATES MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE GAS BARRIER MEMBRANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 INDIA PHTHALATES AND NON PHTHALATES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 INDIA PHTHALATES AND NON PHTHALATES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 INDIA PHTHALATES AND NON PHTHALATES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 INDIA PHTHALATES AND NON PHTHALATES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 INDIA PHTHALATES AND NON PHTHALATES MARKET: SEGMENTATION

FIGURE 14 RISING DEMAND FOR PHTHALATE AND NON PHTHALATE FROM BUSINESS-TO-BUSINESS INDUSTRIES IS EXPECTED TO DRIVE INDIA PHTHALATES AND NON PHTHALATES MARKET IN THE FORECAST PERIOD

FIGURE 15 NON-PHTHALATES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA PHTHALATES AND NON PHTHALATES MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE INDIA PHTHALATES AND NON PHTHALATES MARKET

FIGURE 17 INDIA PHTHALATES AND NON PHTHALATES MARKET: BY PRODUCT, 2022

FIGURE 18 INDIA PHTHALATES AND NON PHTHALATES MARKET: BY APPLICATION, 2022

FIGURE 19 INDIA PHTHALATES AND NON PHTHALATES MARKET: BY END-USE, 2022

FIGURE 20 INDIA PHTHALATE AND NON PHTHALATES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.