Global Vanilla (B2B) Market, By Vanilla Type (Madagascar, Mexican, Synthetic Origin, India, Indonesian, Tahitian, Tonga, Papua New Guinea, Ugandan and Others), Vanilla Origin (Natural and Synthetic), Grade (Grade A (30% Moisture), Grade B (20% Moisture) and Others), Form (Liquid, Powder and Paste), End-Use (Food, Beverages, Personal Care & Cosmetic, Pharmaceuticals, Household/Retail and Others) Distribution Channel (Wholesale and Online), Industry Trends and Forecast to 2029

Market Analysis and Insights

The global vanilla (B2B) market is gaining significant growth due to the growing food & beverage industry and the rise in demand for bakery products. The increase in demand for different types of confectionary products is also boosting the growth of the global vanilla (B2B) market. However, stringent government regulations associated with synthetic vanilla is expected to restrain the market growth of vanilla market during the forecast period.

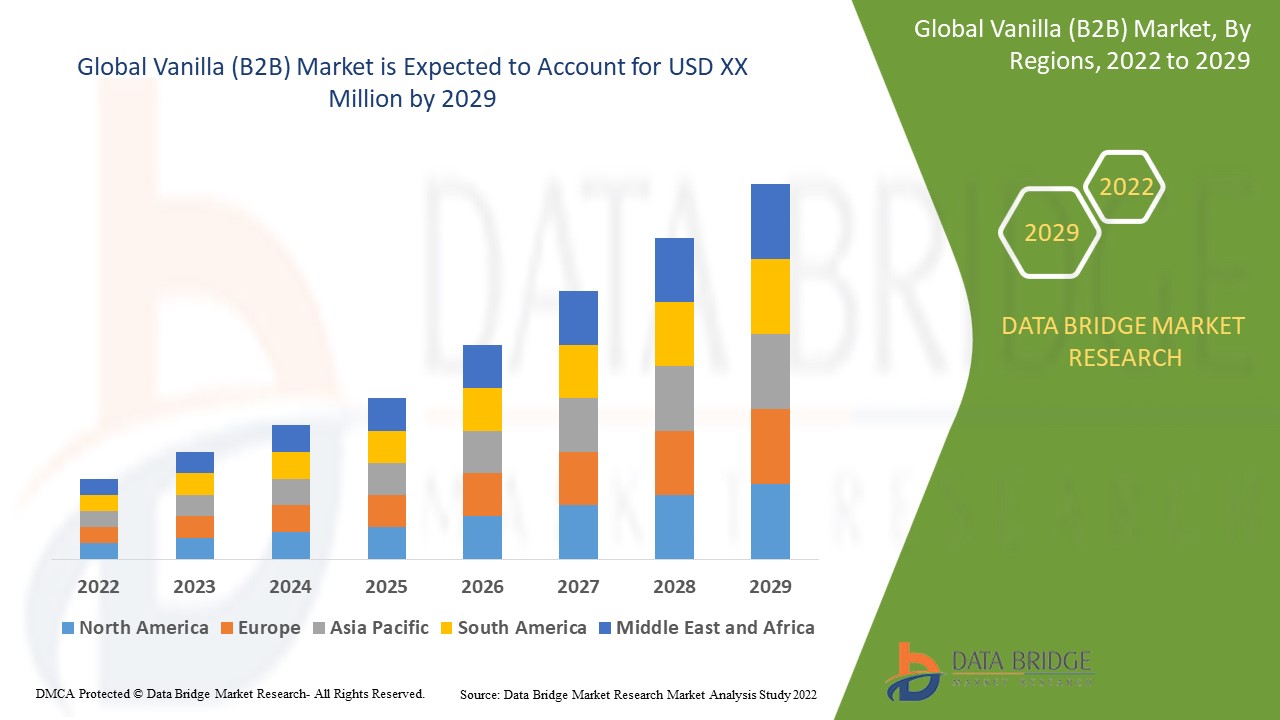

Data Bridge Market Research analyses that the global vanilla (B2B) market will grow at a CAGR of 4.8% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Million, Volume in Tons, Pricing in USD |

|

Segments Covered |

By Vanilla Type (Madagascar, Mexican, Synthetic Origin, India, Indonesian, Tahitian, Tonga, Papua New Guinea, Ugandan and Others), Vanilla Origin (Natural and Synthetic), Grade (Grade A (30% Moisture), Grade B (20% Moisture) and Others), Form (Liquid, Powder and Paste), End-Use (Food, Beverages, Personal Care & Cosmetic, Pharmaceuticals, Household/Retail and Others) Distribution Channel (Wholesale and Online) |

|

Regions Covered |

U.S., Canada, Mexico, Germany, France, Spain, Turkey, U.K., Netherlands, Russia, Switzerland, Belgium, Luxemburg, Italy, Rest of Europe, China, India, Japan, Australia, South Korea, Malaysia, Singapore, Thailand, New Zealand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Egypt, Saudi Arabia, U.A.E, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

McCormick & Company, Inc., IFFinc, Kerry, Givaudan, ADM, Firmenich SA, Prova, Nielsen-Massey Vanillas, Inc., Takasago International Corporation, Madagascar Vanilla Company LLC, SYNERGY, Vanilla Pura, Aust & Hachmann (Canada) Ltd/Ltée, vnlla Extract Co., Boston Vanilla Bean Company among others |

Market Definition

La vanille est une épice dérivée des orchidées du genre vanilla. Elle est largement cultivée dans diverses régions du monde. De plus, Madagascar, le Mexique et l'Indonésie sont les leaders de la production de gousses de vanille. L'arôme de vanille est extrait des gousses de vanille, appelé extrait de vanille naturel sur le marché. Cependant, la demande d'arôme de vanille augmente rapidement parmi les consommateurs, ce qui conduit le transformateur de vanille à produire de l'extrait de vanille synthétique à partir de ressources renouvelables. Les gousses de vanille sont classées en grade A, grade B et autres en fonction de la qualité.

De même, la vanille est segmentée en différentes formes telles que liquide, poudre et pâte. Les gousses de vanille et les extraits sont largement utilisés dans la boulangerie, la confiserie et les produits laitiers. En outre, la vanille a de nombreuses applications dans les produits pharmaceutiques et de soins personnels.

Dynamique du marché mondial de la vanille (B2B)

Conducteurs

- Demande croissante de vanille dans l'industrie agroalimentaire

La demande de vanille dans les industries agroalimentaires augmente rapidement. L'extrait de vanille est un agent aromatisant important dans l'industrie de transformation des aliments et des boissons. Dans l'industrie alimentaire, la vanille est ajoutée à diverses applications alimentaires, notamment les produits laitiers, les produits de boulangerie, les aliments transformés, le chocolat et la confiserie, entre autres, pour rehausser ses saveurs et son goût. Ainsi, l'augmentation de la demande de poudre, de pâte et de liquide de vanille dans l'industrie alimentaire devrait stimuler la croissance du marché.

Parallèlement, les extraits de vanille jouent un rôle important dans la réduction de l'amertume et l'amélioration de la saveur du produit dans l'industrie du chocolat. De plus, la vanille masquera la variation de goût du chocolat causée par le son de cacao. Par conséquent, l'augmentation de la demande de vanille dans l'industrie du chocolat propulse la croissance de la vanille sur le marché.

-

Demande croissante de vanille dans l'industrie pharmaceutique et des soins personnels

Ces dernières années, la demande de produits cosmétiques et de soins personnels à base de parfum a augmenté parmi les clients du monde entier. Par conséquent, l'augmentation du besoin de produits cosmétiques à base de vanille stimule la croissance de la vanille sur le marché. Outre le parfum, la vanille a une propriété fonctionnelle particulière qui permet de réparer les dommages cutanés.

Par exemple, la vanille est naturellement riche en antioxydants, qui aident à neutraliser les radicaux libres et à réduire les dommages cutanés. En raison de ses propriétés fonctionnelles, les liquides, poudres et pâtes de vanille sont largement utilisés dans les produits cosmétiques. Ainsi, l'utilisation croissante de la vanille dans l'industrie cosmétique stimulera la croissance du marché. De plus, la vanille de Madagascar a une large application dans les produits de soins personnels tels que les lotions, les crèmes anti-âge et les baumes à lèvres enrichis en vitamine B, qui sont responsables de la santé de la peau. Ainsi, les fabricants de cosmétiques ajoutent de la vanille dans leurs produits.

Par conséquent, la demande croissante de vanille de Madagascar dans les produits de soins personnels propulsera la croissance du marché.

Opportunité

-

Demande croissante d'extraits synthétiques de vanille

Bien que la faible production de gousses de vanille réduise la production d'extraits de vanille naturels sur le marché, pour répondre à la demande, les fabricants d'extraits de vanille se concentrent sur la production d'extraits de vanille synthétiques. Cela crée une opportunité supplémentaire pour les producteurs d'extraits de vanille d'accroître leur valeur sur le marché mondial. En raison de la préférence croissante des consommateurs pour les produits alimentaires aromatisés à la vanille, l'industrie alimentaire demande davantage d'extraits de vanille synthétiques sur le marché.

Ces dernières années, l'industrie chimique a suscité un intérêt considérable en raison de la possibilité de remplacer les produits à base de vanille synthétique par des ressources renouvelables. Selon la réglementation américaine, l'extrait de vanille obtenu à partir de sources renouvelables peut être qualifié de naturel. Ainsi, les fabricants mettent l'accent sur la production d'extrait de vanille à l'aide de la méthode biotechnologique.

Contraintes/Défis

- Fluctuation du prix des matières premières

La demande d'arômes de vanille augmente dans les industries et les clients du monde entier. Cependant, la demande de vanille dépasse l'offre de vanille sur le marché.

Par exemple,

- Selon le rapport de la NPR, la demande croissante de gousses de vanille de Madagascar a multiplié par dix le prix du produit en 2017 par rapport aux années précédentes. Par conséquent, l'augmentation du prix des gousses de vanille de Madagascar va réduire la croissance du marché car les clients sont sensibles au prix

De même, les consommateurs recherchent des produits de marque propre et exigent des produits naturels et biologiques. Par conséquent, les entreprises produisent des extraits de vanille à partir d'une source naturelle pour satisfaire les clients. Malgré cela, la disponibilité réduite des matières premières conduit les fabricants à vendre leurs produits à un prix plus élevé. En raison des prix élevés, la demande de vanille va diminuer et entraver la croissance du marché mondial.

- Disponibilité de produits de substitution

La vanille est l'arôme le plus courant chez les consommateurs, bien que la disponibilité d'arômes alternatifs sur le marché constitue un défi majeur pour la croissance de la vanille sur le marché. Le sirop d'érable, l'extrait d'amande, le zeste d'agrumes et d'autres sont les arômes de substitution disponibles sur le marché. Le sirop d'érable est un substitut aux extraits de vanille qui offre un arôme agréable et les saveurs douces de la vanille.

Le sirop d’érable est idéal pour préparer des crêpes, des biscuits, des légumes rôtis et d’autres applications alimentaires.

Comme il est économique, les consommateurs optent pour le sirop d'érable comme alternative à l'arôme de vanille. Par conséquent, la demande croissante de sirop d'érable va diminuer la croissance de la vanille sur le marché. Par conséquent, l'extrait d'amande est également utilisé comme source alternative d'extrait de vanille. De plus, l'extrait d'amande est nettement plus puissant que l'arôme de vanille. Cet extrait est largement ajouté aux produits de boulangerie et autres desserts pour rehausser leur saveur et leur goût. Par conséquent, la demande croissante d'extrait d'amande dans l'industrie de la boulangerie va entraver la croissance de la vanille sur le marché.

Impact post-COVID-19 sur le marché mondial de la vanille (B2B)

Après la pandémie de COVID-19, la demande de vanille a augmenté dans la région Asie-Pacifique en raison du changement des habitudes d'achat des consommateurs et de l'évolution progressive vers une augmentation de la demande de produits aromatisés variés parmi divers utilisateurs finaux tels que les aliments et les boissons et autres. En raison de la suppression de nombreuses obligations et restrictions strictes, les fabricants et les producteurs sont en mesure de répondre à la demande de vanille dans la région.

La demande croissante de produits alimentaires aux saveurs différentes permet aux fabricants de lancer diverses vanilles biologiques et synthétiques, ce qui a contribué à la croissance du marché.

Développements récents

- En octobre 2020, Firmenich SA, société privée leader dans le domaine des parfums et des arômes, a signé un partenariat avec Authentic Products, un producteur leader à Madagascar et membre fondateur du groupe Naturals Together. Ce partenariat renforce l'approvisionnement responsable de vanille sur le marché. En outre, les entreprises offrent des formations agricoles aux adolescents de Madagascar et créent une opportunité unique pour les familles productrices de vanille d'améliorer leurs moyens de subsistance

- En janvier 2020, ADM a acquis Yerbalatina Phytoactives, un fabricant leader d'extraits et d'ingrédients à base de plantes. Cette acquisition permettra à ADM d'étendre ses activités au Brésil et de renforcer sa position sur le marché de la santé et du bien-être

Par exemple,

- En juin 2019, Solvay a lancé une nouvelle solution à base de vanille sous la marque vanifolia et vanifolia bean. Les nouveaux produits ont offert un substitut naturel à l' extrait de vanille qui est rentable. Ainsi, vanifolia et vanifolia bean ont répondu aux attentes des clients en matière de goût authentique et de qualité constante

Portée du marché mondial de la vanille (B2B)

Le marché mondial de la vanille (B2B) est segmenté en onze segments notables en fonction du type de vanille, de la qualité, de l'origine de la vanille, de la forme, de l'utilisation finale et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de vanille

- Madagascar

- indonésien

- mexicain

- Origine synthétique

- Papouasie-Nouvelle-Guinée

- Ouganda

- Tahiti

- Inde

- Tonga

- Autres

Sur la base du type de vanille, le marché mondial de la vanille (B2B) est segmenté en Madagascar, Mexique, origine synthétique, Inde, Indonésie, Tahiti, Tonga, Papouasie-Nouvelle-Guinée, Ouganda et autres.

Formulaire

- Liquide

- Poudre

- Coller

Sur la base de la forme, le marché mondial de la vanille (B2B) est segmenté en liquide, en poudre et en pâte.

Origine de la vanille

- Naturel

- Synthétique

Sur la base de l’origine de la vanille, le marché mondial de la vanille (B2B) est segmenté en naturel et synthétique.

Grade

- Catégorie A (30 % d'humidité)

- Catégorie B (20 % d'humidité)

- Autres

Sur la base de la qualité, le marché mondial de la vanille (B2B) est segmenté en qualité A (30 % d'humidité), qualité B (20 % d'humidité) et autres.

Utilisation finale

- Nourriture

- Pharmaceutique

- Boisson

- Soins personnels et cosmétiques

- Ménage/Commerce de détail

- Autres

Sur la base de l'utilisation finale, le marché mondial de la vanille (B2B) est segmenté en aliments, boissons, soins personnels et cosmétiques, produits pharmaceutiques, produits ménagers/de détail et autres.

Canal de distribution

- De gros

- En ligne

Sur la base du canal de distribution, le marché mondial de la vanille (B2B) est segmenté en gros et en ligne.

Analyses/perspectives régionales des marchés mondiaux de la vanille (B2B)

Les marchés mondiaux de la vanille (B2B) sont analysés et les informations et tendances sur la taille du marché sont fournies sur la base des références ci-dessus.

Les pays couverts dans le rapport sur les marchés mondiaux de la vanille (B2B) sont les États-Unis, le Canada, le Mexique, l'Allemagne, la France, l'Espagne, la Turquie, le Royaume-Uni, les Pays-Bas, la Russie, la Suisse, la Belgique, le Luxembourg, l'Italie, le reste de l'Europe, la Chine, l'Inde, le Japon, l'Australie, la Corée du Sud, la Malaisie, Singapour, la Thaïlande, la Nouvelle-Zélande, l'Indonésie, les Philippines, le reste de l'Asie-Pacifique, le Brésil, l'Argentine, le reste de l'Amérique du Sud, l'Afrique du Sud, l'Égypte, l'Arabie saoudite, les Émirats arabes unis, Israël, le reste du Moyen-Orient et l'Afrique.

L'Amérique du Nord domine le marché mondial de la vanille (B2B) en termes de parts de marché et de revenus du marché et continuera de renforcer sa domination au cours de la période de prévision. Cela est dû à la demande croissante de vanille dans diverses industries en Amérique du Nord telles que l'alimentation, les boissons, les soins personnels et autres.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché mondiales de la vanille (B2B)

Le paysage concurrentiel du marché mondial de la vanille (B2B) fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications.

Certains des principaux acteurs du marché sont McCormick & Company, Inc., IFFinc, Kerry, Givaudan, ADM, Firmenich SA, Prova, Nielsen-Massey Vanillas, Inc., Takasago International Corporation, Madagascar Vanilla Company LLC, SYNERGY, Vanilla Pura, Aust & Hachmann (Canada) Ltd/Ltée, vnlla Extract Co., Boston Vanilla Bean Company, entre autres.

Méthodologie de recherche

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VANILLA MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE (B2B)

2.1 TYPE LIFELINE CURVE (B2C)

2.2 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.3 DBMR MARKET POSITION GRID

2.4 VENDOR SHARE ANALYSIS

2.5 MARKET END USER COVERAGE GRID

2.6 SECONDARY SOURCES

2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKET TRENDS

4.2 NEW PRODUCT LAUNCHES

4.3 BIGGEST PLAYERS IN THE MARKET FOR DIRECT TO CONSUMER

4.4 MANUFACTURING PROCESS OF SYNTHETIC VANILLA

4.4.1 PREPARATION OF VANILLA FROM CONIFERIN

4.4.2 PREPARATION OF VANILLA FROM EUGENOL

4.4.3 PREPARATION OF VANILLA FROM SPENT SULPHITE LIQUOR

4.5 MARKETING STRATEGIES

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL PROCUREMENT

4.6.2 MANUFACTURING PROCESS

4.6.3 MARKETING AND DISTRIBUTION

4.6.4 END-USERS

4.7 VALUE CHAIN ANALYSIS

4.7.1 KEY SUPPLIERS

4.7.2 KEY DISTRIBUTORS

4.7.3 CONSUMERS

4.8 REGULATORY FRAMEWORK

4.9 CONSUMER PREFERENCES

4.1 PRICING ANALYSIS

4.11 DIRECT TO CONSUMER VANILLA PRODUCT PRICING AND MARGINS

4.12 KEY GOVERNMENT INITIATIVES

4.13 IMPORT-EXPORT ANALYSIS

4.13.1 EXPORT OF VANILLA, HS CODE: 0905, 2017-2021, IN USD THOUSAND

4.13.2 EXPORT OF VANILLA, HS CODE: 0905 , 2017-2021, IN TONS

4.13.3 IMPORT OF VANILLA, HS CODE: 0905, 2017-2021, IN USD THOUSAND

4.13.4 IMPORT OF VANILLA, HS CODE: 0905, 2017-2021, IN USD THOUSAND

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR VANILLA IN THE FOOD & BEVERAGE INDUSTRY

5.1.2 GROWING DEMAND FOR VANILLA IN THE PHARMACEUTICAL AND PERSONAL CARE INDUSTRY

5.1.3 INCREASING DEMAND FOR BAKERY PRODUCTS

5.1.4 RISE IN DEMAND FOR CLEAN LABEL PRODUCTS

5.2 RESTRAINTS

5.2.1 STRINGENT GOVERNMENT REGULATION ON SYNTHETIC VANILLA EXTRACT

5.2.2 FLUCTUATING PRICE OF RAW MATERIALS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR SYNTHETIC VANILLA EXTRACTS

5.3.2 INCREASING LAUNCHES OF VANILLA-FLAVORED PRODUCTS

5.4 CHALLENGES

5.4.1 AVAILABILITY OF SUBSTITUTE PRODUCTS

5.4.2 DISRUPTED SUPPLY CHAIN DUE TO COVID-19

6 GLOBAL VANILLA MARKET, BY TYPE

6.1 OVERVIEW

6.2 MADAGASCAR

6.3 MEXICAN

6.4 SYNTHERIC ORIGIN

6.5 INDIA

6.6 INDONESIAN

6.7 TAHITIAN

6.8 TONGA

6.9 PAPUA NEW GUINEA

6.1 UGANDAN

6.11 OTHERS

7 GLOBAL VANILLA MARKET, BY ORIGIN

7.1 OVERVIEW

7.2 SYNTHETIC

7.3 NATURAL

8 GLOBAL VANILLA MARKET, BY GRADE

8.1 OVERVIEW

8.2 GRADE A

8.3 GRADE B

8.4 OTHERS

9 GLOBAL VANILLA MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 POWDER

9.4 PASTE

10 GLOBAL VANILLA MARKET, BY END USER

10.1 OVERVIEW

10.2 FOOD

10.3 BEVERAGES

10.4 PERSONAL CARE PRODUCTS

10.5 PHARMACEUTICAL INDUSTRY

10.6 HOUSEHOLDS/ HOME COOKING

10.7 OTHERS

11 GLOBAL MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 B2B

11.3 B2C

12 GLOBAL VANILLA MARKET, BY REGION

12.1 ASIA-PACIFIC

12.2 EUROPE

12.3 SOUTH AMERICA

12.4 NORTH AMERICA

12.5 MIDDLE EAST AND AFRICA:

13 GLOBAL VANILLA MARKET: COMPANY LANDSCAPE (B2B)

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 GLOBAL VANILLA MARKET: COMPANY LANDSCAPE (B2C)

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MCCORMICK & COMPANY, INC.

16.1.1 COMPANY SANPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 IFFINC

16.2.1 COMPANY SANPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 KERRY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 GIVAUDAN

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 ADM

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 APEX FLAVORS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AUST & HACHMANN (CANADA) LTD/LTÉE

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 BOSTON VANILLA BEAN COMPANY

16.8.1 COMPANY SNAPSHOT

16.8.2 COMPANY SHARE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 DAINTREE VANILLA & SPICE

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DR. OETKER

16.10.1 COMPANY SANPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 FIRMENICH SA

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 HEILALA VANILLA US

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 LEMUR INTERNATIONAL, INC

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 LOCHHEAD MANUFACTURING COMPANY

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 MADAGASCAR VANILLA COMPANY LLC

16.15.1 COMPANY SNAPSHOT

16.15.2 COMPANY SHARE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 MANE KANCOR

16.16.1 COMPANY SANPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 NATIVE VANILLA

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 NIELSEN-MASSEY VANILLAS, INC.

16.18.1 COMPANY SANPSHOT

16.18.2 COMPANY SHARE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 PROVA

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 PURE-VANILLA-MG.COM

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SAMBIRANO AROMATIC

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SHANK'S EXTRACTS, INC.

16.22.1 COMPANY SANPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 SYMRISE

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 SYNERGY

16.24.1 COMPANY SANPSHOT

16.25 TAKASAGO INTERNATIONAL CORPORATION

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 THARAKAN AND COMPANY

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 VANILLAPURA

16.27.1 COMPANY SNAPSHOT

16.27.2 COMPANY SHARE ANALYSIS

16.27.3 PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENT

16.28 VENUI VANILLA

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 VIRGINIA DARE.

16.29.1 COMPANY SANPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENTS

16.3 VNLLA EXTRACT CO.

16.30.1 COMPANY SANPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des figures

FIGURE 1 GLOBAL VANILLA (B2B) MARKET: SEGMENTATION

FIGURE 2 GLOBAL VANILLA (B2C) MARKET: SEGMENTATION

FIGURE 3 GLOBAL VANILLA (B2B) MARKET: DATA TRIANGULATION

FIGURE 4 GLOBAL VANILLA (B2C) MARKET: DATA TRIANGULATION

FIGURE 5 GLOBAL VANILLA MARKET: DROC ANALYSIS

FIGURE 6 GLOBAL VANILLA (B2B) MARKET : GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 7 GLOBAL VANILLA (B2C) MARKET : GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 8 GLOBAL VANILLA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 9 GLOBAL VANILLA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 GLOBAL VANILLA MARKET: DBMR MARKET POSITION GRID

FIGURE 11 GLOBAL VANILLA (B2B) MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 GLOBAL VANILLA (B2C) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL VANILLA MARKET: MARKET END USER COVERAGE GRID

FIGURE 14 GLOBAL VANILLA MARKET: SEGMENTATION

FIGURE 15 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL VANILLA (B2B) MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029.

FIGURE 16 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL VANILLA (B2C) MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029.

FIGURE 17 GROWING DEMAND FOR VANILLA ((B2B) IN FOOD & BEVERAGE INDUSTRY IS EXPECTED TO DRIVE THE MARKET GROWTH

FIGURE 18 GROWING DEMAND FOR VANILLA (B2C) IN FOOD & BEVERAGE INDUSTRY IS EXPECTED TO DRIVE THE MARKET GROWTH

FIGURE 19 MADAGASCAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL VANILLA (B2B) MARKET IN 2022 & 2029

FIGURE 20 MADAGASCAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL VANILLA (B2C) MARKET IN 2022 & 2029

FIGURE 21 NORTH AMERICA IS THE FASTEST GROWING MARKET FOR VANILLA (B2B) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029.

FIGURE 22 NORTH AMERICA IS THE FASTEST GROWING MARKET FOR VANILLA (B2C) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029.

FIGURE 23 SUPPLY CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GLOBAL VANILLA MARKET

FIGURE 26 GLOBAL VANILLA (B2B) MARKET, BY TYPE

FIGURE 27 GLOBAL VANILLA (B2C) MARKET, BY TYPE

FIGURE 28 GLOBAL VANILLA (B2B) MARKET, BY ORIGIN

FIGURE 29 GLOBAL VANILLA (B2C) MARKET, BY ORIGIN

FIGURE 30 GLOBAL VANILLA (B2B) MARKET, BY GRADE

FIGURE 31 GLOBAL VANILLA (B2C) MARKET, BY GRADE

FIGURE 32 GLOBAL VANILLA (B2B) MARKET, BY FORM

FIGURE 33 GLOBAL VANILLA (B2C) MARKET, BY FORM

FIGURE 34 GLOBAL VANILLA MARKET, BY END-USER

FIGURE 35 GLOBAL VANILLA (B2B) MARKET, BY DISTIBUTION CHANNEL

FIGURE 36 GLOBAL VANILLA (B2C) MARKET, BY DISTIBUTION CHANNEL

FIGURE 37 GLOBAL VANILLA (B2B) MARKET: SNAPSHOT (2021)

FIGURE 38 GLOBAL VANILLA (B2C) MARKET: SNAPSHOT (2021)

FIGURE 39 GLOBAL VANILLA (B2B) MARKET: BY REGION (2021)

FIGURE 40 GLOBAL VANILLA (B2C) MARKET: BY REGION (2021)

FIGURE 41 GLOBAL VANILLA (B2B) MARKET: BY REGION (2022 & 2029)

FIGURE 42 GLOBAL VANILLA (B2C) MARKET: BY REGION (2022 & 2029)

FIGURE 43 GLOBAL VANILLA (B2B) MARKET: BY REGION (2021 & 2029)

FIGURE 44 GLOBAL VANILLA (B2C) MARKET: BY REGION (2021 & 2029)

FIGURE 45 GLOBAL VANILLA (B2B) MARKET: BY TYPE (2021 & 2029)

FIGURE 46 GLOBAL VANILLA (B2C) MARKET: BY TYPE (2021 & 2029)

FIGURE 47 ASIA- PACIFIC VANILLA (B2B) MARKET: SNAPSHOT (2021)

FIGURE 48 ASIA- PACIFIC VANILLA (B2C) MARKET: SNAPSHOT (2021)

FIGURE 49 ASIA- PACIFIC VANILLA (B2B) MARKET: BY COUNTRY (2021)

FIGURE 50 ASIA- PACIFIC VANILLA (B2C) MARKET: BY COUNTRY (2021)

FIGURE 51 ASIA- PACIFIC VANILLA (B2B) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 52 ASIA- PACIFIC VANILLA (B2C) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 53 ASIA- PACIFIC VANILLA (B2B) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 54 ASIA- PACIFIC VANILLA (B2C) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 55 ASIA- PACIFIC VANILLA (B2B) MARKET: BY TYPE (2022 & 2029)

FIGURE 56 ASIA- PACIFIC VANILLA (B2C) MARKET: BY TYPE (2022 & 2029)

FIGURE 57 EUROPE VANILLA (B2B) MARKET: SNAPSHOT (2021)

FIGURE 58 EUROPE VANILLA (B2C) MARKET: SNAPSHOT (2021)

FIGURE 59 EUROPE VANILLA (B2B) MARKET: BY COUNTRY (2021)

FIGURE 60 EUROPE VANILLA (B2C) MARKET: BY COUNTRY (2021)

FIGURE 61 EUROPE VANILLA (B2B) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 62 EUROPE VANILLA (B2C) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 63 EUROPE VANILLA (B2B) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 64 EUROPE VANILLA (B2C) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 65 EUROPE VANILLA (B2B) MARKET: BY TYPE (2022 & 2029)

FIGURE 66 EUROPE VANILLA (B2C) MARKET: BY TYPE (2022 & 2029)

FIGURE 67 SOUTH AMERICA VANILLA (B2B) MARKET: SNAPSHOT (2021)

FIGURE 68 SOUTH AMERICA VANILLA (B2C) MARKET: SNAPSHOT (2021)

FIGURE 69 SOUTH AMERICA VANILLA (B2B) MARKET: BY COUNTRY (2021)

FIGURE 70 SOUTH AMERICA VANILLA (B2C) MARKET: BY COUNTRY (2021)

FIGURE 71 SOUTH AMERICA VANILLA (B2B) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 72 SOUTH AMERICA VANILLA (B2C) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 73 SOUTH AMERICA VANILLA (B2B) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 74 SOUTH AMERICA VANILLA (B2C) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 75 SOUTH AMERICA VANILLA (B2B) MARKET: BY TYPE (2021 & 2029)

FIGURE 76 SOUTH AMERICA VANILLA (B2C) MARKET: BY TYPE (2021 & 2029)

FIGURE 77 NORTH AMERICA VANILLA (B2B) MARKET: SNAPSHOT (2021)

FIGURE 78 NORTH AMERICA VANILLA (B2C) MARKET: SNAPSHOT (2021)

FIGURE 79 NORTH AMERICA VANILLA (B2B) MARKET: BY COUNTRY (2021)

FIGURE 80 NORTH AMERICA VANILLA (B2C) MARKET: BY COUNTRY (2021)

FIGURE 81 NORTH AMERICA VANILLA (B2B) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 82 NORTH AMERICA VANILLA (B2C) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 83 NORTH AMERICA VANILLA (B2B) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 84 NORTH AMERICA VANILLA (B2C) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 85 NORTH AMERICA VANILLA (B2B) MARKET: BY TYPE (2022 & 2029)

FIGURE 86 NORTH AMERICA VANILLA (B2C) MARKET: BY TYPE (2022 & 2029)

FIGURE 87 MIDDLE EAST & AFRICA VANILLA (B2B) MARKET: SNAPSHOT (2021)

FIGURE 88 MIDDLE EAST & AFRICA VANILLA (B2C) MARKET: SNAPSHOT (2021)

FIGURE 89 MIDDLE EAST & AFRICA VANILLA (B2B) MARKET: BY COUNTRY (2021)

FIGURE 90 MIDDLE EAST & AFRICA VANILLA (B2C) MARKET: BY COUNTRY (2021)

FIGURE 91 MIDDLE EAST & AFRICA VANILLA (B2B) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 92 MIDDLE EAST & AFRICA VANILLA (B2C) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 93 MIDDLE EAST & AFRICA VANILLA (B2B) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 94 MIDDLE EAST & AFRICA VANILLA (B2C) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 95 MIDDLE EAST & AFRICA VANILLA (B2B) MARKET: BY TYPE (2022 & 2029)

FIGURE 96 MIDDLE EAST & AFRICA VANILLA (B2C) MARKET: BY TYPE (2022 & 2029)

FIGURE 97 GLOBAL VANILLA MARKET (B2B): COMPANY SHARE 2021 (%)

FIGURE 98 NORTH AMERICA VANILLA MARKET (B2B): COMPANY SHARE 2021 (%)

FIGURE 99 EUROPE VANILLA MARKET (B2B): COMPANY SHARE 2021 (%)

FIGURE 100 ASIA-PACIFIC VANILLA MARKET (B2B): COMPANY SHARE 2021 (%)

FIGURE 101 GLOBAL VANILLA MARKET (B2C): COMPANY SHARE 2021 (%)

FIGURE 102 NORTH AMERICA VANILLA MARKET (B2C): COMPANY SHARE 2021 (%)

FIGURE 103 EUROPE VANILLA MARKET (B2C): COMPANY SHARE 2021 (%)

FIGURE 104 ASIA-PACIFIC VANILLA MARKET (B2C): COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.