Global Superalloys Market

Taille du marché en milliards USD

TCAC :

%

USD

8.00 Billion

USD

13.75 Billion

2024

2032

USD

8.00 Billion

USD

13.75 Billion

2024

2032

| 2025 –2032 | |

| USD 8.00 Billion | |

| USD 13.75 Billion | |

|

|

|

|

Segmentation du marché mondial des superalliages, par type de produit (superalliages à base de nickel, superalliages à base de cobalt et superalliages à base de fer) et application (aérospatiale et défense, turbines à gaz industrielles, automobile, pétrole et gaz, énergie, industrie maritime, industrie de transformation chimique, réacteurs nucléaires, électricité et électronique, et autres) – Tendances et prévisions de l'industrie jusqu'en 2032.

Taille du marché des superalliages

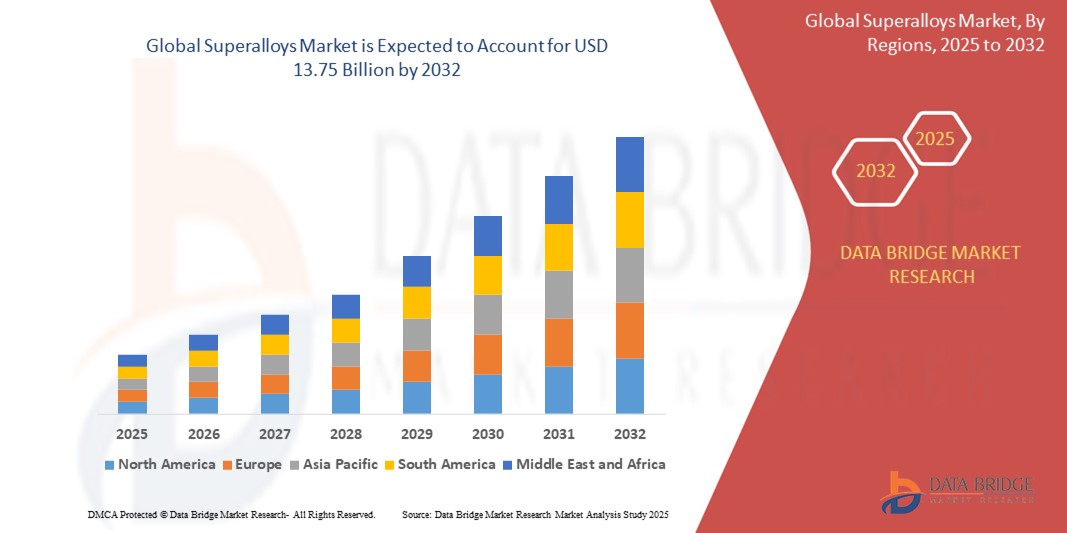

- La taille du marché mondial des superalliages était évaluée à 8,00 milliards USD en 2024 et devrait atteindre 13,75 milliards USD d'ici 2032 , à un TCAC de 7,00 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par la demande croissante de matériaux haute performance dans des environnements à haute température et corrosifs, en particulier dans les secteurs de l'aérospatiale, de la défense et de l'énergie, alimentée par les progrès des technologies de fabrication et les applications industrielles croissantes.

- L'augmentation des investissements dans les infrastructures aérospatiales et énergétiques, associée au besoin de matériaux légers, durables et résistants à la chaleur, sont des facteurs clés qui accélèrent l'adoption des superalliages, stimulant considérablement la croissance de l'industrie.

Analyse du marché des superalliages

- Les superalliages, des alliages hautes performances conçus pour résister aux températures extrêmes, à la corrosion et aux contraintes mécaniques, sont des composants essentiels dans des industries telles que l'aérospatiale, l'énergie et l'automobile en raison de leur résistance supérieure, de leur résistance à l'oxydation et de leur durabilité.

- La demande croissante de superalliages est motivée par l'expansion du secteur de l'aérospatiale et de la défense, la demande croissante en énergie et le besoin de matériaux efficaces et performants dans les turbines à gaz industrielles et les applications automobiles.

- L'Amérique du Nord a dominé le marché des superalliages avec la plus grande part de revenus de 42,5 % en 2024, grâce à une industrie aérospatiale et de défense solide, des capacités de fabrication avancées et d'importants investissements en R&D.

- L'Asie-Pacifique devrait être la région connaissant la croissance la plus rapide au cours de la période de prévision en raison de l'industrialisation rapide, de la demande croissante en énergie et de la croissance de la fabrication aérospatiale dans des pays comme la Chine et l'Inde.

- Le segment des superalliages à base de nickel a dominé le marché avec une part de chiffre d'affaires de 66,88 % en 2024, grâce à leur résistance supérieure aux hautes températures, à la corrosion et à leurs propriétés mécaniques, ce qui les rend idéaux pour les applications exigeantes telles que les moteurs aérospatiaux et les turbines à gaz industrielles.

Portée du rapport et segmentation du marché des superalliages

|

Attributs |

Informations clés sur le marché des superalliages |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des superalliages

« Intégration croissante de la fabrication additive et des techniques de traitement avancées »

- Le marché mondial des superalliages connaît une tendance significative vers l'intégration de la fabrication additive (impression 3D) et de techniques de traitement avancées pour améliorer l'efficacité de la production et les performances des matériaux.

- Ces technologies permettent la création de composants complexes en superalliage avec des déchets de matériaux réduits, des coûts de production inférieurs et des délais de livraison plus courts par rapport aux méthodes de fabrication traditionnelles.

- Par exemple, des innovations telles que le développement du superalliage à base de nickel ABD-900AM pour l'impression 3D sans fissures permettent la production directe de pièces complexes pour les turbines à gaz aérospatiales et industrielles.

- La fabrication additive permet un contrôle précis de la microstructure de l'alliage, améliorant ainsi les propriétés mécaniques telles que la résistance à haute température et la résistance à la corrosion.

- Cette tendance accroît l’attrait des superalliages pour les fabricants des secteurs de l’aérospatiale, de l’automobile et de la production d’énergie, car elle favorise la production de composants légers et performants.

- Les techniques de traitement avancées, telles que la fusion par induction sous vide et la métallurgie des poudres, optimisent davantage la durabilité et les performances des superalliages, élargissant leurs applications dans diverses industries.

Dynamique du marché des superalliages

Conducteur

« Demande croissante de matériaux haute performance dans les secteurs de l'aérospatiale et de l'énergie »

- La demande croissante de matériaux hautes performances capables de résister à des températures extrêmes, à des contraintes mécaniques et à des environnements corrosifs est un moteur majeur du marché mondial des superalliages.

- Les superalliages, en particulier à base de nickel, sont essentiels dans les applications aérospatiales pour des composants tels que les aubes de turbine, les moteurs à réaction et les chambres de combustion, en raison du besoin d'avions économes en carburant et durables.

- Les investissements gouvernementaux dans la modernisation de la défense et l’expansion de l’aviation commerciale, en particulier en Amérique du Nord, stimulent l’adoption des superalliages

- La prolifération des énergies renouvelables et de la production d'électricité à partir du gaz naturel stimule la demande de superalliages dans les turbines à gaz industrielles et les réacteurs nucléaires, où la résistance aux hautes températures et l'intégrité structurelle sont essentielles.

- Les constructeurs automobiles utilisent de plus en plus de superalliages dans les véhicules hautes performances et électriques pour améliorer l'efficacité et la durabilité des moteurs, alimentant ainsi davantage la croissance du marché.

- Le développement de la technologie 5G et de l'IoT permet la surveillance et l'optimisation en temps réel des composants à base de superalliages, améliorant ainsi leur valeur dans les applications industrielles intelligentes

Retenue/Défi

« Coûts de production élevés et volatilité de la chaîne d'approvisionnement »

- Le coût élevé des matières premières, telles que le nickel, le cobalt et le titane, combiné à des procédés de fabrication complexes tels que la refusion à l'arc sous vide et le moulage à la cire perdue, constitue un obstacle important à l'adoption généralisée des superalliages, en particulier sur les marchés sensibles aux coûts.

- L'intégration de superalliages dans des conceptions existantes ou leur adaptation à des systèmes plus anciens peut s'avérer techniquement difficile et coûteuse, limitant leur utilisation dans certaines applications.

- Les perturbations de la chaîne d'approvisionnement, provoquées par les tensions géopolitiques et les fluctuations de la disponibilité des matières premières, créent de l'incertitude sur le marché des superalliages, impactant les délais et les coûts de production.

- Les préoccupations environnementales et les pressions réglementaires liées à l'extraction et au traitement des matières premières, telles que le cobalt, poussent les fabricants à adopter des pratiques durables, ce qui peut encore augmenter les coûts de production.

- Ces facteurs peuvent décourager l’adoption dans les marchés émergents ou les secteurs disposant de budgets plus faibles, ce qui pourrait ralentir l’expansion du marché dans les régions situées en dehors de l’Amérique du Nord et de l’Asie-Pacifique.

Portée du marché des superalliages

Le marché est segmenté en fonction du type de produit et de l’application.

- Par type de produit

En fonction du type de produit, le marché mondial des superalliages est segmenté en superalliages à base de nickel, superalliages à base de cobalt et superalliages à base de fer. Le segment des superalliages à base de nickel a dominé le marché avec une part de chiffre d'affaires de 66,88 % en 2024, grâce à leur résistance supérieure aux températures élevées, à la corrosion et à leurs propriétés mécaniques, ce qui les rend idéaux pour des applications exigeantes telles que les moteurs aéronautiques et les turbines à gaz industrielles. Leur utilisation intensive dans les aubes de turbine, les chambres de combustion et autres composants critiques renforce encore leur domination sur le marché.

Le segment des superalliages à base de cobalt devrait connaître le taux de croissance le plus rapide de 8,9 % entre 2025 et 2032. Cette croissance est alimentée par leur excellente résistance à la sulfuration et leur haute résistance, en particulier dans les applications de niche de l'aérospatiale, des turbines à gaz et des centrales électriques, où la fiabilité et la longévité des matériaux sont essentielles.

- Par application

En fonction des applications, le marché mondial des superalliages est segmenté entre l'aérospatiale et la défense, les turbines à gaz industrielles, l'automobile, le pétrole et le gaz, l'énergie, l'industrie maritime, l'industrie de transformation chimique, les réacteurs nucléaires, l'électricité et l'électronique, entre autres. En 2024, le segment aérospatial et défense détenait la plus grande part de chiffre d'affaires, soit 38,99 %, grâce à la demande croissante de matériaux hautes performances et durables pour les moteurs d'avion, les aubes de turbine et les composants structurels. La recherche d'avions légers et économes en carburant, conjuguée à la hausse des budgets de défense à l'échelle mondiale, soutient la domination de ce segment.

Le segment des turbines à gaz industrielles devrait connaître le taux de croissance le plus rapide, soit 9,2 %, entre 2025 et 2032. Cette croissance est propulsée par la demande croissante de systèmes de production d'électricité économes en énergie et par l'expansion des infrastructures d'énergie renouvelable, telles que les centrales éoliennes et solaires concentrées, qui s'appuient sur des superalliages pour des composants tels que les aubes de turbine et les échangeurs de chaleur qui subissent des contraintes thermiques extrêmes.

Analyse régionale du marché des superalliages

- L'Amérique du Nord a dominé le marché des superalliages avec la plus grande part de revenus de 42,5 % en 2024, grâce à une industrie aérospatiale et de défense solide, des capacités de fabrication avancées et d'importants investissements en R&D.

- Les consommateurs et les industries privilégient les superalliages pour leur résistance exceptionnelle à la chaleur, leur résistance mécanique et leur résistance à la corrosion, en particulier dans les applications nécessitant une durabilité à haute température.

- La croissance est soutenue par les progrès de la technologie des alliages, notamment la fabrication additive et les compositions légères, ainsi que par l'adoption croissante dans les segments OEM et du marché secondaire dans les secteurs de l'aérospatiale, de l'énergie et de l'automobile.

Aperçu du marché américain des superalliages

En 2024, le marché américain des superalliages a représenté la plus grande part de chiffre d'affaires en Amérique du Nord, avec 81,7 %, grâce à la forte demande des secteurs de l'aérospatiale et de la défense et à la prise de conscience croissante des avantages des superalliages pour les applications à haute température. La tendance vers des avions légers et économes en carburant, ainsi que le renforcement des réglementations favorisant les normes de matériaux avancés, stimulent l'expansion du marché. L'intégration croissante des superalliages dans les composants critiques des constructeurs automobiles et aérospatiaux complète les ventes du marché secondaire, créant ainsi un écosystème de produits diversifié.

Aperçu du marché européen des superalliages

Le marché européen des superalliages devrait connaître une croissance significative, soutenue par l'accent réglementaire mis sur l'efficacité énergétique et la sécurité dans les applications aéronautiques et automobiles. Les consommateurs et les industries recherchent des superalliages qui améliorent les performances dans des conditions extrêmes tout en offrant une durabilité accrue. Cette croissance est marquée tant dans les nouvelles installations que dans les projets de modernisation, des pays comme l'Allemagne et la France affichant un fort taux d'adoption en raison des préoccupations environnementales croissantes et des avancées industrielles.

Aperçu du marché britannique des superalliages

Le marché britannique des superalliages devrait connaître une croissance rapide, portée par la demande de matériaux hautes performances pour l'aéronautique et les turbines à gaz industrielles en milieu urbain et industriel. L'intérêt croissant pour les composants légers et durables et la sensibilisation croissante aux avantages de la résistance à la corrosion encouragent leur adoption. L'évolution des réglementations sur les émissions et les normes relatives aux matériaux influence les choix de l'industrie, équilibrant performance et conformité.

Aperçu du marché allemand des superalliages

L'Allemagne devrait connaître une croissance rapide du marché des superalliages, grâce à son secteur aéronautique et automobile de pointe et à l'importance accordée par l'industrie à l'efficacité énergétique et à la durabilité. Les industries allemandes privilégient les superalliages technologiquement avancés, résistants aux températures élevées et contribuant à une consommation de carburant réduite. L'intégration de ces alliages dans les véhicules haut de gamme, les avions et les pièces de rechange soutient une croissance soutenue du marché.

Aperçu du marché des superalliages en Asie-Pacifique

La région Asie-Pacifique devrait connaître la croissance la plus rapide, portée par l'essor de la production aéronautique et automobile et par la hausse des investissements dans les infrastructures énergétiques dans des pays comme la Chine, l'Inde et le Japon. La sensibilisation croissante à la résistance à la chaleur, à la protection contre la corrosion et à la résistance mécanique des superalliages stimule la demande. Les initiatives gouvernementales en faveur de l'efficacité énergétique et de la sécurité industrielle encouragent également l'utilisation de superalliages avancés.

Aperçu du marché japonais des superalliages

Le marché japonais des superalliages devrait connaître une croissance rapide grâce à la forte préférence de l'industrie pour les superalliages de haute qualité et à la pointe de la technologie, qui améliorent les performances et la sécurité dans l'aéronautique et la production d'énergie. La présence de grands constructeurs aéronautiques et automobiles et l'intégration des superalliages dans les composants OEM accélèrent la pénétration du marché. L'intérêt croissant pour les applications de rechange contribue également à cette croissance.

Aperçu du marché chinois des superalliages

La Chine détient la plus grande part du marché des superalliages en Asie-Pacifique, portée par une industrialisation rapide, l'essor de la production aéronautique et automobile, et une demande croissante en matériaux hautes performances. La croissance de son tissu industriel et l'importance accordée à la fabrication de pointe favorisent l'adoption des superalliages. De solides capacités de production nationales et des prix compétitifs facilitent l'accès au marché.

Part de marché des superalliages

L’industrie des superalliages est principalement dirigée par des entreprises bien établies, notamment :

- Special Melted Products Ltd. (Royaume-Uni)

- Proterial, Ltd. (Japon)

- Precision Castparts Corp. (États-Unis)

- BAOTI Group Co., Ltd (Chine)

- Sandvik Coromant US (États-Unis)

- Rolled Alloys Inc. (États-Unis)

- VDM Metals (Allemagne)

- Doncasters Group (Royaume-Uni)

- Fushun Special Steel Co., Ltd. (Chine)

- Alcoa Corporation (États-Unis)

- Outokumpu (Finlande)

- ATI (États-Unis)

- CRS Holdings, LLC. (États-Unis)

- HAYNES INTERNATIONAL (États-Unis)

- AMG ALUMINIUM (États-Unis)

- IBC Advanced Alloys (États-Unis)

- Eramet (France)

- Mishra Dhatu Nigam Limited (Inde)

- Aperam (Luxembourg)

Quels sont les développements récents sur le marché mondial des superalliages ?

- En novembre 2024, Acerinox a finalisé l'acquisition de Haynes International, leader américain des alliages hautes performances. Cette opération stratégique renforce la présence d'Acerinox sur le marché américain et renforce considérablement ses capacités dans le secteur aéronautique. L'intégration de Haynes, aux côtés de VDM Metals, donne naissance à la nouvelle division Alliages Hautes Performances (HPA) d'Acerinox, s'inscrivant ainsi dans l'objectif de l'entreprise d'élargir son portefeuille de produits et sa présence mondiale. Acerinox prévoit de construire sur quatre ans, principalement au sein des activités de Haynes à Kokomo, une plateforme unifiée pour l'acier inoxydable et les alliages. Cette acquisition reflète une tendance plus générale du secteur vers la consolidation et la spécialisation dans les matériaux avancés.

- En novembre 2024, EOS a élargi sa gamme de matériaux pour la fabrication additive avec les poudres EOS IN738 et EOS K500 à base de nickel. Ces deux poudres de superalliages à base de nickel ont été ajoutées à ses machines de fabrication additive par fusion laser sur lit de poudre (PBF-LB). Leur commercialisation est prévue pour les machines EOS M 290 dès décembre 2024 et pour les machines EOS M 400-4 au premier semestre 2025. Ce lancement de produit souligne l'intégration croissante des superalliages dans les technologies de fabrication additive.

- En juin 2024, Aubert & Duval et Alloyed Ltd. ont lancé le superalliage de nickel haute température ABD-1000AM. Ce nouveau superalliage à base de nickel est spécialement conçu pour la fabrication additive métallique (FA). Il présente une résistance environnementale et une résistance aux températures élevées exceptionnelles, ce qui le rend idéal pour les conditions extrêmes propres à cette technique de fabrication avancée. Ce lancement marque une avancée majeure dans le domaine des superalliages de nickel haute température adaptés à la FA.

- En septembre 2023, ATI (Allegheny Technologies Incorporated) a remporté un contrat auprès de Bechtel Plant Machinery Inc. (BPMI) pour soutenir le développement de solutions de pièces de haute technicité destinées au programme de propulsion nucléaire de la marine américaine. Dans le cadre de cette initiative, ATI a annoncé son projet de construction d'une usine de fabrication additive dédiée près de Fort Lauderdale, en Floride, équipée de capacités d'impression 3D métal grand format, de traitement thermique, d'usinage et d'inspection. Cette usine est conçue pour accélérer la construction navale, améliorer la disponibilité opérationnelle et optimiser les performances des applications de défense critiques, ce qui témoigne d'un investissement majeur dans les technologies de fabrication avancées pour les secteurs de la sécurité nationale et de l'aérospatiale.

- En juillet 2023, Doncasters et Safran Aircraft Engines ont renouvelé et étendu leur partenariat de longue date pour soutenir les plateformes de moteurs LEAP-1A et LEAP-1B. Cet accord porte sur la fourniture de pièces moulées structurelles en superalliages de grandes dimensions et de pièces moulées pour flux d'air chaud, essentielles aux applications aéronautiques hautes performances. Cette collaboration témoigne du renforcement de la relation entre les deux entreprises et s'appuie sur les investissements continus de Doncasters pour accroître sa capacité de production. Elle illustre également une tendance plus large du secteur vers des alliances stratégiques visant à garantir un approvisionnement fiable en composants pour les grands programmes aéronautiques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.