Marché mondial des produits de rotomoulage, par produit ( polycarbonate , polyéthylène, polyuréthane, PVC, nylon, polypropylène et autres), usinage (machine à clapet, machine à navette, machine verticale ou rotative, machine à carrousel, machine à bras oscillant et autres), application (emballage, agriculture, industrie, bâtiment et construction, biens de consommation, automobile, meubles, marine et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des produits de rotomoulage

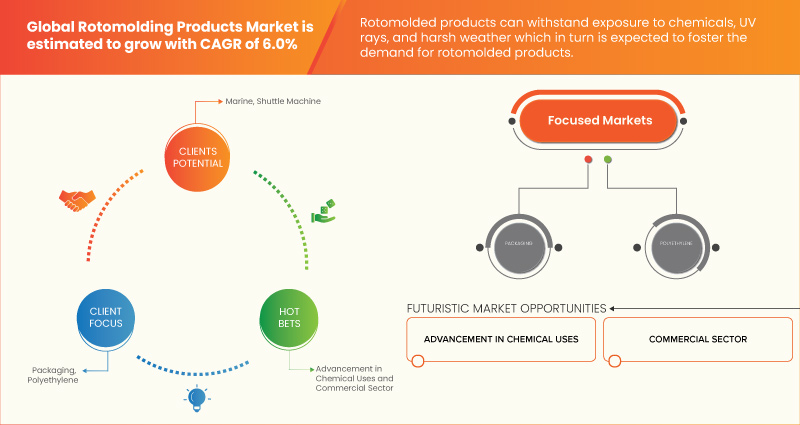

Le marché mondial des produits de rotomoulage est stimulé par la popularité croissante des sports d'athlétisme et nautiques. En outre, l'amélioration de l'industrie de la construction navale est un moteur important pour le marché des produits de rotomoulage en Asie-Pacifique. De plus, la demande de rotomoulage augmente et les fabricants sont désormais plus concentrés et impliqués dans le lancement de nouveaux produits, les promotions, les récompenses, la certification et la participation aux événements sur le marché. Cependant, la consommation d'énergie excessive et les réglementations gouvernementales devraient constituer un défi à la croissance du marché, ce qui pourrait freiner la croissance du marché.

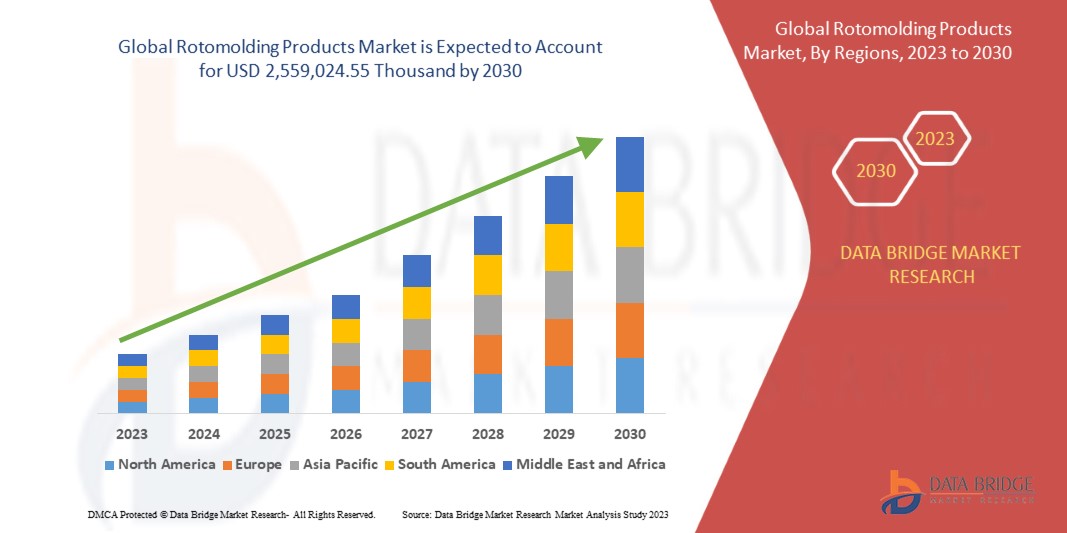

Data Bridge Market Research analyse que le marché mondial des produits de rotomoulage devrait atteindre la valeur de 2 559 024,55 milliers USD d'ici 2030, à un TCAC de 6,0 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers, volumes en unités et prix en USD |

|

Segments couverts |

Produit (polycarbonate, polyéthylène, polyuréthane, PVC, nylon, polypropylène et autres), usinage (machine à coquille, machine à navette, machine verticale ou rotative, machine à carrousel, machine à bras pivotant et autres), application (emballage, agriculture, industrie, bâtiment et construction, biens de consommation, automobile, meubles, marine et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, Russie, France, Italie, Royaume-Uni, Espagne, Pays-Bas, Suisse, Portugal, Belgique et reste de l'Europe, Chine, Inde, Inde, Japon, Corée du Sud, Indonésie, Thaïlande, Singapour, Australie, Philippines, Malaisie et reste de l'Asie-Pacifique, Arabie saoudite, Égypte, Émirats arabes unis, Afrique du Sud, Israël et reste du Moyen-Orient et de l'Afrique, Brésil, Argentine, reste de l'Amérique du Sud |

|

Acteurs du marché couverts |

Rotoplast SAS, KK Nag Pvt. Ltd, FIBERTECH PLASTICS, Top Rotomolding Technology Co., Ltd., Yantai Fangda Rotational Molding Co., Ltd, Rotovia, Carris Pipes & Tubes Private Limited, Starplast Srl, PartnerPlast, ROTOMADE, Comos Corporation Co., Ltd, Rototek Limited, Tank Holding Corp., Sherman Roto Tank, Dutchland Plastics, Ocean Plastic Intertrade Co., Ltd., Ningbo Fly Plastic Co., Ltd., Changzhou Treering Plastics Co., ltd, et Myers Industries, entre autres |

Définition du marché

Le rotomoulage est un procédé de production permettant de former des pièces creuses de taille illimitée. Il s'agit d'une méthode rentable pour produire de grandes pièces en plastique. Les résines sont ajoutées dans un moule qui est chauffé et tourné lentement, à la fois verticalement et horizontalement. Le chauffage et la rotation simultanés répartissent et fusionnent la résine sur les surfaces intérieures du moule. Le résultat est un produit qui contient des pièces sans soudure avec une épaisseur de paroi uniforme et plus de matière dans les coins pour absorber les chocs et les contraintes là où ils se produisent le plus.

Dynamique du marché mondial des produits de rotomoulage

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs :

- Acceptation croissante des produits rotomoulés tels que les conteneurs et les palettes dans les applications de manutention et d'emballage

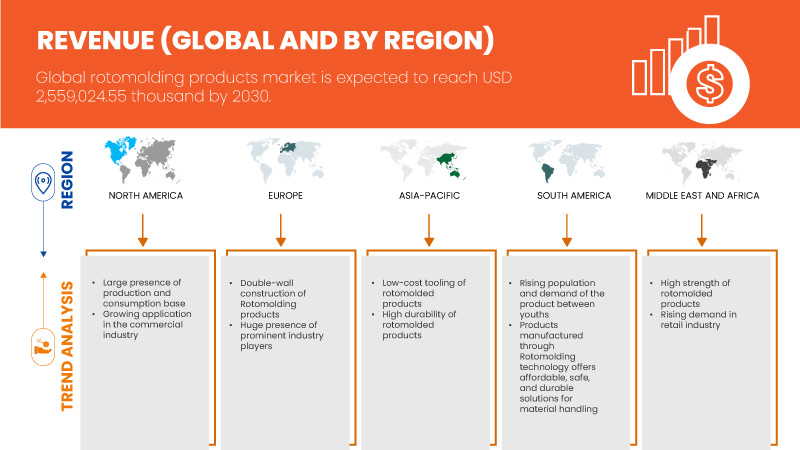

La manutention et l'emballage des matériaux font partie des cinq rôles logistiques interconnectés qui contribuent de manière significative à la logistique. Le transport, le stockage, le contrôle et la protection des matériaux, des produits et des articles emballés pendant les processus de fabrication, de distribution et d'élimination font tous partie de la manutention des matériaux. L'emballage joue un rôle crucial dans l'encapsulation des matériaux et des marchandises pour la distribution et le transport. Ils sont importants pour améliorer le service client, minimiser les coûts et réduire les risques d'accidents et de dommages. Les produits fabriqués grâce à la technologie du rotomoulage offrent des solutions abordables, sûres et durables pour les applications de manutention et d'emballage des matériaux dans diverses industries. Ils ont également une capacité de charge élevée en raison de leur conception monobloc sans soudure. Les composants moulés par rotation sont également une meilleure alternative aux pièces en acier conventionnelles. Le moulage par rotation est le processus idéal pour produire des pièces et des composants qui peuvent être utilisés pour collecter, stocker ou déplacer presque n'importe quelle substance en raison de son poids plus faible, de sa résistance améliorée à la corrosion et de sa fabrication sans joint.

- Perspectives positives pour le secteur de la construction

Le secteur de la construction est associé à la construction, à la réparation, à la rénovation et à l'entretien des infrastructures. L'industrie de la construction contribue au développement socioéconomique et à la croissance économique du pays. L'industrie de la construction génère de l'activité et de l'emploi dans d'autres secteurs de l'économie tels que la fabrication, la logistique, le commerce et les services financiers. La croissance démographique, l'urbanisation croissante, le marché du logement et le développement des infrastructures sont les principaux moteurs de l'industrie de la construction.

Le secteur de la construction a le potentiel de devenir un moteur majeur de l'expansion des produits rotomoulés. Les produits rotomoulés ont une large gamme d'applications dans les projets de construction de bâtiments tels que les réservoirs de stockage d'eau et les fosses septiques, entre autres. De plus, des produits tels que les barricades et les cônes de signalisation utilisés dans la construction de routes et d'autoroutes sont également fabriqués grâce à la technologie du rotomoulage. Ces produits sont durables, résistants à la corrosion et nécessitent peu d'entretien, ce qui les rend idéaux pour les applications d'infrastructure. De plus, en raison du poids léger des produits tels que les barricades et les cônes de signalisation, ils sont faciles à transporter, ce qui entraîne une réduction des coûts de carburant pour l'utilisateur final. En outre, ils sont faciles à transporter et à déplacer par rapport à d'autres produits fabriqués à partir de matériaux tels que le métal. L'accent croissant mis sur le développement d'infrastructures efficaces et durables contribue à la croissance des applications des produits rotomoulés dans le secteur de la construction.

RESTRICTIONS/DÉFIS

- Restriction concernant le traitement d'autres matériaux, à savoir les métaux et les céramiques

La technologie de rotomoulage est utilisée pour traiter des matériaux polymères thermoplastiques tels que le polyéthylène et le polypropylène. De plus, la matière première utilisée dans la formation des produits rotomoulés peut être facilement convertie de granulés en poudre fine et doit avoir une stabilité thermique élevée. Cela limite le choix des matériaux aux seules résines à base de poly dans la formation des produits rotomoulés. L'exigence de stabilité thermique élevée entraîne le coût élevé des matières premières et le coût du broyage du matériau en poudre.

Bien que le rotomoulage offre divers avantages lors de la transformation de produits à base de plastique, il est toutefois confronté à des contraintes lors du traitement d'autres matériaux tels que les métaux et la céramique. Ces derniers ont des points de fusion élevés par rapport aux polymères, ce qui présente un inconvénient car le métal et la céramique nécessitent des températures élevées. Les céramiques et les métaux ont également une résistance structurelle et une capacité de charge élevées, ce qui est moins le cas des plastiques rotomoulés. Les métaux et les céramiques ont également une résistance à la chaleur et une conductivité thermique élevées, et sont donc utilisés dans des applications industrielles où des propriétés de résistance à la chaleur et à la chaleur sont requises. Par conséquent, l'incapacité à traiter des matériaux tels que les métaux et la céramique grâce à la technologie du rotomoulage limite la croissance du marché des produits de rotomoulage en Asie-Pacifique.

- Des règles et réglementations strictes pour le traitement des polymères

Il existe diverses règles et réglementations strictes imposées par diverses organisations gouvernementales et autorités internationales concernant les polymères utilisés dans le processus de rotomoulage. Ces règles, réglementations et normes sont élaborées pour que les industries les respectent afin de garantir la santé et la sécurité des travailleurs et des consommateurs. Voici quelques-unes des réglementations relatives aux polymères utilisés pour la production de produits de rotomoulage :

OPPORTUNITÉS

- Possibilité d'inclusion de nouvelles technologies d'impression et d'étiquetage

Au fil du temps, les nouvelles exigences des clients en matière d'étiquettes et l'évolution de la dynamique du marché influenceront le choix du type d'étiquette imprimée et les nouveaux développements technologiques en matière d'étiquettes. L'industrie de l'emballage et ses clients s'efforcent constamment de réduire le poids des emballages de produits, soit en utilisant des contenants rigides plus petits en métal, en verre ou en plastique, soit en passant à des formats en plastique souple. L'étiquetage est essentiel au processus de fabrication. Les étiquettes peuvent être utilisées pour l'identification des produits, l'étiquetage des entrepôts et le suivi des éléments tout au long de la chaîne d'approvisionnement. Les étiquettes contribuent également à accroître la satisfaction des consommateurs en fournissant des informations correctes sur un produit ou un service. Les fabricants veillent à ce que les utilisateurs finaux, tels que les clients, puissent prendre des décisions d'achat éclairées en identifiant correctement un produit ou un service à l'aide d'étiquettes.

- Améliorer l’accès aux polymères biosourcés

Les polymères biosourcés sont des polymères produits à partir de ressources durables telles que les déchets agricoles, les matières premières d'origine végétale ou les matériaux biodégradables. Ils présentent de nombreux avantages environnementaux, notamment une faible utilisation de combustibles fossiles, une production moindre de déchets plastiques et une faible empreinte carbone. L'utilisation de ces polymères contribuera également à surmonter les réglementations mises en place par les autorités gouvernementales sur les polymères tels que le polyéthylène et le polypropylène. De plus, les consommateurs sont de plus en plus conscients des effets secondaires des plastiques, ce qui a entraîné une augmentation de la tendance des consommateurs à se tourner vers des polymères respectueux de l'environnement.

Portée du marché mondial des produits de rotomoulage

Le marché mondial des produits de rotomoulage est classé en trois segments notables, par produit, par usinage et par application. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Polyéthylène

- Polypropylène

- PVC

- Polycarbonate

- Nylon

- Polyuréthane

- Autres

Sur la base du produit, le marché est segmenté en polycarbonate, polyéthylène, élastomères, polyuréthane, PVC, nylon, polypropylène et autres.

Usinage

- Machine à coquilles

- Machine à navette

- Machine verticale ou rotative

- Machine à carrousel

- Machine à bras oscillant

- Autres

Sur la base de l'usinage, le marché est segmenté en machine à clapet, machine à navette, machine verticale ou rotative, machine à carrousel, machine à bras oscillant et autres.

Application

- Conditionnement

- Agriculture

- Industriel

- Bâtiment et construction

- Biens de consommation

- Automobile

- Meubles

- Marin

- Autres

Sur la base des applications, le marché est segmenté en emballage, agriculture, industrie, bâtiment et construction, biens de consommation, automobile, mobilier, marine et autres.

Analyse/perspectives régionales du marché mondial des produits de rotomoulage

Le marché mondial des produits de rotomoulage est analysé et des informations et tendances sur la taille du marché sont fournies par pays, produit, usinage et application comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché mondial des produits de rotomoulage sont les États-Unis, le Canada, le Mexique, l'Allemagne, la Russie, la France, l'Italie, le Royaume-Uni, l'Espagne, les Pays-Bas, la Suisse, le Portugal, la Belgique et le reste de l'Europe, la Chine, l'Inde, l'Inde, le Japon, la Corée du Sud, l'Indonésie, la Thaïlande, Singapour, l'Australie, les Philippines, la Malaisie et le reste de l'Asie-Pacifique, l'Arabie saoudite, l'Égypte, les Émirats arabes unis, l'Afrique du Sud, Israël et le reste du Moyen-Orient et de l'Afrique, le Brésil, l'Argentine, le reste de l'Amérique du Sud.

L'Asie-Pacifique devrait dominer le marché mondial des produits de rotomoulage en raison de l'adoption croissante de la technique de moulage en raison de son faible coût, car les moules n'ont pas à résister à la pression, ce qui constitue l'un des principaux facteurs de croissance du marché du rotomoulage. Cependant, l'exigence d'un temps de cycle élevé et d'une sélection limitée de matières premières devrait limiter la croissance du marché.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché mondiales des produits de rotomoulage

Le paysage concurrentiel du marché mondial des produits de rotomoulage fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que les entreprises se concentrant sur le marché mondial des produits de rotomoulage.

Français Certains des principaux acteurs opérant sur le marché mondial des produits de rotomoulage sont Rotoplast SAS, KK Nag Pvt. Ltd, FIBERTECH PLASTICS, Top Rotomolding Technology Co., Ltd., Yantai Fangda Rotational Molding Co., Ltd, Rotovia, Carris Pipes & Tubes Private Limited, Starplast Srl, PartnerPlast, ROTOMADE, Comos Corporation Co., Ltd, Rototek Limited, Tank Holding Corp., Sherman Roto Tank, Dutchland Plastics, Ocean Plastic Intertrade Co., Ltd., Ningbo Fly Plastic Co., Ltd., Changzhou Treering Plastics Co., ltd, et Myers Industries, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MANUFACTURING PROCESS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CASE STUDY: GLOBAL ROTOMOLDING PRODUCTS MARKET

4.2 GROWTH POTENTIAL FOR ROTATIONAL MOLDING IN THE INTERMEDIATE BULK CONTAINERS MARKET

4.3 TENDANCE OF OEMS INTEGRATING ROTATIONAL MOLDING IN-HOUSE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING ACCEPTANCE OF ROTOMOLDED PRODUCTS SUCH AS CONTAINERS AND PALLETS IN MATERIAL HANDLING AND PACKAGING APPLICATIONS

5.1.2 POSITIVE OUTLOOK TOWARDS THE CONSTRUCTION SECTOR

5.1.3 GROWTH IN THE POPULARITY OF ATHLETICS AND WATER SPORTS

5.1.4 IMPROVEMENT IN THE SHIPBUILDING INDUSTRY

5.1.5 FAVOURABLE ADOPTION SCENARIO IN VARIOUS SEGMENTS INCLUDING AGRICULTURE AND FOOD & BEVERAGE SEGMENTS

5.2 RESTRAINTS

5.2.1 LIMITATIONS REGARDING PROCESSING OF OTHER MATERIALS NAMELY METALS AND CERAMICS

5.2.2 SUBSTITUTIONAL THREAT FROM OTHER MOLDED MATERIALS

5.3 OPPORTUNITIES

5.3.1 POSSIBILITY OF INCLUSION OF NEW PRINTING AND LABELLING TECHNOLOGIES

5.3.2 INCREASING ACCESS TO BIO-BASED POLYMERS

5.4 CHALLENGES

5.4.1 STRINGENT RULES AND REGULATIONS AIMED AT POLYMERS PROCESSING

5.4.2 EXCESSIVE ENERGY CONSUMPTION

6 GLOBAL ROTOMOLDING PRODUCTS MARKET BY REGION

6.1 OVERVIEW

6.2 NORTH AMERICA

6.3 EUROPE

6.4 ASIA-PACIFIC

6.5 SOUTH AMERICA

6.6 MIDDLE EAST & AFRICA

7 COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: GLOBAL

7.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.3 COMPANY SHARE ANALYSIS: EUROPE

7.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

8 COMPANY PROFILE

8.1 MYERS INDUSTRIES

8.1.1 COMPANY SNAPSHOT

8.1.2 REVENUE ANALYSIS

8.1.3 COMPANY SHARE ANALYSIS

8.1.4 PRODUCT PORTFOLIO

8.1.5 RECENT DEVELOPMENTS

8.2 TANK HOLDING CORP.

8.2.1 COMPANY SNAPSHOT

8.2.2 COMPANY SHARE ANALYSIS

8.2.3 PRODUCT PORTFOLIO

8.2.4 RECENT DEVELOPMENT

8.3 DUTCHLAND PLASTICS

8.3.1 COMPANY SNAPSHOT

8.3.2 COMPANY SHARE ANALYSIS

8.3.3 PRODUCT PORTFOLIO

8.3.4 RECENT DEVELOPMENTS

8.4 ROTOVIA.

8.4.1 COMPANY SNAPSHOT

8.4.2 COMPANY SHARE ANALYSIS

8.4.3 PRODUCT PORTFOLIO

8.4.4 RECENT DEVELOPMENT

8.5 COMOS CORPORATION CO., LTD

8.5.1 COMPANY SNAPSHOT

8.5.2 COMPANY SHARE ANALYSIS

8.5.3 PRODUCT PORTFOLIO

8.5.4 RECENT DEVELOPMENT

8.6 CARRIS PIPES & TUBES PRIVATE LIMITED

8.6.1 COMPANY SNAPSHOT

8.6.2 PRODUCT PORTFOLIO

8.6.3 RECENT DEVELOPMENT

8.7 CHANGZHOU TREEING PLASTICS CO., LTD

8.7.1 COMPANY SNAPSHOT

8.7.2 PRODUCT PORTFOLIO

8.7.3 RECENT DEVELOPMENT

8.8 FIBERTECH PLASTICS

8.8.1 COMPANY SNAPSHOT

8.8.2 PRODUCT PORTFOLIO

8.8.3 RECENT DEVELOPMENT

8.9 K.K NAG PVT. LTD

8.9.1 COMPANY SNAPSHOT

8.9.2 PRODUCT PORTFOLIO

8.9.3 RECENT DEVELOPMENT

8.1 NINGBO FLY CO., LTD.

8.10.1 COMPANY SNAPSHOT

8.10.2 PRODUCT PORTFOLIO

8.10.3 RECENT DEVELOPMENT

8.11 OCEAN PLASTIC INTERTRADE CO., LTD.

8.11.1 COMPANY SNAPSHOT

8.11.2 PRODUCT PORTFOLIO

8.11.3 RECENT DEVELOPMENT

8.12 PARTNERPLAST

8.12.1 COMPANY SNAPSHOT

8.12.2 PRODUCT PORTFOLIO

8.12.3 RECENT DEVELOPMENT

8.13 ROTOMADE

8.13.1 COMPANY SNAPSHOT

8.13.2 PRODUCT PORTFOLIO

8.13.3 RECENT DEVELOPMENT

8.14 ROTOPLAST S.A.S

8.14.1 COMPANY SNAPSHOT

8.14.2 PRODUCT PORTFOLIO

8.14.3 RECENT DEVELOPMENT

8.15 ROTOTEK LIMITED

8.15.1 COMPANY SNAPSHOT

8.15.2 PRODUCT PORTFOLIO

8.15.3 RECENT DEVELOPMENT

8.16 SHERMAN ROTO TANK

8.16.1 COMPANY SNAPSHOT

8.16.2 PRODUCT PORTFOLIO

8.16.3 RECENT DEVELOPMENT

8.17 STARPLAST S.R.L.

8.17.1 COMPANY SNAPSHOT

8.17.2 PRODUCT PORTFOLIO

8.17.3 RECENT DEVELOPMENT

8.18 TOP ROTOMOLDING TECHNOLOGY CO., LTD.

8.18.1 COMPANY SNAPSHOT

8.18.2 PRODUCT PORTFOLIO

8.18.3 RECENT DEVELOPMENT

8.19 YANTAI FANGDA ROTATIONAL MOLDING CO., LTD

8.19.1 COMPANY SNAPSHOT

8.19.2 PRODUCT PORTFOLIO

8.19.3 RECENT DEVELOPMENT

9 QUESTIONNAIRE

10 RELATED REPORTS

Liste des figures

FIGURE 1 GLOBAL ROTOMOLDING PRODUCTS MARKET: SEGMENTATION

FIGURE 2 GLOBAL ROTOMOLDING PRODUCTS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL ROTOMOLDING PRODUCTS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL ROTOMOLDING PRODUCTS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 GLOBAL ROTOMOLDING PRODUCTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL ROTOMOLDING PRODUCTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL ROTOMOLDING PRODUCTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL ROTOMOLDING PRODUCTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 GLOBAL ROTOMOLDING PRODUCTS MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL ROTOMOLDING PRODUCTS MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 11 GROWTH IN THE POPULARITY OF ATHLETICS AND WATER SPORTS IS EXPECTED TO DRIVE THE GLOBAL ROTOMOLDING PRODUCTS MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 12 THE POLYETHYLENE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL ROTOMOLDING PRODUCTS MARKET IN 2023 AND 2030

FIGURE 13 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR ROTOMOLDING MANUFACTURERS IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL ROTOMOLDING PRODUCTS MARKET

FIGURE 15 GLOBAL ROTOMOLDING PRODUCTS MARKET: SNAPSHOT (2022)

FIGURE 16 GLOBAL ROTOMOLDING PRODUCTS MARKET: BY REGION (2022)

FIGURE 17 GLOBAL ROTOMOLDING PRODUCTS MARKET: BY REGION (2023-2030)

FIGURE 18 GLOBAL ROTOMOLDING PRODUCTS MARKET: BY REGION (2023-2030)

FIGURE 19 GLOBAL ROTOMOLDING PRODUCTS MARKET: BY PRODUCT (2022)

FIGURE 20 NORTH AMERICA ROTOMOLDING PRODUCTS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA ROTOMOLDING PRODUCTS MARKET: COUNTRY (2022)

FIGURE 22 NORTH AMERICA ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2023-2030)

FIGURE 23 NORTH AMERICA ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2022-2030)

FIGURE 24 NORTH AMERICA ROTOMOLDING PRODUCTS MARKET: BY PRODUCT (2023-2030)

FIGURE 25 EUROPE ROTOMOLDING PRODUCTS MARKET: SNAPSHOT (2022)

FIGURE 26 EUROPE ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2022)

FIGURE 27 EUROPE ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2023-2030)

FIGURE 28 EUROPE ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2022-2030)

FIGURE 29 EUROPE ROTOMOLDING PRODUCTS MARKET: BY PRODUCT (2023-2030)

FIGURE 30 ASIA-PACIFIC ROTOMOLDING PRODUCTS MARKET: SNAPSHOT (2022)

FIGURE 31 ASIA-PACIFIC ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2022)

FIGURE 32 ASIA-PACIFIC ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2023-2030)

FIGURE 33 ASIA-PACIFIC ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2022-2030)

FIGURE 34 ASIA-PACIFIC ROTOMOLDING PRODUCTS MARKET: BY PRODUCT (2023-2030)

FIGURE 35 SOUTH AMERICA ROTOMOLDING PRODUCTS MARKET: SNAPSHOT (2022)

FIGURE 36 SOUTH AMERICA ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2022)

FIGURE 37 SOUTH AMERICA ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2023-2030)

FIGURE 38 SOUTH AMERICA ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2022-2030)

FIGURE 39 SOUTH AMERICA ROTOMOLDING PRODUCTS MARKET: BY PRODUCT (2023-2030)

FIGURE 40 MIDDLE EAST & AFRICA ROTOMOLDING PRODUCTS MARKET: SNAPSHOT (2022)

FIGURE 41 MIDDLE EAST & AFRICA ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2022)

FIGURE 42 MIDDLE EAST & AFRICA ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2023-2030)

FIGURE 43 MIDDLE EAST & AFRICA ROTOMOLDING PRODUCTS MARKET: BY COUNTRY (2022-2030)

FIGURE 44 MIDDLE EAST & AFRICA ROTOMOLDING PRODUCTS MARKET: BY PRODUCT (2023-2030)

FIGURE 45 GLOBAL ROTOMOLDING PRODUCTS MARKET: COMPANY SHARE 2022 (%)

FIGURE 46 NORTH AMERICA ROTOMOLDING PRODUCTS MARKET: COMPANY SHARE 2022 (%)

FIGURE 47 EUROPE ROTOMOLDING PRODUCTS MARKET: COMPANY SHARE 2022 (%)

FIGURE 48 ASIA-PACIFIC ROTOMOLDING PRODUCTS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.