Global Polyglycerol Esters Market

Taille du marché en milliards USD

TCAC :

%

USD

595.78 Million

USD

725.50 Million

2024

2032

USD

595.78 Million

USD

725.50 Million

2024

2032

| 2025 –2032 | |

| USD 595.78 Million | |

| USD 725.50 Million | |

|

|

|

|

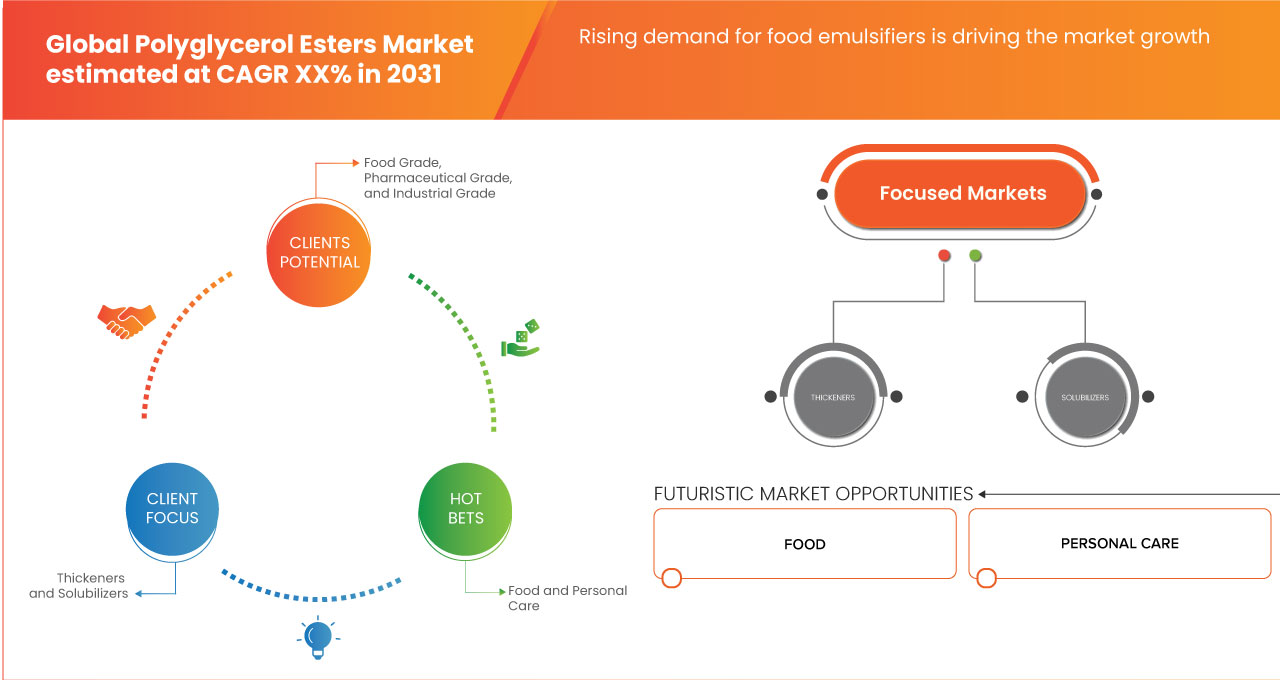

Segmentation du marché mondial des esters de polyglycérol , par qualité ( qualité alimentaire , qualité pharmaceutique et qualité industrielle), forme (épaississants, solubilisants, agents d'étalement, additifs , solides cireux et ingrédients inertes), indice d'hydroxyle (50 à 150, 30 à 49, moins de 30 et plus de 150), couleur (jaune clair, ambre, beige clair et marron), application (alimentation, soins personnels, produits pharmaceutiques, tensioactifs et détergents, et autres) - Tendances et prévisions de l'industrie jusqu'en 2031.

Analyse du marché des esters de polyglycérol

La demande croissante d'émulsifiants alimentaires stimule considérablement le marché mondial des esters de polyglycérol. Les préférences des consommateurs se tournant vers les aliments transformés et les aliments prêts à l'emploi, le besoin d'une émulsification efficace devient de plus en plus important. Les esters de polyglycérol, reconnus pour leurs propriétés émulsifiantes supérieures, jouent un rôle crucial dans l'amélioration de la qualité et de la stabilité d'une large gamme de produits alimentaires.

Les émulsifiants alimentaires tels que les esters de polyglycérol (PGE) sont essentiels pour maintenir la texture et la consistance souhaitées dans les aliments transformés. Ils aident à stabiliser les émulsions, à prévenir la séparation des phases et à prolonger la durée de conservation des produits. Cela est particulièrement pertinent dans l'industrie de la boulangerie, où les esters de polyglycérol améliorent la texture et le volume du pain, des gâteaux et des pâtisseries. Dans la margarine et les pâtes à tartiner, les PGE facilitent la formation d'émulsions eau dans huile stables, garantissant la consistance du produit. De plus, dans les produits laitiers et les glaces, les esters de polyglycérol contribuent à une texture lisse et crémeuse et empêchent la formation de cristaux de glace.

Taille du marché des esters de polyglycérol

Français La taille du marché mondial des esters de polyglycérol était évaluée à 583,41 millions USD en 2023 et devrait atteindre 707,86 millions USD d’ici 2031, avec un TCAC de 2,49 % au cours de la période de prévision de 2024 à 2031. Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d’approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire.

Tendances du marché des esters de polyglycérol

« Demande croissante d’émulsifiants alimentaires »

La demande croissante d'émulsifiants alimentaires stimule considérablement le marché mondial des esters de polyglycérol. Les préférences des consommateurs se tournant vers les aliments transformés et les aliments prêts à l'emploi, le besoin d'une émulsification efficace devient de plus en plus important. Les esters de polyglycérol, reconnus pour leurs propriétés émulsifiantes supérieures, jouent un rôle crucial dans l'amélioration de la qualité et de la stabilité d'une large gamme de produits alimentaires.

La tendance vers des options alimentaires plus saines et plus pratiques stimule encore davantage la demande en PGE. Les consommateurs étant de plus en plus à la recherche de produits offrant une fraîcheur prolongée et une qualité améliorée sans compromettre le goût ou la texture, les fabricants de produits alimentaires se tournent vers des émulsifiants avancés comme les PGE pour répondre à ces attentes. Par exemple, dans les secteurs des snacks et de la confiserie, les PGE sont utilisés pour obtenir une texture uniforme et éviter la cristallisation, ce qui est essentiel pour maintenir l'attrait et la qualité du produit.

Portée du rapport et segmentation du marché des esters de polyglycérol

|

Attributs |

Principales informations sur le marché des esters de polyglycérol |

|

Segments couverts |

|

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, France, Royaume-Uni, Italie, Russie, Espagne, Turquie, Belgique, Pays-Bas, Suisse, reste de l'Europe, Chine, Japon, Corée du Sud, Inde, Australie et Nouvelle-Zélande, Singapour, Thaïlande, Malaisie, Indonésie, Philippines, reste de l'Asie-Pacifique, Brésil, Argentine, reste de l'Amérique du Sud, Émirats arabes unis, Arabie saoudite, Afrique du Sud, Égypte, Israël et reste du Moyen-Orient et de l'Afrique |

|

Principaux acteurs du marché |

Taiyo Kagaku Co., Ltd. (Japon), Olean NV (Belgique), Evonik Industries AG (Allemagne), Lonza (Suisse), NIHON EMULSION Co., Ltd. (Japon), Guangzhou Cardlo biotechnology Co., LTD (Chine), BASF SE (Allemagne), Sakamoto Yakuhin Kogyo Co., Ltd (Japon), Shandong BinZhou GIN&ING New Material Technology Co., Ltd. (Chine), Qingdao HuaYi Biological Technology Co., LTD. (Chine), Henan Chemsino Industry Co., Ltd (Chine), Compass Foods Pte Ltd. (Singapour), ABITEC (États-Unis), Foodchem International Corporation (Chine), Estelle Chemicals Pvt. Ltd. (Inde) et ATAMAN KIMYA (Turquie) entre autres |

|

Opportunités de marché |

|

|

Ensembles d'informations sur les données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Définition du marché des esters de polyglycérol

Le marché mondial des esters de polyglycérol fait référence au commerce et à la production d'une classe de tensioactifs non ioniques dérivés de l'estérification de polyglycérols avec des acides gras. Ces esters sont largement utilisés dans diverses industries, notamment l'alimentation et les boissons, les cosmétiques, les produits pharmaceutiques et les applications industrielles. Dans l'industrie alimentaire, les PGE agissent comme émulsifiants , stabilisant les mélanges huile-eau dans des produits tels que les produits de boulangerie, les sauces et la margarine. Leur application dans les cosmétiques améliore la texture et la stabilité des crèmes et des lotions, tandis que dans les produits pharmaceutiques, ils améliorent la solubilité et la biodisponibilité des principes actifs.

Dynamique du marché des esters de polyglycérol

Conducteurs

- Demande croissante d'émulsifiants alimentaires

La demande croissante d'émulsifiants alimentaires stimule considérablement le marché mondial des esters de polyglycérol. Les préférences des consommateurs se tournant vers les aliments transformés et les aliments prêts à l'emploi, le besoin d'une émulsification efficace devient de plus en plus important. Les esters de polyglycérol, reconnus pour leurs propriétés émulsifiantes supérieures, jouent un rôle crucial dans l'amélioration de la qualité et de la stabilité d'une large gamme de produits alimentaires.

Les émulsifiants alimentaires tels que les esters de polyglycérol (PGE) sont essentiels pour maintenir la texture et la consistance souhaitées dans les aliments transformés. Ils aident à stabiliser les émulsions, à prévenir la séparation des phases et à prolonger la durée de conservation des produits. Cela est particulièrement pertinent dans l'industrie de la boulangerie, où les esters de polyglycérol améliorent la texture et le volume du pain, des gâteaux et des pâtisseries. Dans la margarine et les pâtes à tartiner, les PGE facilitent la formation d'émulsions eau dans huile stables, garantissant la consistance du produit.

Par exemple,

En décembre 2023, selon un rapport de Henan Chemsino Industry Co., Ltd, la demande d'émulsifiants alimentaires tels que les esters de polyglycérol (PGE) a augmenté en raison de leur capacité à améliorer la texture et la stabilité des aliments transformés. Les PGE sont de plus en plus utilisés dans les produits de boulangerie, les produits laitiers et les sauces, conformément aux préférences des consommateurs pour des produits alimentaires homogènes, de haute qualité et plus durables.

- Expansion rapide de l'industrie pharmaceutique

L'expansion rapide de l'industrie pharmaceutique est un facteur clé de la croissance du marché mondial des esters de polyglycérol. Les esters de polyglycérol, connus pour leurs propriétés émulsifiantes, stabilisantes et solubilisantes exceptionnelles, sont de plus en plus adoptés dans les formulations pharmaceutiques, en particulier dans les produits oraux, topiques et injectables. Alors que la demande de systèmes avancés d'administration de médicaments et de produits pharmaceutiques de haute qualité augmente, les PGE jouent un rôle essentiel pour répondre aux besoins évolutifs de l'industrie.

Les PGE sont largement utilisés dans les médicaments oraux tels que les comprimés, les gélules et les suspensions, où ils agissent comme émulsifiants pour assurer la distribution uniforme des principes actifs pharmaceutiques (API). En améliorant la biodisponibilité et la stabilité de ces API, les PGE contribuent à accroître l'efficacité des médicaments. En outre, ils contribuent à la production de formulations à libération prolongée, qui deviennent de plus en plus populaires dans l'industrie pharmaceutique pour assurer une libération constante et contrôlée des médicaments au fil du temps. Cette tendance devrait alimenter la demande de PGE à mesure que de plus en plus de sociétés pharmaceutiques intègrent ces formulations avancées dans leurs gammes de produits.

Par exemple,

En octobre 2020, selon un rapport de l'agence allemande de commerce et d'investissement, l'industrie pharmaceutique allemande a connu une croissance significative, portée par de solides investissements en recherche et développement (R&D) et par l'innovation dans le domaine biopharmaceutique. Avec plus de 500 sociétés pharmaceutiques opérant dans le pays, l'expansion rapide de l'industrie alimente la demande d'excipients avancés tels que les esters de polyglycérol (PGE) pour soutenir le développement de formulations médicamenteuses complexes.

Opportunités

- Expansion vers des gammes de produits durables et écologiques

À mesure que la sensibilisation à l’environnement s’accroît et que les consommateurs demandent des alternatives plus écologiques, les industries se tournent de plus en plus vers des pratiques durables. Les PGE, avec leurs origines naturelles et leurs propriétés respectueuses de l’environnement, sont bien placés pour répondre à cette évolution de la demande. Les esters de polyglycérol, dérivés de sources renouvelables comme les huiles et graisses végétales , sont biodégradables et non toxiques, ce qui en fait un choix attrayant pour les entreprises soucieuses de réduire leur empreinte environnementale. Cela correspond à la tendance croissante dans divers secteurs, notamment l’alimentation, les cosmétiques et les produits pharmaceutiques, où l’on observe une forte demande d’ingrédients naturels et durables.

Dans l’industrie agroalimentaire, les consommateurs privilégient de plus en plus les produits clean label, perçus comme plus sains et plus respectueux de l’environnement. Les PGE servent d’émulsifiants et de stabilisateurs efficaces, offrant une alternative naturelle aux additifs synthétiques. Cela permet non seulement aux fabricants de produits alimentaires de répondre aux attentes des consommateurs en matière de transparence et de durabilité, mais aussi de se conformer à des réglementations plus strictes en matière de sécurité alimentaire et d’impact environnemental. Ainsi, les PGE deviennent un ingrédient clé des produits alimentaires clean label et biologiques, stimulant ainsi leur croissance sur le marché.

Par exemple,

En novembre 2023, selon un article publié par Elsevier BV, cette étude explore la synthèse rentable d'esters de polyglycérol (PGE) à l'aide d'huile d'acide de soja distillée (DSAO) et de glycérol, en exploitant les sous-produits des raffineries d'huile végétale. La polymérisation catalysée par une base du glycérol à 250 °C et l'estérification catalysée par un acide de DSAO à 210 °C ont été utilisées pour créer des PGE avec un équilibre hydrophile-lipophile (HLB) variable. Les PGE ont considérablement réduit la tension superficielle à 31,55 mNm−1 et la tension interfaciale à 4,81 mNm−1, avec une concentration micellaire critique comprise entre 15,8 et 69,7 mgL−1. Les PGE ont montré une excellente amplifiabilité dans les huiles végétales, et leurs performances dans les crèmes hydratantes ont été comparées à celles des produits commerciaux, mettant en valeur une émulsification efficace, rentable et renouvelable.

- Expansion dans les marchés émergents

Alors que les économies en développement connaissent une industrialisation et une urbanisation rapides, ainsi qu’une hausse des dépenses de consommation, la demande en PGE est appelée à croître, sous l’effet de plusieurs facteurs clés. Tout d’abord, les marchés émergents connaissent une croissance substantielle dans le secteur des aliments et des boissons, où les PGE sont de plus en plus utilisés comme émulsifiants et stabilisants. Dans ces régions, l’essor de la classe moyenne alimente la demande en aliments transformés et prêts à l’emploi, qui nécessitent souvent des PGE pour améliorer la texture, la stabilité et la durée de conservation. À mesure que ces marchés continuent de se développer, il existe un besoin croissant d’ingrédients de haute qualité capables de répondre à la fois aux attentes des consommateurs et aux normes réglementaires. Les PGE, avec leurs origines naturelles et leurs propriétés fonctionnelles efficaces, sont bien placés pour répondre à cette demande et soutenir la croissance de l’industrie des aliments et des boissons dans les économies émergentes.

Par exemple,

En juin 2024, selon un article publié par Greengredients, les esters de polyglycérol sont devenus incontournables dans les cosmétiques naturels pour leurs bienfaits polyvalents. Ces composés d'origine végétale, produits à partir de polyglycérols et d'acides gras, excellent comme émulsifiants , améliorant à la fois les formulations huile dans eau et eau dans huile. Ils améliorent la texture, l'hydratation de la peau et l'attrait sensoriel global tout en étant biodégradables et respectueux de la peau. Greengredients propose des esters de polyglycérol de haute qualité comme Oleamuls OW et Sesamuls OW, qui sont idéaux pour les hydratants, les nettoyants, les soins capillaires et les produits solaires. Ces ingrédients répondent aux normes écologiques et soutiennent des formulations de beauté durables et efficaces. Explorez la gamme de Greengredients pour rehausser vos produits cosmétiques naturels.

Contraintes/Défis

- Problèmes de complexité et d'intégration des technologies avancées

Les PGE sont utilisés dans des applications diverses, allant des aliments et boissons aux cosmétiques et produits pharmaceutiques. La technologie complexe impliquée dans leur production et leur application pose plusieurs problèmes. Tout d’abord, la synthèse des PGE nécessite des processus chimiques sophistiqués. Ces esters sont produits par estérification de polyglycérols avec des acides gras, un processus qui exige un contrôle précis des conditions de réaction telles que la température, la pression et la concentration du catalyseur. Cette complexité technique nécessite des installations de fabrication avancées et du personnel qualifié. Les entreprises doivent investir dans des technologies et une expertise de pointe pour garantir une qualité et des performances constantes des produits. Pour les petites entreprises ou celles qui sont nouvelles sur le marché, ces exigences technologiques peuvent constituer un obstacle important à l’entrée.

De plus, le développement et l’optimisation des formulations de PGE pour des applications spécifiques ajoutent un niveau de complexité supplémentaire. Chaque application, qu’elle soit alimentaire, cosmétique ou pharmaceutique, a des exigences uniques en matière d’émulsification, de stabilité et de compatibilité. Le développement de PGE qui répondent à ces besoins spécifiques implique souvent des efforts de recherche et développement (R&D) considérables, notamment des essais, des tests et des ajustements de formulation. Ce processus de R&D peut être à la fois long et coûteux, nécessitant des investissements substantiels en technologie et en innovation.

Par exemple,

En octobre 2023, selon un article publié par Walter de Gruyter GmbH, les esters de polyglycérol (PGE) sont des tensioactifs non ioniques utilisés comme émulsifiants, agents mouillants et modificateurs de viscosité dans les industries cosmétiques, pharmaceutiques et alimentaires. Ils sont considérés comme des alternatives plus sûres aux tensioactifs à base de glycol éthoxylé. Composés d'un acide gras (lipophile) et de polyglycérol (hydrophile), les PGE peuvent être synthétisés par diverses méthodes, notamment l'estérification directe, la transestérification chimique ou enzymatique et l'irradiation par micro-ondes. Comme ils dérivent d'huiles végétales renouvelables, les PGE sont considérés comme respectueux de l'environnement et polyvalents. Les principaux défis de leur synthèse consistent à augmenter le rendement, à contrôler les niveaux d'estérification et à minimiser les réactions secondaires.

- Conformité réglementaire et questions d'approbation

Ces défis découlent de réglementations strictes, de normes variables selon les régions et de la nécessité de se conformer en permanence à des directives en constante évolution. Tout d’abord, les exigences réglementaires relatives aux PGE peuvent différer considérablement d’un pays et d’une région à l’autre, ce qui crée des difficultés pour les fabricants opérant à l’échelle mondiale. Dans l’industrie agroalimentaire, par exemple, les PGE doivent répondre à des normes de sécurité et d’efficacité spécifiques qui varient d’une juridiction à l’autre. Le processus d’approbation des additifs alimentaires, y compris les PGE, implique des tests et une documentation rigoureux pour démontrer la sécurité et l’efficacité. La navigation dans ces réglementations disparates peut être gourmande en ressources et en temps pour les entreprises, ce qui peut retarder l’entrée sur le marché et augmenter les coûts.

De même, dans le secteur des cosmétiques et des soins personnels, les réglementations sur la sécurité et l’étiquetage des ingrédients deviennent de plus en plus strictes. Différentes régions, comme l’Union européenne et les États-Unis, ont des exigences différentes pour les ingrédients cosmétiques, y compris les PGE. Par exemple, l’UE a des directives strictes sur la sécurité et les concentrations autorisées des ingrédients cosmétiques, tandis que la Food and Drug Administration (FDA) américaine a son propre ensemble de réglementations. Le respect de ces différentes normes nécessite des investissements importants dans les affaires réglementaires et le contrôle de la qualité, ce qui peut être difficile pour les entreprises qui tentent de rationaliser leurs opérations à l’échelle mondiale.

Par exemple,

En décembre 2020, selon un article publié par Elsevier BV, cette étude présente une nouvelle méthode de création de comprimés matriciels à libération prolongée avec des performances stables par compactage direct. Des esters de polyglycérol d'acides gras (PGFA), connus pour leur stabilité à l'état solide, ont été utilisés comme agents matriciels. La metformine HCl, un API hautement soluble, a servi de substance modèle. Trois composés PGFA avec des valeurs HLB de 1,8 à 4,5 ont été testés. Les comprimés contenant des PGFA présentaient une pression d'élasticité réduite et des propriétés d'écoulement améliorées. La compression directe de ces mélanges, sans granulation, a produit des comprimés avec une résistance à la traction et une friabilité optimales. La variation des valeurs HLB des PGFA a permis d'adapter le profil de libération de l'API, avec une libération stable liée à l'état solide stable des lipides. Aucun effet cytotoxique n'a été détecté.

Ce rapport de marché fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact et scénario actuel du marché en cas de pénurie de matières premières et de retards d'expédition

Data Bridge Market Research propose une analyse de haut niveau du marché et fournit des informations en tenant compte de l'impact et de l'environnement actuel du marché en matière de pénurie de matières premières et de retards d'expédition. Cela se traduit par l'évaluation des possibilités stratégiques, la création de plans d'action efficaces et l'assistance aux entreprises dans la prise de décisions importantes.

Outre le rapport standard, nous proposons également une analyse approfondie du niveau d'approvisionnement à partir des retards d'expédition prévus, de la cartographie des distributeurs par région, de l'analyse des produits de base, de l'analyse de la production, des tendances de la cartographie des prix, de l'approvisionnement, de l'analyse des performances des catégories, des solutions de gestion des risques de la chaîne d'approvisionnement, de l'analyse comparative avancée et d'autres services d'approvisionnement et de soutien stratégique.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Polyglycerol Esters Market Scope

The market is segmented on the basis of grade, form, hydroxyl value, color, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Grade

- Food Grade

- Pharmaceutical Grade

- Industrial Grade

Form

- Thickeners

- Solubilizers

- Spreading Agents

- Additives

- Waxy Solids

- Inert Ingredients

Hydroxyl Value

- 50 To 150

- 30 To 49

- Less Than 30

- More Than 150

Color

- Light Yellow

- Amber

- Light Tan

- Brown

Application

- Food

- Food, By Type

- Bakery

- Bread & Rolls

- Cakes, Pastries & Truffle

- Biscuit, Cookies & Crackers

- Tart & Pies

- Swiss Rolls

- Brownies

- Others

- Confectionery

- Candy Bars

- Jelly Candies

- Jams and Jellies

- Marmalades

- Fruit Jelly Dessert

- Toppings

- Others

- Oil Products

- Desserts

- Bakery

- Food, By Type

- Personal Care

- Personal Care, By Application

- Moisturizers

- Hair Conditioners

- Foundation

- Anti- Ageing Serums

- Lip Gloss

- Mascara

- Others

- Personal Care, By Application

- Pharmaceuticals

- Surfactants & Detergents

- Others

Polyglycerol Esters Market Regional Analysis

The market is analyzed and market size insights and trends are provided by grade, form, hydroxyl value, color, and application as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Italy, Russia, Spain, Turkey, Belgium, Netherlands, Switzerland, Rest of Europe, China, Japan, South Korea, India, Australia & New Zealand, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East and Africa.

Asia-Pacific is expected to dominate and the fastest growing region in the market due to rapidly expanding food processing sector, especially in countries such as China, India, and Southeast Asia. Polyglycerol esters are widely used as emulsifiers in baked goods, dairy products, and processed foods.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Part de marché des esters de polyglycérol

Le paysage concurrentiel du marché fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Les leaders du marché des esters de polyglycérol opérant sur le marché sont :

- Taiyo Kagaku Co., Ltd. (Japon)

- Olean NV (Belgique)

- Evonik Industries AG (Allemagne)

- Lonza (Suisse)

- NIHON EMULSION Co., Ltd. (Japon)

- Guangzhou Cardlo Biotechnology Co., Ltd (Chine)

- BASF SE (Allemagne)

- Sakamoto Yakuhin Kogyo Co., Ltd (Japon)

- Shandong BinZhou GIN&ING New Material Technology Co., Ltd. (Chine)

- Qingdao HuaYi Biological Technology Co., Ltd. (Chine)

- Henan Chemsino Industry Co., Ltd (Chine)

- Compass Foods Pte Ltd. (Singapour)

- ABITEC (États-Unis)

- Foodchem International Corporation (Chine)

- Estelle Chemicals Pvt. Ltd. (Inde)

- ATAMAN KIMYA (Turquie)

Derniers développements sur le marché des esters de polyglycérol

- En mars 2024, Lonza a annoncé l'acquisition du site de produits biologiques Genentech de Roche à Vacaville, en Californie, pour 1,2 milliard de dollars. Cette acquisition, qui renforce la capacité de production de Lonza, prévoit d'investir environ 500 millions de dollars pour moderniser l'usine et soutenir la croissance

- En août 2024, Foodchem, acteur majeur de l'industrie des ingrédients alimentaires, est ravi d'annoncer sa participation au salon FISA 2024, à São Paulo, au Brésil. Stand de l'entreprise D-95 pour découvrir ses dernières innovations en matière de solutions d'ingrédients alimentaires. Cet événement contribue à accroître la présence des produits dans diverses régions

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.