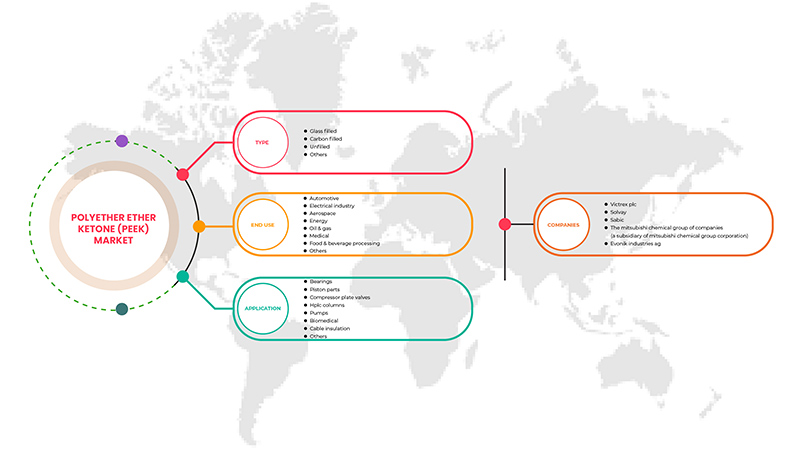

Marché mondial du polyéther éther cétone (PEEK), par type (rempli de verre, rempli de carbone, non rempli et autres), application (roulements, pièces de piston, pompes, colonnes HPLC, vannes à plaques de compresseur, isolation de câbles, biomédical et autres), utilisation finale (aérospatiale, automobile, transformation des aliments et des boissons, pétrole et gaz, industrie électrique, énergie, médical et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché du polyéther éther cétone (PEEK)

L'augmentation des applications du polyétheréthercétone (PEEK) dans diverses industries est un moteur important du marché mondial du polyétheréthercétone (PEEK). Les excellentes caractéristiques et propriétés du PEEK et du PEEK en tant qu'alternative potentielle aux métaux dans l'industrie automobile devraient propulser la croissance du marché mondial du polyétheréthercétone (PEEK).

Les principales contraintes susceptibles d’avoir un impact négatif sur le marché mondial du polyétheréthercétone (PEEK) sont les coûts élevés des produits en polyétheréthercétone (PEEK) et la disponibilité facile de substituts.

Les progrès rapides dans les applications médicales et de santé et les réglementations strictes visant à réduire les émissions de CO2 devraient offrir des opportunités sur le marché mondial du polyétheréthercétone (PEEK). Cependant, les conditions de traitement difficiles pour les polyétheréthercétones peuvent remettre en cause la croissance du marché mondial du polyétheréthercétone (PEEK).

Le marché mondial du polyéther éther cétone (PEEK) devrait connaître une croissance significative au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 5,6 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 1 062,29 millions USD d'ici 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (rempli de verre, rempli de carbone, non rempli et autres), application (roulements, pièces de piston, pompes, colonnes HPLC, vannes à plaques de compresseur, isolation de câbles, biomédical et autres), utilisation finale (aérospatiale, automobile, transformation des aliments et des boissons, pétrole et gaz, industrie électrique, énergie, médical et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique, Royaume-Uni, Allemagne, Royaume-Uni, France, Italie, Espagne, Russie, Suisse, Turquie, Belgique, Pays-Bas et reste de l'Europe, Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie et Nouvelle-Zélande et reste de l'Asie-Pacifique, Égypte, Arabie saoudite, Émirats arabes unis, Afrique du Sud, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Victrex Plc, Evonik Industries AG, Solvay, DAIKIN COMPOUNDING ITALY SpA, Freudenberg, Arkema, Ensinger, le groupe de sociétés Mitsubishi Chemical (une filiale de Mitsubishi Chemical Group Corporation), Avient, BARLOG Plastics GmbH, SABIC, SAINT-GOBAIN, Westlake Plastics, Fluorocarbon Group, entre autres |

Définition du marché

Le PEEK est un polymère thermoplastique organique incolore, membre de la famille des polyaryl éther cétones (PAEK). Il s'agit d'un homopolymère constitué d'un seul monomère. C'est un thermoplastique semi-cristallin aux propriétés chimiques et mécaniques exceptionnelles qui sont conservées même à des températures plus élevées. Il présente une résistance à la détérioration lors de diverses procédures de stérilisation. Il peut donc être stérilisé par des méthodes de stérilisation thermique sans affecter ses propriétés. Sa structure chimique le rend très résistant aux dommages chimiques et radiologiques, compatible avec les agents de renforcement tels que les fibres de verre et de carbone et possède une résistance supérieure à celle des métaux. Ces propriétés le rendent particulièrement adapté aux applications industrielles.

Dynamique du marché mondial du polyéther éther cétone (PEEK)

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Applications croissantes du polyétheréthercétone (PEEK) dans diverses industries

Ces polymères ont de nombreuses applications émergentes dans l'industrie aérospatiale, automobile, pétrolière et gazière, médicale et électronique dans un avenir proche, ce qui améliorera encore les perspectives de croissance du marché mondial du polyétheréthercétone (PEEK). De plus, le polyétheréthercétone (PEEK) est considéré comme un polymère haute performance de premier plan dans toute l'industrie du plastique. Les métaux étaient autrefois les matériaux de choix dans l'automobile, l'aérospatiale, les appareils médicaux et d'autres industries, mais le polymère PEEK les remplace désormais rapidement en se conformant aux réglementations mondiales actuelles en matière d'émissions et en contribuant à réduire les émissions de CO2 grâce à une technologie plus efficace.

- Excellentes caractéristiques et propriétés du PEEK

Les polymères PEEK fondent à une température relativement élevée par rapport aux autres thermoplastiques. La plage de température de fusion peut être traitée et améliorée davantage à l'aide de méthodes de moulage par injection, d'extrusion, de formage par pulvérisation ou de méthodes de pressage. En outre, la possibilité de traiter les polymères de polyétheréthercétone (PEEK) par impression 3D en fait un matériau recherché pour ses applications accrues.

- Le PEEK comme alternative potentielle aux métaux dans l'industrie automobile

L'augmentation du pouvoir d'achat des consommateurs, l'industrialisation rapide de divers pays et l'expansion rapide du secteur automobile en Chine, en Inde, en Allemagne et dans de nombreux autres pays ont propulsé la croissance du secteur automobile. Le polyétheréthercétone est de plus en plus utilisé dans les pièces automobiles, telles que les moteurs, les joints, les anneaux de transmission, les anneaux de friction et les rondelles de butée, ce qui stimule à son tour la croissance du marché.

Opportunités

- Progrès rapides dans les applications médicales et de santé

Le marché global devrait également connaître une large gamme d'applications dans l'industrie médicale au cours de la période de prévision. Actuellement, il est utilisé pour la chirurgie de la colonne vertébrale et devrait être utilisé pour davantage d'applications cliniques et de produits médicaux commerciaux avec davantage de recherche et développement. Il existe un besoin continu de recherche et développement dans l'industrie médicale pour explorer les applications cliniques inexploitées du PEEK. En raison du manque de données cliniques à long terme, le produit PEEK a actuellement une application limitée dans le domaine, mais il devrait augmenter dans un avenir proche en raison de son énorme potentiel en tant que remplacement d'autres matériaux utilisés.

- Des réglementations strictes pour réduire les émissions de CO2

Le PEEK est en passe de devenir une solution respectueuse de l'environnement dans diverses applications. Son application conduit à de faibles émissions de carbone par rapport à d'autres polymères, notamment le stratifié polyester, le chlorure de polyvinyle et le polystyrène , entre autres. Le PEEK augmente la durée de vie des produits dans lesquels il est utilisé en offrant une excellente résistance à la corrosion. Il fonctionne également bien à haute température. C'est l'un des produits les plus polyvalents en termes de liberté de conception de fabrication et entraîne ainsi une moindre dépendance à la main-d'œuvre.

Contraintes/Défis

- Coûts élevés des produits en polyétheréthercétone (PEEK)

Le fabricant de polymères polyétheréthercétone (PEEK) et ses produits nécessitent un investissement considérable, car le processus de fabrication est plus complexe que celui de tout autre groupe de polymères ou de métaux. De plus, la fabrication de produits PEEK capables de résister à des températures élevées nécessite un niveau élevé de compétences techniques, de techniciens et de recherche. En raison de ces facteurs, la production de PEEK est coûteuse et donc le coût des produits finis est également très élevé.

- Disponibilité facile de substituts

Le plastique est un matériau léger, durable, peu coûteux et facilement modifiable. C'est la raison pour laquelle son utilisation a augmenté rapidement et continue de croître. Le plastique est composé de polymères, qui sont de grosses molécules organiques. Sur le marché des polymères, divers substituts sont disponibles pour être utilisés à la place du polymère PEEK. Il existe une variété de polymères hautes performances disponibles sur le marché.

- Conditions de traitement difficiles pour les polyétheréthercétones

Le moulage par compression du PEEK présente de nombreux défis. Le processus est long, très sensible et très spécifique au type d'outillage requis. Le moulage par compression est connu pour sa faible productivité ; même un grand transformateur ne peut consommer que 20 à 25 kg par jour de production. Le processus réel de moulage par compression du PEEK n'est pas non plus simple et doit être peaufiné jusqu'à ce qu'un processus qui convienne le mieux à l'équipement soit disponible. De plus, le choix des matrices est essentiel. Sous sa forme fondue, le PEEK peut être un matériau très agressif et réactif et l'acier se corrode pendant le moulage. Par conséquent, trouver un équilibre entre un métal de matrice résistant et le processus approprié est essentiel pour obtenir un processus final à la fois économique et productif et qui donne un produit final de haute qualité.

- Une concurrence accrue des composites et des polymères hybrides

De plus, les composites polymères renforcés par des fibres gagnent en importance dans divers domaines, des articles ménagers à l'industrie automobile. Les fibres naturelles et synthétiques sont peu coûteuses, légères et présentent une résistance spécifique et mécanique élevée. Les composites hybrides renforcés par des fibres sont largement apparus comme des matériaux potentiels pour la fabrication de composites destinés à différentes applications. L'utilisation de techniques de traitement et de méthodes de modification bien caractérisées permet d'obtenir des qualités de produit souhaitées.

Développement récent

- En février 2022, Arkema est devenu finaliste des JEC Composites Innovation Awards 2022. Arkema, en partenariat avec Somocap, fait partie des 30 finalistes de cette édition 2022 dans la catégorie Bâtiment et Génie Civil grâce au projet porté par Optimas. Cela renforce la notoriété de l'entreprise sur le marché

Portée du marché mondial du polyéther éther cétone (PEEK)

Le marché mondial du polyétheréthercétone (PEEK) est classé en fonction du type, de l'application et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Rempli de carbone

- Rempli de verre

- Non rempli

- Autres

Sur la base du type, le marché mondial du polyétheréthercétone (PEEK) est classé en verre chargé, carbone chargé, non chargé et autres.

Application

- Roulements

- Pièces de piston

- Vannes à plaques de compresseur

- Colonnes HPLC

- Pompes

- Biomédical

- Isolation des câbles

- Autres

Sur la base de l'application, le marché mondial du polyétheréthercétone (PEEK) est classé en roulements, pièces de piston, pompes, colonnes HPLC, vannes à plaques de compresseur, isolation de câbles, biomédical et autres.

Utilisation finale

- Automobile

- Industrie électrique

- Aérospatial

- Énergie

- Pétrole et gaz

- Médical

- Transformation des aliments et des boissons

- Autres

Sur la base de l'utilisation finale, le marché mondial du polyéthe éther cétone (PEEK) est classé en aérospatiale, automobile, transformation des aliments et des boissons, pétrole et gaz, industrie électrique, énergie, médical et autres.

Analyse/perspectives régionales du marché mondial du polyéther éther cétone (PEEK)

The global polyether ether ketone (PEEK) market is segmented based on country, type, application and end use.

Some countries in the global polyether ether ketone (PEEK) market are the U.S., Canada, Mexico, U.K., Germany, U.K., France, Italy, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands and Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia and New Zealand and Rest of Asia-Pacific, Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and Rest of the Middle East and Africa.

China is expected to dominate the Asia-Pacific polyether ether ketone (PEEK) market owing to the growing demand for automobiles and consumer goods in the region. The U.S. is expected to dominate in the North American region owing to the increasing demand for PEEK polymer for bearings in the region. Germany is expected to dominate the Europe polyether ether ketone (PEEK) market due to growing awareness of the excellent characteristics and properties of PEEK in the region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends and porter's five forces analysis and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Polyether Ether Ketone (PEEK) Market Share Analysis

The global polyether ether ketone (PEEK) market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the global polyether ether ketone (PEEK) market.

Some of the prominent participants operating in the global polyether ether ketone (PEEK) market are Victrex Plc, Evonik Industries AG, Solvay, DAIKIN COMPOUNDING ITALY S.p.A, Freudenberg, Arkema, Ensinger, the Mitsubishi Chemical Group of Companies (A Subsidiary of Mitsubishi Chemical Group Corporation), Avient, BARLOG Plastics GmbH, SABIC, SAINT-GOBAIN, Westlake Plastics, Fluorocarbon Group, among others.

Research Methodology

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent des grilles de positionnement des fournisseurs, une analyse de la chronologie du marché, un aperçu et un guide du marché, des grilles de positionnement des entreprises, une analyse des parts de marché des entreprises, des normes de mesure, une analyse globale par rapport aux régions et des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.3 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING APPLICATIONS OF POLYETHER ETHER KETONE (PEEK) IN VARIOUS INDUSTRIES

5.1.2 EXCELLENT CHARACTERISTICS AND PROPERTIES OF PEEK

5.1.3 PEEK AS A POTENTIAL ALTERNATIVE TO METALS IN THE AUTOMOTIVE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COSTS OF POLYETHER ETHER KETONE (PEEK) PRODUCTS

5.2.2 EASY AVAILABILITY OF SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 RAPID ADVANCEMENT IN MEDICAL AND HEALTHCARE APPLICATION

5.3.2 STRINGENT REGULATIONS TO REDUCE CO2 EMISSIONS

5.4 CHALLENGES

5.4.1 CHALLENGING PROCESSING CONDITIONS FOR POLYETHER ETHER KETONES

5.4.2 AN INCREASE IN COMPETITION FROM COMPOSITES AND HYBRID POLYMERS

6 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE

6.1 OVERVIEW

6.2 CARBON FILLED

6.3 GLASS FILLED

6.4 UNFILLED

6.5 OTHERS

7 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 BEARINGS

7.3 PISTON PARTS

7.4 COMPRESSOR PLATE VALVES

7.5 HPLC COLUMNS

7.6 PUMPS

7.7 BIOMEDICAL

7.8 CABLE INSULATION

7.9 OTHERS

8 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY END-USE

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.3 ELECTRICAL INDUSTRY

8.4 AEROSPACE

8.5 ENERGY

8.6 OIL & GAS

8.7 MEDICAL

8.8 FOOD & BEVERAGE PROCESSING

8.9 OTHERS

9 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA PACIFIC

9.2.1 CHINA

9.2.2 INDIA

9.2.3 JAPAN

9.2.4 SOUTH KOREA

9.2.5 THAILAND

9.2.6 SINGAPORE

9.2.7 INDONESIA

9.2.8 AUSTRALIA & NEW ZEALAND

9.2.9 PHILIPPINES

9.2.10 MALAYSIA

9.2.11 REST OF ASIA-PACIFIC

9.3 MIDDLE EAST AND AFRICA

9.3.1 SAUDI ARABIA

9.3.2 U.A.E.

9.3.3 SOUTH AFRICA

9.3.4 EGYPT

9.3.5 ISRAEL

9.3.6 REST OF MIDDLE EAST AND AFRICA

9.4 SOUTH AMERICA

9.4.1 BRAZIL

9.4.2 ARGENTINA

9.4.3 REST OF SOUTH AMERICA

9.5 EUROPE

9.5.1 GERMANY

9.5.2 U.K.

9.5.3 FRANCE

9.5.4 ITALY

9.5.5 SPAIN

9.5.6 RUSSIA

9.5.7 SWITZERLAND

9.5.8 TURKEY

9.5.9 BELGIUM

9.5.10 NETHERLANDS

9.5.11 REST OF EUROPE

9.6 NORTH AMERICA

9.6.1 U.S.

9.6.2 CANADA

9.6.3 MEXICO

10 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.5 REGULATORY APPROVAL

10.6 PRODUCT LAUNCH

10.7 AWARD

10.8 MERGER

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 VICTREX PLC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 SOLVAY

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT UPDATES

12.3 SABIC

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT UPDATES

12.4 THE MITSUBISHI CHEMICAL GROUP OF COMPANIES (A SUBSIDIARY OF MITSUBISHI CHEMICAL GROUP CORPORATION)

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATES

12.5 EVONIK INDUSTRIES AG

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT UPDATES

12.6 ARKEMA

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATES

12.7 AVIENT

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATES

12.8 BARLOG PLASTICS GMBH

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATES

12.9 DAIKIN COMPOUNDING ITALY S.P.A

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATES

12.1 ENSINGER

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT UPDATES

12.11 FREUDENBERG

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT UPDATES

12.12 FLUOROCARBON GROUP

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT UPDATES

12.13 SAINT-GOBAIN

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT UPDATES

12.14 WESTLAKE PLASTICS

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF SATURATED POLYESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE TEREPHTHALATE, AND POLYLACTIC ACID); HS CODE – 390799 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SATURATED POLYESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE TEREPHTHALATE, AND POLYLACTIC ACID); HS CODE – 390799 (USD THOUSAND)

TABLE 3 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 5 GLOBAL CARBON FILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL CARBON FILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 7 GLOBAL GLASS FILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL GLASS FILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 GLOBAL UNFILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL UNFILLEDIN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 GLOBAL OTHERS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL OTHERS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL BEARINGS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL PISTON PARTS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL COMPRESSOR PLATE VALVES IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL HPLC COLUMNS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL PUMPS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL BIOMEDICAL IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL CABLE INSULATION IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL OTHERS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL AUTOMOTIVE IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL ELECTRICAL INDUSTRY IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL AEROSPACE IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL ENERGY IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL OIL & GAS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL MEDICAL IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL FOOD & BEVERAGE PROCESSING IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL OTHERS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 33 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 35 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 37 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 39 CHINA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 CHINA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 41 CHINA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 CHINA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 43 INDIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 INDIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 45 INDIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 INDIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 47 JAPAN POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 JAPAN POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 49 JAPAN POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 JAPAN POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 51 SOUTH KOREA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 SOUTH KOREA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 53 SOUTH KOREA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SOUTH KOREA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 55 THAILAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 THAILAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 57 THAILAND POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 THAILAND POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 59 SINGAPORE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 SINGAPORE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 61 SINGAPORE POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 SINGAPORE POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 63 INDONESIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 INDONESIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 65 INDONESIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 INDONESIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA & NEW ZEALAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA & NEW ZEALAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 69 AUSTRALIA & NEW ZEALAND POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 AUSTRALIA & NEW ZEALAND POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 71 PHILIPPINES POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 PHILIPPINES POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 PHILIPPINES POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 PHILIPPINES POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 75 MALAYSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MALAYSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 77 MALAYSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 MALAYSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 79 REST OF ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 REST OF ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 81 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 83 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 85 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 89 SAUDI ARABIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 SAUDI ARABIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 91 U.A.E. POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E. POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 93 U.A.E. POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 U.A.E. POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 95 SOUTH AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 97 SOUTH AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SOUTH AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 99 EGYPT POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 EGYPT POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 101 EGYPT POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 EGYPT POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 103 ISRAEL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 ISRAEL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 105 ISRAEL POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 ISRAEL POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 107 REST OF MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 REST OF MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 109 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 111 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 113 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 115 BRAZIL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 BRAZIL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 117 BRAZIL POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 BRAZIL POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 119 ARGENTINA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 ARGENTINA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 121 ARGENTINA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 ARGENTINA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 123 REST OF SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 REST OF SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 125 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 126 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 127 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 129 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 131 GERMANY POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 GERMANY POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 133 GERMANY POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 GERMANY POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 135 U.K. POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.K. POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 137 U.K. POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 U.K. POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 139 FRANCE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 FRANCE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 141 FRANCE POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 FRANCE POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 143 ITALY POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 ITALY POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 145 ITALY POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 ITALY POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 147 SPAIN POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 SPAIN POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 149 SPAIN POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 SPAIN POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 RUSSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 153 RUSSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 155 SWITZERLAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 SWITZERLAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 157 SWITZERLAND POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 SWITZERLAND POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 159 TURKEY POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 TURKEY POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 161 TURKEY POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 162 TURKEY POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 163 BELGIUM POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 BELGIUM POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 165 BELGIUM POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 BELGIUM POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 167 NETHERLANDS POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 NETHERLANDS POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 169 NETHERLANDS POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 NETHERLANDS POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 171 REST OF EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 REST OF EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 173 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 174 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 175 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 177 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 178 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 179 U.S. POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 U.S. POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 181 U.S. POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 U.S. POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 183 CANADA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 CANADA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 185 CANADA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 CANADA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 187 MEXICO POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 MEXICO POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 189 MEXICO POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 190 MEXICO POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET

FIGURE 2 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: SEGMENTATION

FIGURE 14 ASIA PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 RISING APPLICATIONS OF POLYETHER ETHER KETONE (PEEK) IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 16 CARBON FILLED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET IN 2022 & 2029

FIGURE 17 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR POLYETHER ETHER KETONE (PEEK) MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET

FIGURE 19 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE, 2021

FIGURE 20 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY APPLICATION, 2021

FIGURE 21 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY END-USE, 2021

FIGURE 22 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 23 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY REGION (2021)

FIGURE 24 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY REGION (2022 & 2029)

FIGURE 25 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY REGION (2021 & 2029)

FIGURE 26 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022-2029)

FIGURE 27 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 28 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021)

FIGURE 29 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022-2029)

FIGURE 32 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 33 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021)

FIGURE 34 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 35 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 36 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022 & 2029)

FIGURE 37 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 38 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021)

FIGURE 39 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 40 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 41 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022-2029)

FIGURE 42 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 43 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021)

FIGURE 44 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022-2029)

FIGURE 47 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 48 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021)

FIGURE 49 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 50 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 51 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022-2029)

FIGURE 52 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY SHARE 2021 (%)

FIGURE 53 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY SHARE 2021 (%)

FIGURE 54 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY SHARE 2021 (%)

FIGURE 55 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.