Global Pharmaceutical Excipients Market

Taille du marché en milliards USD

TCAC :

%

USD

8.85 Billion

USD

14.77 Billion

2024

2032

USD

8.85 Billion

USD

14.77 Billion

2024

2032

| 2025 –2032 | |

| USD 8.85 Billion | |

| USD 14.77 Billion | |

|

|

|

|

Segmentation du marché mondial des excipients pharmaceutiques par fonctionnalité (liants et adhésifs, délitants, matériaux d'enrobage, colorants, solubilisants, arômes, édulcorants, diluants, lubrifiants, tampons, émulsifiants, conservateurs, antioxydants, sorbants, solvants, émollients, agents glissants, agents chélatants, antimousse, etc.), forme galénique (solide, semi-solide et liquide), voie d'administration (excipients oraux, excipients topiques, excipients parentéraux et autres excipients), utilisateur final (sociétés pharmaceutiques et biopharmaceutiques, formulateurs sous contrat, organismes de recherche et universitaires, etc.), canal de distribution (appel d'offres direct, vente au détail, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des excipients pharmaceutiques

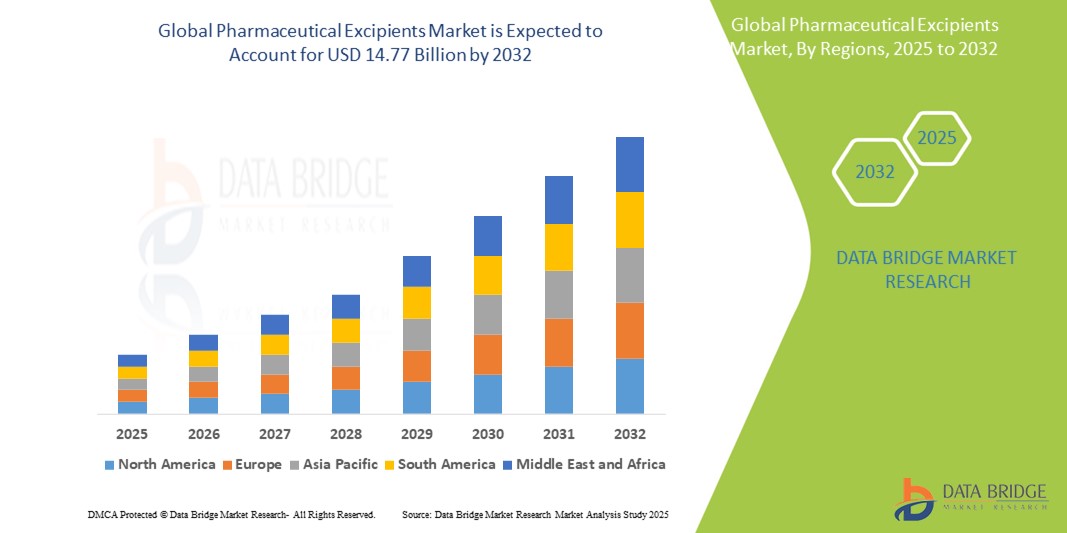

- La taille du marché mondial des excipients pharmaceutiques était évaluée à 8,85 milliards USD en 2024 et devrait atteindre 14,77 milliards USD d'ici 2032 , à un TCAC de 6,60 % au cours de la période de prévision.

- Cette croissance est tirée par des facteurs tels que l’expansion de l’industrie pharmaceutique, l’augmentation du développement de médicaments génériques et les progrès technologiques dans les systèmes d’administration de médicaments.

Analyse du marché des excipients pharmaceutiques

- Les excipients pharmaceutiques sont des substances non actives essentielles utilisées dans les formulations médicamenteuses pour améliorer la stabilité, la biodisponibilité et l'observance du traitement. Ils jouent un rôle crucial dans la fabrication des médicaments, servant de liants, de charges, d'enrobages et de stabilisants.

- La demande d'excipients pharmaceutiques est fortement stimulée par la prévalence croissante des maladies chroniques, l'augmentation de la production de médicaments génériques et les progrès des technologies d'administration de médicaments.

- L'Amérique du Nord domine le marché des excipients pharmaceutiques , avec une part de 39,8 % du marché mondial des excipients pharmaceutiques, grâce à ses capacités de fabrication pharmaceutique avancées, à ses dépenses de santé élevées et à la forte présence d'acteurs clés du marché.

- Le marché de l'Asie-Pacifique détient une part de 30,4 % du marché mondial des excipients pharmaceutiques, stimulé par l'expansion rapide de la fabrication pharmaceutique, l'augmentation des dépenses de santé et la demande croissante de formulations de médicaments rentables.

- Les liants et adhésifs devraient dominer le marché des excipients pharmaceutiques avec une part de marché de 56,72 % en 2023, grâce à leur rôle essentiel dans la formulation des comprimés et des gélules. Ces excipients assurent l'intégrité structurelle et l'homogénéité du contenu médicamenteux, favorisant ainsi des résultats thérapeutiques constants.

Portée du rapport et segmentation du marché des excipients pharmaceutiques

|

Attributs |

Informations clés sur le marché des excipients pharmaceutiques |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des excipients pharmaceutiques

« Innovations dans les excipients pharmaceutiques pour une administration avancée des médicaments »

- L'une des tendances marquantes du marché des excipients pharmaceutiques est l'accent croissant mis sur les excipients multifonctionnels qui prennent en charge les systèmes avancés d'administration de médicaments, notamment les formulations à libération contrôlée, à administration ciblée et à désintégration orale.

- Ces excipients innovants améliorent la stabilité des médicaments, la biodisponibilité et l'observance du traitement par les patients, jouant un rôle crucial dans la formulation de médicaments complexes, de produits biologiques et de médicaments personnalisés.

- For instance, excipients such as cyclodextrins improve solubility and stability for poorly water-soluble drugs, while lipid-based excipients support the delivery of highly lipophilic compounds, facilitating efficient absorption and therapeutic impact

- These advancements are transforming drug development, enabling pharmaceutical companies to overcome formulation challenges, enhance therapeutic outcomes, and drive the demand for novel, high-performance excipients

Pharmaceutical Excipients Market Dynamics

Driver

“Rising Demand for Innovative Drug Delivery Systems”

- The growing focus on patient-centric therapies and personalized medicine is significantly driving the demand for advanced pharmaceutical excipients that support innovative drug delivery systems, such as controlled-release, targeted delivery, and orally disintegrating tablets

- As pharmaceutical companies strive to improve therapeutic outcomes and patient compliance, the need for excipients that can enhance bioavailability, stability, and solubility of active pharmaceutical ingredients (APIs) is rising

- In addition, the trend toward biologics and complex drug formulations, which often require specialized excipients, is further fueling market growth

For instance,

- According to a 2024 report by the Pharmaceutical Research and Manufacturers of America (PhRMA), the number of biologic drugs in development has more than doubled in the past decade, creating a substantial demand for novel excipients that can address the unique challenges of biologic formulations

- As the pharmaceutical industry continues to innovate, the demand for advanced excipients that can support these cutting-edge therapies is expected to grow significantly

Opportunity

“Expansion into Emerging Markets with Rapid Pharmaceutical Growth”

- Emerging economies, particularly in the Asia-Pacific and Latin American regions, present a significant opportunity for pharmaceutical excipient manufacturers, driven by rapid economic growth, increasing healthcare spending, and expanding pharmaceutical manufacturing capabilities

- These regions are experiencing a surge in demand for cost-effective generic drugs, over-the-counter (OTC) medications, and biologics, creating a favorable market for excipients that can support diverse formulation needs

- In addition, favorable government policies, rising health awareness, and growing investments in local pharmaceutical manufacturing are expected to further boost excipient demand

For instance,

- In January 2025, according to a report by the Indian Pharmaceutical Alliance, India is projected to become the world’s third-largest pharmaceutical market by 2030, driven by strong domestic demand and expanding export opportunities. This growth will significantly increase the demand for pharmaceutical excipients required for drug formulation and manufacturing

- As a result, excipient manufacturers that strategically expand into these fast-growing markets stand to benefit from increased sales and market share

Restraint/Challenge

“Stringent Regulatory Requirements and High Compliance Costs”

- The pharmaceutical excipients market faces significant challenges related to stringent regulatory requirements that govern the safety, quality, and performance of excipients used in drug formulations

- These regulations, which vary significantly across regions, often require extensive testing, documentation, and validation, increasing the overall cost and time required for product development and commercialization

- In addition, the need for compliance with Good Manufacturing Practices (GMP), pharmacopoeial standards, and other quality certifications adds to the financial burden for excipient manufacturers

For instance,

- According to a 2024 report by the International Pharmaceutical Excipients Council (IPEC), the cost of regulatory compliance for excipient manufacturers has increased by over 30% in the past five years, as regulatory agencies globally tighten their oversight to ensure patient safety and product efficacy

- These regulatory pressures can limit market entry for smaller players and increase the overall cost of excipient production, impacting profitability and market growth

Pharmaceutical Excipients Market Scope

The market is segmented on the basis of functionality, dosage form, route of administration, end user and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Functionality |

|

|

By Dosage Form |

|

|

By Route of Administration |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the binders and adhesives is projected to dominate the market with a largest share in functionality segment

The binders and adhesives segment is expected to dominate the pharmaceutical excipients market with the largest share of 56.72%, driven by their critical role in tablet and capsule formulations. These excipients provide structural integrity and ensure uniformity in drug content, supporting consistent therapeutic outcomes. Their widespread use is further propelled by the high demand for solid oral dosage forms, which are preferred for their convenience, stability, and patient compliance, reinforcing their market dominance.

The oral excipients is expected to account for the largest share during the forecast period in route of administration market

In 2025, the oral excipients segment dominated the pharmaceutical excipients market with the largest market share of 55.49%, driven by its widespread use and patient preference for oral drug delivery. These formulations are favoured due to their ease of administration, cost-effectiveness, and high patient compliance. Excipients in this category are essential for enhancing the bioavailability, stability, and taste of oral medications, reinforcing their market dominance.

Pharmaceutical Excipients Market Regional Analysis

“North America Holds the Largest Share in the Pharmaceutical Excipients Market”

- North America dominates the pharmaceutical excipients market, with share of 39.8% of the global pharmaceutical excipients market driven by its advanced pharmaceutical manufacturing capabilities, high healthcare expenditure, and strong presence of key market players

- U.S. holds a significant share of 39% due to its well-established pharmaceutical industry, extensive research and development activities, and growing demand for innovative drug delivery systems, including controlled-release and targeted formulations

- In addition, the presence of major pharmaceutical companies and stringent regulatory standards for drug safety and efficacy further strengthen the market in the region

- The increasing focus on biologics, personalized medicine, and specialty drugs also contributes to the high demand for high-quality excipients, reinforcing North America's leadership in the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Pharmaceutical Excipients Market”

- Asia-Pacific is expected to witness the highest growth rate in the pharmaceutical excipients Market with a market share of share of 30.4%, driven by rapid expansion in pharmaceutical manufacturing, rising healthcare expenditures, and growing demand for cost-effective drug formulations

- Countries such as China, India, and Japan are emerging as key markets, supported by favorable government policies, a large patient population, and increasing prevalence of chronic diseases requiring long-term medication

- Japan, known for its cutting-edge pharmaceutical research and advanced drug manufacturing technologies, remains a crucial market for premium excipients that support innovative drug formulations

- India is projected to register the highest growth in market share with CAGR of 5.1%, driven by the rapid growth of its generic drug industry, expanding healthcare infrastructure, and increasing investments in pharmaceutical R&D, making it a key player in the global excipients market

Pharmaceutical Excipients Market Share

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- Kerry Group plc (Irlande)

- DFE Pharma (Allemagne)

- Cargill, Incorporated (États-Unis)

- Pfanstiehl Inc. (États-Unis)

- Colorcon Inc. (États-Unis)

- MEGGLE Group GmbH (Allemagne)

- Omya International AG (Suisse)

- Peter Greven GmbH & Co. KG (Allemagne)

- Ashland (États-Unis)

- Evonik Industries AG (Allemagne)

- Dow (États-Unis)

- Croda International Plc (Royaume-Uni)

- Roquette Frères (France)

- La société Lubrizol (États-Unis)

- BASF (Allemagne)

- Avantor, Inc. (États-Unis)

- BENEO GmbH (Allemagne)

- Chemie Trade (Inde)

Derniers développements sur le marché mondial des excipients pharmaceutiques

- En novembre 2024, Clariant a présenté huit nouveaux excipients pharmaceutiques hautement performants lors du salon CPHI India 2024. Ces excipients sont conçus pour soutenir le développement de médicaments sûrs et efficaces, destinés à des applications telles que les principes actifs sensibles, les formulations parentérales et celles nécessitant des solutions incolores.

- En janvier 2025, Roquette a lancé trois nouvelles qualités d'excipients spécifiquement conçues pour les principes actifs pharmaceutiques sensibles à l'humidité (API), améliorant la stabilité et l'efficacité des formulations difficiles.

- En janvier 2025, Evonik a élargi son portefeuille d'excipients pharmaceutiques à base de lipides grâce à des acquisitions stratégiques, répondant à la demande croissante de nouveaux systèmes d'administration de médicaments et d'excipients de haute qualité qui améliorent la biodisponibilité et la stabilité.

- En janvier 2025, Akums Drugs and Pharmaceuticals a annoncé le développement d'une nouvelle installation dédiée à la fabrication de dosages lyophilisés et stériles, en se concentrant sur les produits injectables et biologiques, pour répondre à la demande croissante de médicaments stériles et biologiques.

- En septembre 2024, Glenmark Pharmaceuticals a lancé une variante biosimilaire du médicament antidiabétique Liraglutide, marquant une initiative pionnière dans le paysage pharmaceutique indien et élargissant son portefeuille de produits biologiques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.