Global Natural Fibers Market

Taille du marché en milliards USD

TCAC :

%

USD

60.42 Billion

USD

108.57 Billion

2024

2032

USD

60.42 Billion

USD

108.57 Billion

2024

2032

| 2025 –2032 | |

| USD 60.42 Billion | |

| USD 108.57 Billion | |

|

|

|

|

Segmentation du marché mondial des fibres naturelles, par fibres (coton, laine, lin, soie, jute, chanvre, sisal, kénaf et autres), canal de distribution (fabricants, distributeurs, grossistes, détaillants et autres), application (mode et habillement, ameublement et maison, et industrie et technique) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des fibres naturelles

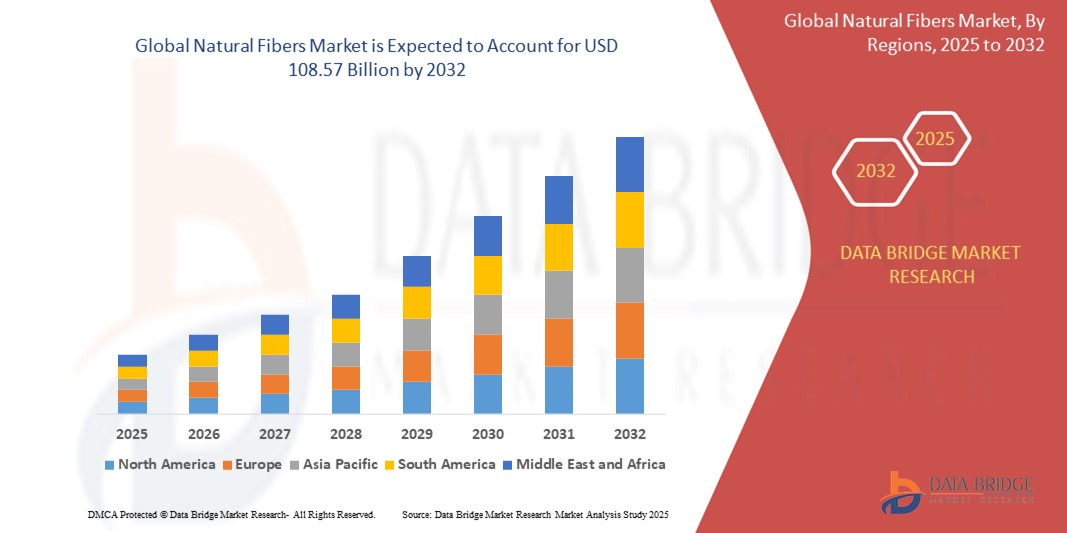

- La taille du marché mondial des fibres naturelles était évaluée à 60,42 milliards USD en 2024 et devrait atteindre 108,57 milliards USD d'ici 2032 , à un TCAC de 7,60 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante d'alternatives écologiques et biodégradables aux fibres synthétiques dans des secteurs tels que le textile, l'automobile, la construction et l'emballage.

- La sensibilisation croissante des consommateurs à la durabilité, ainsi que les pressions réglementaires visant à réduire l’empreinte plastique et carbone, accélèrent encore l’adoption des fibres naturelles dans les économies développées et émergentes.

Analyse du marché des fibres naturelles

- Le marché connaît une évolution vers des matériaux durables tels que le coton, le lin, le jute, le chanvre, la fibre de coco et le sisal, qui offrent un impact environnemental moindre et des applications polyvalentes.

- Les industries intègrent de plus en plus de fibres naturelles dans les composites et les textiles pour répondre aux normes de certification écologique et attirer les consommateurs soucieux de l'environnement.

- L'Asie-Pacifique a dominé le marché des fibres naturelles avec la plus grande part de revenus de 38,74 % en 2024, grâce à une forte présence de sources de matières premières, de faibles coûts de main-d'œuvre et une demande croissante des industries du textile et de l'emballage.

- L'Amérique du Nord devrait connaître le taux de croissance le plus élevé sur le marché mondial des fibres naturelles, grâce à la sensibilisation croissante des consommateurs aux matériaux durables et biodégradables, ainsi qu'à la demande croissante de produits respectueux de l'environnement dans les secteurs de la mode, de l'automobile et de la construction.

- Le segment du coton a dominé le marché avec une part de chiffre d'affaires de 34,5 % en 2024, grâce à son utilisation généralisée dans l'industrie textile et de l'habillement, grâce à son confort, sa respirabilité et sa forte acceptation par les consommateurs. La biodégradabilité du coton et sa compatibilité avec les pratiques de l'agriculture biologique ont également renforcé son attrait face aux préoccupations croissantes en matière de développement durable. Les fabricants privilégient de plus en plus le coton biologique pour répondre aux exigences des écolabels et à la demande des consommateurs en matière d'approvisionnement éthique.

Portée du rapport et segmentation du marché des fibres naturelles

|

Attributs |

Informations clés sur le marché des fibres naturelles |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des fibres naturelles

« Intégration croissante des fibres naturelles dans les composites automobiles »

- Les fibres naturelles telles que le jute, le lin et le kénaf sont de plus en plus utilisées dans les intérieurs de véhicules, notamment les panneaux de porte et les tableaux de bord.

- Les constructeurs automobiles préfèrent les fibres naturelles pour leur légèreté, ce qui contribue à améliorer l'efficacité énergétique

- La pression réglementaire en Europe favorise les matériaux biosourcés et recyclables dans la production automobile

- Les composites en fibres naturelles offrent un impact environnemental inférieur à celui des matériaux synthétiques traditionnels

- Les investissements des constructeurs automobiles dans les matériaux durables stimulent l'adoption des fibres naturelles

- Par exemple, BMW utilise de la fibre de kénaf dans les panneaux de porte de sa voiture électrique i3 pour réduire le poids et améliorer la durabilité.

Dynamique du marché des fibres naturelles

Conducteur

« Demande croissante de matériaux durables et biodégradables »

- Les préoccupations environnementales entraînent une évolution mondiale vers des matériaux biodégradables et renouvelables

- Les consommateurs privilégient de plus en plus les alternatives écologiques en matière de textiles, d’emballages et d’ameublement

- Les interdictions gouvernementales sur les plastiques et les matériaux non biodégradables favorisent l’adoption des fibres naturelles

- Les fibres naturelles réduisent la charge d’enfouissement et les émissions de carbone par rapport à leurs homologues synthétiques

- Les marques intègrent des fibres biologiques pour atteindre leurs objectifs de durabilité et attirer les acheteurs conscients

- Par exemple, Levi's a lancé des collections utilisant du chanvre et du coton biologique pour soutenir ses initiatives positives pour le climat.

Retenue/Défi

« Problèmes de qualité incohérente et de chaîne d'approvisionnement »

- Les fibres naturelles varient souvent en texture, en résistance et en durabilité en raison des conditions agricoles et météorologiques

- La disponibilité saisonnière entraîne un approvisionnement imprévisible, ce qui a un impact sur les applications à grande échelle

- Une mauvaise infrastructure de stockage et de transport peut entraîner la détérioration et la dégradation des fibres.

- Les fabricants ont du mal à standardiser la qualité des fibres pour les applications hautes performances

- La volatilité des coûts due à des rendements irréguliers entrave la planification et l'approvisionnement à long terme

- Par exemple, le secteur de la construction a limité son utilisation du jute dans les composites structurels en raison de la résistance à la traction variable selon les lots.

Portée du marché des fibres naturelles

Le marché est segmenté en fonction des fibres, du canal de distribution et de l’application.

• Par fibres

En termes de fibres, le marché des fibres naturelles est segmenté en coton, laine, lin, soie, jute, chanvre, sisal, kénaf, etc. Le coton a dominé le marché avec une part de chiffre d'affaires de 34,5 % en 2024, grâce à son utilisation généralisée dans l'industrie textile et de l'habillement, en raison de son confort, de sa respirabilité et de sa forte acceptation par les consommateurs. La biodégradabilité du coton et sa compatibilité avec les pratiques de l'agriculture biologique ont également renforcé son attrait face aux préoccupations croissantes en matière de développement durable. Les fabricants privilégient de plus en plus le coton biologique pour répondre aux exigences des écolabels et à la demande des consommateurs en matière d'approvisionnement éthique.

Le segment du chanvre devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à son cycle de culture rapide, sa faible empreinte environnementale et son utilisation croissante dans les applications textiles et industrielles. La résistance et la durabilité du chanvre, combinées à son faible recours aux pesticides, suscitent l'intérêt des secteurs de la mode, de l'automobile et de la construction, notamment en Europe et en Amérique du Nord.

• Par canal de distribution

En fonction du canal de distribution, le marché des fibres naturelles est segmenté entre fabricants, distributeurs, grossistes, détaillants, etc. En 2024, le segment des fabricants détenait la plus grande part de chiffre d'affaires, soutenu par le nombre croissant d'entreprises verticalement intégrées qui privilégient l'approvisionnement durable et la transformation en interne pour garantir la qualité et la traçabilité. L'engagement direct avec les producteurs de fibres permet également aux fabricants de réduire les coûts et d'adapter les caractéristiques des fibres aux exigences de l'utilisateur final.

Le segment des détaillants devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par l'intérêt croissant des consommateurs pour les produits écologiques et le développement des plateformes de vente au détail spécialisées et de commerce électronique. Les détaillants capitalisent sur la demande croissante de vêtements, de décoration intérieure et d'articles de style de vie durables en proposant des alternatives à base de fibres naturelles et en mettant en avant leurs avantages environnementaux par le biais de leur image de marque et de certifications.

• Sur demande

En fonction de leurs applications, le marché des fibres naturelles est segmenté en mode et habillement, ameublement et maison, et industrie et technique. Ce segment a représenté la plus grande part de chiffre d'affaires en 2024, grâce à la préférence croissante des consommateurs pour les tissus respirants et doux pour la peau, et à la forte demande de mode durable. Les fibres naturelles telles que le coton, la laine et la soie sont de plus en plus adoptées par les marques de mode internationales qui cherchent à réduire leur empreinte environnementale.

Le secteur industriel et technique devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à l'utilisation croissante de fibres telles que le lin, le kénaf et le chanvre dans les secteurs de l'automobile, de l'emballage et de la construction. Ces fibres sont intégrées aux biocomposites et aux matériaux isolants, offrant des solutions durables et légères, tout en respectant les normes réglementaires et de développement durable.

Analyse régionale du marché des fibres naturelles

- L'Asie-Pacifique a dominé le marché des fibres naturelles avec la plus grande part de revenus de 38,74 % en 2024, grâce à une forte présence de sources de matières premières, de faibles coûts de main-d'œuvre et une demande croissante des industries du textile et de l'emballage.

- Les pays de la région bénéficient de secteurs agricoles établis du coton et du jute, ainsi que d'une base industrielle en croissance rapide qui utilise le chanvre et le kénaf pour des applications techniques

- Les incitations gouvernementales favorisant l’utilisation de matériaux biodégradables et respectueux de l’environnement accélèrent encore l’adoption des fibres naturelles dans des pays comme l’Inde, la Chine et le Bangladesh.

Aperçu du marché chinois des fibres naturelles

En 2024, le marché chinois des fibres naturelles représentait la plus grande part de chiffre d'affaires de la région Asie-Pacifique, grâce à sa solide base de production de coton, de chanvre et de soie, ainsi qu'à son leadership dans la fabrication textile mondiale. Les vastes capacités de la chaîne d'approvisionnement chinoise, combinées aux initiatives gouvernementales en faveur de l'agriculture durable et des matériaux biodégradables, favorisent l'utilisation des fibres naturelles dans l'habillement, l'ameublement et les applications industrielles. Les marques et les exportateurs nationaux intègrent de plus en plus de matériaux respectueux de l'environnement afin de répondre aux normes réglementaires mondiales et aux attentes des consommateurs, notamment sur les marchés nord-américain et européen.

Aperçu du marché japonais des fibres naturelles

Le marché japonais des fibres naturelles devrait connaître une croissance soutenue au cours de la période de prévision, soutenu par la préférence croissante des consommateurs pour des matériaux de haute qualité, naturels et respectueux de l'environnement dans la mode et les articles pour la maison. La longue tradition japonaise d'utilisation de la soie et du coton, associée à l'innovation moderne en matière de mélange et de finition des textiles, encourage l'adoption de fibres naturelles dans les segments de l'habillement haut de gamme et de l'art de vivre. De plus, l'accent mis par le pays sur l'architecture durable et les emballages écologiques stimule la demande de composites et de matériaux à base de fibres naturelles pour des applications industrielles de niche.

Aperçu du marché des fibres naturelles en Amérique du Nord

Le marché nord-américain des fibres naturelles devrait connaître sa plus forte croissance entre 2025 et 2032, soutenu par une sensibilisation croissante des consommateurs à l'impact environnemental, une transition vers les textiles biologiques et une demande croissante dans les secteurs de l'ameublement et de l'emballage. Aux États-Unis, les grandes marques intègrent des fibres naturelles comme le coton et la laine biologiques à leurs gammes de produits afin d'atteindre leurs objectifs de développement durable et de satisfaire les consommateurs soucieux de l'environnement.

Aperçu du marché américain des fibres naturelles

Le marché américain des fibres naturelles devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à l'intérêt croissant pour des modes de vie durables, au développement de la culture du coton biologique et aux avancées technologiques dans le traitement des fibres. Les industries de la mode, de l'ameublement et de l'automobile se tournent de plus en plus vers les fibres naturelles pour des applications allant du rembourrage aux biocomposites. La présence de grandes marques de vêtements et une solide infrastructure de vente au détail contribuent également à la croissance du marché, notamment via les circuits de vente écologiques, en ligne et hors ligne.

Aperçu du marché européen des fibres naturelles

L'Europe devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, porté par une réglementation environnementale stricte, la préférence des consommateurs pour les produits durables et l'intégration des fibres naturelles dans les applications industrielles. Les politiques de l'Union européenne en faveur des pratiques d'économie circulaire encouragent l'utilisation du lin, du chanvre et de la laine dans les secteurs de la mode, de l'automobile et de la construction. La France, l'Allemagne et le Royaume-Uni sont à la pointe de l'innovation et de l'adoption dans la région.

Aperçu du marché allemand des fibres naturelles

L'Allemagne devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, grâce à la vigueur de ses secteurs textile et automobile, qui adoptent activement les fibres naturelles comme le lin et le chanvre dans les intérieurs et les composants techniques. L'accent mis par le pays sur un mode de vie éco-responsable et une construction éco-énergétique crée également un environnement favorable à l'utilisation de solutions d'isolation et d'emballage biodégradables à base de fibres naturelles.

Aperçu du marché britannique des fibres naturelles

Le marché britannique des fibres naturelles devrait connaître sa plus forte croissance entre 2025 et 2032, porté par la demande croissante de vêtements issus de sources éthiques, les objectifs gouvernementaux de développement durable et la popularité croissante des matériaux naturels pour la décoration et l'ameublement. La présence de chaînes de distribution responsables et de marques de mode promouvant des « collections vertes » stimule l'intérêt des consommateurs, tandis que les innovations dans le domaine des textiles d'origine végétale attirent également les investissements en recherche et développement.

Part de marché des fibres naturelles

L'industrie des fibres naturelles est principalement dirigée par des entreprises bien établies, notamment :

- Vardhman Textiles Limited (Inde)

- Grasim Industries Limited (Inde)

- ANANDHI TEXTYLES (Inde)

- Bcomp (Suisse)

- The Natural Fibre Company (Royaume-Uni)

- Procotex (Belgique)

- FlexForm Technologies (États-Unis)

- Bast Fibre Technologies Inc. (Canada)

- Lenzing AG (Autriche)

- Fibres naturelles Barnhardt (États-Unis)

Derniers développements sur le marché mondial des fibres naturelles

- En octobre 2022, Bast Fibre Technologies Inc. a conclu un accord de financement stratégique avec Ahlstrom Capital Group, aux termes duquel Ahlstrom a acquis une participation de 20 % dans Bast. Cet investissement vise à accélérer l'expansion des activités de production de fibres de Bast, à améliorer ses capacités de fabrication et à consolider sa position sur le marché des fibres naturelles.

- En février 2022, Bast Fibre Technologies Inc. a finalisé l'acquisition de Lumberton Cellulose auprès de Georgia-Pacific, rebaptisant l'usine BFT Lumberton. Cette acquisition devrait porter la capacité de production annuelle de l'entreprise à plus de 30 000 tonnes, la positionnant comme un pôle clé de transformation des fibres naturelles en Amérique du Nord et renforçant la résilience de sa chaîne d'approvisionnement.

- En janvier 2022, Reality Paskov sro a fusionné avec Lenzing Biocel Paskov as, toutes deux basées en République tchèque. Cette consolidation vise à rationaliser les opérations et à soutenir la croissance future, permettant ainsi à Lenzing de mieux répondre à la demande croissante de fibres naturelles et durables sur les marchés mondiaux.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL NATURAL FIBERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 TYPE LIFELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 IMPORT-EXPORT ANALYSIS

4.4 SUPPLY CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING APPLICATION OF NATURAL FIBERS IN FASHION INDUSTRY

5.1.2 EXTENDED APPLICATION OF NATURAL FIBERS IN THE AUTOMOTIVE INDUSTRY

5.1.3 ADVANCEMENT IN THE APPLICATION OF NATURAL FIBERS IN THE PACKAGING INDUSTRY

5.1.4 TECHNOLOGICAL ADVANCEMENTS IN NATURAL FIBER PROCESSING

5.2 RESTRAINTS

5.2.1 REGIONAL CROP VARIABILITY

5.2.2 LIMITATIONS ASSOCIATED WITH NATURAL FIBERS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR SILK

5.3.2 RISING SUSTAINABLE AGRICULTURE INITIATIVES

5.3.3 GROWING E-COMMERCE AND DIRECT-TO-CONSUMER MODELS

5.4 CHALLENGES

5.4.1 PRESENCE OF ALTERNATIVES SUCH AS SYNTHETIC POLYESTERS

5.4.2 INCREASING AWARENESS REGARDING VEGANISM CAN AFFECT THE ANIMAL DERIVED FIBERS

6 GLOBAL NATURAL FIBERS MARKET, BY FIBERS

6.1 OVERVIEW

6.2 COTTON

6.3 JUTE

6.4 FLAX

6.5 HEMP

6.6 WOOL

6.7 SILK

6.8 SISAL

6.9 KENAF

6.1 OTHERS

7 GLOBAL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL

7.1 OVERVIEW

7.2 MANUFACTURERS

7.3 DISTRIBUTORS

7.4 WHOLESALERS

7.5 RETAILERS

7.6 OTHERS

8 GLOBAL NATURAL FIBERS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 INDUSTRIAL & TECHNICAL

8.2.1 AUTOMOTIVE TEXTILES

8.2.1.1 CHAIR CUSHIONS

8.2.1.2 HEADLINERS

8.2.1.3 CAR COVERS

8.2.1.4 OTHERS

8.2.2 SMART TEXTILES

8.2.3 ROPES AND NETTINGS

8.2.4 MEDICAL TEXTILES

8.2.5 SUN BLINDS

8.2.6 OTHERS

8.3 FURNISHING & HOME

8.3.1 BED LINEN

8.3.2 CARPETS

8.3.3 CURTAINS

8.3.4 UPHOLSTERY

8.3.5 OTHERS

8.4 FASHION & CLOTHING

8.4.1 SUITS

8.4.2 COAT

8.4.3 DRESSES

8.4.4 SHIRTS

8.4.5 OTHERS

9 GLOBAL NATURAL FIBERS MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 INDIA

9.2.3 HONG KONG

9.2.4 AUSTRALIA

9.2.5 JAPAN

9.2.6 THAILAND

9.2.7 INDONESIA

9.2.8 SINGAPORE

9.2.9 MALAYSIA

9.2.10 TAIWAN

9.2.11 SOUTH KOREA

9.2.12 PHILIPPINES

9.2.13 REST OF ASIA-PACIFIC

9.3 NORTH AMERICA

9.3.1 U.S.

9.3.2 MEXICO

9.3.3 CANADA

9.4 EUROPE

9.4.1 GERMANY

9.4.2 ITALY

9.4.3 U.K.

9.4.4 FRANCE

9.4.5 SPAIN

9.4.6 RUSSIA

9.4.7 BELGIUM

9.4.8 NETHERLANDS

9.4.9 TURKEY

9.4.10 SWITZERLAND

9.4.11 REST OF EUROPE

9.5 SOUTH AMERICA

9.5.1 BRAZIL

9.5.2 ARGENTINA

9.5.3 REST OF SOUTH AMERICA

9.6 MIDDLE EAST AND AFRICA

9.6.1 SOUTH AFRICA

9.6.2 EGYPT

9.6.3 SAUDI ARABIA

9.6.4 U.A.E

9.6.5 ISRAEL

9.6.6 REST OF AFRICA

10 GLOBAL NATURAL FIBERS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

11 NORTH AMERICA NATURAL FIBERS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 EUROPE NATURAL FIBERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 ASIA-PACIFIC NATURAL FIBERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 LENZING AG

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 GRASIM INDUSTRIES LIMITED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 VARDHMAN TEXTILES LIMITED

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 BCOMP

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 BARNHARDT NATURAL FIBERS

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ANANDHI TEXSTYLES

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BAST FIBRE TECHNOLOGIES INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT (PRESS RELEASE)

15.8 FLEXFORM TECHNOLOGIES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 PROCOTEX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 THE NATURAL FIBRE COMPANY

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF WORLD AND TOP 10 COUNTRIES (2022) FOR " FLAX YARN "; HS CODE OF PRODUCT: 5306

TABLE 2 EXPORT DATA OF WORLD AND TOP 10 COUNTRIES (2022) FOR " FLAX YARN "; HS CODE OF PRODUCT: 5306

TABLE 3 GLOBAL NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 4 GLOBAL COTTON IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 5 GLOBAL JUTE IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 GLOBAL FLAX IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 GLOBAL HEMP IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 GLOBAL WOOL IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 9 GLOBAL SILK IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 GLOBAL SISAL IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 GLOBAL KENAF IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 GLOBAL OTHERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 GLOBAL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 14 GLOBAL MANUFACTURERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 15 GLOBAL DISTRIBUTORS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 GLOBAL WHOLESALERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 17 GLOBAL RETAILERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 18 GLOBAL OTHERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 19 GLOBAL NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 20 GLOBAL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 GLOBAL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 22 GLOBAL AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 23 GLOBAL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 24 GLOBAL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 25 GLOBAL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 26 GLOBAL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 27 GLOBAL NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 28 ASIA-PACIFIC NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 29 ASIA-PACIFIC NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 30 ASIA-PACIFIC NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 31 ASIA-PACIFIC NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 32 ASIA-PACIFIC INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 33 ASIA-PACIFIC AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 34 ASIA-PACIFIC FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 35 ASIA-PACIFIC FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 36 CHINA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 37 CHINA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 38 CHINA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 39 CHINA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 40 CHINA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 41 CHINA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 42 CHINA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 43 INDIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 44 INDIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 45 INDIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 46 INDIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 47 INDIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 48 INDIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 49 INDIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 50 HONG KONG NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 51 HONG KONG NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 52 HONG KONG NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 53 HONG KONG INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 54 HONG KONG AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 55 HONG KONG FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 56 HONG KONG FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 57 AUSTRALIA AND NEW ZEALAND NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 58 AUSTRALIA AND NEW ZEALAND NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 59 AUSTRALIA AND NEW ZEALAND NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 60 AUSTRALIA AND NEW ZEALAND INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 61 AUSTRALIA AND NEW ZEALAND AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 62 AUSTRALIA AND NEW ZEALAND FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 63 AUSTRALIA AND NEW ZEALAND FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 64 JAPAN NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 65 JAPAN NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 66 JAPAN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 67 JAPAN INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 68 JAPAN AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 69 JAPAN FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 70 JAPAN FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 71 THAILAND NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 72 THAILAND NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 73 THAILAND NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 74 THAILAND INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 75 THAILAND AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 76 THAILAND FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 77 THAILAND FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 78 INDONESIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 79 INDONESIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 80 INDONESIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 81 INDONESIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 82 INDONESIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 83 INDONESIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 84 INDONESIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 85 SINGAPORE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 86 SINGAPORE NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 87 SINGAPORE NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 88 SINGAPORE INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 89 SINGAPORE AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 90 SINGAPORE FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 91 SINGAPORE FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 92 MALAYSIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 93 MALAYSIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 94 MALAYSIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 95 MALAYSIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 96 MALAYSIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 97 MALAYSIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 98 MALAYSIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 99 TAIWAN NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 100 TAIWAN NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 101 TAIWAN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 102 TAIWAN INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 103 TAIWAN AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 104 TAIWAN FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 105 TAIWAN FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 106 SOUTH KOREA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 107 SOUTH KOREA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 108 SOUTH KOREA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 109 SOUTH KOREA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 110 SOUTH KOREA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 111 SOUTH KOREA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 112 SOUTH KOREA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 113 PHILIPPINES NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 114 PHILIPPINES NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 115 PHILIPPINES NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 116 PHILIPPINES INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 117 PHILIPPINES AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 118 PHILIPPINES FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 119 PHILIPPINES FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 120 REST OF ASIA-PACIFIC NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 121 NORTH AMERICA NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 122 NORTH AMERICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 123 NORTH AMERICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 124 NORTH AMERICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 125 NORTH AMERICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 126 NORTH AMERICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 127 NORTH AMERICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 128 NORTH AMERICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 129 U.S. NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 130 U.S. NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 131 U.S. NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 132 U.S. INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 133 U.S. AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 134 U.S. FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 135 U.S. FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 136 MEXICO NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 137 MEXICO NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 138 MEXICO NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 139 MEXICO INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 140 MEXICO AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 141 MEXICO FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 142 MEXICO FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 143 CANADA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 144 CANADA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 145 CANADA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 146 CANADA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 147 CANADA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 148 CANADA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 149 CANADA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 150 EUROPE NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 151 EUROPE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 152 EUROPE NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 153 EUROPE NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 154 EUROPE INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 155 EUROPE AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 156 EUROPE FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 157 EUROPE FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 158 GERMANY NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 159 GERMANY NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 160 GERMANY NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 161 GERMANY INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 162 GERMANY AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 163 GERMANY FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 164 GERMANY FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 165 ITALY NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 166 ITALY NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 167 ITALY NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 168 ITALY INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 169 ITALY AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 170 ITALY FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 171 ITALY FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 172 U.K. NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 173 U.K. NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 174 U.K. NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 175 U.K. INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 176 U.K. AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 177 U.K. FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 178 U.K. FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 179 FRANCE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 180 FRANCE NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 181 FRANCE NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 182 FRANCE INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 183 FRANCE AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 184 FRANCE FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 185 FRANCE FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 186 SPAIN NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 187 SPAIN NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 188 SPAIN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 189 SPAIN INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 190 SPAIN AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 191 SPAIN FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 192 SPAIN FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 193 RUSSIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 194 RUSSIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 195 RUSSIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 196 RUSSIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 197 RUSSIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 198 RUSSIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 199 RUSSIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 200 BELGIUM NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 201 BELGIUM NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 202 BELGIUM NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 203 BELGIUM INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 204 BELGIUM AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 205 BELGIUM FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 206 BELGIUM FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 207 NETHERLANDS NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 208 NETHERLANDS NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 209 NETHERLANDS NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 210 NETHERLANDS INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 211 NETHERLANDS AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 212 NETHERLANDS FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 213 NETHERLANDS FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 214 TURKEY NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 215 TURKEY NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 216 TURKEY NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 217 TURKEY INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 218 TURKEY AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 219 TURKEY FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 220 TURKEY FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 221 SWITZERLAND NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 222 SWITZERLAND NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 223 SWITZERLAND NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 224 SWITZERLAND INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 225 SWITZERLAND AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 226 SWITZERLAND FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 227 SWITZERLAND FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 228 REST OF EUROPE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 229 SOUTH AMERICA NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 230 SOUTH AMERICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 231 SOUTH AMERICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 232 SOUTH AMERICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 233 SOUTH AMERICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 234 SOUTH AMERICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 235 SOUTH AMERICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 236 SOUTH AMERICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 237 BRAZIL NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 238 BRAZIL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 239 BRAZIL NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 240 BRAZIL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 241 BRAZIL AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 242 BRAZIL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 243 BRAZIL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 244 ARGENTINA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 245 ARGENTINA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 246 ARGENTINA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 247 ARGENTINA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 248 ARGENTINA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 249 ARGENTINA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 250 ARGENTINA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 251 REST OF SOUTH AMERICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 252 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 253 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 254 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 255 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 256 MIDDLE EAST AND AFRICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 257 MIDDLE EAST AND AFRICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 258 MIDDLE EAST AND AFRICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 259 MIDDLE EAST AND AFRICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 260 SOUTH AFRICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 261 SOUTH AFRICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 262 SOUTH AFRICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 263 SOUTH AFRICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 264 SOUTH AFRICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 265 SOUTH AFRICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 266 SOUTH AFRICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 267 EGYPT NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 268 EGYPT NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 269 EGYPT NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 270 EGYPT INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 271 EGYPT AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 272 EGYPT FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 273 EGYPT FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 274 SAUDI ARABIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 275 SAUDI ARABIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 276 SAUDI ARABIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 277 SAUDI ARABIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 278 SAUDI ARABIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 279 SAUDI ARABIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 280 SAUDI ARABIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 281 U.A.E. NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 282 U.A.E. NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 283 U.A.E. NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 284 U.A.E. INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 285 U.A.E. AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 286 U.A.E. FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 287 U.A.E. FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 288 ISRAEL NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 289 ISRAEL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 290 ISRAEL NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 291 ISRAEL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 292 ISRAEL AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 293 ISRAEL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 294 ISRAEL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 295 REST OF MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

Liste des figures

FIGURE 1 GLOBAL NATURAL FIBERS MARKET: SEGMENTATION

FIGURE 2 GLOBAL NATURAL FIBERS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL NATURAL FIBERS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL NATURAL FIBERS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL NATURAL FIBERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL NATURAL FIBERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL NATURAL FIBERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL NATURAL FIBERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 GLOBAL NATURAL FIBERS MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE GLOBAL NATURAL FIBERS MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 11 EXTENDED APPLICATION OF NATURAL FIBERS IN AUTOMOTIVE INDUSTRY IS DRIVING THE GROWTH OF THE GLOBAL NATURAL FIBERS MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 12 COTTON SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL NATURAL FIBERS MARKET IN 2024 & 2031

FIGURE 13 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR NATURAL FIBERS MANUFACTURERS IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 14 SUPPLY CHAIN ANALYSIS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL NATURAL FIBERS MARKET

FIGURE 16 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, 2023

FIGURE 17 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, 2024-2031 (USD MILLION)

FIGURE 18 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, CAGR (2024-2031)

FIGURE 19 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, LIFELINE CURVE

FIGURE 20 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 21 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 22 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 23 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 24 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, 2023

FIGURE 25 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, 2024-2031 (USD MILLION)

FIGURE 26 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, CAGR (2024-2031)

FIGURE 27 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 GLOBAL NATURAL FIBERS MARKET: SNAPSHOT (2023)

FIGURE 29 GLOBAL NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 30 NORTH AMERICA NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 31 EUROPE NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 32 AISA-PACIFIC NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.