Global Maltitol In Chocolate Market

Taille du marché en milliards USD

TCAC :

%

USD

178.26 Billion

USD

288.44 Billion

2024

2032

USD

178.26 Billion

USD

288.44 Billion

2024

2032

| 2025 –2032 | |

| USD 178.26 Billion | |

| USD 288.44 Billion | |

|

|

|

|

Segmentation du marché mondial du maltitol dans le chocolat, par forme (poudre cristalline et sirops), catégorie de chocolat (chocolat blanc, chocolat au lait et chocolat noir), application (boulangerie, chocolats de détail et inclusions de chocolat) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché du maltitol dans le chocolat

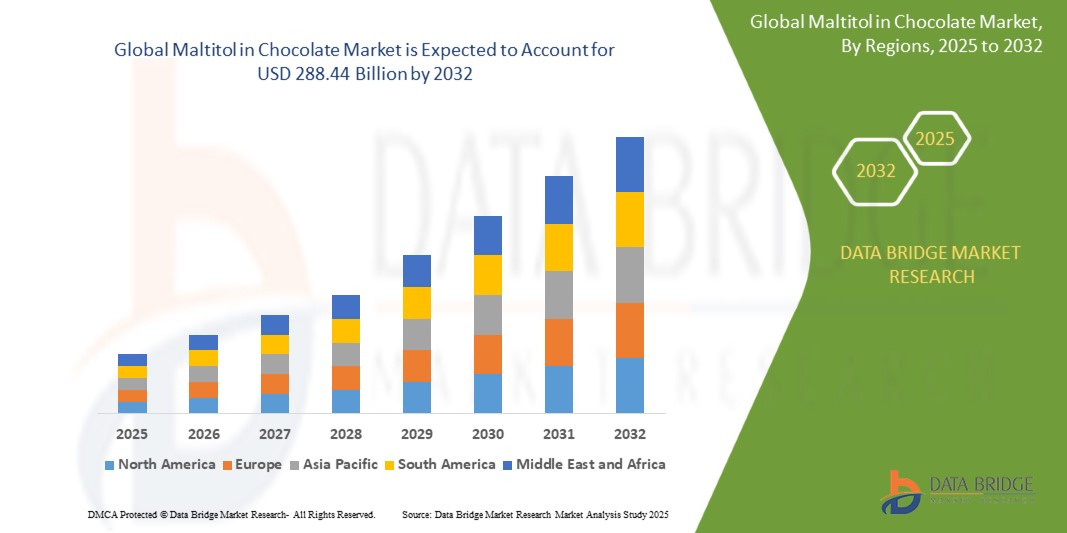

- La taille du marché mondial du maltitol dans le chocolat était évaluée à 178,26 milliards USD en 2024 et devrait atteindre 288,44 milliards USD d'ici 2032 , à un TCAC de 6,20 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de produits de confiserie hypocaloriques et sans sucre, la sensibilisation croissante des consommateurs à la santé et la prévalence croissante de maladies liées au mode de vie telles que le diabète et l'obésité.

- De plus, l'utilisation croissante du maltitol par les fabricants de chocolat pour maintenir la douceur et la texture tout en réduisant la teneur en calories soutient davantage l'expansion du marché.

Analyse du marché du maltitol dans le chocolat

- Les consommateurs se tournent de plus en plus vers des alternatives plus saines, et le maltitol offre un goût semblable à celui du sucre avec moins de calories, ce qui en fait un substitut de sucre préféré dans les chocolats.

- La population diabétique croissante et la sensibilisation croissante aux édulcorants à faible indice glycémique stimulent la demande de formulations de chocolat à base de maltitol.

- L'Europe a dominé le marché du maltitol dans le chocolat avec la plus grande part de revenus de 37,45 % en 2024, tirée par la demande croissante de produits chocolatés sans sucre et à faible teneur en calories, ainsi que par une population diabétique croissante dans la région.

- La région Asie-Pacifique devrait connaître le taux de croissance le plus élevé sur le marché mondial du maltitol dans le chocolat, grâce à l'élargissement de la base de consommateurs, à la préférence croissante pour les confiseries de style occidental présentant des avantages pour la santé et à l'adoption croissante d'édulcorants à faible indice glycémique dans des pays comme l'Inde, la Chine et le Japon.

- Le segment des poudres cristallines a dominé le marché avec une part de chiffre d'affaires de 57,3 % en 2024, grâce à sa facilité de manipulation, sa durée de conservation prolongée et sa compatibilité avec les procédés traditionnels de fabrication du chocolat. Le maltitol cristallin permet une douceur et une texture constantes tout en conservant la sensation en bouche souhaitée dans les applications de chocolat solide. Sa capacité à imiter les propriétés du saccharose tout en étant moins calorique en fait un choix privilégié des grands producteurs de confiserie.

Portée du rapport et segmentation du marché du maltitol dans le chocolat

|

Attributs |

Informations clés sur le marché du maltitol dans le chocolat |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché du maltitol dans le chocolat

« Préférence croissante pour les édulcorants naturels et à étiquette propre »

- Les consommateurs optent de plus en plus pour des produits à base de chocolat avec des étiquettes d'ingrédients transparentes, privilégiant les édulcorants naturels aux édulcorants artificiels.

- Le maltitol, dérivé de l'amidon, gagne en popularité en tant qu'alternative clean label qui permet d'affirmer qu'il est sans sucre sans sacrifier le goût.

- Les marques positionnent les chocolats à base de maltitol comme étant adaptés au régime cétogène, sans danger pour les diabétiques et sans OGM, conformément aux attentes des consommateurs modernes.

- Le segment du chocolat haut de gamme connaît une croissance notable de l'utilisation du maltitol, en particulier parmi les marques axées sur le bien-être et les marques spécialisées

- Par exemple, la marque américaine Lily's élargit son offre de chocolat sans sucre en utilisant du maltitol pour attirer les consommateurs soucieux de leur santé et en quête d'une étiquette propre.

Dynamique du marché du maltitol dans le chocolat

Conducteur

« Sensibilisation croissante à la santé et demande croissante de produits à base de chocolat à faible indice glycémique »

- La prévalence croissante du diabète, de l'obésité et des troubles du mode de vie alimente la demande de chocolats à teneur réduite en sucre utilisant des alternatives telles que le maltitol.

- Le faible indice glycémique du maltitol et son impact minimal sur la glycémie le rendent idéal pour les produits adaptés aux diabétiques et à la gestion du poids.

- Les consommateurs recherchent des friandises gourmandes qui apportent de la douceur sans les effets négatifs du sucre raffiné, ce qui stimule l'adoption du maltitol

- Les fabricants utilisent le maltitol pour créer des formulations à la fois fonctionnelles et attrayantes, répondant aux normes de santé et aux attentes gustatives.

- Par exemple, au Japon, les entreprises de confiserie lancent des chocolats à base de maltitol destinés aux consommateurs vieillissants soucieux de contrôler leur glycémie et de leur santé cardiaque.

Retenue/Défi

« Inconfort digestif associé à une consommation excessive d'alcools de sucre »

- Une surconsommation de maltitol peut entraîner des troubles gastro-intestinaux, notamment des ballonnements et des effets laxatifs, en particulier chez les personnes sensibles.

- La sensibilisation des consommateurs à ces effets secondaires peut dissuader certains d'acheter des produits à teneur plus élevée en maltitol.

- Les exigences réglementaires en matière d’étiquetage soulignant les problèmes digestifs potentiels peuvent avoir un impact négatif sur l’attrait et la confiance du produit.

- Équilibrer la douceur et les niveaux de tolérance sans compromettre le goût ou le coût reste un défi pour les fabricants

- Par exemple, dans l'Union européenne, les produits à base de chocolat contenant plus de 10 % de maltitol doivent porter une étiquette d'avertissement concernant d'éventuels effets laxatifs, ce qui peut décourager les acheteurs soucieux de leur santé malgré les avantages du produit.

Portée du marché du maltitol dans le chocolat

Le marché est segmenté en fonction de la forme, de la catégorie de chocolat et de l’application.

• Par formulaire

Sur le plan de la forme, le marché du maltitol dans le chocolat se divise en poudre cristalline et en sirops. Le segment de la poudre cristalline a dominé le marché avec une part de chiffre d'affaires de 57,3 % en 2024, grâce à sa facilité de manipulation, sa durée de conservation plus longue et sa compatibilité avec les procédés traditionnels de fabrication du chocolat. Le maltitol cristal permet une douceur et une texture constantes tout en préservant la sensation en bouche souhaitée dans les applications de chocolat solide. Sa capacité à imiter les propriétés du saccharose tout en étant moins calorique en fait un choix privilégié par les grands producteurs de confiserie.

Le segment des sirops devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à son utilisation croissante dans les chocolats moelleux, les fourrages et les inclusions. Le maltitol à base de sirop offre une excellente solubilité et une excellente rétention d'humidité, ce qui contribue à maintenir une consistance onctueuse dans les produits chocolatés feuilletés et enrobés. La demande croissante de chocolats fonctionnels et fourrés contribue à l'adoption croissante du sirop.

• Par catégorie de chocolat

Le marché du chocolat est segmenté en chocolat blanc, chocolat au lait et chocolat noir. Le chocolat au lait a représenté la plus grande part de marché en 2024, grâce à sa large préférence des consommateurs et à son profil aromatique équilibré. Le maltitol est fréquemment utilisé dans les chocolats au lait pour préserver leur douceur et leur onctuosité tout en réduisant significativement leur teneur en sucre. Sa stabilité thermique et sa capacité à reproduire les propriétés physiques du sucre le rendent particulièrement adapté aux applications grand public.

Le segment du chocolat noir devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par l'intérêt croissant des consommateurs pour les options riches en cacao et faibles en sucres. Le chocolat noir continuant d'être positionné comme un plaisir plus sain, les fabricants reformulent leurs produits avec du maltitol pour répondre à la demande d'alternatives à indice glycémique réduit et adaptées aux diabétiques, sans compromettre l'intensité des saveurs.

• Sur demande

En fonction de ses applications, le marché du maltitol dans le chocolat est segmenté en boulangerie, chocolats de détail et inclusions de chocolat. En 2024, le segment des chocolats de détail a dominé le marché, représentant la part de marché la plus importante, grâce à la popularité croissante des barres et snacks chocolatés sans sucre et hypocaloriques. Les consommateurs recherchent des plaisirs plus sains, et les marques utilisent le maltitol pour développer des chocolats qui préservent leur goût et leur texture tout en répondant aux besoins nutritionnels.

Le segment des inclusions de chocolat devrait connaître la croissance la plus rapide entre 2025 et 2032, soutenu par la demande croissante de barres de céréales, de produits laitiers et de pâtisseries. Les fabricants intègrent des pépites et des morceaux de chocolat à base de maltitol dans divers aliments fonctionnels pour rehausser le goût tout en réduisant la teneur en sucre. Cette tendance est particulièrement marquée dans les formules de produits riches en protéines et faibles en glucides destinées aux consommateurs soucieux de leur forme physique et aux diabétiques.

Analyse régionale du marché du maltitol dans le chocolat

- L'Europe a dominé le marché du maltitol dans le chocolat avec la plus grande part de revenus de 37,45 % en 2024, tirée par la demande croissante de produits chocolatés sans sucre et à faible teneur en calories, ainsi que par une population diabétique croissante dans la région.

- Les consommateurs européens sont de plus en plus attentifs aux ingrédients clean label et recherchent activement des alternatives au chocolat plus saines qui ne compromettent pas le goût.

- Cette tendance est également soutenue par des normes réglementaires strictes sur la teneur en sucre, un nombre croissant de consommateurs soucieux de leur santé et une forte innovation dans la confiserie fonctionnelle, ce qui fait des produits de chocolat à base de maltitol des produits très appréciés dans les segments de la vente au détail et des spécialités.

Aperçu du marché allemand du maltitol dans le chocolat

En 2024, le marché allemand du maltitol dans le chocolat a représenté la plus grande part de chiffre d'affaires en Europe, soit 31 %, grâce à la popularité croissante des confiseries à teneur réduite en sucre auprès des consommateurs soucieux de leur santé. La présence de grands fabricants de chocolat, conjuguée à la volonté du pays de réduire la teneur en sucre dans les formulations alimentaires, favorise l'adoption croissante du maltitol. De plus, l'essor des gammes de chocolat véganes et adaptées aux diabétiques intégrant du maltitol a accéléré son utilisation sur les segments grand public et de niche.

Aperçu du marché britannique du maltitol dans le chocolat

Le marché britannique du maltitol dans le chocolat devrait connaître sa plus forte croissance entre 2025 et 2032, porté par une prise de conscience croissante des enjeux santé et une demande croissante de confiseries à teneur réduite en sucre. Les consommateurs britanniques recherchent activement des chocolats faibles en calories, adaptés aux diabétiques et répondant aux préférences des consommateurs. Les initiatives gouvernementales visant à réduire la consommation de sucre, telles que le Programme de réduction du sucre, ont encouragé les fabricants à reformuler leurs produits en utilisant des alternatives comme le maltitol. La popularité croissante des snacks fonctionnels et des marques de chocolat haut de gamme axées sur le bien-être soutient l'expansion du marché dans les magasins de détail et les boutiques spécialisées.

Aperçu du marché nord-américain du maltitol dans le chocolat

Le marché nord-américain du maltitol dans le chocolat devrait connaître la croissance la plus rapide entre 2025 et 2032, soutenu par la préférence croissante des consommateurs pour les produits chocolatés sans sucre et cétogènes. Aux États-Unis et au Canada, les fabricants reformulent de plus en plus leurs gammes de produits en utilisant des polyols comme le maltitol afin de s'adapter à l'évolution des tendances alimentaires. La demande croissante de snacks fonctionnels et de friandises saines dans les circuits de distribution continue de renforcer les perspectives du marché dans la région.

Aperçu du marché américain du maltitol dans le chocolat

Le marché américain du maltitol dans le chocolat a représenté la plus grande part de chiffre d'affaires en Amérique du Nord en 2024, porté par une prise de conscience croissante des enjeux santé, l'essor des produits adaptés aux diabétiques et l'intérêt croissant pour les régimes faibles en glucides et cétogènes. Les marques de produits alimentaires et de confiserie proposent de plus en plus de produits chocolatés à base de maltitol pour séduire les consommateurs soucieux de leur apport calorique et en quête de plaisir sans sucres ajoutés. De plus, la présence de fabricants leaders de chocolat clean label stimule la croissance du marché aux États-Unis.

Aperçu du marché du maltitol dans le chocolat en Asie-Pacifique

Le marché du maltitol dans le chocolat en Asie-Pacifique devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par l'urbanisation croissante, la hausse des revenus disponibles et la demande croissante de produits alimentaires à faible teneur en sucre dans des pays comme la Chine, le Japon et l'Inde. Face à la sensibilisation croissante aux problèmes de diabète et d'obésité dans la région, les consommateurs manifestent un vif intérêt pour les produits à indice glycémique réduit et les substituts de sucre. De plus, l'influence croissante des régimes alimentaires occidentaux et le développement des segments de chocolat haut de gamme contribuent à l'adoption croissante des formules à base de maltitol.

Aperçu du marché japonais du maltitol dans le chocolat

Le marché japonais du maltitol dans le chocolat devrait connaître la croissance la plus rapide entre 2025 et 2032, en raison de l'importance accordée par le pays à l'innovation axée sur la santé, du vieillissement de la population et de l'intérêt croissant pour les aliments fonctionnels. Le maltitol est de plus en plus utilisé dans les produits chocolatés adaptés aux diabétiques, notamment ceux destinés aux seniors en quête de plaisirs plus sains à faible impact glycémique. L'intégration du maltitol dans les offres de chocolat grand public et de spécialité reflète l'engagement plus large du Japon en faveur d'un en-cas à teneur réduite en sucre et axé sur le bien-être.

Aperçu du marché du maltitol dans le chocolat en Chine

En 2024, le marché chinois du maltitol dans le chocolat représentait la plus grande part de chiffre d'affaires de la région Asie-Pacifique, porté par la croissance de la classe moyenne, l'intérêt croissant pour les produits de bien-être et la demande de confiseries sans sucre. L'essor des chaînes de distribution urbaines et des plateformes de commerce électronique proposant des produits chocolatés à faible teneur en sucre a accru leur accessibilité et leur portée auprès des consommateurs. De plus, les fabricants de chocolat locaux utilisent le maltitol comme ingrédient clé dans le développement de nouveaux produits destinés aux jeunes consommateurs soucieux de leur santé et aux segments adaptés aux diabétiques.

Part de marché du maltitol dans le chocolat

L'industrie du maltitol dans le chocolat est principalement dirigée par des entreprises bien établies, notamment :

- Zhejiang Huakang Pharmaceutical Co. Ltd. (Chine)

- Roquette Frères (France)

- Ingredion (États-Unis)

- Mitsubishi Corporation Life Sciences Limited (Japon)

- ADM (États-Unis)

- Brenntag (Allemagne)

- Merck KGaA (Allemagne)

- Shandong Futaste Co. (Chine)

- Cargill, Incorporated (États-Unis)

- B Food Science Co., Ltd. (Chine)

- Hangzhou Verychem Science And Technology Co. Ltd. (Chine)

- Haihang Industry (Chine)

- Sosa (Espagne)

- Foodchem International Corporation (Chine)

- PT. Ecogreen Oleochemicals (Indonésie)

- Mitushi Biopharma (Inde)

- MUBY CHEMICALS (Inde)

- Hylen Co., Ltd. (Corée du Sud)

- Ingrédients alimentaires Nutra (États-Unis)

Derniers développements sur le marché mondial du maltitol dans le chocolat

- En juillet 2023, Tate & Lyle PLC a annoncé l'élargissement de sa gamme d'édulcorants afin de répondre aux défis posés par la solubilité des produits alimentaires et des boissons. Cette initiative stratégique vise à améliorer la fonctionnalité des produits, garantissant ainsi aux fabricants un goût et une texture améliorés. En développant des solutions innovantes, Tate & Lyle entend répondre à l'évolution des préférences des consommateurs et, à terme, favoriser leur satisfaction et leur fidélité dans un marché concurrentiel.

- En 2023, Ingredion Incorporated a annoncé son intention d'investir 150 millions de dollars dans l'agrandissement de son usine de production de maltitol située en Allemagne. Cet investissement important vise à renforcer ses capacités de production afin de répondre à la demande croissante de maltitol, un substitut du sucre populaire. En renforçant ses activités de production, Ingredion s'efforce de soutenir la tendance mondiale croissante vers des aliments et des boissons plus sains et moins caloriques, se positionnant ainsi comme un leader sur le marché.

- En janvier 2023, Cargill a enregistré une forte croissance de ses ventes de 8 % sur un an, portée par une demande accrue pour ses ingrédients alimentaires et boissons. Pour capitaliser sur cette dynamique, l'entreprise a annoncé un investissement de 100 millions de dollars dans son centre d'innovation en Inde. Cet investissement vise à développer des solutions sur mesure adaptées au marché local, permettant à Cargill de renforcer son avantage concurrentiel et de répondre efficacement aux besoins des consommateurs régionaux.

- En février 2023, DuPont a enregistré une hausse de 5 % de ses ventes dans le secteur agroalimentaire par rapport à l'année précédente. L'expansion stratégique de l'entreprise sur les marchés émergents a contribué à un chiffre d'affaires mensuel moyen de 1,25 milliard de dollars en 2023. Cette croissance reflète l'engagement de DuPont à investir dans les nouvelles technologies et à nouer des partenariats stratégiques, lui permettant de saisir de nouvelles opportunités et de répondre à l'évolution des besoins des consommateurs à l'échelle mondiale.

- En août 2022, Luker Chocolate, fabricant privé de chocolat colombien, a lancé une nouvelle variété de couvertures à base d'érythritol et de stévia pour répondre à la demande croissante de ses clients. Cette gamme innovante comprend également une variante sucrée au maltitol et à l'allulose destinée aux marchés spécialisés. En diversifiant son offre, Luker Chocolate vise à satisfaire les consommateurs soucieux de leur santé et à la recherche d'alternatives savoureuses, consolidant ainsi sa présence dans un secteur chocolaté concurrentiel.

- En 2022, MCLS ASIA CO., LTD. a lancé Lesys, un produit à base de maltitol cristallin conçu comme substitut naturel du sucre. Fabriqué à partir de tapioca non OGM, une ressource renouvelable, Lesys offre un goût varié en sucres totaux tout en étant moins calorique que le sucre traditionnel. Ce produit innovant s'adresse aux consommateurs soucieux de leur santé et aux fabricants à la recherche d'alternatives sans compromis sur le goût, positionnant MCLS ASIA comme un acteur majeur sur le marché des édulcorants naturels.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.