Marché mondial des alliages de magnésium, par produit (alliage moulé et alliage forgé), application (automobile et transport, aérospatiale et défense, électronique, outils électriques et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des alliages de magnésium

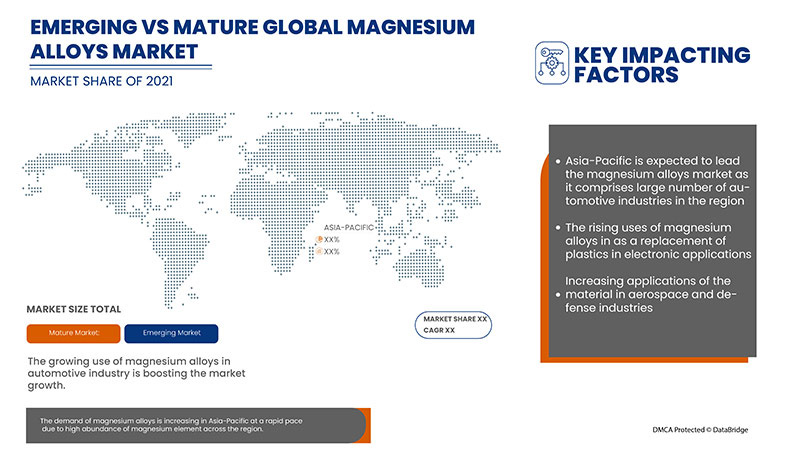

L'utilisation croissante des alliages de magnésium dans l'industrie automobile devrait stimuler la croissance du marché et la demande pour le marché mondial des alliages de magnésium. Cependant, les principaux obstacles à l'expansion de ce marché sont l'incertitude des prix du magnésium et les problèmes de soudabilité et de résistance à la corrosion.

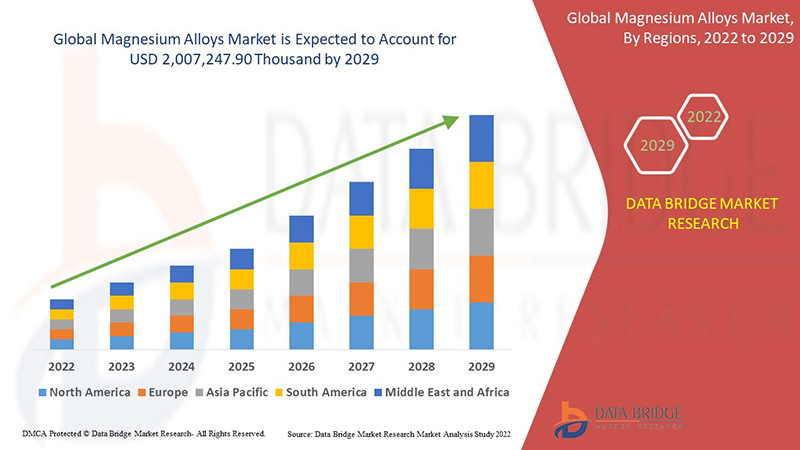

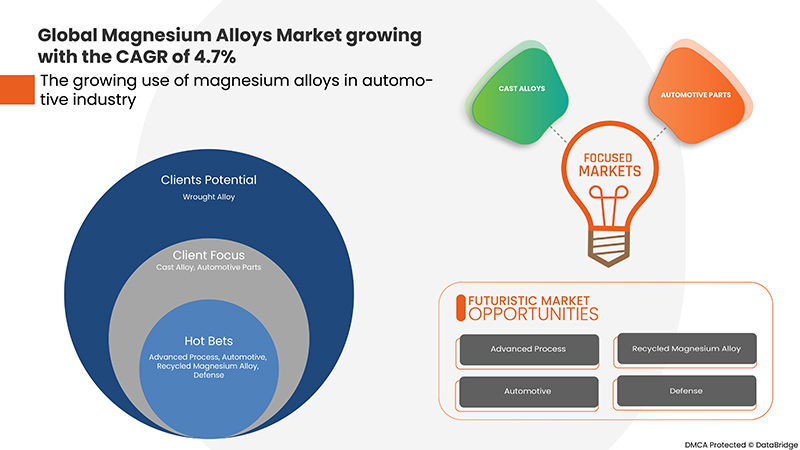

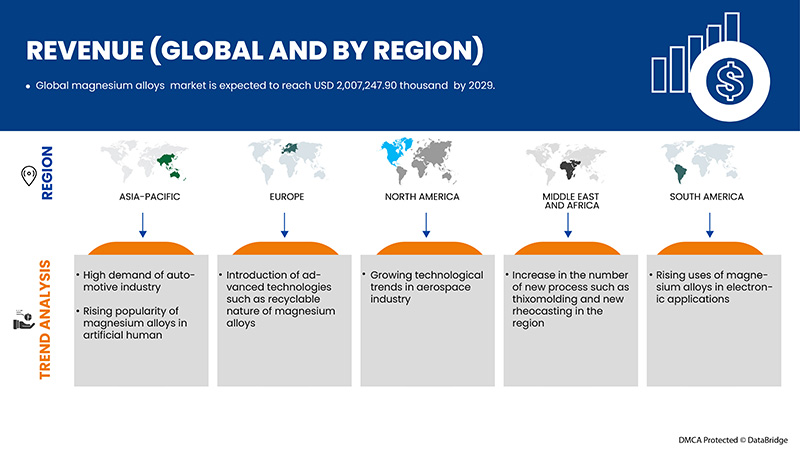

Ces alliages de magnésium mondiaux sont principalement utilisés dans l'automobile et le transport, les boîtes de vitesses, les parties avant, les poutres IP, la colonne de direction et les boîtiers d'airbag conducteur, les volants, les cadres de siège et les couvercles de réservoir de carburant. Data Bridge Market Research analyse que le marché mondial des alliages de magnésium devrait atteindre la valeur de 2 007 247,90 milliers USD d'ici 2029, à un TCAC de 4,7 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en tonnes |

|

Segments couverts |

Par produit (alliage moulé et alliage forgé), application (automobile et transport, aérospatiale et défense, électronique, outils électriques et autres). |

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, Italie, France, Espagne, Russie, Suisse, Turquie, Belgique, Pays-Bas, reste de l'Europe. Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie et Nouvelle-Zélande, reste de l'Asie-Pacifique, Brésil, Argentine et reste de l'Amérique du Sud, Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël et reste du Moyen-Orient et de l'Afrique. |

|

Acteurs du marché couverts |

Luxfer MEL Technologies, Shandong Feixian County Yinguang Magnesium Industry Co. Ltd., regal-mg, US Magnesium LLC, Namoalloy, Dead sea Magnesium, DSM, Amacor, Dynacast, RIMA INDUSTRIAL, Mag Specialties Inc., MAGONTEC Limited, Nanjing Yunhai Special Metal Co., Ltd entre autres. |

Définition du marché

Le magnésium est le matériau structurel le plus léger avec une densité de 1,74 g/cm2. L'alliage du magnésium avec du métal augmente la dureté, la coulabilité et la résistance tout en ayant un effet négligeable sur la viscosité. L'aluminium est principalement utilisé comme métal d'alliage avec le magnésium. Les alliages de magnésium ont des propriétés telles que la légèreté, la conductivité thermique, la résistance, la durabilité, la résistance à la corrosion et le fluage à haute température.

Le COVID-19 a eu un impact minimal sur le marché mondial des alliages de magnésium

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Pendant l'épidémie de COVID-19, le marché des alliages de magnésium a subi une perte importante, la fabrication dans les industries automobile et aérospatiale ayant été interrompue. Seuls les secteurs de l'approvisionnement médical et du maintien des fonctions vitales ont été autorisés à fonctionner. La chaîne d'approvisionnement a également été perturbée en raison de restrictions logistiques mondiales. En conséquence, la croissance du marché mondial des alliages de magnésium a également été entravée.

La dynamique du marché mondial des alliages de magnésium comprend :

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Facteurs moteurs/opportunités rencontrés par le marché mondial des alliages de magnésium

- La croissance de l'utilisation des alliages de magnésium dans l'industrie automobile

L'utilisation croissante des alliages de magnésium dans l'industrie automobile est essentielle car elle stimulera davantage le marché mondial des alliages de magnésium. Le marché est stimulé par la fabrication croissante de composants techniques pour réduire le poids sans compromettre la résistance globale des véhicules et la demande croissante de capacité d'amortissement des vibrations. De plus, les alliages de magnésium offrent au véhicule résistance, légèreté, durabilité, conductivité thermique, fluage à haute température et résistance à la corrosion. En conséquence, la demande d'alliages de magnésium devrait augmenter considérablement en raison de ces caractéristiques.

- Augmentation de la popularité des alliages de magnésium dans les implants humains artificiels et les dispositifs médicaux

La popularité croissante de l'alliage de magnésium dans les implants humains artificiels et les applications croissantes du matériau dans les dispositifs médicaux devraient propulser la croissance de l'industrie. Les fabricants de dispositifs et d'implants médicaux utilisent principalement l'alliage de magnésium en raison de sa faible densité. Les alliages de magnésium sont utilisés dans la fabrication d'équipements médicaux portables et de fauteuils roulants en raison de leur légèreté.

Forts de ces avantages, divers fabricants d’implants et de dispositifs médicaux ont commencé à utiliser des alliages de magnésium comme matériau important dans leurs productions.

- Augmentation des applications du matériau dans les industries aérospatiales et de défense

La demande croissante de composants légers dans le secteur de l'aérospatiale et de la défense est un facteur clé du marché mondial des alliages de magnésium. Les alliages de magnésium sont utilisés dans la fabrication de carters de transmission d'hélicoptères, de moteurs d'avion, de carters de boîtes de vitesses, de moteurs à turbine, de châssis de soufflantes de moteurs à réaction, d'engins spatiaux et de missiles. Ainsi, l'augmentation des dépenses dans le secteur de la défense et la demande de nouveaux avions commerciaux devraient rester des facteurs clés de croissance pour le marché mondial des alliages de magnésium.

Par exemple:

- En 2019, le gouvernement américain a proposé un budget de 686 milliards de dollars pour le ministère de la Défense. Les principaux investissements du budget dans les avions comprenaient 77 chasseurs d'attaque interarmées F-35, 10 avions P-8A et 15 avions de ravitaillement KC-46 de remplacement.

- En 2019, selon une étude publiée par Boeing, l’Amérique du Nord devrait connaître 9 130 livraisons d’avions neufs d’ici 2038, soit le deuxième chiffre le plus élevé après l’Asie-Pacifique. De plus, la préférence pour les véhicules économes en carburant devrait stimuler l’utilisation de ces matériaux légers, augmentant ainsi la demande de produits en alliages de magnésium

- Introduction de nouveaux procédés tels que le thixomoulage et le nouveau rhéomoulage

Pour introduire les alliages de magnésium dans les applications hydrauliques et structurelles, des composants à haute résistance, résistants à la traction et à la pression sont coulés à faible coût. De nombreux travaux de développement ont été entrepris pour couler des pièces à des températures inférieures au liquidus - à l'état semi-solide ou sous une forme contenant une quantité importante de solide. Par conséquent, tous ces procédés nouvellement développés qui offrent des avantages dans le traitement des alliages de magnésium offriront des opportunités lucratives pour la croissance et le développement du marché mondial des alliages de magnésium.

Contraintes/défis rencontrés par le marché mondial des alliages de magnésium

- Fluctuation des prix du magnésium

Les fluctuations des prix du magnésium et de ses alliages devraient limiter dans une certaine mesure l'expansion du marché mondial des alliages de magnésium. Ces derniers temps, divers facteurs tels que la réduction de l'offre de charbon, la fermeture et d'autres politiques ont fait grimper les prix du magnésium et, du côté de l'offre, le resserrement général a fait baisser la production de lingots de magnésium.

Face aux fluctuations violentes des prix du magnésium, les entreprises d'alliages de magnésium tentent de se positionner activement dans l'industrie par l'expansion de la production, la modernisation des équipements et l'introduction de projets à haute valeur ajoutée.

- Problèmes liés à la corrosion et au soudage des alliages de magnésium

L'utilisation des alliages de magnésium est limitée en raison de leur faible résistance à la corrosion et de leur faible flexibilité. Ces alliages ont à peu près la même résistance à la corrosion dans les environnements courants que l'acier doux, mais sont moins résistants à la corrosion que les alliages d'aluminium, qu'il s'agisse de corrosion générale ou galvanique.

En outre, l'une des plus grandes difficultés pour l'ingénieur de fabrication est de définir quel procédé produira des propriétés satisfaisantes des alliages de magnésium au moindre coût par le procédé de soudage. En général, le soudage des alliages de magnésium n'est pas une tâche facile car il nécessite l'utilisation de techniques et de procédés avancés et fiables, tels que le soudage à l'arc au tungstène sous gaz inerte (TIG),

- Diverses disponibilités de matériaux alternatifs pour les alliages de magnésium

L'aluminium reste l'alliage le moins cher par pouce cube de tous les alliages couramment utilisés dans le moulage sous pression. Ainsi, la disponibilité de divers autres types d'alliages constituera un défi pour les ventes et la croissance du marché mondial des alliages de magnésium.

Développements récents

- En novembre 2019, Hyundai Motor a investi 1,55 milliard de dollars dans sa nouvelle usine automobile en Indonésie. La production dans sa nouvelle usine automobile a démarré fin 2021

- En 2016, l'échafaudage en magnésium Magmaris a été lancé par Biotronik, et il est désormais le premier échafaudage résorbable à base de magnésium cliniquement prouvé au monde à obtenir un marquage CE.

Il s'agit d'un stent cardiovasculaire qui se résorbe au fil du temps. Cette nouvelle technologie sur mesure a été lancée à la suite d'un programme de recherche d'une décennie au cours duquel SynergMag 410, un système en alliage de magnésium, a été créé comme colonne vertébrale essentielle de l'échafaudage Magmaris de Biotronik

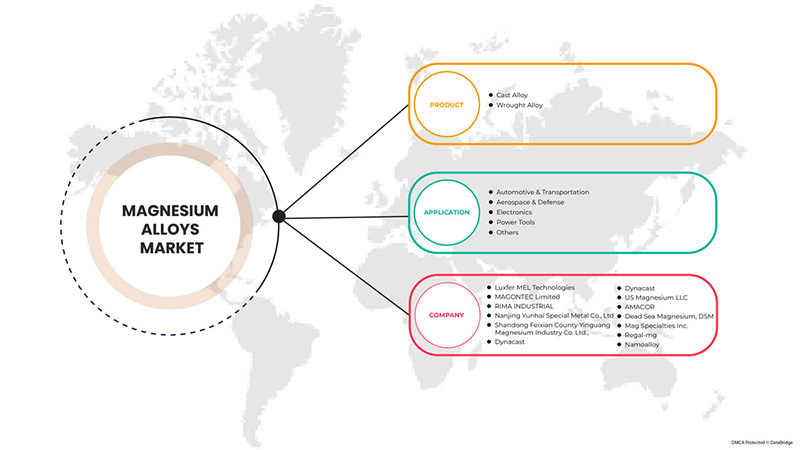

Portée du marché mondial des alliages de magnésium

Le marché mondial des alliages de magnésium est segmenté en fonction du produit et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Alliage moulé

- Alliage forgé

Sur la base du produit, le marché est segmenté en alliage moulé et alliage forgé.

Application

- Automobile et transport

- Aérospatiale et défense

- Électronique

- Outils électriques

- Autres

Sur la base des applications, le marché est segmenté en automobile et transport, aérospatiale et défense, électronique, outils électriques et autres.

Analyse/perspectives régionales du marché mondial des alliages de magnésium

Le marché mondial des alliages de magnésium est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, produit et application, comme référencé ci-dessus.

Sur la base de la géographie, le marché mondial des alliages de magnésium est segmenté en Amérique du Nord, Amérique du Sud, Asie-Pacifique, Europe, Moyen-Orient et Afrique. L'Amérique du Nord est segmentée en États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, Italie, France, Espagne, Russie, Suisse, Turquie, Belgique, Pays-Bas et reste de l'Europe. Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie et Nouvelle-Zélande, reste de l'Asie-Pacifique, Brésil, Argentine et reste de l'Amérique du Sud, Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël et reste du Moyen-Orient et de l'Afrique.

En 2022, l’Asie-Pacifique devrait dominer le marché mondial des alliages de magnésium en raison des applications croissantes du matériau dans les industries aérospatiale et de la défense.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui influencent les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des alliages de magnésium dans le monde

Le paysage concurrentiel du marché mondial des alliages de magnésium fournit des détails sur le concurrent. Les composants inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation du marché mondial des alliages de magnésium des entreprises.

Certains des principaux acteurs opérant sur le marché mondial des alliages de magnésium sont Luxfer MEL Technologies, Shandong Feixian County Yinguang Magnesium Industry Co. Ltd., regal-mg, US Magnesium LLC, Namoalloy, Dead sea Magnesium, DSM, Amacor, Dynacast, RIMA INDUSTRIAL, Mag Specialties Inc., MAGONTEC Limited, Nanjing Yunhai Special Metal Co., Ltd entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL MAGNESIUM ALLOYS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 IMPORT EXPORT SCENARIO

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 TECHNOLOGICAL FACTORS

4.3.5 LEGAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES:

4.4.1 THE THREAT OF NEW ENTRANTS:

4.4.2 THREAT OF SUBSTITUTES:

4.4.3 CUSTOMER BARGAINING POWER:

4.4.4 SUPPLIER BARGAINING POWER:

4.4.5 INTERNAL COMPETITION (RIVALRY):

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 RAW MATERIAL COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 REGULATORY COVERAGE

5 PRODUCTION CAPACITY OUTLOOK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE GROWING USE OF MAGNESIUM ALLOYS IN THE AUTOMOTIVE INDUSTRY

6.1.2 RISING POPULARITY OF MAGNESIUM ALLOYS IN ARTIFICIAL HUMAN IMPLANTS AND MEDICAL DEVICES

6.1.3 INCREASING APPLICATIONS OF THE MATERIAL IN AEROSPACE AND DEFENSE INDUSTRIES

6.1.4 RISING USES AS A REPLACEMENT OF PLASTICS IN ELECTRONIC APPLICATIONS

6.2 RESTRAINTS

6.2.1 FLUCTUATING MAGNESIUM PRICES

6.2.2 ISSUES ASSOCIATED WITH CORROSION AND WELDING OF MAGNESIUM ALLOYS

6.2.3 ENGINEERING BARRIERS SUCH AS FORMABILITY AT ROOM TEMPERATURE AND DIFFICULTY FORGING

6.3 OPPORTUNITIES

6.3.1 INTRODUCTION OF NEW PROCESSES SUCH AS THIXOMOLDING AND NEW RHEOCASTING

6.3.2 RECYCLABLE NATURE OF MAGNESIUM ALLOYS

6.3.3 HIGH ABUNDANCE OF MAGNESIUM ELEMENTS ACROSS THE GLOBE

6.4 CHALLENGES

6.4.1 VARIOUS AVAILABILITY OF ALTERNATIVE MATERIALS FOR MAGNESIUM ALLOYS

6.4.2 PROBLEMS RELATED TO PURITY OF MAGNESIUM ALLOYS

7 GLOBAL MAGNESIUM ALLOYS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CAST ALLOY

7.3 WROUGHT ALLOY

8 GLOBAL MAGNESIUM ALLOYS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE & TRANSPORTATION

8.2.1 CAST ALLOY

8.2.2 WROUGHT ALLOY

8.3 AEROSPACE & DEFENSE

8.3.1 CAST ALLOY

8.3.2 WROUGHT ALLOY

8.4 ELECTRONICS

8.4.1 CAST ALLOY

8.4.2 WROUGHT ALLOY

8.5 POWER TOOLS

8.5.1 CAST ALLOY

8.5.2 WROUGHT ALLOY

8.6 OTHERS

8.6.1 CAST ALLOY

8.6.2 WROUGHT ALLOY

9 GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION

9.1 OVERVIEW

9.2 NORTH AMERICA

9.2.1 U.S.

9.2.2 CANADA

9.2.3 MEXICO

9.3 ASIA-PACIFIC

9.3.1 CHINA

9.3.2 INDIA

9.3.3 JAPAN

9.3.4 SOUTH KOREA

9.3.5 AUSTRALIA & NEW ZEALAND

9.3.6 SINGAPORE

9.3.7 INDOENASIA

9.3.8 THAILAND

9.3.9 MALAYSIA

9.3.10 PHILIPPINES

9.3.11 REST OF ASIA PACIFIC

9.4 EUROPE

9.4.1 GERMANY

9.4.2 U.K.

9.4.3 FRANCE

9.4.4 ITALY

9.4.5 SPAIN

9.4.6 RUSSIA

9.4.7 TURKEY

9.4.8 NETHERLANDS

9.4.9 BELGIUM

9.4.10 SWITZERLAND

9.4.11 REST OF EUROPE

9.5 MIDDLE EAST AND AFRICA

9.5.1 UNITED ARAB EMIRATED

9.5.2 SAUDI ARABIA

9.5.3 SOUTH AFRICA

9.5.4 EGYPT

9.5.5 ISRAEL

9.5.6 REST OF MIDDLE EAST AND AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

9.6.3 REST OF SOUTH AMERICA

10 GLOBAL MAGNESIUM ALLOYS MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.4.1 EXPANSIONS

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 LUXFER MEL TECHNOLOGIES

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 SWOT

12.1.5 RECENT DEVELOPMENT

12.2 MAGNOTEC LIMITED

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY PROFILE

12.2.4 SWOT

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT UPDATES

12.3 RIMA INDUSTRIAL

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 SWOT

12.3.5 RECENT DEVELOPMENTS

12.4 NANJING YUNHAI SPECIAL METAL CO., LTD

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 SWOT

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATE

12.5 SHANDONG FEIXIAN COUNTY YINGUANG MAGNESIUM INDUSTRY CO. LTD.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT DEVELOPMENT

12.6 AMACOR

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT DEVELOPMENT

12.7 DEAD SEA MAGNESIUM, DSM

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT DEVELOPMENTS

12.8 DYNACAST

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT DEVELOPMENTS

12.9 MAG SPECIALITY INC

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 SWOT

12.9.4 RECENT DEVELOPMENTS

12.1 NAMOALLOY

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT DEVELOPMENT

12.11 REGAL-MG

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT DEVELOPMENTS

12.12 US MAGNESIUM LLC

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF ARTICLES OF MAGNESIUM, N.E.S.; HS CODE – 810490 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF MAGNESIUM, N.E.S.; HS CODE – 810490 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 GLOBAL MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 GLOBAL MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 6 GLOBAL CAST ALLOY IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 GLOBAL CAST ALLOY IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 8 GLOBAL WROUGHT ALLOY IN GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 GLOBAL WROUGHT ALLOY IN GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 10 GLOBAL MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 11 GLOBAL MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 12 GLOBAL AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 GLOBAL AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 14 GLOBAL AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 15 GLOBAL AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 16 GLOBAL AEROSPACE & DEFENSE IN GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 GLOBAL AEROSPACE & DEFENSE IN GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 18 GLOBAL AEROSPACE & DEFENSE IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 GLOBAL AEROSPACE & DEFENSE IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 20 GLOBAL ELECTRONICS IN GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 GLOBAL ELECTRONICS IN GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 22 GLOBAL ELECTRONICS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 23 GLOBAL ELECTRONICS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 24 GLOBAL POWER TOOLS IN GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 GLOBAL POWER TOOLS IN GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 26 GLOBAL POWER TOOLS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 GLOBAL POWER TOOLS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 28 GLOBAL OTHERS IN GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 GLOBAL OTHERS IN GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 30 GLOBAL OTHERS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 31 GLOBAL OTHERS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 32 GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 GLOBAL MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 34 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 36 NORTH AMERICA MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 38 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 40 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 42 NORTH AMERICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 44 NORTH AMERICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 46 NORTH AMERICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 48 NORTH AMERICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 50 U.S. MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 52 U.S. MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 54 U.S. AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 U.S. AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 56 U.S. AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 58 U.S. ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 59 U.S. ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 60 U.S. POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 61 U.S. POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 62 U.S. OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 63 U.S. OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 64 CANADA MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 66 CANADA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 67 CANADA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 68 CANADA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 CANADA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 70 CANADA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 CANADA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 72 CANADA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 CANADA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 74 CANADA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 CANADA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 76 CANADA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 77 CANADA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 78 MEXICO MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 79 MEXICO MAGNESIUM ALLOYS MARKETMARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 80 MEXICO MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 MEXICO MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 82 MEXICO AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 83 MEXICO AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 84 MEXICO AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 85 MEXICO AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 86 MEXICO ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 MEXICO ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 88 MEXICO POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 MEXICO POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 90 MEXICO OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 91 MEXICO OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 92 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 93 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 94 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 95 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 96 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 97 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 98 ASIA-PACIFIC AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 99 ASIA-PACIFIC AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 100 ASIA-PACIFIC AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 101 ASIA-PACIFIC AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 102 ASIA-PACIFIC ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 103 ASIA-PACIFIC ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 104 ASIA-PACIFIC POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 105 ASIA-PACIFIC POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 106 ASIA-PACIFIC OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 107 ASIA-PACIFIC OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 108 CHINA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 109 CHINA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 110 CHINA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 CHINA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 112 CHINA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 113 CHINA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 114 CHINA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 CHINA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 116 CHINA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 117 CHINA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 118 CHINA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 119 CHINA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 120 CHINA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 121 CHINA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 122 INDIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 123 INDIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 124 INDIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 INDIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 126 INDIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 127 INDIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 128 INDIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 129 INDIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 130 INDIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 131 INDIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 132 INDIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 133 INDIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 134 INDIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 135 INDIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 136 JAPAN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 137 JAPAN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 138 JAPAN MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 139 JAPAN MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 140 JAPAN AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 141 JAPAN AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 142 JAPAN AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 143 JAPAN AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 144 JAPAN ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 145 JAPAN ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 146 JAPAN POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 147 JAPAN POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 148 JAPAN OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 149 JAPAN OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 150 SOUTH KOREA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 151 SOUTH KOREA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 152 SOUTH KOREA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 SOUTH KOREA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 154 SOUTH KOREA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 155 SOUTH KOREA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 156 SOUTH KOREA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 157 SOUTH KOREA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 158 SOUTH KOREA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 159 SOUTH KOREA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 160 SOUTH KOREA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 161 SOUTH KOREA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 162 SOUTH KOREA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 163 SOUTH KOREA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 164 AUSTRALIA & NEW ZEALAND MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 165 AUSTRALIA & NEW ZEALAND MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 166 AUSTRALIA & NEW ZEALAND MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 167 AUSTRALIA & NEW ZEALAND MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 168 AUSTRALIA & NEW ZEALAND AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 169 AUSTRALIA & NEW ZEALAND AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 170 AUSTRALIA & NEW ZEALAND AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 171 AUSTRALIA & NEW ZEALAND AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 172 AUSTRALIA & NEW ZEALAND ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 173 AUSTRALIA & NEW ZEALAND ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 174 AUSTRALIA & NEW ZEALAND POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 175 AUSTRALIA & NEW ZEALAND POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 176 AUSTRALIA & NEW ZEALAND OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 177 AUSTRALIA & NEW ZEALAND OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 178 SINGAPORE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 179 SINGAPORE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 180 SINGAPORE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 181 SINGAPORE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 182 SINGAPORE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 183 SINGAPORE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 184 SINGAPORE AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 185 SINGAPORE AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 186 SINGAPORE ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 187 SINGAPORE ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 188 SINGAPORE POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 189 SINGAPORE POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 190 SINGAPORE OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 191 SINGAPORE OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 192 INDONESIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 193 SINGAPORE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 194 INDONESIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 INDONESIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 196 INDONESIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 197 INDONESIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 198 INDONESIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 199 INDONESIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 200 INDONESIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 201 INDONESIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 202 INDONESIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 203 INDONESIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 204 INDONESIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 205 INDONESIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 206 THAILAND MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 207 THAILAND MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 208 THAILAND MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 209 THAILAND MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 210 THAILAND AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 211 THAILAND AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 212 THAILAND AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 213 THAILAND AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 214 THAILAND ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 215 THAILAND ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 216 THAILAND POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 217 THAILAND POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 218 THAILAND OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 219 THAILAND OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 220 MALAYSIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 221 MALAYSIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 222 MALAYSIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 223 MALAYSIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 224 MALAYSIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 225 MALAYSIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 226 MALAYSIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 227 MALAYSIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 228 MALAYSIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 229 MALAYSIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 230 MALAYSIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 231 MALAYSIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 232 MALAYSIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 233 MALAYSIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 234 PHILIPPINES MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 235 PHILIPPINES MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 236 PHILIPPINES MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 237 PHILIPPINES MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 238 PHILIPPINES AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 239 PHILIPPINES AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 240 PHILIPPINES AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 241 PHILIPPINES AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 242 PHILIPPINES ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 243 PHILIPPINES ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 244 PHILIPPINES POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 245 PHILIPPINES POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 246 PHILIPPINES OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 247 PHILIPPINES OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 248 REST OF ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 249 REST OF ASIA PACIFIC MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 250 EUROPE MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 251 EUROPE MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 252 EUROPE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 253 EUROPE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 254 EUROPE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 255 EUROPE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 256 EUROPE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 257 EUROPE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 258 EUROPE AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 259 EUROPE AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 260 EUROPE ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 261 EUROPE ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 262 EUROPE POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 263 EUROPE POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 264 EUROPE OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 265 EUROPE OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 266 GERMANY MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 267 GERMANY MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 268 GERMANY MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 269 GERMANY MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 270 GERMANY AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 271 GERMANY AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 272 GERMANY AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 273 GERMANY AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 274 GERMANY ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 275 GERMANY ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 276 GERMANY POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 277 GERMANY POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 278 GERMANY OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 279 GERMANY OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 280 U.K. MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 281 U.K. MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 282 U.K. MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 283 U.K. MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 284 U.K. AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 285 U.K. AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 286 U.K. AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 287 U.K. AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 288 U.K. ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 289 U.K. ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 290 U.K. POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 291 U.K. POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 292 U.K. OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 293 U.K. OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 294 FRANCE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 295 FRANCE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 296 FRANCE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 297 FRANCE MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 298 FRANCE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 299 FRANCE AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 300 FRANCE AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 301 FRANCE AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 302 FRANCE ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 303 FRANCE ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 304 FRANCE POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 305 FRANCE POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 306 FRANCE OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 307 FRANCE OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 308 ITALY MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 309 ITALY MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 310 ITALY MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 311 ITALY MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 312 ITALY AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 313 ITALY AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 314 ITALY AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 315 ITALY AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 316 ITALY ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 317 ITALY ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 318 ITALY POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 319 ITALY POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 320 ITALY OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 321 ITALY OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 322 SPAIN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 323 SPAIN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 324 SPAIN MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 325 SPAIN MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 326 SPAIN AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 327 SPAIN AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 328 SPAIN AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 329 SPAIN AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 330 SPAIN ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 331 SPAIN ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 332 SPAIN POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 333 SPAIN POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 334 SPAIN OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 335 SPAIN OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 336 RUSSIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 337 RUSSIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 338 RUSSIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 339 RUSSIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 340 RUSSIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 341 RUSSIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 342 RUSSIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 343 RUSSIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 344 RUSSIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 345 RUSSIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 346 RUSSIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 347 RUSSIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 348 RUSSIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 349 RUSSIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 350 TURKEY MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 351 TURKEY MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 352 TURKEY MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 353 TURKEY MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 354 TURKEY AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 355 TURKEY AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 356 TURKEY AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 357 TURKEY AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 358 TURKEY ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 359 TURKEY ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 360 TURKEY POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 361 TURKEY POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 362 TURKEY OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 363 TURKEY OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 364 NETHERLANDS MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 365 NETHERLANDS MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 366 NETHERLANDS MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 367 NETHERLANDS MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 368 NETHERLANDS AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 369 NETHERLANDS AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 370 NETHERLANDS AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 371 NETHERLANDS AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 372 NETHERLANDS ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 373 NETHERLANDS ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 374 NETHERLANDS POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 375 NETHERLANDS POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 376 NETHERLANDS OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 377 NETHERLANDS OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 378 BELGIUM MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 379 BELGIUM MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 380 BELGIUM MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 381 BELGIUM MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 382 BELGIUM AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 383 BELGIUM AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 384 BELGIUM AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 385 BELGIUM AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 386 BELGIUM ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 387 BELGIUM ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 388 BELGIUM POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 389 BELGIUM POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 390 BELGIUM OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 391 BELGIUM OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 392 SWITZERLAND MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 393 SWITZERLAND MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 394 SWITZERLAND MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 395 SWITZERLAND MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 396 SWITZERLAND AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 397 SWITZERLAND AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 398 SWITZERLAND AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 399 SWITZERLAND AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 400 SWITZERLAND ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 401 SWITZERLAND ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 402 SWITZERLAND POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 403 SWITZERLAND POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 404 SWITZERLAND OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 405 SWITZERLAND OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 406 REST OF EUROPE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 407 REST OF EUROPE MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 408 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 409 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 410 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 411 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 412 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 413 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 414 MIDDLE EAST AND AFRICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 415 MIDDLE EAST AND AFRICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 416 MIDDLE EAST AND AFRICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 417 MIDDLE EAST AND AFRICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 418 MIDDLE EAST AND AFRICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 419 MIDDLE EAST AND AFRICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 420 MIDDLE EAST AND AFRICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 421 MIDDLE EAST AND AFRICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 422 MIDDLE EAST AND AFRICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 423 MIDDLE EAST AND AFRICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 424 UNITED ARAB EMIRATES MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 425 UNITED ARAB EMIRATES MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 426 UNITED ARAB EMIRATES MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 427 UNITED ARAB EMIRATES MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 428 UNITED ARAB EMIRATES AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 429 UNITED ARAB EMIRATES AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 430 UNITED ARAB EMIRATES AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 431 UNITED ARAB EMIRATES AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 432 UNITED ARAB EMIRATES ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 433 UNITED ARAB EMIRATES ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 434 UNITED ARAB EMIRATES POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 435 UNITED ARAB EMIRATES POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 436 UNITED ARAB EMIRATES OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 437 UNITED ARAB EMIRATES OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 438 SAUDI ARABIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 439 SAUDI ARABIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 440 SAUDI ARABIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 441 SAUDI ARABIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 442 SAUDI ARABIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 443 SAUDI ARABIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 444 SAUDI ARABIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 445 SAUDI ARABIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 446 SAUDI ARABIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 447 SAUDI ARABIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 448 SAUDI ARABIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 449 SAUDI ARABIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 450 SAUDI ARABIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 451 SAUDI ARABIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 452 SOUTH AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 453 SOUTH AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 454 SOUTH AFRICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 455 SOUTH AFRICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 456 SOUTH AFRICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 457 SOUTH AFRICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 458 SOUTH AFRICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 459 SOUTH AFRICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 460 SOUTH AFRICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 461 SOUTH AFRICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 462 SOUTH AFRICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 463 SOUTH AFRICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 464 SOUTH AFRICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 465 SOUTH AFRICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 466 EGYPT MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 467 EGYPT MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 468 EGYPT MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 469 EGYPT MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 470 EGYPT AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 471 EGYPT AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 472 EGYPT AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 473 EGYPT AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 474 EGYPT ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 475 EGYPT ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 476 EGYPT POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 477 EGYPT POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 478 EGYPT OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 479 EGYPT OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 480 ISRAEL MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 481 ISRAEL MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 482 ISRAEL MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 483 ISRAEL MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 484 ISRAEL AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 485 ISRAEL AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 486 ISRAEL AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 487 ISRAEL AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 488 ISRAEL ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 489 ISRAEL ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 490 ISRAEL POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 491 ISRAEL POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 492 ISRAEL OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 493 ISRAEL OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 494 REST OF MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 495 REST OF MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 496 SOUTH AMERICA MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 497 SOUTH AMERICA MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 498 SOUTH AMERICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 499 SOUTH AMERICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 500 SOUTH AMERICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 501 SOUTH AMERICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 502 SOUTH AMERICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 503 SOUTH AMERICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 504 SOUTH AMERICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 505 SOUTH AMERICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 506 SOUTH AMERICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 507 SOUTH AMERICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 508 SOUTH AMERICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 509 SOUTH AMERICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 510 SOUTH AMERICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 511 SOUTH AMERICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 512 BRAZIL MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 513 BRAZIL MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 514 BRAZIL MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 515 BRAZIL MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 516 BRAZIL AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 517 BRAZIL AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 518 BRAZIL AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 519 BRAZIL AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 520 BRAZIL ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 521 BRAZIL ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 522 BRAZIL POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 523 BRAZIL POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 524 BRAZIL OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 525 BRAZIL OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 526 ARGENTINA MAGNESIUM ALLOYSMARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 527 ARGENTINA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 528 ARGENTINA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 529 ARGENTINA MAGNESIUM ALLOYSMARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 530 ARGENTINA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 531 ARGENTINA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 532 ARGENTINA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 533 ARGENTINA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 534 ARGENTINA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 535 ARGENTINA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 536 ARGENTINA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 537 ARGENTINA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 538 ARGENTINA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 539 ARGENTINA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 540 REST OF SOUTH AMERICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 541 REST OF SOUTH AMERICA MAGNESIUM ALLOYSMARKET, BY PRODUCT, 2020-2029 (TONS)

Liste des figures

FIGURE 1 GLOBAL MAGNESIUM ALLOYS MARKET

FIGURE 2 GLOBAL MAGNESIUM ALLOYS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL MAGNESIUM ALLOYS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL MAGNESIUM ALLOYS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL MAGNESIUM ALLOYS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL MAGNESIUM ALLOYS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 GLOBAL MAGNESIUM ALLOYS MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL MAGNESIUM ALLOYS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL MAGNESIUM ALLOYS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL MAGNESIUM ALLOYS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL MAGNESIUM ALLOYS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL MAGNESIUM ALLOYS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL MAGNESIUM ALLOYS MARKET: SEGMENTATION

FIGURE 14 ASIA PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL MAGNESIUM ALLOYS MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 THE GROWING USE OF MAGNESIUM ALLOYS IN THE AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE GLOBAL MAGNESIUM ALLOYS MARKET IN THE FORECAST PERIOD

FIGURE 16 CAST ALLOY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL MAGNESIUM ALLOY MARKET IN 2022 & 2029

FIGURE 17 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR MAGNESIUM ALLOYS MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GLOBAL MAGNESIUM ALLOYS MARKET

FIGURE 20 GLOBAL MAGNESIUM ALLOYS MARKET: BY PRODUCT, 2021

FIGURE 21 GLOBAL MAGNESIUM ALLOYS MARKET: BY APPLICATION, 2021

FIGURE 22 GLOBAL MAGNESIUM ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 23 GLOBAL MAGNESIUM ALLOYS MARKET: BY REGION (2021)

FIGURE 24 GLOBAL MAGNESIUM ALLOYS MARKET: BY REGION (2022 & 2029)

FIGURE 25 GLOBAL MAGNESIUM ALLOYS MARKET: BY REGION (2021 & 2029)

FIGURE 26 GLOBAL MAGNESIUM ALLOYS MARKET: BY PRODUCT (2022 & 2029)

FIGURE 27 NORTH AMERICA MAGNESIUM ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 NORTH AMERICA MAGNESIUM ALLOYS MARKET: BY PRODUCT (2022-2029)

FIGURE 32 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 33 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021)

FIGURE 34 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 35 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 36 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET: BY PRODUCT (2022-2029)

FIGURE 37 EUROPE MAGNESIUM ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 38 EUROPE MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021)

FIGURE 39 EUROPE MAGNESIUM ALLOYS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 40 EUROPE MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 41 EUROPE MAGNESIUM ALLOYS MARKET: BY PRODUCT (2022-2020)

FIGURE 42 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 43 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021)

FIGURE 44 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET: BY PRODUCT (2022-2029)

FIGURE 47 SOUTH AMERICA MAGNESIUM ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 48 SOUTH AMERICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021)

FIGURE 49 SOUTH AMERICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 50 SOUTH AMERICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 51 SOUTH AMERICA MAGNESIUM ALLOYS MARKET: BY PRODUCT (2022-2029)

FIGURE 52 GLOBAL MAGNESIUM ALLOYS MARKET: COMPANY SHARE 2021 (%)

FIGURE 53 NORTH AMERICA MAGNESIUM ALLOYS MARKET: COMPANY SHARE 2021 (%)

FIGURE 54 EUROPE MAGNESIUM ALLOYS MARKET: COMPANY SHARE 2021 (%)

FIGURE 55 ASIA-PACIFIC MAGNESIUM ALLOYS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche