Global Lubricants Market

Taille du marché en milliards USD

TCAC :

%

USD

145.02 Billion

USD

215.19 Billion

2024

2032

USD

145.02 Billion

USD

215.19 Billion

2024

2032

| 2025 –2032 | |

| USD 145.02 Billion | |

| USD 215.19 Billion | |

|

|

|

|

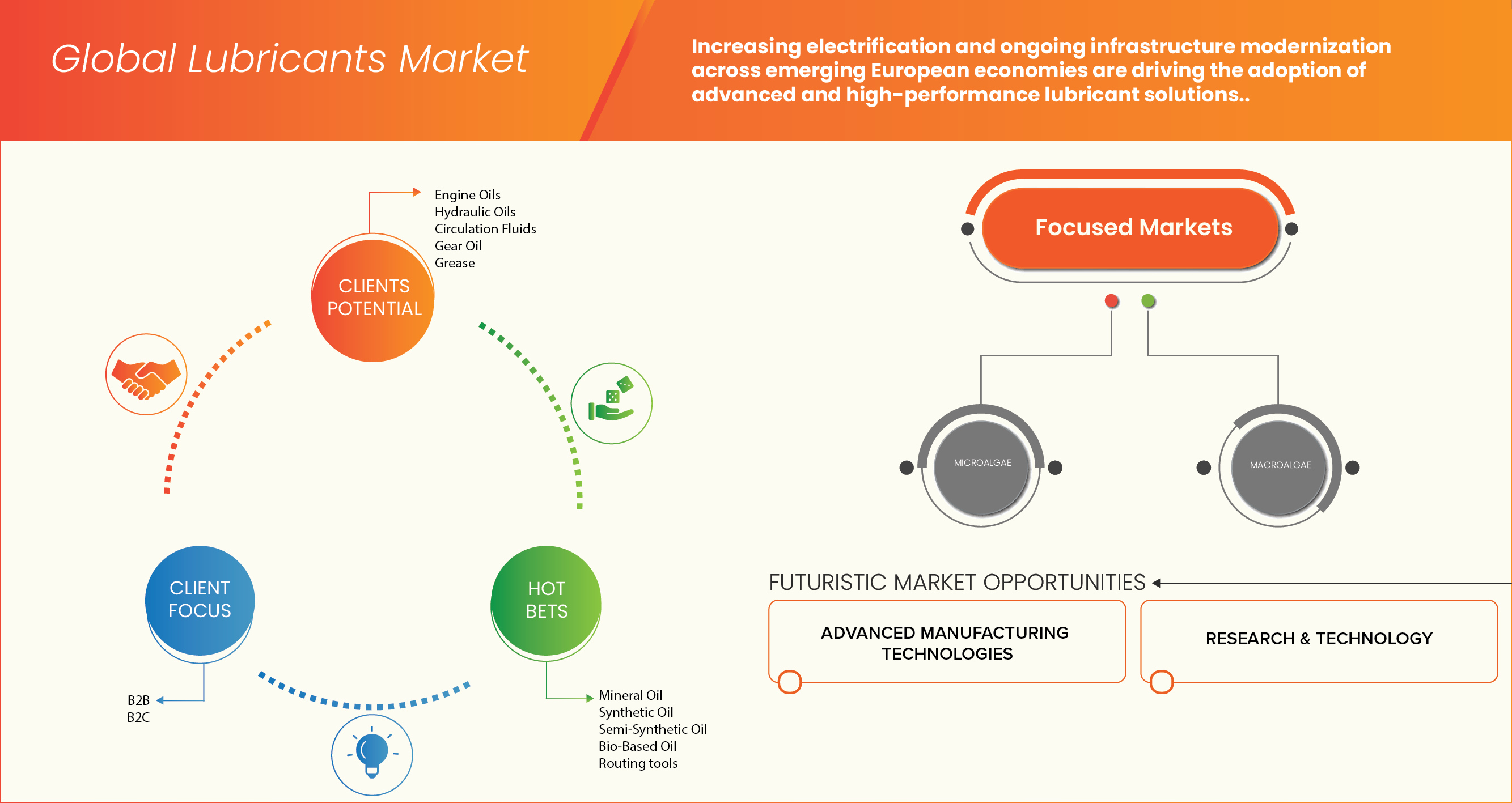

Segmentation mondiale des lubrifiants, par produit (huile moteur, huile hydraulique, fluides de circulation, graisse, huile pour engrenages, huile pour compresseurs, huile pour turbines à gaz, huile pour éoliennes, huiles de transfert thermique, huiles antirouille, huiles pour le travail des métaux, autres), huile de base (huile minérale, huile synthétique, huile semi-synthétique, huile biosourcée, autres), canal de distribution (B2B, B2C), utilisateur final (automobile et transport, secteur maritime, énergie et production d'électricité, métallurgie et travail des métaux, industrie chimique, engins de chantier/terrassement, équipements lourds, agroalimentaire, industrie, aérospatiale, autres), pays (États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, France, Russie, Italie, Espagne, Turquie, Pologne, Pays-Bas, Suisse, Norvège, Autriche, Irlande, reste de l'Europe, Chine, Japon, Inde, Australie, Corée du Sud, Singapour, Thaïlande, Philippines, Malaisie, Indonésie, Vietnam, Taïwan, reste de l'Asie-Pacifique, Brésil, Argentine, reste de l'Amérique du Sud, Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Koweït, Israël et reste du Moyen-Orient et du Moyen-Orient). Afrique) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des lubrifiants

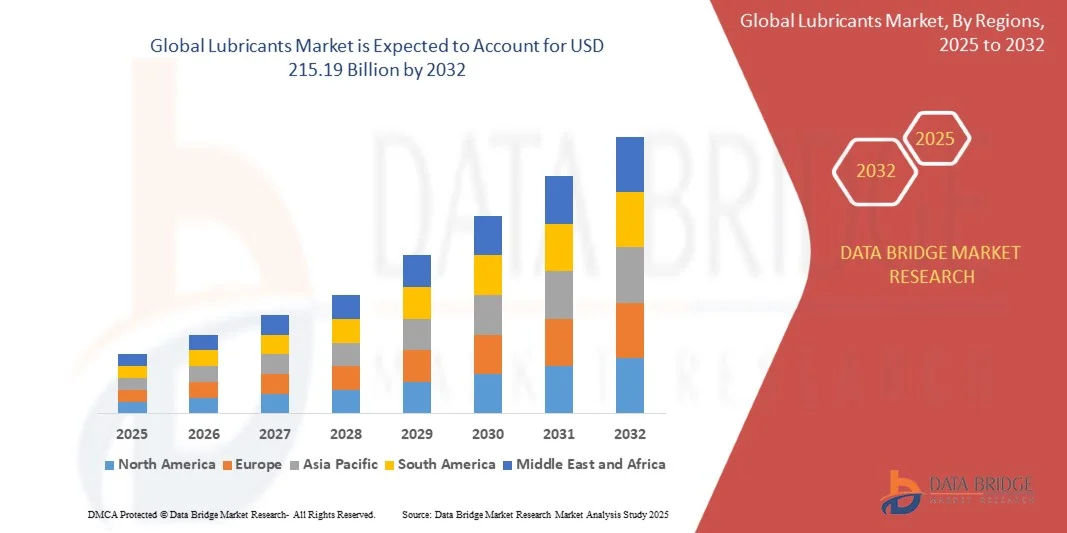

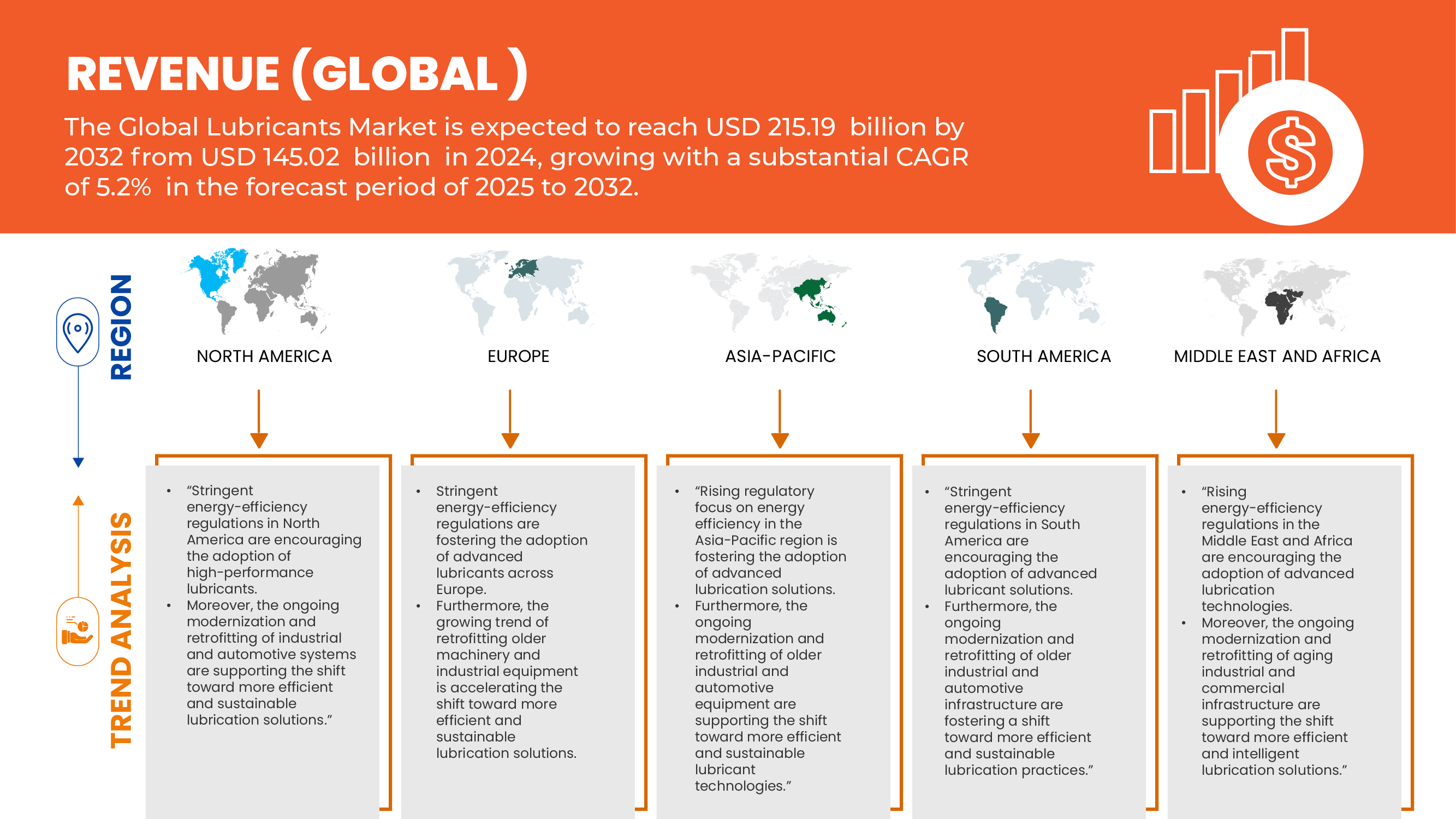

- Le marché mondial des lubrifiants était évalué à 145,02 milliards de dollars en 2024 et devrait atteindre 215,19 milliards de dollars d'ici 2032.

- Au cours de la période prévisionnelle allant de 2025 à 2032, le marché devrait croître à un TCAC de 5,2 %, principalement grâce à l'utilisation croissante des cellules CHO dans les études génétiques.

- La croissance du marché des lubrifiants est stimulée par des facteurs tels que l'industrialisation croissante, la demande accrue de lubrifiants automobiles et industriels haute performance, les progrès technologiques dans les formulations synthétiques et biosourcées, et l'expansion des secteurs de la fabrication et des transports dans le monde entier.

Analyse du marché des lubrifiants

- Les lubrifiants sont des substances essentielles qui permettent de réduire le frottement entre les surfaces en mouvement, de minimiser l'usure et d'améliorer l'efficacité et la durée de vie des machines et des moteurs. Ils jouent un rôle crucial dans de nombreux secteurs industriels, notamment l'automobile, l'aérospatiale, le secteur maritime, les machines industrielles et la production d'énergie. Les lubrifiants modernes sont formulés avec des additifs qui améliorent la viscosité, la stabilité à l'oxydation, la résistance à la corrosion et les performances thermiques.

- L'une des principales applications des lubrifiants se trouve dans le secteur automobile, où ils sont utilisés dans les huiles moteur, les fluides de transmission et les graisses pour garantir un fonctionnement optimal, une consommation de carburant réduite et des émissions polluantes moindres. L'essor des véhicules électriques stimule également le développement de lubrifiants spécifiques, les e-lubrifiants, conçus pour refroidir et protéger les groupes motopropulseurs et les composants électriques. Dans le secteur industriel, les lubrifiants sont indispensables pour le travail des métaux, l'hydraulique et les machines lourdes, assurant des performances constantes et des coûts de maintenance réduits.

- En 2025, le segment des huiles moteur devrait dominer le marché avec une part de marché de 34,09 % en raison de l'augmentation de la production de véhicules, de la demande croissante de lubrifiants synthétiques offrant des performances améliorées et de l'intérêt croissant pour les solutions de lubrification économes en énergie et respectueuses de l'environnement.

Portée du rapport et segmentation du marché des lubrifiants

|

Attributs |

Principaux enseignements du marché des lubrifiants |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des lubrifiants

« Intégration croissante de l’intelligence artificielle (IA) dans la formulation et la fabrication des lubrifiants »

- L'une des principales tendances du marché mondial des lubrifiants est l'intégration croissante de l'intelligence artificielle (IA) dans la formulation, la production et l'optimisation des performances des lubrifiants.

- Les technologies d'IA et d'apprentissage automatique sont utilisées pour analyser des ensembles de données complexes, prédire le comportement des lubrifiants dans diverses conditions de fonctionnement et concevoir des formulations avancées offrant une stabilité thermique, une viscosité et une protection contre l'usure améliorées.

- Par exemple, les modèles d'IA prédictifs peuvent simuler les performances des lubrifiants dans les moteurs ou les machines industrielles, permettant ainsi aux fabricants d'optimiser les formulations sans tests physiques approfondis.

- Cette technologie permet de réduire le temps de recherche et développement, de minimiser les coûts de production et d'améliorer la qualité et la constance globales des lubrifiants.

- L'adoption de systèmes de maintenance prédictive basés sur l'IA dans les secteurs automobile et industriel favorise également une utilisation efficace des lubrifiants, prolongeant ainsi la durée de vie des équipements et réduisant les temps d'arrêt.

- L'intégration croissante de l'IA transforme ainsi la production de lubrifiants et la gestion des performances, offrant aux fabricants un avantage concurrentiel grâce à l'innovation, l'efficacité et la durabilité.

Dynamique du marché des lubrifiants

Conducteur

« Utilisation croissante des matériaux avancés et des technologies additives dans le développement des lubrifiants »

- L'application croissante des sciences des matériaux avancées et de la chimie des additifs s'impose comme un moteur essentiel du marché mondial des lubrifiants. Avec l'évolution constante des nanotechnologies, de la chimie de synthèse et de la recherche en tribologie, les lubrifiants ne sont plus considérés comme de simples fluides réduisant la friction ; ils deviennent des solutions techniques conçues pour améliorer la performance, l'efficacité énergétique et la durabilité dans tous les secteurs industriels.

- Cette évolution accroît la demande sur trois dimensions de marché interconnectées : (1) Innovation de formulation — l'utilisation de nanoparticules, d'esters et de liquides ioniques pour développer des lubrifiants de nouvelle génération avec une stabilité thermique et oxydative supérieure ; (2) Optimisation des performances — l'intégration de la modélisation par IA, de l'analyse rhéologique et de la surveillance des performances en temps réel pour prédire le comportement du lubrifiant dans des conditions extrêmes ; et (3) Durabilité et circularité — l'augmentation des investissements en R&D dans les huiles de base biodégradables, peu toxiques et renouvelables pour répondre aux réglementations environnementales et aux objectifs de durabilité des entreprises.

- En bref, les progrès réalisés dans le domaine des matériaux et des technologies d'additifs alimentent un écosystème en expansion qui comprend des fournisseurs de produits chimiques, des fabricants d'additifs, des laboratoires de R&D, des services d'essais et des solutions de surveillance numérique, élargissant ainsi la portée et le potentiel commercial de l'innovation en matière de lubrifiants.

- Par exemple, début 2025, plusieurs fabricants de lubrifiants ont annoncé l'incorporation de nanomatériaux à base de graphène et de nitrure de bore dans leurs lubrifiants industriels, améliorant ainsi la résistance à l'usure et la dissipation de la chaleur. De même, de nouvelles formulations d'esters biosourcés ont démontré une biodégradabilité accrue et des performances équivalentes à celles des lubrifiants synthétiques classiques, confirmant la tendance du marché vers des matériaux durables.

- L'utilisation croissante d'additifs de pointe et de matériaux techniques renforce non seulement les performances et le profil environnemental des lubrifiants, mais les transforme également en leviers stratégiques pour l'efficacité, la fiabilité des équipements et la décarbonation dans les secteurs de l'automobile, de la fabrication et de l'énergie.

Opportunité

« Développement continu des technologies de lubrification et d’additifs »

- Les progrès constants des technologies de lubrification et d'additifs créent de nouvelles opportunités de croissance pour le marché mondial des lubrifiants. Les innovations en chimie de synthèse, en nanotechnologie et en ingénierie tribologique, associées à la surveillance numérique et à l'optimisation des formulations par l'IA, améliorent l'efficacité, la durabilité et la performance environnementale des lubrifiants dans tous les secteurs industriels.

- Les améliorations apportées à la formulation des huiles de base (groupes III, IV et huiles biosourcées), ainsi qu'aux ensembles d'additifs qui offrent une stabilité à l'oxydation supérieure, des propriétés anti-usure et un contrôle thermique, permettent de créer des lubrifiants de nouvelle génération conçus pour des applications automobiles, aérospatiales et industrielles hautes performances.

- Par exemple, en 2024, TotalEnergies et Michelin ont annoncé un projet commun visant à développer des lubrifiants 100 % biosourcés et renouvelables, contribuant ainsi à la neutralité carbone et au développement durable des produits. De même, ExxonMobil a mis en place des plateformes de formulation assistées par intelligence artificielle qui prédisent les performances des lubrifiants sous différentes contraintes mécaniques et thermiques, réduisant ainsi les délais de R&D et améliorant la précision du mélange.

- Ces initiatives soulignent que le développement technologique continu dans le domaine de la chimie et de la fabrication des lubrifiants ne se limite plus à des améliorations progressives des performances ; il est désormais accéléré par l’innovation collaborative entre les grandes entreprises énergétiques, les fournisseurs de produits chimiques et les fabricants d’équipements. Cet effort concerté remodèle les capacités de production mondiales, améliore l’efficacité énergétique et soutient la transition vers des solutions de lubrification durables et performantes.

Retenue/Défi

« Le coût élevé de production des lubrifiants synthétiques et biosourcés constitue un frein au marché »

- Les coûts élevés de production et de formulation des lubrifiants synthétiques et biosourcés constituent un frein important au marché mondial des lubrifiants. Bien que ces lubrifiants de pointe offrent une stabilité thermique supérieure, une meilleure résistance à l'oxydation et une durée de vie prolongée, leur fabrication requiert des matières premières coûteuses, des procédés de raffinage complexes et des technologies de mélange spécialisées, ce qui se traduit par des prix plus élevés pour le consommateur final que pour les lubrifiants minéraux classiques.

- Les infrastructures de production à forte intensité de capital, les investissements en R&D dans la formulation d'additifs et la nécessité d'un mélange précis et d'une assurance qualité rigoureuse augmentent encore les coûts d'exploitation des fabricants de lubrifiants. De plus, la fluctuation des prix du pétrole brut, la volatilité des chaînes d'approvisionnement en huiles de base et la disponibilité limitée de matières premières biosourcées de haute qualité alourdissent encore la charge financière globale.

- Ces pressions économiques réduisent les marges bénéficiaires, freinent l'adoption de ces technologies dans les secteurs industriels et automobiles sensibles aux coûts, et constituent un frein pour les petites et moyennes entreprises manufacturières. De plus, la mise en conformité avec l'évolution des normes environnementales et de performance (telles que les réglementations REACH, EPA et Euro VI) accroît la complexité et le coût de la production.

- Par exemple, en 2024, la Direction européenne de l'industrie des lubrifiants (ELID) a indiqué que la transition vers des lubrifiants à faibles émissions, biodégradables et à haute efficacité avait entraîné une hausse de 20 à 30 % des coûts d'approvisionnement en huiles de base et de développement d'additifs par rapport aux lubrifiants conventionnels. De même, plusieurs études sectorielles menées par l'API et SAE International ont souligné que la production d'huiles de base synthétiques des groupes IV et V implique des synthèses chimiques complexes et des procédés énergivores, contribuant ainsi à l'augmentation des prix.

- Bien que les lubrifiants synthétiques et biosourcés soient essentiels à des opérations performantes et respectueuses de l'environnement, leur coût élevé constitue un frein important à leur utilisation. Le recours à des matériaux de pointe, à une main-d'œuvre qualifiée, à des normes de formulation rigoureuses et à des investissements importants en R&D continue de limiter leur accessibilité et leur adoption à grande échelle, notamment sur les marchés émergents.

Étendue du marché mondial des lubrifiants

Le marché est segmenté en fonction du produit, du canal de distribution, de l'huile de base et de l'utilisation finale.

|

Segmentation |

Sous-segmentation |

|

Sous-produit |

|

|

Par huile de base |

|

|

Par canal de vente

|

|

|

Par utilisation finale |

|

Analyse régionale du marché des lubrifiants

« La région Asie-Pacifique est la région dominante dans le secteur des lubrifiants »

- La région Asie-Pacifique détient la plus grande part du marché mondial des lubrifiants, grâce à une industrialisation rapide, à l'expansion des secteurs automobile et manufacturier et à la forte présence de fabricants de lubrifiants multinationaux et régionaux.

- La Chine, l'Inde et le Japon contribuent de manière significative à la domination régionale en raison de l'augmentation du nombre de véhicules en circulation, des opérations industrielles à grande échelle et de la demande croissante de lubrifiants synthétiques et haute performance.

- Les politiques gouvernementales favorables à l'efficacité énergétique, à la durabilité environnementale et au développement des capacités de production nationale accélèrent encore la croissance du marché. De plus, les collaborations stratégiques entre acteurs mondiaux et locaux, les progrès technologiques dans les formulations de lubrifiants synthétiques et biosourcés, ainsi que l'expansion des réseaux de mélange et de distribution continuent de stimuler la croissance du marché dans toute la région .

« La région Asie-Pacifique devrait enregistrer le taux de croissance le plus élevé. »

- La région Asie-Pacifique détient la plus grande part du marché mondial des lubrifiants, portée par une industrialisation rapide, une production automobile en expansion et une forte croissance économique dans les pays émergents tels que la Chine, l'Inde, le Japon et la Corée du Sud. Véritable plaque tournante de la production mondiale, elle connaît une demande croissante de lubrifiants haute performance dans les secteurs de l'automobile, des machines industrielles, de la construction et du transport maritime.

- La Chine et l'Inde contribuent largement à la domination de la région, grâce à la croissance du parc automobile, au développement d'infrastructures à grande échelle et à l'expansion des activités industrielles. Les investissements continus des principaux acteurs dans les capacités de raffinage et les usines de mélange de lubrifiants renforcent encore les capacités de production régionales.

- De plus, la présence d'acteurs majeurs du marché — notamment Shell, ExxonMobil, BP, Indian Oil Corporation et Sinopec — ainsi que de sociétés régionales telles qu'ENEOS, GS Caltex et PTT, a renforcé les réseaux d'approvisionnement et amélioré la disponibilité des produits.

- Les progrès technologiques réalisés dans le domaine des lubrifiants synthétiques et biosourcés, conjugués aux initiatives gouvernementales favorisant l'efficacité énergétique et la production durable, stimulent la croissance du marché en Asie-Pacifique. L'environnement de production compétitif de la région, la sensibilisation croissante des consommateurs et le développement du marché de l'après-vente automobile devraient lui permettre de conserver sa position de leader sur le marché mondial des lubrifiants durant toute la période de prévision.

part de marché des lubrifiants

L'analyse concurrentielle du marché fournit des informations détaillées par concurrent. Ces informations comprennent un aperçu de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses initiatives sur de nouveaux marchés, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, ses lancements de produits, l'étendue de sa gamme de produits et sa position dominante sur le marché. Les données présentées ci-dessus concernent uniquement les activités principales des entreprises liées au marché.

Les principaux acteurs du marché sont :

- Shell PLC (Royaume-Uni)

- Chevron Corporation (États-Unis)

- Société nationale chinoise du pétrole (CNPC) (Chine)

- PTT Public Company Limited (Thaïlande)

- Eni SpA (Italie)

- Société chinoise du pétrole et des produits chimiques (Chine)

- Exxon Mobil Corporation (États-Unis)

- BP plc (Royaume-Uni)

- TotalEnergies (France)

- ENEOS Corporation (Japon)

- Idemitsu Kosan Co., Ltd. (Japon)

- Lubrifiants PT Pertamina (Indonésie)

- ROSNEFT (Russie)

- FUCHS (Allemagne)

- Indian Oil Corporation Ltd. (Inde)

- Valvoline (États-Unis)

- GS Caltex Corporation (Corée du Sud)

- Motul (France)

- LUKOIL (Russie)

- Phillips 66 (États-Unis)

- Schaeffer (États-Unis)

- Pétrole du Golfe (Émirats arabes unis)

- PETRONAS (Malaisie)

- BECHEM (Allemagne)

- Quaker Houghton (États-Unis)

- Hardcastle Petrofer (Inde)

- Lubrifiants HP (Inde)

- Terpel (Colombie)

Dernières évolutions dans le secteur mondial des lubrifiants

- En juillet 2025, Shell Lubricants India a acquis Raj Petro Specialities Pvt. Ltd., élargissant ainsi son portefeuille de lubrifiants industriels et automobiles et renforçant sa présence sur le marché indien.

- En juin 2025, Eni Sustainable Mobility SpA (via sa société mère Eni SpA) a signé une lettre d'intention stratégique avec BMW Italia pour collaborer à la décarbonation des transports routiers — en combinant des biocarburants (notamment du HVO issu de matières premières 100 % renouvelables) et en développant l'infrastructure de recharge pour la mobilité électrique sous le réseau à marque commune.

- En avril 2025, Idemitsu Kosan a achevé les travaux d'agrandissement de son usine pilote n° 1 à Ichihara, dans la préfecture de Chiba. Cette petite unité est dédiée à la production en série d'électrolytes solides, matériaux essentiels aux batteries tout-solide. Le projet a bénéficié du soutien du METI (Ministère de l'Économie, du Commerce et de l'Industrie) grâce à une subvention pour les projets de stockage d'énergie à grande échelle. Cette initiative vise à contribuer au développement des véhicules électriques et à la création d'une société axée sur le recyclage des ressources.

- En novembre 2024, PTT Lubricants, marque phare de lubrifiants de PTT Oil and Retail Business (OR) en Thaïlande, a annoncé une collaboration stratégique avec PT Sumber Suwarna Unisindo (SUN-D) afin de renforcer sa présence sur le marché indonésien. Ce partenariat vise à garantir l'approvisionnement des clients indonésiens en lubrifiants PTT de haute qualité et à leur fournir un service après-vente performant. L'Indonésie a été identifiée comme un marché à forte croissance dans le secteur automobile, ce qui en fait un axe prioritaire de la stratégie d'expansion internationale de PTT Lubricants.

- En juin 2024, GS Caltex a signé un protocole d'accord avec Summit Cosmetics (Japon) pour fournir son ingrédient écologique « GreenDiol » à l'échelle mondiale, en tirant parti du réseau de Summit en Amérique du Nord, en Europe et en Asie, accélérant ainsi l'expansion de GS Caltex dans le segment des cosmétiques bio et durables.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL LUBRICANT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.3.1 OVERVIEW

4.3.2 ADVANCED BASE OIL TECHNOLOGIES

4.3.3 ADDITIVE CHEMISTRY INNOVATION

4.3.4 SMART AND FUNCTIONAL LUBRICANTS

4.3.5 DIGITALIZATION AND PROCESS AUTOMATION

4.3.6 ELECTRIFICATION AND EV-COMPATIBLE LUBRICANTS

4.3.7 SUSTAINABILITY AND CIRCULAR ECONOMY INITIATIVES

4.3.8 ADDITIVE MANUFACTURING AND TESTING INNOVATIONS

4.3.9 COLLABORATION AND R&D TRENDS

4.3.10 OUTLOOK

4.4 PRODUCTION AND CONSUMPTION ANALYSIS

4.4.1 GLOBAL PRODUCTION OVERVIEW

4.4.2 REGIONAL PRODUCTION DISTRIBUTION

4.4.3 CONSUMPTION PATTERNS

4.4.4 TRADE FLOW AND SUPPLY BALANCE

4.4.5 INDUSTRIAL AND AUTOMOTIVE SEGMENT ANALYSIS

4.4.6 KEY TRENDS IMPACTING PRODUCTION AND CONSUMPTION

4.5 SUPPLY CHAIN ANALYSIS – GLOBAL LUBRICANTS MARKET

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5.4 CONCLUSION

4.6 CLIMATE CHANGE SCENARIO

4.6.1 ENVIRONMENTAL CONCERNS

4.6.2 INDUSTRY RESPONSE

4.6.3 GOVERNMENT’S ROLE

4.6.4 ANALYST RECOMMENDATIONS

4.6.5 CONCLUSION

4.7 PRICING ANALYSIS

4.7.1 INTRODUCTION

4.7.2 PRICING ANALYSIS

4.7.3 CONCLUSION

4.8 RAW MATERIAL COVERAGE

4.8.1 BASE OILS

4.8.2 ADDITIVE PACKAGES

4.8.3 SYNTHETIC ESTERS

4.8.4 POLYALKYLENE GLYCOLS (PAGS)

4.8.5 VEGETABLE AND BIO-BASED OILS

4.8.6 THICKENERS AND SOAP COMPLEXES (FOR GREASES)

4.8.7 SOLVENTS AND PROCESSING AIDS

4.9 VENDOR SELECTION CRITERIA – GLOBAL LUBRICANTS MARKET

4.9.1 OVERVIEW

4.9.2 REGULATORY AND PRODUCT STEWARDSHIP COMPLIANCE

4.9.3 MANAGEMENT SYSTEMS AND GOVERNANCE

4.9.4 PRODUCT PERFORMANCE, SAFETY & SUSTAINABLE FORMULATION

4.9.5 LIFE-CYCLE ASSESSMENT AND ENVIRONMENTAL FOOTPRINT

4.9.6 DUE-DILIGENCE WORKFLOW FOR PROCUREMENT

4.9.7 CONCLUSION

5 REGULATION COVERAGE

5.1 PRODUCT CODES

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN AUTOMOTIVE PRODUCTION & VEHICLE FLEETS

6.1.2 INDUSTRIALIZATION & LARGE-SCALE INFRASTRUCTURE EXPANSION

6.1.3 RISING DEMAND FOR HIGH PERFORMANCE AND ENERGY-EFFICIENT LUBRICANTS

6.1.4 RISING ADOPTION OF ADVANCED MANUFACTURING & AUTOMATION TECHNOLOGIES

6.2 RESTRAINS

6.2.1 STRINGENT & DIVERGENT REGULATORY FRAMEWORKS

6.2.2 DECLINING DEMAND FROM ELECTRIC VEHICLES (EVS) FOR CONVENTIONAL LUBRICANTS

6.3 OPPORTUNITIES

6.3.1 DEVELOPMENT & COMMERCIALIZATION OF BIO-BASED AND SUSTAINABLE LUBRICANTS

6.3.2 GROWTH IN DEMAND FROM CONSTRUCTION, AGRICULTURE, AND MINING SECTORS

6.3.3 SERVICES AND TECHNOLOGY INTEGRATION FOR PREDICTIVE MAINTENANCE, IOT, AND LIFECYCLE MANAGEMENT

6.4 CHALLENGES

6.4.1 VOLATILITY IN RAW MATERIAL & BASE OIL PRICES

6.4.2 COMPETITION FROM ALTERNATIVE LUBRICATION TECHNOLOGIES & SUBSTITUTES

7 GLOBAL LUBRICANTS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 ENGINE OILS

7.2.1 MINERAL OIL

7.2.2 SYNTHETIC OIL

7.3 HYDRAULIC OILS

7.3.1 MINERAL OIL

7.3.2 SYNTHETIC OIL

7.4 CIRCULATION FLUIDS

7.4.1 MINERAL OIL

7.4.2 SYNTHETIC OIL

7.5 GEAR OIL

7.5.1 MINERAL OIL

7.5.2 SYNTHETIC OIL

7.6 GREASE

7.6.1 GREASE, BY BASE OIL

7.6.2 MINERAL OIL

7.6.3 SYNTHETIC OIL

7.7 METALWORKING FLUIDS

7.7.1 MINERAL OIL

7.7.2 SYNTHETIC OIL

7.8 WIND TURBINE OILS

7.8.1 MINERAL OIL

7.8.2 SYNTHETIC OIL

7.9 COMPRESSOR OILS

7.9.1 MINERAL OIL

7.9.2 SYNTHETIC OIL

7.1 GAS TURBINE OILS

7.10.1 MINERAL OIL

7.10.2 SYNTHETIC OIL

7.11 HEAT TRANSFER OILS

7.11.1 MINERAL OIL

7.11.2 SYNTHETIC OIL

7.12 RUST PREVENTIVE OILS

7.12.1 MINERAL OIL

7.12.2 SYNTHETIC OIL

7.13 OTHERS

7.13.1 MINERAL OIL

7.13.2 SYNTHETIC OIL

8 GLOBAL LUBRICANTS MARKET, BY BASE OIL

8.1 OVERVIEW

8.2 MINERAL OIL

8.3 SYNTHETIC OIL

8.4 SEMI-SYNTHETIC OIL

8.5 BIO-BASED OIL

8.6 OTHERS

9 GLOBAL LUBRICANTS MARKET, BY SALES CHANNEL

9.1 OVERVIEW

9.2 B2B

9.3 B2C

10 GLOBAL LUBRICANTS MARKET, BY END-USE

10.1 OVERVIEW

10.2 AUTOMOBILE & TRANSPORTATION

10.3 MARINE

10.4 METALLURGY AND METAL

10.5 ENERGY & POWER GENERATION

10.6 INDUSTRIAL

10.7 CHEMICAL MANUFACTURING

10.8 CONSTRUCTION MACHINERY/EARTHMOVING

10.9 HEAVY EQUIPMENT

10.1 FOOD & BEVERAGE

10.11 AEROSPACE

10.12 OTHERS

11 GLOBAL LUBRICANTS MARKET, BY REGION

11.1 OVERVIEW

11.2 ASIA-PACIFIC

11.2.1 CHINA

11.2.2 INDIA

11.2.3 JAPAN

11.2.4 SOUTH KOREA

11.2.5 AUSTRALIA

11.2.6 INDONESIA

11.2.7 VIETNAM

11.2.8 THAILAND

11.2.9 TAIWAN

11.2.10 MALAYSIA

11.2.11 SINGAPORE

11.2.12 PHILIPPINES

11.2.13 NEW ZEALAND

11.2.14 REST OF ASIA-PACIFIC

11.3 NORTH AMERICA

11.3.1 U.S.

11.3.2 MEXICO

11.3.3 CANADA

11.4 EUROPE

11.4.1 GERMANY

11.4.2 RUSSIA

11.4.3 FRANCE

11.4.4 ITALY

11.4.5 SPAIN

11.4.6 UNITED KINGDOM

11.4.7 POLAND

11.4.8 TURKEY

11.4.9 NETHERLANDS

11.4.10 BELGIUM

11.4.11 SWITZERLAND

11.4.12 SWEDEN

11.4.13 DENMARK

11.4.14 NORWAY

11.4.15 FINLAND

11.4.16 REST OF EUROPE

11.5 MIDDLE EAST AND AFRICA

11.5.1 SAUDI ARABIA

11.5.2 UNITED ARAB EMIRATES

11.5.3 SOUTH AFRICA

11.5.4 EGYPT

11.5.5 ISRAEL

11.5.6 QATAR

11.5.7 KUWAIT

11.5.8 OMAN

11.5.9 BAHRAIN

11.5.10 REST OF MIDDLE EAST AND AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL LUBRICANTS MARKET: COMPANY LANDSCAPE

12.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: EUROPE

12.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 SHELL PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 CHEVRON CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 CHINA NATIONAL PETROLEUM CORPORATION (CNPC)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 PTT PUBLIC COMPANY LIMITED

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 ENI S.P.A.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 BP P.L.C.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 CARL BECHEM GMBH.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CHINA PETROCHEMICAL CORPORATION

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 EXXON MOBIL CORPORATION.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 ENEOS CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 FUCHS

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 GS CALTEX CORPORATION

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 GULF OIL INTERNATIONAL LTD

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 HARDCASTLE PETROFER

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 HP LUBRICANTS.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 IDEMITSU KOSAN CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 INDIAN OIL CORPORATION LTD

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 LUKOIL

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 MOTUL

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 ORGANIZACIÓN TERPEL

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 PETRONAS LUBRICANTS INTERNATIONAL

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 PT PERTAMINA LUBRICANTS

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENT

14.23 PHILLIPS 66 COMPANY

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 PRODUCT PORTFOLIO

14.23.4 RECENT DEVELOPMENT

14.24 QUAKER CHEMICAL CORPORATION D/B/A QUAKER HOUGHTON

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 PRODUCT PORTFOLIO

14.24.4 RECENT DEVELOPMENT

14.25 ROSNEFT

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENT

14.26 SCHAEFFER MANUFACTURING CO.

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENT

14.27 TOTALENERGIES

14.27.1 COMPANY SNAPSHOT

14.27.2 REVENUE ANALYSIS

14.27.3 PRODUCT PORTFOLIO

14.27.4 RECENT DEVELOPMENT

14.28 VALVOLINE

14.28.1 COMPANY SNAPSHOT

14.28.2 REVENUE ANALYSIS

14.28.3 PRODUCT PORTFOLIO

14.28.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 GLOBAL LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 2 GLOBAL LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 3 GLOBAL ENGINE OILS IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 GLOBAL ENGINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 5 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 7 GLOBAL HYDRAULIC OILS IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL HYDRAULIC OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 9 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 10 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 11 GLOBAL CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 13 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 14 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 15 GLOBAL GEAR OIL IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL GEAR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 17 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 18 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 19 GLOBAL GREASE IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL GREASE IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 21 GLOBAL GREASE IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 22 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 23 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 24 GLOBAL METALWORKING FLUIDS IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL METALWORKING FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 26 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 27 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 28 GLOBAL WIND TURBINE OILS IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL WIND TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 30 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 31 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 GLOBAL COMPRESSOR OILS IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL COMPRESSOR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 34 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 35 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 36 GLOBAL GAS TURBINE OILS IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 GLOBAL GAS TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 38 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 40 GLOBAL HEAT TRANSFER OILS IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 GLOBAL HEAT TRANSFER OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 42 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 43 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 44 GLOBAL RUST PREVENTIVE OILS IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 GLOBAL RUST PREVENTIVE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 46 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 47 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 GLOBAL OTHERS IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 GLOBAL OTHERS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 50 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 52 GLOBAL LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 53 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 54 GLOBAL MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 55 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 GLOBAL SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 GLOBAL SEMI-SYNTHETIC OIL IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 58 GLOBAL SEMI-SYNTHETIC OIL IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 59 GLOBAL OTHERS IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 60 GLOBAL LUBRICANTS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 61 GLOBAL B2B IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 62 GLOBAL B2B IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 63 GLOBAL B2C IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 64 GLOBAL B2C IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 65 GLOBAL LUBRICANTS MARKET, BY END-USE, 2018-2032 (USD MILLION)

TABLE 66 GLOBAL AUTOMOBILE & TRANSPORTATION IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 67 GLOBAL AUTOMOBILE & TRANSPORTATION IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 68 GLOBAL COMMERCIAL VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 69 GLOBAL TRUCKS IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 70 GLOBAL PASSENGER VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 GLOBAL MARINE IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 72 GLOBAL METALLURGY AND METAL WORKING IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 73 GLOBAL ENERGY & POWER GENERATION IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 74 GLOBAL INDUSTRIAL IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 75 GLOBAL CHEMICAL MANUFACTURING IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 76 GLOBAL CONSTRUCTION MACHINERY/ EARTHMOVING IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 77 GLOBAL HEAVY EQUIPMENT IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 78 GLOBAL FOOD & BEVERAGE IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 79 GLOBAL AEROSPACE IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 80 GLOBAL OTHERS IN LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 81 GLOBAL LUBRICANTS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 82 GLOBAL LUBRICANTS MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 83 ASIA-PACIFIC LUBRICANTS MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 84 ASIA-PACIFIC LUBRICANTS MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 85 ASIA-PACIFIC LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 86 ASIA-PACIFIC LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 87 ASIA-PACIFIC ENGINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 88 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 89 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 ASIA-PACIFIC HYDRAULIC OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 91 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 92 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 93 ASIA-PACIFIC CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 94 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 95 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 96 ASIA-PACIFIC GEAR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 97 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 98 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 99 ASIA-PACIFIC GREASE IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 100 ASIA-PACIFIC GREASE IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 101 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 102 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 103 ASIA-PACIFIC METALWORKING FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 104 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 105 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 106 ASIA-PACIFIC WIND TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 107 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 108 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 109 ASIA-PACIFIC COMPRESSOR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 110 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 111 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 112 ASIA-PACIFIC GAS TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 113 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 114 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 115 ASIA-PACIFIC HEAT TRANSFER OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 116 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 117 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 118 ASIA-PACIFIC RUST PREVENTIVE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 119 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 120 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 121 ASIA-PACIFIC OTHERS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 122 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 123 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 124 ASIA-PACIFIC LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 125 ASIA-PACIFIC MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 126 ASIA-PACIFIC SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 127 ASIA-PACIFIC LUBRICANTS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 128 ASIA-PACIFIC B2B IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 129 ASIA-PACIFIC B2C IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 130 ASIA-PACIFIC LUBRICANTS MARKET, BY END-USE, 2018-2032 (USD MILLION)

TABLE 131 ASIA-PACIFIC AUTOMOBILE & TRANSPORTATION IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 132 ASIA-PACIFIC COMMERCIAL VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 133 ASIA-PACIFIC TRUCKS IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 134 ASIA-PACIFIC PASSENGER VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 135 CHINA LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 136 CHINA LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 137 CHINA ENGINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 138 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 139 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 140 CHINA HYDRAULIC OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 141 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 142 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 143 CHINA CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 144 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 145 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 146 CHINA GEAR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 147 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 148 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 149 CHINA GREASE IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 150 CHINA GREASE IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 151 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 152 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 153 CHINA METALWORKING FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 154 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 155 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 156 CHINA WIND TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 157 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 158 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 159 CHINA COMPRESSOR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 160 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 161 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 162 CHINA GAS TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 163 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 164 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 165 CHINA HEAT TRANSFER OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 166 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 167 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 168 CHINA RUST PREVENTIVE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 169 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 170 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 171 CHINA OTHERS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 172 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 173 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 174 CHINA LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 175 CHINA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 176 CHINA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 177 CHINA LUBRICANTS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 178 CHINA B2B IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 179 CHINA B2C IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 180 CHINA LUBRICANTS MARKET, BY END-USE, 2018-2032 (USD MILLION)

TABLE 181 CHINA AUTOMOBILE & TRANSPORTATION IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 182 CHINA COMMERCIAL VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 183 CHINA TRUCKS IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 184 CHINA PASSENGER VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 185 INDIA LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 186 INDIA LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 187 INDIA ENGINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 188 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 189 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 190 INDIA HYDRAULIC OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 191 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 192 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 INDIA CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 194 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 195 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 196 INDIA GEAR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 197 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 198 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 199 INDIA GREASE IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 200 INDIA GREASE IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 201 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 202 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 203 INDIA METALWORKING FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 204 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 205 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 206 INDIA WIND TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 207 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 208 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 209 INDIA COMPRESSOR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 210 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 211 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 212 INDIA GAS TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 213 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 214 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 215 INDIA HEAT TRANSFER OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 216 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 217 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 218 INDIA RUST PREVENTIVE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 219 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 220 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 221 INDIA OTHERS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 222 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 223 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 224 INDIA LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 225 INDIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 226 INDIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 227 INDIA LUBRICANTS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 228 INDIA B2B IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 229 INDIA B2C IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 230 INDIA LUBRICANTS MARKET, BY END-USE, 2018-2032 (USD MILLION)

TABLE 231 INDIA AUTOMOBILE & TRANSPORTATION IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 232 INDIA COMMERCIAL VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 233 INDIA TRUCKS IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 234 INDIA PASSENGER VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 235 JAPAN LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 236 JAPAN LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 237 JAPAN ENGINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 238 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 239 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 240 JAPAN HYDRAULIC OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 241 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 242 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 243 JAPAN CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 244 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 245 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 246 JAPAN GEAR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 247 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 248 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 249 JAPAN GREASE IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 250 JAPAN GREASE IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 251 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 252 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 253 JAPAN METALWORKING FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 254 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 255 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 256 JAPAN WIND TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 257 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 258 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 259 JAPAN COMPRESSOR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 260 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 261 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 262 JAPAN GAS TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 263 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 264 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 265 JAPAN HEAT TRANSFER OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 266 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 267 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 268 JAPAN RUST PREVENTIVE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 269 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 270 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 271 JAPAN OTHERS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 272 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 273 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 274 JAPAN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 275 JAPAN MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 276 JAPAN SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 277 JAPAN LUBRICANTS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 278 JAPAN B2B IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 279 JAPAN B2C IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 280 JAPAN LUBRICANTS MARKET, BY END-USE, 2018-2032 (USD MILLION)

TABLE 281 JAPAN AUTOMOBILE & TRANSPORTATION IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 282 JAPAN COMMERCIAL VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 283 JAPAN TRUCKS IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 284 JAPAN PASSENGER VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 285 SOUTH KOREA LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 286 SOUTH KOREA LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 287 SOUTH KOREA ENGINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 288 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 289 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 290 SOUTH KOREA HYDRAULIC OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 291 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 292 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 293 SOUTH KOREA CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 294 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 295 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 296 SOUTH KOREA GEAR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 297 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 298 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 299 SOUTH KOREA GREASE IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 300 SOUTH KOREA GREASE IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 301 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 302 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 303 SOUTH KOREA METALWORKING FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 304 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 305 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 306 SOUTH KOREA WIND TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 307 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 308 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 309 SOUTH KOREA COMPRESSOR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 310 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 311 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 312 SOUTH KOREA GAS TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 313 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 314 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 315 SOUTH KOREA HEAT TRANSFER OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 316 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 317 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 318 SOUTH KOREA RUST PREVENTIVE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 319 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 320 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 321 SOUTH KOREA OTHERS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 322 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 323 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 324 SOUTH KOREA LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 325 SOUTH KOREA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 326 SOUTH KOREA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 327 SOUTH KOREA LUBRICANTS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 328 SOUTH KOREA B2B IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 329 SOUTH KOREA B2C IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 330 SOUTH KOREA LUBRICANTS MARKET, BY END-USE, 2018-2032 (USD MILLION)

TABLE 331 SOUTH KOREA AUTOMOBILE & TRANSPORTATION IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 332 SOUTH KOREA COMMERCIAL VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 SOUTH KOREA TRUCKS IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 334 SOUTH KOREA PASSENGER VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 335 AUSTRALIA LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 336 AUSTRALIA LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 337 AUSTRALIA ENGINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 338 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 339 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 340 AUSTRALIA HYDRAULIC OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 341 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 342 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 343 AUSTRALIA CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 344 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 345 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 346 AUSTRALIA GEAR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 347 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 348 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 349 AUSTRALIA GREASE IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 350 AUSTRALIA GREASE IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 351 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 352 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 353 AUSTRALIA METALWORKING FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 354 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 355 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 356 AUSTRALIA WIND TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 357 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 358 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 359 AUSTRALIA COMPRESSOR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 360 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 361 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 362 AUSTRALIA GAS TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 363 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 364 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 365 AUSTRALIA HEAT TRANSFER OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 366 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 367 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 368 AUSTRALIA RUST PREVENTIVE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 369 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 370 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 371 AUSTRALIA OTHERS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 372 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 373 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 374 AUSTRALIA LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 375 AUSTRALIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 376 AUSTRALIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 377 AUSTRALIA LUBRICANTS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 378 AUSTRALIA B2B IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 379 AUSTRALIA B2C IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 380 AUSTRALIA LUBRICANTS MARKET, BY END-USE, 2018-2032 (USD MILLION)

TABLE 381 AUSTRALIA AUTOMOBILE & TRANSPORTATION IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 382 AUSTRALIA COMMERCIAL VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 383 AUSTRALIA TRUCKS IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 384 AUSTRALIA PASSENGER VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 385 INDONESIA LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 386 INDONESIA LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 387 INDONESIA ENGINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 388 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 389 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 390 INDONESIA HYDRAULIC OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 391 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 392 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 393 INDONESIA CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 394 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 395 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 396 INDONESIA GEAR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 397 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 398 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 399 INDONESIA GREASE IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 400 INDONESIA GREASE IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 401 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 402 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 403 INDONESIA METALWORKING FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 404 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 405 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 406 INDONESIA WIND TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 407 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 408 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 409 INDONESIA COMPRESSOR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 410 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 411 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 412 INDONESIA GAS TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 413 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 414 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 415 INDONESIA HEAT TRANSFER OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 416 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 417 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 418 INDONESIA RUST PREVENTIVE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 419 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 420 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 421 INDONESIA OTHERS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 422 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 423 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 424 INDONESIA LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 425 INDONESIA MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 426 INDONESIA SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 427 INDONESIA LUBRICANTS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 428 INDONESIA B2B IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 429 INDONESIA B2C IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 430 INDONESIA LUBRICANTS MARKET, BY END-USE, 2018-2032 (USD MILLION)

TABLE 431 INDONESIA AUTOMOBILE & TRANSPORTATION IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 432 INDONESIA COMMERCIAL VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 433 INDONESIA TRUCKS IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 434 INDONESIA PASSENGER VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 435 VIETNAM LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 436 VIETNAM LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 437 VIETNAM ENGINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 438 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 439 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 440 VIETNAM HYDRAULIC OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 441 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 442 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 443 VIETNAM CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 444 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 445 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 446 VIETNAM GEAR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 447 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 448 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 449 VIETNAM GREASE IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 450 VIETNAM GREASE IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 451 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 452 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 453 VIETNAM METALWORKING FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 454 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 455 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 456 VIETNAM WIND TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 457 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 458 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 459 VIETNAM COMPRESSOR OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 460 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 461 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 462 VIETNAM GAS TURBINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 463 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 464 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 465 VIETNAM HEAT TRANSFER OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 466 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 467 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 468 VIETNAM RUST PREVENTIVE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 469 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 470 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 471 VIETNAM OTHERS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 472 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 473 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 474 VIETNAM LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 475 VIETNAM MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 476 VIETNAM SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 477 VIETNAM LUBRICANTS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 478 VIETNAM B2B IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 479 VIETNAM B2C IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 480 VIETNAM LUBRICANTS MARKET, BY END-USE, 2018-2032 (USD MILLION)

TABLE 481 VIETNAM AUTOMOBILE & TRANSPORTATION IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 482 VIETNAM COMMERCIAL VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 483 VIETNAM TRUCKS IN LUBRICANTS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 484 VIETNAM PASSENGER VEHICLES IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 485 THAILAND LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 486 THAILAND LUBRICANTS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 487 THAILAND ENGINE OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 488 THAILAND MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 489 THAILAND SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 490 THAILAND HYDRAULIC OILS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 491 THAILAND MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 492 THAILAND SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 493 THAILAND CIRCULATION FLUIDS IN LUBRICANTS MARKET, BY BASE OIL, 2018-2032 (USD MILLION)

TABLE 494 THAILAND MINERAL OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 495 THAILAND SYNTHETIC OIL IN LUBRICANTS MARKET, BY TYPE, 2018-2032 (USD MILLION)