Global Liability Insurance Market

Taille du marché en milliards USD

TCAC :

%

USD

290.45 Billion

USD

462.93 Billion

2024

2032

USD

290.45 Billion

USD

462.93 Billion

2024

2032

| 2025 –2032 | |

| USD 290.45 Billion | |

| USD 462.93 Billion | |

|

|

|

|

Segmentation du marché mondial de l'assurance responsabilité civile, par type (assurance responsabilité civile générale, assurance responsabilité civile professionnelle, assurance responsabilité civile des produits et assurance cyber-responsabilité), application (commerciale, industrielle et résidentielle), secteur d'utilisation (grandes entreprises, PME, travailleurs indépendants, organismes sans but lucratif et entités gouvernementales), canal de distribution (vente directe, courtier, plateforme en ligne, agents d'assurance et bancassurance), durée des polices (court, moyen et long terme) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché de l'assurance responsabilité civile

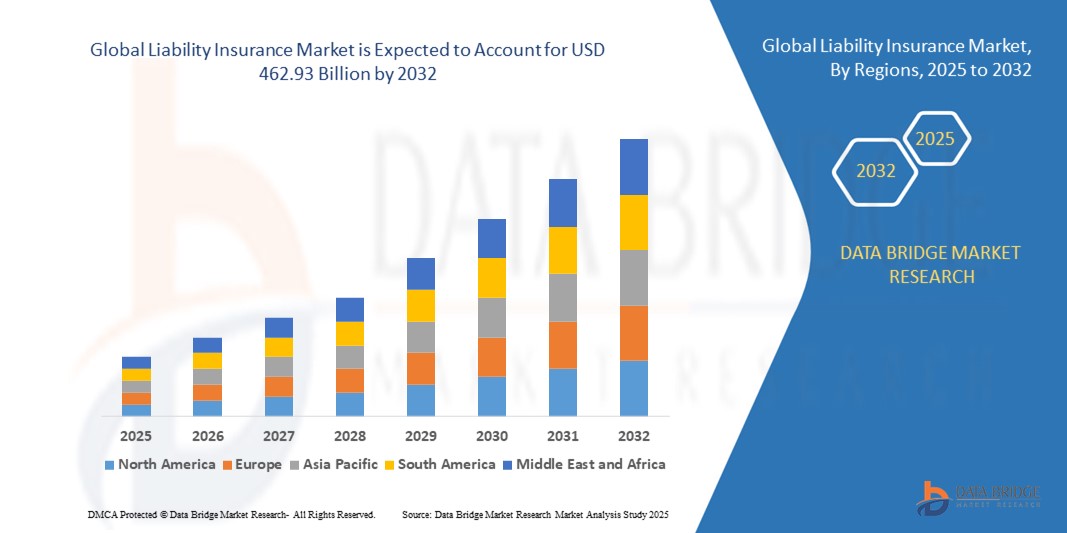

- La taille du marché mondial de l'assurance responsabilité civile était évaluée à 290,45 milliards USD en 2024 et devrait atteindre 462,93 milliards USD d'ici 2032 , à un TCAC de 6,00 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prise de conscience croissante de la protection financière contre les réclamations juridiques, l’augmentation des risques commerciaux dus à la mondialisation et la montée en flèche des litiges dans tous les secteurs.

- Les exigences réglementaires croissantes imposant une assurance responsabilité civile dans plusieurs secteurs soutiennent également l’expansion du marché.

Analyse du marché de l'assurance responsabilité civile

- Le marché de l'assurance responsabilité civile connaît une croissance robuste en raison de la responsabilité accrue des entreprises, de l'augmentation des erreurs et omissions professionnelles et de la fréquence croissante des cyberattaques qui nécessitent une couverture.

- Les petites et moyennes entreprises (PME) émergent comme un segment de croissance clé, car elles reconnaissent de plus en plus l’importance de l’assurance responsabilité civile pour se protéger contre les risques imprévus.

- L'Amérique du Nord a dominé le marché de l'assurance responsabilité civile avec la plus grande part de revenus de 38,5 % en 2024, grâce à des coûts de litige élevés, des mandats réglementaires stricts et une forte sensibilisation des entreprises à la gestion des risques.

- La région Asie-Pacifique devrait connaître le taux de croissance le plus élevé du marché mondial de l'assurance responsabilité civile , stimulé par l'expansion des économies, la demande croissante de couverture de responsabilité professionnelle et cybernétique et l'intégration croissante des plateformes d'assurance numériques.

- Le segment de l'assurance responsabilité civile générale a représenté la plus grande part de chiffre d'affaires du marché en 2024, grâce à sa large couverture des dommages corporels, matériels et corporels. Sa large applicabilité à tous les secteurs en fait le pilier de la protection en responsabilité civile des entreprises.

Portée du rapport et segmentation du marché de l'assurance responsabilité civile

|

Attributs |

Informations clés sur le marché de l'assurance responsabilité civile |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

• Demande croissante d'assurance responsabilité civile cybernétique |

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon. |

Tendances du marché de l'assurance responsabilité civile

Adoption croissante des plateformes numériques et des solutions InsurTech

L'intégration croissante des technologies numériques dans le secteur de l'assurance transforme les offres d'assurance responsabilité civile en accélérant l'émission des polices, l'évaluation des risques et le traitement des sinistres. Les approches privilégiant le numérique réduisent les formalités administratives et améliorent l'expérience client, favorisant ainsi une adoption plus large.

L'essor des startups InsurTech et de la souscription assistée par l'IA permet aux assureurs de personnaliser leurs garanties responsabilité civile en fonction des profils de risque spécifiques à leur secteur. L'automatisation de la détection des fraudes et l'analyse prédictive renforcent l'efficacité opérationnelle et améliorent la gestion des risques.

Les plateformes cloud et les applications mobiles facilitent l'accès à l'assurance responsabilité civile pour les PME et les particuliers, réduisant ainsi les barrières à l'entrée. Cette portée numérique assure une pénétration plus large des polices sur les marchés émergents où les canaux de distribution traditionnels étaient limités.

Par exemple, en 2023, plusieurs assureurs américains et européens se sont associés à des sociétés d'InsurTech pour introduire des polices d'assurance responsabilité civile pilotées par l'IA, ce qui a permis de réduire les délais de règlement des sinistres de près de 30 %. Cela a considérablement amélioré la satisfaction client et l'évolutivité opérationnelle.

Alors que la numérisation accélère l'innovation en assurance responsabilité civile, la croissance à long terme dépend du maintien de la cybersécurité, de la conformité réglementaire et du renforcement de la confiance des clients dans les plateformes numériques. Les assureurs doivent continuer d'investir dans des solutions sécurisées et évolutives pour exploiter pleinement cette opportunité.

Dynamique du marché de l'assurance responsabilité civile

Conducteur

L'augmentation des risques commerciaux et des obligations réglementaires stimule le recours à l'assurance

L'augmentation mondiale des risques commerciaux, notamment les poursuites judiciaires, les cyberattaques et les erreurs professionnelles, rend l'assurance responsabilité civile essentielle pour les entreprises comme pour les PME. Dans plusieurs pays, les cadres réglementaires imposent une couverture pour certains secteurs, ce qui favorise son adoption.

La sensibilisation croissante des entreprises aux risques financiers liés aux litiges et aux réclamations de tiers stimule une demande constante. Les entreprises réalisent que la couverture responsabilité civile ne se limite pas à la conformité, mais vise également à préserver la rentabilité et la réputation.

Des initiatives des secteurs public et privé soutiennent le développement de l'assurance responsabilité civile par le biais de subventions, de programmes de sensibilisation et d'incitations politiques. Cela a renforcé son adoption dans les économies développées et en développement.

• Par exemple, en 2022, l’Union européenne a élargi les exigences de conformité pour l’assurance responsabilité civile professionnelle dans les services financiers, ce qui a accru la demande de polices d’assurance responsabilité civile dans plusieurs États membres.

• Alors que le soutien réglementaire et les risques croissants stimulent l'expansion du marché, les assureurs doivent également garantir l'accessibilité, des conceptions de politiques innovantes et de meilleurs outils d'évaluation des risques pour maintenir la dynamique de croissance à long terme

Retenue/Défi

Des primes élevées et une sensibilisation limitée sur les marchés émergents

Le coût relativement élevé des primes d'assurance responsabilité civile demeure un obstacle important, notamment pour les petites entreprises et les start-ups aux budgets limités. De nombreuses entreprises des économies en développement considèrent encore l'assurance responsabilité civile comme une dépense supplémentaire plutôt qu'une nécessité.

Le manque de sensibilisation des entreprises des zones rurales et semi-urbaines à l'importance de la couverture responsabilité civile limite encore davantage la pénétration de l'assurance. Ce manque de connaissances conduit souvent à une sous-assurance, rendant les entreprises vulnérables aux pertes financières.

Les difficultés d'infrastructure et de distribution sur les marchés émergents limitent également l'accès. La présence limitée d'assureurs et d'agents spécialisés dans ces régions freine la croissance du marché, car les entreprises dépendent de produits d'assurance traditionnels qui peuvent ne pas couvrir adéquatement les risques de responsabilité civile.

• Par exemple, en 2023, des rapports provenant d’Asie du Sud-Est indiquaient que plus de 60 % des PME avaient peu ou pas de couverture responsabilité civile en raison des coûts élevés des primes et du manque de produits sur mesure adaptés à l’échelle de leurs opérations.

• Alors que l’innovation produit et les plateformes numériques répondent progressivement à ces défis, garantir l’accessibilité, des campagnes de sensibilisation ciblées et des modèles de distribution localisés restent essentiels pour libérer le potentiel inexploité des marchés émergents

Portée du marché de l'assurance responsabilité civile

Le marché est segmenté en fonction du type, de l’application, du secteur d’utilisation finale, du canal de distribution et de la durée de la police.

- Par type

Le marché de l'assurance responsabilité civile est segmenté en fonction du type d'assurance : responsabilité civile générale, responsabilité civile professionnelle, responsabilité civile des produits et cyber-responsabilité. En 2024, l'assurance responsabilité civile générale a représenté la plus grande part de chiffre d'affaires du marché, grâce à sa large couverture des dommages corporels, matériels et corporels. Sa large applicabilité à tous les secteurs d'activité en fait le pilier de la protection en responsabilité civile des entreprises.

Le segment de l'assurance responsabilité civile cybernétique devrait connaître la croissance la plus rapide entre 2025 et 2032, sous l'effet de la multiplication des cyberattaques, des violations de données et des exigences réglementaires croissantes en matière de sécurité numérique. La transformation numérique croissante des entreprises stimule la demande de polices d'assurance responsabilité civile cybernétique offrant une protection contre les pertes financières liées aux cyberrisques.

- Par application

En fonction des applications, le marché est segmenté en secteurs commercial, industriel et résidentiel. Le segment commercial a dominé le marché en 2024, les entreprises étant constamment exposées aux réclamations et aux poursuites de tiers, ce qui fait de la couverture responsabilité civile une exigence opérationnelle essentielle.

Le segment résidentiel devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, soutenu par une sensibilisation croissante des propriétaires à la couverture responsabilité civile personnelle et par l'adoption croissante de polices d'assurance responsabilité civile générale pour se protéger contre les réclamations juridiques imprévues.

- Par secteur d'utilisateur final

En fonction du secteur d'utilisation final, le marché est classé en grandes entreprises, petites et moyennes entreprises, travailleurs indépendants, organismes à but non lucratif et entités gouvernementales. Le segment des grandes entreprises représentait la plus grande part de marché en 2024, en raison de l'exposition élevée aux risques des grandes entreprises et des exigences obligatoires en matière d'assurance responsabilité civile dans plusieurs secteurs réglementés.

Le segment des petites et moyennes entreprises (PME) devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, grâce à une prise de conscience croissante des risques financiers, à l’augmentation des litiges et à des offres d’assurance sur mesure conçues spécifiquement pour les PME avec des structures de primes rentables.

- Par canal de distribution

En fonction des canaux de distribution, le marché de l'assurance responsabilité civile est segmenté en ventes directes, courtiers, plateformes en ligne, agents d'assurance et bancassurance. Le segment des courtiers a représenté la plus grande part de chiffre d'affaires du marché en 2024, car ils demeurent un canal privilégié pour des solutions de responsabilité civile personnalisées et un accompagnement expert dans des environnements à risques complexes.

Le segment des plateformes en ligne devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, en raison de l'adoption croissante des plateformes d'assurance numériques, de l'émission instantanée de polices et de la pénétration croissante des solutions InsurTech qui améliorent l'accessibilité et la commodité.

- Par terme de police

En fonction de la durée des polices, le marché est segmenté en assurances court terme, moyen terme et long terme. Le segment moyen terme a conquis la plus grande part de marché en 2024, car il allie accessibilité financière et couverture adéquate, ce qui en fait l'option la plus largement adoptée par les entreprises de toutes tailles.

Le segment à long terme devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, car les entreprises recherchent de plus en plus une stabilité à long terme en matière de couverture pour atténuer les risques récurrents et garantir des avantages en termes de coûts de prime sur des durées prolongées.

Analyse régionale du marché de l'assurance responsabilité civile

• L’Amérique du Nord a dominé le marché de l’assurance responsabilité civile avec la plus grande part de revenus de 38,5 % en 2024, en raison des coûts de litige élevés, des mandats réglementaires stricts et d’une forte sensibilisation des entreprises à la gestion des risques.

• Les entreprises de la région dépendent fortement de l’assurance responsabilité civile pour atténuer l’exposition financière découlant des poursuites judiciaires, des rappels de produits et des réclamations pour négligence professionnelle.

• Cette adoption généralisée est également soutenue par la présence d’assureurs mondiaux de premier plan, de canaux de distribution numériques avancés et d’un cadre juridique solide, positionnant l’Amérique du Nord comme un marché d’assurance responsabilité civile mature et hautement réglementé.

Aperçu du marché de l'assurance responsabilité civile aux États-Unis

Le marché américain de l'assurance responsabilité civile a représenté la plus grande part de chiffre d'affaires en Amérique du Nord en 2024, porté par la fréquence croissante des litiges et la complexité croissante des risques d'entreprise. La demande croissante de couvertures de cyberresponsabilité, conjuguée à une surveillance réglementaire accrue dans les secteurs des services financiers, de la santé et de l'industrie manufacturière, stimule l'adoption de ces solutions. De plus, la forte présence des entreprises d'InsurTech proposant des solutions de souscription pilotées par l'IA et de traitement numérique des sinistres contribue à la croissance du marché.

Aperçu du marché européen de l'assurance responsabilité civile

Le marché européen de l'assurance responsabilité civile devrait connaître sa plus forte croissance entre 2025 et 2032, principalement grâce au renforcement des normes de conformité, à la mise en œuvre d'une réglementation européenne en matière de responsabilité civile et à une sensibilisation accrue des PME aux risques. La région connaît une forte demande d'assurance responsabilité civile professionnelle et responsabilité civile produits, notamment dans des secteurs comme l'industrie pharmaceutique, l'automobile et les services financiers. La couverture responsabilité civile est de plus en plus intégrée aux plans de continuité des activités, renforçant ainsi son rôle dans tous les secteurs commerciaux.

Aperçu du marché de l'assurance responsabilité civile au Royaume-Uni

Le marché britannique de l'assurance responsabilité civile devrait connaître sa plus forte croissance entre 2025 et 2032, soutenu par la tendance croissante à la gestion des risques des entreprises et par l'importance accordée par le cadre juridique à la responsabilité. Les préoccupations liées à la négligence professionnelle, aux cyberrisques et à la sécurité au travail incitent les petites et grandes entreprises à souscrire des polices d'assurance responsabilité civile. De plus, la position de Londres comme pôle mondial de l'assurance favorise la croissance grâce à l'accès à une expertise de souscription spécialisée et à une gamme diversifiée de produits d'assurance responsabilité civile.

Aperçu du marché allemand de l'assurance responsabilité civile

Le marché allemand de l'assurance responsabilité civile devrait connaître sa plus forte croissance entre 2025 et 2032, porté par la solidité de son tissu industriel, l'importance accordée à l'innovation et des normes de qualité et de sécurité rigoureuses. La demande d'assurance responsabilité civile produits est particulièrement forte chez les fabricants, tandis que les PME optent de plus en plus pour des garanties de responsabilité civile professionnelle et de cyber-responsabilité. L'environnement réglementaire structuré de l'Allemagne et sa préférence pour une protection complète continuent d'accélérer l'adoption de l'assurance responsabilité civile dans les secteurs des entreprises et de l'industrie.

Aperçu du marché de l'assurance responsabilité civile en Asie-Pacifique

Le marché de l'assurance responsabilité civile en Asie-Pacifique devrait connaître la croissance la plus rapide entre 2025 et 2032, soutenu par l'industrialisation et l'urbanisation rapides, ainsi que par l'essor des PME dans la région. La prise de conscience croissante des risques commerciaux, conjuguée aux initiatives gouvernementales favorisant l'adoption de l'assurance, stimule la croissance. Des pays comme la Chine, le Japon et l'Inde stimulent la demande en assurances cyber-responsabilité et responsabilité civile professionnelle, la transformation numérique et le commerce transfrontalier exposant les entreprises à de nouveaux risques.

Aperçu du marché japonais de l'assurance responsabilité civile

Le marché japonais de l'assurance responsabilité civile devrait connaître sa plus forte croissance entre 2025 et 2032, grâce au développement important du secteur des entreprises, à l'adoption croissante du numérique et à l'importance accordée à la conformité réglementaire. La demande d'assurance responsabilité civile cybernétique connaît une croissance rapide, les entreprises intégrant des systèmes informatiques avancés et des processus basés sur l'IoT. Par ailleurs, le vieillissement de la population japonaise et le besoin de couverture responsabilité civile liée aux soins de santé devraient stimuler davantage la croissance, notamment en matière de responsabilité civile professionnelle et de responsabilité civile médicale.

Aperçu du marché de l'assurance responsabilité civile en Chine

En 2024, le marché chinois de l'assurance responsabilité civile représentait la plus grande part de chiffre d'affaires en Asie-Pacifique, soutenu par une expansion industrielle rapide, l'essor de la classe moyenne et une attention réglementaire croissante portée à la responsabilité des entreprises. La demande est particulièrement forte en assurance responsabilité civile produits, la Chine renforçant sa législation sur la protection des consommateurs et développant ses exportations. Les efforts déployés par le gouvernement pour atténuer les risques financiers, conjugués à l'essor des assureurs nationaux et des plateformes InsurTech, rendent l'assurance responsabilité civile plus accessible et plus abordable pour les entreprises de toutes tailles.

Part de marché de l'assurance responsabilité civile

Le secteur de l’assurance responsabilité civile est principalement dirigé par des sociétés bien établies, notamment :

- Allianz (Allemagne)

- AXA SA (France)

- Zurich Insurance Group (Suisse)

- Chubb Limited (Suisse)

- American International Group, Inc. (États-Unis)

- Berkshire Hathaway Inc. (États-Unis)

- Liberty Mutual Insurance Group (États-Unis)

- La Travelers Indemnity Company (États-Unis)

- Tokio Marine Holdings, Inc. (Japon)

- Groupe Munich Re (Allemagne)

Derniers développements sur le marché mondial de l'assurance responsabilité civile

- En janvier 2024, Zurich Insurance Group a lancé un nouveau produit d'assurance responsabilité civile spécialement conçu pour les petites et moyennes entreprises (PME). Ce produit offre une couverture complète en responsabilité civile générale, responsabilité civile professionnelle et responsabilité civile produits, permettant aux PME de mieux se protéger contre divers risques. En répondant aux besoins spécifiques des petites entreprises, ce produit améliore la protection financière, renforce la résilience et devrait consolider le positionnement de Zurich sur le segment de l'assurance des PME tout en favorisant une adoption accrue de la couverture responsabilité civile sur ce marché.

- En février 2024, Allianz SE a lancé une solution d'assurance responsabilité civile des dirigeants visant à protéger les dirigeants d'entreprise contre les responsabilités juridiques liées à leurs responsabilités managériales. Ce produit couvre les frais de défense, les transactions et les jugements en cas d'actes répréhensibles ou de manquements fiduciaires. Ce lancement renforce non seulement la gouvernance d'entreprise et la gestion des risques, mais élargit également le portefeuille de produits d'Allianz, renforçant ainsi son rôle d'acteur clé pour répondre aux besoins évolutifs en matière d'assurance responsabilité civile des entreprises du monde entier.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.