Marché mondial du kaolin, par qualité (calciné, hydraté, délaminé, traité en surface et structuré), procédé (lavé à l'eau, flotté à l'air, calciné, délaminé et modifié en surface et non traité), application (papier, céramique , peinture et revêtements, fibre de verre, plastique, caoutchouc, produits pharmaceutiques et médicaux, cosmétiques et autres) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché du kaolin

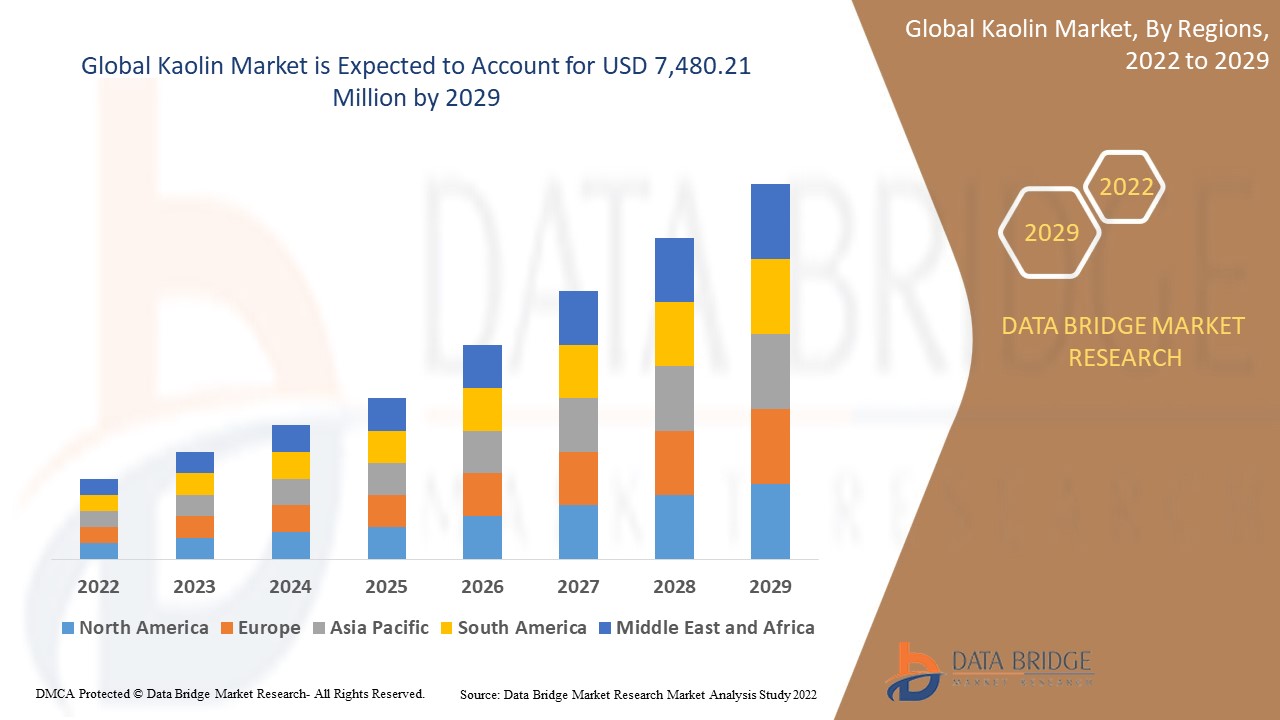

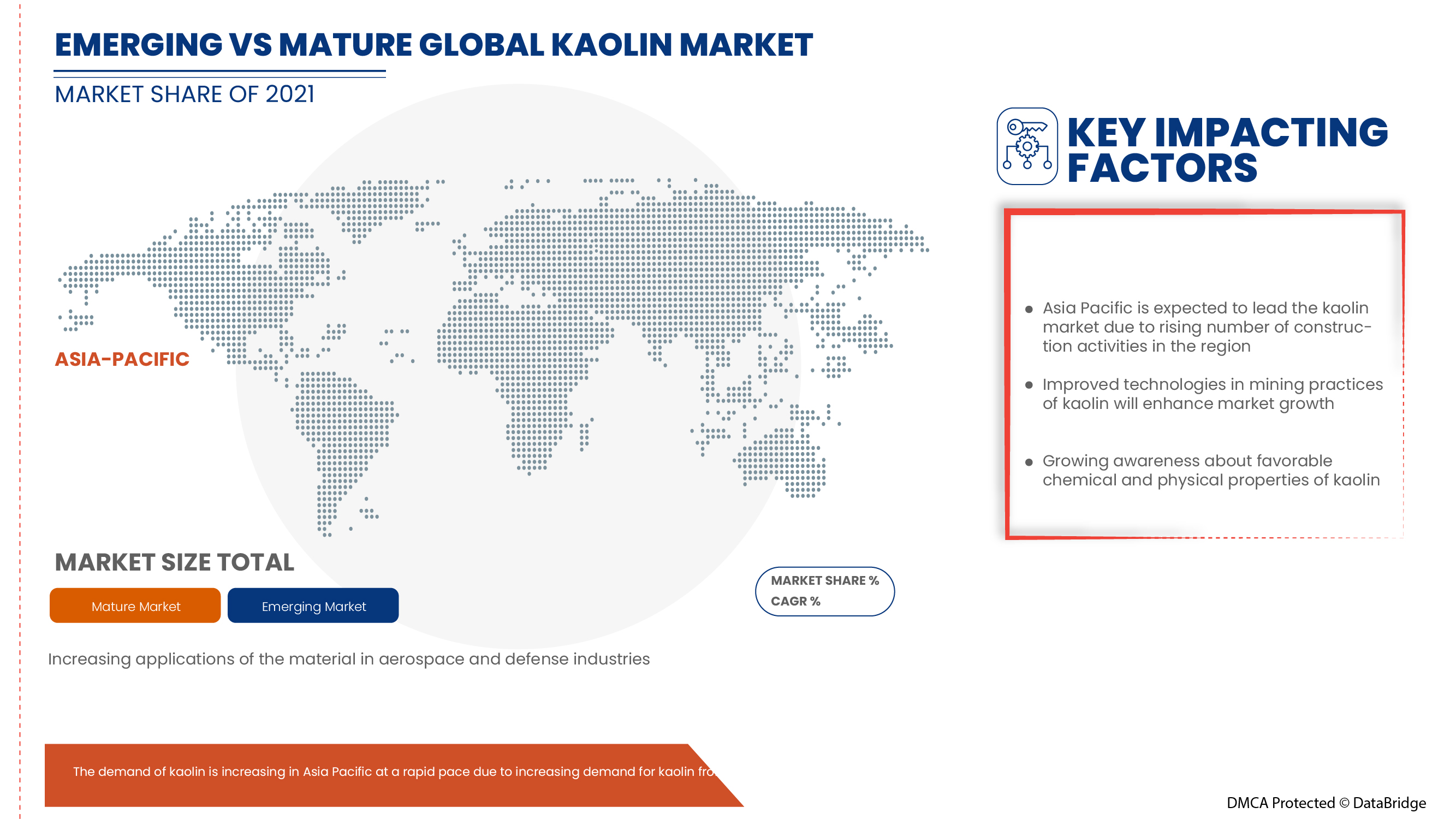

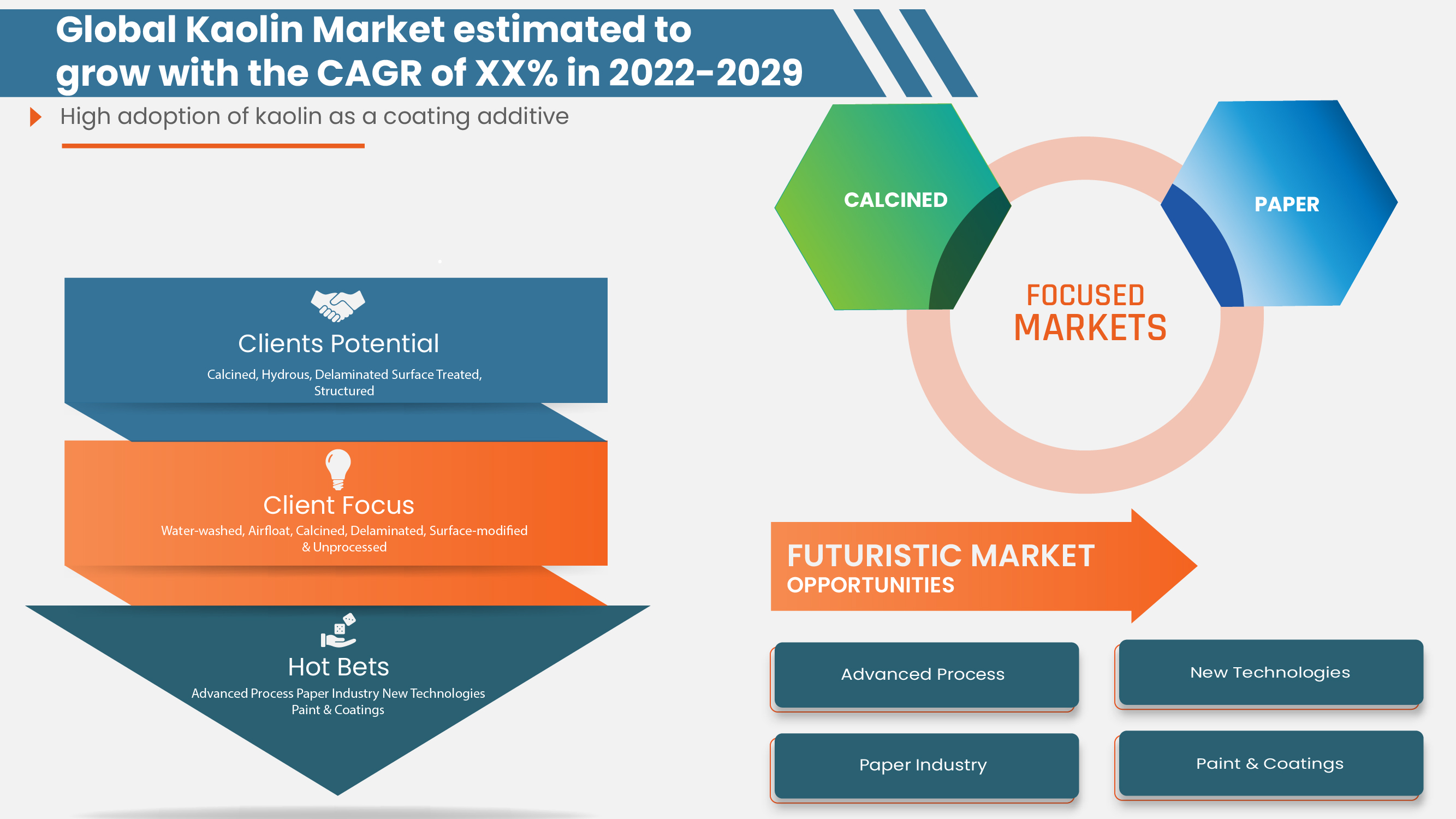

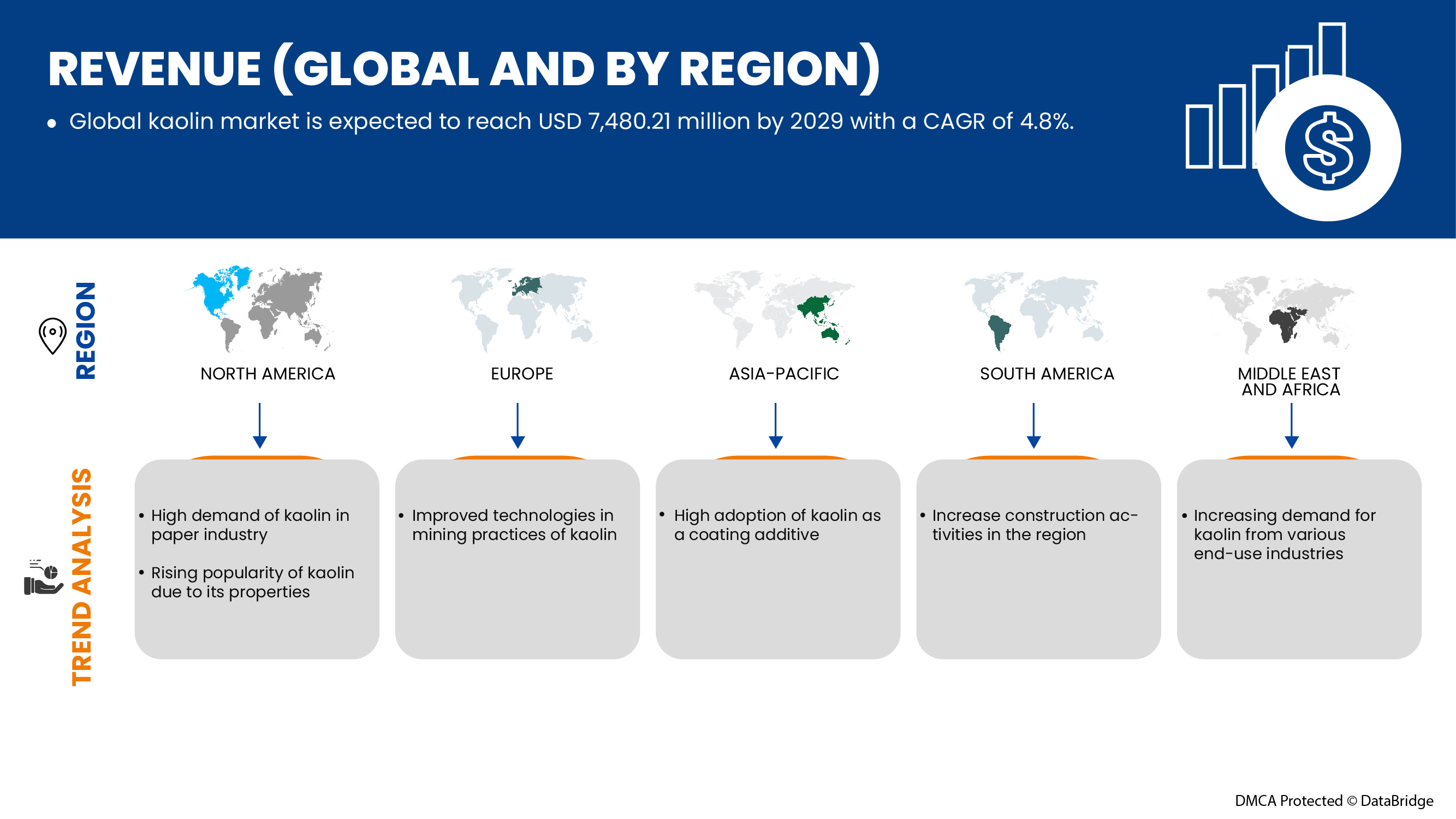

Le marché mondial du kaolin devrait croître de manière significative au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,8% au cours de la période de prévision de 2022 à 2029 et devrait atteindre 7 480,21 millions USD d'ici 2029. Le principal facteur à l'origine de la croissance du marché du kaolin est l'augmentation des activités de construction à travers le monde, les propriétés chimiques et physiques favorables du kaolin, l'augmentation de la demande de kaolin de diverses industries d'utilisation finale et la forte adoption du kaolin comme additif de revêtement.

Les industries adoptent de plus en plus le kaolin comme matière première pour la production de produits médicinaux et cosmétiques d'importance commerciale. De plus, des propriétés chimiques telles que l'adsorption de protéines, de lipides et d'huiles ont augmenté l'utilisation du kaolin pour produire des nettoyants pour le visage, des masques faciaux, des enveloppements de boue, des gommages corporels et d'autres produits cosmétiques. Les produits médicinaux, tels que les bains de bouche, les compresses chirurgicales, les agents desséchants et les protections temporaires contre l'érythème fessier, utilisent le kaolin comme ingrédient clé en raison de ses propriétés chimiques favorables. Par conséquent, l'utilisation intensive du kaolin dans diverses applications et industries peut stimuler la croissance du marché mondial du kaolin.

Le rapport sur le marché mondial du kaolin fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par catégorie (calciné, hydraté, délaminé, traité en surface et structuré), procédé (lavé à l'eau, flotté à l'air, calciné, délaminé et modifié en surface et non traité), application (papier, céramique, peinture et revêtements, fibre de verre, plastique, caoutchouc, produits pharmaceutiques et médicaux, cosmétiques et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique, Royaume-Uni, Russie, France, Espagne, Italie, Allemagne, Turquie, Pays-Bas, Suisse, Belgique, reste de l'Europe, Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie et Nouvelle-Zélande, et le reste de l'Asie-Pacifique, Brésil, Argentine, reste de l'Amérique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Afrique du Sud, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

BASF SE, LB MINERALS, Ltd., Thiele Kaolin Company, Quartz Works GmbH, KaMin LLC. / CADAM, Groupe Ashapura, Imerys SA, SIBELCO, I-Minerals Inc., EICL |

Définition du marché

Le kaolin, également appelé kaolin, est une argile blanche molle utilisée comme ingrédient nécessaire à la fabrication du papier, du caoutchouc, des cosmétiques et autres. Le kaolin est utilisé comme agent de remplissage dans l'industrie du papier avec un adhésif, ce qui améliore l'apparence du papier, lui donnant une brillance, une douceur, une luminosité, une opacité et une imprimabilité variées. De plus, le produit améliore l'imprimabilité du papier en offrant une absorption d'encre accrue, une rétention des pigments d'encre et une rugosité accrue. Il est très utilisé dans l'industrie céramique pour la fabrication de porcelaine et de réfractaires. Le kaolin améliore la résistance mécanique et la résistance à l'abrasion dans l'industrie du caoutchouc.

Dynamique du marché mondial du kaolin

Cette section traite de la compréhension des moteurs, des contraintes, des opportunités et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Hausse des activités de construction à travers le monde

L'augmentation des activités de construction dans les économies en développement a été soutenue par une plus grande migration de la population rurale vers les centres urbains et par l'augmentation des investissements dans le développement des infrastructures. La demande croissante de produits due à l'augmentation des pratiques de rénovation résidentielle dans divers pays, comme l'orientation des consommateurs américains vers le remplacement des parquets par des carreaux de céramique, stimule la croissance du marché du kaolin. De plus, l'Europe devrait également connaître un rythme rapide en raison de la croissance de la production et de la consommation de céramique dans ses pays.

- Propriétés chimiques et physiques favorables du kaolin

Le kaolin est un métal de choix dans diverses applications et industries d'utilisation finale en raison de ses propriétés chimiques et physiques souhaitées et favorables qu'il présente lorsqu'il est utilisé. La demande d'argile de kaolin augmente dans l'industrie des plastiques car son utilisation améliore ses performances électriques, sa durabilité et sa résistance. De plus, l'adoption croissante de la céramique est due à l'opacité, à l'inertie chimique, à la texture non abrasive et à la forme plate de l'argile de kaolin. De plus, l'utilisation du kaolin dans les bétons et les mortiers augmente en raison de sa stabilité thermique. Certaines qualités de kaolin ont des tailles de particules fines, une adsorption élevée et des propriétés de suspension.

- Augmentation de la demande de kaolin de la part de diverses industries d'utilisation finale

De nombreuses variables et propriétés importantes qui jouent en faveur du kaolin et la demande croissante de produits à base de kaolin ont permis au marché du kaolin de croître régulièrement dans le monde entier. L'application la plus courante du kaolin est dans le secteur du papier, ce qui lui permet d'être utilisé comme revêtement de papier avec une texture lisse et une opacité appropriée. Cette augmentation est attribuable à la demande accrue de papier de la part de diverses industries d'utilisation finale, telles que l'emballage et l'impression. De plus, ce matériau est largement utilisé pour remplir et enduire des pièces car il réduit la taille des particules et améliore la résistance. Le kaolin est fréquemment utilisé dans l'industrie du papier car il offre diverses qualités, notamment une bonne réceptivité à l'encre, une douceur du papier et une opacité optimale pour la fabrication du papier.

- Forte adoption du kaolin comme additif de revêtement

L'industrie du papier et des peintures et revêtements compte parmi les principaux utilisateurs de kaolin dans ses produits. Le kaolin est utilisé pour améliorer les performances des peintures sous la forme de meilleures propriétés de suspension, de dispersion rapide, de résistance à la corrosion, de résistance supérieure à l'eau et de viscosités réduites. De plus, le kaolin est utilisé comme agent de revêtement et de remplissage lorsqu'il est combiné avec des adhésifs dans le couchage du papier pour lui donner son opacité, sa couleur et son imprimabilité. Le kaolin est le minéral particulaire le plus largement utilisé dans le remplissage et le couchage du papier. Il améliore l'apparence du papier, caractérisée par la brillance, la douceur, la luminosité et l'opacité, et surtout, il améliore l'imprimabilité. Le papier est également chargé de kaolin pour étendre les fibres.

Opportunité

- Initiatives stratégiques clés mises en œuvre par des entreprises leaders

Le marché mondial du kaolin a connu un effet négatif inattendu en raison de l'émergence du COVID-19 et des confinements et restrictions de mouvement à l'échelle nationale. Par conséquent, les fabricants se concentrent principalement sur le maintien du flux de liquidités pour éviter de nouvelles pertes. De plus, les principaux acteurs du marché du kaolin ont mis en œuvre diverses initiatives et développements stratégiques pour gagner une part de marché majeure et dominante et améliorer leurs opérations.

Contraintes/Défis

- Effets négatifs sur l'industrie papetière en raison de l'émergence du covid-19

L'épidémie de COVID-19 a perturbé la fabrication et l'approvisionnement du marché du kaolin, retardant l'expansion de l'industrie mondiale. De nombreuses entreprises de kaolin emploient des moyens pour éviter les pertes dues aux temps d'arrêt, qui sont de plus en plus préoccupantes à mesure que les effets de la pandémie perdurent. Les performances du kaolin dans les applications de remplissage de papier ont été érodées par la concurrence de matériaux alternatifs, en particulier les carbonates de calcium. La lente croissance de la production de papier couché limitera les progrès du kaolin à l'avenir, ce qui freinera le développement du marché mondial du kaolin.

- Disponibilité facile de substituts

L'argile bentonite est un autre substitut facilement disponible sur le marché. L'argile bentonite possède de puissantes propriétés d'absorption d'huile et peut absorber plus que sa masse corporelle en eau. Cela en fait un excellent ingrédient pour les personnes ayant une peau extrêmement grasse et favorise son utilisation dans les produits cosmétiques. L'argile bentonite est composée de montmorillonite, un type d'argile smectite. Elle a une teneur en eau élevée et gonfle au contact de l'eau. Cela la rend efficace pour éliminer les impuretés de la peau. Une autre alternative est la terre à foulon, qui est également utilisée pour les soins de la peau et la détoxification. De plus, l'argile rhassoul est une argile extraite dans les montagnes de l'Atlas au Maroc. Elle est riche en minéraux, possède des propriétés nettoyantes et revitalisantes et constitue une excellente alternative à l'argile kaolin.

- Hausse du prix du kaolin

Les entreprises et les acteurs opérant sur le marché mondial du kaolin se concentrent sur l'augmentation des prix du kaolin pour assurer la durabilité à long terme de l'entreprise. Ces acteurs ont annoncé une augmentation des prix en 2021 pour différentes applications, parmi lesquelles le papier figurait parmi les applications clés. La plupart des entreprises ont connu une inflation dans divers aspects de l'activité, notamment l'inflation des produits chimiques et des coûts de transport. En outre, la dégradation causée par l'éclatement de la pandémie dans les secteurs d'application clés a eu un impact direct sur les revenus des principaux acteurs du marché.

Développement récent

- En juillet 2022, Thiele Kaolin Company a annoncé une augmentation de prix de 9 % pour toutes les catégories de produits en raison du climat économique mondial actuel, qui a entraîné une augmentation des coûts des opérations de fabrication dans le monde entier. Pour l'entreprise, ces augmentations de coûts ont eu un impact sur l'énergie, les produits chimiques, la main-d'œuvre, l'exploitation minière, la maintenance et d'autres intrants nécessaires à la production de produits de qualité

- En novembre 2021, KaMin LLC et CADAM SA ont convenu d'acquérir l'activité kaolin de BASF SE. L'activité kaolin fait partie de la division Performance Chemicals de BASF. Cela renforce considérablement l'activité kaolin de l'entreprise à travers le monde

Portée du marché mondial du kaolin

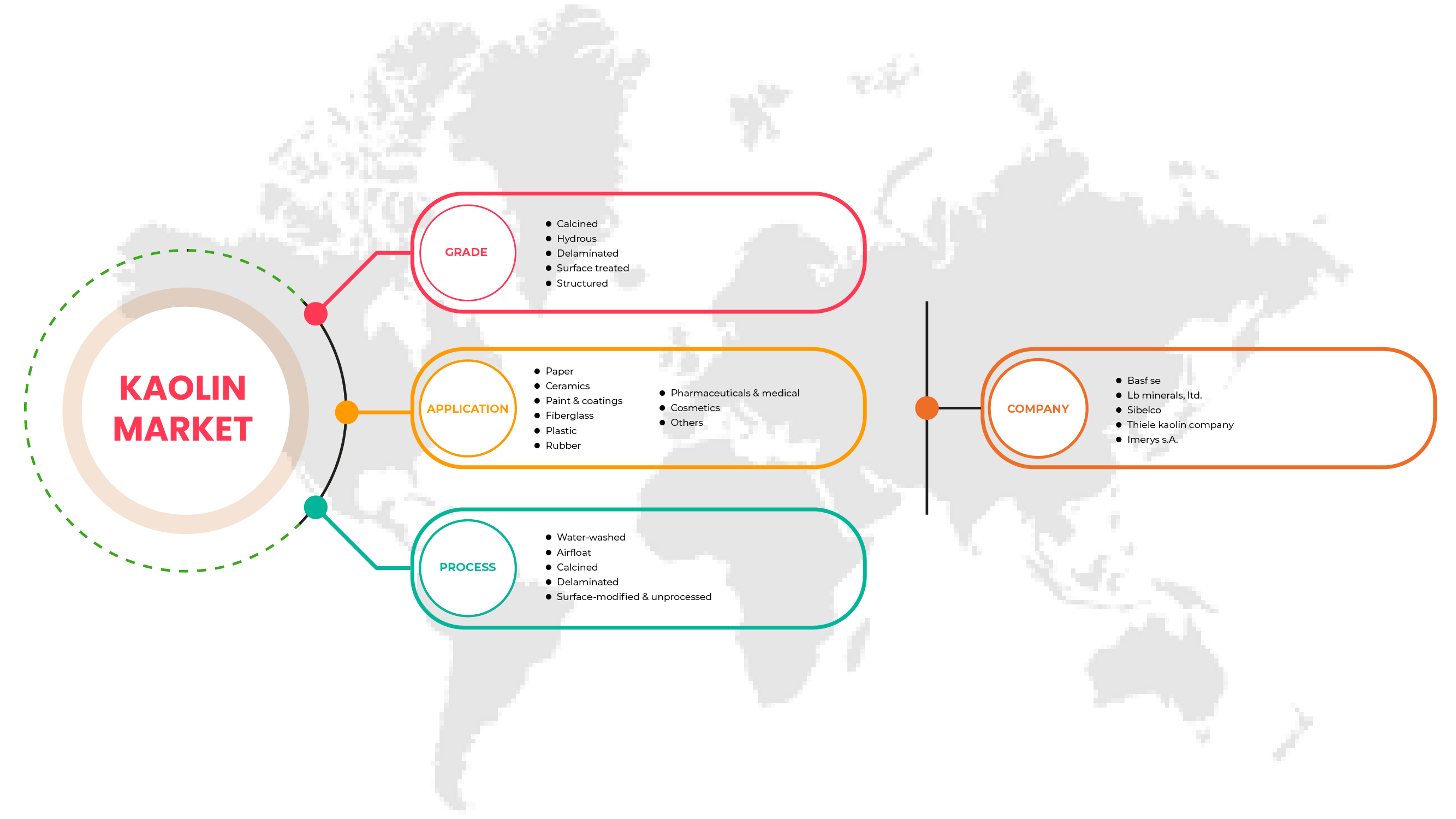

Le marché mondial du kaolin est classé en fonction de la qualité, du processus et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Grade

- Calciné

- hydrique

- Délaminé

- Surface traitée

- Structuré

En fonction de la qualité, le marché mondial du kaolin est classé en cinq segments, à savoir calciné, hydraté, délaminé, traité en surface et structuré.

Processus

- Lavé à l'eau

- Flotteur d'air

- Calciné

- Délaminé

- Surface modifiée et non traitée

En fonction du processus, le marché mondial du kaolin est classé en cinq segments : lavé à l'eau, flottant à l'air, calciné, délaminé et modifié en surface et non traité.

Application

- Papier

- Céramique

- Peinture et revêtements

- Fibre de verre

- Plastique

- Caoutchouc

- Produits pharmaceutiques et médicaux

- Produits de beauté

- Autres

Based on the application, the global kaolin market is classified into nine segments paper, ceramics, paint & coatings, fiberglass, plastic, rubber, pharmaceuticals & medical, cosmetics, and others.

Global Kaolin Market Regional Analysis/Insights

The global kaolin market is segmented based on grade, process, and application.

The countries in the global kaolin market are the U.S., Canada, Mexico, U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, and the Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the rest of Asia-Pacific, Brazil, Argentina, rest of South America, Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and rest of the Middle East and Africa.

The U.S. dominates in the North American region due to the region's high adoption of kaolin as a coating additive. Germany dominated expected to dominate the Europe Kaolin market due to growing awareness of the excellent characteristics and properties of kaolin in the region. Saudi Arabia dominated the Kaolin market in the Middle East and Africa, increasing the use of paints & coatings in the region.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data point downstream and upstream value chain analysis, technological trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Kaolin Market Share Analysis

Global kaolin market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies focus on the global kaolin market.

Some prominent participants operating in the global kaolin market are BASF SE, LB MINERALS, Ltd., Thiele Kaolin Company, Quartz Works GmbH, KaMin LLC. / CADAM, Ashapura Group, Imerys S.A., SIBELCO, I-MineralsInc., and EICL.

Research Methodology

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, les grilles de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse mondiale et régionale et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL KAOLIN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CRITICAL SELECTION CRITERIA FOR BUSINESS DECISION

4.4 IMPORT EXPORT SCENARIO

4.5 MANUFACTURING PROCESS: GLOBAL KAOLIN MARKET

4.6 MARKET CHANGES / CURRENT EVENTS

4.7 PRODUCTION CAPACITY BY MANUFACTURERS: GLOBAL KAOLIN MARKET

4.8 SUPPLY CHAIN ANALYSIS- GLOBAL KAOLIN MARKET

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGIES OVERVIEW

4.1 VENDOR SELECTION CRITERIA

4.11 PRICE ANALYSIS SCENARIO

4.11.1 RAW MATERIALS PRICE ANALYSIS

4.11.2 CURRENT PRICE STATISTICS

4.11.3 PRICE FORECASTS

4.12 PRODUCTION CONSUMPTION ANALYSIS

4.13 REGULATION COVERAGE

4.14 MANUFACTURING COST SCENARIO AND FUTURE IMPACT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN CONSTRUCTION ACTIVITIES ACROSS THE GLOBE

5.1.2 FAVOURABLE CHEMICAL AND PHYSICAL PROPERTIES OF KAOLIN

5.1.3 INCREASE IN DEMAND FOR KAOLIN FROM VARIOUS END-USE INDUSTRIES

5.1.4 HIGH ADOPTION OF KAOLIN AS A COATING ADDITIVE

5.2 RESTRAINTS

5.2.1 NEGATIVE EFFECT ON PAPER INDUSTRY DUE TO EMERGENCE OF COVID-19

5.2.2 KAOLIN MINING CAUSES NUMEROUS ENVIRONMENTAL AND HEALTH HAZARDS

5.3 OPPORTUNITIES

5.3.1 KEY STRATEGIC INITIATIVES IMPLEMENTED BY LEADING COMPANIES

5.3.2 IMPROVED TECHNOLOGIES IN MINING PRACTICES OF KAOLIN

5.4 CHALLENGES

5.4.1 EASY AVAILABILITY OF SUBSTITUTES

5.4.2 RISE IN THE PRICE OF KAOLIN

6 GLOBAL KAOLIN MARKET, BY GRADE

6.1 OVERVIEW

6.2 CALCINED

6.3 HYDROUS

6.4 DELAMINATED

6.5 SURFACE TREATED

6.6 STRUCTURED

7 GLOBAL KAOLIN MARKET, BY PROCESS

7.1 OVERVIEW

7.2 WATER-WASHED

7.3 AIRFLOAT

7.4 CALCINED

7.5 DELAMINATED

7.6 SURFACE-MODIFIED & UNPROCESSED

8 GLOBAL KAOLIN MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 PAPER

8.3 CERAMICS

8.4 PAINT & COATINGS

8.5 FIBERGLASS

8.6 PLASTIC

8.7 RUBBER

8.8 PHARMACEUTICALS & MEDICAL

8.9 COSMETICS

8.1 OTHERS

9 GLOBAL KAOLIN MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 INDIA

9.2.3 JAPAN

9.2.4 SOUTH KOREA

9.2.5 THAILAND

9.2.6 SINGAPORE

9.2.7 INDONESIA

9.2.8 AUSTRALIA & NEW ZEALAND

9.2.9 PHILIPPINES

9.2.10 MALAYSIA

9.2.11 REST OF ASIA-PACIFIC

9.3 EUROPE

9.3.1 GERMANY

9.3.2 U.K.

9.3.3 FRANCE

9.3.4 ITALY

9.3.5 SPAIN

9.3.6 RUSSIA

9.3.7 SWITZERLAND

9.3.8 TURKEY

9.3.9 BELGIUM

9.3.10 NETHERLANDS

9.3.11 REST OF EUROPE

9.4 NORTH AMERICA

9.4.1 U.S.

9.4.2 CANADA

9.4.3 MEXICO

9.5 MIDDLE EAST AND AFRICA

9.5.1 SAUDI ARABIA

9.5.2 U.A.E.

9.5.3 SOUTH AFRICA

9.5.4 EGYPT

9.5.5 ISRAEL

9.5.6 REST OF MIDDLE EAST AND AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

9.6.3 REST OF SOUTH AMERICA

10 GLOBAL KAOLIN MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.5 DISINVESTMENT

10.6 PRICE INCREASE

10.7 ACQUISITION

10.8 FACILITY EXPANSION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 IMERYS S.A.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 SIBELCO

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 BASF SE

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENT

12.4 KAMIN LLC. / CADAM

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENTS

12.5 THIELE KAOLIN COMPANY

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 ASHAPURA GROUP

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 EICL

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 I-MINERALSINC.

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENTS

12.9 LB MINERALS, LTD.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 QUARTZ WORKS GMBH

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF KAOLIN AND OTHER KAOLINIC CLAYS, WHETHER OR NOT CALCINED; HS CODE – 2507 (USD THOUSAND)

TABLE 2 EXPORT DATA OF KAOLIN AND OTHER KAOLINIC CLAYS, WHETHER OR NOT CALCINED; HS CODE – 2507 (USD THOUSAND)

TABLE 3 THE FOLLOWING TABLE SHOWS THE PRODUCTION CAPACITIES OF VARIOUS COMPANIES OPERATING IN THE GLOBAL KAOLIN MARKET.

TABLE 4 REGULATORY FRAMEWORK

TABLE 5 GLOBAL KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 7 GLOBAL CALCINED IN KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL CALCINED IN KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 GLOBAL HYDROUS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL HYDROUS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 GLOBAL DELAMINATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL DELAMINATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 GLOBAL SURFACE TREATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL SURFACE TREATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 GLOBAL STRUCTURED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL STRUCTURED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 17 GLOBAL KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 19 GLOBAL WATER-WASHED IN KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL WATER-WASHED IN KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 21 GLOBAL AIRFLOAT IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL AIRFLOAT IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 23 GLOBAL CALCINED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL CALCINED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 25 GLOBAL DELAMINATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL DELAMINATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 27 GLOBAL SURFACE-MODIFIED & UNPROCESSED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL SURFACE-MODIFIED & UNPROCESSED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 29 GLOBAL KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 31 GLOBAL PAPER IN KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL PAPER IN KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 33 GLOBAL CERAMICS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL CERAMICS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 35 GLOBAL PAINT & COATINGS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 GLOBAL PAINT & COATINGS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 37 GLOBAL FIBERGLASS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 GLOBAL FIBERGLASS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 39 GLOBAL PLASTIC IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 GLOBAL PLASTIC IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 41 GLOBAL RUBBER IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 GLOBAL RUBBER IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 43 GLOBAL PHARMACEUTICALS & MEDICAL IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 GLOBAL PHARMACEUTICALS & MEDICAL IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 45 GLOBAL COSMETICS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 GLOBAL COSMETICS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 47 GLOBAL OTHERS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 GLOBAL OTHERS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 49 GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 51 ASIA-PACIFIC KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 53 ASIA-PACIFIC KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 55 ASIA-PACIFIC KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 57 ASIA-PACIFIC KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 59 CHINA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 60 CHINA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 61 CHINA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 62 CHINA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 63 CHINA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 65 INDIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 66 INDIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 67 INDIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 68 INDIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 69 INDIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 INDIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 71 JAPAN KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 72 JAPAN KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 73 JAPAN KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 74 JAPAN KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 75 JAPAN KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 JAPAN KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 77 SOUTH KOREA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 79 SOUTH KOREA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 81 SOUTH KOREA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 83 THAILAND KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 84 THAILAND KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 85 THAILAND KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 86 THAILAND KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 87 THAILAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 THAILAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 89 SINGAPORE KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 90 SINGAPORE KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 91 SINGAPORE KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 92 SINGAPORE KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 93 SINGAPORE KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 SINGAPORE KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 95 INDONESIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 96 INDONESIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 97 INDONESIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 98 INDONESIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 99 INDONESIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 INDONESIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 101 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 103 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 105 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 107 PHILIPPINES KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 108 PHILIPPINES KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 109 PHILIPPINES KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 110 PHILIPPINES KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 111 PHILIPPINES KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 PHILIPPINES KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 113 MALAYSIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 114 MALAYSIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 115 MALAYSIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 116 MALAYSIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 117 MALAYSIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 MALAYSIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 119 REST OF ASIA-PACIFIC KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 120 REST OF ASIA-PACIFIC KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 121 EUROPE KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 122 EUROPE KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 123 EUROPE KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 124 EUROPE KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 125 EUROPE KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 126 EUROPE KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 127 EUROPE KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 EUROPE KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 129 GERMANY KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 130 GERMANY KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 131 GERMANY KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 132 GERMANY KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 133 GERMANY KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 GERMANY KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 135 U.K. KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 136 U.K. KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 137 U.K. KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 138 U.K. KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 139 U.K. KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 U.K. KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 141 FRANCE KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 142 FRANCE KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 143 FRANCE KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 144 FRANCE KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 145 FRANCE KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 FRANCE KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 147 ITALY KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 148 ITALY KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 149 ITALY KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 150 ITALY KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 151 ITALY KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 ITALY KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 153 SPAIN KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 154 SPAIN KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 155 SPAIN KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 156 SPAIN KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 157 SPAIN KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 SPAIN KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 159 RUSSIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 160 RUSSIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 161 RUSSIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 162 RUSSIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 163 RUSSIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 RUSSIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 165 SWITZERLAND KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 166 SWITZERLAND KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 167 SWITZERLAND KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 168 SWITZERLAND KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 169 SWITZERLAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 SWITZERLAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 171 TURKEY KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 172 TURKEY KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 173 TURKEY KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 174 TURKEY KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 175 TURKEY KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 176 TURKEY KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 177 BELGIUM KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 178 BELGIUM KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 179 BELGIUM KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 180 BELGIUM KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 181 BELGIUM KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 BELGIUM KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 183 NETHERLANDS KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 184 NETHERLANDS KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 185 NETHERLANDS KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 186 NETHERLANDS KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 187 NETHERLANDS KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 188 NETHERLANDS KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 189 REST OF EUROPE KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 190 REST OF EUROPE KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 191 NORTH AMERICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 192 NORTH AMERICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 193 NORTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 194 NORTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 195 NORTH AMERICA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 196 NORTH AMERICA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 197 NORTH AMERICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 198 NORTH AMERICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 199 U.S. KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 200 U.S. KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 201 U.S. KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 202 U.S. KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 203 U.S. KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 204 U.S. KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 205 CANADA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 206 CANADA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 207 CANADA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 208 CANADA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 209 CANADA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 210 CANADA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 211 MEXICO KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 212 MEXICO KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 213 MEXICO KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 214 MEXICO KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 215 MEXICO KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 216 MEXICO KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 217 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 218 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 219 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 220 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 221 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 222 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 223 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 224 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 225 SAUDI ARABIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 226 SAUDI ARABIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 227 SAUDI ARABIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 228 SAUDI ARABIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 229 SAUDI ARABIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 230 SAUDI ARABIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 231 U.A.E. KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 232 U.A.E. KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 233 U.A.E. KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 234 U.A.E. KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 235 U.A.E. KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 236 U.A.E. KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 237 SOUTH AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 238 SOUTH AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 239 SOUTH AFRICA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 240 SOUTH AFRICA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 241 SOUTH AFRICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 242 SOUTH AFRICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 243 EGYPT KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 244 EGYPT KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 245 EGYPT KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 246 EGYPT KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 247 EGYPT KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 248 EGYPT KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 249 ISRAEL KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 250 ISRAEL KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 251 ISRAEL KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 252 ISRAEL KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 253 ISRAEL KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 254 ISRAEL KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 255 REST OF MIDDLE EAST AND AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 256 REST OF MIDDLE EAST AND AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 257 SOUTH AMERICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 258 SOUTH AMERICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 259 SOUTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 260 SOUTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 261 SOUTH AMERICA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 262 SOUTH AMERICA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 263 SOUTH AMERICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 264 SOUTH AMERICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 265 BRAZIL KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 266 BRAZIL KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 267 BRAZIL KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 268 BRAZIL KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 269 BRAZIL KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 270 BRAZIL KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 271 ARGENTINA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 272 ARGENTINA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 273 ARGENTINA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 274 ARGENTINA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 275 ARGENTINA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 276 ARGENTINA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 277 REST OF SOUTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 278 REST OF SOUTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

Liste des figures

FIGURE 1 GLOBAL KAOLIN MARKET

FIGURE 2 GLOBAL KAOLIN MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL KAOLIN MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL KAOLIN MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL KAOLIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL KAOLIN MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 GLOBAL KAOLIN MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL KAOLIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL KAOLIN MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL KAOLIN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL KAOLIN MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL KAOLIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL KAOLIN MARKET: SEGMENTATION

FIGURE 14 ASIA PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL KAOLIN MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 RISE IN CONSTRUCTION ACTIVITIES ACROSS THE GLOBE IS EXPECTED TO DRIVE THE GLOBAL KAOLIN MARKET IN THE FORECAST PERIOD

FIGURE 16 CALCINED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL KAOLIN MARKET IN 2022 & 2029

FIGURE 17 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR KAOLIN MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 18 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 CURRENT PRICE STATISTICS (PER KG)

FIGURE 20 PRICE FORECASTS (PER KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL KAOLIN MARKET

FIGURE 23 GLOBAL KAOLIN MARKET: BY GRADE, 2021

FIGURE 24 GLOBAL KAOLIN MARKET: BY PROCESS, 2021

FIGURE 25 GLOBAL KAOLIN MARKET: BY APPLICATION, 2021

FIGURE 26 GLOBAL KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 27 GLOBAL KAOLIN MARKET: BY REGION (2021)

FIGURE 28 GLOBAL KAOLIN MARKET: BY REGION (2022 & 2029)

FIGURE 29 GLOBAL KAOLIN MARKET: BY REGION (2021 & 2029)

FIGURE 30 GLOBAL KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 31 ASIA-PACIFIC KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 32 ASIA-PACIFIC KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 33 ASIA-PACIFIC KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 ASIA-PACIFIC KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 ASIA-PACIFIC KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 36 EUROPE KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 37 EUROPE KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 38 EUROPE KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 EUROPE KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 EUROPE KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 41 NORTH AMERICA KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 42 NORTH AMERICA KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 43 NORTH AMERICA KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 NORTH AMERICA KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 NORTH AMERICA KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 46 MIDDLE EAST AND AFRICA KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 47 MIDDLE EAST AND AFRICA KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 48 MIDDLE EAST AND AFRICA KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 MIDDLE EAST AND AFRICA KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 MIDDLE EAST AND AFRICA KAOLIN MARKET: BY GRADE (2022 & 2029)

FIGURE 51 SOUTH AMERICA KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 52 SOUTH AMERICA KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 53 SOUTH AMERICA KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 54 SOUTH AMERICA KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 55 SOUTH AMERICA KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 56 GLOBAL KAOLIN MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 NORTH AMERICA KAOLIN MARKET: COMPANY SHARE 2021 (%)

FIGURE 58 EUROPE KAOLIN MARKET: COMPANY SHARE 2021 (%)

FIGURE 59 ASIA-PACIFIC KAOLIN MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.