Global Iron Ore Pellets Market

Taille du marché en milliards USD

TCAC :

%

USD

70.38 Billion

USD

95.58 Billion

2024

2032

USD

70.38 Billion

USD

95.58 Billion

2024

2032

| 2025 –2032 | |

| USD 70.38 Billion | |

| USD 95.58 Billion | |

|

|

|

|

Segmentation du marché mondial des boulettes de minerai de fer, par source (hématite, magnétite, taconite et autres), qualité (haut fourneau et réduction directe), technologie (à base d'oxygène/haut fourneau, four à arc électrique et four à induction électrique), processus de bouletage (four à grille et grille mobile droite), technologie de bouletage (disque de bouletage et tambour de bouletage), application (produits chimiques à base de fer et production d'acier), industrie (construction, automobile, chemin de fer, biens de consommation, transport maritime, industrie, aérospatiale et autres) - Tendances et prévisions de l'industrie jusqu'en 2031

Analyse du marché des boulettes de minerai de fer

Le marché des boulettes de minerai de fer connaît une croissance importante, portée par les progrès technologiques et les méthodes innovantes. L'une des dernières tendances est l'utilisation de procédés de réduction directe du fer (DRI) qui utilisent l'hydrogène au lieu des méthodes traditionnelles à base de carbone. Ce changement permet non seulement de réduire les émissions de carbone, mais aussi d'améliorer l'efficacité globale de la production d'acier. Les entreprises investissent dans des technologies durables, notamment des techniques de bouletage améliorées qui améliorent la qualité et la résistance des boulettes, augmentant ainsi leur compétitivité sur le marché.

De plus, l’intégration de l’intelligence artificielle et de l’apprentissage automatique dans le suivi et l’optimisation du processus de granulation révolutionne l’efficacité de la production. Ces technologies permettent un meilleur contrôle de l’environnement de fabrication, ce qui se traduit par des granulés de meilleure qualité et une réduction des déchets.

La demande croissante de boulettes de minerai de fer sur les marchés émergents, notamment en Asie, où la production d'acier est en plein essor, stimule encore davantage la croissance du marché. L'évolution vers des processus de production d'acier respectueux de l'environnement et l'accent croissant mis sur la durabilité devraient stimuler considérablement le marché des boulettes de minerai de fer.

Taille du marché des boulettes de minerai de fer

Français La taille du marché mondial des boulettes de minerai de fer était évaluée à 67,74 milliards USD en 2023 et devrait atteindre 92,00 milliards USD d’ici 2031, avec un TCAC de 3,90 % au cours de la période de prévision de 2024 à 2031. En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d’approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire.

Tendances du marché des boulettes de minerai de fer

« Demande croissante de production d’acier »

La croissance du marché des boulettes de minerai de fer est en grande partie due à la demande croissante de production d'acier , en particulier dans les économies émergentes comme l'Inde et la Chine. À mesure que les projets d'infrastructure et l'urbanisation s'accélèrent, ces pays développent leurs capacités de production d'acier. Par exemple, la politique nationale de l'acier de l'Inde vise à augmenter la production à 300 millions de tonnes d'ici 2030, ce qui entraînera une demande accrue de boulettes de minerai de fer de haute qualité. Cette évolution est motivée par la nécessité de processus de fabrication d'acier plus propres et plus efficaces, où les boulettes de minerai de fer sont préférées au minerai en morceaux en raison de leur faible teneur en impuretés et de leurs performances métallurgiques améliorées, ce qui stimule la demande du marché.

Portée du rapport et segmentation du marché des boulettes de minerai de fer

|

Attributs |

Informations clés sur le marché des boulettes de minerai de fer |

|

Segments couverts |

|

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord, Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, Reste de l'Europe en Europe, Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, Reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), Brésil, Argentine et Reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud |

|

Principaux acteurs du marché |

Vale (Brésil), Mitsubishi Corporation RtM Japan Ltd (Japon), Cleveland-Cliffs Inc (États-Unis), United States Steel Corporation (États-Unis), ARCELORMITTAL (Luxembourg), Metso Outotec (Finlande), KIOCL Limited (Inde), FERREXPO PLC (Suisse), JINDAL SAW LTD. (Inde), Iron Ore Company of Canada (Canada), LKAB Koncernkontor (Suède), METALLOINVEST MC LLC (Russie), Bahrain Steel (Bahreïn), SIMEC (Angleterre) |

|

Opportunités de marché |

|

|

Ensembles d'informations sur les données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Définition du marché des boulettes de minerai de fer

Les boulettes de minerai de fer sont des boules sphériques de minerai de fer utilisées dans le processus de fabrication de l'acier. Elles sont produites en agglomérant du concentré de minerai de fer finement broyé, mélangé à des liants et des additifs, puis soumis à des températures élevées dans un four. Ce processus, appelé pelletisation, augmente la teneur en fer et améliore les propriétés physiques du minerai. Les boulettes ont généralement une teneur en fer plus élevée (environ 65 à 67 %) que les minerais de fer traditionnels, ce qui les rend plus efficaces pour une utilisation dans les hauts fourneaux. Elles contribuent également à réduire les émissions et à améliorer l'efficacité du processus de production d'acier, contribuant ainsi à une industrie plus durable.

Dynamique du marché des boulettes de minerai de fer

Conducteurs

- Passage au fer réduit directement (DRI)

La transition vers la production de fer réduit directement (DRI) stimule considérablement le marché des boulettes de minerai de fer. Le DRI, produit à partir de boulettes de minerai de fer, offre une alternative plus respectueuse de l'environnement aux méthodes traditionnelles de haut fourneau, réduisant les émissions de carbone. Par exemple, en mars 2023, Blastr Green Steel a révélé son projet de construction d'une usine de fabrication de boulettes de minerai de fer à la pointe de la technologie dans le nord de la Norvège, avec un investissement prévu de 1,10 milliard USD. L'installation est conçue pour fournir des boulettes à une aciérie verte en Finlande. Une décision d'investissement finale sera prise d'ici 2025, sous réserve de l'obtention des permis nécessaires, la production devant débuter provisoirement d'ici 2028.

- Améliorations de la logistique et des transports

L’amélioration des infrastructures logistiques et de transport est cruciale pour le marché des boulettes de minerai de fer. Des systèmes de transport efficaces, tels que des réseaux ferroviaires et des installations portuaires améliorés, rationalisent le mouvement des boulettes des sites de production aux aciéries, réduisant ainsi considérablement les délais et les coûts. Par exemple, en août 2023, la branche Foulath, Bahreïn Steel, a annoncé une collaboration avec le groupe Essar pour le projet KSA Green Steel, axé sur la fourniture de boulettes de minerai de fer à l’initiative Green Steel Arabia (GSA). Ce partenariat vise à améliorer la durabilité de la production d’acier en Arabie saoudite en garantissant un approvisionnement constant en matières premières de haute qualité nécessaires à la fabrication d’acier vert.

Opportunités

- Augmenter les investissements dans les énergies renouvelables

La transition vers des sources d’énergie renouvelables a un impact significatif sur le marché des boulettes de minerai de fer, créant d’importantes opportunités de croissance. Les producteurs d’acier adoptent de plus en plus de pratiques durables pour s’aligner sur les objectifs mondiaux de réduction du carbone, ce qui entraîne une demande croissante d’acier à faible teneur en carbone, qui nécessite des boulettes de minerai de fer de haute qualité. Par exemple, en août 2023, Green Steel a conclu un partenariat avec les géants de l’industrie Rio Tinto et Vale pour se procurer des boulettes de minerai de fer à réduction directe. Cette collaboration est essentielle pour soutenir leurs opérations de production d’acier vert en Suède. En garantissant un approvisionnement fiable en boulettes de minerai de fer de haute qualité, Green Steel vise à réduire considérablement les émissions de carbone et à promouvoir une fabrication d’acier respectueuse de l’environnement, conformément aux objectifs mondiaux de durabilité.

- Progrès technologiques

Les progrès technologiques dans le domaine de la granulation créent des opportunités importantes sur le marché des boulettes de minerai de fer. Des innovations telles que le développement de la granulation en lit fluidisé et des liants améliorés améliorent la qualité des boulettes et l'efficacité de la production. Par exemple, des entreprises telles que Vale ont adopté des technologies de granulation avancées, ce qui permet d'obtenir des boulettes à teneur en fer plus élevée et à faible teneur en impuretés. Ces améliorations réduisent les coûts de production et la consommation d'énergie, ce qui rend les boulettes plus compétitives par rapport aux autres matières premières. De plus, l'automatisation et les processus pilotés par l'IA dans la production de boulettes optimisent les opérations et minimisent les déchets, attirant les investissements et encourageant les nouveaux entrants. Cette évolution technologique positionne les boulettes de minerai de fer comme un élément crucial de la production d'acier durable.

Contraintes/Défis

- Fluctuations des prix des matières premières

Les fluctuations des prix des matières premières entravent considérablement le marché des boulettes de minerai de fer. La volatilité du minerai de fer et des coûts des matières premières associées peut avoir un impact sur les dépenses de production et la rentabilité globale des fabricants. Lorsque les prix augmentent de manière imprévisible, les fabricants ont du mal à maintenir des prix compétitifs pour leurs produits, ce qui peut entraîner une baisse de la demande des clients à la recherche de coûts plus stables et prévisibles. En outre, ces fluctuations créent une incertitude dans la budgétisation et la planification financière, ce qui rend difficile pour les entreprises de prendre des décisions d'investissement éclairées. Par conséquent, l'environnement de prix incohérent sape la confiance et la croissance du marché, affectant en fin de compte la durabilité à long terme du marché des boulettes de minerai de fer.

- La concurrence de la ferraille

Le marché des boulettes de minerai de fer est de plus en plus mis à rude épreuve par l'utilisation croissante de ferraille dans la production d'acier. Alors que les fabricants d'acier se concentrent sur la réduction des coûts et l'amélioration de la durabilité, le passage aux matériaux recyclés gagne du terrain. La ferraille d'acier est souvent moins chère et nécessite moins d'apports énergétiques pendant la production que les boulettes de minerai de fer. Cette tendance constitue une menace importante pour la demande de boulettes de minerai de fer, car les fabricants peuvent donner la priorité à la ferraille d'acier pour maintenir des prix compétitifs et réduire l'empreinte carbone. Par conséquent, le potentiel de croissance du marché des boulettes de minerai de fer peut être entravé, ce qui entraînera une baisse des parts de marché et de la rentabilité.

Ce rapport de marché fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact et scénario actuel du marché en cas de pénurie de matières premières et de retards d'expédition

Data Bridge Market Research propose une analyse de haut niveau du marché et fournit des informations en tenant compte de l'impact et de l'environnement actuel du marché en matière de pénurie de matières premières et de retards d'expédition. Cela se traduit par l'évaluation des possibilités stratégiques, la création de plans d'action efficaces et l'assistance aux entreprises dans la prise de décisions importantes. Outre le rapport standard, nous proposons également une analyse approfondie du niveau d'approvisionnement à partir des retards d'expédition prévus, de la cartographie des distributeurs par région, de l'analyse des produits de base, de l'analyse de la production, des tendances de la cartographie des prix, de l'approvisionnement, de l'analyse des performances des catégories, des solutions de gestion des risques de la chaîne d'approvisionnement, de l'analyse comparative avancée et d'autres services d'approvisionnement et de soutien stratégique.

Impact attendu du ralentissement économique sur les prix et la disponibilité des produits

Lorsque l'activité économique ralentit, les industries commencent à souffrir. Les effets prévus du ralentissement économique sur les prix et l'accessibilité des produits sont pris en compte dans les rapports d'analyse du marché et les services de renseignements fournis par DBMR. Grâce à cela, nos clients peuvent généralement garder une longueur d'avance sur leurs concurrents, projeter leurs ventes et leurs revenus et estimer leurs dépenses de profits et pertes.

Portée du marché des boulettes de minerai de fer

Le marché est segmenté en fonction de la source, de la qualité, de la technologie, du processus de granulation, de la technologie de bouletage, de l'application et de l'industrie. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Source

- Hématite

- Magnétite

- Taconite

- Autres

Grade

- Haut fourneau

- Réduction directe

Technologie

- Four à oxygène/haut fourneau

- Four à arc électrique

- Four à induction électrique

Procédé de granulation

- Four à grille

- Grille mobile droite

Technologie de mise en boule

- Disque à billes

- Tambour à billes

Application

- Produits chimiques à base de fer

- Production d'acier

Industrie

- Construction

- Automobile

- Chemin de fer

- Biens de consommation

- Expédition

- Industriel

- Aérospatial

- Autres

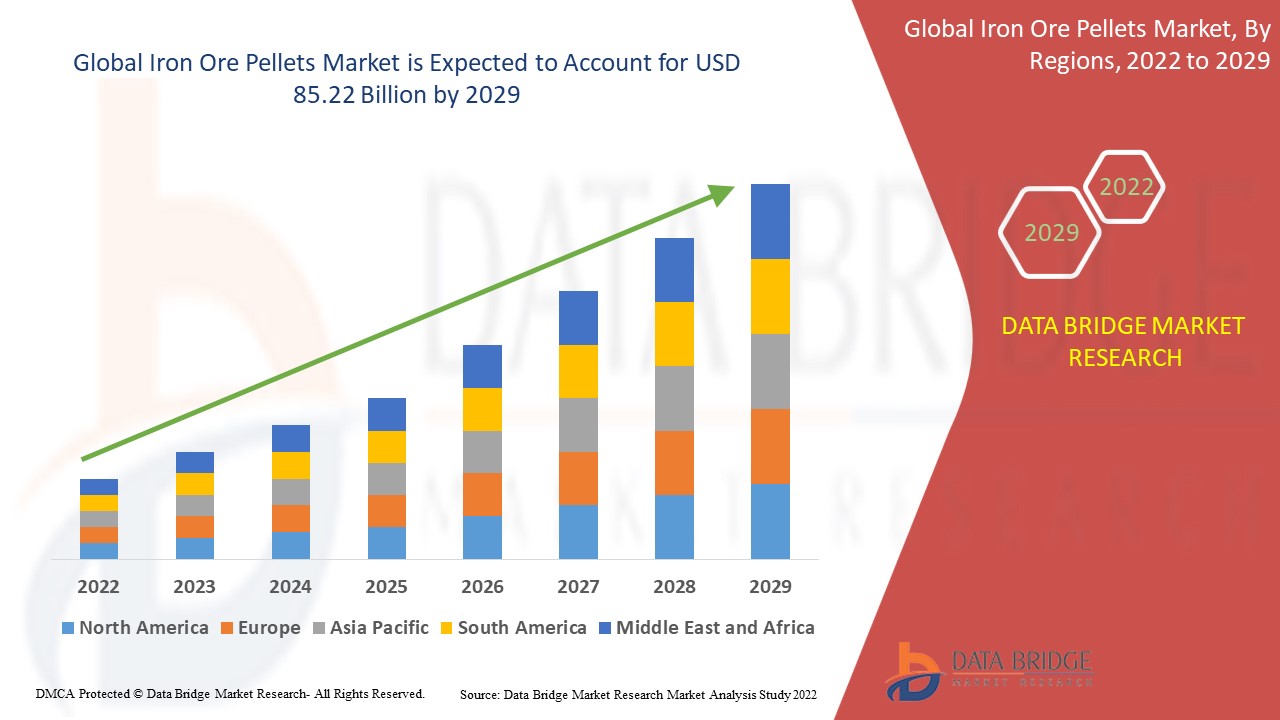

Analyse régionale du marché des boulettes de minerai de fer

Le marché est analysé et des informations sur la taille et les tendances du marché sont fournies par source, qualité, technologie, processus de granulation, technologie de bouletage, application et industrie comme référencé ci-dessus.

Les pays couverts dans le rapport de marché sont les États-Unis, le Canada et le Mexique en Amérique du Nord, l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie, le reste de l'Europe en Europe, la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines, le reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), l'Arabie saoudite, les Émirats arabes unis, l'Afrique du Sud, l'Égypte, Israël, le reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), le Brésil, l'Argentine et le reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud.

L'Asie-Pacifique devrait dominer le marché des boulettes de minerai de fer en termes de part de marché et de chiffre d'affaires, poursuivant sa position dominante au cours de la période de prévision. Cette croissance est tirée par les avantages des boulettes par rapport aux autres matières premières pour la fabrication du fer, notamment leur taille uniforme et leur taux de métallisation élevé. L'accent mis par la région sur des méthodes de production efficaces renforce encore la demande de boulettes de minerai de fer sur le marché.

L'Amérique du Nord devrait connaître une croissance lucrative sur le marché des boulettes de minerai de fer au cours de la période de prévision, stimulée par la forte demande d'acier dans les industries à forte consommation d'énergie. La rentabilité des boulettes de fer renforce encore leur attrait. En outre, le faible impact environnemental associé à l'utilisation de boulettes de minerai de fer stimulera considérablement la demande dans la région, car les industries accordent de plus en plus d'importance à la durabilité dans leurs opérations.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Iron Ore Pellets Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Iron Ore Pellets Market Leaders Operating in the Market Are:

- Vale (Brazil)

- Mitsubishi Corporation RtM Japan Ltd (Japan)

- Cleveland-Cliffs Inc (U.S.)

- United States Steel Corporation. (U.S.)

- ARCELORMITTAL (Luxembourg)

- Metso Outotec (Finland)

- KIOCL Limited (India)

- FERREXPO PLC (Switzerland)

- JINDAL SAW LTD. (India)

- Iron Ore Company of Canada (Canada)

- LKAB Koncernkontor (Sweden)

- METALLOINVEST MC LLC (Russia)

- Bahrain Steel (Bahrain)

- SIMEC (England)

Latest Developments in Iron Ore Pellets Market

- In August 2023, Foulath arm Bahrain Steel announced a collaboration with Essar Group for the KSA Green Steel Project, focusing on the supply of iron ore pellets to the Green Steel Arabia (GSA) initiative. This partnership aims to enhance the sustainability of steel production in Saudi Arabia by ensuring a steady supply of high-quality raw materials necessary for green steel manufacturing

- In August 2023, Green Steel forged a partnership with industry giants Rio Tinto and Vale to procure direct reduction iron ore pellets. This collaboration is pivotal for supporting their green steel production operations in Sweden. By securing a reliable supply of high-grade iron ore pellets, Green Steel aims to significantly lower carbon emissions and promote environmentally responsible steel manufacturing, aligning with global sustainability goals

- In May 2023, JSW Steel announced a significant investment of USD 1,077.8 million to establish an 8.0 million tons per year iron ore pellet production plant in Odisha, India. This project underscores JSW’s commitment to expanding its operations and supporting the demand for high-quality iron ore pellets in domestic and international markets, contributing to the growth of India’s steel industry

- In March 2023, Blastr Green Steel revealed plans to construct a state-of-the-art iron ore pellet manufacturing plant in Northern Norway, with an anticipated investment of USD 1.10 billion. The facility is designed to supply pellets to a green steel mill in Finland. A final investment decision will be made by 2025, contingent on obtaining necessary permits, with production tentatively set to commence by 2028.

- In May 2021, Fortescue Metals declared its ambitious goal to achieve net-zero operational emissions by 2040. The company plans to implement renewable energy sources, green hydrogen, and other innovative clean technologies across its operations. This commitment reflects Fortescue’s dedication to sustainability and positions it as a leader in the mining sector’s transition towards environmentally friendly practices and technologies

- In March 2021, U.S. Steel announced a strategic investment of USD 1.2 billion for the development of a new sustainable endless casting and rolling facility in the United States. This facility aims to enhance the company's steelmaking capabilities while minimizing environmental impacts. The investment is part of U.S. Steel's broader initiative to embrace sustainable manufacturing processes, thereby promoting eco-friendly practices within the steel industry

- In February 2021, Rio Tinto unveiled plans to invest USD 2.4 billion in its Gudai-Darri iron ore mine in Western Australia. This substantial investment is aimed at increasing production capacity while integrating advanced automation and digitalization technologies to boost operational efficiency. By leveraging these innovations, Rio Tinto aims to enhance productivity and reduce its environmental footprint, contributing to more sustainable mining practices

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.