Global Industrial Metrology Market

Taille du marché en milliards USD

TCAC :

%

USD

11.76 Billion

USD

19.19 Billion

2024

2032

USD

11.76 Billion

USD

19.19 Billion

2024

2032

| 2025 –2032 | |

| USD 11.76 Billion | |

| USD 19.19 Billion | |

|

|

|

|

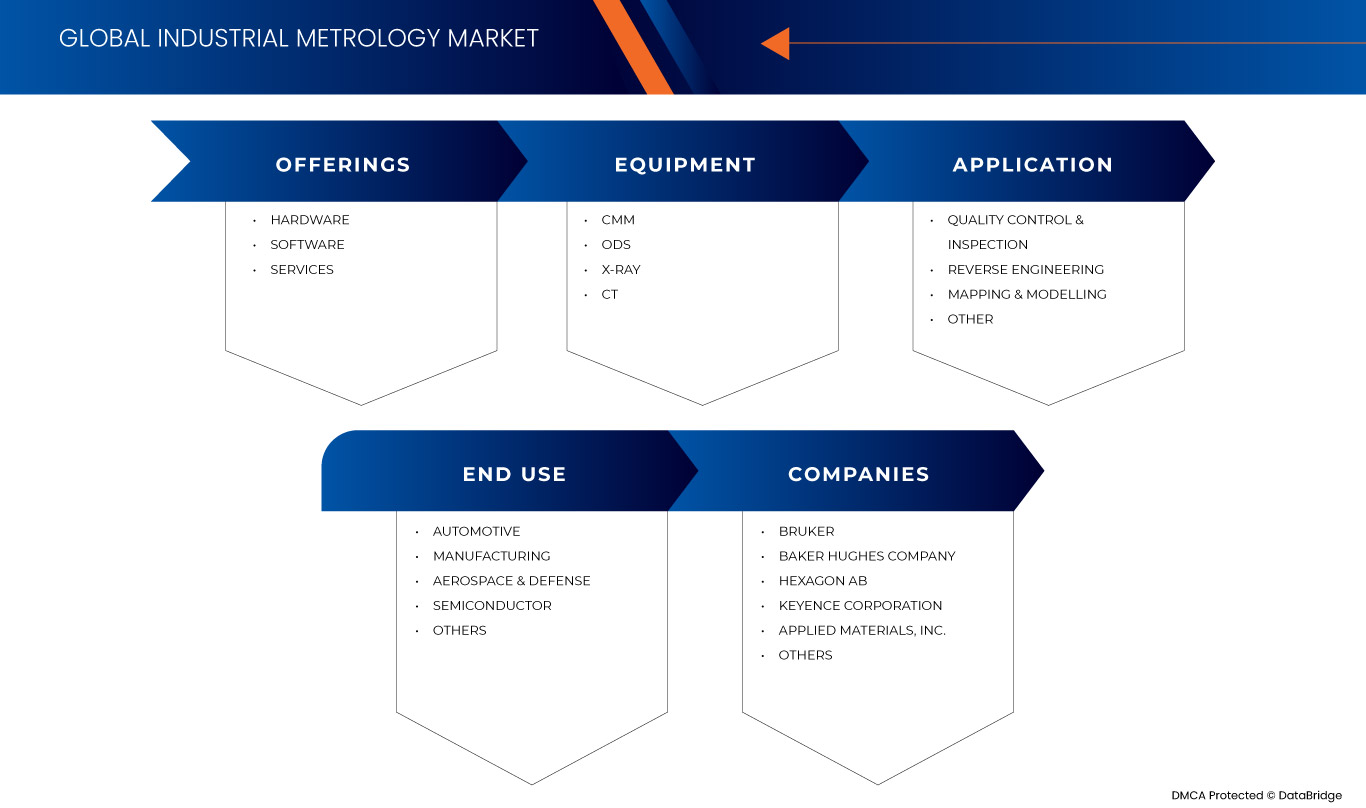

Global Industrial Metrology Market Segmentation, By Offering (Hardware, Software, and Services), Equipment (CMM, ODS, X-ray, and CT), Application (Quality Control & Inspection, Reverse Engineering, Mapping & Modelling, and Others), End User (Automotive, Manufacturing, Aerospace & Defense, Semiconductor, and Others) - Industry Trends and Forecast to 2031

Industrial Metrology Market Analysis

The global industrial metrology market is significantly driven by the increasing demand for high-precision measurement solutions. As industries seek to enhance efficiency and accuracy, advanced metrology technologies, such as 3D scanning and laser measurement systems, are being adopted to ensure precise component production. In addition, the rising demand for quality control across various sectors, including automotive, aerospace, and electronics, further fuels this market. Stringent regulatory requirements and the necessity for compliance with international quality standards compel manufacturers to invest in reliable measurement systems. This focus on quality assurance not only minimizes defects and production costs but also enhances product reliability and customer satisfaction, solidifying the market's growth trajectory.

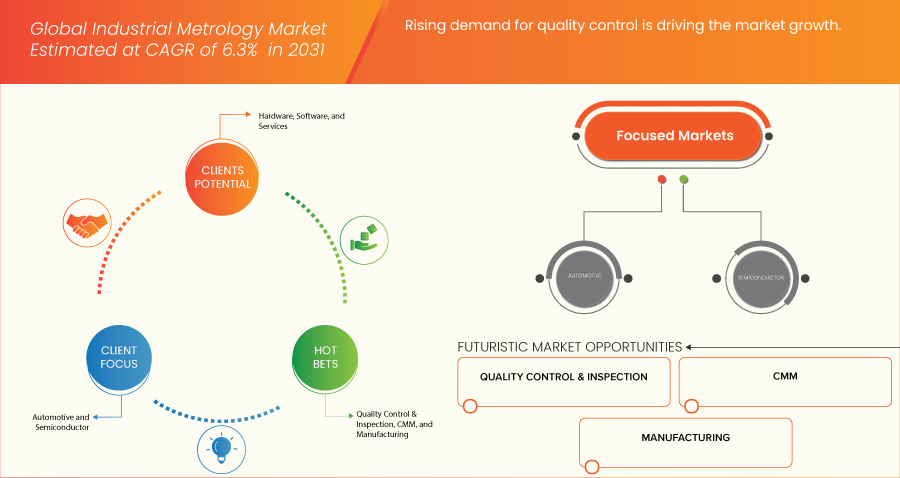

Industrial Metrology Market Size

Global industrial metrology market is expected to reach a value of USD 18.05 billion by 2031 from USD 11.23 billion in 2023, growing at a CAGR of 6.3% during the forecast period 2024 to 2031. In addition to the Market insights such as Market value, growth rate, Market segments, geographical coverage, Market players, and Market scenario, the Market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Industrial Metrology Market Trends

"Stringent Regulatory Requirements and Standards Compliance"

Stringent regulatory requirements across various industries present a significant opportunity for the global industrial metrology market. Industries such as aerospace, automotive, and pharmaceuticals are governed by strict standards that dictate the accuracy and reliability of measurement processes. As these regulations evolve and become more rigorous, manufacturers are compelled to invest in advanced metrology solutions to ensure compliance and avoid penalties associated with non-compliance

De plus, le respect des normes internationales, telles que ISO 9001 et AS9100, nécessite des contrôles de qualité constants tout au long du processus de production. Les outils de métrologie qui facilitent les mesures et la documentation précises sont essentiels pour respecter ces normes. Ce besoin de conformité entraîne une demande de systèmes de mesure sophistiqués, créant un marché croissant pour les fournisseurs de solutions de métrologie qui peuvent aider les fabricants à s'orienter dans des environnements réglementaires complexes. Cette tendance non seulement stimule la demande du marché, mais souligne également l'importance de la mesure de précision dans les industries réglementées.

Portée du rapport et segmentation du marché de la métrologie industrielle

|

Attributs |

Informations clés sur le marché de la métrologie industrielle |

|

Segments couverts |

|

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, France, Italie, Espagne, Russie, Turquie, Pays-Bas, Norvège, Finlande, Danemark, Suède, Pologne, Suisse, Belgique, reste de l'Europe, Chine, Japon, Inde, Corée du Sud, Australie, Nouvelle-Zélande, Indonésie, Thaïlande, Malaisie, Singapour, Philippines, Taïwan, Vietnam, reste de l'Asie-Pacifique, Brésil, Argentine, reste de l'Amérique du Sud, Émirats arabes unis, Arabie saoudite, Afrique du Sud, Égypte, Israël, Bahreïn, Oman, Qatar, Koweït et reste du Moyen-Orient et de l'Afrique |

|

Principaux acteurs du marché |

Bruker (États-Unis), Baker Hughes Company (États-Unis), Hexagon AB (Suède), KEYENCE CORPORATION (Japon), Applied Materials, Inc. (États-Unis), SGS Société Générale de Surveillance (Suisse), FARO (États-Unis), TriMet (États-Unis), Intertek Group plc (Royaume-Uni), CREAFORM (Canada), Automated Precision Inc (API) (États-Unis), CyberOptics Corporation (États-Unis), Cairnhill (Singapour), Metrologic Group (France) et ATT Metrology Solutions (États-Unis), entre autres |

|

Opportunités de marché |

|

|

Ensembles d'informations sur les données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur du marché, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE. |

Définition du marché de la métrologie industrielle

Le marché mondial de la métrologie industrielle englobe le développement, la fabrication et l'utilisation de technologies de mesure et d'inspection conçues pour garantir la précision et l'exactitude des processus industriels. Ce marché comprend une large gamme d'équipements et de solutions tels que des machines à mesurer tridimensionnelles (MMT), des systèmes de mesure optiques et laser et des logiciels d'analyse de données et de contrôle qualité. La métrologie industrielle joue un rôle essentiel dans divers secteurs, notamment l'automobile, l'aérospatiale, l'électronique et la santé, en permettant aux fabricants de maintenir des normes de qualité élevées, de réduire les erreurs et d'améliorer la productivité. À mesure que les industries adoptent de plus en plus l'automatisation et les technologies de fabrication avancées, la demande de solutions de mesure précises devrait augmenter, poussée par la nécessité de se conformer à des réglementations de qualité strictes et la recherche d'une efficacité opérationnelle. Le marché se caractérise par des avancées technologiques continues et un paysage d'application en expansion, contribuant à sa croissance et à son évolution globales.

Dynamique du marché de la métrologie industrielle

Conducteurs

- Demande croissante de solutions de mesure de haute précision

Le paysage industriel est de plus en plus caractérisé par le besoin de solutions de mesure de haute précision dans divers secteurs, notamment l'aéronautique, l'automobile et l'électronique. À mesure que les produits deviennent plus sophistiqués et que les tolérances se resserrent, les fabricants doivent s'appuyer sur des outils de métrologie avancés pour garantir que les composants répondent à des spécifications strictes. La mesure de haute précision est essentielle non seulement pour l'assurance qualité, mais aussi pour la conformité réglementaire, ce qui en fait une priorité absolue pour les industries qui souhaitent maintenir la sécurité et la fiabilité de leurs produits.

Par exemple,

- En octobre 2024, ZEISS a présenté le ZEISS VersaXRM 730, un système de microscopie à rayons X 3D révolutionnaire qui répond à la demande croissante de technologie de précision dans diverses industries. Ce système innovant offre une résolution améliorée et un débit plus rapide, permettant aux fabricants d'effectuer une numérisation efficace et un contrôle qualité précis des composants. Avec des fonctionnalités telles que le logiciel primé ZEN navx et le mode FAST pour une imagerie rapide, le VersaXRM 730 améliore considérablement la productivité, répondant au besoin croissant de solutions de mesure de haute précision dans des secteurs tels que l'automobile, l'aérospatiale et les appareils médicaux.

Demande croissante de contrôle de la qualité

Le contrôle qualité est devenu un aspect incontournable de la fabrication, influençant considérablement le marché mondial de la métrologie industrielle. Les consommateurs s'attendant à des produits de haute qualité et à une surveillance accrue de la part des organismes de réglementation, les fabricants sont obligés de mettre en œuvre des mesures de contrôle qualité rigoureuses. Les solutions de métrologie avancées offrent les capacités nécessaires pour surveiller et garantir la qualité des produits tout au long du processus de production, réduisant ainsi la probabilité de défauts et garantissant la conformité aux normes du secteur.

Par exemple,

En octobre 2024, selon E-Zine Media, l’intégration de la réalité augmentée (AR) a considérablement transformé les processus de contrôle qualité dans la fabrication avancée. En superposant des informations numériques sur des composants physiques, la réalité augmentée a permis une visualisation des données en temps réel et une précision accrue des inspections. Cette technologie a rationalisé les opérations, amélioré la précision et facilité la collaboration entre les opérateurs sur site et les experts à distance.

Opportunités

- Personnalisation des solutions en métrologie

La possibilité de personnaliser les solutions de métrologie pour répondre aux besoins uniques de différentes industries offre une opportunité précieuse sur le marché mondial de la métrologie industrielle. Différents secteurs, notamment l'automobile, l'électronique et les appareils médicaux, ont des exigences de mesure spécifiques auxquelles les solutions standard ne peuvent pas répondre de manière adéquate. En fournissant des systèmes de métrologie sur mesure, les entreprises peuvent mieux répondre aux divers besoins de leurs clients, améliorant ainsi leur satisfaction et leur fidélité.

Par exemple,

En août 2023, Bowers Group a aidé Virtue Aerospace avec une solution de mesure personnalisée qui a accéléré la vitesse d'inspection de 92 %. Le système sur mesure a aidé Virtue Aerospace à répondre aux exigences de conformité strictes pour les turbines de pompes à carburant d'aviation. Ian Smith, responsable qualité et environnement, a salué le système pour sa facilité d'utilisation et les améliorations significatives du flux de travail.

- Adoption croissante de la technologie des jumeaux numériques

L’adoption croissante de la technologie des jumeaux numériques dans les processus de fabrication représente une opportunité considérable pour le marché de la métrologie industrielle. Les jumeaux numériques créent des répliques virtuelles d’actifs physiques, permettant aux fabricants de simuler, d’analyser et d’optimiser les opérations en temps réel. Des données de métrologie précises sont essentielles pour développer et maintenir des jumeaux numériques efficaces, car elles garantissent que les modèles virtuels reflètent les conditions et les performances réelles des actifs physiques.

Par exemple,

Selon le livre blanc de Siemens, la technologie des jumeaux numériques a permis aux fabricants de développer des répliques virtuelles d'actifs physiques, améliorant ainsi les simulations opérationnelles. Des données de métrologie précises se sont avérées essentielles pour garantir que ces modèles numériques reflètent avec précision les conditions du monde réel. Cela accroît l'adoption de la technologie des jumeaux numériques sur le marché mondial de la métrologie industrielle.

Contraintes/Défis

- L'investissement initial élevé freine la croissance du marché

L'investissement initial élevé requis pour les solutions de métrologie avancées constitue un frein important sur le marché mondial de la métrologie industrielle. Les systèmes de mesure sophistiqués, tels que les scanners laser, les machines de mesure tridimensionnelles (MMT) et les technologies d'inspection automatisées, s'accompagnent souvent de coûts substantiels qui peuvent être prohibitifs, en particulier pour les petites et moyennes entreprises (PME). Ces entreprises peuvent avoir du mal à allouer des budgets pour de telles dépenses d'investissement, ce qui entraîne un retard dans l'adoption d'outils de métrologie essentiels.

Par exemple,

En juin 2024, l’article soulignait que l’investissement initial élevé requis pour les solutions de métrologie avancées constitue un frein important pour le marché de la métrologie industrielle. De nombreuses petites et moyennes entreprises (PME) sont confrontées à des contraintes budgétaires, ce qui retarde l’adoption de technologies de mesure essentielles. En outre, les dépenses courantes de maintenance et de mises à jour logicielles compliquent encore davantage leur capacité à investir, limitant ainsi le potentiel de croissance du marché.

Ce rapport de marché fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Champ d'application du marché de la métrologie industrielle

Le marché est segmenté en quatre segments notables, qui sont basés sur l'offre, l'équipement, l'application et l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Offre

- Matériel

- Logiciel

- Services

Équipement

- CMM

- SAO

- Radiographie

- CT

Application

- Contrôle de la qualité et inspection

- Ingénierie inverse

- Cartographie et modélisation

- Autre

Utilisateur final

- Automobile

- Fabrication

- Aérospatiale et Défense

- Semi-conducteur

- Autres

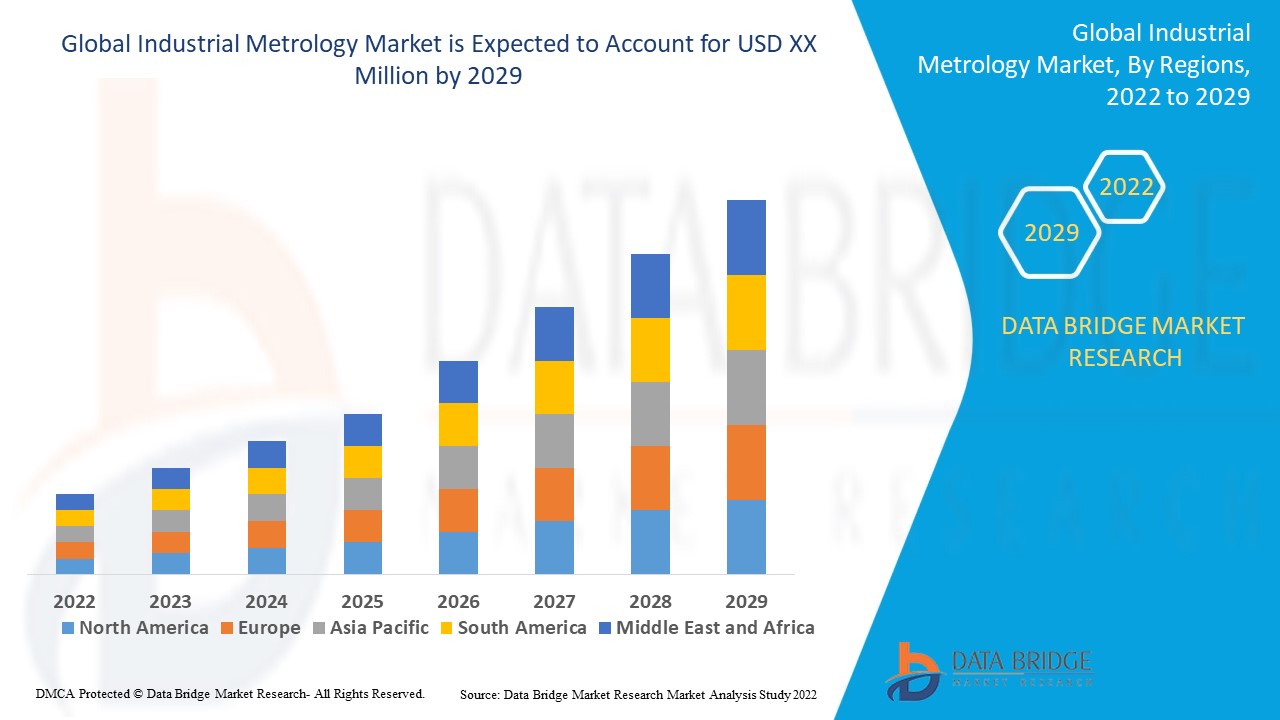

Analyse régionale du marché de la métrologie industrielle

Le marché mondial de la métrologie industrielle est segmenté en quatre segments notables, qui sont basés sur l'offre, l'équipement, l'application et l'utilisateur final.

Les pays couverts dans le rapport sur le marché de la métrologie industrielle sont les suivants : États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, France, Italie, Espagne, Russie, Turquie, Pays-Bas, Norvège, Finlande, Danemark, Suède, Pologne, Suisse, Belgique, reste de l'Europe, Chine, Japon, Inde, Corée du Sud, Australie, Nouvelle-Zélande, Indonésie, Thaïlande, Malaisie, Singapour, Philippines, Taïwan, Vietnam, reste de l'Asie-Pacifique, Brésil, Argentine, reste de l'Amérique du Sud, Émirats arabes unis, Arabie saoudite, Afrique du Sud, Égypte, Israël, Bahreïn, Oman, Qatar, Koweït et reste du Moyen-Orient et de l'Afrique.

La région Amérique du Nord domine le marché mondial de la métrologie industrielle en raison de ses capacités de fabrication avancées, de ses investissements importants dans la technologie, de l’accent mis sur le contrôle de la qualité et de la présence d’acteurs clés de l’industrie.

Asia-Pacific region is expected to be the fastest-growing region due to the presence of key manufacturers further solidifies the region's market leadership and stringent regulatory standards drive demand for precise measurement solutions across various sectors.

The country section of the report also provides individual Market impacting factors and changes in Market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the Market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Industrial Metrology Market Share

Global industrial metrology market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, Market potential, investment in research and development, new Market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global industrial metrology market.

Industrial Metrology Market Leaders Operating in the Market are:

- Bruker (U.S.)

- Baker Hughes Company (U.S.)

- Hexagon AB (Sweden)

- KEYENCE CORPORATION (Japan)

- Applied Materials, Inc. (U.S.)

- SGS Société Générale de Surveillance (Switzerland)

- FARO (U.S.)

- TriMet (U.S.)

- Intertek Group plc (U.K.)

- CREAFORM (Canada)

- Automated Precision Inc (API) (U.S.)

- CyberOptics Corporation (U.S.)

- Cairnhill (Singapore)

- Metrologic Group (France)

- ATT Metrology Solutions (U.S.)

Latest Developments in Industrial Metrology Market

- In July 2024, Professors Andrew Webb and Bernhard Blumich received the Richard R. Ernst Prize at EUROMAR 2024, recognizing their significant contributions to NMR and magnetic resonance research, advancing scientific understanding in these fields

- In February 2021, Baker Hughes Company has acquired ARMS Reliability to bolster its Asset Performance Management (APM) portfolio, advancing its digital solutions across industries such as mining, power, and utilities. This acquisition enhances Baker Hughes’ industrial asset management capabilities by integrating ARMS Reliability’s solutions into its Bently Nevada platform, providing more precise asset monitoring and lifecycle management, and supporting the company’s commitment to improving productivity in Industrial Metrology

- En septembre 2024, Hexagon AB a présenté une nouvelle technologie visant à réduire les délais d'inspection de la qualité dans la fabrication à grande échelle. Le Leica Absolute Tracker ATS800 associe le suivi laser et les fonctionnalités radar, permettant aux fabricants de mesurer des caractéristiques détaillées à distance et de respecter des tolérances d'assemblage strictes. Ce système a amélioré la productivité en minimisant les goulots d'étranglement dans les secteurs de l'aérospatiale et de l'automobile. Le lancement a renforcé la position de Hexagon AB sur le marché, démontrant son engagement à répondre aux besoins fondamentaux de l'industrie et à améliorer les capacités d'inspection automatisée

- En mars 2023, KEYENCE CORPORATION a lancé le système de mesure multicapteur haute précision LM-X, combinant des mesures optiques, laser et par palpage tactile dans une seule unité. Ce système permet des mesures faciles et de haute précision sans positionnement fastidieux, permettant aux utilisateurs d'obtenir des rapports d'inspection fiables de manière efficace et précise

- En juin 2022, Applied Materials, Inc. a annoncé l'acquisition de Picosun Oy, renforçant ainsi les capacités de son groupe ICAPS grâce à la technologie de dépôt de couches atomiques de Picosun. Cette opération visait à répondre à la demande croissante de semi-conducteurs spécialisés sur divers marchés

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.