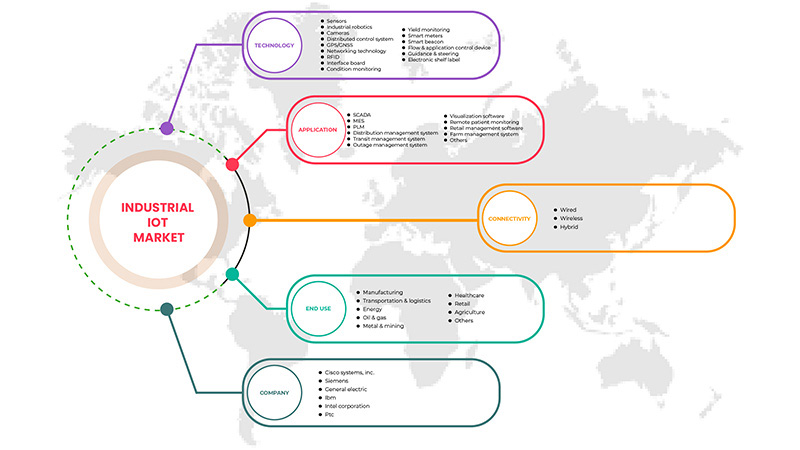

Marché mondial de l'IoT industriel, par technologie (capteurs, robotique industrielle, caméras, système de contrôle distribué, GPS/GNSS, technologie de réseau, RFID, carte d'interface, surveillance de l'état, surveillance du rendement, compteurs intelligents, balise intelligente, flux et application, dispositif de contrôle, guidage et direction et étiquette électronique de rayon ), application (SCADA, MES, PLM, système de gestion de la distribution, système de gestion du transit, système de gestion des pannes, logiciel de visualisation, surveillance à distance des patients, logiciel de gestion de la vente au détail, système de gestion agricole et autres), connectivité (filaire, sans fil et hybride), utilisation finale (fabrication, transport et logistique, énergie, pétrole et gaz, métaux et mines, soins de santé, vente au détail, agriculture et autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché de l'IoT industriel

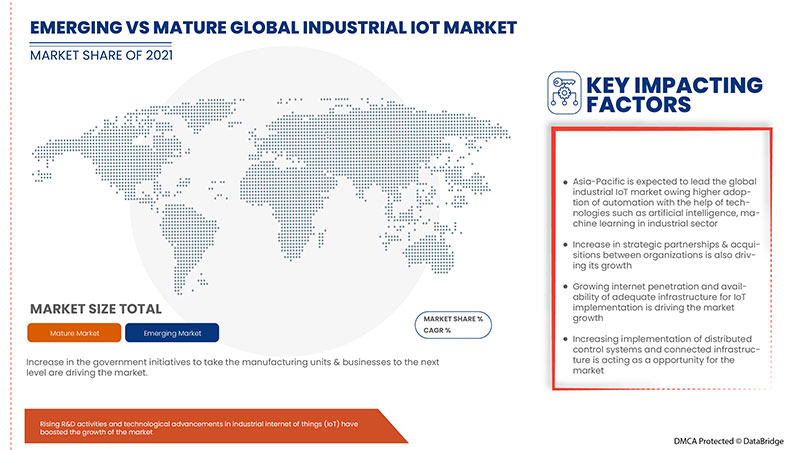

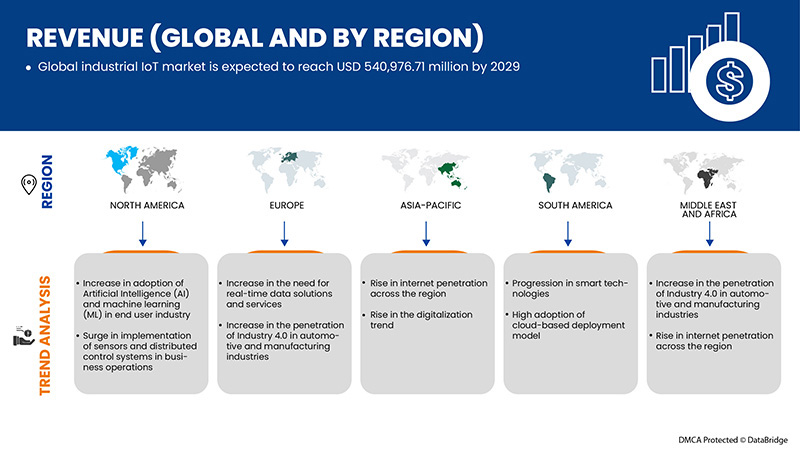

L'utilisation accrue du marché de l'IoT industriel en raison de l'adoption de l'intelligence artificielle (IA) et de l'apprentissage automatique (ML) dans l'industrie des utilisateurs finaux stimule également la croissance du marché. La probabilité accrue de vol d'appareils et de violations de données devrait freiner le marché de l'IoT industriel. La pénétration croissante d'Internet et la numérisation à travers le monde sont une opportunité pour le marché de l'IoT industriel. Les coûts d'installation élevés et les difficultés d'intégration des appareils IoT constituent un défi pour le marché mondial de l'IoT industriel.

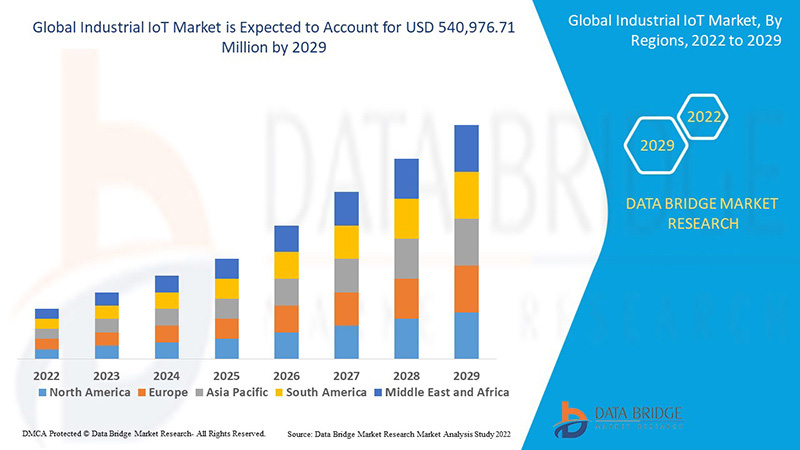

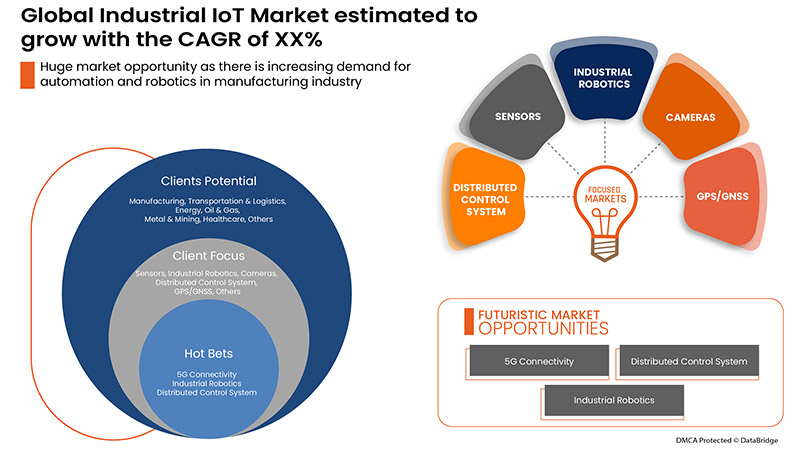

Data Bridge Market Research analyse que le marché mondial de l'IoT industriel devrait atteindre une valeur de 540 976,71 millions USD d'ici 2029, à un TCAC de 10,1 % au cours de la période de prévision. Les « capteurs » représentent le segment technologique le plus important car ce type de technologie est très demandé et constitue la meilleure option pour extraire des informations des composants industriels. Le rapport sur le marché de l'IoT industriel couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par technologie (capteurs, robotique industrielle, caméras, système de contrôle distribué, GPS/GNSS, technologie de mise en réseau, RFID, carte d'interface, surveillance de l'état, surveillance du rendement, compteurs intelligents, balise intelligente, dispositif de contrôle de flux et d'application, guidage et pilotage et étiquette électronique de rayon), application (SCADA, MES, PLM, système de gestion de la distribution, système de gestion du transit, système de gestion des pannes, logiciel de visualisation, surveillance à distance des patients, logiciel de gestion de la vente au détail, système de gestion agricole et autres), connectivité (filaire, sans fil et hybride), utilisation finale (fabrication, transport et logistique, énergie, pétrole et gaz, métaux et mines, soins de santé, vente au détail, agriculture et autres) - Tendances et prévisions de l'industrie jusqu'en 2029 |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord, Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, Reste de l'Europe en Europe, Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, Reste du Moyen-Orient et de l'Afrique, Brésil, Argentine et Reste de l'Amérique du Sud |

|

Acteurs du marché couverts |

Cisco Systems, Inc., Siemens, General Electric, IBM Corporation, Intel Corporation, PTC, Honeywell International Inc., NEC Corporation, Rockwell Automation, ABB, SAP SE, Texas Instruments Incorporated, Robert Bosch GmbH, Emerson Electric Co., Microsoft, KUKA AG, Sigfox Network Limited (une filiale d'UnaBiz), Wipro, Arm Limited (une filiale de Softbank Group Corp.) et Huawei Technologies Co., Ltd., entre autres |

Définition du marché

L'extension et l'application de l'Internet des objets (IoT) dans les secteurs et applications industriels sont appelées Internet industriel des objets (IIoT). L'Internet des objets machine à machine (M2M) (IIoT) permet aux entreprises et aux industries de fonctionner de manière plus efficace et plus fiable en raison de l'importance accordée à la connectivité M2M, au big data et à l'apprentissage automatique. Les applications industrielles telles que la robotique, la technologie médicale et les processus de production définis par logiciel sont toutes incluses dans l'IIoT.

Dynamique du marché de l'IoT industriel

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de l'adoption de l'intelligence artificielle (IA) et de l'apprentissage automatique (ML) dans l'industrie des utilisateurs finaux

La popularité de l'IA et du ML augmente d'année en année dans divers secteurs tels que la fabrication, la santé, l'énergie, le pétrole et le gaz, et bien d'autres. La plupart de ces secteurs adoptent la technologie pour accroître l'efficacité du travail, automatiser le processus de prestation de services et moderniser les offres, ce qui a acquis un rôle important dans la concurrence avec les concurrents sur le marché. Ainsi, la tendance croissante de l'adoption de l'IA et du ML est un moteur majeur de la croissance du marché mondial de l'IoT industriel.

- Augmentation de la mise en œuvre de capteurs et de systèmes de contrôle distribués dans les opérations commerciales

L'adoption de capteurs et de systèmes de contrôle distribués permettra de contrôler et de gérer le processus de travail et d'automatiser le processus de gestion de tous les processus industriels. Ainsi, la demande de mise en œuvre de capteurs et de DCS dans diverses opérations commerciales augmentera chaque année. Ainsi, à l'échelle mondiale, le besoin de capteurs et de DCS augmente en raison des multiples avantages associés à la mise en œuvre, ce qui favorise la croissance du marché mondial de l'IoT industriel et agit comme un moteur du développement du marché.

- Augmentation du besoin de solutions et de services de données en temps réel

Les solutions de données en temps réel nécessitent une large gamme d'appareils électroniques, et la demande en appareils IoT devrait augmenter en raison de la nécessité de prendre en charge l'analyse des données en temps réel dans les opérations commerciales, de favoriser la compréhension rapide des données et de guider les décisions de livraison de produits ou de services aux clients. Il existe donc une forte demande pour l'adoption de solutions en temps réel qui impliquent directement l'utilisation d'appareils IoT pour les industries. Par conséquent, il est prévu qu'il s'agisse d'un moteur majeur de la croissance du marché.

Contraintes/Défis

- Manque de main d'oeuvre qualifiée et de sessions de formation

L'adoption de solutions IoT pour les industries n'est pas simple et rapide ; elle nécessite une visualisation détaillée et une méthode adéquate d'automatisation du secteur. Par conséquent, les utilisateurs finaux ont besoin de plus de temps et de travail pour adopter les solutions et former les employés à comprendre le processus et la maintenance.

- Probabilité accrue de vol d'appareils et de violations de données

La fiabilité du système informatique implique que les ressources, l'organisation et les informations de l'usine soient générées par ces dispositifs associés. La fiabilité est davantage responsable de l'adoption de la numérisation dans les opérations commerciales ; cependant, il existe une forte probabilité de désavantages en matière de sécurité.

- Augmentation des complexités techniques en raison des progrès technologiques quotidiens

La sécurité flexible est une idée pour fournir des soins médicaux, une formation et une aide au logement, que la personne soit officiellement employée ou non. En outre, les dossiers d'activité peuvent soutenir une formation approfondie et la reconversion des travailleurs. Quelle que soit la façon dont les gens décident d'investir leur temps, il doit y avoir des moyens pour que les gens puissent vivre une vie satisfaisante, même si la société a besoin de moins de professionnels. Ainsi, le progrès technologique continu entraînera une formation continue des employés et freinera la croissance du marché.

Impact post-COVID-19 sur le marché de l'IoT industriel

La COVID-19 a eu un impact considérable sur le marché de l'IoT industriel, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles produisant des biens essentiels. Le gouvernement a pris des mesures strictes, telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres, pour empêcher la propagation de la COVID-19. Les seules entreprises en activité dans cette situation de pandémie sont les services essentiels autorisés à ouvrir et à exécuter les processus.

La croissance du marché de l’IoT industriel est en hausse en raison de la numérisation des processus de production et des chaînes d’approvisionnement dans l’agriculture, les services publics d’électricité, l’exploitation minière, le pétrole et le gaz et les transports. De plus, l’adoption de l’IoT dans les industries a connu d’énormes progrès entre 2020 et 2021, car la pandémie a démontré l’importance de l’IoT dans tous les types d’entreprises. L’augmentation de la demande d’automatisation pour éviter l’implication d’une main-d’œuvre maximale a favorisé l’adoption de l’IoT dans les industries. Cela reproduit l’impact positif de la COVID-19 sur le marché de l’IIoT, qui a encore plus catalysé l’activité grâce à l’adoption des technologies de l’industrie 4.0.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer la technologie sur le marché de l'IoT industriel. Les entreprises apporteront au marché des solutions avancées et précises.

Développement récent

- En mars 2022, Cisco Systems, Inc. a développé une plateforme avancée de centre de contrôle IoT pour améliorer la fiabilité du service et réduire les coûts opérationnels. Ce développement aidera l'entreprise à diversifier son portefeuille de solutions et à proposer des solutions de meilleure qualité

- En avril 2022, Arm Limited a lancé deux nouvelles solutions, Arm Cortex-M85 et Cortex-A. Ces nouveaux produits et solutions aideront l'entreprise à offrir de meilleures solutions aux clients, à attirer de nouveaux clients et à accélérer la croissance des revenus

Portée du marché mondial de l'IoT industriel

Le marché de l'IoT industriel est segmenté en fonction de la technologie, de l'application, de la connectivité et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par technologie

- Capteurs

- Robotique industrielle

- Caméras

- Système de contrôle distribué

- GPS/GNSS

- Technologie de mise en réseau

- RFID

- Carte d'interface

- Surveillance de l'état

- Suivi du rendement

- Compteurs intelligents

- Balise intelligente

- Dispositif de contrôle de flux et d'application

- Guidage et pilotage

- Étiquette électronique de gondole

Sur la base de la technologie, le marché mondial de l'IoT industriel est segmenté en capteurs, robotique industrielle, caméras, système de contrôle distribué, GPS/GNSS, technologie de réseau, RFID, carte d'interface, surveillance de l'état, surveillance du rendement, compteurs intelligents, balise intelligente, dispositif de contrôle de flux et d'application, guidage et direction, et étiquette électronique de rayon.

Par application

- SCADA

- Mes

- PLM

- Système de gestion de la distribution

- Système de gestion du transit

- Système de gestion des pannes

- Logiciel de visualisation

- Surveillance à distance des patients

- Logiciel de gestion de vente au détail

- Système de gestion agricole

- Autres

Sur la base des applications, le marché mondial de l'IoT industriel a été segmenté en SCADA, MES, PLM, système de gestion de la distribution, système de gestion du transit, système de gestion des pannes, logiciel de visualisation, surveillance à distance des patients, logiciel de gestion de la vente au détail, système de gestion agricole, et autres.

Par connectivité

- Câblé

- Sans fil

- Hybride

Sur la base de la connectivité, le marché mondial de l'IoT industriel a été segmenté en filaire, sans fil et hybride

Par utilisation finale

- Fabrication

- Transport et logistique

- Énergie

- Pétrole et gaz

- Métallurgie et mines

- Soins de santé

- Vente au détail

- Agriculture

- Autres

Sur la base de l'utilisation finale, le marché mondial de l'IoT industriel a été segmenté en fabrication, transport et logistique, énergie, pétrole et gaz, métallurgie et mines, soins de santé, vente au détail, agriculture et autres

Analyse/perspectives régionales du marché de l'IoT industriel

Le marché de l’IoT industriel est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, technologie, application, connectivité et utilisation finale, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de l'IoT industriel sont les États-Unis, le Canada et le Mexique en Amérique du Nord, l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie, le reste de l'Europe en Europe, la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines, le reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), l'Arabie saoudite, les Émirats arabes unis, l'Afrique du Sud, l'Égypte, Israël, le reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), le Brésil, l'Argentine et le reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud.

L'Asie-Pacifique domine le marché de l'IoT industriel. L'Asie-Pacifique devrait être le marché mondial de l'IoT industriel qui connaîtra la croissance la plus rapide. Le marché de l'IoT industriel de l'Asie-Pacifique devrait connaître la croissance la plus rapide au monde. Le développement croissant du nombre d'entreprises manufacturières du pays et la demande croissante d'automatisation stimuleront la demande de produits du marché de l'IoT industriel dans la région Asie-Pacifique.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'IoT industriel

Le paysage concurrentiel du marché de l'IoT industriel fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de l'IoT industriel.

Certains des principaux acteurs opérant sur le marché de l'IoT industriel sont :

- Cisco Systems, Inc.

- Siemens

- Général Électrique

- Société IBM

- Société Intel

- PTC

- Honeywell International Inc.

- Société NEC

- Rockwell Automation, Inc.

- ABB

- SAP SE

- Texas Instruments Incorporated

- Robert Bosch GmbH

- Société d'Électricité Emerson

- Microsoft

- KUKA SA

- Réseau de partenaires Sigfox (une filiale d'UnaBiz)

- Wipro

- Arm Limited (une filiale de Softbank Group Corp.)

- Huawei Technologies Co., Ltd.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INDUSTRIAL IOT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 USE CASE ANALYSIS

4.1.1 OVERVIEW

4.1.2 PREDICTIVE MAINTENANCE

4.1.3 LOCATION TRACKING

4.1.4 WORKPLACE ANALYTICS

4.1.5 REMOTE QUALITY MONITORING

4.1.6 ENERGY OPTIMIZATION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) IN END USER INDUSTRY

5.1.2 SURGE IN IMPLEMENTATION OF SENSORS AND DISTRIBUTED CONTROL SYSTEMS IN BUSINESS OPERATIONS

5.1.3 INCREASE IN THE NEED FOR REAL-TIME DATA SOLUTIONS AND SERVICES

5.1.4 INCREASE IN THE PENETRATION OF INDUSTRY 4.0 IN AUTOMOTIVE AND MANUFACTURING INDUSTRIES

5.2 RESTRAINTS

5.2.1 LACK OF SKILLED LABOR AND TRAINING SESSIONS

5.2.2 HIGHER PROBABILITY OF DEVICE THEFT AND DATA BREACHES

5.2.3 RISE IN THE TECHNICAL COMPLEXITIES DUE TO DAY-BY-DAY TECHNOLOGICAL ADVANCEMENT

5.3 OPPORTUNITIES

5.3.1 RISE IN INTERNET PENETRATION ACROSS THE GLOBE

5.3.2 RISE IN THE DIGITALIZATION TREND

5.3.3 PROGRESSION IN SMART TECHNOLOGIES

5.3.4 HIGH ADOPTION OF CLOUD-BASED DEPLOYMENT MODEL

5.4 CHALLENGES

5.4.1 HIGH INSTALLATION COST

5.4.2 DIFFICULTIES IN INTEGRATION OF IOT DEVICES

6 GLOBAL INDUSTRIAL IOT MARKET, BY TECHNOLOGY

6.1 OVERVIEW

6.2 SENSORS

6.3 INDUSTRIAL ROBOTICS

6.4 CAMERAS

6.5 DISTRIBUTED CONTROL SYSTEM

6.6 GPS/GNSS

6.7 NETWORKING TECHNOLOGY

6.8 RFID

6.9 INTERFACE BOARD

6.1 CONDITION MONITORING

6.11 YIELD MONITORING

6.12 SMART METERS

6.13 SMART BEACON

6.14 FLOW & APPLICATION CONTROL DEVICE

6.15 GUIDANCE & STEERING

6.16 ELECTRONIC SHELF LABEL

7 GLOBAL INDUSTRIAL IOT MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SCADA

7.3 MES

7.4 PLM

7.5 DISTRIBUTED CONTROL SYSTEM

7.6 TRANSIT MANAGEMENT SYSTEM

7.7 OUTAGE MANAGEMENT SYSTEM

7.8 VISUALIZATION SOFTWARE

7.9 REMOTE PATIENT MONITORING

7.1 RETAIL MANAGEMENT SOFTWARE

7.11 FARM MANAGEMENT SYSTEM

7.12 OTHERS

8 GLOBAL INDUSTRIAL IOT MARKET, BY CONNECTIVITY

8.1 OVERVIEW

8.2 WIRED

8.3 WIRELESS

8.4 HYBRID

9 GLOBAL INDUSTRIAL IOT MARKET, BY END USE

9.1 OVERVIEW

9.2 MANUFACTURING

9.3 TRANSPORTATION & LOGISTICS

9.4 ENERGY

9.5 OIL & GAS

9.6 METAL & MINING

9.7 HEALTHCARE

9.8 RETAIL

9.9 AGRICULTURE

9.1 OTHERS

10 GLOBAL INDUSTRIAL IOT MARKET, BY REGION

10.1 OVERVIEW

10.2 ASIA-PACIFIC

10.2.1 CHINA

10.2.2 JAPAN

10.2.3 SOUTH KOREA

10.2.4 INDIA

10.2.5 AUSTRALIA

10.2.6 INDONESIA

10.2.7 THAILAND

10.2.8 SINGAPORE

10.2.9 MALAYSIA

10.2.10 PHILIPPINES

10.2.11 REST OF ASIA-PACIFIC

10.3 NORTH AMERICA

10.3.1 U.S.

10.3.2 CANADA

10.3.3 MEXICO

10.4 EUROPE

10.4.1 GERMANY

10.4.2 U.K.

10.4.3 FRANCE

10.4.4 ITALY

10.4.5 SPAIN

10.4.6 SWITZERLAND

10.4.7 NETHERLANDS

10.4.8 TURKEY

10.4.9 RUSSIA

10.4.10 BELGIUM

10.4.11 REST OF EUROPE

10.5 MIDDLE EAST AND AFRICA

10.5.1 SAUDI ARABIA

10.5.2 SOUTH AFRICA

10.5.3 EGYPT

10.5.4 ISRAEL

10.5.5 REST OF MIDDLE EAST AND AFRICA

10.6 SOUTH AMERICA

10.6.1 BRAZIL

10.6.2 ARGENTINA

10.6.3 REST OF SOUTH AMERICA

11 GLOBAL INDUSTRIAL IOT MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.4 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 CISCO SYSTEMS, INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 SIEMENS

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 GENERAL ELECTRIC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 IBM CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 INTEL CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ARM LIMITED (A SUBSIDIAIRY OF SOFTBANK GROUP)

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 EMERSON ELECTRIC CO.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 HONEYWELL INTERNATIONAL INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 HUAWEI TECHNOLOGIES CO., LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 KUKA AG

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 MICROSOFT

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 NEC CORPORATION

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 PTC

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 ROBERT BOSCH GMBH

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 ROCKWELL AUTOMATION, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 SAP SE

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 SIGFOX PARTNER NETWORK

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 TEXAS INSTRUMENTS INCORPORATED

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 WIPRO

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 GLOBAL INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL SENSORS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL INDUSTRIAL ROBOTICS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL CAMERAS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL DISTRIBUTED CONTROL SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL GPS/GNSS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL NETWORKING TECHNOLOGY IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL RFID IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL INTERFACE BOARD IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL CONDITION MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL YIELD MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL SMART METERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL SMART BEACON IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL FLOW & APPLICATION CONTROL DEVICE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL GUIDANCE & STEERING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL ELECTRONIC SHELF LABEL IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL SCADA IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL MES IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 20 GLOBAL PLM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL DISTRIBUTED CONTROL SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL TRANSIT MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL OUTAGE MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL VISUALIZATION SOFTWARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL REMOTE PATIENT MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL RETAIL MANAGEMENT SOFTWARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL FARM MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL OTHERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL WIRED IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL WIRELESS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL HYBRID IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOBAL INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL MANUFACTURING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 GLOBAL TRANSPORTATION & LOGISTICS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 GLOBAL ENERGY IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 GLOBAL OIL & GAS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 GLOBAL METAL & MINING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 GLOBAL HEALTHCARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 GLOBAL RETAIL IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 GLOBAL AGRICULTURE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 GLOBAL OTHERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 GLOBAL INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 49 CHINA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 50 CHINA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 CHINA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 52 CHINA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 54 JAPAN INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 JAPAN INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 56 JAPAN INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 57 SOUTH KOREA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 58 SOUTH KOREA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 SOUTH KOREA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 60 SOUTH KOREA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 61 INDIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 INDIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 INDIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 64 INDIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 65 AUSTRALIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 66 AUSTRALIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 69 INDONESIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 INDONESIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 INDONESIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 72 INDONESIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 73 THAILAND INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 THAILAND INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 THAILAND INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 76 THAILAND INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 77 SINGAPORE INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 78 SINGAPORE INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 SINGAPORE INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 80 SINGAPORE INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 81 MALAYSIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 82 MALAYSIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 MALAYSIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 84 MALAYSIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 85 PHILIPPINES INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 86 PHILIPPINES INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 PHILIPPINES INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 88 PHILIPPINES INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 89 REST OF ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 NORTH AMERICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 95 U.S. INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 96 U.S. INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 U.S. INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 98 U.S. INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 99 CANADA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 100 CANADA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 CANADA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 102 CANADA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 104 MEXICO INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 MEXICO INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 106 MEXICO INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 107 EUROPE INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 108 EUROPE INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 109 EUROPE INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 EUROPE INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 111 EUROPE INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 112 GERMANY INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 113 GERMANY INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 GERMANY INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 115 GERMANY INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 116 U.K. INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 117 U.K. INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 U.K. INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 119 U.K. INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 120 FRANCE INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 121 FRANCE INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 FRANCE INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 123 FRANCE INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 124 ITALY INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 125 ITALY INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 ITALY INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 127 ITALY INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 128 SPAIN INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 129 SPAIN INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 SPAIN INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 131 SPAIN INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 132 SWITZERLAND INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 133 SWITZERLAND INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 SWITZERLAND INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 135 SWITZERLAND INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 136 NETHERLANDS INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 137 NETHERLANDS INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 NETHERLANDS INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 139 NETHERLANDS INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 140 TURKEY INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 141 TURKEY INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 TURKEY INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 143 TURKEY INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 144 RUSSIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 145 RUSSIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 RUSSIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 147 RUSSIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 148 BELGIUM INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 149 BELGIUM INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 BELGIUM INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 151 BELGIUM INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 152 REST OF EUROPE INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 158 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 159 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 161 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 162 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 163 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 165 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 166 EGYPT INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 167 EGYPT INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 EGYPT INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 169 EGYPT INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 170 ISRAEL INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 171 ISRAEL INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 172 ISRAEL INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 173 ISRAEL INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 174 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 175 SOUTH AMERICA INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 176 SOUTH AMERICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 177 SOUTH AMERICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 178 SOUTH AMERICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 179 SOUTH AMERICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 180 BRAZIL INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 181 BRAZIL INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 BRAZIL INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 183 BRAZIL INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 184 ARGENTINA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 185 ARGENTINA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 ARGENTINA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 187 ARGENTINA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 188 REST OF SOUTH AMERICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 GLOBAL INDUSTRIAL IOT MARKET: SEGMENTATION

FIGURE 2 GLOBAL INDUSTRIAL IOT MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL INDUSTRIAL IOT MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL INDUSTRIAL IOT MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL INDUSTRIAL IOT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL INDUSTRIAL IOT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL INDUSTRIAL IOT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL INDUSTRIAL IOT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL INDUSTRIAL IOT MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 GLOBAL INDUSTRIAL IOT MARKET: SEGMENTATION

FIGURE 11 INCREASE IN ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) IN END USER INDUSTRY IS EXPECTED TO DRIVE THE GLOBAL INDUSTRIAL IOT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SCADA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL INDUSTRIAL IOT MARKET IN 2022 AND 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND THE FASTEST GROWING REGION IN THE GLOBAL INDUSTRIAL IOT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR INDUSTRIAL IOT IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL INDUSTRIAL IOT MARKET

FIGURE 16 AI ADOPTION RATES AROUND THE GLOBE

FIGURE 17 COMPANIES GETTING BENEFITS FROM ANALYTICAL SOLUTIONS

FIGURE 18 GROWING INTERNET USERS WORLDWIDE

FIGURE 19 UNEMPLOYMENT RATE IN THE MIDDLE EAST AND NORTH AFRICA REGION

FIGURE 20 RESEARCH AND DEVELOPMENT EXPENDITURE (% OF GDP)

FIGURE 21 WORLDWIDE CLOUD INVESTMENT, 2019 – 2025

FIGURE 22 GLOBAL INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2021

FIGURE 23 GLOBAL INDUSTRIAL IOT MARKET, BY APPLICATION, 2021

FIGURE 24 GLOBAL INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2021

FIGURE 25 GLOBAL INDUSTRIAL IOT MARKET, BY END USE, 2021

FIGURE 26 GLOBAL INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 27 GLOBAL INDUSTRIAL IOT MARKET: BY REGION (2021)

FIGURE 28 GLOBAL INDUSTRIAL IOT MARKET: BY REGION (2022 & 2029)

FIGURE 29 GLOBAL INDUSTRIAL IOT MARKET: BY REGION (2021 & 2029)

FIGURE 30 GLOBAL INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 31 ASIA-PACIFIC INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 32 ASIA-PACIFIC INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 33 ASIA-PACIFIC INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 ASIA-PACIFIC INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 ASIA-PACIFIC INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 36 NORTH AMERICA INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 37 NORTH AMERICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 38 NORTH AMERICA INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 NORTH AMERICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 NORTH AMERICA INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 41 EUROPE INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 42 EUROPE INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 43 EUROPE INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 EUROPE INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 EUROPE INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 46 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 47 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 48 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 51 SOUTH AMERICA INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 52 SOUTH AMERICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 53 SOUTH AMERICA INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 54 SOUTH AMERICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 55 SOUTH AMERICA INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 56 GLOBAL INDUSTRIAL IOT MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 ASIA-PACIFIC INDUSTRIAL IOT MARKET: COMPANY SHARE 2021 (%)

FIGURE 58 NORTH AMERICA INDUSTRIAL IOT MARKET: COMPANY SHARE 2021 (%)

FIGURE 59 EUROPE INDUSTRIAL IOT MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.