Global Home Healthcare Market

Taille du marché en milliards USD

TCAC :

%

USD

117.67 Billion

USD

232.76 Billion

2024

2032

USD

117.67 Billion

USD

232.76 Billion

2024

2032

| 2025 –2032 | |

| USD 117.67 Billion | |

| USD 232.76 Billion | |

|

|

|

|

Marché mondial des soins à domicile, par type (appareils, services et logiciels), pathologie (maladies cardiaques, hypertension, maladies osseuses et articulaires, diabète, bronchopneumopathie chronique obstructive, obésité, démence/maladies d'Alzheimer, maladies infectieuses (VIH/sida), maladie de Parkinson, tabagisme, asthme et dépression), canal de distribution (appels d'offres directs et vente au détail) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des soins à domicile

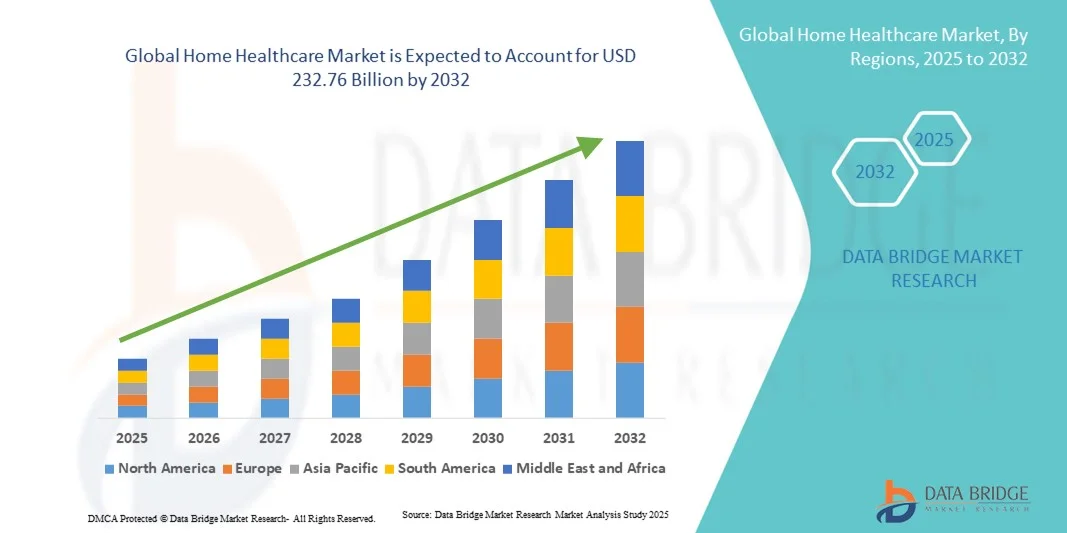

- La taille du marché mondial des soins de santé à domicile était évaluée à 117,67 milliards USD en 2024 et devrait atteindre 232,76 milliards USD d'ici 2032 , à un TCAC de 8,90 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l’adoption croissante de la surveillance à distance des patients, des services de télésanté et des dispositifs médicaux avancés, favorisant la numérisation à la fois dans les soins à domicile et dans le cadre du soutien clinique.

- Par ailleurs, la demande croissante des consommateurs pour des solutions de soins de santé pratiques, fiables et intégrées à domicile accélère l'adoption de services et d'appareils de soins à domicile, stimulant ainsi considérablement la croissance du secteur. Les solutions de soins à domicile sont de plus en plus prisées pour permettre des soins continus, une intervention précoce et de meilleurs résultats pour les patients, tout en réduisant les séjours hospitaliers et les coûts associés.

Analyse du marché des soins à domicile

- Les soins de santé à domicile, qui englobent la surveillance à distance des patients, les services de télésanté et l’assistance médicale à domicile, sont de plus en plus essentiels pour améliorer les résultats des patients, réduire les visites à l’hôpital et diminuer les coûts des soins de santé dans les régions développées et émergentes.

- La demande croissante de soins de santé à domicile est principalement alimentée par le vieillissement de la population, la prévalence croissante des maladies chroniques et l'importance croissante accordée aux modèles de soins centrés sur le patient qui permettent un traitement dans le confort de son domicile.

- L'Amérique du Nord a dominé le marché des soins de santé à domicile avec la plus grande part de revenus de 38,7 % en 2024, caractérisée par une forte adoption des technologies de télésanté, une solide infrastructure de soins de santé et une forte présence d'acteurs clés du marché, les États-Unis connaissant une croissance substantielle des appareils de surveillance à distance des patients et des services de soins à domicile.

- L'Asie-Pacifique devrait être la région connaissant la croissance la plus rapide sur le marché des soins de santé à domicile au cours de la période de prévision, avec une croissance prévue à un TCAC de 2025 à 2032, tirée par l'urbanisation croissante, la hausse des revenus disponibles, les initiatives gouvernementales visant à améliorer l'accès aux soins de santé et l'expansion des infrastructures de télémédecine dans des pays comme la Chine et l'Inde.

- Le segment des appareils a dominé le marché des soins de santé à domicile avec la plus grande part de revenus de 42,5 % en 2024, en raison de l'adoption rapide d'appareils de surveillance à domicile tels que les glucomètres, les tensiomètres, les concentrateurs d'oxygène, les trackers de santé portables et les thermomètres connectés.

Portée du rapport et segmentation du marché des soins de santé à domicile

|

Attributs |

Informations clés sur le marché des soins à domicile |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des soins de santé à domicile

Confort amélioré grâce à la surveillance à distance et à l'intégration de la télésanté

- Une tendance importante et croissante sur le marché mondial des soins de santé à domicile est l’intégration croissante des dispositifs de surveillance à distance des patients (RPM) et des plateformes de télésanté, ce qui améliore considérablement la commodité et la continuité des soins pour les patients gérant des maladies chroniques à domicile.

- Par exemple, en mars 2023, Philips a lancé son dispositif de surveillance à distance portable de nouvelle génération pour les patients cardiaques, permettant la transmission en temps réel des signes vitaux aux prestataires de soins de santé, améliorant la détection précoce des complications et réduisant les réadmissions à l'hôpital.

- L'intégration avec les plateformes de télésanté permet aux patients de recevoir des consultations virtuelles, des rappels de médicaments en temps opportun et des alertes de santé automatisées, améliorant ainsi l'adhésion aux plans de soins et réduisant le besoin de visites fréquentes en personne.

- L'intégration transparente des dispositifs de surveillance avec les plateformes de gestion des soins de santé facilite également la collecte et l'analyse centralisées des données, permettant aux prestataires de suivre les progrès des patients, d'ajuster les plans de traitement à distance et de gérer de manière proactive les risques pour la santé.

- Cette tendance vers des solutions de soins à domicile plus connectées et centrées sur le patient transforme fondamentalement les attentes des patients et des prestataires de soins de santé, en mettant l'accent sur la commodité, l'efficacité et l'amélioration des résultats cliniques.

- La demande de solutions intégrées de soins de santé à domicile augmente rapidement sur les marchés développés et émergents, car les gouvernements, les assureurs et les prestataires de soins de santé privilégient de plus en plus des approches évolutives, rentables et axées sur la technologie pour fournir des soins de haute qualité en dehors des milieux hospitaliers.

Dynamique du marché des soins à domicile

Conducteur

Besoin croissant en raison du vieillissement de la population et de la prévalence croissante des maladies chroniques

- La prévalence croissante des maladies chroniques, le vieillissement de la population et l’accent croissant mis sur les soins centrés sur le patient sont des facteurs importants de la demande accrue de solutions de soins de santé à domicile.

- Par exemple, en avril 2024, Philips a lancé ses solutions de télésurveillance et d'appareils portables de nouvelle génération, permettant aux professionnels de santé de suivre les signes vitaux et les indicateurs de maladies chroniques en temps réel. Ces stratégies, mises en œuvre par des entreprises clés, devraient stimuler la croissance du secteur des soins à domicile au cours de la période de prévision.

- Alors que les patients et les soignants sont de plus en plus conscients des avantages des soins à domicile, les solutions de soins à domicile offrent des fonctionnalités avancées telles que la surveillance à distance, les téléconsultations, la gestion des médicaments et les alertes d'urgence, améliorant ainsi la sécurité des patients et réduisant les réadmissions à l'hôpital.

- En outre, la popularité croissante des plateformes de télésanté et des appareils de santé connectés fait des soins à domicile un élément essentiel des systèmes de santé modernes, offrant une intégration transparente avec les dossiers médicaux électroniques (DME) et le réseau de prestataires.

- La commodité d'une surveillance continue de la santé, des plans de soins personnalisés et des interactions à distance avec les prestataires de soins sont des facteurs clés qui stimulent l'adoption des solutions de soins à domicile, tant sur les marchés développés qu'émergents. La tendance vers des solutions de soins économiques et conviviales contribue également à la croissance du marché.

Retenue /Défi

Coûts initiaux élevés, obstacles réglementaires et barrières à l'adoption de la technologie

- Le coût initial relativement élevé des systèmes et appareils de soins de santé à domicile avancés peut constituer un obstacle à l’adoption, en particulier pour les consommateurs sensibles aux prix et les établissements de santé dans les régions en développement.

- Les exigences réglementaires strictes pour les dispositifs médicaux et les solutions de télésanté posent des défis pour l'expansion du marché, car les entreprises doivent garantir la conformité avec diverses autorités sanitaires et normes régionales.

- Les limitations de remboursement et de couverture d'assurance dans certaines régions peuvent restreindre l'adoption de solutions de soins à domicile, en particulier dans les économies émergentes où les dépenses personnelles sont élevées.

- Les variations dans l’infrastructure technologique et la connectivité Internet peuvent affecter le déploiement efficace des services de surveillance à distance et de télésanté dans les zones rurales ou mal desservies.

- La maîtrise limitée du numérique par les patients et les soignants peut ralentir l'adoption d'appareils intelligents de soins de santé à domicile, car certains utilisateurs peuvent avoir du mal à utiliser des systèmes de surveillance avancés ou des plateformes de télésanté.

- Les préoccupations en matière de confidentialité des données et de confidentialité des patients peuvent entraver l'acceptation, car les informations médicales sensibles sont transmises et stockées électroniquement, ce qui nécessite un strict respect des réglementations en matière de confidentialité.

- Le manque de professionnels de santé formés pour la surveillance à distance et la prestation de soins virtuels peut affecter l'efficacité et la fiabilité des services de soins à domicile.

- Surmonter ces défis grâce à des solutions rentables, un meilleur soutien réglementaire, une meilleure couverture d’assurance, des programmes d’éducation des patients et des mesures de cybersécurité robustes sera essentiel pour une croissance soutenue du marché des soins de santé à domicile.

Portée du marché des soins à domicile

Le marché est segmenté en fonction du type, de la maladie et du canal de distribution.

- Par type

Le marché des soins à domicile est segmenté en fonction du type de produit : appareils, services et logiciels. Le segment des appareils a dominé le marché avec une part de chiffre d’affaires de 42,5 % en 2024, grâce à l’adoption rapide des dispositifs de surveillance à domicile tels que les glucomètres, les tensiomètres, les concentrateurs d’oxygène, les appareils de suivi de santé portables et les thermomètres connectés. Ces dispositifs sont de plus en plus prisés pour leur capacité à assurer un suivi des patients en temps réel, un diagnostic précoce et des interventions proactives, contribuant ainsi à réduire les réadmissions à l’hôpital et à améliorer la sécurité des patients. L’intégration avec les applications mobiles et les plateformes cloud permet aux patients et aux soignants d’accéder facilement aux données de santé, aux alertes et aux analyses, améliorant ainsi l’autogestion. Par ailleurs, la sensibilisation croissante à la prise en charge des maladies chroniques, l’augmentation des dépenses de santé et le vieillissement de la population mondiale stimulent une demande soutenue. Ce segment bénéficie également des initiatives gouvernementales en faveur des soins à domicile, des avancées technologiques dans le domaine des dispositifs médicaux miniaturisés et du renforcement des partenariats entre les professionnels de santé et les fabricants de dispositifs.

Le segment des logiciels devrait connaître le TCAC le plus rapide, soit 18,7 % entre 2025 et 2032, grâce à l'adoption croissante des solutions de télésanté, des applications de gestion de la santé basées sur l'IA et des plateformes de télésurveillance des patients. Les solutions logicielles permettent une communication fluide entre les patients et les professionnels de santé, un suivi en temps réel des signes vitaux et des analyses prédictives de la santé pour une intervention précoce. La popularité croissante des applications de santé mobiles et des dossiers médicaux électroniques en nuage permet une meilleure implication des patients et une meilleure gestion des soins à distance. Des politiques réglementaires favorables, la pénétration croissante des smartphones et l'intégration des logiciels aux appareils portables favorisent leur adoption. Les établissements de santé exploitent ces solutions pour le suivi des maladies chroniques, l'observance thérapeutique, les soins post-opératoires et la gestion des soins préventifs. De plus, les innovations continues en matière d'algorithmes d'IA et d'analyse de données favorisent une prestation de soins plus personnalisée et plus efficace, contribuant ainsi à la croissance rapide de ce segment.

- Par maladie

En fonction des pathologies, le marché des soins à domicile est segmenté en maladies cardiaques, hypertension, maladies ostéoarticulaires, diabète, bronchopneumopathie chronique obstructive (BPCO), obésité, démence/maladie d'Alzheimer, maladies infectieuses (VIH/sida), maladie de Parkinson, tabagisme, asthme et dépression. Le segment du diabète a dominé avec la plus grande part de chiffre d'affaires (38,4 %) en 2024, portée par la prévalence croissante du diabète dans le monde et l'utilisation croissante des dispositifs de surveillance de la glycémie à domicile, des stylos à insuline et des systèmes d'administration continue d'insuline. Les patients privilégient de plus en plus l'auto-prise en charge et des solutions pratiques de gestion des maladies qui réduisent les visites à l'hôpital et améliorent leur qualité de vie. La croissance de ce segment est également soutenue par des programmes de sensibilisation, des politiques de remboursement et des initiatives gouvernementales favorisant la prise en charge des maladies chroniques. Les avancées technologiques, telles que les lecteurs de glycémie connectés et les systèmes intelligents d'administration d'insuline, améliorent la précision de la surveillance et l'engagement des patients, tandis que les professionnels de santé recommandent la prise en charge du diabète à domicile pour améliorer l'observance du traitement et réduire les complications.

Le segment des maladies démentes et d'Alzheimer devrait connaître le TCAC le plus rapide, soit 19,3 %, entre 2025 et 2032, porté par l'augmentation de la population âgée et l'incidence croissante des maladies neurodégénératives dans le monde. Ce segment bénéficie d'une demande croissante de soins cognitifs à domicile, d'appareils de sécurité portables, de solutions de télésurveillance et de plateformes de télésanté permettant aux soignants de suivre les activités des patients, l'observance du traitement et leurs paramètres vitaux. L'augmentation des dépenses de santé, la sensibilisation accrue au dépistage précoce et les programmes gouvernementaux en faveur des personnes âgées sont des moteurs clés. L'adoption d'appareils et de logiciels de surveillance basés sur l'IA pour les soins de la mémoire, la détection des chutes et les alertes d'urgence soutient également la croissance rapide de ce segment, en particulier dans les régions où la population vieillit et les infrastructures de santé avancées.

- Par canal de distribution

En fonction du canal de distribution, le marché des soins à domicile est segmenté entre les appels d'offres directs et la vente au détail. Le segment de la vente au détail a dominé le marché avec la plus grande part de chiffre d'affaires, soit 44,7 % en 2024, grâce à la préférence croissante des consommateurs pour l'achat d'appareils et de services de soins à domicile directement auprès des pharmacies, des boutiques en ligne et des revendeurs de matériel médical. Les canaux de distribution offrent praticité, accès rapide aux appareils, variété d'options de produits et possibilité de comparer les caractéristiques et les prix. La sensibilisation croissante à l'importance des soins à domicile, conjuguée aux campagnes promotionnelles et à la croissance des plateformes de commerce électronique, favorise l'adoption de ces solutions. Ce segment bénéficie également des collaborations entre fabricants d'appareils et chaînes de distribution, facilitant la distribution et la démonstration de solutions de soins à domicile avancées.

Le segment des appels d'offres directs devrait connaître le TCAC le plus rapide, soit 17,9 %, entre 2025 et 2032, grâce aux achats groupés des hôpitaux, des cliniques, des institutions gouvernementales et des établissements de soins de longue durée. Les achats institutionnels garantissent la standardisation des produits, la rentabilité, la conformité réglementaire et un approvisionnement fiable pour de nombreux patients. Ce segment est stimulé par la hausse des investissements dans les infrastructures de santé sur les marchés émergents, les programmes gouvernementaux favorisant l'adoption des soins à domicile et la demande croissante de systèmes et d'appareils de surveillance avancés. Les contrats d'approvisionnement à long terme, les partenariats stratégiques entre fabricants et établissements de santé, ainsi que l'exigence d'une qualité constante dans la gestion des soins chroniques, renforcent encore la croissance. De plus, l'adoption de solutions groupées, comprenant des appareils, des logiciels et des services, favorise l'efficacité et l'évolutivité des structures institutionnelles, contribuant ainsi à l'expansion rapide du segment.

Analyse régionale du marché des soins à domicile

- L'Amérique du Nord a dominé le marché des soins de santé à domicile avec la plus grande part de revenus de 38,7 % en 2024, caractérisée par une forte adoption des technologies de télésanté, une solide infrastructure de soins de santé et une forte présence d'acteurs clés du marché.

- Le marché a connu une croissance substantielle des dispositifs de surveillance à distance des patients et des services de soins à domicile, stimulée par la demande croissante de prestations de soins de santé pratiques et rentables et de politiques de remboursement favorables.

- La présence de grands prestataires de soins de santé et de solutions technologiques médicales avancées a encore renforcé la pénétration du marché dans la région

Aperçu du marché des soins de santé à domicile aux États-Unis

Le marché américain des soins à domicile a représenté la plus grande part de chiffre d'affaires en 2024 en Amérique du Nord, porté par la prévalence croissante des maladies chroniques, l'augmentation du vieillissement de la population et l'adoption rapide des dispositifs de télésoins connectés. Les consommateurs s'appuient de plus en plus sur les solutions de soins à domicile pour un suivi médical continu, un confort accru et une réduction des visites à l'hôpital. De plus, les réglementations gouvernementales et les programmes de remboursement encouragent le recours aux services de télésanté, accélérant ainsi l'adoption des solutions de soins à domicile dans tout le pays.

Aperçu du marché européen des soins à domicile

Le marché européen des soins à domicile devrait connaître une croissance annuelle moyenne (TCAC) substantielle tout au long de la période de prévision, porté par une sensibilisation croissante aux soins de santé, l'augmentation du nombre de personnes âgées et des politiques de santé favorables. Les pays européens privilégient les solutions de soins à domicile pour désengorger les hôpitaux et améliorer le confort des patients. La demande croissante en matière de prise en charge des maladies chroniques, les progrès des dispositifs de télésurveillance à domicile et la solidité des infrastructures de santé alimentent également cette croissance. Le marché constate une adoption croissante dans les établissements de soins résidentiels et spécialisés.

Aperçu du marché des soins à domicile au Royaume-Uni

Le marché britannique des soins à domicile devrait connaître une croissance annuelle moyenne (TCAC) remarquable au cours de la période de prévision, soutenue par la demande croissante de télésurveillance des patients et de services de soins à domicile. La prévalence croissante des maladies chroniques, conjuguée au vieillissement de la population, favorise l'adoption de solutions de télésanté et de soins à domicile. La robustesse des infrastructures de santé du Royaume-Uni et l'augmentation des investissements dans les technologies de santé numérique renforcent encore l'expansion du marché.

Aperçu du marché allemand des soins à domicile

Le marché allemand des soins à domicile devrait connaître une croissance annuelle moyenne (TCAC) considérable au cours de la période de prévision, stimulé par des dépenses de santé élevées, des infrastructures bien développées et une population vieillissante nécessitant des soins médicaux à domicile. Les initiatives gouvernementales visant à promouvoir la santé numérique, notamment la télémédecine et les solutions de télésurveillance, encouragent l'adoption de dispositifs et de services de soins à domicile. De plus, la sensibilisation croissante des patients aux soins personnalisés et au suivi médical continu stimule la croissance du marché.

Aperçu du marché des soins à domicile en Asie-Pacifique

Le marché des soins à domicile en Asie-Pacifique devrait connaître la croissance la plus rapide, avec un TCAC prévu entre 2025 et 2032. Cette croissance est portée par l'urbanisation croissante, la hausse des revenus disponibles, les initiatives gouvernementales visant à améliorer l'accès aux soins et le développement des infrastructures de télémédecine dans des pays comme la Chine et l'Inde. L'augmentation rapide du nombre de personnes âgées et l'incidence croissante des maladies chroniques contribuent également à l'adoption de solutions de soins à domicile dans la région.

Aperçu du marché japonais des soins à domicile

Le marché japonais des soins à domicile connaît une croissance soutenue en raison du vieillissement de la population, de la forte sensibilisation aux soins de santé et de la forte demande de services de télésurveillance et de soins à domicile. Le soutien gouvernemental aux soins à domicile et à la télémédecine, conjugué aux avancées technologiques en matière de dispositifs médicaux, favorise l'adoption de solutions de santé à domicile. La tendance à la personnalisation des soins et l'attention croissante portée aux soins aux personnes âgées devraient continuer à stimuler la croissance du marché.

Aperçu du marché chinois des soins de santé à domicile

En 2024, le marché chinois des soins à domicile représentait la plus grande part de chiffre d'affaires de la région Asie-Pacifique, porté par une urbanisation rapide, l'expansion de la classe moyenne, la hausse des revenus disponibles et la prévalence croissante des maladies chroniques. Les initiatives gouvernementales visant à améliorer l'accessibilité aux soins, ainsi que les investissements accrus dans la télémédecine et les infrastructures de soins à domicile, accélèrent l'adoption de ces solutions. Le marché connaît une demande croissante d'appareils de télésurveillance des patients, de services de soins infirmiers à domicile et d'autres solutions de télésanté, faisant de la Chine un pôle de croissance majeur dans la région.

Part de marché des soins à domicile

Le secteur des soins de santé à domicile est principalement dirigé par des entreprises bien établies, notamment :

- Koninklijke Philips NV (Pays-Bas)

- Omron Healthcare, Inc. (Japon)

- B. Braun SE (Allemagne)

- Medtronic (Irlande)

- DaVita Inc. (États-Unis)

- Cardinal Health (États-Unis)

- Sunrise Medical (États-Unis)

- General Electric Company (États-Unis)

- A&D Company, Limited (Japon)

- Soins à domicile BAYADA (États-Unis)

- Invacare Corporation (États-Unis)

- Fresenius SE & Co KGaA (Allemagne)

- Baxter (États-Unis)

- F. Hoffmann-La Roche SA (Suisse)

- Health Care At Home Private Limited (Inde)

Derniers développements sur le marché mondial des soins de santé à domicile

- En mai 2025, Axle Health, entreprise technologique pionnière transformant les soins à domicile, a annoncé un tour de financement de série A de 10 millions de dollars américains. Cet investissement a été mené par F-Prime Capital, avec la participation de Y Combinator, Pear VC et Lightbank. Ce financement vise à améliorer les algorithmes de planification et de routage basés sur l'IA d'Axle Health, afin de les rendre plus efficaces et plus réactifs aux conditions réelles. Par ailleurs, l'entreprise prévoit d'accélérer le développement de ses solutions d'engagement patient génératives basées sur l'IA, promettant ainsi d'améliorer encore l'expérience patient et les résultats cliniques.

- En juin 2025, Ellipsis Health, entreprise de technologie médicale basée à San Francisco, a levé 45 millions de dollars US lors d'un premier tour de table pour développer Sage, sa plateforme de soins basée sur l'IA. Conçue pour alléger la pression sur les systèmes de santé confrontés à des pénuries de personnel, Sage communique de manière autonome avec les patients entre deux rendez-vous médicaux, les aidant à comprendre les instructions de sortie, à surveiller l'observance du traitement, à organiser leur transport, et bien plus encore. Ce nouveau financement, mené par CVS Health Ventures, Salesforce et Khosla Ventures, permettra d'intégrer Sage aux dossiers médicaux électroniques, d'adapter ses fonctionnalités à des maladies spécifiques comme le diabète et le cancer, d'élargir son portefeuille clients et de soutenir la recherche visant à faire progresser les méthodes d'évaluation de l'IA dans le secteur de la santé.

- En août 2025, Arintra, plateforme texane de codage médical autonome et native de GenAI, a levé 21 millions de dollars lors d'un tour de table de série A mené par Peak XV Partners. Arintra vise à révolutionner le processus de documentation médicale en automatisant le codage médical, en améliorant l'efficacité et en allégeant la charge administrative du secteur de la santé. Cet investissement marque une étape importante dans la croissance d'Arintra, soutenant son innovation continue et son expansion dans le secteur des technologies de santé basées sur l'IA.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.