Calcul haute performance mondial pour le marché automobile, par offre (solution, logiciel et services), modèle de déploiement (sur site et dans le cloud), taille de l'organisation (grandes entreprises, petites et moyennes entreprises (PME)), type de calcul (calcul parallèle, calcul distribué et calcul exascale), plate-forme (HPC de sécurité et de mouvement, HPC de conduite autonome, HPC de carrosserie, HPC de cockpit et HPC inter-domaines), type de véhicule (voiture de tourisme, véhicule utilitaire léger et véhicule utilitaire lourd) - Tendances et prévisions du secteur jusqu'en 2030.

Analyse et taille du marché du calcul haute performance pour l'automobile

L'augmentation de la demande de recherche HPC à travers le monde est l'un des principaux facteurs de croissance du marché du calcul haute performance. L'augmentation du besoin de calcul efficace, d'évolutivité améliorée et de stockage fiable, ainsi que le besoin croissant de diversification continue, d'expansion de l'industrie informatique, de calcul à haute efficacité et de progrès en matière de virtualisation, accélèrent la croissance du marché. L'augmentation de l'adoption du calcul haute performance en raison de la capacité des systèmes HPC à traiter de gros volumes de données à des vitesses plus élevées et à une utilisation intensive dans divers secteurs influencent encore davantage le marché.

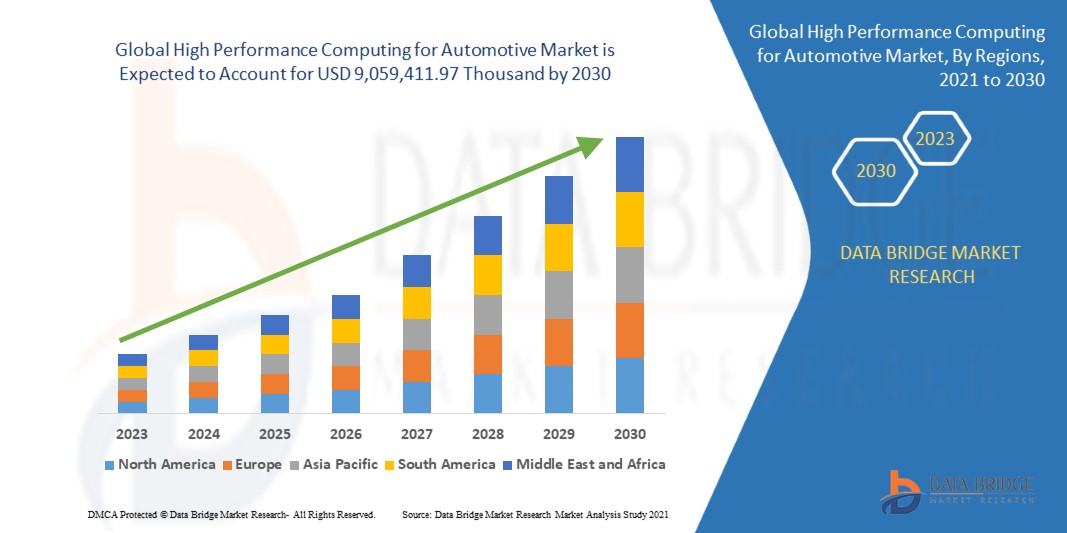

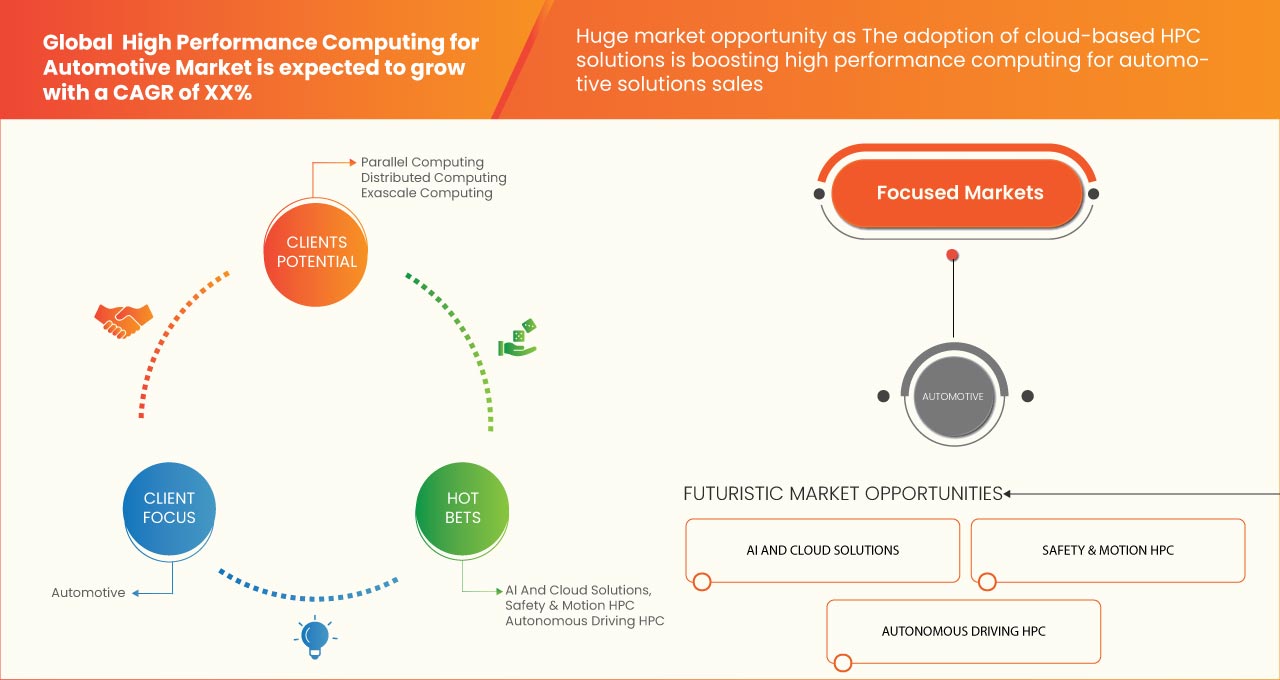

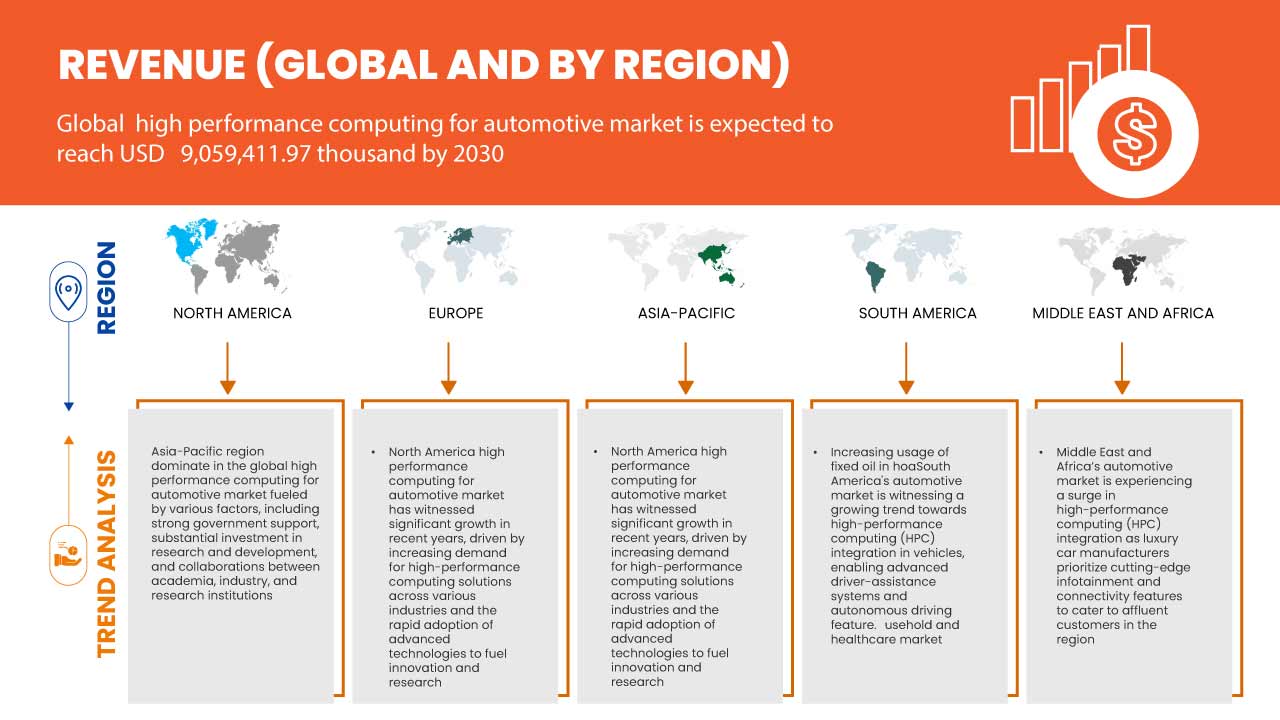

Data Bridge Market Research estime que le marché mondial du calcul haute performance pour l'automobile devrait atteindre une valeur de 9 059 411,97 milliers de dollars d'ici 2030, à un TCAC de 12,1 % au cours de la période de prévision. Le rapport sur le marché mondial du calcul haute performance pour l'automobile couvre également de manière exhaustive l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Offre (solution, logiciel et services), modèle de déploiement (sur site et dans le cloud), taille de l'organisation (grandes entreprises, petites et moyennes entreprises (PME)), type de calcul (calcul parallèle, calcul distribué et calcul exascale), plateforme (HPC de sécurité et de mouvement, HPC de conduite autonome, HPC de carrosserie, HPC de cockpit et HPC inter-domaines), type de véhicule (voiture de tourisme, véhicule utilitaire léger et véhicule utilitaire lourd) |

|

Régions couvertes |

États-Unis, Canada, Mexique, Brésil, Argentine, Reste de l'Amérique du Sud, Allemagne, France, Royaume-Uni, Russie, Italie, Espagne, Pays-Bas, Pologne, Suisse, Belgique, Suède, Turquie, Danemark, Reste de l'Europe, Japon, Chine, Inde, Corée du Sud, Vietnam, Taïwan, Australie et Nouvelle-Zélande, Singapour, Malaisie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique, Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, Koweït, Qatar, Reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Français Hewlett Packard Enterprise Development LP, IBM, Lenovo, NVIDIA Corporation, Advanced Micro Devices, Inc., Microsoft, Taiwan Semiconductor Manufacturing Company Limited, Dell Inc., Fujitsu, Elektrobit, NEC Corporation, Beijing Jingwei Hirain Technologies Co., Inc., NXP Semiconductors, ANSYS, Inc., ESI Group, Super Micro Computer, Inc., Altair Engineering Inc., TotalCAE, Vector Informatik GmbH, MiTAC Computing Technology Corporation, Rescale, Inc. |

Définition du marché

Le calcul haute performance (HPC) fait référence à l'utilisation de systèmes informatiques puissants et spécialisés, capables de traiter et d'analyser de vastes quantités de données à des vitesses incroyablement élevées. Ces systèmes utilisent des techniques avancées de traitement parallèle et font souvent appel à plusieurs processeurs ou nœuds travaillant ensemble pour résoudre des problèmes complexes dans la recherche scientifique, les simulations d'ingénierie, la modélisation financière, les prévisions météorologiques et d'autres tâches nécessitant beaucoup de calcul. Le HPC permet aux chercheurs et aux professionnels de relever des défis qui seraient impossibles ou peu pratiques avec des ordinateurs conventionnels, ce qui conduit à des découvertes accélérées, à de meilleures connaissances et à une résolution plus efficace des problèmes dans divers domaines.

Dynamique du marché mondial du calcul haute performance pour l'automobile

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

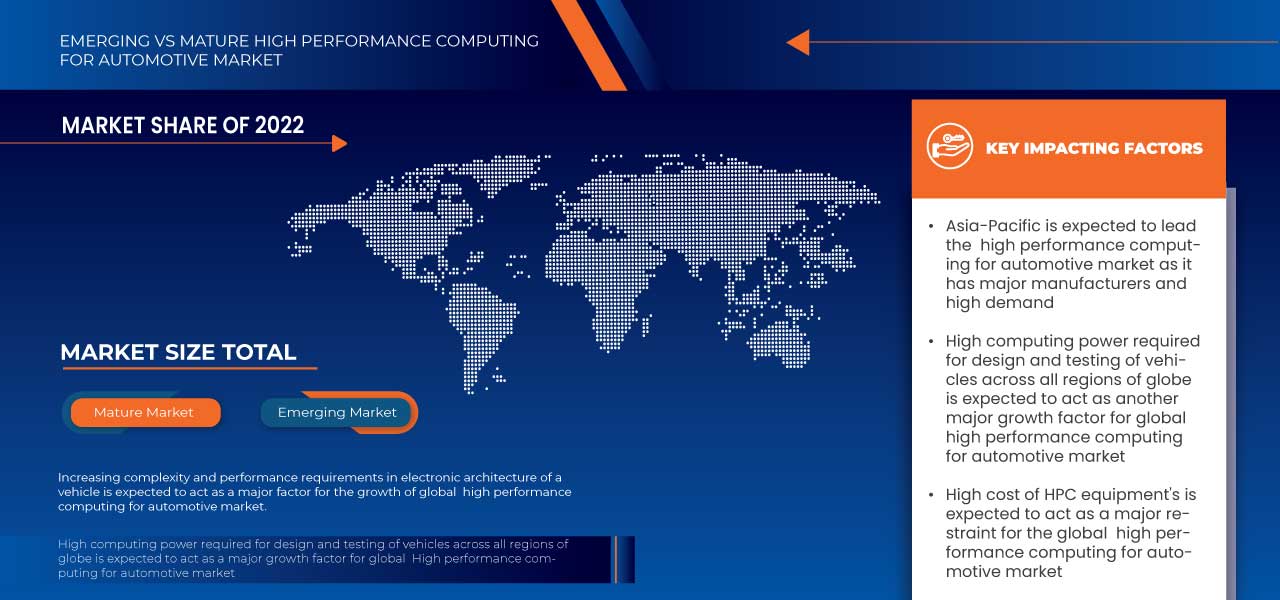

- Complexité croissante et exigences de performance dans l'architecture électronique d'un véhicule

La mobilité du futur bénéficiera d'une multitude de nouvelles fonctionnalités et de nouveaux services grâce à la numérisation. Mais elle entraîne également une augmentation exponentielle du volume de données et d'informations à traiter. L'architecture électrique/électronique (E/E) actuelle a déjà dépassé son point de rupture. Les grandes tendances de l'industrie automobile, notamment la conduite automatisée, les véhicules définis par logiciel et la mobilité connectée, exigent une quantité croissante d'intelligence et de capacité informatique. La complexité et les performances des architectures électriques/électroniques automobiles actuelles sont à leur maximum. Il faut beaucoup de puissance de traitement pour prendre en charge la connectivité, les mises à jour en direct, la conduite automatisée et autonome et les systèmes avancés d'assistance à la conduite (ADAS).

- Une puissance de calcul élevée est nécessaire pour la conception et les tests des véhicules

Le calcul haute performance (HPC) pour l'automobile est un type amélioré de calcul haute performance créé pour répondre aux exigences de l'industrie automobile en termes de puissance de calcul et de compatibilité logicielle. Les véhicules modernes sont produits à l'aide d'une ingénierie de précision assistée par logiciel, ce qui nécessite un degré important de performances de calcul. Le calcul haute performance peut fournir la capacité de traitement nécessaire à n'importe quel niveau du processus de conception, y compris les tests de fonctionnalités et la simulation de sécurité. Les fonctionnalités fournies par logiciel au sein des voitures elles-mêmes reçoivent également une attention accrue. Avec une vision CASE (connected, independent, shared, electric), les voitures évoluent vers des véhicules définis par logiciel (SDV), où les caractéristiques rendues possibles par le code relient les capacités mécaniques.

Opportunité

- L'adoption de solutions HPC basées sur le cloud

Les avancées technologiques qui stimulent les innovations dans les domaines de la mobilité électrique, des véhicules autonomes et des voitures connectées ont entraîné une transformation radicale de l’industrie automobile. Les constructeurs automobiles cherchent des moyens d’accélérer le développement de leurs produits, d’améliorer les performances de leurs véhicules et d’optimiser leurs processus de production pour rester compétitifs dans cet environnement en constante évolution. L’adoption de technologies de calcul haute performance (HPC) basées sur le cloud est une stratégie qui a récemment pris de l’ampleur. Les entreprises automobiles ouvrent de nouvelles portes à des processus de recherche, de conception et de test plus rapides, plus productifs et moins coûteux en exploitant la puissance du cloud computing et des capacités informatiques de pointe.

Retenue/Défi

- Coût élevé des équipements HPC

L'un des principaux obstacles à l'adoption des technologies HPC dans le secteur automobile est leur coût. Le coût élevé de l'achat et de la maintenance des systèmes HPC peut constituer un obstacle important pour les constructeurs automobiles, en particulier les petites et moyennes entreprises. Les systèmes HPC disposent généralement d'un grand nombre de processeurs, ce qui peut augmenter les coûts. Les systèmes HPC utilisent généralement des processeurs à grande vitesse, ce qui peut également augmenter les coûts. Les systèmes HPC nécessitent généralement beaucoup de mémoire, ce qui peut également augmenter les coûts. Les systèmes HPC génèrent beaucoup de chaleur, ce qui nécessite des systèmes de refroidissement spécialisés. Cela peut également augmenter les coûts.

- Gestion des données automobiles sensibles

Les constructeurs automobiles et les fournisseurs de services de mobilité accordent désormais une grande importance à la sécurité des véhicules connectés et à la confidentialité des données. Les informations d’identification personnelle (PII), la localisation des clients, leur comportement et leurs données financières, ainsi que la propriété intellectuelle associée au véhicule et aux services proposés, peuvent toutes être incluses dans les données sensibles collectées via les véhicules connectés. Les employés et les sous-traitants du monde entier ont accès à ces données sensibles lorsqu’elles circulent dans de nombreux environnements et plateformes, à la fois sur site et dans le cloud. Les fabricants sont particulièrement exposés aux cyberattaques en raison de ce pot de miel d’informations.

Développements récents

- En janvier 2023, NVIDIA Corporation et Hon Hai Technology Group (Foxconn) ont annoncé aujourd'hui un partenariat stratégique visant à développer des plateformes de véhicules automatisés et autonomes. Dans le cadre de cet accord, Foxconn produira des unités de contrôle électronique (ECU) basées sur NVIDIA DRIVE Orin pour le marché automobile mondial en tant que fabricant de premier plan

- En novembre 2022, Dell Inc. a annoncé une extension de son portefeuille de calcul haute performance (HPC), avec de nouveaux matériels, de nouveaux services et une solution de calcul quantique hybride. La solution de calcul quantique Dell permet aux entreprises de bénéficier de l'informatique améliorée de la technologie quantique. Les clients peuvent l'utiliser pour accélérer l'apprentissage automatique, le traitement du langage naturel et la simulation de la chimie et des matériaux

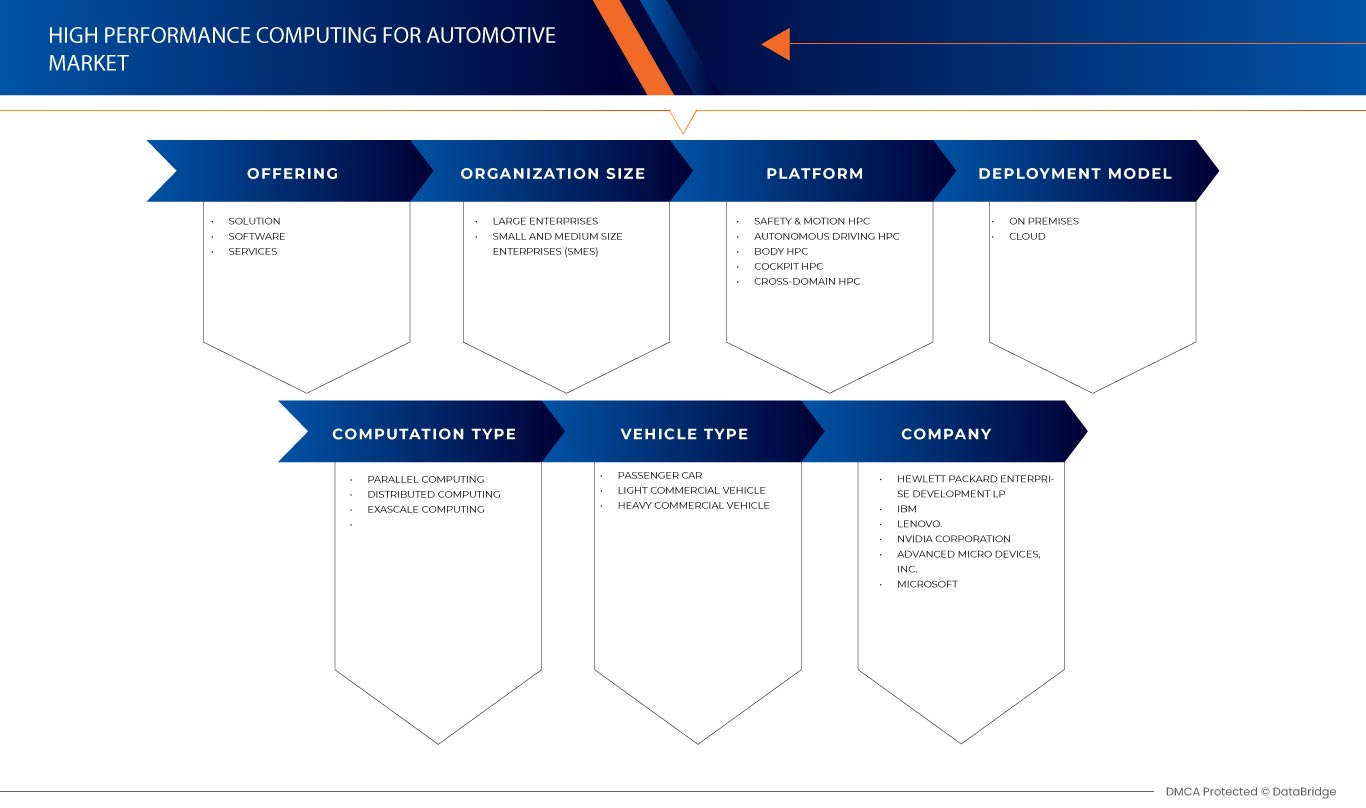

Portée du marché mondial du calcul haute performance pour l'automobile

Le marché mondial du calcul haute performance pour l'automobile est segmenté en fonction de l'offre, du modèle de déploiement, de la taille de l'organisation, du type de calcul, de la plate-forme et du type de véhicule. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Offre

- Solution

- Logiciel

- Services

Sur la base de l'offre, le marché mondial du calcul haute performance pour l'automobile a été segmenté en solutions, logiciels et services.

Modèle de déploiement

- Sur place

- Nuage

Sur la base du modèle de déploiement, le marché mondial du calcul haute performance pour l'automobile a été segmenté en sur site et en cloud.

Taille de l'organisation

- Grandes entreprises

- Petites et moyennes entreprises (PME)

Sur la base de la taille de l'organisation, le marché mondial du calcul haute performance pour l'automobile a été segmenté en grandes entreprises et petites et moyennes entreprises (PME).

Type de calcul

- Calcul parallèle

- Informatique distribuée

- Calcul exascale

Sur la base du type de calcul, le marché mondial du calcul haute performance pour l'automobile a été segmenté en calcul parallèle, calcul distribué et calcul exascale.

Plate-forme

- Sécurité et mouvement HPC

- Conduite autonome HPC

- Corps HPC

- Poste de pilotage HPC

- HPC inter-domaines

Sur la base de la plateforme, le marché mondial du calcul haute performance pour l'automobile a été segmenté en HPC de sécurité et de mouvement, HPC de conduite autonome, HPC de carrosserie, HPC de cockpit et HPC inter-domaines.

Type de véhicule

- Voiture de tourisme

- Véhicule utilitaire léger

- Véhicule utilitaire lourd

Sur la base du type de véhicule, le marché mondial du calcul haute performance pour l'automobile a été segmenté en voiture de tourisme, véhicule utilitaire léger et véhicule utilitaire lourd.

Analyse/perspectives régionales du marché mondial du calcul haute performance pour l'automobile

Le marché mondial du calcul haute performance pour l’automobile est analysé et des informations sur la taille du marché et les tendances sont fournies par région, type, mode de déploiement, application et utilisateur final, comme référencé ci-dessus.

The regions covered in the global high performance computing for automotive market report are North America, South America, Europe, Asia-Pacific, Middle East and Africa. Asia-Pacific region is expected to dominate in the global high performance computing for automotive market fuelled by various factors, including strong government support, substantial investment in research and development, and collaborations between academia, industry, and research institutions. China dominates in the Asia-Pacific region as China has been investing heavily in HPC infrastructure and research to enhance its technological capabilities and scientific advancements. Moreover, U.S. dominates the North America region owing to factors such as high adoption of HPC technologies in automotive sectors which rely on HPC to accelerate product development, enhance scientific discoveries, and optimize operations.

Europe high performance computing for automotive market has witnessed the highest growth rate among all regions in high performance computing for the automotive market. Owing to factors such as the growing adoption of electric vehicle (EVs) and autonomous driving technology. Germany is dominating the region due to collaborative efforts between automotive manufacturers and HPC providers to develop eco-friendly, lightweight materials and streamline manufacturing processes, promoting sustainability and reducing environmental impact.

The region section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Global High Performance Computing For Automotive Market Share Analysis

Global high performance computing for automotive market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global high performance computing for automotive market.

Certains des principaux acteurs opérant sur le marché mondial du calcul haute performance pour l'automobile sont, Hewlett Packard Enterprise Development LP, IBM, Lenovo., NVIDIA Corporation, Advanced Micro Devices, Inc., Microsoft, Taiwan Semiconductor Manufacturing Company Limited, Dell Inc., Fujitsu, Elektrobit., NEC Corporation, Beijing Jingwei Hirain Technologies Co., Inc., NXP Semiconductors., ANSYS, Inc, ESI Group, Super Micro Computer, Inc., Altair Engineering Inc., TotalCAE., Vector Informatik GmbH, MiTAC Computing Technology Corporation, Rescale, Inc. et entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPANY SHARE ANALYSIS AT COUNTRY LEVEL

4.2 COMPANY COMPARATIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING COMPLEXITY AND PERFORMANCE REQUIREMENTS IN THE ELECTRONIC ARCHITECTURE OF A VEHICLE

5.1.2 HIGH COMPUTING POWER REQUIRED FOR DESIGN AND TESTING OF VEHICLES

5.1.3 RISING INTEGRATION OF AI AND ML TECHNOLOGIES IN AUTOMOBILES

5.2 RESTRAINTS

5.2.1 HIGH COST OF HPC EQUIPMENTS

5.3 OPPORTUNITIES

5.3.1 HIGH-PERFORMANCE COMPUTING CAN OPTIMIZE AUTOMOTIVE MANUFACTURING PROCESSES

5.3.2 THE ADOPTION OF CLOUD-BASED HPC SOLUTIONS

5.4 CHALLENGES

5.4.1 HANDLING SENSITIVE AUTOMOTIVE DATA

6 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 SERVER

6.2.2 STORAGE

6.2.3 NETWORKING DEVICE

6.3 SOFTWARE

6.4 SERVICES

6.4.1 INTEGRATION AND IMPLEMENTATION

6.4.2 SUPPORT AND MAINTENANCE

6.4.3 DESIGNING AND CONSULTING

7 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 ON PREMISES

7.3 CLOUD

8 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISES

8.2.1 ON PREMISES

8.2.2 CLOUD

8.3 SMALL AND MEDIUM SIZE ENTERPRISES (SMES)

8.3.1 ON PREMISES

8.3.2 CLOUD

9 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY COMPUTATION TYPE

9.1 OVERVIEW

9.2 PARALLEL COMPUTING

9.3 DISTRIBUTED COMPUTING

9.4 EXASCALE COMPUTING

10 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY PLATFORM

10.1 OVERVIEW

10.2 SAFETY & MOTION HPC

10.3 AUTONOMOUS DRIVING HPC

10.4 BODY HPC

10.5 COCKPIT HPC

10.6 CROSS-DOMAIN HPC

11 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PASSENGER CAR

11.2.1 BY TYPE

11.2.1.1 SUV

11.2.1.2 HATCHBACK

11.2.1.3 SEDAN

11.2.1.4 COUPE

11.2.1.5 SPORT CAR

11.2.1.6 CONVERTIBLE

11.2.1.7 OTHERS

11.2.2 BY OFFERING

11.2.2.1 SOLUTION

11.2.2.1.1 SERVER

11.2.2.1.2 STORAGE

11.2.2.1.3 NETWORKING DEVICE

11.2.2.2 SOFTWARE

11.2.2.3 SERVICES

11.3 LIGHT COMMERCIAL VEHICLE

11.3.1 BY TYPE

11.3.1.1 VANS

11.3.1.2 PICK UP TRUCKS

11.3.1.3 MINI BUS

11.3.1.4 TOW TRUCK

11.3.1.5 OTHER

11.3.2 BY OFFERING

11.3.2.1 SOLUTION

11.3.2.1.1 SERVER

11.3.2.1.2 STORAGE

11.3.2.1.3 NETWORKING DEVICE

11.3.2.2 SOFTWARE

11.3.2.3 SERVICES

11.4 HEAVY COMMERCIAL VEHICLE

11.4.1 BY TYPE

11.4.1.1 HEAVY TRUCK

11.4.1.1.1 SEMI-TRAILER TRUCK

11.4.1.1.2 BOX TRUCK

11.4.1.2 OTHERS

11.4.2 BY OFFERING

11.4.2.1 SOLUTION

11.4.2.1.1 SERVER

11.4.2.1.2 STORAGE

11.4.2.1.3 NETWORKING DEVICE

11.4.2.2 SOFTWARE

11.4.2.3 SERVICES

12 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION

12.1 OVERVIEW

12.2 ASIA-PACIFIC

12.2.1 CHINA

12.2.2 JAPAN

12.2.3 SOUTH KOREA

12.2.4 INDIA

12.2.5 AUSTRALIA & NEW ZEALAND

12.2.6 SINGAPORE

12.2.7 TAIWAN

12.2.8 THAILAND

12.2.9 INDONESIA

12.2.10 MALAYSIA

12.2.11 PHILIPPINES

12.2.12 VIETNAM

12.2.13 REST OF ASIA-PACIFIC

12.3 NORTH AMERICA

12.3.1 U.S.

12.3.2 CANADA

12.3.3 MEXICO

12.4 EUROPE

12.4.1 GERMANY

12.4.2 FRANCE

12.4.3 U.K.

12.4.4 RUSSIA

12.4.5 ITALY

12.4.6 SPAIN

12.4.7 NETHERLANDS

12.4.8 POLAND

12.4.9 SWITZERLAND

12.4.10 BELGIUM

12.4.11 SWEDEN

12.4.12 TURKEY

12.4.13 DENMARK

12.4.14 REST OF EUROPE

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SAUDI ARABIA

12.6.2 U.A.E.

12.6.3 ISRAEL

12.6.4 SOUTH AFRICA

12.6.5 EGYPT

12.6.6 KUWAIT

12.6.7 QATAR

12.6.8 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.4 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 IBM

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 LENOVO

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 NVIDIA CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PROTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ADVANCED MICRO DEVICES, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ALTAIR ENGINEERING INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ANSYS, INC

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 BEIJING JINGWEI HIRAIN TECHNOLOGIES CO., INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 DELL INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 ELEKTROBIT

15.10.1 COMPANY SNAPSHOT

15.10.2 SOLUTION PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 ESI GROUP

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 FUJITSU

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 MICROSOFT

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 NEC CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 NXP SEMICONDUCTORS

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 RESCALE, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SUPER MICRO COMPUTER, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TAIWAN SEMICONDUCTOR

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 TOTALCAE

15.19.1 COMPANY SNAPSHOT

15.19.2 SOLUTION PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TYAN

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 VECTOR INFORMATIK GMBH

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 2 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL SOFTWARE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL SERVICES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL SERVICES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL ON PREMISES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL CLOUD IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 11 GLOBAL LARGE ENTERPRISES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 GLOBAL LARGE ENTERPRISES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 13 GLOBAL SMALL AND MEDIUM SIZE ENTERPRISES (SMES) IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 GLOBAL SMALL AND MEDIUM SIZE ENTERPRISES (SMES) IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 15 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY COMPUTATION TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 GLOBAL PARALLEL COMPUTING IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 GLOBAL DISTRIBUTED COMPUTING IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 GLOBAL EXASCALE COMPUTING IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 20 GLOBAL SAFETY & MOTION HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 GLOBAL AUTONOMOUS DRIVING HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 GLOBAL BODY HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 GLOBAL COCKPIT HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 GLOBAL CROSS-DOMAIN HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 GLOBAL PASSENGER CAR IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 GLOBAL PASSENGER CAR IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 GLOBAL PASSENGER CAR IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 29 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 GLOBAL LIGHT COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 GLOBAL LIGHT COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 GLOBAL LIGHT COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 33 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 GLOBAL HEAVY COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 GLOBAL HEAVY COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 GLOBAL HEAVY TRUCK IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 GLOBAL HEAVY COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 2 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: MULTIVARIATE MODELING

FIGURE 10 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: OFFERING TIMELINE CURVE

FIGURE 11 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 12 INCREASING COMPLEXITY AND PERFORMANCE REQUIREMENT IN ELECTRONICS ARCHITECTURE OF A VEHICLE IS EXPECTED TO DRIVE THE GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET IN 2023 & 2030

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE IN THE GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 EUROPE IS THE FASTEST GROWING MARKET FOR HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 COMPANY SHARE ANALYSIS AT COUNTRY LEVEL

FIGURE 17 COMPANY COMPARISON

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET

FIGURE 19 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY OFFERING, 2022

FIGURE 20 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 21 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 22 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY COMPUTATION TYPE, 2022

FIGURE 23 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY PLATFORM, 2022

FIGURE 24 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2022

FIGURE 25 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: SNAPSHOT (2022)

FIGURE 26 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY COUNTRY (2022)

FIGURE 27 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 28 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 29 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY REGION (2023-2030)

FIGURE 30 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

FIGURE 31 ASIA-PACIFIC HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

FIGURE 32 NORTH AMERICA HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

FIGURE 33 EUROPE HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.