Global Glass Substrate Market

Taille du marché en milliards USD

TCAC :

%

USD

7.01 Billion

USD

12.33 Billion

2024

2032

USD

7.01 Billion

USD

12.33 Billion

2024

2032

| 2025 –2032 | |

| USD 7.01 Billion | |

| USD 12.33 Billion | |

|

|

|

|

Segmentation du marché mondial des substrats en verre, par type (à base de borosilicate, de silice fondue/quartz, de silicium et autres), diamètre de plaquette (300 mm, 200 mm, 150 mm, 125 mm, plus de 300 mm et jusqu'à 100 mm), application (emballage de plaquette, support de substrat et interposeur TGV), utilisation finale (électronique, applications optiques, aérospatiale et défense, automobile et solaire, et médical) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des substrats en verre

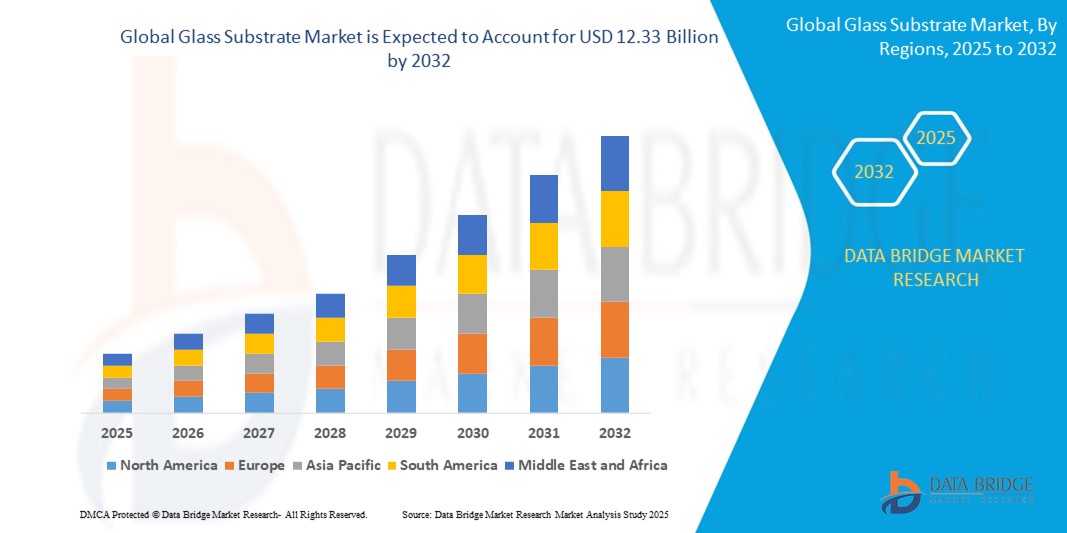

- La taille du marché mondial des substrats en verre était évaluée à 7,01 milliards USD en 2024 et devrait atteindre 12,33 milliards USD d'ici 2032 , à un TCAC de 7,30 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de technologies d'affichage avancées dans l'électronique grand public, telles que les smartphones, les tablettes et les téléviseurs, ainsi que par l'expansion des applications dans les panneaux solaires et l'électronique flexible.

- En outre, l'adoption croissante des écrans OLED et AMOLED, qui nécessitent des substrats en verre de haute qualité pour de meilleures performances et une meilleure durabilité, stimule davantage l'expansion du marché à l'échelle mondiale.

Analyse du marché des substrats en verre

- Le marché des substrats en verre est en pleine expansion en raison de la demande croissante d'écrans hautes performances dans l'électronique grand public, offrant une durabilité et une clarté améliorées pour des appareils tels que les smartphones et les téléviseurs.

- Les fabricants se concentrent sur le développement de substrats en verre plus fins et plus flexibles pour répondre aux besoins évolutifs des technologies d'affichage flexibles et pliables.

- L'Amérique du Nord a dominé le marché des substrats en verre avec la plus grande part de revenus en 2024, grâce à une industrie électronique robuste, une demande croissante de technologies d'affichage avancées et la présence de fabricants de semi-conducteurs de premier plan.

- La région Asie-Pacifique devrait connaître le taux de croissance le plus élevé sur le marché mondial des substrats en verre, grâce à une industrialisation rapide, à l'expansion de la fabrication électronique et à la demande croissante de semi-conducteurs et de panneaux d'affichage dans des pays comme la Chine, le Japon, la Corée du Sud et l'Inde.

- Le segment des substrats borosilicatés a dominé le marché, enregistrant la plus grande part de chiffre d'affaires en 2024, grâce à sa haute résistance thermique et chimique, ce qui le rend adapté à diverses applications microélectroniques et photoniques. La demande de substrats borosilicatés est forte dans le conditionnement des semi-conducteurs en raison de leur stabilité dimensionnelle et de leur rentabilité.

Portée du rapport et segmentation du marché des substrats en verre

|

Attributs |

Informations clés sur le marché des substrats en verre |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande. |

Tendances du marché des substrats en verre

« L'essor des substrats en verre flexibles et pliables pour écrans »

- Le marché des substrats en verre connaît une tendance significative vers le développement et l'adoption de substrats en verre flexibles et pliables, stimulée par la popularité croissante des smartphones pliables et des appareils portables.

- Les fabricants innovent avec des matériaux en verre ultra-minces et pliables qui peuvent résister à des pliages répétés sans compromettre la durabilité ou la clarté de l'affichage.

- Par exemple, les smartphones pliables de Samsung et le Surface Duo de Microsoft utilisent des substrats en verre flexibles, soulignant la viabilité commerciale et la demande des consommateurs pour de telles technologies.

- Cette tendance pousse les producteurs de verre à améliorer la résistance et l'élasticité du verre grâce à des techniques avancées de renforcement chimique et de revêtement.

- En outre, cette tendance soutient la croissance de nouvelles catégories de produits dans l'électronique grand public, telles que les écrans enroulables et les tablettes flexibles, ouvrant de nouvelles opportunités pour les applications de substrats en verre au-delà des écrans rigides traditionnels.

Dynamique du marché des substrats de verre

Conducteur

« Demande croissante de technologies d'affichage avancées »

- La demande croissante de technologies d'affichage avancées stimule le marché des substrats en verre, car les consommateurs recherchent des appareils haute résolution, durables et conviviaux.

- Les substrats en verre sont essentiels pour les écrans tels que les écrans à cristaux liquides, les diodes électroluminescentes organiques et les nouveaux écrans flexibles et pliables, offrant une surface lisse et plate pour des couches électroniques uniformes.

- Des innovations telles que le verre ultra-mince et renforcé chimiquement permettent des écrans plus légers et plus robustes, répondant aux besoins des consommateurs en matière de gadgets élégants mais durables.

- L'adoption généralisée de smartphones, tablettes, ordinateurs portables et téléviseurs dotés d'écrans avancés accélère la croissance du marché ; par exemple, les grandes marques de smartphones utilisent du verre renforcé chimiquement pour améliorer la résistance aux rayures et la durabilité.

- Les nouveaux formats d'affichage, notamment les écrans flexibles et enroulables, dépendent de substrats en verre spécialisés qui maintiennent la flexibilité sans sacrifier la transparence ou la résistance, élargissant ainsi leur utilisation dans les tableaux de bord automobiles et les appareils portables.

- Par exemple, les derniers smartphones pliables de Samsung utilisent des substrats en verre ultra-minces et renforcés chimiquement qui permettent à l'écran de se plier en douceur tout en conservant durabilité et clarté.

Retenue/Défi

« Coûts de production élevés et complexités de fabrication »

- Le marché des substrats en verre est confronté à des défis en raison des coûts élevés liés à la production de matériaux en verre avancés, en particulier ceux qui sont ultra-minces ou traités chimiquement.

- La fabrication nécessite plusieurs étapes précises telles que la fusion, le formage, le recuit et le renforcement chimique, chacune nécessitant des contrôles de qualité stricts et un équipement spécialisé

- La production de substrats en verre flexibles implique de maintenir la pliabilité et la clarté optique, ce qui est techniquement exigeant et augmente les coûts opérationnels.

- Par exemple, le développement de verre flexible ultra-mince pour les écrans pliables nécessite un contrôle de l'épaisseur au niveau nanométrique pour éviter la casse tout en garantissant les performances visuelles.

- Les matériaux alternatifs tels que les substrats en plastique, bien que moins durables, gagnent en popularité pour les écrans flexibles en raison de coûts de production inférieurs et d'un traitement plus facile.

Portée du marché des substrats en verre

Le marché est segmenté en fonction du type, du diamètre de la plaquette, de l’application et de l’utilisation finale.

- Par type

Le marché des substrats à haute teneur en verre se divise en plusieurs catégories : substrats à base de borosilicate, substrats à base de silice/quartz fondu, substrats à base de silicium, etc. En 2024, le segment des substrats à base de borosilicate a dominé le marché, affichant la plus grande part de chiffre d'affaires, grâce à sa haute résistance thermique et chimique, ce qui le rend adapté à diverses applications microélectroniques et photoniques. La demande de substrats à base de borosilicate est forte dans le conditionnement des semi-conducteurs en raison de leur stabilité dimensionnelle et de leur rentabilité.

Le segment des matériaux à base de silice/quartz fondus devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à son exceptionnelle transparence optique et à son faible coefficient de dilatation thermique. Ces propriétés en font un matériau idéal pour l'électronique haute fréquence, les composants optiques et la lithographie avancée, notamment dans les applications des semi-conducteurs et de l'aérospatiale.

- Par diamètre de plaquette

En fonction du diamètre des plaquettes, le marché des substrats en verre de haute qualité est segmenté en 300 mm, 200 mm, 150 mm, 125 mm, plus de 300 mm et jusqu'à 100 mm. Le segment 200 mm a représenté la plus grande part de chiffre d'affaires en 2024, grâce à son utilisation intensive dans les installations de fabrication de semi-conducteurs traditionnelles et à sa rentabilité dans la production de MEMS et de dispositifs analogiques.

Le segment des 300 mm devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce aux progrès constants de la fabrication de semi-conducteurs, notamment le packaging 3D et la production de circuits intégrés en grande série. Alors que les fonderies se tournent vers des plaquettes plus grandes pour améliorer leur rendement et réduire le coût par puce, la demande de substrats en verre de 300 mm augmente rapidement.

- Par application

En fonction des applications, le marché des substrats à haute teneur en verre est segmenté en encapsulation de plaquettes, supports de substrat et interposeurs TGV. Le segment de l'encapsulation de plaquettes a représenté la plus grande part de chiffre d'affaires du marché en 2024, stimulé par la demande croissante de solutions d'encapsulation haute densité et miniaturisées pour l'électronique grand public et les appareils de communication. Les substrats en verre offrent d'excellentes surfaces planes et des performances thermiques idéales pour l'encapsulation de plaquettes.

Le segment des interposeurs TGV devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à l'adoption croissante de la technologie Through Glass Via pour l'intégration de puces avancées et le packaging hétérogène. Sa haute précision et ses faibles pertes diélectriques sont attractives pour les applications de calcul haute performance et de radiofréquence.

- Par utilisation finale

En fonction de l'utilisation finale, le marché des substrats à haute teneur en verre est segmenté en électronique, applications optiques, aérospatiale et défense, automobile et solaire, et médical. Le segment électronique a dominé le marché en 2024, porté par la forte demande de smartphones, d'objets connectés et de semi-conducteurs nécessitant des substrats compacts et performants.

Le secteur médical devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, en raison de l’adoption croissante de biocapteurs, de puces microfluidiques et de technologies de laboratoire sur puce qui utilisent des substrats en verre pour leur biocompatibilité, leur stabilité chimique et leur transparence.

Analyse régionale du marché des substrats en verre

- L'Amérique du Nord a dominé le marché des substrats en verre avec la plus grande part de revenus en 2024, grâce à une industrie électronique robuste, une demande croissante de technologies d'affichage avancées et la présence de fabricants de semi-conducteurs de premier plan.

- La région bénéficie d’investissements croissants en R&D pour les applications microélectroniques et optoélectroniques, ce qui renforce la demande de substrats en verre haute performance.

- De plus, les initiatives gouvernementales de soutien et l’expansion des installations de fabrication aux États-Unis et au Canada accélèrent l’adoption par le marché dans les industries d’utilisation finale telles que l’automobile, l’aérospatiale et les soins de santé.

Aperçu du marché américain des substrats de verre

Le marché américain des substrats de verre a représenté la plus grande part de chiffre d'affaires en Amérique du Nord en 2024, grâce à la forte présence d'entreprises leaders dans le secteur de l'électronique et des semi-conducteurs. L'écosystème technologique avancé du pays, associé à une forte demande de composants miniaturisés et de haute précision pour l'électronique grand public, alimente le marché. L'augmentation des applications dans les dispositifs d'imagerie médicale et les modules photovoltaïques contribue également à la croissance. L'innovation continue dans les techniques de fabrication du verre et la science des matériaux améliore encore les perspectives du marché.

Aperçu du marché européen des substrats de verre

Le marché européen des substrats en verre devrait connaître sa plus forte croissance entre 2025 et 2032, porté par la hausse des investissements dans la photonique, les MEMS et les technologies d'affichage. La forte présence de la région dans l'électronique automobile, associée à l'adoption croissante des écrans intelligents et des composants optiques, soutient une demande soutenue. Des réglementations environnementales et de qualité strictes favorisent également l'utilisation de substrats en verre durables et de haute pureté dans de nombreuses applications en Allemagne, en France et au Royaume-Uni.

Aperçu du marché britannique des substrats de verre

Le marché britannique des substrats en verre devrait connaître sa croissance la plus rapide entre 2025 et 2032, soutenu par la demande croissante de matériaux avancés dans les secteurs médical, aérospatial et optoélectronique. Les innovations dans les domaines de l'électronique flexible et des capteurs optiques, ainsi que le soutien gouvernemental à la production nationale, améliorent les perspectives du marché. De plus, l'accent mis par le pays sur le développement durable et la fabrication de précision encourage l'adoption de ces technologies dans les secteurs émergents de haute technologie.

Aperçu du marché allemand des substrats de verre

Le marché allemand des substrats en verre devrait connaître sa plus forte croissance entre 2025 et 2032, grâce à son leadership dans les technologies automobiles, l'optique et l'automatisation industrielle. Axée sur l'ingénierie de précision et les matériaux haute performance, l'Allemagne investit massivement dans la microfabrication et les matériaux de substrat avancés. L'essor de l'Industrie 4.0 et des usines intelligentes accroît encore la demande de substrats en verre pour l'intégration de capteurs et d'écrans.

Aperçu du marché des substrats de verre en Asie-Pacifique

Le marché des substrats de verre en Asie-Pacifique devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à l'essor de la production d'électronique grand public, à des politiques gouvernementales favorables et à une industrialisation rapide. Des pays comme la Chine, le Japon, la Corée du Sud et Taïwan sont à la pointe de l'innovation dans les domaines des écrans, des semi-conducteurs et de la technologie solaire. La disponibilité d'une production à faible coût, d'une main-d'œuvre qualifiée et d'investissements stratégiques dans des salles blanches accélère considérablement la croissance régionale.

Aperçu du marché japonais des substrats de verre

Le marché japonais des substrats en verre devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à son expertise solide dans les matériaux de précision, la microélectronique et les technologies optiques haut de gamme. Les industries japonaises matures de l'électronique grand public et des écrans d'affichage sont des moteurs clés de la demande. De plus, les applications dans les affichages tête haute (HUD) automobiles, les masques photographiques et les équipements médicaux de pointe stimulent l'adoption de ces technologies. L'accent mis sur la miniaturisation et la durabilité des produits renforce encore la position du marché dans les applications à forte valeur ajoutée.

Aperçu du marché chinois des substrats de verre

En 2024, le marché chinois des substrats de verre représentait la plus grande part de chiffre d'affaires de la région Asie-Pacifique, soutenu par la production de masse de smartphones, de tablettes et d'écrans. La volonté du pays d'atteindre l'autosuffisance en semi-conducteurs et le développement de la production photovoltaïque stimulent la demande de substrats de verre de qualité. Grâce à des fournisseurs nationaux performants et à des mesures gouvernementales incitatives pour soutenir le développement technologique, la Chine continue de dominer la croissance régionale, tant en termes de volume que de capacité.

Part de marché des substrats en verre

L'industrie des substrats en verre est principalement dirigée par des entreprises bien établies, notamment :

- AGC Inc. (Japon)

- SCHOTT (Allemagne)

- AvanStrate Inc. (Japon)

- Dongxu Group Co., Ltd. (Chine)

- Irico Group New Energy Company Limited (Chine)

- TECNISCO, LTD. (Japon)

- Corning Incorporated (États-Unis)

- Nippon Electric Glass Co., Ltd. (Japon)

- HOYA Corporation (Japon)

- Plan Optik AG (Allemagne)

- Ohara Inc. (Japon)

Derniers développements sur le marché mondial des substrats de verre

- En avril 2024, AGC Inc. a obtenu une Déclaration Environnementale de Produit (DEP) pour son verre flotté architectural issu de l'usine de Kashima, validée par SuMPO. Cette initiative vise à aider les acheteurs à évaluer les impacts environnementaux de manière plus transparente et à soutenir le respect des normes de construction écologique telles que LEED. En s'alignant sur son objectif à moyen terme de réduction de l'impact environnemental, AGC renforce sa stratégie d'approvisionnement écologique et accroît ainsi les opportunités de croissance dans le secteur de la construction.

- En janvier 2024, SCHOTT a élargi sa collaboration avec Lumus afin de répondre à la demande croissante de lunettes de réalité augmentée (RA). L'agrandissement de l'usine malaisienne de SCHOTT permettra la production de la technologie de guide d'ondes Z-Lens de Lumus. Ce partenariat vise à rationaliser le développement de la RA, du prototypage à la production en série, rendant les lunettes de RA plus accessibles et renforçant la présence de SCHOTT dans l'électronique grand public.

- En mai 2023, Corning Incorporated a augmenté de 20 % le prix de ses substrats de verre pour écrans à l'échelle mondiale afin de faire face à la flambée des coûts de l'énergie et des matières premières. Cette stratégie tarifaire vise à maintenir la rentabilité dans un contexte d'inflation tout en capitalisant sur la demande croissante de verre pour écrans. Cet ajustement positionne Corning pour maintenir son leadership sur le marché et assurer la croissance de son chiffre d'affaires dans un secteur électronique en pleine reprise.

- En avril 2023, SCHOTT a dévoilé des solutions de cuisine innovantes lors du salon AWE 2023 à Shanghai, introduisant des fonctionnalités telles que le revêtement CleanPlus pour un entretien facile et le luminaire CERAN pour des tables de cuisson au design sophistiqué. Ces produits, reconnus par le secteur, témoignent de l'engagement de SCHOTT en matière d'innovation pour les cuisines intelligentes et renforcent sa compétitivité sur le marché de l'électroménager.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.