Global Fleet Management Market

Taille du marché en milliards USD

TCAC :

%

USD

38.98 Billion

USD

112.75 Billion

2024

2032

USD

38.98 Billion

USD

112.75 Billion

2024

2032

| 2025 –2032 | |

| USD 38.98 Billion | |

| USD 112.75 Billion | |

|

|

|

|

Marché mondial de la gestion de flotte, par mode de transport (voitures particulières, véhicules utilitaires légers et véhicules utilitaires lourds), offre (solutions et services), type de location (avec ou sans location), type de véhicule (moteur à combustion interne et véhicule électrique), matériel (dispositifs de suivi GPS, caméras DASH, balises de suivi Bluetooth, enregistreurs de données et autres), taille de la flotte (petites flottes (moins de 100 véhicules), flottes moyennes (100 à 500 véhicules) et grandes flottes et entreprises (plus de 500 véhicules)), modèle de déploiement (sur site, cloud et hybride), technologie (GNSS, systèmes cellulaires, échange de données informatisé (EDI), télédétection, méthode informatique et prise de décision, RFID et autres), fonctions (gestion des actifs, gestion des itinéraires, consommation de carburant, localisation des véhicules en temps réel, calendrier de livraison, prévention des accidents, applications mobiles, surveillance du comportement du conducteur, mises à jour de maintenance des véhicules, conformité ELD et autres), portée de communication (communication à courte portée et Communication longue portée) et opérations (commerciales et privées), type d'entreprise (grande et petite entreprise) - Tendances et prévisions de l'industrie jusqu'en 2032.

Taille du marché de la gestion de flotte

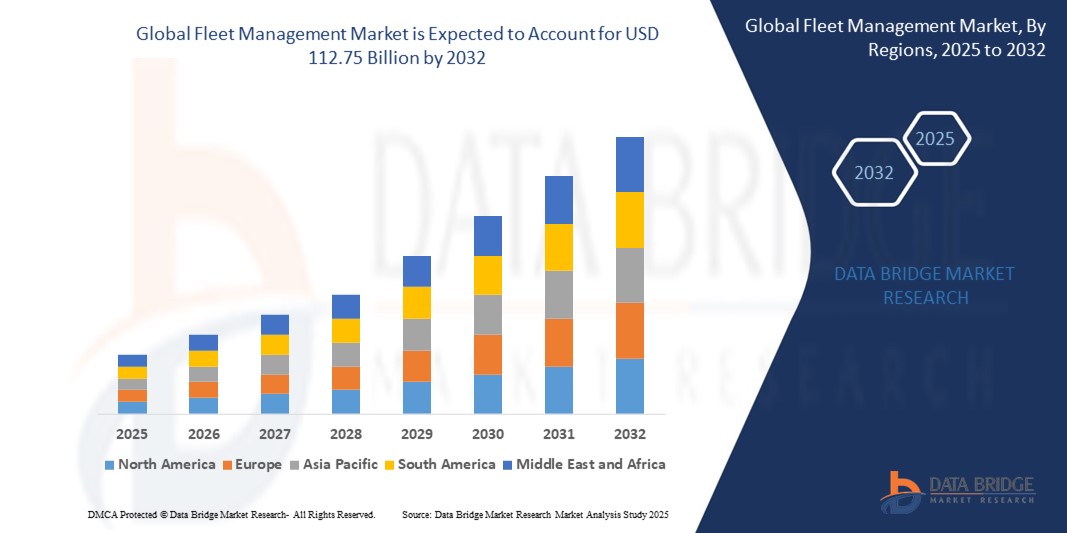

- La taille du marché mondial de la gestion de flotte était évaluée à 38,98 milliards USD en 2024 et devrait atteindre 112,75 milliards USD d'ici 2032 , à un TCAC de 14,20 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par l'adoption croissante de technologies avancées de télématique, d'intégration IoT et de suivi en temps réel, qui améliorent l'efficacité opérationnelle et réduisent les coûts d'exploitation des flottes.

- La demande croissante de solutions de transport durables, une conformité réglementaire plus stricte et le besoin croissant d'une logistique optimisée dans les secteurs commercial et privé propulsent davantage l'expansion du marché.

Analyse du marché de la gestion de flotte

- Les systèmes de gestion de flotte, englobant des solutions et des services de suivi des véhicules, de diagnostic et d'optimisation opérationnelle, deviennent essentiels pour les entreprises qui cherchent à améliorer l'efficacité, la sécurité et la conformité dans le transport et la logistique.

- L'augmentation de la demande en matière de gestion de flotte est alimentée par le besoin d'analyses de données en temps réel, d'efficacité énergétique et de sécurité des conducteurs, associé à l'adoption rapide de véhicules électriques et de solutions de mobilité intelligente.

- L'Amérique du Nord a dominé le marché de la gestion de flotte avec la plus grande part de revenus de 38,5 % en 2024, grâce à une infrastructure avancée, à l'adoption généralisée de la télématique et à la présence d'acteurs majeurs de l'industrie.

- L'Asie-Pacifique devrait être la région à la croissance la plus rapide au cours de la période de prévision, en raison de l'urbanisation rapide, de l'expansion du commerce électronique et de l'augmentation des investissements dans les infrastructures de transport intelligentes.

- Le segment des véhicules utilitaires lourds a dominé la plus grande part de revenus du marché, soit 45,2 % en 2024, grâce à l'utilisation intensive de solutions de gestion de flotte dans les secteurs de la logistique et du transport pour optimiser les opérations longue distance, l'efficacité énergétique et la conformité aux réglementations.

Portée du rapport et segmentation du marché de la gestion de flotte

|

Attributs |

Informations clés sur le marché de la gestion de flotte |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon. |

Tendances du marché de la gestion de flotte

« Intégration croissante de l'IA et de l'analyse des mégadonnées »

- Le marché mondial de la gestion de flotte connaît une tendance notable vers l'intégration de l'intelligence artificielle (IA) et de l'analyse du Big Data.

- Ces technologies facilitent le traitement avancé des données, offrant des informations plus approfondies sur les performances de la flotte, le comportement des conducteurs, l'efficacité énergétique et les exigences de maintenance prédictive.

- Les solutions de gestion de flotte basées sur l'IA permettent une prise de décision proactive, en identifiant les problèmes potentiels des véhicules avant qu'ils n'entraînent des réparations coûteuses ou des temps d'arrêt opérationnels

- Par exemple, les entreprises exploitent des plateformes d'IA pour analyser les données sur le comportement des conducteurs, telles que les excès de vitesse, les freinages brusques ou les itinéraires inefficaces, afin d'optimiser la consommation de carburant, d'améliorer la sécurité et de fournir des stratégies de gestion de flotte sur mesure.

- Cette tendance améliore l'efficacité et la valeur des systèmes de gestion de flotte, les rendant de plus en plus attrayants pour les petites et les grandes entreprises.

- Les algorithmes d'IA peuvent traiter de vastes ensembles de données, notamment la localisation en temps réel des véhicules, les habitudes de consommation de carburant et les mesures de performance des conducteurs, pour optimiser les itinéraires et garantir le respect des réglementations.

Dynamique du marché de la gestion de flotte

Conducteur

« Demande croissante de flottes connectées et de fonctionnalités de sécurité avancées »

- La demande croissante de services de flotte connectés, tels que le suivi GPS en temps réel, l'optimisation des itinéraires et les diagnostics à distance, est un moteur clé du marché mondial de la gestion de flotte.

- Les systèmes de gestion de flotte améliorent la sécurité grâce à des fonctionnalités telles que la prévention des accidents, la surveillance en temps réel du comportement du conducteur, la conformité des dispositifs d'enregistrement électronique (ELD) et la récupération des véhicules volés.

- Les réglementations gouvernementales, notamment en Amérique du Nord, qui domine le marché, favorisent l'adoption de dispositifs de sécurité et de conformité tels que l'ELD pour les véhicules commerciaux

- La prolifération de l'IoT et les progrès de la technologie 5G permettent une transmission de données plus rapide et une latence plus faible, prenant en charge des applications sophistiquées de gestion de flotte pour les voitures particulières, les véhicules utilitaires légers et les véhicules utilitaires lourds.

- Les exploitants de flottes adoptent de plus en plus des solutions de gestion de flotte installées en usine ou de rechange pour répondre aux exigences opérationnelles et améliorer l'efficacité des véhicules.

Retenue/Défi

« Coûts de mise en œuvre élevés et problèmes de sécurité des données »

- Les coûts initiaux importants liés à l'intégration du matériel et des logiciels constituent un obstacle à l'adoption, en particulier pour les petites entreprises et les petites flottes dans les régions sensibles aux coûts comme l'Asie-Pacifique, le marché à la croissance la plus rapide.

- La modernisation des véhicules existants avec des systèmes de gestion de flotte peut s'avérer complexe et coûteuse, en particulier pour les flottes de véhicules à moteur à combustion interne et de véhicules électriques.

- Les préoccupations en matière de sécurité et de confidentialité des données constituent des défis majeurs, car les systèmes de gestion de flotte collectent des données sensibles sur l'emplacement des véhicules, le comportement des conducteurs et les mesures opérationnelles, augmentant ainsi les risques de violation ou d'utilisation abusive des données.

- Le paysage réglementaire fragmenté selon les régions, avec des exigences variables en matière de protection des données et de conformité, complique les opérations des fournisseurs mondiaux de gestion de flotte.

- Ces défis peuvent décourager l’adoption, en particulier dans les régions où la sensibilisation à la confidentialité des données est élevée ou où les contraintes budgétaires sont fortes, ce qui pourrait ralentir la croissance du marché.

Portée du marché de la gestion de flotte

Le marché est segmenté en fonction du mode de transport, de l'offre, du type de location, du type de véhicule, du matériel, de la taille de la flotte, du modèle de déploiement, de la technologie, des fonctions, de la portée de communication, des opérations et du type d'entreprise.

- Par mode de transport

En fonction du mode de transport, le marché mondial de la gestion de flotte se segmente en voitures particulières, véhicules utilitaires légers et véhicules utilitaires lourds. Le segment des véhicules utilitaires lourds a dominé le marché avec 45,2 % de chiffre d'affaires en 2024, grâce à l'utilisation intensive de solutions de gestion de flotte dans les secteurs de la logistique et du transport pour optimiser les opérations longue distance, la consommation de carburant et le respect des réglementations.

Le segment des voitures particulières devrait connaître le taux de croissance le plus rapide de 2025 à 2032, avec un TCAC de 15,8 %, alimenté par la demande croissante des consommateurs pour les technologies de voitures connectées, le suivi en temps réel et les fonctionnalités de sécurité améliorées dans les services de mobilité personnelle et partagée.

- En offrant

Sur la base de l'offre, le marché mondial de la gestion de flotte est segmenté en solutions et services. En 2024, le segment des solutions dominait le marché avec une part de marché de 66,27 %, grâce à l'adoption généralisée des logiciels de gestion de flotte pour le suivi des actifs, l'optimisation des itinéraires et l'analyse en temps réel.

Le segment des services devrait connaître la croissance la plus rapide entre 2025 et 2032, avec un TCAC de 16,5 %, grâce à la demande croissante de services gérés, de maintenance prédictive et de conseil pour améliorer l'efficacité opérationnelle et réduire les temps d'arrêt.

- Par type de bail

En fonction du type de leasing, le marché mondial de la gestion de flotte se segmente entre leasing et sans leasing. Le segment de leasing détenait la plus grande part de marché, avec 64,98 % en 2024, grâce à la tendance croissante à la location avec services complets chez les entreprises en quête d'une gestion de flotte rentable et sans contraintes de propriété.

Le segment sans leasing devrait croître à un TCAC robuste de 14,9 % entre 2025 et 2032, car les entreprises, en particulier les petites et moyennes entreprises, optent pour la propriété directe du véhicule associée à des systèmes avancés de gestion de flotte pour plus de flexibilité et de contrôle.

- Par type de véhicule

En fonction du type de véhicule, le marché mondial de la gestion de flotte est segmenté entre véhicules à moteur à combustion interne (MCI) et véhicules électriques (VE). Le segment des MCI dominait avec une part de marché de 83,37 % en 2024, grâce à son infrastructure établie et à son utilisation généralisée dans les flottes commerciales.

Le segment des véhicules électriques devrait connaître la croissance la plus rapide entre 2025 et 2032, avec un TCAC de 18,3 %, grâce aux initiatives mondiales de développement durable, aux incitations gouvernementales et à l'intégration de la télématique pour la surveillance spécifique aux véhicules électriques, comme l'état de la batterie et l'optimisation de la charge.

- Par matériel

En termes de matériel, le marché mondial de la gestion de flotte se segmente en dispositifs de localisation GPS, caméras embarquées, balises de localisation Bluetooth, enregistreurs de données, etc. Le segment des dispositifs de localisation GPS détenait la plus grande part de marché, soit 38,7 % en 2024, en raison de son rôle essentiel dans la localisation en temps réel des véhicules, la prévention des vols et l'optimisation des itinéraires.

Le segment des caméras de tableau de bord devrait connaître la croissance la plus rapide de 2025 à 2032, avec un TCAC de 17,2 %, grâce à la demande croissante de surveillance du comportement des conducteurs, de prévention des accidents et de conformité aux réglementations de sécurité.

- Par taille de flotte

En fonction de la taille des flottes, le marché mondial de la gestion de flottes se segmente en petites flottes (moins de 100 véhicules), moyennes flottes (100 à 500 véhicules) et grandes flottes et flottes d'entreprise (plus de 500 véhicules). Ce segment domine avec une part de marché de 52,4 % en 2024, porté par le besoin de solutions complètes de gestion de flotte dans les secteurs de la logistique, du transport et du e-commerce.

Le segment des petites flottes devrait connaître le TCAC le plus rapide, soit 16,1 %, entre 2025 et 2032, car les petites entreprises adoptent de plus en plus des solutions abordables basées sur le cloud pour améliorer l'efficacité opérationnelle.

- Par modèle de déploiement

En fonction du modèle de déploiement, le marché mondial de la gestion de flotte est segmenté en modèles sur site, cloud et hybrides. Le segment cloud détenait la plus grande part de marché, avec 59,8 % en 2024, grâce à son évolutivité, sa rentabilité et sa capacité d'intégration avec l'IoT et l'analytique pour des informations en temps réel.

Le segment hybride devrait connaître le TCAC le plus rapide de 15,4 % entre 2025 et 2032, les entreprises recherchant un équilibre entre la sécurité des systèmes sur site et la flexibilité des solutions basées sur le cloud.

- Par technologie

Sur le plan technologique, le marché mondial de la gestion de flotte est segmenté en GNSS, systèmes cellulaires, échange de données informatisé (EDI), télédétection, méthodes informatiques et aide à la décision, RFID, etc. Le segment des systèmes cellulaires dominait avec une part de marché de 62,3 % en 2024, grâce à sa couverture fiable et à son intégration transparente aux écosystèmes IoT pour la transmission de données en temps réel.

Le segment GNSS devrait connaître la croissance la plus rapide entre 2025 et 2032, avec un TCAC de 16,7 %, grâce aux progrès de la navigation par satellite et à la demande de suivi de localisation précis dans les zones reculées.

- Par fonctions

En fonction des fonctions, le marché mondial de la gestion de flotte est segmenté en plusieurs catégories : gestion des actifs, gestion des itinéraires, consommation de carburant, localisation des véhicules en temps réel, planning de livraison, prévention des accidents, applications mobiles, suivi du comportement des conducteurs, mises à jour de maintenance des véhicules, conformité ELD, etc. Le segment de la localisation des véhicules en temps réel détenait la plus grande part de marché (34,6 %) en 2024, grâce à son rôle essentiel dans l'optimisation des flottes, la prévention des vols et l'efficacité des livraisons.

Le segment de la surveillance du comportement des conducteurs devrait connaître la croissance la plus rapide de 2025 à 2032, avec un TCAC de 17,5 %, alimenté par l'accent croissant mis sur la sécurité, la conformité réglementaire et l'adoption d'analyses basées sur l'IA pour améliorer les performances des conducteurs et réduire les accidents.

- Par portée de communication

En fonction de la portée de communication, le marché mondial de la gestion de flotte est segmenté en communications à courte et longue portée. Le segment des communications à longue portée dominait avec une part de marché de 68,2 % en 2024, grâce à sa capacité à assurer une connectivité fluide pour les opérations de flotte sur de vastes zones géographiques, notamment dans les secteurs de la logistique et du transport.

Le segment des communications à courte portée devrait connaître le TCAC le plus rapide de 15,9 % entre 2025 et 2032, soutenu par l'utilisation croissante de solutions Bluetooth et Wi-Fi pour la communication de véhicule à véhicule (V2V) et de véhicule à infrastructure (V2I) dans les environnements urbains.

- Par opérations

Sur la base des opérations, le marché mondial de la gestion de flotte est segmenté en opérations commerciales et privées. Le segment des opérations commerciales détenait la plus grande part de marché, soit 78,4 % en 2024, grâce à l'adoption massive de solutions de gestion de flotte dans des secteurs tels que la logistique, le e-commerce et la construction, afin d'améliorer l'efficacité et de réduire les coûts.

Le segment des opérations privées devrait croître à un TCAC de 14,8 % entre 2025 et 2032, à mesure que les propriétaires de véhicules individuels et les petites entreprises adoptent de plus en plus la télématique pour le suivi et l'entretien des véhicules personnels.

- Par type d'entreprise

Selon le type d'entreprise, le marché mondial de la gestion de flotte est segmenté en grandes et petites entreprises. Le segment des grandes entreprises dominait avec une part de marché de 65,7 % en 2024, en raison de la forte demande de systèmes complets de gestion de flotte parmi les entreprises disposant de flottes étendues.

Le segment des petites entreprises devrait connaître la croissance la plus rapide entre 2025 et 2032, avec un TCAC de 16,3 %, grâce à l'accessibilité des solutions basées sur le cloud et au besoin croissant d'efficacité opérationnelle des petites et moyennes entreprises.

Analyse régionale du marché de la gestion de flotte

- L'Amérique du Nord a dominé le marché de la gestion de flotte avec la plus grande part de revenus de 38,5 % en 2024, grâce à une infrastructure avancée, à l'adoption généralisée de la télématique et à la présence d'acteurs majeurs de l'industrie.

- Les consommateurs et les entreprises privilégient les solutions de gestion de flotte pour optimiser l'efficacité des véhicules, réduire les coûts opérationnels et garantir la conformité réglementaire, en particulier dans les régions dotées de vastes réseaux de chaîne d'approvisionnement.

- La croissance est soutenue par les progrès de la télématique, de l'IoT et des solutions basées sur le cloud, ainsi que par l'adoption croissante des opérations de flottes commerciales et privées.

Aperçu du marché de la gestion de flotte aux États-Unis

Le marché américain de la gestion de flotte a représenté la plus grande part de chiffre d'affaires en Amérique du Nord en 2024, avec 77,9 %, grâce à la forte demande des secteurs du transport et de la logistique et à la prise de conscience croissante des avantages en matière d'efficacité énergétique et de sécurité. La tendance au suivi en temps réel et à la maintenance prédictive, conjuguée à des réglementations strictes telles que la conformité aux ELD, stimule l'expansion du marché. De grandes entreprises comme UPS et FedEx exploitent les systèmes de gestion de flotte pour optimiser leurs opérations de livraison, stimulant ainsi la croissance du marché.

Aperçu du marché européen de la gestion de flotte

Le marché européen de la gestion de flotte devrait connaître une croissance significative, soutenue par l'accent réglementaire mis sur la sécurité des véhicules, la réduction des émissions et l'efficacité opérationnelle. Les particuliers et les entreprises recherchent des solutions améliorant l'optimisation des itinéraires et le suivi du comportement des conducteurs. Cette croissance est marquée tant pour les flottes commerciales que privées, des pays comme l'Allemagne et la France affichant un fort taux d'adoption en raison des réglementations environnementales et des exigences de logistique urbaine.

Aperçu du marché de la gestion de flotte au Royaume-Uni

Le marché britannique de la gestion de flotte devrait connaître une croissance rapide, portée par la demande d'amélioration de l'efficacité opérationnelle et de la sécurité dans la logistique urbaine et périurbaine. L'intérêt croissant pour le suivi des véhicules en temps réel et la gestion du carburant encourage leur adoption. L'évolution des réglementations, comme celle imposant l'utilisation de dispositifs d'enregistrement électronique, incite les exploitants de flottes à trouver un équilibre entre conformité et rentabilité.

Aperçu du marché allemand de la gestion de flotte

L'Allemagne devrait connaître une croissance rapide du marché de la gestion de flotte, grâce à son secteur logistique de pointe et à l'importance accordée à l'efficacité énergétique et au développement durable. Les entreprises allemandes privilégient les solutions technologiques avancées, telles que le GNSS et les systèmes cellulaires, qui optimisent les opérations de flotte et réduisent les émissions. L'intégration de ces solutions aux flottes, grandes comme petites, favorise une croissance soutenue du marché.

Aperçu du marché de la gestion de flotte en Asie-Pacifique

La région Asie-Pacifique devrait connaître la croissance la plus rapide, portée par l'essor des secteurs de la logistique et du e-commerce dans des pays comme la Chine, l'Inde et le Japon. La sensibilisation croissante à l'optimisation des itinéraires, à la consommation de carburant et à la sécurité des conducteurs stimule la demande. Les initiatives gouvernementales en faveur des transports intelligents et du développement durable encouragent l'adoption de solutions avancées de gestion de flotte.

Aperçu du marché de la gestion de flotte au Japon

Le marché japonais de la gestion de flotte devrait connaître une croissance rapide grâce à la forte préférence des consommateurs et des entreprises pour des solutions de haute qualité et technologiquement avancées qui améliorent l'efficacité opérationnelle et la sécurité. La présence de grandes entreprises automobiles et logistiques, ainsi que l'intégration de systèmes de gestion de flotte dans les véhicules utilitaires, accélèrent la pénétration du marché. L'intérêt croissant pour les solutions de rechange contribue également à la croissance.

Aperçu du marché chinois de la gestion de flotte

La Chine détient la plus grande part du marché de la gestion de flotte en Asie-Pacifique, propulsée par une urbanisation rapide, une augmentation du parc automobile et une demande croissante de solutions logistiques performantes. Le secteur du e-commerce en pleine expansion et l'accent mis sur la mobilité intelligente favorisent l'adoption de technologies avancées de gestion de flotte. De solides capacités de production nationales et des prix compétitifs facilitent l'accès au marché.

Part de marché de la gestion de flotte

Le secteur de la gestion de flotte est principalement dirigé par des entreprises bien établies, notamment :

- Geotab (Canada)

- Verizon Connect (États-Unis)

- Samsara (États-Unis)

- Trimble (États-Unis)

- Omnitracs (États-Unis)

- Teletrac Navman (États-Unis)

- TomTom Telematics (Pays-Bas)

- Mix Telematics (Afrique du Sud)

- Fleetmatics (États-Unis)

- Masternaut (Royaume-Uni)

- KeepTruckin (États-Unis)

- ORBCOMM (États-Unis)

- Zonar Systems (États-Unis)

- Wialon (Biélorussie)

- Flotte complète (Canada)

- NexTraq (États-Unis)

- Azuga (États-Unis)

- Spireon (États-Unis)

Quels sont les développements récents sur le marché mondial de la gestion de flotte ?

- En octobre 2024, Beans.ai s'est associé à Nauto pour révolutionner la livraison du dernier kilomètre pour les flottes commerciales. Cette collaboration stratégique intègre les solutions de routage de précision et de données géospatiales de Beans.ai à la technologie d'enregistrement vidéo des données d'événements (VEDR) basée sur l'IA de Nauto. La plateforme combinée améliore la précision des livraisons, rationalise les opérations et renforce la sécurité des conducteurs, tout en garantissant la conformité VEDR pour les prestataires de livraison de colis. En optimisant les lieux de prise en charge et de dépose et en réduisant les créneaux de livraison jusqu'à 50 %, ce partenariat reflète une évolution plus large du secteur vers des solutions logistiques intelligentes et basées sur les données, qui optimisent les performances des flottes.

- En avril 2024, Penske Truck Leasing a lancé Catalyst AI, une plateforme numérique révolutionnaire conçue pour transformer la gestion de flotte. Cette solution, basée sur l'IA, fournit des informations en temps réel sur les performances de la flotte, permettant aux gestionnaires de comparer leurs opérations à celles de flottes similaires grâce à des données comparatives dynamiques. En analysant plus de 57 milliards de points de données, Catalyst AI identifie l'ADN unique d'une flotte et fournit des indicateurs clés de performance personnalisés pour optimiser la consommation de carburant, l'utilisation et la réduction des coûts. Cette plateforme marque une rupture avec les méthodes d'analyse comparative traditionnelles, en fournissant aux responsables de flotte des informations exploitables pour prendre des décisions plus judicieuses et plus rapides.

- En mars 2024, Waymo s'est associé à Uber Freight pour déployer des camions autonomes pour le transport de marchandises dans certains États américains, marquant ainsi une avancée majeure dans l'automatisation logistique. Cette collaboration stratégique intègre la technologie de conduite autonome de Waymo à la plateforme de courtage numérique d'Uber Freight, permettant aux transporteurs d'exploiter des camions équipés du Waymo Driver au sein d'un réseau hybride. Cette initiative vise à optimiser les opérations de fret longue distance, à réduire les délais de livraison et à pallier la pénurie de main-d'œuvre en permettant aux camions autonomes de gérer des trajets longs, tandis que les conducteurs se concentrent sur les trajets courts. Ce partenariat marque une transformation radicale vers une solution logistique intelligente et évolutive.

- En janvier 2024, MoveEV, une plateforme d'IA axée sur la transition vers les véhicules électriques, s'est associée à Geotab pour intégrer son produit phare, ReimburseEV, à la marketplace Geotab. Cette collaboration permet un remboursement fluide des recharges de véhicules électriques à domicile en combinant les données télématiques des véhicules avec les informations des services publics pour générer des reçus conformes aux normes fiscales. Conçue pour les flottes de véhicules électriques et hybrides rechargeables, la solution simplifie les remboursements des employés, prend en charge la recharge en heures creuses et réduit le besoin d'infrastructures sur site. Ce partenariat marque une étape importante dans la promotion d'une gestion durable des flottes et l'accélération de l'adoption des véhicules électriques dans les secteurs commercial et public.

- En septembre 2023, Trimble s'est associé au fournisseur de solutions de transport Next Generation Logistics pour intégrer sa plateforme d'approvisionnement Engage Lane au système Dynamics TMS® via Trimble Transportation Cloud. Cette collaboration inédite permet un processus d'approvisionnement de fret dynamique et à l'échelle de chaque voie, de la passation des marchés à l'attribution et à l'exécution des commandes, grâce à un flux de travail numérique fluide. En connectant les systèmes TMS des expéditeurs et des transporteurs, ce partenariat améliore la visibilité de la chaîne d'approvisionnement, accélère la contractualisation et optimise l'utilisation des capacités. Il reflète une volonté plus large du secteur de privilégier des solutions logistiques connectées et basées sur les données, qui rationalisent les opérations et favorisent la résilience des réseaux de transport.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.