Global Endpoint Detection Response Market

Taille du marché en milliards USD

TCAC :

%

USD

4.22 Billion

USD

23.83 Billion

2024

2032

USD

4.22 Billion

USD

23.83 Billion

2024

2032

| 2025 –2032 | |

| USD 4.22 Billion | |

| USD 23.83 Billion | |

|

|

|

|

Segmentation du marché mondial de la détection et de la réponse aux points d'extrémité, par solution (logiciel et service), terminal (périphériques réseau et serveurs, appareils mobiles, terminaux de point de vente (POS) et autres), déploiement (cloud et sur site), taille de l'entreprise (petites et moyennes entreprises et grandes entreprises), secteur vertical (banque, services financiers et assurances (BFSI), santé et sciences de la vie, gouvernement et défense, vente au détail et commerce électronique, informatique et télécommunications, énergie et services publics, fabrication et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché de la détection et de la réponse aux points finaux

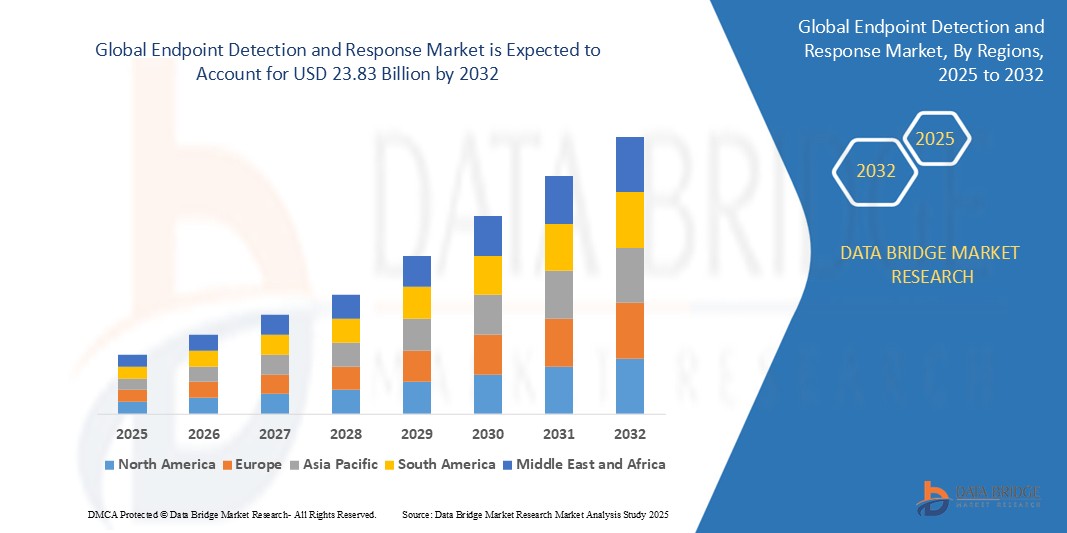

- La taille du marché mondial de la détection et de la réponse aux points finaux était évaluée à 4,22 milliards USD en 2024 et devrait atteindre 23,83 milliards USD d'ici 2032 , à un TCAC de 24,16 % au cours de la période de prévision.

- Cette croissance est due à des facteurs tels que la fréquence croissante des cybermenaces, la croissance du travail à distance et les besoins croissants en matière de conformité réglementaire.

Analyse du marché de la détection et de la réponse aux points finaux

- La détection et la réponse aux terminaux (EDR) désignent une solution de cybersécurité qui surveille en permanence les terminaux afin de détecter, d'analyser et de répondre aux menaces potentielles en temps réel. Elle intègre la veille sur les menaces, l'analyse comportementale et la réponse automatisée pour se protéger contre les cyberattaques en constante évolution sur les ordinateurs de bureau, les ordinateurs portables, les appareils mobiles et les serveurs.

- Le marché EDR connaît une forte croissance tirée par la montée en puissance des cybermenaces sophistiquées, l'adoption croissante de modèles de travail à distance et hybrides, les pressions réglementaires croissantes en matière de protection des données, l'adoption rapide du cloud et l'attention croissante des entreprises à la détection et à l'atténuation des menaces en temps réel sur divers points de terminaison.

- L'Amérique du Nord devrait dominer le marché de la détection et de la réponse aux points de terminaison avec une part de 32,9 % , en raison de l'adoption précoce de la technologie dans tous les secteurs et d'une forte présence de fournisseurs de solutions de cybersécurité.

- L'Asie-Pacifique devrait être la région connaissant la croissance la plus rapide sur le marché de la détection et de la réponse aux points de terminaison au cours de la période de prévision en raison de la transformation numérique rapide et de la sensibilisation croissante aux risques de cybersécurité dans divers secteurs.

- Le segment des logiciels devrait dominer le marché avec une part de marché de 65 % en raison de la demande croissante de solutions EDR évolutives et basées sur le cloud, offrant des capacités de détection des menaces, d'investigation et de réponse automatisée en temps réel. Cette évolution est motivée par la sophistication croissante des cyberattaques et le besoin d'outils de sécurité agiles et facilement déployables sur divers terminaux.

Portée du rapport et segmentation du marché de la détection et de la réponse aux points finaux

|

Attributs |

Informations clés sur le marché de la détection et de la réponse aux points de terminaison |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon. |

Tendances du marché de la détection et de la réponse aux points finaux

« Adoption croissante des solutions basées sur le cloud »

- L’une des tendances majeures du marché mondial de la détection et de la réponse aux points de terminaison est l’adoption croissante de solutions basées sur le cloud.

- Cette tendance est motivée par le besoin croissant d'outils de cybersécurité évolutifs et rentables , l'essor du travail à distance et la demande de surveillance centralisée des menaces dans des environnements distribués.

- Par exemple, des fournisseurs de premier plan tels que CrowdStrike, Microsoft et SentinelOne proposent des plateformes EDR natives du cloud qui permettent des analyses en temps réel, une détection automatisée des menaces et une réponse rapide aux incidents sur les terminaux mondiaux.

- Le déploiement basé sur le cloud gagne du terrain auprès des grandes entreprises comme des petites et moyennes entreprises en raison d'une intégration plus facile, de coûts d'infrastructure réduits et d'une accessibilité améliorée.

- Alors que la transformation numérique s'accélère et que les organisations privilégient l'agilité et la résilience, les solutions EDR basées sur le cloud devraient jouer un rôle central dans la définition de la trajectoire de croissance future du marché.

Dynamique du marché de la détection et de la réponse aux points terminaux

Conducteur

« L'essor des fournisseurs de services de sécurité gérés (MSSP) »

- L'essor des fournisseurs de services de sécurité gérés (MSSP) est un moteur majeur de la croissance du marché de la détection et de la réponse aux points de terminaison (EDR), car les organisations recherchent des solutions rentables et axées sur des experts pour gérer les défis complexes de la cybersécurité.

- Ce changement est particulièrement évident parmi les petites et moyennes entreprises qui ne disposent pas d’équipes de cybersécurité internes et qui ont besoin de capacités continues de surveillance et de réponse aux menaces.

- À mesure que les cyberattaques gagnent en fréquence et en sophistication, les entreprises externalisent de plus en plus les fonctions EDR aux MSSP pour une protection en temps réel, une réponse plus rapide aux incidents et une conformité réglementaire.

- Les fournisseurs de services améliorent leurs offres avec des analyses avancées, une détection des menaces basée sur l'IA et des plateformes EDR basées sur le cloud pour répondre aux besoins évolutifs des entreprises.

- La dépendance croissante aux MSSP élargit la portée des solutions EDR dans des secteurs tels que la santé, la finance et la fabrication.

Par exemple,

- Secureworks propose un EDR géré avec des analyses comportementales et une détection en temps réel ; AT&T Cybersecurity intègre EDR à sa plateforme de gestion de sécurité unifiée pour une meilleure réponse aux menaces

- IBM Security fournit un EDR géré dans le cadre de ses services de gestion des menaces X-Force, aidant les entreprises à détecter les menaces avancées sur les terminaux mondiaux.

- Alors que les entreprises privilégient l'efficacité opérationnelle et la résilience aux menaces, la demande de solutions EDR pilotées par MSSP devrait être un facteur clé de croissance du marché jusqu'en 2032.

Opportunité

« Intégration avec les outils de sécurité »

- L'intégration avec des outils de sécurité plus larges présente une opportunité significative pour le marché de la détection et de la réponse aux points de terminaison (EDR), permettant une meilleure visibilité des menaces, une réponse plus rapide aux incidents et des opérations de cybersécurité plus cohérentes.

- Les fournisseurs EDR s'alignent de plus en plus sur les plateformes SIEM, SOAR et XDR pour offrir un partage de données transparent, des flux de travail automatisés et une gestion centralisée des menaces dans divers environnements de sécurité.

- Cette opportunité répond au besoin croissant de solutions de cybersécurité unifiées qui réduisent la fatigue liée aux alertes, rationalisent la correction et permettent une prise de décision plus rapide au sein des équipes de sécurité de l'entreprise.

Par exemple,

- CrowdStrike Falcon s'intègre aux outils SIEM tels que Splunk et IBM QRadar pour fournir une télémétrie des points de terminaison en temps réel et des informations contextuelles sur les menaces à travers les couches de sécurité.

- Microsoft Defender for Endpoint fonctionne avec Azure Sentinel et Microsoft 365 Defender pour permettre une détection et une réponse automatisées à l'aide de playbooks préconfigurés

- Alors que les organisations privilégient les architectures de sécurité unifiées et évolutives, l'intégration avec les outils existants devrait être un facteur clé de l'adoption des solutions EDR et de l'expansion du marché à long terme jusqu'en 2032.

Retenue/Défi

« Coûts de mise en œuvre élevés »

- Les coûts de mise en œuvre élevés représentent un défi important pour le marché de la détection et de la réponse aux points de terminaison (EDR), car les dépenses liées aux logiciels avancés, au personnel qualifié et à l'intégration avec l'infrastructure informatique existante créent des barrières financières importantes.

- Ces coûts sont particulièrement prohibitifs pour les petites et moyennes entreprises (PME) qui ne disposent pas de budgets dédiés à la cybersécurité ni de l’expertise interne nécessaire pour gérer des déploiements EDR complexes.

- Le défi est aggravé par la nécessité de mises à jour continues, de réglages du système et de formation des analystes de sécurité, ce qui augmente encore le coût total de possession et limite une adoption plus large.

Par exemple,

- Les plateformes EDR de niveau entreprise de fournisseurs tels que CrowdStrike, Palo Alto Networks et VMware Carbon Black nécessitent souvent des frais de licence initiaux, des abonnements annuels et des dépenses supplémentaires pour les services d'intégration et de surveillance.

- Sans modèles de tarification plus abordables ou options de déploiement simplifiées, les coûts de mise en œuvre élevés peuvent entraver l'adoption dans les secteurs à budget limité et les marchés en développement, ce qui pourrait ralentir la croissance globale du marché EDR jusqu'en 2032.

Portée du marché de la détection et de la réponse aux points finaux

Le marché est segmenté en fonction de la solution, du périphérique terminal, du déploiement, de la taille de l'entreprise et du secteur vertical.

|

Segmentation |

Sous-segmentation |

|

Par solution |

|

|

Par périphérique de point de terminaison |

|

|

Par déploiement |

|

|

Par taille d'entreprise

|

|

|

Par Vertical |

|

En 2025, le logiciel devrait dominer le marché avec une part de marché plus importante dans le segment des solutions

Le segment des logiciels devrait dominer le marché de la détection et de la réponse aux terminaux, avec une part de marché de 65 % en 2025, en raison de la demande croissante de solutions EDR évolutives et basées sur le cloud, offrant des capacités de détection des menaces, d'investigation et de réponse automatisée en temps réel. Cette évolution est motivée par la sophistication croissante des cyberattaques et le besoin d'outils de sécurité agiles et facilement déployables sur divers terminaux.

Le cloud devrait représenter la plus grande part du segment de déploiement au cours de la période de prévision.

En 2025, le segment cloud devrait dominer le marché avec une part de marché de 55,3 %, grâce à sa rentabilité, sa facilité de déploiement et sa capacité à fournir des renseignements sur les menaces en temps réel et une gestion centralisée sur des terminaux géographiquement dispersés. L'adoption croissante du télétravail et des environnements hybrides accélère encore la demande de solutions EDR cloud flexibles et évolutives.

Analyse régionale du marché de la détection et de la réponse aux points finaux

« L'Amérique du Nord détient la plus grande part du marché de la détection et de la réponse aux points terminaux »

- L'Amérique du Nord domine le marché de la détection et de la réponse aux points de terminaison avec une part de 32,9 % , grâce à l'adoption précoce de la technologie dans tous les secteurs et à une forte présence de fournisseurs de solutions de cybersécurité.

- Les États-Unis détiennent une part importante en raison de la forte adoption parmi les petites et moyennes entreprises (PME), des investissements substantiels dans l'infrastructure de cybersécurité et d'un environnement réglementaire proactif axé sur la protection des données.

- La croissance du marché est également soutenue par de vastes activités de recherche et développement, des partenariats public-privé et un écosystème bien établi de fournisseurs de services de sécurité gérés.

- Avec une innovation continue, des cybermenaces croissantes et une forte demande des entreprises pour une protection avancée des terminaux, l'Amérique du Nord devrait maintenir sa position de leader sur le marché mondial des EDR jusqu'en 2032.

« L'Asie-Pacifique devrait enregistrer le TCAC le plus élevé sur le marché de la détection et de la réponse aux points terminaux »

- L'Asie-Pacifique devrait connaître le taux de croissance le plus élevé sur le marché de la détection et de la réponse aux points de terminaison , grâce à une transformation numérique rapide et à une prise de conscience croissante des risques de cybersécurité dans divers secteurs.

- La Chine détient une part importante en raison des initiatives menées par le gouvernement en matière de sécurité numérique, de l'expansion de l'infrastructure cloud et de l'augmentation des dépenses des entreprises en technologies de détection des menaces.

- La dynamique régionale est encore renforcée par la pénétration croissante d'Internet, l'adoption croissante des appareils mobiles et IoT et une augmentation des cyberattaques ciblant les entreprises et les entités gouvernementales.

- Avec une demande croissante de solutions de sécurité évolutives de nouvelle génération, l'Asie-Pacifique est sur le point de devenir la région à la croissance la plus rapide sur le marché mondial de la détection et de la réponse aux points de terminaison d'ici 2032.

Part de marché de la détection et de la réponse aux points finaux

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- Cisco Systems, Inc. (États-Unis)

- Broadcom (États-Unis)

- Belden Inc. (États-Unis)

- Sophos Ltd. (Royaume-Uni)

- F-Secure (Finlande)

- McAfee, LLC (États-Unis)

- Trend Micro Incorporated (Japon)

- NortonLifeLock Inc. (États-Unis)

- Symantec Corporation (États-Unis)

- VMware, Inc. (États-Unis)

- CrowdStrike (États-Unis)

- Palo Alto Networks (États-Unis)

- Forcepoint (États-Unis)

- InfraRed Integrated Systems Ltd (Royaume-Uni)

- Digital Guardian (États-Unis)

- Cybereason (États-Unis)

- Open Text Corporation (Canada)

- FireEye, Inc. (États-Unis)

- RSA Security LLC (États-Unis)

- Intel Corporation (États-Unis)

Derniers développements sur le marché mondial de la détection et de la réponse aux points terminaux

- En octobre 2023, HarfangLab, entreprise française de cybersécurité spécialisée dans la détection et la réponse aux menaces sur les terminaux, a levé 25 millions d'euros lors d'une levée de fonds de série A. Cet investissement facilitera le développement de l'entreprise en Europe et lui permettra de renforcer ses capacités d'identification et de neutralisation des cyberattaques. La croissance d'HarfangLab reflète la demande croissante de solutions de cybersécurité robustes dans un contexte de menaces en constante évolution.

- En août 2023, Fortinet a été nommé Partenaire technologique Google Cloud de l'année en matière de sécurité, notamment pour sa solution FortiEDR. Cette distinction récompense l'efficacité de Fortinet en matière d'identification et de prévention des failles de sécurité en temps réel, essentielles à la résilience des organisations face aux cybermenaces. Cette reconnaissance renforce la réputation de Fortinet et soutient sa croissance future sur le marché de la sécurité grâce à des capacités d'intégration améliorées.

- En octobre 2022, SyncDog, Inc. s'est associé à 3Eye Technologies pour améliorer sa stratégie de mobilité et de cloud, en se concentrant sur une solution plus sécurisée pour l'utilisation des appareils mobiles. Leur espace de travail sécurisé vise à résoudre les difficultés liées à l'accès des employés aux plateformes mobiles. Cette collaboration vise à accroître les objectifs de vente en offrant aux entreprises et aux agences gouvernementales un environnement évolutif et sécurisé pour leurs opérations mobiles.

- En juillet 2022, Raytheon Intelligence & Space s'est associé à CrowdStrike pour renforcer ses services de détection et de réponse gérées (MDR). En intégrant les technologies avancées de sécurité des terminaux de CrowdStrike, cette collaboration vise à améliorer les capacités de détection et de réponse aux menaces. Ce partenariat souligne l'importance de combiner les ressources pour fournir des solutions de sécurité complètes, positionnant Raytheon comme un acteur majeur dans le secteur de la cybersécurité.

- En juin 2021, Cisco a acquis Kenna Security, Inc. afin d'améliorer significativement ses capacités de sécurité des terminaux. Cette acquisition stratégique vise à consolider le portefeuille de sécurité de Cisco et à créer un cadre complet de sécurité des terminaux. En intégrant les technologies de Kenna, Cisco souhaite proposer des solutions plus robustes contre les cybermenaces, renforçant ainsi sa position de leader du secteur de la cybersécurité tout en améliorant la protection globale de l'organisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.