Global Diagnostic Tests Market

Taille du marché en milliards USD

TCAC :

%

USD

286.36 Billion

USD

545.94 Billion

2024

2032

USD

286.36 Billion

USD

545.94 Billion

2024

2032

| 2025 –2032 | |

| USD 286.36 Billion | |

| USD 545.94 Billion | |

|

|

|

|

Segmentation du marché mondial des tests diagnostiques, par type (tests de routine et tests spécialisés), composant (services et produits), technologie (immuno-essai, PCR, séquençage de nouvelle génération, spectroscopie, chromatographie, microfluidique, etc.), mode de test (tests sur ordonnance et tests en vente libre), application (oncologie, cardiologie, orthopédie, gastroentérologie, gynécologie, neurologie, odontologie, etc.), type d'échantillon (sang, urine, salive, sueur, cheveux, etc.), site de test (tests en laboratoire et tests à domicile), type de test (biochimie, hématologie, microbiologie, histopathologie, etc.), âge (gériatrie, adulte et pédiatrie), utilisateur final (hôpitaux, centres de diagnostic, centres de chirurgie ambulatoire (CCA), cliniques spécialisées, soins à domicile, banques du sang, Laboratoires et instituts de recherche, et autres), canal de distribution (appels d'offres directs, ventes au détail et ventes en ligne) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des tests de diagnostic

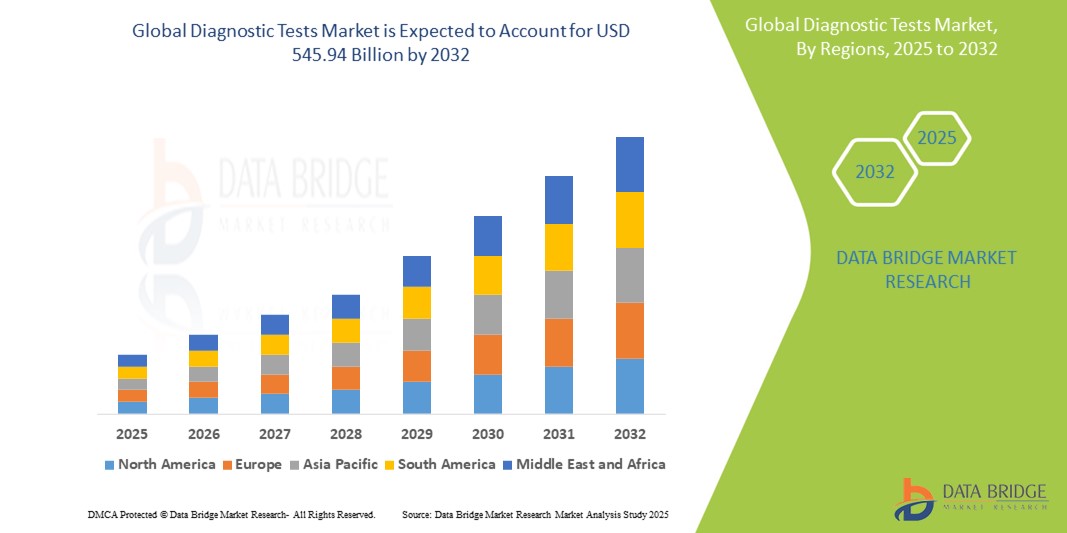

- La taille du marché mondial des tests de diagnostic était évaluée à 286,36 milliards USD en 2024 et devrait atteindre 545,94 milliards USD d'ici 2032 , à un TCAC de 8,4 % au cours de la période de prévision.

- L'expansion du marché est fortement stimulée par la prévalence croissante des maladies chroniques et infectieuses , ce qui entraîne une demande accrue d'outils de diagnostic précoces et précis dans les systèmes de santé du monde entier.

- De plus, les innovations technologiques telles que les tests au point d'intervention , les diagnostics intégrés à l'IA et les diagnostics moléculaires transforment le paysage, améliorant la précision et l'accessibilité. Ces tendances accélèrent l'adoption et stimulent une forte croissance du marché des tests diagnostiques.

Analyse du marché des tests de diagnostic

- Les tests de diagnostic, offrant une détection en laboratoire ou au point de service pour une gamme de maladies et d'affections, sont des éléments de plus en plus essentiels des systèmes de santé modernes, tant en milieu clinique qu'à domicile, en raison de leur précision accrue, de leurs résultats rapides et de leur intégration transparente avec les plateformes de santé numériques.

- La demande croissante de tests de diagnostic est principalement alimentée par la prévalence mondiale croissante des maladies chroniques et infectieuses, l'importance croissante accordée à la détection précoce des maladies et une préférence croissante pour les solutions de soins de santé personnalisées et préventives.

- L'Amérique du Nord a dominé le marché des tests de diagnostic avec la plus grande part de revenus de 42,5 % en 2024, caractérisée par une infrastructure de soins de santé avancée, des dépenses de santé élevées et une forte présence d'acteurs clés de l'industrie, les États-Unis connaissant une croissance substantielle des tests moléculaires et génétiques, en particulier dans les hôpitaux et les cliniques spécialisées, grâce aux innovations dans les technologies de PCR et de séquençage de nouvelle génération.

- L'Asie-Pacifique devrait être la région connaissant la croissance la plus rapide sur le marché des tests de diagnostic au cours de la période de prévision en raison de l'accès croissant aux soins de santé et de l'augmentation des investissements publics et privés dans les infrastructures de diagnostic.

- Le segment des tests de routine a dominé le marché des tests de diagnostic avec une part de marché de 63,82 % en 2024, grâce à son utilisation généralisée dans les bilans de santé réguliers, la détection précoce des maladies et la surveillance des maladies chroniques dans divers contextes de soins de santé.

Portée du rapport et segmentation du marché des tests de diagnostic

|

Attributs |

Analyses clés du marché des tests de diagnostic |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des tests de diagnostic

« Progrès dans l'intégration de l'IA et du diagnostic à domicile »

- Une tendance importante et croissante sur le marché mondial des tests de diagnostic est l’intégration de l’intelligence artificielle (IA) aux plateformes de diagnostic numériques et aux solutions de test à domicile, améliorant considérablement la précision, la rapidité et l’accessibilité du diagnostic dans divers contextes de soins.

- Par exemple, les plateformes basées sur l'IA telles que PathAI et Aidoc aident les cliniciens en interprétant rapidement des données d'imagerie et de pathologie complexes, tandis que les outils de diagnostic à domicile tels que Cue Health et LetsGetChecked proposent des kits de test compatibles avec les smartphones pour les maladies infectieuses et la surveillance générale de la santé.

- L'IA dans le diagnostic offre des fonctionnalités telles que l'analyse prédictive, l'interprétation des résultats en temps réel et l'aide à la décision clinique, améliorant ainsi la précision du diagnostic et réduisant les délais d'exécution. Certaines plateformes s'adaptent également aux données des patients et en tirent des enseignements pour affiner les recommandations de tests, améliorant ainsi la personnalisation des soins.

- L'intégration de l'IA aux dispositifs de dépistage à distance facilite le diagnostic décentralisé, permettant aux utilisateurs d'auto-surveiller des pathologies telles que le diabète, le cholestérol ou les infections avec une intervention clinique minimale. Les résultats des tests peuvent être partagés en toute transparence avec les professionnels de santé via des applications connectées ou des plateformes de télésanté.

- Cette tendance favorise le développement d'écosystèmes de diagnostic intelligents, où les capteurs portables, les algorithmes d'IA et les diagnostics mobiles convergent pour offrir une surveillance proactive et personnalisée des soins de santé.

- La demande d’outils de diagnostic conviviaux et améliorés par l’IA augmente rapidement, tant dans les milieux cliniques qu’à domicile, alors que les systèmes de santé évoluent vers la détection précoce, l’autonomisation des patients et des solutions de santé numériques évolutives.

Dynamique du marché des tests de diagnostic

Conducteur

« Demande croissante due à l'augmentation des maladies chroniques et à l'accent mis sur les soins de santé préventifs »

- La charge mondiale croissante des maladies chroniques et infectieuses, combinée à une forte évolution vers des pratiques de soins de santé préventives, est un facteur clé de la demande croissante de tests de diagnostic dans les milieux cliniques et à domicile.

- Par exemple, en mars 2024, Roche Diagnostics a lancé de nouvelles plateformes PCR à haut débit visant à accélérer le dépistage des maladies chroniques et des agents infectieux, améliorant ainsi l'accessibilité et l'efficacité des diagnostics. Ces avancées réalisées par des acteurs de premier plan devraient stimuler l'expansion du marché dans les années à venir.

- Alors que les systèmes de santé privilégient la détection précoce et l'intervention rapide pour réduire la charge de morbidité et les coûts de traitement, les tests diagnostiques sont devenus des outils essentiels pour le dépistage, la surveillance et la gestion des maladies dans tous les groupes d'âge.

- En outre, l’importance croissante accordée à la médecine personnalisée, portée par les innovations en matière de génomique et de tests de biomarqueurs, positionne le diagnostic comme un élément central des plans de traitement personnalisés.

- La commodité et la précision des technologies diagnostiques modernes, ainsi que leur capacité à fournir des informations exploitables en temps réel, encouragent patients et professionnels de santé à se faire dépister régulièrement. La disponibilité croissante de tests rapides et conviviaux et de diagnostics mobiles élargit également l'accès aux régions reculées et mal desservies.

Retenue/Défi

« Préoccupations liées à la confidentialité des données et coût élevé des technologies de diagnostic avancées »

- Les préoccupations croissantes concernant la confidentialité des données et le traitement sécurisé des informations de santé sensibles constituent un défi important pour l'adoption plus large de solutions de diagnostic avancées, en particulier celles intégrées à l'IA ou aux plateformes basées sur le cloud.

- Par exemple, plusieurs organismes de réglementation, dont HIPAA aux États-Unis et GDPR dans l'UE, ont introduit des directives strictes sur l'utilisation et le stockage des données des patients, exigeant des sociétés de diagnostic qu'elles mettent en œuvre des cadres de cybersécurité et de conformité robustes.

- Assurer la sécurité de la transmission, du stockage et de la gestion du consentement des patients est essentiel pour gagner la confiance des utilisateurs. Les entreprises investissent de plus en plus dans les technologies de chiffrement et les systèmes basés sur la blockchain pour renforcer la sécurité des données diagnostiques.

- De plus, le coût élevé des technologies diagnostiques de pointe, telles que le séquençage de nouvelle génération (NGS), les tests moléculaires et les plateformes d'IA, limite l'accès à ces technologies, notamment dans les pays à revenu faible et intermédiaire et parmi les populations sous-assurées. Si les tests de base restent abordables, les solutions avancées impliquent souvent des coûts d'équipement et de fonctionnement importants.

- Combler ces lacunes grâce à l’harmonisation réglementaire, à une innovation rentable et à une infrastructure évolutive sera essentiel pour élargir l’accès au diagnostic et maintenir une croissance durable dans divers environnements de soins de santé.

Portée du marché des tests de diagnostic

Le marché est segmenté sur la base du type, du composant, de la technologie, du mode de test, de l'application, du type d'échantillon, du site de test, du type de test, de la tranche d'âge, de l'utilisateur final et du canal de distribution.

- Par type

Le marché des tests diagnostiques est segmenté en tests de routine et tests spécialisés. Le segment des tests de routine a dominé le marché avec une part de chiffre d'affaires de 63,82 % en 2024, grâce à leur utilisation généralisée pour les évaluations de santé courantes et à leur rapport coût-efficacité. Les tests de routine sont largement utilisés dans divers contextes de soins de santé en raison de leur standardisation et de leur efficacité dans la détection et le suivi précoces des maladies.

Les tests spécialisés devraient connaître le taux de croissance le plus rapide au cours de la période de prévision, alimenté par les progrès de la médecine personnalisée et la demande croissante de diagnostics précis dans les maladies complexes.

- Par composant

Sur la base des composants, le marché est segmenté en services et produits. Le segment des services détenait la plus grande part de marché en 2024, en raison de la demande croissante de services de tests diagnostiques dans les hôpitaux et les centres de diagnostic.

Le segment des produits devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce aux innovations dans les réactifs de diagnostic, les instruments et les consommables essentiels à diverses procédures de test.

- Par technologie

Sur le plan technologique, le marché est segmenté en immuno-essais, PCR, séquençage de nouvelle génération, spectroscopie, chromatographie, microfluidique, etc. En 2024, les technologies d'immuno-essais ont dominé le marché grâce à leur grande sensibilité et à leur large champ d'application dans la détection de biomarqueurs.

La technologie basée sur la CR devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à son rôle essentiel dans le diagnostic moléculaire et la détection des maladies infectieuses, en particulier après la pandémie.

- Par mode de test

En fonction du mode de test, le marché est segmenté en tests sur ordonnance et tests en vente libre. Les tests sur ordonnance détenaient la plus grande part de marché en 2024, car ils sont largement utilisés dans les contextes cliniques nécessitant une supervision professionnelle.

Cependant, les tests en vente libre devraient connaître la croissance la plus rapide au cours de la période de prévision, en raison de la sensibilisation accrue des consommateurs, de la demande de commodité et des progrès technologiques permettant des kits de test à domicile précis.

- Par application

En fonction des applications, le marché est segmenté en oncologie, cardiologie, orthopédie, gastroentérologie, gynécologie, neurologie, odontologie, etc. L'oncologie a représenté la part la plus importante en 2024, en raison de la prévalence croissante du cancer et de la nécessité d'un dépistage et d'une surveillance précoces.

La cardiologie et les autres tests de diagnostic liés aux maladies chroniques devraient connaître la croissance la plus rapide, soutenue par l’augmentation des dépenses de santé et le vieillissement de la population.

- Par type d'échantillon

En fonction du type d'échantillon, le marché est segmenté en sang, urine, salive, sueur, cheveux, etc. Les échantillons sanguins ont dominé le marché en 2024, en raison de leur fiabilité et de leur large utilisation dans divers tests diagnostiques.

Les tests de salive et d’urine devraient connaître la croissance la plus rapide entre 2025 et 2032, en tant qu’alternatives non invasives, améliorant l’observance des patients et la facilité de prélèvement des échantillons.

- Par site de test

En fonction des sites de test, le marché est segmenté en tests en laboratoire et tests à domicile. Les tests en laboratoire détenaient la part majoritaire en 2024, grâce à la disponibilité d'équipements de pointe et à l'expertise professionnelle.

Toutefois, les tests à domicile devraient connaître la croissance la plus rapide au cours de la période de prévision, stimulés par la demande des consommateurs pour la commodité et des résultats rapides, soutenue par les avancées technologiques.

- Par type de test

En fonction des types de tests, le marché est segmenté en biochimie, hématologie, microbiologie, histopathologie, etc. La biochimie a dominé le marché en 2024, en raison de son rôle essentiel dans le diagnostic des maladies métaboliques, fonctionnelles des organes et d'autres maladies systémiques.

Les tests de microbiologie devraient connaître la croissance la plus rapide au cours de la période de prévision en raison du besoin continu de gestion des maladies infectieuses.

- Par âge

En fonction de l'âge, le marché est segmenté en gériatrie, adulte et pédiatrie. Le segment adulte détenait la plus grande part en 2024, en raison de la charge de morbidité plus élevée et du besoin fréquent de diagnostics.

Le segment pédiatrique devrait connaître une croissance plus rapide du TCAC entre 2025 et 2032, en raison d’une sensibilisation et d’un dépistage accrus des maladies congénitales et infectieuses chez les enfants.

- Par utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, centres de diagnostic, centres de chirurgie ambulatoire (CCA), cliniques spécialisées, soins à domicile, banques de sang, laboratoires et instituts de recherche, etc. En 2024, les hôpitaux et les centres de diagnostic ont dominé le marché avec la plus forte part de chiffre d'affaires, car ils constituent les principaux établissements de services de tests diagnostiques.

Le segment des soins à domicile devrait connaître la croissance la plus rapide au cours de la période de prévision, à mesure que les services de diagnostic à domicile et la télésanté se développent à l'échelle mondiale.

- Par canal de distribution

En fonction des canaux de distribution, le marché est segmenté en appels d'offres directs, ventes au détail et ventes en ligne. Les appels d'offres directs ont dominé le marché en 2024, en raison des achats groupés des établissements de santé.

Les ventes en ligne connaissent une croissance rapide au cours de la période de prévision, tirées par l’expansion du commerce électronique et la préférence croissante des consommateurs pour l’achat direct de kits de diagnostic à domicile.

Analyse régionale du marché des tests de diagnostic

- L'Amérique du Nord a dominé le marché des tests de diagnostic avec la plus grande part de revenus de 42,5 % en 2024, grâce à une infrastructure de soins de santé avancée, des dépenses de santé élevées et une forte présence d'acteurs clés de l'industrie.

- Les consommateurs de la région apprécient grandement la précision, la rapidité et la commodité offertes par les technologies de diagnostic avancées, notamment les tests moléculaires et génétiques

- Cette adoption généralisée est en outre soutenue par de fortes initiatives gouvernementales, une sensibilisation croissante aux soins de santé préventifs et une prévalence croissante des maladies chroniques, établissant les tests de diagnostic comme un élément essentiel des soins de santé modernes dans les hôpitaux, les centres de diagnostic et les établissements de soins à domicile.

Aperçu du marché des tests de diagnostic aux États-Unis

Le marché américain des tests diagnostiques a représenté la plus grande part de chiffre d'affaires en Amérique du Nord en 2024, avec 79 % de parts de marché, grâce à une infrastructure de santé de pointe et à l'adoption généralisée de technologies diagnostiques de pointe. La sensibilisation croissante aux soins préventifs et à la gestion des maladies chroniques stimule la demande de tests diagnostiques de routine et spécialisés. L'intégration croissante de l'IA et des outils de santé numériques dans le diagnostic, associée à une forte concentration sur la médecine personnalisée, accélère encore la croissance du marché. La présence de grandes entreprises de diagnostic et le développement des options de tests à domicile contribuent également à l'expansion du marché américain.

Aperçu du marché européen des tests de diagnostic

Le marché européen des tests diagnostiques devrait connaître une croissance régulière, porté par des cadres réglementaires stricts et une hausse des dépenses de santé. Le vieillissement de la population et la forte prévalence des maladies chroniques dans la région accroissent la demande de diagnostics précoces et précis. L'augmentation des investissements dans le diagnostic moléculaire et l'élargissement des politiques de remboursement favorisent son adoption par les hôpitaux et les centres de diagnostic. De plus, les initiatives gouvernementales favorisant la santé numérique et l'intégration des tests diagnostiques dans les programmes de santé préventive dynamisent le marché européen.

Aperçu du marché des tests de diagnostic au Royaume-Uni

Le marché britannique des tests diagnostiques devrait connaître une forte croissance, soutenue par des stratégies nationales de santé privilégiant le dépistage précoce des maladies et les soins préventifs. La sensibilisation croissante des patients et le financement public des technologies diagnostiques avancées stimulent l'expansion du marché. Le système de santé développé du Royaume-Uni et l'adoption croissante des tests à domicile, notamment dans un contexte de développement des tests diagnostiques en vente libre, contribuent à une demande soutenue. De plus, le développement des services de télésanté facilite l'accès aux solutions diagnostiques.

Aperçu du marché allemand des tests de diagnostic

Le marché allemand des tests diagnostiques devrait connaître une croissance significative, porté par une infrastructure de santé solide et des investissements croissants dans la recherche et l'innovation. L'accent mis par le pays sur la médecine de précision et la demande croissante en séquençage de nouvelle génération et en diagnostic moléculaire stimulent le marché. L'augmentation du fardeau des maladies chroniques et les politiques de remboursement favorables favorisent leur adoption dans les hôpitaux et les cliniques spécialisées. L'accent mis sur la sécurité des données et la conformité réglementaire répond aux attentes des consommateurs, renforçant ainsi la croissance du marché.

Aperçu du marché des tests de diagnostic en Asie-Pacifique

Le marché des tests diagnostiques en Asie-Pacifique devrait enregistrer le TCAC le plus rapide au cours de la période de prévision, propulsé par l'urbanisation galopante, l'augmentation des dépenses de santé et la sensibilisation croissante au dépistage précoce des maladies. Le développement des infrastructures de santé dans des pays comme la Chine, l'Inde et le Japon, ainsi que la prévalence croissante des maladies liées au mode de vie, stimulent la demande de tests de routine et spécialisés. Les initiatives gouvernementales visant à améliorer l'accès aux soins et l'adoption de la santé numérique renforcent encore la pénétration du marché. La région bénéficie également d'une fabrication rentable et d'un développement des tests à domicile.

Aperçu du marché japonais des tests de diagnostic

Le marché japonais des tests diagnostiques est en constante expansion, porté par une population vieillissante nécessitant des diagnostics avancés pour la gestion des maladies chroniques. L'accent mis par le pays sur l'intégration des tests diagnostiques aux systèmes de santé intelligents et aux appareils IoT stimule leur adoption. Le soutien croissant du gouvernement à l'innovation en matière de santé et aux programmes de médecine préventive stimule la croissance. La demande de tests diagnostiques non invasifs et rapides augmente, notamment en gériatrie et en oncologie.

Aperçu du marché indien des tests de diagnostic

En 2024, l'Inde représentait la plus grande part de marché des revenus en Asie-Pacifique, grâce au développement des infrastructures de santé et à l'accent accru mis sur la prévention. L'augmentation de la population de la classe moyenne, l'urbanisation et les programmes de santé publics stimulent la demande de services de diagnostic accessibles. La présence croissante de centres de diagnostic privés et la pénétration croissante de technologies de diagnostic abordables favorisent l'expansion du marché. De plus, la sensibilisation croissante au diagnostic précoce des maladies et le développement de la télémédecine contribuent au développement rapide du marché indien des tests de diagnostic.

Part de marché des tests de diagnostic

L’industrie des tests de diagnostic est principalement dirigée par des entreprises bien établies, notamment :

- Abbott (États-Unis)

- F. Hoffmann-La Roche SA (Suisse)

- Siemens Healthineers AG (Allemagne)

- Danaher Corporation (États-Unis)

- Thermo Fisher Scientific Inc. (États-Unis)

- BD (États-Unis)

- Bio-Rad Laboratories, Inc. (États-Unis)

- BIOMÉRIEUX (France)

- QIAGEN (Pays-Bas)

- Sysmex Corporation (Japon)

- Ortho Clinical Diagnostics (États-Unis)

- Hologic, Inc. (États-Unis)

- Céphéide (États-Unis)

- Illumina, Inc. (États-Unis)

- Genomic Health, Inc. (États-Unis)

- Myriad Genetics, Inc. (États-Unis)

- DiaSorin SpA (Italie)

- THERADIAG (France)

- Exact Sciences Corporation (États-Unis)

- Beckman Coulter, Inc. (États-Unis)

Quels sont les développements récents sur le marché mondial des tests de diagnostic ?

- En septembre 2024, des chercheurs de la Pritzker School of Molecular Engineering de l'Université de Chicago et de la Samueli School of Engineering de l'UCLA ont dévoilé un nouveau système de diagnostic intégrant un transistor à effet de champ et une cartouche d'analyse papier. Ce biocapteur hybride, optimisé par des algorithmes d'apprentissage automatique, a démontré une précision de plus de 97 % dans la mesure du taux de cholestérol dans les échantillons sériques. Cette innovation allie la haute sensibilité de la détection par transistor à l'accessibilité et à la simplicité des tests papier, et pourrait révolutionner le diagnostic à domicile de diverses pathologies.

- En septembre 2024, ARCpoint Inc. a renforcé sa collaboration avec MD Care Group en améliorant son interface de programmation d'applications (API) afin de permettre aux praticiens de télésanté de commander des tests diagnostiques directement via la plateforme MyARCpointLabs d'ARCpoint. Cette intégration simplifie le processus pour les prestataires de soins virtuels et facilite ainsi l'accès des patients à des évaluations de santé rapides et pratiques.

- En août 2024, Qiagen et AstraZeneca ont annoncé l'élargissement de leur partenariat visant à développer des diagnostics compagnons pour les maladies chroniques au-delà de l'oncologie. S'appuyant sur la plateforme QIAstat-Dx de Qiagen, cette collaboration vise à créer des tests de génotypage permettant d'identifier les patients éligibles à des thérapies ciblées lors des évaluations cliniques de routine, marquant ainsi une étape importante vers la médecine personnalisée dans la prise en charge des maladies chroniques.

- En juin 2024, BioAI, une entreprise de biotechnologie spécialisée dans les applications d'intelligence artificielle, s'est associée à Genomic Testing Cooperative pour développer des solutions de pathologie numérique basées sur l'IA. Cette collaboration vise à créer des algorithmes et des tests de criblage de biomarqueurs génomiques, améliorant ainsi la recherche clinique et les applications diagnostiques grâce à des outils informatiques avancés.

- En juin 2024, l'Organisation mondiale de la Santé (OMS) s'est associée aux États membres de l'ASEAN lors d'une réunion consultative régionale en Thaïlande afin d'améliorer l'accès à des tests diagnostiques de qualité. Cette initiative visait à soutenir l'élaboration et la mise en œuvre de listes nationales de diagnostics essentiels (LNE), garantissant ainsi la disponibilité et l'accessibilité de ces tests dans toute l'Asie du Sud-Est.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.