Global Commercial Turf Utility Vehicle Market

Taille du marché en milliards USD

TCAC :

%

USD

452.40 Million

USD

812.88 Million

2024

2032

USD

452.40 Million

USD

812.88 Million

2024

2032

| 2025 –2032 | |

| USD 452.40 Million | |

| USD 812.88 Million | |

|

|

|

|

Marché mondial des véhicules utilitaires commerciaux à gazon, par type de propulsion (électrique, essence et diesel), puissance de sortie ( 8 kW et 8 kW-15 kW), abonnement (achat neuf et location), nombre de places (2 places et plus de 2 places), type de gazon (gazon naturel et artificiel), capacité de remorquage (moins de 680 kg et plus de 680 kg) et application (terrains de golf, hôtels et complexes hôteliers, aéroports, collèges et universités, zoos et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des véhicules utilitaires commerciaux pour gazon

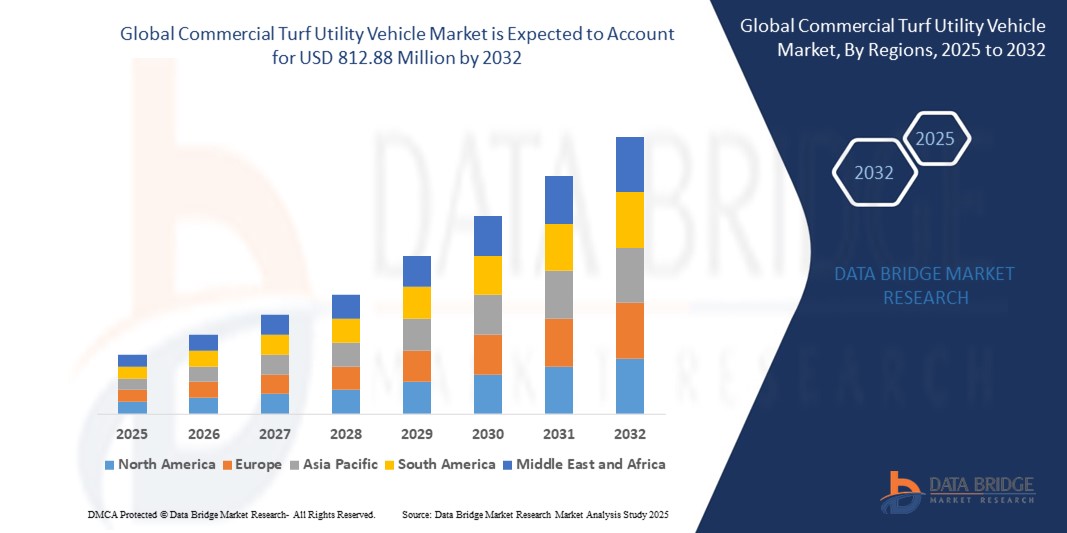

- La taille du marché mondial des véhicules utilitaires commerciaux pour gazon était évaluée à 452,40 millions USD en 2024 et devrait atteindre 812,88 millions USD d'ici 2032 , à un TCAC de 7,60 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par la demande croissante de solutions efficaces d'entretien du gazon, l'adoption croissante de véhicules électriques pour la durabilité et les avancées technologiques en matière d'automatisation et de connectivité des véhicules.

- Les investissements croissants dans les installations récréatives, telles que les terrains de golf et les centres de villégiature, ainsi que l'accent accru mis sur les solutions d'aménagement paysager respectueuses de l'environnement, accélèrent l'adoption de véhicules utilitaires commerciaux à gazon, stimulant considérablement la croissance du secteur.

Analyse du marché des véhicules utilitaires commerciaux pour gazon

- Les véhicules utilitaires commerciaux pour gazon, conçus pour l'entretien et le transport du gazon dans diverses applications, sont essentiels pour des opérations efficaces dans des environnements tels que les terrains de golf, les centres de villégiature et les terrains institutionnels, offrant une maniabilité, une durabilité et des capacités de charge améliorées.

- L'augmentation de la demande est due à l'expansion des installations sportives et récréatives, à l'augmentation des réglementations environnementales favorisant les véhicules électriques et au besoin d'équipements de maintenance rentables et polyvalents.

- L'Amérique du Nord a dominé le marché des véhicules utilitaires commerciaux pour gazon avec la plus grande part de revenus de 42,5 % en 2024, grâce au développement généralisé des terrains de golf, à l'adoption élevée de technologies avancées d'entretien du gazon et à la présence de grands fabricants.

- L'Asie-Pacifique devrait être la région à la croissance la plus rapide au cours de la période de prévision, alimentée par une urbanisation rapide, des investissements croissants dans le tourisme et l'hôtellerie et une hausse des revenus disponibles.

- Le segment électrique a dominé le marché avec 48,7 % de chiffre d'affaires en 2024, porté par des préoccupations environnementales croissantes, des réglementations plus strictes en matière d'émissions et une demande croissante de solutions écologiques. Les véhicules utilitaires électriques pour l'entretien des espaces verts offrent l'avantage de ne produire aucune émission, ce qui les rend idéaux pour les travaux d'aménagement paysager et d'entretien durables.

Portée du rapport et segmentation du marché des véhicules utilitaires commerciaux pour gazon

|

Attributs |

Aperçu du marché des véhicules utilitaires commerciaux sur gazon |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon. |

Tendances du marché des véhicules utilitaires commerciaux pour gazon

« Intégration croissante de l'IoT et de la connectivité avancée »

- Le marché mondial des véhicules utilitaires commerciaux connaît une tendance significative vers l'intégration de l'Internet des objets (IoT) et de solutions de connectivité avancées, telles que le GPS et la télématique.

- Ces technologies permettent une surveillance en temps réel des performances du véhicule, de l'état du gazon et de l'efficacité de l'opérateur, fournissant des informations exploitables pour la maintenance et l'optimisation opérationnelle.

- Les véhicules utilitaires pour gazon compatibles IoT permettent une maintenance prédictive, en identifiant les problèmes mécaniques potentiels avant qu'ils n'entraînent des temps d'arrêt, réduisant ainsi les coûts de réparation et améliorant l'efficacité opérationnelle.

- Par exemple, des fabricants tels que Club Car et John Deere développent des plateformes connectées qui s'intègrent aux applications mobiles pour surveiller l'utilisation des véhicules, optimiser les itinéraires pour l'entretien du gazon et fournir des informations basées sur les données pour la gestion de flotte.

- Cette tendance améliore la proposition de valeur des véhicules utilitaires pour gazon, les rendant plus attrayants pour les terrains de golf, les centres de villégiature et autres installations à grande échelle nécessitant une gestion efficace du gazon.

- La connectivité avancée prend également en charge des fonctionnalités telles que le géorepérage et les diagnostics à distance, permettant aux opérateurs de suivre l'emplacement des véhicules et de garantir une utilisation optimale sur de vastes zones telles que les terrains de golf ou les aéroports.

Dynamique du marché des véhicules utilitaires commerciaux sur gazon

Conducteur

« Demande croissante pour une gestion efficace et durable du gazon »

- La demande croissante de solutions efficaces d'entretien du gazon, stimulée par l'expansion des terrains de golf, des complexes hôteliers et des espaces verts urbains, est un moteur clé du marché mondial des véhicules utilitaires pour gazon commercial.

- Les véhicules utilitaires pour gazon améliorent l'efficacité opérationnelle en fournissant des solutions polyvalentes pour la tonte, le transport, la pulvérisation et l'ensemencement, adaptées à la fois aux surfaces en gazon naturel et en gazon artificiel.

- Les initiatives gouvernementales favorisant l’aménagement paysager durable et la conservation de l’environnement, notamment en Amérique du Nord et en Europe, stimulent l’adoption de véhicules utilitaires électriques pour le gazon, qui offrent des avantages en termes d’émissions zéro.

- La prolifération de la technologie 5G et de l'IoT permet une transmission de données plus rapide et une communication en temps réel, prenant en charge des applications avancées telles que l'entretien automatisé du gazon et la gestion intelligente de la flotte.

- Les constructeurs proposent de plus en plus de modèles électriques et hybrides montés en usine pour répondre à la demande de solutions respectueuses de l'environnement, en particulier dans des applications telles que les terrains de golf, les hôtels, les complexes hôteliers et les universités.

Retenue/Défi

« Coûts initiaux élevés et limitations d'infrastructure »

Coûts initiaux élevés et limitations d'infrastructure

- Les coûts initiaux élevés liés à l'achat et à l'intégration de véhicules utilitaires pour terrains de sport avancés, en particulier les modèles électriques dotés de capacités IoT et télématiques, constituent un obstacle important à l'adoption, en particulier sur les marchés sensibles aux coûts tels que certaines régions d'Asie-Pacifique et d'Amérique latine.

- La modernisation des véhicules existants avec des systèmes de connectivité avancés ou de propulsion électrique peut être complexe et coûteuse, ce qui limite l'adoption parmi les petits opérateurs

- Les limitations des infrastructures, telles que les réseaux de recharge inadéquats pour les véhicules utilitaires électriques, en particulier dans les marchés émergents, entravent la croissance et l'évolutivité du marché.

- Les préoccupations en matière de sécurité et de confidentialité des données liées aux véhicules compatibles IoT, qui collectent et transmettent des données opérationnelles et de localisation, soulèvent des défis concernant les violations potentielles et la conformité aux différentes réglementations régionales en matière de protection des données.

- Le paysage réglementaire fragmenté entre les pays, notamment en ce qui concerne les normes d'émissions et l'utilisation des données, complique les opérations des fabricants et des prestataires de services, ce qui peut décourager l'expansion du marché dans les régions où la réglementation est stricte ou peu claire.

Portée du marché des véhicules utilitaires commerciaux pour gazon

Le marché est segmenté en fonction du type de propulsion, de la puissance de sortie, de l'abonnement, de la capacité d'accueil, du type de gazon, de la capacité de remorquage et de l'application.

- Par type de propulsion

Le marché mondial des véhicules utilitaires pour espaces verts est segmenté en fonction du type de propulsion : électrique, essence et diesel. En 2024, le segment électrique a dominé le marché avec une part de marché de 48,7 %, portée par des préoccupations environnementales croissantes, des réglementations plus strictes en matière d'émissions et une demande croissante de solutions écologiques. Les véhicules utilitaires électriques pour espaces verts offrent l'avantage de ne produire aucune émission, ce qui les rend idéaux pour les travaux d'aménagement paysager et d'entretien durables.

Le segment électrique devrait également connaître la croissance la plus rapide entre 2025 et 2032, grâce aux progrès technologiques des batteries, à la baisse de leur coût et aux mesures gouvernementales incitatives en faveur des véhicules zéro émission. L'évolution vers le développement durable dans des secteurs comme les terrains de golf et les complexes hôteliers accélère encore l'adoption de ces technologies.

- Par puissance de sortie

En termes de puissance, le marché mondial des véhicules utilitaires pour gazon est segmenté en > 8 kW et 8 kW-15 kW. Le segment 8 kW-15 kW dominait le marché avec une part de marché de 66,4 % en 2024, grâce à son équilibre entre performances et rentabilité, et répond à diverses applications telles que la tonte, le transport et l'entretien du gazon.

Le segment des 8 à 15 kW devrait maintenir une forte croissance de 2025 à 2032, grâce à sa polyvalence et à son adéquation aux tâches légères et lourdes dans des environnements commerciaux tels que les terrains de golf et les universités.

- Par abonnement

Sur la base des abonnements, le marché mondial des véhicules utilitaires commerciaux pour terrains gazonnés est segmenté entre l'achat neuf et la location. Le segment de l'achat neuf détenait la plus grande part de chiffre d'affaires du marché, avec 54,2 % en 2024, grâce à la préférence des grands opérateurs tels que les terrains de golf et les complexes hôteliers pour la propriété à long terme, garantissant des performances et une personnalisation constantes.

Le segment de la location devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, alimenté par la demande croissante de solutions rentables et flexibles parmi les petits opérateurs et les utilisateurs saisonniers, tels que les lieux d'événements et les zoos.

- Par capacité d'accueil

En fonction du type de capacité d'accueil, le marché mondial des véhicules utilitaires commerciaux pour gazon est segmenté en deux places et plus de deux places. Le segment des deux places représentait la plus grande part de chiffre d'affaires du marché, soit 62,3 % en 2024, grâce à sa polyvalence, sa rentabilité et son adéquation aux tâches nécessitant des véhicules compacts, comme l'entretien en espaces confinés.

Le segment des véhicules de plus de 2 places devrait connaître une croissance robuste de 2025 à 2032, tirée par la demande croissante de véhicules pouvant accueillir plusieurs passagers dans des applications telles que les centres de villégiature, les aéroports et les collèges, où le transport de groupe est essentiel.

- Par type de gazon

En fonction du type de gazon, le marché mondial des véhicules utilitaires commerciaux est segmenté en gazon naturel et gazon artificiel. Le segment du gazon naturel dominait le marché avec une part de marché de 71,3 % en 2024, car il demeure la surface prédominante dans des applications telles que les terrains de golf, les terrains de sport et les parcs, nécessitant des véhicules spécialisés pour leur entretien.

Le segment artificiel devrait connaître une croissance significative entre 2025 et 2032, tirée par l’adoption croissante du gazon artificiel dans les installations sportives et l’aménagement paysager urbain, nécessitant des véhicules adaptés à ses besoins d’entretien uniques.

- Par capacité de remorquage

Sur la base de la capacité de remorquage, le marché mondial des véhicules utilitaires commerciaux pour gazon est segmenté en moins de 680 kg et plus de 680 kg. Le segment de moins de 680 kg détenait la plus grande part de revenus du marché, soit 63,8 % en 2024, en raison de sa polyvalence, de sa rentabilité et de son adéquation à diverses applications, notamment les tâches légères dans les zoos et les universités.

Le segment des véhicules de plus de 680 kg devrait connaître une croissance rapide entre 2025 et 2032, en raison du besoin de remorquage lourd dans des applications telles que l'entretien des terrains de golf et les opérations de villégiature, où des charges plus importantes sont courantes.

- Par application

En fonction des applications, le marché mondial des véhicules utilitaires pour terrains de golf est segmenté en terrains de golf, hôtels et complexes touristiques, aéroports, universités et zoos, entre autres. Le segment des terrains de golf a dominé le marché avec une part de marché de 38,9 % en 2024, grâce à l'utilisation intensive de véhicules utilitaires pour l'entretien, le transport et d'autres tâches essentielles à l'exploitation des terrains de golf.

Le segment des hôtels et des complexes hôteliers devrait connaître la croissance la plus rapide entre 2025 et 2032, alimentée par la croissance de l'industrie du tourisme de luxe et le besoin de solutions de transport efficaces et respectueuses de l'environnement dans les grands complexes hôteliers.

Analyse régionale du marché des véhicules utilitaires commerciaux sur gazon

- L'Amérique du Nord a dominé le marché des véhicules utilitaires commerciaux pour gazon avec la plus grande part de revenus de 42,5 % en 2024, grâce au développement généralisé des terrains de golf, à l'adoption élevée de technologies avancées d'entretien du gazon et à la présence de grands fabricants.

- Les consommateurs privilégient les véhicules pour leur polyvalence, leur maniabilité et leur capacité à effectuer des tâches telles que la tonte, le transport et la pulvérisation, en particulier dans les régions dotées de vastes espaces verts et de divers types de gazon.

- La croissance est soutenue par les progrès de la technologie des véhicules, notamment les systèmes de propulsion électriques et hybrides, ainsi que par l'adoption croissante des nouveaux achats et des marchés de location.

Aperçu du marché américain des véhicules utilitaires commerciaux sur gazon

Le marché américain des véhicules utilitaires pour gazon a représenté la plus grande part de chiffre d'affaires en Amérique du Nord en 2024, avec 87,2 %, grâce à une forte demande sur les terrains de golf, les universités et les projets d'aménagement paysager urbain. La tendance à la gestion durable des pelouses et le renforcement des réglementations en faveur des véhicules zéro émission stimulent l'expansion du marché. L'intégration de technologies avancées telles que le GPS et l'IoT dans les véhicules complète les segments de l'achat et de la location, créant ainsi un écosystème de marché diversifié.

Aperçu du marché européen des véhicules utilitaires commerciaux sur gazon

Le marché européen des véhicules utilitaires pour gazon devrait connaître une croissance significative, soutenue par l'accent mis par la réglementation sur la durabilité environnementale et l'entretien efficace du gazon. Les consommateurs recherchent des véhicules à faibles émissions et performants pour les applications sur gazon naturel et artificiel. La croissance est marquée dans des pays comme l'Allemagne et le Royaume-Uni, portée par des investissements croissants dans les installations sportives et les espaces verts publics.

Aperçu du marché britannique des véhicules utilitaires commerciaux sur gazon

Le marché britannique des véhicules utilitaires commerciaux pour terrains gazonnés devrait connaître une croissance rapide, portée par la demande de solutions d'entretien efficaces dans les parcs urbains et les installations de loisirs. L'intérêt croissant pour les véhicules écologiques, notamment les modèles électriques, et la sensibilisation croissante à l'efficacité opérationnelle encouragent leur adoption. L'évolution des réglementations environnementales influence les choix des consommateurs, équilibrant performance et conformité.

Aperçu du marché allemand des véhicules utilitaires commerciaux sur gazon

L'Allemagne devrait connaître une croissance rapide du marché des véhicules utilitaires commerciaux pour l'aménagement paysager, grâce à son secteur d'aménagement paysager de pointe et à l'importance accordée par les consommateurs aux questions de durabilité et d'efficacité. Les consommateurs allemands privilégient les véhicules à la pointe de la technologie, à propulsion électrique ou hybride, qui réduisent l'impact environnemental et les coûts d'exploitation. L'intégration de ces véhicules dans les terrains de golf et les projets municipaux soutient une croissance soutenue du marché.

Aperçu du marché des véhicules utilitaires commerciaux sur gazon en Asie-Pacifique

La région Asie-Pacifique devrait connaître la croissance la plus rapide, portée par le développement des activités d'aménagement paysager et de loisirs dans des pays comme la Chine, l'Inde et le Japon. La sensibilisation croissante à la gestion durable des pelouses, conjuguée à la hausse des revenus disponibles, stimule la demande de véhicules électriques et à essence. Les initiatives gouvernementales en faveur des espaces verts et de l'efficacité énergétique encouragent l'adoption de véhicules utilitaires performants.

Aperçu du marché japonais des véhicules utilitaires commerciaux sur gazon

Le marché japonais des véhicules utilitaires pour terrains commerciaux devrait connaître une croissance rapide grâce à la forte préférence des consommateurs pour des véhicules de haute qualité, à la pointe de la technologie et améliorant l'efficacité opérationnelle et la durabilité. La présence de grands constructeurs et l'intégration de véhicules électriques dans les terrains de golf et les complexes hôteliers accélèrent la pénétration du marché. L'intérêt croissant pour les abonnements de location contribue également à cette croissance.

Aperçu du marché chinois des véhicules utilitaires commerciaux sur gazon

La Chine détient la plus grande part du marché des véhicules utilitaires commerciaux pour gazon en Asie-Pacifique, propulsée par une urbanisation rapide, le développement croissant des espaces verts et la demande croissante de solutions efficaces d'entretien des pelouses. L'essor de la classe moyenne et l'importance accordée à l'aménagement paysager durable favorisent l'adoption de véhicules électriques et hybrides. De solides capacités de production nationales et des prix compétitifs facilitent l'accès au marché.

Part de marché des véhicules utilitaires commerciaux pour gazon

L'industrie des véhicules utilitaires commerciaux pour gazon est principalement dirigée par des entreprises bien établies, notamment :

- Textron Inc. (États-Unis)

- Deere & Company (États-Unis)

- Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd (Chine)

- The Toro Company (États-Unis)

- Polaris Inc. (États-Unis)

- Yamaha Motor Co. Ltd. (Japon)

- KUBOTA Corporation (Japon)

- Columbia Vehicle Group Inc. (États-Unis)

- SPEEDWAYS (Inde)

- VÉHICULE ÉLECTRIQUE HDK (ÉTATS-UNIS)

- Marshell Green Power (Chine)

- STAR EV CORPORATION (États-Unis)

- Tropos Motors (États-Unis)

- American Landmaster (États-Unis)

- Garia A/S (Danemark)

- Ingersoll Rand (États-Unis)

- Véhicules électriques Bintelli (États-Unis)

- Véhicules électriques à moteur (États-Unis)

Quels sont les développements récents sur le marché mondial des véhicules utilitaires commerciaux sur gazon ?

- En février 2024, Polaris Inc. a lancé une variante électrique de son véhicule utilitaire robuste Pro XD, spécifiquement destinée aux secteurs de la construction, de la location d'équipement et de l'industrie. Baptisé Pro XD Kinetic, ce véhicule offre des capacités de remorquage et de transport améliorées, avec une autonomie allant jusqu'à 72,4 km (45 miles) sur une seule charge. Ce lancement souligne l'engagement de Polaris à élargir son offre de véhicules électriques pour les environnements de travail exigeants.

- En mars 2023, Club Car, leader mondial des véhicules électriques à petites roues et zéro émission, a dévoilé ses derniers modèles utilitaires électriques homologués pour la route : les Club Car Urban LSV et Urban XR. Ces véhicules arborent un style inspiré de l'automobile, une conception ergonomique et sont adaptés aux applications commerciales, municipales et de livraison du dernier kilomètre. L'Urban LSV est homologué pour la route avec une vitesse de pointe de 40 km/h, tandis que la version XR, non homologuée, atteint 30 km/h. Les deux modèles offrent des configurations flexibles, incluant des bennes de pick-up et des caisses de fourgon, et sont désormais disponibles auprès du réseau de distributeurs commerciaux nord-américains de Club Car, favorisant ainsi des solutions de transport durables et économiques.

- En octobre 2023, Metalcraft, basé à Mayville, fabricant américain connu pour sa marque Scag Power Equipment, a acquis Bluebird Turf Products, située à Auburn Hills, dans le Michigan. Cette acquisition, effective le 9 octobre 2023, renforce la position de Metalcraft sur le marché des équipements d'entretien des pelouses en élargissant sa gamme de produits et en renforçant sa présence dans les secteurs de la location et de l'aménagement paysager commercial. Dans le cadre de cette transaction, les 21 employés actuels de Bluebird ont été conservés. Cette acquisition permet aux revendeurs Scag de proposer des produits complémentaires pour la rénovation des pelouses, tandis que le réseau de location de Bluebird accède à la gamme élargie de Scag.

- L'acquisition d'Excel Industries par Stanley Black & Decker a eu lieu avant septembre 2023 : elle a été officiellement annoncée le 13 septembre 2021. Dans le cadre de cette transaction de 375 millions de dollars américains, Stanley Black & Decker a acquis Excel, un fabricant américain d'équipements d'entretien des pelouses haut de gamme pour les professionnels et les particuliers, sous les marques Hustler Turf Equipment et BigDog Mower Co. Cette acquisition a marqué l'entrée stratégique de Stanley Black & Decker sur le marché des équipements d'entretien des pelouses, élargissant son offre de produits d'extérieur et exploitant ses capacités de production et de distribution pour se diversifier dans un nouveau secteur.

- En juillet 2023, Target Specialty Products a lancé Turf Fuel Infinite au Canada après son enregistrement auprès de l'ACIA. Turf Fuel Infinite est un tensioactif de sol avancé et une solution phytosanitaire conçue pour améliorer la gestion de l'humidité, la tolérance des plantes au stress et la vitalité globale du gazon. Ce produit associe le Diuturon, une technologie polymère en instance de brevet, au Templar™, un activateur de défense des plantes contre le stress, ainsi qu'à quatre autres polymères tensioactifs. Cette formule assure une hydratation constante du sol et une résistance accrue à la sécheresse, ce qui en fait un produit idéal pour les terrains de golf, les terrains de sport et les espaces verts commerciaux. Bien qu'il ne s'agisse pas d'un véhicule, il complète l'utilisation des véhicules utilitaires commerciaux pour gazon en optimisant l'état du gazon pour l'entretien et la performance.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.